Market Research Reports Are Free Markstrat: The very phrase sounds like a unicorn sighting in the cutthroat world of business simulations! We’re about to dissect this seemingly paradoxical claim, exploring the hilarious implications of free market research within the Markstrat universe. Prepare for a rollercoaster ride of strategic insights, cost-benefit analyses that’ll make your head spin, and enough ethical dilemmas to fill a semester’s worth of philosophy classes. Buckle up, buttercup!

This exploration will cover the typical costs of market research, the potential advantages (and disadvantages!) of offering free reports, and a comparison of free versus paid options. We’ll then delve into the Markstrat simulation itself, examining the role of market research within the game, exploring its various data types, and highlighting how (and how *not* to) use this information for strategic advantage. We’ll even venture into the ethically murky waters of free market research, exploring potential biases and manipulation. Get ready for a wild ride!

Understanding the Claim: “Market Research Reports are Free” in the Context of Markstrat

The alluring phrase “free market research reports” often dances like a mischievous pixie in the business world, promising untold riches without the usual financial outlay. However, in the context of a sophisticated business simulation like Markstrat, the reality is considerably more nuanced – and perhaps a little funnier. Let’s delve into the complexities of this seemingly simple statement.

The typical cost structure associated with market research reports extends far beyond the immediate monetary price tag. Consider the time investment: analysts spend countless hours gathering data, crunching numbers, and crafting compelling narratives. Then there’s the opportunity cost – the potential profits forgone while resources are diverted to research. Finally, there’s the cost of the software, databases, and other tools required to conduct thorough analysis. While a “free” report might seem like a bargain, the true cost is often hidden, like a sneaky extra charge on a hotel bill.

The Implications of Offering Free Market Research Reports

Offering free market research reports, while seemingly generous, can have profound implications. A company might adopt this strategy to gain market share, particularly if it’s a new entrant hoping to disrupt an established market. By providing valuable information freely, they could attract customers who would otherwise be hesitant to commit to a paid service. However, this strategy could also lead to a significant reduction in revenue if not carefully managed. It might even create a perception of lower quality, as customers often associate “free” with “inferior.” Think of it like a free sample – tempting, but it might not be enough to win over customers long-term. A hypothetical example would be a small startup offering free market research on niche products to build brand awareness and establish credibility, thus attracting potential investors or larger companies for acquisition. The short-term loss in revenue would be balanced by long-term gains in brand recognition and market penetration.

Comparison of Free and Paid Market Research Reports

Free and paid market research reports differ significantly in scope and quality. Free reports, due to cost constraints, often offer a superficial overview of the market, perhaps focusing on readily available data. They may lack the depth of analysis, customized insights, and detailed projections found in paid reports. Paid reports, on the other hand, are usually comprehensive, tailored to specific client needs, and often involve direct interaction with experienced analysts. The quality is typically higher, offering a more reliable foundation for strategic decision-making. Imagine comparing a quick Google search to a detailed, commissioned study by a leading market research firm – the difference is night and day.

A Hypothetical Scenario: Gaining a Competitive Advantage with Free Reports, Market research reports are free markstrat

Let’s imagine a new beverage company, “Fizzical,” enters a saturated market dominated by established brands. To gain a foothold, Fizzical offers free market research reports focusing on consumer preferences within specific niche segments. These reports, while not revealing their proprietary formulas or strategies, highlight untapped market potential and emerging trends. This shrewd tactic attracts attention from smaller retailers and influencers, building brand awareness and securing initial distribution channels. The free reports act as a sophisticated marketing tool, generating valuable leads and establishing Fizzical as a knowledgeable and customer-centric brand, thereby gaining a competitive edge over its larger, more established rivals. This approach could be considered a form of guerilla marketing, using information as a weapon to conquer the market.

Markstrat Simulation and Market Research

Ah, Markstrat. That delightful business simulation where the stakes are high, the competition is fierce, and the only thing more unpredictable than the market is your team’s ability to interpret the data. But fear not, intrepid entrepreneurs! Understanding market research is your key to navigating this digital battlefield. It’s the difference between a triumphant market leader and a company destined for the digital scrap heap.

Market research within the Markstrat simulation serves as your crystal ball (a slightly cloudy one, admittedly), offering glimpses into consumer preferences, competitor strategies, and the overall market landscape. It’s your lifeline, your secret weapon, your… well, you get the idea. Essentially, it provides the vital intelligence needed to make informed decisions and outmaneuver your rivals. Without it, you’re essentially playing blindfolded – a recipe for disaster, especially when facing off against equally (or more) cunning opponents.

Types of Market Research Data in Markstrat

Markstrat provides several types of market research data, each offering a unique perspective on the market. Ignoring this data is akin to ignoring a flashing red light – you might get away with it once, but eventually, disaster will strike. The types of data available are crucial for building a comprehensive understanding of your market position and potential opportunities. Failure to analyze this data fully is a surefire way to end up with a product no one wants and a dwindling market share.

- Consumer Surveys: These surveys provide insights into consumer preferences, purchase intentions, and brand perceptions. Imagine it as a direct line to the minds of your target audience – invaluable for product development and marketing.

- Competitive Analysis: This reveals information about your competitors’ marketing strategies, pricing, and product features. Think of it as industrial espionage, but perfectly legal (and crucial for success).

- Market Segmentation Data: This data helps to identify distinct groups of consumers with shared characteristics, enabling targeted marketing campaigns. Knowing who your ideal customer is allows you to tailor your message, saving you money and maximizing impact.

- Historical Sales Data: This shows past sales figures, trends, and market share. This is your historical record, showing you what worked (and what spectacularly failed) in the past.

Using Market Research Data for Strategic Decisions

The real power of Markstrat’s market research lies in its application. Data is useless without action; it’s the interpretation and strategic implementation that transforms information into profit. Here are some examples:

- Product Development: Consumer surveys can reveal unmet needs or preferences that can inform new product development or product improvements. For example, if surveys reveal a strong preference for a particular feature, incorporating it into your product can boost its appeal significantly.

- Pricing Strategies: Competitive analysis and historical sales data can help determine optimal pricing strategies, balancing profitability with market competitiveness. Imagine carefully analyzing competitor pricing to find the sweet spot – a price that undercuts competitors without sacrificing profitability.

- Marketing Campaigns: Market segmentation data allows for targeted marketing campaigns, maximizing efficiency and impact. Instead of a shotgun approach, you can focus your marketing efforts on the most receptive segments, increasing return on investment.

- Resource Allocation: Analyzing historical sales data and market trends can guide resource allocation decisions, focusing efforts on high-potential areas and avoiding costly mistakes. For example, if sales data shows a decline in a specific product line, you can redirect resources to more promising areas.

Limitations of Markstrat Market Research Data

While invaluable, Markstrat’s market research isn’t perfect. It provides a simplified representation of the real world, and it’s crucial to acknowledge its limitations. Remember, even the best crystal ball can be a bit hazy.

- Simplified Model: The data reflects a simplified model of the market, omitting many real-world complexities and uncertainties. This means that, while helpful, it should not be the sole basis for decision-making.

- Potential for Bias: The data may be subject to biases or inaccuracies, requiring careful interpretation and validation. Always cross-reference findings and consider alternative explanations.

- Limited Scope: The available data may not cover all relevant aspects of the market, necessitating supplementary analysis and external research (if allowed within the simulation parameters).

Analyzing the Value of Market Research in Markstrat: Market Research Reports Are Free Markstrat

Embarking on the thrilling, yet occasionally terrifying, world of Markstrat requires a keen eye and a strategic mind. While gut feeling might get you through a round or two, consistent success hinges on leveraging the power of market research. Think of it as your crystal ball, albeit one that occasionally shows you a blurry image of a particularly aggressive competitor. But even a blurry crystal ball is better than no crystal ball at all.

Effective utilization of market research within Markstrat transforms you from a hopeful entrepreneur into a data-driven marketing maestro. Ignoring it, however, risks turning you into a marketing mime, flailing wildly in a marketplace you don’t understand.

Effective Market Research Utilization in Markstrat

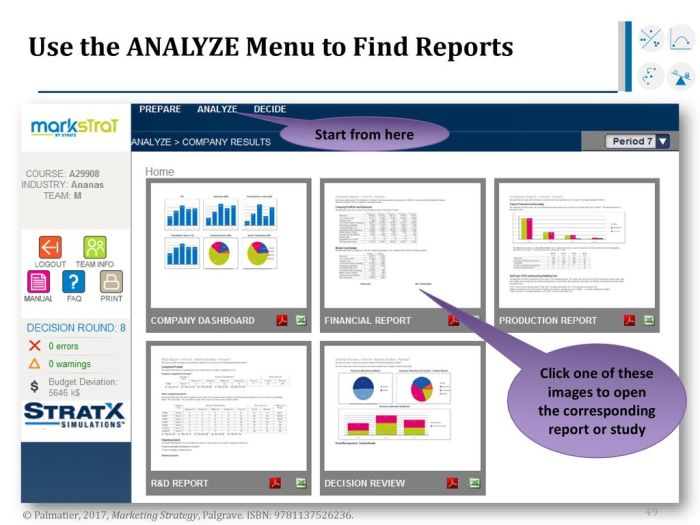

A step-by-step guide to successfully navigating the murky waters of Markstrat market research involves a methodical approach, blending careful planning with a dash of intrepid data analysis. First, identify your key objectives. Are you launching a new product? Trying to understand competitor strategies? Once you have your targets, select the appropriate research tools. Markstrat offers a variety of options, each with its own strengths and weaknesses. Carefully analyze the results, cross-referencing data to avoid misinterpretations. Finally, integrate your findings into your marketing strategy, adjusting your plans based on the insights gained. Think of it as a feedback loop, constantly refining your approach.

Cost-Benefit Analysis of Markstrat’s Market Research Tools

The following table illustrates the cost-benefit relationship of different research tools within Markstrat. Remember, the “cost” is often a trade-off between time, money, and potential delay in decision-making. The “benefit” is the value of the information gained, leading to better decisions and improved market performance.

| Research Type | Cost | Information Gained | Decision Impact |

|---|---|---|---|

| Consumer Surveys | Moderate (in-game currency) | Detailed consumer preferences, brand perceptions, and purchase intentions. | Improved product development, targeted marketing campaigns, and pricing strategies. |

| Competitive Analysis | High (in-game currency) | Comprehensive data on competitor products, marketing strategies, and market share. | Informed competitive strategies, identification of market gaps, and strategic adjustments. |

| Sales Force Reports | Low (minimal in-game currency) | Sales performance data, customer feedback, and market trends from the sales team. | Improved sales force training, product improvements, and adjustments to sales territories. |

| Distribution Analysis | Moderate (in-game currency) | Information on distribution channel effectiveness, consumer reach, and competitor distribution strategies. | Optimized distribution network, improved reach, and enhanced market penetration. |

Consequences of Ignoring or Misinterpreting Market Research Data

Ignoring or misinterpreting market research data in Markstrat can lead to several negative consequences, ranging from minor setbacks to catastrophic market failure. The importance of a rigorous approach cannot be overstated. Failure to analyze data effectively could lead to poor product development, ineffective marketing campaigns, and ultimately, lost market share and reduced profits. Consider it akin to sailing a ship without a map; you might get lucky, but the chances of hitting an iceberg are significantly higher.

Specifically, ignoring crucial data could result in:

- Developing products that don’t meet consumer needs.

- Launching marketing campaigns that fail to resonate with the target audience.

- Mispricing products, leading to lost sales or reduced profitability.

- Failing to identify emerging market trends, resulting in lost opportunities.

- Underestimating or overestimating competitor actions, leading to poor strategic decisions.

Integrating Market Research Findings into Marketing Strategy

Integrating market research findings requires a holistic approach, ensuring that the insights gained inform all aspects of your marketing strategy. This isn’t just about reacting to data; it’s about using it to proactively shape your actions. For example, if consumer surveys reveal a strong preference for a specific product feature, this should directly influence your product development roadmap. Similarly, if competitive analysis reveals a gap in the market, it might inspire the development of a new product or service. Finally, remember that market research is an iterative process; your strategy should evolve based on ongoing analysis and feedback. Think of it as a dynamic dance between data and decision-making.

Alternative Sources of Market Information in Markstrat (Beyond the Simulation’s Built-in Tools)

While Markstrat generously provides a wealth of internal data, a savvy Markstrat CEO knows that relying solely on the simulation’s built-in tools is akin to navigating a vast ocean with only a tiny, slightly leaky dinghy. To truly conquer the market, one must supplement their internal data with external sources – a powerful, well-equipped yacht, if you will. This involves venturing outside the confines of the simulation and exploring the real-world parallels to gain a competitive edge.

External sources can offer valuable insights unavailable within the simulation, providing a more nuanced understanding of market trends and consumer behavior. This enriched perspective can significantly improve the accuracy of forecasting and strategic decision-making, leading to greater success within the competitive Markstrat environment. The reliability of this external information, however, needs careful consideration, as its quality can vary significantly depending on the source. A critical approach, comparing and contrasting with internal data, is crucial.

Comparison of Internal and External Information Reliability

Internal data from Markstrat, while convenient, offers a somewhat sanitized view of the market. It presents a controlled environment, potentially lacking the unpredictable elements of the real world. External sources, on the other hand, can introduce “noise” – extraneous information that may be inaccurate or irrelevant. However, this “noise” can also uncover unexpected trends or insights that the simulation’s internal data might miss. For instance, a news article about a competitor’s recall could be invaluable information not reflected in the simulation’s sales figures. Therefore, a balanced approach using both internal and external sources is recommended – think of it as using both a highly accurate GPS and a seasoned navigator’s intuition.

Scenario: Utilizing External Data for Improved Decision-Making

Imagine a Markstrat scenario where your company’s new product, a revolutionary self-folding laundry basket (yes, it exists in our simulation!), is underperforming. Internal data shows declining sales and low consumer interest, but the reason remains unclear. Turning to external sources, you discover a recent surge in articles and social media discussions highlighting the rising popularity of minimalist living. This external data suggests a potential mismatch between your product’s features (perhaps it’s too large and bulky for minimalist apartments) and current consumer preferences. Using this insight, you pivot your marketing strategy, emphasizing the product’s space-saving capabilities (when folded, of course!), leading to a significant sales increase. The external data, therefore, acted as a corrective lens, focusing the internal data’s blurry picture into a clear and actionable strategy.

Hypothetical Marketing Campaign Based on Combined Data

Let’s consider a Markstrat product: a high-end, eco-friendly dog food. Internal Markstrat data shows strong sales in the premium pet food segment but reveals a lack of awareness among environmentally conscious consumers. External data – gleaned from consumer surveys and market reports found online – indicates a growing trend of “conscious consumerism” in pet products, with a significant demand for sustainable and ethically sourced ingredients. Our marketing campaign, therefore, will leverage both internal and external data. We’ll maintain our focus on the high-quality ingredients (internal data), but we’ll amplify our messaging to highlight the eco-friendly aspects of our dog food (external data). We’ll utilize social media marketing targeting environmentally conscious pet owners, emphasizing the sustainable sourcing of ingredients and the minimal environmental impact of packaging. This combined approach utilizes the strength of internal sales data and the insightful external trend analysis to create a more effective and targeted marketing campaign.

Ethical Considerations of Free Market Research

The siren song of “free” market research is undeniably tempting, especially for startups or businesses with tight budgets. However, like a delicious-looking cupcake from a questionable bakery, free market research can sometimes leave a bitter aftertaste. The ethical considerations surrounding freely available market data are far from trivial, and understanding these pitfalls is crucial for making informed business decisions. Ignoring these ethical nuances can lead to disastrous consequences, akin to relying on a faulty GPS for a cross-country road trip.

The potential for biased or inaccurate free market research to negatively impact businesses is significant. Imagine basing your entire marketing strategy on data suggesting a massive untapped market for left-handed, purple-loving, polka-dot-obsessed goldfish owners – only to discover the data was fabricated by a mischievous competitor. Such inaccuracies can lead to misallocation of resources, flawed product development, and ultimately, financial losses. Inaccurate data can also lead to missed opportunities, as businesses might dismiss potentially lucrative markets based on unreliable information. For example, a company might ignore a growing segment of eco-conscious consumers based on flawed free market research, losing out to competitors who successfully target this market.

Potential Biases in Free Market Research

Free market research, often sourced from unknown or less reputable sources, can be riddled with biases. These biases might stem from the methodology used to collect the data, the sample population chosen, or even the inherent motivations of the data provider. For instance, a free report sponsored by a competitor might subtly highlight the weaknesses of your product line while downplaying the strengths of their own offerings. Such subtle manipulations can easily go unnoticed, leading businesses down a path of poor strategic decisions. The lack of transparency in the data collection process is another key concern. Without understanding how the data was gathered, it’s impossible to assess its reliability and validity.

Impact of Inaccurate Data on Business Decisions

The consequences of using inaccurate free market research can range from minor inconveniences to catastrophic failures. A company might invest heavily in a new product line based on flawed market projections, only to discover that there’s significantly less demand than anticipated. This could lead to significant financial losses, damage to brand reputation, and even business closure. Similarly, incorrect market sizing can lead to under- or over-production, resulting in lost sales or wasted resources. The reliance on unreliable data can essentially blindside a business, preventing it from reacting effectively to actual market trends.

Best Practices for Ethical Sourcing and Use of Market Research Data

It is vital to establish clear best practices for handling market research data, regardless of its cost.

- Verify Data Sources: Always investigate the credibility and reputation of the source providing the free market research. Look for evidence of rigorous methodology and transparency in data collection. Cross-reference information with data from multiple sources to ensure consistency.

- Assess Methodology: Critically evaluate the methodology used to gather and analyze the data. Understand the sample size, sampling method, and potential biases. A well-designed study will clearly articulate its limitations.

- Consider Potential Conflicts of Interest: Be wary of free market research provided by organizations with a vested interest in influencing your business decisions. Identify and assess potential biases stemming from the source’s motivations.

- Consult with Experts: If you lack the internal expertise, consult with market research professionals to evaluate the quality and reliability of free market research before making significant business decisions.

- Transparency and Documentation: Maintain meticulous records of all market research used, including the source, methodology, and any identified limitations. This transparency ensures accountability and allows for future scrutiny.

Potential for Manipulation and Misrepresentation

The ease with which free market research can be manipulated or misrepresented is a serious concern. Data can be selectively presented, outliers can be ignored, and conclusions can be drawn that are not supported by the evidence. This manipulation can be intentional, driven by malicious actors seeking to gain a competitive advantage, or unintentional, resulting from sloppy research practices. The lack of oversight and regulation in the realm of free market research makes it particularly vulnerable to such abuses. A company might, for example, selectively highlight positive data points while burying negative ones, creating a misleading picture of market trends.

Final Conclusion

So, are free market research reports in Markstrat a blessing or a curse? The answer, like a perfectly executed marketing campaign, is nuanced. While the allure of free information is undeniable, it’s crucial to approach it with a healthy dose of skepticism and a keen eye for potential pitfalls. Remember, even free data can be misleading, and a poorly informed strategy is a recipe for disaster (and possibly a spectacularly funny business failure). By carefully weighing the costs and benefits, understanding the limitations, and incorporating both internal and external data sources, you can transform free market research from a potential liability into a powerful tool for achieving Markstrat dominance (and maybe even a few chuckles along the way). Go forth and conquer… or at least, try not to bankrupt your virtual company.

Common Queries

What happens if I completely ignore market research in Markstrat?

Expect a spectacular crash and burn. Your competitors will laugh all the way to the bank (or, you know, the virtual equivalent).

Are there any “hidden” data sources within Markstrat that aren’t immediately obvious?

Possibly! Experimentation and careful observation are key to unlocking Markstrat’s secrets. Think Sherlock Holmes meets a marketing MBA.

Can I use real-world market research data to inform my Markstrat decisions?

While not explicitly encouraged, you could certainly try! It might be a fun (and potentially enlightening) experiment, though be aware that real-world data might not perfectly align with the Markstrat simulation’s parameters.