Market research reports are essential tools for businesses navigating the complexities of today’s dynamic marketplace. They provide crucial insights into consumer behavior, competitive landscapes, and market trends, ultimately informing strategic decision-making and driving business growth. This report delves into the multifaceted world of market research, exploring methodologies, data analysis techniques, and the art of translating raw data into actionable strategies.

From defining the purpose and scope of various report types – including industry analyses, consumer behavior studies, and competitive assessments – to mastering data collection and analysis methods, this guide equips readers with a practical understanding of the entire market research process. We’ll examine both primary and secondary data sources, quantitative and qualitative analysis techniques, and the importance of visually presenting findings to maximize impact.

Defining Market Research Reports

Market research reports are crucial documents that provide in-depth analysis of specific markets, offering valuable insights for businesses to make informed decisions. They synthesize data and findings to paint a clear picture of market trends, consumer behavior, and competitive landscapes. The purpose is to reduce uncertainty and risk associated with market entry, product development, or strategic planning. The scope can vary widely, depending on the research objectives and the client’s needs, ranging from a narrow focus on a specific product segment to a broader examination of an entire industry.

Market research reports are not simply collections of data; they offer interpretations and actionable recommendations based on the findings. They aim to provide a comprehensive understanding of the market dynamics, helping businesses to identify opportunities and challenges, assess potential risks, and develop effective strategies for growth and profitability. This understanding enables more effective resource allocation, optimized marketing campaigns, and ultimately, increased return on investment.

Types of Market Research Reports

Market research reports come in various forms, each tailored to specific research needs and objectives. The choice of report type depends heavily on the client’s goals and the information required.

Key Components of a Comprehensive Market Research Report

A well-structured market research report typically includes several key components to ensure a thorough and insightful analysis. These elements work together to provide a holistic view of the market under investigation. The inclusion of each component depends on the specific type of report and its objectives, but most reports will include some form of the following:

- Executive Summary: A concise overview of the entire report, highlighting key findings and recommendations.

- Introduction: Provides background information on the market, research objectives, and methodology.

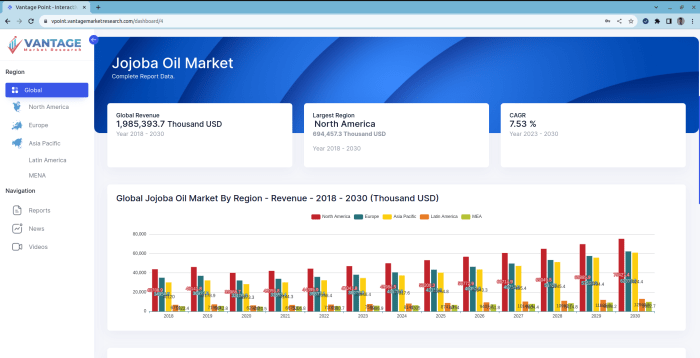

- Market Overview: A general description of the market size, growth rate, and key trends.

- Market Segmentation: Divides the market into smaller, more manageable segments based on various factors (e.g., demographics, geography, product type).

- Competitive Analysis: Evaluates the strengths and weaknesses of key competitors in the market.

- Consumer Analysis: Explores consumer behavior, preferences, and purchasing patterns.

- SWOT Analysis: Identifies the strengths, weaknesses, opportunities, and threats facing the market.

- Financial Projections: Forecasts future market growth and revenue potential.

- Recommendations: Suggests actionable strategies based on the research findings.

- Appendix: Includes supporting data, methodology details, and other supplementary information.

Comparison of Market Research Report Types

The following table compares different types of market research reports based on their methodology, data sources, and target audience.

| Report Type | Methodology | Data Sources | Target Audience |

|---|---|---|---|

| Industry Report | Secondary research, potentially supplemented by primary research (e.g., surveys, interviews) | Industry publications, government data, company reports, market databases | Industry professionals, investors, market analysts |

| Consumer Report | Primary research (e.g., surveys, focus groups, observational studies) | Surveys, focus groups, interviews, observational data | Businesses, marketing agencies, product developers |

| Competitive Analysis Report | Both primary and secondary research | Company websites, financial reports, news articles, market share data, customer reviews | Businesses, investors, strategic planners |

| Specific Product Report | Primarily primary research focused on the product itself and its market segment | Customer feedback, sales data, product reviews, market share data specific to the product | Product managers, marketing teams, sales departments |

Data Collection and Analysis Methods

Effective market research hinges on the meticulous collection and analysis of relevant data. This section details the various methods employed to gather and interpret information, ultimately informing strategic business decisions. Understanding these methods is crucial for conducting robust and insightful market research.

Data collection in market research can be broadly categorized into primary and secondary methods. Primary data is collected directly from sources, while secondary data utilizes existing information. The choice of method depends on research objectives, budget, and timeline.

Primary Data Collection Methods

Primary data collection involves gathering original information specifically for the research project. Several methods exist, each with its strengths and weaknesses. Choosing the appropriate method is crucial for obtaining accurate and reliable results.

Surveys, interviews, and focus groups are common primary data collection methods. Surveys, often distributed online or via mail, allow for large-scale data collection with standardized questions. Interviews, either structured or unstructured, offer deeper insights through direct interaction with respondents. Focus groups, involving moderated discussions with small groups, explore opinions and perspectives in a dynamic setting. Each method offers a unique perspective on the target market.

Secondary Data Sources and Their Importance

Secondary data, pre-existing information gathered by others, plays a vital role in market research. It provides a valuable foundation for understanding the market landscape and can significantly reduce the cost and time of research.

A wide array of sources provides secondary data, including industry publications (like market reports from firms like Nielsen or Statista), government databases (census data, economic indicators), and company websites (annual reports, press releases). Analyzing this information allows researchers to establish a baseline understanding of the market, identify trends, and pinpoint potential opportunities and threats. This contextual information is essential before embarking on primary data collection.

Quantitative and Qualitative Data Analysis Techniques

Market research data is often analyzed using both quantitative and qualitative methods. Quantitative analysis involves numerical data and statistical methods to identify patterns and relationships, while qualitative analysis focuses on understanding meanings, interpretations, and perspectives.

Quantitative techniques include descriptive statistics (mean, median, mode, standard deviation), correlation analysis, regression analysis, and hypothesis testing. These methods allow researchers to quantify market trends and test specific hypotheses. Qualitative techniques, such as thematic analysis, content analysis, and grounded theory, provide rich insights into consumer behavior, motivations, and perceptions. Combining both approaches often provides a more comprehensive understanding.

Hypothetical Data Collection Plan: Pet Food Industry

Let’s consider a hypothetical market research project focused on the premium pet food segment.

Target Audience: Pet owners aged 25-55, with household incomes exceeding $75,000 annually, owning at least one dog or cat. This segment represents a key demographic for premium pet food brands.

Sampling Method: A stratified random sampling method will be used to ensure representation across different geographic regions and pet types (dogs and cats). A sample size of 500 respondents will be targeted.

Data Collection Methods: An online survey will be the primary method, supplemented by a smaller number of in-depth interviews with key pet owners. The survey will collect quantitative data on purchasing habits, brand preferences, and price sensitivity. The interviews will gather qualitative data on motivations and perceptions regarding premium pet food.

Data Analysis Approach: Quantitative data from the survey will be analyzed using descriptive statistics and correlation analysis to identify key trends and relationships between variables. Qualitative data from interviews will be analyzed using thematic analysis to identify recurring themes and insights into consumer preferences. The combined findings will provide a comprehensive understanding of the premium pet food market.

Report Structure and Presentation

A well-structured market research report is crucial for effective communication of findings and recommendations. Clear organization and visually appealing presentation enhance readability and impact, ensuring key insights are readily understood by the intended audience. This section Artikels best practices for structuring and presenting your market research report.

Logical Report Structure

A standard market research report follows a logical flow, guiding the reader from the overview to detailed findings and concluding recommendations. This structure ensures clarity and allows for easy navigation. The key sections typically include an executive summary, a methodology section detailing the research approach, a comprehensive presentation of findings, and finally, actionable recommendations. Maintaining a consistent structure across all reports ensures ease of comparison and analysis for future projects.

Visually Appealing Report Design

Visual appeal is critical for effective communication. Employing a consistent font, font size, and appropriate use of headings and subheadings enhances readability. White space should be used generously to avoid a cluttered appearance. The use of high-quality visuals, such as charts and graphs, is crucial for presenting complex data in an easily digestible manner. Consistency in formatting and style across the entire document further improves the overall aesthetic appeal and professionalism of the report.

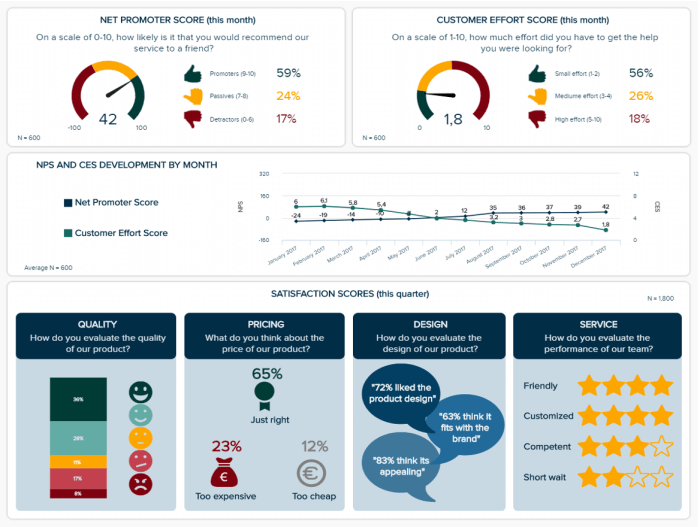

Data Presentation Using Charts and Tables

Tables and charts are invaluable tools for summarizing and presenting complex data effectively. They allow for a quick understanding of trends and patterns that might be missed in textual descriptions alone.

Example Visualizations

Market Share Analysis

Imagine a bar chart showing the market share of different brands within a specific product category. The x-axis would represent the different brands (Brand A, Brand B, Brand C, etc.), and the y-axis would represent their respective market share percentages. The height of each bar would visually represent the market share, allowing for quick comparison between brands. For example, Brand A might have a 40% market share, represented by a significantly taller bar compared to Brand B with a 20% share. This visualization clearly communicates the dominance of Brand A in the market. This chart could be easily represented within an HTML table, using CSS for styling.

Trend Analysis Over Time

A line graph would be ideal for illustrating market trends over time. The x-axis would represent time (e.g., months or years), and the y-axis would represent the variable being tracked (e.g., sales, market size, customer satisfaction). The line would visually connect data points, illustrating the trend. For instance, a steadily increasing line would indicate growth, while a fluctuating line might suggest market volatility. Consider a scenario where sales of a new technology product show exponential growth in the first year, followed by a plateauing effect in subsequent years. This trend would be immediately clear from the visualization. Again, this can be easily replicated in an HTML table using appropriate CSS for styling.

| Brand | Market Share (%) | Sales Growth (Last Year) | Customer Satisfaction Score |

|---|---|---|---|

| Brand A | 40 | 15% | 4.2 |

| Brand B | 20 | 5% | 3.8 |

| Brand C | 15 | -2% | 3.5 |

| Brand D | 10 | 10% | 4.0 |

| Brand E | 15 | 8% | 3.9 |

Interpreting Findings and Drawing Insights

Interpreting market research findings involves more than just looking at numbers; it’s about uncovering the story behind the data and translating it into actionable strategies. This process requires a careful examination of statistical data, identification of key trends, and a critical assessment of potential limitations. Ultimately, the goal is to transform raw data into meaningful insights that drive effective business decisions.

The interpretation of statistical data begins with understanding the descriptive statistics, such as means, medians, and standard deviations. These provide a summary of the data’s central tendency and variability. Beyond descriptive statistics, inferential statistics, like t-tests and ANOVA, help determine the significance of observed differences or relationships. Visualizations, such as charts and graphs, are crucial for identifying patterns and trends within the data. For instance, a line graph might reveal a clear upward trend in sales over time, while a bar chart could highlight significant differences in customer preference across various demographics. This visual representation makes complex data more accessible and understandable.

Translating Raw Data into Actionable Insights

Transforming raw data into actionable insights involves identifying key trends and patterns and linking them to specific business objectives. For example, if market research reveals a strong preference for eco-friendly products among a target demographic, a business could develop and market new sustainable product lines to capitalize on this trend. Similarly, if customer satisfaction surveys indicate a need for improved customer service, the business could invest in training programs and implement new customer relationship management (CRM) systems to address these concerns. These insights aren’t just about identifying problems; they’re about identifying opportunities for growth and improvement. A company might discover that a particular marketing campaign is highly effective with a specific age group, leading to a more targeted advertising strategy.

Identifying Potential Limitations and Biases

Market research data is rarely perfect. It’s crucial to acknowledge and address potential limitations and biases that might influence the results. Sampling bias, for instance, occurs when the sample used in the research doesn’t accurately represent the target population. This can lead to skewed results and inaccurate conclusions. Response bias, where participants answer questions in a way they believe is socially desirable or expected, is another common issue. Furthermore, the way questions are phrased in surveys can introduce bias, influencing responses and potentially skewing the overall results. Researchers must carefully consider these factors and implement strategies to minimize their impact. For example, using a larger, more representative sample can help reduce sampling bias. Carefully crafted, neutral questions can mitigate response bias.

Formulating Effective Business Strategies and Recommendations

The insights derived from market research should directly inform business strategies and recommendations. For example, if research reveals a growing demand for a particular product or service, the business could expand its product line or invest in additional resources to meet this demand. If research identifies a competitor’s strength, the business could adapt its strategies to better compete. The recommendations should be specific, measurable, achievable, relevant, and time-bound (SMART). For instance, instead of a vague recommendation like “improve customer service,” a more effective recommendation might be “increase customer satisfaction scores by 15% within the next six months by implementing a new CRM system and providing additional employee training.” This level of specificity ensures that the recommendations are actionable and lead to tangible results.

Case Studies and Examples

This section presents two case studies illustrating both the successes and challenges inherent in market research. The first showcases a successful application, while the second highlights potential pitfalls and strategies for mitigation. Analyzing these contrasting examples provides valuable insights into effective market research practices.

Successful Market Research: Netflix’s Expansion into International Markets

Netflix’s global expansion provides a compelling example of successful market research. Facing the challenge of entering diverse international markets with varying cultural preferences and technological infrastructure, Netflix employed a multi-faceted research strategy. This included extensive qualitative research, such as focus groups and in-depth interviews, to understand local viewing habits, preferred content genres, and technological access. Quantitative research, such as surveys and data analytics on existing streaming platforms, provided crucial information on market size and potential subscriber base. The analysis of this data revealed significant regional variations in content preferences. For example, while American audiences favored specific genres, Latin American audiences showed a strong preference for telenovelas and Spanish-language content. This insight directly influenced Netflix’s content acquisition and localization strategies. The result? Netflix successfully tailored its content offerings and marketing campaigns to resonate with local audiences, achieving significant subscriber growth in various international markets. Their success demonstrates the power of combining qualitative and quantitative research methods for informed decision-making in global expansion.

Challenging Market Research: The New Coke Debacle

The infamous “New Coke” launch in 1985 serves as a cautionary tale in market research. Coca-Cola, relying heavily on blind taste tests, concluded that consumers preferred the sweeter taste of the new formula. However, this research overlooked a crucial aspect: the emotional connection consumers had with the original Coca-Cola formula. The taste test, while quantitatively sound, failed to capture the brand’s powerful sentimental value and its historical significance. This led to a massive consumer backlash, forcing Coca-Cola to quickly reinstate the original formula. The failure highlights the limitations of relying solely on quantitative data and neglecting qualitative aspects like brand loyalty and emotional attachment. The challenge was not in the methodology itself but in the interpretation and application of the findings. A more comprehensive approach, including qualitative research methods exploring consumer sentiment towards the brand, could have prevented this costly mistake. While Coca-Cola ultimately rectified the situation, it illustrates the importance of a holistic research approach that considers both quantitative and qualitative data, and understands the full context of consumer behavior.

Lessons Learned from the Case Studies

The following points summarize key lessons learned from the Netflix and New Coke case studies:

- Employ a mixed-methods approach, combining quantitative and qualitative research to gain a comprehensive understanding of the market.

- Don’t solely rely on quantitative data; qualitative research provides crucial insights into consumer motivations and emotions.

- Thoroughly analyze the context and limitations of research findings before making critical business decisions.

- Consider the emotional connection consumers have with your brand and product.

- Adapt your research methods to the specific context and objectives of your market research project.

Conclusive Thoughts

Ultimately, effective market research is about more than just collecting data; it’s about transforming information into actionable insights that drive business success. By understanding the intricacies of report structure, mastering data interpretation, and learning from real-world case studies, businesses can leverage the power of market research to make informed decisions, mitigate risks, and capitalize on emerging opportunities. This comprehensive guide provides a solid foundation for anyone seeking to understand and utilize market research effectively.

Q&A

What is the difference between primary and secondary data?

Primary data is collected directly from sources like surveys or interviews, while secondary data is pre-existing information gathered from publications or databases.

How much does a market research report cost?

The cost varies greatly depending on scope, methodology, and the research firm. Expect a wide range of pricing.

What are some common pitfalls to avoid in market research?

Common pitfalls include biased sampling, flawed methodology, and misinterpreting data. Careful planning and rigorous analysis are crucial.

How long does it take to complete a market research report?

The timeline depends on the complexity of the research, but it can range from a few weeks to several months.