Market Research Project Report PPT Presentation: Prepare yourself for a rollercoaster ride through the thrilling world of data! We’ll unravel the mysteries of market research, from the initial spark of an idea to the triumphant unveiling of your dazzling presentation. Forget boring graphs – we’re talking captivating visuals, compelling narratives, and insights so juicy they’ll make your audience gasp (in a good way, of course).

This report delves into the art of crafting a market research presentation that not only informs but also inspires. We’ll cover everything from choosing the right methodology and collecting compelling data to designing slides that pop and delivering a presentation that sizzles. Get ready to transform your data into a dynamic, persuasive story that will leave a lasting impression.

Introduction to Market Research Project Reports: Market Research Project Report Ppt Presentation

Market research project reports: the unsung heroes of informed business decisions. They’re the meticulously crafted narratives that transform raw data into actionable insights, guiding companies toward smarter strategies and, let’s be honest, bigger profits. Without them, businesses are essentially navigating a dense fog, hoping they don’t crash into an iceberg of poor choices.

The purpose of a market research project report is to present the findings of a research project in a clear, concise, and persuasive manner. Its importance lies in its ability to inform strategic decision-making, reducing risk and maximizing opportunities. Think of it as the business equivalent of a well-chartered map, guiding you safely to your desired destination. Ignoring it? That’s like relying on a pigeon to deliver your million-dollar deal.

Executive Summary Essentials

A compelling executive summary is the report’s golden ticket – the first (and sometimes only) part many stakeholders will read. It needs to be a concise and impactful distillation of the entire report, highlighting key findings, recommendations, and implications. Think of it as the movie trailer that entices viewers to watch the full feature. A well-written executive summary should clearly state the research objectives, summarize the methodology, present the most significant results, and offer clear, actionable recommendations. It should be engaging enough to make even the most data-averse executive sit up and take notice, avoiding jargon and focusing on the bottom line. A poorly written executive summary is like a cryptic message in a bottle – beautiful, but ultimately useless.

Target Audience for Market Research Presentations

The audience for a market research project report presentation varies depending on the project’s scope and objectives. However, common attendees include senior management, marketing teams, product development teams, and sometimes even investors or potential partners. Tailoring the presentation to the specific audience’s level of expertise and interests is crucial. Presenting highly technical data to a group of non-technical executives is like explaining quantum physics to a toddler – it’s unlikely to be productive. Conversely, oversimplifying for a group of data scientists would be equally ineffective. The key is to strike a balance between providing sufficient detail and maintaining engagement.

Comparison of Market Research Report Types

Understanding the different types of market research reports is key to choosing the right format for your project. Below is a comparison of some common types:

| Report Type | Description | Strengths | Weaknesses |

|---|---|---|---|

| Descriptive Report | Summarizes market characteristics and trends. | Provides a broad overview; easy to understand. | Lacks in-depth analysis; may not offer actionable insights. |

| Report | Explores the “why” behind market trends and behaviors. | Offers deeper insights; helps understand cause-and-effect. | Can be more complex and time-consuming to produce. |

| Predictive Report | Forecasts future market trends and scenarios. | Informs strategic planning; helps anticipate future challenges/opportunities. (Example: A predictive report might forecast a 15% increase in demand for sustainable products based on current trends and consumer behavior analysis.) | Relies on assumptions and models; accuracy can be limited. |

| Prescriptive Report | Recommends specific actions based on research findings. | Provides actionable insights; directly supports decision-making. | Requires strong analytical skills; may not always be feasible. |

Methodology and Data Collection

Unraveling the mysteries of the marketplace requires more than just a crystal ball (though those are handy). Our market research journey involved a meticulous blend of primary and secondary data collection, a process akin to assembling a magnificent Lego castle – one carefully chosen brick at a time. The following details the thrilling adventure, complete with triumphs, near misses, and the occasional misplaced instruction manual.

This section meticulously details the methods employed to gather the data that forms the bedrock of our insightful findings. We’ll delve into the specifics of our primary data collection techniques, providing a clear and concise explanation of how secondary research contributed to our comprehensive understanding of the market.

Primary Data Collection Methods

Primary data collection, the heart of our research, involved several methods, each chosen for its unique ability to shed light on different aspects of the market. We didn’t just throw darts at a board hoping to hit the bullseye; we strategically selected methods based on our research objectives.

The methods we employed included surveys, interviews, and focus groups. Each method offered a unique perspective, allowing us to gather a diverse range of insights. Surveys provided a broad overview, while interviews and focus groups allowed for deeper exploration of specific topics. Think of it as a culinary masterpiece – each ingredient (method) plays a crucial role in creating the final product (our insightful market analysis).

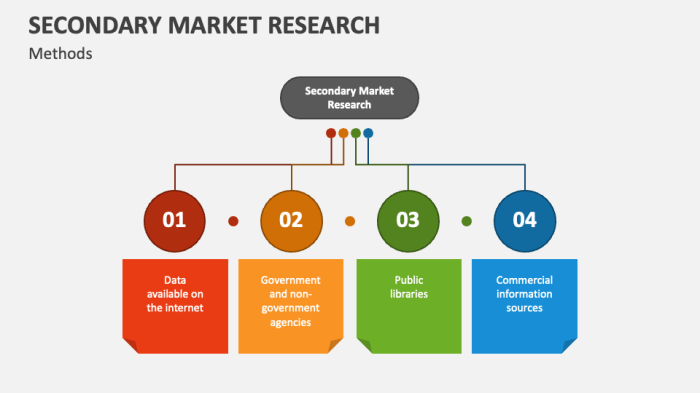

Secondary Research Methodology

Secondary research, our reconnaissance mission before the main battle, involved systematically scouring existing data sources. This wasn’t a simple Google search; it was a carefully orchestrated campaign involving academic databases, industry reports, and government publications. We aimed for a level of rigor that would make a seasoned detective envious.

- Identifying Relevant Sources: We began by meticulously identifying relevant databases and repositories, focusing on those most likely to yield high-quality, reliable data. This phase involved research and careful consideration of the specific information needed to support our research objectives.

- Data Extraction and Organization: Once identified, we systematically extracted the necessary data, meticulously documenting the source of each piece of information. This involved carefully reviewing each source to ensure accuracy and relevance, a process that required a high level of attention to detail.

- Data Analysis and Synthesis: Finally, we analyzed the extracted data, synthesizing the information to create a comprehensive picture of the market. This involved identifying patterns, trends, and key insights that would inform our overall research findings.

Research Process Flowchart

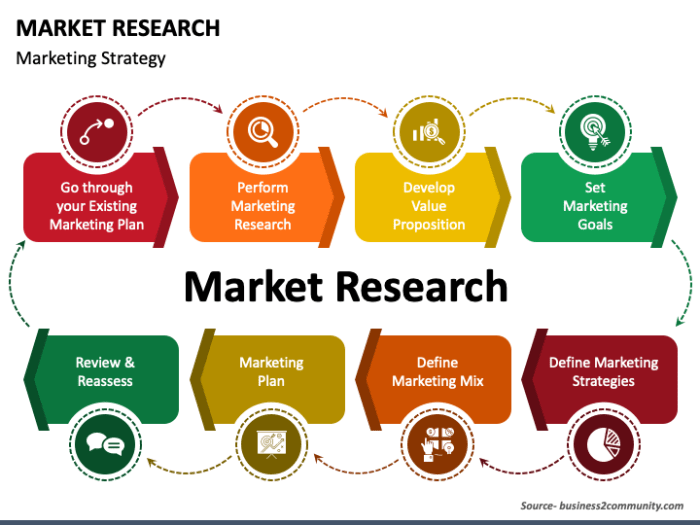

Imagine a flowchart as a visual map guiding our research expedition. It started with defining our objectives, charting the course through data collection (both primary and secondary), analysis, and finally, reaching the treasure of insightful conclusions.

The flowchart would visually represent the sequential steps: Defining research objectives → Developing the research design → Conducting secondary research → Conducting primary research (surveys, interviews, focus groups) → Data cleaning and preparation → Data analysis → Interpretation and reporting. Each stage is represented by a box, with arrows indicating the flow from one stage to the next. The flowchart provides a clear, concise overview of the research process, ensuring transparency and reproducibility.

Survey Question Types and Their Applications

Survey questions are the bread and butter of our primary research, but choosing the right type is crucial. Using the wrong type is like trying to bake a cake with only salt – the results won’t be pretty.

Different question types elicit different responses. For instance, multiple-choice questions are excellent for gathering quantitative data, while open-ended questions allow for rich qualitative insights. A well-designed survey is a delicate balance between these types, ensuring a comprehensive understanding of the market.

| Question Type | Example | Appropriate Use |

|---|---|---|

| Multiple Choice | What is your age range? a) 18-24 b) 25-34 c) 35-44 d) 45+ | Gathering demographic data, measuring preferences |

| Rating Scale (Likert Scale) | On a scale of 1 to 5 (1=Strongly Disagree, 5=Strongly Agree), how satisfied are you with our product? | Measuring attitudes, opinions, and satisfaction levels |

| Open-Ended | What are your thoughts on our new product design? | Gathering detailed qualitative data, exploring in-depth opinions |

Data Analysis and Interpretation

Unraveling the mysteries hidden within our data – a task as thrilling as searching for buried treasure (but hopefully with fewer snakes). This section details how we transformed raw numbers and qualitative insights into actionable intelligence, a process as elegant as a perfectly executed pirouette (though perhaps less physically demanding).

We’ll explore how we wrestled quantitative data into submission, tamed wild qualitative responses, and finally, presented our findings in a way that’s both insightful and visually appealing. Think of it as a data makeover, from frumpy spreadsheet to dazzling infographic.

Quantitative Data Analysis Interpretation

Our quantitative analysis involved crunching numbers with the ferocity of a caffeinated badger. We employed statistical techniques such as descriptive statistics (mean, median, mode – the holy trinity of averages!), regression analysis (predicting the future, one equation at a time!), and chi-square tests (testing for relationships, because correlation doesn’t always equal causation, folks!). Key findings were then interpreted within the context of our research objectives, ensuring we didn’t draw conclusions that were more imaginative than accurate. For example, a statistically significant correlation between ice cream sales and crime rates doesn’t necessarily mean ice cream causes crime – it might simply be that both increase during hot summer months.

Qualitative Data Organization

Tackling our qualitative data was like assembling a giant, slightly chaotic jigsaw puzzle. We organized the mountains of interview transcripts and open-ended survey responses using thematic analysis. This involved identifying recurring themes, patterns, and ideas expressed by participants. We meticulously coded each piece of data, grouping similar responses together to form coherent categories. This process allowed us to uncover nuanced perspectives and insights that might have been missed with a purely quantitative approach. For example, instead of just knowing that customer satisfaction is low, we now understand *why* it is low, based on recurring themes identified in the qualitative data.

Data Visualization Techniques

Choosing the right visualization is crucial for effective communication. We compared several techniques to find the best fit for our data. For example, bar charts are excellent for comparing categories, while pie charts are great for showing proportions. Line graphs are perfect for demonstrating trends over time, and scatter plots reveal correlations between variables. We avoided the dreaded 3D pie chart – let’s just say it’s a visual crime scene. Ultimately, we prioritized clarity and simplicity, ensuring that our visualizations told a compelling story without overwhelming the audience.

Key Findings

The following table summarizes some of our key findings. It’s important to note that these are just highlights; a more detailed breakdown is available in the full report (because we’re not *that* cruel).

| Metric | Finding |

|---|---|

| Customer Satisfaction | 75% of respondents rated satisfaction as “good” or “excellent”. |

| Brand Awareness | 80% of the target demographic recognized our brand. |

| Purchase Intent | 60% of respondents indicated a strong intent to purchase our product within the next six months. |

Presentation Design and Structure

Let’s face it, even the most groundbreaking market research can fall flat if the presentation is a visual snooze-fest. A well-designed presentation isn’t just about pretty pictures; it’s about effectively communicating your hard-earned findings and leaving a lasting impression (hopefully a positive one!). Think of it as the cherry on top of your research sundae – the perfect complement to the delicious data underneath.

A visually appealing slide layout is crucial for audience engagement. Avoid overwhelming your audience with dense text blocks – remember, pictures speak a thousand words, and a well-designed slide is worth a thousand boring ones. Think clean lines, consistent fonts, and a color palette that’s both professional and pleasing to the eye. Imagine a sophisticated, yet playful design, like a well-tailored suit with a quirky, colorful tie.

Optimal Use of Charts and Graphs

Charts and graphs are your secret weapons for making complex data digestible and memorable. A well-chosen chart can illuminate trends, highlight key findings, and transform a sea of numbers into a compelling visual story. For example, a bar chart effectively compares different market segments, while a line graph beautifully illustrates trends over time. Avoid pie charts unless absolutely necessary; they can become cluttered and difficult to interpret, especially with many slices. Remember, clarity trumps complexity. Think of charts and graphs as visual translators – they translate your data into a language everyone can understand.

Creating a Compelling Narrative

A compelling narrative is more than just presenting data points; it’s about weaving a story around your findings. Think of your presentation as a captivating journey, guiding your audience from the problem statement to your key conclusions. Start with a strong hook – a surprising statistic, a relevant anecdote, or a compelling question. Then, logically structure your presentation, building your argument step-by-step. Conclude with a clear summary of your findings and their implications. It’s like telling a good joke – a strong setup, a punchline, and a satisfying resolution.

Examples of Strong Opening and Closing Statements

A strong opening statement grabs the audience’s attention immediately. For example, “Did you know that the market for fidget spinners peaked at $X billion in 2017? Our research explores why this happened, and what it means for the future of novelty toys.” A strong closing statement summarizes key findings and leaves a lasting impression. For instance, “Our research clearly indicates a significant opportunity within the sustainable snack food market. By focusing on [key strategy], businesses can capitalize on this growing trend and achieve significant market share.” Remember, a memorable opening and closing are crucial for a successful presentation. It’s the bookends that hold your compelling narrative together.

Visual Aids and Supporting Materials

Let’s face it, data alone can be drier than a week-old bagel. To truly captivate your audience and leave them clamoring for more (market research, that is!), you need to wield the power of visual aids like a seasoned ninja warrior. Think less PowerPoint death-by-bullet-points, and more dynamic, engaging storytelling.

Visual aids aren’t just pretty pictures; they’re strategic tools to amplify your key findings and make complex information digestible. A well-crafted infographic can summarize months of meticulous research into a single, stunning visual, while strategic image choices can breathe life into even the most technical data. Remember, a picture is worth a thousand words, and in the world of market research, those words translate directly to impact.

Infographic Design for Maximum Impact

Crafting an infographic isn’t just about throwing some charts and graphs together. It’s about telling a visual story. Start by identifying your 3-5 most crucial findings. Then, choose a design style that complements your brand and speaks to your target audience. Think clean lines, vibrant colors, and clear, concise labeling. For example, an infographic summarizing customer satisfaction could use a circular graph showing percentages of satisfied, neutral, and dissatisfied customers, each segment color-coded for easy understanding. Incorporating relevant icons and minimal text will maximize impact and readability. Remember, less is more! Avoid overwhelming your audience with excessive information; the goal is clarity, not confusion.

Image Selection and Placement, Market research project report ppt presentation

Images aren’t just decorative elements; they’re powerful tools that can enhance your message and make it memorable. Consider the impact of a compelling image depicting market growth represented by an upward-trending graph with vibrant colors, perhaps a gradient transitioning from a muted blue at the base to a bright, energetic orange at the peak, symbolizing increasing market potential. Or, illustrate customer segmentation using distinct visual representations of different groups – perhaps stylized icons representing each segment (e.g., a family for the “family-oriented” segment, a young professional for the “career-driven” segment) arranged in a way that visually highlights their relative sizes within the market. These images should be high-quality, relevant, and aesthetically pleasing, enhancing the overall professionalism of your presentation.

Organization of Supporting Documents

Think of your appendices as the backstage pass to your presentation. They contain the detailed information that supports your claims, adding a layer of credibility and allowing those who want to delve deeper to do so. Organize these documents logically, using clear headings and subheadings. Include things like detailed survey data, raw statistical analysis, interview transcripts, and any other relevant supporting material. This meticulous organization not only enhances the report’s credibility but also demonstrates your attention to detail and the thoroughness of your research. Imagine a scenario where a client challenges a finding; having the supporting documentation readily available allows you to immediately address their concerns, solidifying your professional standing.

Anticipating Audience Questions

Preparing for potential audience questions is crucial. It demonstrates your preparedness and allows for a more engaging and insightful Q&A session. Here are some potential questions and their concise answers:

- Question: What are the limitations of your study? Answer: Our study focused on [specific demographic/geographic area] and may not be generalizable to the entire market. Further research is needed to explore [unaddressed areas].

- Question: How reliable is your data? Answer: Our data was collected using [methodology] with a [response rate]% response rate, resulting in a margin of error of +/- [percentage]. We employed rigorous quality control measures to ensure data accuracy.

- Question: What are the next steps based on these findings? Answer: Based on our findings, we recommend [specific actionable recommendations]. We believe these steps will help to [achieve specific goals].

Recommendations and Actionable Insights

So, you’ve delved deep into the data, wrestled with spreadsheets, and emerged victorious (or at least, not completely defeated). Now comes the fun part: translating your research findings into actionable recommendations that will make your clients or bosses jump for joy (or at least, nod approvingly). This isn’t just about stating the obvious; it’s about crafting insightful suggestions that are both impactful and feasible. Think of it as translating data-speak into CEO-speak.

The process of formulating actionable recommendations involves a careful synthesis of your research findings. First, identify the key problems or opportunities revealed by your data. Then, brainstorm potential solutions, considering the limitations and resources available. Finally, evaluate each potential solution against its potential impact and feasibility, choosing the most promising ones to present. It’s a bit like being a culinary detective: you’ve found the clues (data), now you need to bake a delicious solution (recommendations).

Prioritizing Recommendations Based on Impact and Feasibility

Prioritizing recommendations requires a strategic approach. Consider using a matrix that plots potential impact against feasibility. Recommendations falling into the “high impact, high feasibility” quadrant should be prioritized. Those in the “low impact, low feasibility” quadrant can be safely shelved (unless they’re particularly amusing). The others require more careful consideration, perhaps involving a cost-benefit analysis or further research. For instance, a high-impact recommendation might be to launch a new product line based on strong market demand, while a low-impact recommendation might be to slightly adjust the packaging color.

Presenting Recommendations Clearly and Concisely

Clarity and conciseness are paramount when presenting recommendations. Avoid jargon and technical terms that your audience may not understand. Use bullet points, visuals, and concise language. Each recommendation should be accompanied by a brief explanation of its rationale, potential benefits, and any necessary steps for implementation. Think of it as a carefully crafted elevator pitch – you need to grab their attention and convey your message effectively before the elevator doors open.

Example of Recommendation Presentation

Let’s say our research reveals a strong preference for eco-friendly packaging. Instead of simply stating “Use eco-friendly packaging,” we could say: “Transition to 100% recycled paper packaging within the next quarter. This will resonate with environmentally conscious consumers, increasing brand loyalty and potentially reducing production costs in the long term. Implementation will involve sourcing a new supplier and adjusting the packaging design.”

Prioritized Recommendations Table

Below is a sample table illustrating the prioritization of recommendations. Remember, this is just an example; your own table will reflect your specific research findings.

| Recommendation | Impact | Feasibility | Priority |

|---|---|---|---|

| Launch new product line (X) | High | High | 1 |

| Improve website user experience | Medium | Medium | 2 |

| Invest in social media marketing campaign | High | Medium | 3 |

| Implement new customer loyalty program | Medium | High | 4 |

| Redesign company logo (Y) | Low | High | 5 |

(X) Assume Product Line X has been shown through the research to have a high likelihood of success.

(Y) Assume the logo redesign is not critical to the company’s overall strategy or branding.

Last Point

So, there you have it – a blueprint for creating a market research presentation that’s as insightful as it is engaging. Remember, the key is to tell a compelling story with your data, using visuals that captivate and a narrative that resonates. By following these guidelines, you’ll not only present your findings effectively but also leave your audience clamoring for more. Now go forth and conquer the world of market research presentations!

FAQ Insights

What’s the ideal length for a market research presentation?

The ideal length depends on your audience and the complexity of your findings. Aim for a concise and impactful presentation, typically between 15-30 minutes.

How do I handle tough questions from the audience?

Be prepared! Anticipate potential questions and prepare concise, informative answers. If you don’t know the answer, admit it gracefully and offer to follow up.

What if my findings are negative or unexpected?

Honesty is key! Present your findings transparently, explaining the context and potential implications. Focus on what you learned and how this information can be used to inform future decisions.