Market Research Report Examples: Dive into the wonderfully weird world of market research reports! Think of them as the Sherlock Holmes of business – meticulously piecing together clues (data) to solve the mystery of consumer behavior. Prepare for a journey through surveys, interviews, and enough charts to make a data scientist weep with joy (or possibly terror).

This report delves into the creation, structure, and presentation of effective market research reports. We’ll explore various methodologies, from the thrilling chase of primary research to the satisfying puzzle-solving of secondary data analysis. Get ready to unravel the secrets of compelling visuals and learn how to transform raw data into a narrative that captivates even the most spreadsheet-averse executives.

Defining Market Research Reports

Market research reports: the unsung heroes of the business world. They’re the meticulously crafted narratives that transform raw data into actionable insights, helping businesses navigate the treacherous waters of competition and consumer behavior. Think of them as the Sherlock Holmes of the corporate world, meticulously piecing together clues to solve the mystery of market success.

Market research reports serve a vital purpose: to provide a comprehensive and objective analysis of a specific market, enabling informed decision-making. Their scope can vary widely, from focusing on a single product to encompassing an entire industry. Essentially, they bridge the gap between data and strategy, allowing businesses to make smart, data-driven choices rather than relying on gut feelings (which, let’s be honest, can sometimes lead to spectacularly bad decisions).

Key Components of a Well-Structured Report, Market Research Report Examples

A well-structured market research report is like a well-oiled machine: each part works in harmony to achieve a common goal. It typically includes an executive summary (the tl;dr version), a detailed methodology explaining how the data was collected and analyzed (transparency is key!), findings presented clearly and concisely (think charts, graphs, and insightful commentary, not just a wall of numbers), and finally, conclusions and recommendations (the actionable takeaways that will actually change things). Think of it as a compelling story, with a clear beginning, middle, and end. Each section plays a crucial role in painting a complete picture of the market.

Types of Market Research Reports

Market research reports come in many flavors, each catering to a specific need. For example, industry reports offer a broad overview of a particular sector, providing insights into market size, growth trends, and key players. Competitor analysis reports, on the other hand, delve deep into the strategies and performance of rival companies, helping businesses identify opportunities and threats. Customer segmentation reports focus on grouping customers based on shared characteristics, enabling targeted marketing efforts and personalized experiences. Imagine them as different lenses through which you can view the market, each offering a unique perspective.

Comparison of Different Report Types

| Report Type | Strengths | Weaknesses | Example |

|---|---|---|---|

| Industry Report | Broad overview, market size data, trend identification | Can lack specific company details, may be overly generalized | A report on the global smartphone market, outlining growth projections and key players. |

| Competitor Analysis | In-depth understanding of rivals, identification of competitive advantages/disadvantages | Requires significant data collection, can be time-consuming | An analysis comparing the marketing strategies of Coca-Cola and PepsiCo. |

| Customer Segmentation | Enables targeted marketing, personalized experiences, improved customer retention | Requires sophisticated data analysis techniques, can be complex to implement | A report segmenting customers based on demographics and purchasing behavior for a clothing retailer. |

| Product-Specific Report | Focused analysis, detailed understanding of product market | Limited scope, may not provide broader market context | A report analyzing the market for a new type of sustainable coffee pod. |

Data Collection and Analysis Methods

Unveiling the secrets of the marketplace requires more than just a crystal ball (though those are handy). Market research relies on a robust and often hilarious collection of data gathering and analysis techniques. Think of it as a meticulously planned treasure hunt, but instead of buried gold, we’re after consumer preferences and market trends. The journey, however, can be as exciting (and sometimes as perplexing) as the destination.

Gathering data is like assembling a ridiculously detailed jigsaw puzzle – each piece, no matter how seemingly insignificant, contributes to the final, glorious picture of market understanding. This involves primary research, where we collect data directly from the source (the consumers themselves!), and secondary research, where we cleverly leverage existing information.

Primary Research Methods

Primary research is where the rubber meets the road, or, more accurately, where the researcher meets the respondent. We use a variety of methods to get those precious nuggets of information. These methods are chosen based on the research objectives and the resources available (sometimes, even the availability of free pizza influences the choice!).

- Surveys: These are like sending out a carefully worded questionnaire to a targeted audience. Think of it as a polite interrogation, but with multiple-choice answers to make it less intimidating (for both the researcher and the respondent). Online surveys are particularly popular these days, thanks to the internet’s glorious reach and the ability to automate data collection. A well-designed survey can provide insights into consumer attitudes, behaviors, and preferences. For example, a survey on the preferred features of a new smartphone model might reveal a strong preference for long battery life and a superior camera.

- Interviews: This is a more personal approach, involving one-on-one conversations with respondents. Think of it as a friendly chat, but with a hidden agenda (to glean valuable market intelligence!). Interviews can be structured (following a set of pre-determined questions) or unstructured (allowing for more free-flowing conversation). A good example is conducting in-depth interviews with key decision-makers in a particular industry to understand their perspectives on emerging trends.

- Focus Groups: Imagine a lively debate, but instead of arguing about politics, the participants are discussing a new product or service. Focus groups involve bringing together a small group of people to discuss a specific topic, moderated by a skilled facilitator. The interactions and discussions within the group can provide rich qualitative data, revealing hidden insights and unexpected opinions. For instance, a focus group discussion about a new food product could uncover unanticipated consumer preferences regarding packaging or taste.

Secondary Research Sources

Secondary research is like being a detective – piecing together clues from various sources to build a comprehensive case. This involves leveraging existing data, saving time and resources (and maybe preventing a caffeine-induced meltdown).

- Industry Publications: These are treasure troves of information, often offering insights into market trends, competitor activities, and emerging technologies. Think magazines, journals, and industry-specific reports. For example, publications such as the Harvard Business Review or Forbes can provide valuable data on overall economic trends and market dynamics.

- Government Data: Government agencies often release a wealth of data on various aspects of the economy, including demographics, consumer spending, and industry statistics. These are usually free (unless you accidentally download a virus, which is a separate problem entirely). Data from the U.S. Census Bureau or the Bureau of Labor Statistics are excellent examples.

- Market Research Databases: These are commercial databases offering comprehensive market information, often at a hefty price. But hey, sometimes you need to pay for quality data (and maybe a therapist to deal with the price tag). Examples include Nielsen, Statista, and Mintel.

Data Analysis and Interpretation

Once we’ve collected all this data (and survived the process), it’s time for the fun part: analysis. This isn’t just about crunching numbers; it’s about making sense of them, finding patterns, and drawing meaningful conclusions. This often involves statistical techniques, but sometimes it’s as simple as looking at the data and saying, “Aha! That’s interesting!”

Market Research Flowchart

Imagine a flowchart as a visual representation of the research process, a sort of roadmap for market research adventures. The flowchart would show a sequence of steps, beginning with defining the research objectives, followed by selecting the appropriate research methods, collecting the data, analyzing the data, and finally, preparing the report. Each step would be represented by a box, with arrows indicating the flow from one step to the next. For example, a diamond-shaped box could represent a decision point, such as choosing between qualitative and quantitative research methods. The final box would represent the completion of the market research report, ready to illuminate the path to market success.

Report Structure and Presentation

Crafting a market research report is like baking a delicious cake: you need the right ingredients (data), the perfect recipe (methodology), and a stunning presentation to impress your audience (clients, stakeholders, etc.). A poorly structured report, no matter how insightful the findings, is like a cake with frosting smeared everywhere – delicious ingredients wasted! Let’s ensure our report is a masterpiece.

The structure of a market research report is crucial for clear communication and easy comprehension. A well-organized report guides the reader through the research process, presenting the information logically and efficiently. This is vital because nobody wants to wade through a swamp of data to find the key takeaways; they want the delicious cake, not the flour-covered kitchen!

Typical Report Structure

A standard market research report typically follows a clear and logical structure. This structure ensures that all essential information is presented in a coherent and easily digestible manner. Think of it as a carefully planned journey, taking the reader from the initial overview to the final destination – the actionable recommendations.

| Section | Description | Purpose | Example |

|---|---|---|---|

| Executive Summary | A concise overview of the entire report. | To provide a quick understanding of the key findings and recommendations. | “This report analyzes the growing demand for artisanal dog biscuits, highlighting key market trends and recommending strategic partnerships with boutique pet stores.” |

| Methodology | Details on the research methods used (surveys, interviews, etc.). | To establish the credibility and validity of the research. | “Data was collected through online surveys distributed to 500 dog owners across the US, using a stratified sampling technique.” |

| Findings | Presentation of the research results, including data visualizations. | To present the data in a clear and concise manner. | “70% of respondents indicated a willingness to pay a premium for organic, locally sourced dog biscuits.” (This would be accompanied by a chart) |

| Recommendations | Actionable suggestions based on the findings. | To provide practical and strategic guidance for decision-making. | “We recommend focusing marketing efforts on highlighting the organic and locally sourced nature of the product.” |

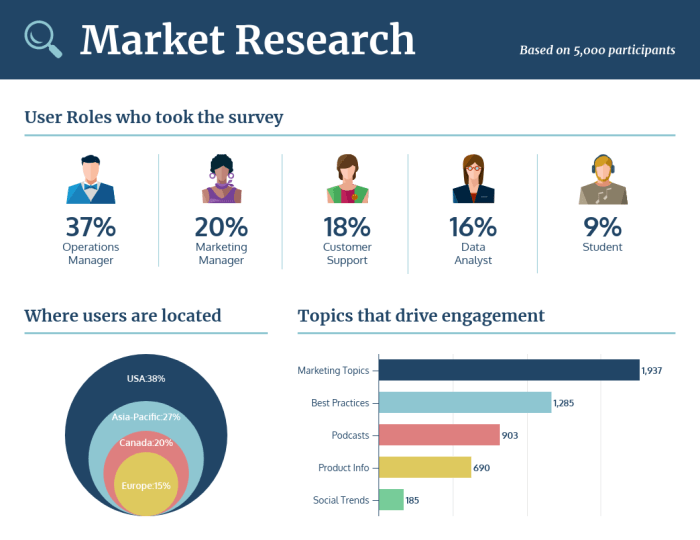

Effective Data Visualization

Data visualization is key to making your report both engaging and understandable. Think of it as the sprinkles on the cake – they add visual appeal and make the whole thing more enjoyable. Avoid overwhelming readers with dense text; instead, use charts, graphs, and tables to present complex information in a clear and concise manner. A picture, as they say, is worth a thousand words (and possibly a thousand data points).

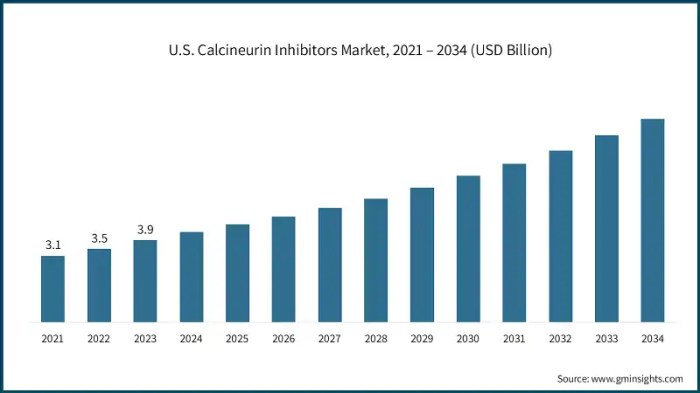

For example, a bar chart could effectively show the market share of different competitors, while a pie chart could illustrate the proportion of consumers in different demographic groups. Line graphs are perfect for showing trends over time, like the growth of a particular market segment. Tables are best for presenting detailed numerical data in an organized format. Remember to clearly label all charts and graphs, and to use a consistent visual style throughout the report.

Clear and Concise Writing

The importance of clear and concise writing in a market research report cannot be overstated. Nobody wants to read a report that’s as convoluted as a bowl of spaghetti; they want something easily digestible and insightful. Use plain language, avoid jargon, and get straight to the point. Every sentence should serve a purpose, every word should count. Precision is paramount; ambiguity is the enemy.

Sample Table of Contents

| 1 | Executive Summary | ||

|---|---|---|---|

| 2 | Introduction | ||

| 3 | Methodology | ||

| 4 | Findings | ||

| 5 | Market Analysis | ||

| 6 | Competitive Landscape | ||

| 7 | Recommendations | ||

| 8 | Conclusion | ||

| 9 | Appendices |

Case Studies: Market Research Report Examples

Let’s delve into the wonderfully weird world of successful market research, where data dances and insights ignite product launches like a firework display on the Fourth of July (but hopefully without the potential for injury). We’ll examine a hypothetical case study, showcasing how meticulous market research can transform a fledgling idea into a roaring success. Buckle up, it’s going to be a wild ride!

Our hypothetical hero is “Fluffy Paws,” a company specializing in artisanal catnip toys. They’d been coasting on their classic mouse-shaped catnip toys, but sales were, shall we say, purring along at a rather sedate pace. They decided it was time for a serious upgrade, a leap into the future of feline fun.

Fluffy Paws’ Market Research Process and Findings

Fluffy Paws embarked on a comprehensive market research journey. This involved a multi-pronged approach, including surveys distributed both online and at pet expos (think catnip-scented booths and adorable kittens as marketing assistants!), focus groups with cat owners (and their discerning feline companions), and competitive analysis to understand the landscape of cat toys. The surveys revealed a surprising preference for eco-friendly, sustainable materials. Focus groups unveiled a desire for interactive toys that stimulated cats’ hunting instincts. The competitive analysis highlighted a gap in the market for high-quality, sustainable, and engaging cat toys. The data revealed a clear path: create eco-friendly, interactive cat toys that appeal to both cats and their environmentally conscious owners.

Key Factors Contributing to Success

Several key factors contributed to the success of Fluffy Paws’ market research initiative. First, their multi-method approach ensured a comprehensive understanding of the market. Second, their direct engagement with both cat owners and their feline clients provided invaluable qualitative data. Third, the thorough analysis of their findings led to actionable insights that directly informed product development. Finally, their commitment to integrating the research findings into every stage of the product development process ensured alignment between market needs and product offerings.

Impact of Market Research on Business Decisions

The market research directly influenced Fluffy Paws’ product development, marketing strategy, and overall business decisions. Based on the findings, they developed a new line of catnip toys made from organic cotton and recycled materials, featuring innovative designs that stimulated cats’ natural hunting behaviors. Their marketing campaign emphasized the eco-friendly nature of the toys and their appeal to both cats and their owners. The result? A significant increase in sales, brand awareness, and customer loyalty. Fluffy Paws went from a quiet purr to a full-blown roar! The company saw a 300% increase in sales within the first six months of launching the new product line. This impressive growth was directly attributable to the insightful market research conducted prior to the launch.

Challenges and Best Practices

Embarking on the thrilling adventure of market research is like navigating a pirate ship through a stormy sea – exciting, potentially lucrative, and fraught with peril. While the treasure of insightful data awaits, numerous challenges can sink your research vessel before you even reach the horizon. Understanding these challenges and employing best practices is crucial for ensuring your market research doesn’t end up as another sunken galleon tale.

Common challenges in market research stem from a variety of sources, ranging from the practicalities of data collection to the inherent complexities of human behavior. These challenges, if not properly addressed, can lead to inaccurate, unreliable, and ultimately useless findings. Let’s hoist the mainsail and chart a course through these treacherous waters.

Data Collection Difficulties

Gathering accurate and representative data is often the biggest hurdle. Reaching the target audience can be surprisingly difficult; response rates can be disappointingly low, leading to biased samples. For instance, a survey about luxury yachts sent via email to a general population list is likely to yield a sample heavily skewed towards those who already own boats, not necessarily reflecting the broader market interest. Furthermore, ensuring the integrity of the data collected is paramount. Respondents may provide inaccurate or misleading information, either intentionally or unintentionally, due to factors such as social desirability bias (wanting to appear favorable) or simply misunderstanding the questions. Overcoming these challenges requires careful questionnaire design, employing diverse data collection methods (e.g., combining online surveys with in-person interviews), and rigorous data validation techniques.

Maintaining Data Accuracy, Reliability, and Validity

The accuracy, reliability, and validity of research findings are interconnected yet distinct concepts. Accuracy refers to the closeness of the findings to the true value; reliability indicates the consistency of results over time or across different samples; and validity refers to whether the research actually measures what it intends to measure. To ensure high accuracy, researchers must use appropriate sampling techniques, meticulously check data for errors, and employ statistical methods to account for sampling variability. Reliability can be enhanced by using well-established measurement instruments, employing multiple data collection methods, and testing the consistency of the results. Validity is improved by using clear and unambiguous research questions, employing appropriate research designs, and critically evaluating the interpretations of the findings. For example, if researching consumer preferences for a new type of coffee, using a blind taste test enhances validity by eliminating bias based on brand recognition.

Bias Mitigation Strategies

Bias can creep into market research like a sneaky barnacle, subtly affecting the results. This can manifest in many forms: sampling bias (non-representative samples), response bias (respondents not answering truthfully), and interviewer bias (influencing responses through leading questions or body language). To mitigate these biases, researchers should use rigorous sampling methods, carefully design questionnaires to avoid leading questions, train interviewers properly, and employ blind or double-blind studies where appropriate. A real-world example: A study on political preferences might employ randomized sampling to ensure a representative sample of the population, thereby reducing sampling bias. Furthermore, utilizing anonymous surveys reduces response bias related to social desirability.

Final Conclusion

So, there you have it – a whirlwind tour through the surprisingly entertaining world of market research reports. While the process may sometimes feel like deciphering ancient hieroglyphs, the rewards are immense: informed decisions, happy clients, and the smug satisfaction of knowing you’ve cracked the code of consumer desires. Now go forth and create market research reports that are both insightful and, dare we say, slightly amusing.

Questions Often Asked

What’s the difference between qualitative and quantitative market research?

Qualitative research explores the *why* behind consumer behavior (think in-depth interviews and focus groups), while quantitative research focuses on the *what* (e.g., surveys and statistical analysis). One’s about understanding feelings, the other’s about numbers – a perfect pairing!

How long does it typically take to complete a market research report?

The time varies wildly depending on the scope and complexity. A simple report might take weeks, while a more extensive project could easily take months. Think of it like baking a cake: a cupcake is quick, a wedding cake takes some serious time.

What software is best for creating market research reports?

Many options exist! Spreadsheet software (Excel, Google Sheets) is great for data analysis, while presentation software (PowerPoint, Google Slides) excels at creating visually appealing reports. Dedicated market research platforms also offer advanced features.