Market Research Reports UK: sets the stage for this enthralling narrative, offering readers a glimpse into the surprisingly hilarious world of British market analysis. Forget dreary spreadsheets; we’re talking about uncovering hidden truths about the nation’s shopping habits, from the price of a proper cuppa to the latest trends in artisanal marmalade. Prepare for a journey filled with statistical surprises and enough data to make your head spin (in a good way, of course).

This exploration delves into the diverse landscape of UK market research reports, examining their various types, reliable sources, and insightful methodologies. We’ll navigate the complexities of data analysis, discovering how to spot a dodgy statistic a mile off, and ultimately, learn how to wield these reports like a weapon in the cutthroat world of business strategy. Think of it as your secret weapon for conquering the UK market, one meticulously researched pie chart at a time.

Market Research Report Types in the UK

Navigating the bewildering world of UK market research reports can feel like trying to decipher a particularly cryptic crossword – challenging, but ultimately rewarding (with the right tools, of course!). This section provides a clear and (dare we say it) entertaining overview of the various report types available, ensuring you’re armed with the knowledge to make informed decisions.

Types of Market Research Reports

UK market research reports come in a dazzling array of shapes and sizes, each tailored to a specific need. Think of them as bespoke suits for your business intelligence needs – some are tailored for a sharp, formal look, while others are more relaxed and casual, depending on the occasion (and your budget). Broadly speaking, these reports can be categorized into several key types, each offering unique insights. These categories often overlap, however, creating a delightful, if slightly confusing, tapestry of market intelligence.

Examples by Industry

Let’s get down to brass tacks (or, more appropriately, spreadsheets). The types of reports available vary significantly depending on the industry. For example, a technology report might delve into the adoption rate of AI in the fintech sector, meticulously analysing market share and predicting future growth. Meanwhile, a retail report could focus on consumer behaviour towards sustainable fashion, examining purchasing patterns and brand loyalty. The financial sector, naturally, demands a different approach, with reports often focusing on risk assessment, investment strategies, and regulatory compliance. Each industry has its own unique set of challenges and opportunities, and the reports reflect this diversity.

Typical Content Structure

A typical UK market research report follows a fairly standard structure, although the specifics can vary depending on the report’s purpose and the client’s requirements. Generally, you can expect to find an executive summary (the TL;DR version), a detailed methodology section (explaining how they got their data – no magic involved, we promise!), a comprehensive analysis of the market landscape, key findings, and finally, conclusions and recommendations. Think of it as a well-structured argument, meticulously building its case to persuade you (the reader) of its findings.

Comparison of Report Types

| Report Type | Scope | Methodology | Cost (Estimate) |

|---|---|---|---|

| Desk Research Report | Narrow, specific topic | Secondary data analysis | £1,000 – £5,000 |

| Quantitative Report | Broad, large sample size | Surveys, experiments | £5,000 – £20,000+ |

| Qualitative Report | In-depth understanding, smaller sample size | Focus groups, interviews | £3,000 – £15,000+ |

| Custom Report | Tailored to specific client needs | Varies depending on requirements | Varies greatly |

Sources of UK Market Research Reports

Finding the right UK market research report can feel like searching for a needle in a haystack – except the haystack is made of spreadsheets and the needle is… well, still a needle. But fear not, intrepid researcher! This section navigates the sometimes bewildering world of UK market research report sources, helping you separate the wheat from the chaff (and the genuinely useful data from the marketing fluff).

Reputable Publishers and Providers of UK Market Research offer a range of reports, from niche analyses to broad market overviews. Choosing the right source depends heavily on your specific needs and budget. A key factor to consider is the methodology employed; rigorous research is paramount. Remember, garbage in, garbage out.

Reputable Publishers and Providers

The UK boasts a vibrant market research landscape. Some well-established players include Mintel, Statista, IBISWorld, and Euromonitor International. These companies invest heavily in data collection and analysis, resulting in reports that are generally considered highly reliable. Smaller, specialist firms often focus on specific sectors, providing deeper insights into niche markets. Think of them as the artisanal bakers of the research world – their products may be less widely available, but they offer unparalleled quality in their area of expertise. For example, a firm specialising in the UK craft beer market will likely provide far more detailed information than a general market research firm.

Free Versus Paid Reports: Advantages and Disadvantages

The allure of free reports is undeniable, but as the old saying goes, “you get what you pay for.” Free reports often lack the depth and detail of paid reports, potentially relying on publicly available data and offering less rigorous analysis. They may also contain marketing bias, subtly pushing a particular product or service. Paid reports, conversely, typically offer comprehensive data, detailed analysis, and robust methodologies. The investment provides access to exclusive data and expert insights that can significantly impact strategic decision-making. Consider it like comparing a quick Google search to hiring a seasoned private investigator – one gets you some information, the other gets you the whole truth.

Information Quality and Reliability of Different Report Sources

The quality and reliability of market research reports vary considerably. Reports from established publishers generally adhere to higher standards of methodological rigor. Their reputations are built on delivering accurate and reliable data, and they have a vested interest in maintaining credibility. However, even reputable sources can be subject to limitations; the timing of data collection, the sampling methodology, and potential biases can all influence the accuracy of findings. Always critically assess the methodology employed before relying on any report’s conclusions. Think of it like this: even the best chef can’t make a gourmet meal with rotten ingredients.

Key Online Databases and Platforms

Several online databases and platforms aggregate UK market research reports. These platforms often provide search functionalities, allowing you to filter reports by industry, geography, and other criteria. Examples include the databases offered by major publishers (like those mentioned previously), as well as subscription-based platforms that collate reports from multiple sources. These platforms can be invaluable tools for researchers, offering a centralized location to access a wide range of information. Think of them as the ultimate research libraries, only instead of dusty books, they are filled with cutting-edge market data.

Analyzing Report Data & Methodology

Unpacking the mysteries of market research reports in the UK requires more than just a cuppa and a biscuit (though those certainly help). Understanding the data collection methods, interpreting the statistical shenanigans, and sniffing out potential biases is crucial to making sense of the findings and avoiding any potentially disastrous business decisions based on dodgy data. Let’s delve into the fascinating world of data analysis, shall we?

Market research reports in the UK employ a variety of data collection methods, each with its own strengths and weaknesses. Think of it as a culinary adventure, with different ingredients contributing to the final flavour (or, in this case, insights).

Common Data Collection Methods in UK Market Research

The methods used to gather information significantly impact the reliability and generalizability of the findings. A poorly chosen method can lead to results as useful as a chocolate teapot – completely useless, yet somehow still intriguing. Understanding these methods is therefore paramount.

- Surveys: These can range from online questionnaires (quick, cheap, and easily scalable) to telephone interviews (allowing for deeper probing but more expensive) and face-to-face interviews (providing rich qualitative data, but time-consuming and costly). Imagine a spectrum of survey methods, from the casual online poll to the highly structured in-depth interview.

- Focus Groups: These involve small groups of consumers discussing a particular topic, providing valuable qualitative insights into attitudes and behaviours. Think of it as a carefully orchestrated conversation, where the moderator guides the discussion and uncovers hidden gems of consumer opinion.

- Secondary Data Analysis: This involves using existing data sources, such as government statistics, industry reports, and academic publications. It’s a cost-effective way to gain a broad overview, but the data may not always perfectly align with the specific research question.

- Experiments: These are used to test the effectiveness of different marketing strategies or product features. Imagine carefully controlled tests, like A/B testing website designs or comparing the impact of different advertising campaigns. This method helps isolate cause and effect but can be complex and expensive.

- Observational Studies: These involve observing consumer behaviour in natural settings, such as supermarkets or shopping malls. Think of researchers discreetly observing shopping habits to uncover valuable insights into consumer choices and preferences.

Interpreting Key Statistical Indicators

Statistical indicators are the lifeblood of market research reports. They’re the numbers that tell the story, but interpreting them correctly requires a discerning eye and a healthy dose of skepticism. Misinterpreting these indicators can lead to wildly inaccurate conclusions, much like mistaking a chihuahua for a Great Dane.

- Market Size: This indicates the overall value or volume of a particular market. For example, the UK market for organic food might be valued at £X billion.

- Market Share: This represents the percentage of a market controlled by a specific company or brand. Company A might hold a 25% market share in the UK soft drinks market.

- Market Growth Rate: This shows the percentage change in market size over a specific period. The UK electric vehicle market might be growing at 15% annually.

- Average Revenue Per User (ARPU): This metric is relevant for subscription-based services and shows the average revenue generated per user. A streaming service might have an ARPU of £10 per month.

- Customer Acquisition Cost (CAC): This measures the cost of acquiring a new customer. A high CAC indicates challenges in attracting new customers.

Identifying Potential Biases and Limitations

No market research report is perfect. Every study has limitations, and biases can creep in, distorting the results. Think of it as a delicious cake with a slightly off-key ingredient – it might still be enjoyable, but it’s not quite as it should be. Identifying these flaws is crucial for a fair and accurate assessment.

Potential biases include sampling bias (where the sample doesn’t accurately represent the population), response bias (where respondents answer in a way they think is socially desirable), and interviewer bias (where the interviewer influences the responses).

Limitations might include the size and representativeness of the sample, the time frame of the study, or the specific methodology used. A small sample size, for instance, might not accurately reflect the opinions of the entire population.

Critically Evaluating the Methodology of a Market Research Report

Before accepting a report’s findings as gospel, it’s essential to critically examine the methodology. This involves a systematic approach to ensure the results are reliable and valid. Think of it as a thorough quality check before accepting a product – you wouldn’t buy a car without checking the engine, would you?

- Examine the research question and objectives: Are they clearly defined and relevant?

- Assess the sample size and sampling method: Is the sample large enough and representative of the target population?

- Evaluate the data collection methods: Are they appropriate for the research question? Are potential biases addressed?

- Review the data analysis techniques: Are they appropriate and correctly applied?

- Consider the limitations of the study: Are they acknowledged and discussed?

- Check the credibility of the research firm or author: Do they have a good reputation and relevant expertise?

Applications of UK Market Research Reports

Market research reports in the UK aren’t just dusty tomes gathering cobwebs in a forgotten corner; they’re dynamic tools that can propel businesses to dizzying heights (or at least, to slightly more profitable heights). Their applications are as diverse as the UK’s own quirky traditions, ranging from strategic planning to the development of products that even your nan would find appealing. Let’s delve into the fascinating world of how these reports are put to practical, and often hilarious, use.

Businesses utilize UK market research reports in a myriad of ways to inform strategic decision-making. It’s less about gazing into a crystal ball and more about using data to navigate the often-bewildering landscape of the British marketplace. Think of it as having a highly caffeinated, data-obsessed sherpa guiding you through the treacherous mountains of market competition.

Strategic Planning with Market Research Reports

Market research reports provide invaluable insights for strategic planning. For example, a report detailing shifting consumer preferences towards sustainable products could prompt a company to revise its supply chain, invest in eco-friendly materials, and reposition its brand as environmentally conscious. This isn’t just about doing good; it’s about doing good *business*. Another example: a report highlighting the growth of a specific niche market segment could inspire a company to tailor its offerings to that segment, potentially capturing a previously untapped market share. Imagine a company selling bespoke dog sweaters for Chihuahuas – the market research would have told them that was a goldmine!

Product Development Informed by Market Research

The role of market research reports in product development is crucial. Reports can identify unmet needs and gaps in the market, allowing companies to develop innovative products and services. A report highlighting a lack of affordable, high-quality vegan sausages, for instance, could lead to the creation of a successful new product line. Similarly, consumer feedback gathered through market research can be used to refine existing products, making them more appealing to the target market. Imagine a company making incredibly delicious but oddly-shaped biscuits – the market research might suggest a change to a more conventional shape!

Identifying Emerging Market Trends and Opportunities

UK market research reports are indispensable for identifying emerging trends and opportunities. These reports often track shifts in consumer behavior, technological advancements, and regulatory changes. A report highlighting the increasing popularity of plant-based diets, for example, could help a food company capitalize on this trend by expanding its vegan product offerings. Or perhaps a report showcasing the rise of online shopping among older demographics could lead a retailer to invest in improving its e-commerce platform and marketing strategies targeting this growing segment. This isn’t just about predicting the future; it’s about getting there first.

Hypothetical Scenario: The Case of the Perplexed Pickle Producer

Let’s imagine “Pickles R’ Us,” a venerable pickle producer facing declining sales. A market research report reveals that younger consumers are less inclined to purchase traditional dill pickles, preferring more adventurous flavour combinations. The report also highlights the growing popularity of spicy food. Armed with this information, Pickles R’ Us decides to develop a new line of spicy pickle flavours, such as jalapeño and habanero pickles, targeting a younger demographic. The marketing campaign emphasizes the exciting new flavours and the “adventurous” nature of the product. The result? A significant boost in sales and a revitalized brand image. The once-perplexed pickle producer is now happily munching on the fruits (or should we say, pickles?) of its labour.

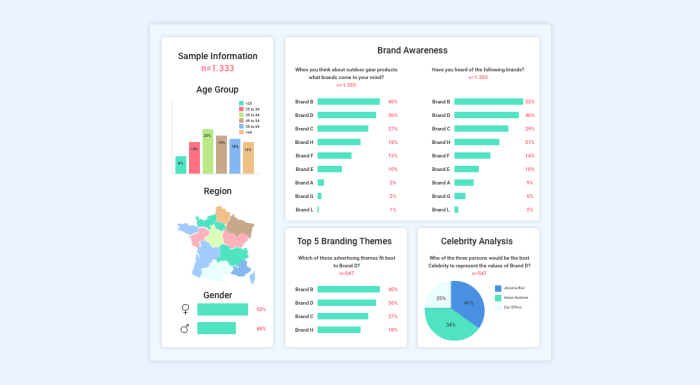

Visualizing Market Research Data

Data visualization is the unsung hero of market research reports. Without it, even the most meticulously gathered data risks resembling a particularly dull episode of Antiques Roadshow – fascinating to a select few, but ultimately leaving the majority scratching their heads. Effective visualization transforms complex information into easily digestible insights, allowing readers to grasp key trends and patterns with the speed and grace of a seasoned ballroom dancer.

Effective methods for visualizing data from UK market research reports involve choosing the right chart type to match the data and employing best practices for clarity and impact. Mismatched charts are like wearing socks and sandals to a royal wedding – technically possible, but aesthetically questionable and potentially offensive. The key is to select a visual representation that accurately reflects the nature of the data and helps tell a compelling story.

Chart Selection for Different Data Types

The selection of an appropriate chart type depends heavily on the type of data being presented. A pie chart, for example, is perfect for showing proportions of a whole (e.g., market share distribution among competing brands). However, using a pie chart to display time-series data would be like trying to use a tea cosy to mend a broken bicycle – utterly inappropriate. Line graphs, on the other hand, excel at illustrating trends over time, while bar charts are ideal for comparing discrete categories. Scatter plots are useful for exploring correlations between two variables. The wrong chart choice can lead to misinterpretations and a general air of confusion. Remember, clarity is king!

Best Practices for Creating Clear and Informative Data Visualizations

Creating effective visualizations is more than just picking a chart type; it’s an art form. Consider these best practices:

- Keep it simple: Avoid cluttering the chart with excessive detail. Remember, less is more. A cluttered chart is like a badly organized pantry – you might find what you need eventually, but the journey will be painful.

- Use clear and concise labels: Axis labels, titles, and legends should be unambiguous and easily understood. Think of it as writing a good headline – it needs to grab attention and accurately reflect the content.

- Choose appropriate colours: Use a consistent colour scheme that is both visually appealing and easy to interpret. Avoid clashing colours or using too many different shades. Colour blindness is a consideration, so ensure sufficient contrast.

- Highlight key findings: Use annotations or callouts to draw attention to important data points or trends. This is like highlighting key passages in a text; it makes it easier for the reader to identify the main points.

Examples of Data Visualizations

Let’s illustrate with three hypothetical visualizations representing market trends in the UK:

Visualization 1: Market Share of Coffee Shops in London (Pie Chart)

Imagine a pie chart showing the market share of different coffee shop chains in London. “Costa Coffee” might occupy the largest slice (35%), followed by “Starbucks” (25%), “Caffè Nero” (20%), and “Independent Coffee Shops” (20%). This instantly communicates the dominance of Costa and the relatively even split between the remaining players. The chart uses clear labels and easily distinguishable colours, avoiding overly complex designs.

Visualization 2: Growth of Online Grocery Shopping in the UK (Line Graph)

A line graph would perfectly depict the growth of online grocery shopping in the UK over the past five years. The x-axis would represent the years (2019-2023), and the y-axis would show the percentage growth. The line would likely demonstrate a steep upward trend, reflecting the increasing popularity of online grocery shopping, especially during and after the pandemic. Key data points (like a significant jump in 2020) could be highlighted with annotations. This clear representation illustrates a trend easily.

Visualization 3: Correlation between Disposable Income and Spending on Luxury Goods (Scatter Plot)

A scatter plot would effectively illustrate the relationship between disposable income and spending on luxury goods. Each point on the graph would represent an individual or household, with the x-axis representing disposable income and the y-axis representing spending on luxury goods. A positive correlation would be indicated by a general upward trend in the data points, suggesting that as disposable income increases, so does spending on luxury goods. This visual representation provides a simple way to identify and explore a relationship between two variables.

Regional Variations in UK Market Research: Market Research Reports Uk

The United Kingdom, despite its relatively small size, boasts a fascinating tapestry of regional differences that can significantly impact the success or failure of any product or service. Ignoring these nuances is akin to navigating a labyrinth blindfolded – you might stumble upon the cheese, but you’ll likely bruise yourself in the process. Understanding these regional variations is crucial for interpreting market research data accurately and developing effective marketing strategies. This section delves into the fascinating discrepancies that make the UK market so uniquely challenging (and rewarding!).

Regional variations in consumer behaviour and market dynamics across the UK are substantial and multifaceted, influencing the interpretation of market research findings profoundly. A one-size-fits-all approach is simply not viable. Think of it like trying to fit a square peg into a round hole – it’s possible, but it’s going to be messy and inefficient.

Key Regional Differences in Consumer Behaviour and Market Dynamics

The UK’s diverse regional economies and cultural identities result in distinct consumer preferences and purchasing habits. London, for instance, often displays a more cosmopolitan and internationally influenced consumer base compared to the more traditional markets of the North East. The South East, with its affluent commuter belt, shows different spending patterns than the more budget-conscious areas of Wales or the North West. These differences are reflected in everything from preferred brands and retail channels to attitudes towards sustainability and ethical consumption. Consider, for example, the popularity of independent retailers in certain areas versus the dominance of large supermarket chains in others. This necessitates a nuanced approach to market research, accounting for these regional disparities.

Influence of Regional Variations on Market Research Interpretation, Market research reports uk

Failing to consider regional variations can lead to skewed and misleading conclusions. For instance, a national survey showing high demand for a particular product might mask significantly lower demand in specific regions, rendering a national marketing campaign ineffective, or even wasteful. Imagine launching a luxury ice cream brand based solely on London data – you might find yourself with a freezer full of unsold goods in the North East. Therefore, it’s imperative to segment data geographically to gain a more accurate understanding of regional market potential and consumer preferences. A regional breakdown of data allows for targeted marketing campaigns and product adaptations, maximizing efficiency and return on investment.

Importance of Considering Regional Factors When Using UK Market Research Reports

The importance of incorporating regional perspectives into the interpretation of UK market research reports cannot be overstated. A national average can hide a multitude of sins, masking significant regional variations that can make or break a business. By analyzing regional data, businesses can identify untapped opportunities, tailor their offerings to specific markets, and optimize their marketing strategies for maximum impact. This detailed, granular analysis allows for a more effective allocation of resources and minimizes the risk of costly mistakes based on inaccurate, overly generalized insights.

A Mental Map of Key Regional Markets

Imagine a map of the UK. London, a vibrant hub of international influence, sits in the South East, radiating outwards with its influence, but showing distinctly different characteristics from its surrounding areas. The South West, with its coastal charm and tourist economy, displays different market dynamics than the industrial heartlands of the Midlands. The North, encompassing regions like the North West and North East, exhibits its own unique blend of industrial heritage and burgeoning digital sectors, demanding a tailored approach. Scotland and Wales, with their distinct cultures and languages, present further unique market opportunities, each demanding a separate and careful analysis. Each region, a distinct character in the grand narrative of the UK market, must be considered individually to gain a true understanding of the national landscape.

Final Summary

So, there you have it – a whirlwind tour of the fascinating, and occasionally funny, world of UK market research reports. From deciphering complex data to visualizing trends with flair (think less boring bar charts, more dazzling data dashboards!), we’ve covered the essentials. Armed with this knowledge, you’re now equipped to navigate the UK market with confidence, avoiding statistical pitfalls and making data-driven decisions that would make even the most seasoned market analyst envious. Now go forth and conquer (the market, that is!).

Answers to Common Questions

What’s the difference between qualitative and quantitative market research reports?

Qualitative reports delve into the “why” behind consumer behavior, using methods like interviews and focus groups. Quantitative reports focus on the “what,” using numerical data and statistical analysis to identify trends.

How can I ensure the reliability of a market research report?

Check the methodology section carefully. Look for clear descriptions of data collection methods, sample sizes, and potential biases. Reputable publishers and transparent methodologies are key indicators of reliability.

Are free market research reports worth using?

Free reports can offer valuable insights, but they often have limitations in scope and detail. Paid reports typically provide more comprehensive data and analysis.

Where can I find free UK market research reports?

Government websites (like the Office for National Statistics), industry associations, and some academic databases often offer free reports, though their scope may be limited.