Market Research Survey Report Sample: Prepare yourself for a rollercoaster ride through the thrilling world of data! Forget dry statistics; we’re diving headfirst into the captivating realm of consumer preferences, uncovering hidden truths about what makes people tick (and buy). We’ll unravel the mysteries of survey design, data visualization that’s actually visually appealing, and the art of interpreting results without losing your sanity. Buckle up, buttercup, it’s going to be a wild ride!

This report delves into the essential components of a market research survey report, from crafting compelling survey questions to presenting your findings in a way that even your grandma could understand (and maybe even enjoy). We’ll explore different survey types, show you how to avoid common pitfalls, and equip you with the tools to make sense of the data deluge. Think of it as your survival guide to the often-bewildering world of market research.

Understanding Market Research Survey Reports

Market research survey reports: the unsung heroes of informed business decisions. They’re like the crystal ball of the corporate world, but instead of hazy predictions, they offer data-driven insights – hopefully, without the need for a goat sacrifice. Let’s delve into their fascinating structure and decipher their secrets.

These reports aren’t just random collections of numbers; they’re meticulously crafted documents designed to present findings in a clear, concise, and (dare we say) engaging manner. Think of them as the well-organized, slightly less chaotic cousins of raw data.

Typical Structure of a Market Research Survey Report

A typical market research survey report follows a logical flow, guiding the reader from the problem statement to the actionable conclusions. It’s a journey, not a sprint, and each section plays a vital role in the overall narrative. Imagine it as a well-structured argument presented before a panel of very serious (and possibly slightly bored) executives.

Key Components of Market Research Survey Reports

Several key components ensure a report’s comprehensibility and impact. These components aren’t just randomly thrown together; they’re strategically placed to tell a compelling story about the market and the research findings. Missing even one could leave the narrative feeling incomplete, like a pizza with only cheese.

- Executive Summary: This is the tl;dr version, providing a concise overview of the entire report. Think of it as the appetizer – it needs to be enticing enough to make the reader want the main course.

- Introduction: Sets the stage, outlining the research objectives and methodology. This section provides context, like the introduction to a captivating novel.

- Methodology: Details how the research was conducted, including the sample size, data collection methods, and any limitations. Transparency is key here; it’s like showing your work in a math problem – you want to demonstrate the rigor of your approach.

- Findings: This is the heart of the report, presenting the data in a clear and organized manner, often using charts and graphs. It’s the main course – the most substantial part of the report.

- Analysis & Interpretation: Provides context and meaning to the findings, explaining trends and patterns. This section transforms raw data into actionable insights; it’s the chef’s special sauce that elevates the dish.

- Conclusions & Recommendations: Summarizes the key takeaways and offers actionable recommendations based on the findings. It’s the dessert – a sweet ending that leaves a lasting impression.

- Appendices: Contains supplementary materials, such as questionnaires and detailed data tables. Think of this as the recipe for the main course – detailed information for those who want a deeper dive.

Purpose of Each Section Within a Market Research Survey Report

Each section plays a crucial role in the overall narrative, building a cohesive and compelling case for the findings. Think of it as a well-orchestrated symphony, where each instrument (section) contributes to the overall harmony.

Examples of Different Types of Market Research Survey Reports

Market research reports aren’t a one-size-fits-all affair; their style and focus depend heavily on the research objectives. Choosing the right type is crucial, like choosing the right tool for the job. A hammer won’t work well for fixing a leaky faucet.

- Quantitative Reports: These reports focus on numerical data, often using statistical analysis to identify trends and patterns. Think large-scale surveys with lots of numbers and graphs – perfect for understanding broad market trends.

- Qualitative Reports: These reports delve into the “why” behind the numbers, exploring in-depth consumer opinions and experiences through interviews, focus groups, and open-ended survey questions. These reports provide rich insights into consumer motivations and perceptions – perfect for understanding the “why” behind the numbers.

Sample Survey Questions and Design

Designing a market research survey is like crafting the perfect comedic routine – you need the right mix of setup, punchline, and audience engagement (or in this case, respondent participation!). A well-structured survey, with questions that are both insightful and engaging, is crucial for extracting valuable data. This section delves into the art of crafting effective survey questions and designing a questionnaire that will leave your respondents both informed and entertained (hopefully!).

Multiple-Choice Questions for New Product Preference

Multiple-choice questions are the workhorses of market research, offering a simple yet effective way to gather data on preferences. The key is to keep the options concise, mutually exclusive, and, if possible, a little bit amusing. Below are five examples focusing on a hypothetical new “self-folding laundry basket” – because who doesn’t need a bit less laundry-related drudgery in their lives?

| Question | Response Options |

|---|---|

| What is your primary laundry-folding method? |

|

| How much would you be willing to pay for a self-folding laundry basket? |

|

| How often do you do laundry? |

|

| What is the most important feature of a laundry basket for you? |

|

| Would you recommend this self-folding laundry basket to a friend? |

|

Open-Ended Questions for Customer Satisfaction

Open-ended questions provide a more nuanced understanding of customer sentiment. They allow respondents to express their thoughts and feelings in their own words, offering richer insights than multiple-choice questions. The challenge is to keep them concise and focused to avoid rambling responses. Here are three examples for a customer satisfaction survey on a fictional artisanal pickle company:

| Question |

|---|

| What did you like most about our artisanal pickles? |

| What could we improve to enhance your pickle-eating experience? |

| Would you recommend our pickles to a friend? If so, why? If not, why not? (Be honest, we can take it!) |

Rating Scales in Market Research Surveys

Rating scales provide a structured way to quantify respondent opinions. Different scales offer varying levels of granularity and sensitivity.

| Scale Type | Description | Advantages | Disadvantages |

|---|---|---|---|

| Likert Scale | Respondents rate their agreement or disagreement with a statement on a scale (e.g., Strongly Agree to Strongly Disagree). | Easy to understand and administer; provides quantitative data. | Can be susceptible to response bias (e.g., central tendency bias). |

| Semantic Differential Scale | Respondents rate a concept on a scale between two bipolar adjectives (e.g., Good-Bad, Expensive-Inexpensive). | Provides a nuanced understanding of attitudes; visually appealing. | Can be difficult to interpret if the adjectives are not clearly defined. |

| Numerical Rating Scale | Respondents rate a concept on a numerical scale (e.g., 1-5, 1-10). | Simple and straightforward; easy to analyze statistically. | Can lack the richness of detail provided by other scales. |

Sample Survey Questionnaire

Putting it all together, here’s a sample survey questionnaire incorporating the above question types and some demographic questions (because knowing your audience is half the battle).

| Section | Question | Question Type |

|---|---|---|

| Demographics | Age Range | Multiple Choice |

| Demographics | Gender | Multiple Choice |

| Product Preference | What is your primary laundry-folding method? | Multiple Choice |

| Product Preference | How much would you be willing to pay for a self-folding laundry basket? | Multiple Choice |

| Product Preference | How often do you do laundry? | Multiple Choice |

| Product Preference | What is the most important feature of a laundry basket for you? | Multiple Choice |

| Product Preference | Would you recommend this self-folding laundry basket to a friend? | Multiple Choice |

| Customer Satisfaction (Hypothetical Pickle Company) | What did you like most about our artisanal pickles? | Open-ended |

| Customer Satisfaction (Hypothetical Pickle Company) | What could we improve to enhance your pickle-eating experience? | Open-ended |

| Customer Satisfaction (Hypothetical Pickle Company) | Would you recommend our pickles to a friend? If so, why? If not, why not? | Open-ended |

| Overall Satisfaction | Rate your overall satisfaction with [Product/Service] on a scale of 1-5 (1 being very dissatisfied, 5 being very satisfied). | Numerical Rating Scale |

Data Presentation and Visualization

Let’s face it, raw data is about as exciting as watching paint dry. Unless you’re a particularly enthusiastic paint-watcher, that is. To truly understand the insights hidden within your market research, you need to transform those numbers into something visually appealing and easily digestible. Think of data visualization as the superhero of market research – it rescues your findings from the clutches of boredom and presents them in a way that’s both informative and, dare we say, even fun.

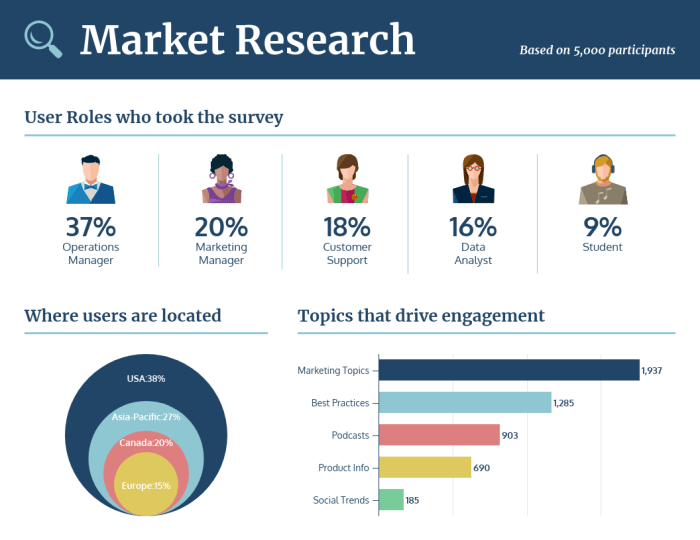

Data visualization techniques are crucial for effectively communicating the results of your survey. They allow you to identify patterns, trends, and relationships in your data that might otherwise go unnoticed. A well-designed visual can be worth a thousand (or more!) words, especially when dealing with complex datasets.

Bar Charts: A Visual Feast

Bar charts are a classic and versatile way to display the distribution of responses to multiple-choice questions. They’re simple to understand, easy to create, and can effectively highlight differences between categories.

Let’s imagine a survey question: “What is your favorite type of pizza?” with the options: Pepperoni, Cheese, Veggie, and Hawaiian. The results might look something like this (imagine a visually stunning bar chart here!):

Sample Bar Chart:

A bar chart would display “Type of Pizza” on the horizontal (x) axis and “Number of Respondents” on the vertical (y) axis. Each type of pizza would have a corresponding bar, the height of which represents the number of respondents who selected that option. For example, if 50 people chose Pepperoni, the bar for Pepperoni would reach the 50 mark on the y-axis. A clear and concise title, such as “Favorite Pizza Type Preferences,” would sit at the top.

Pie Charts: A Slice of Insight

Pie charts are excellent for showcasing the percentage breakdown of responses. They’re particularly effective when illustrating proportions or market share.

Let’s say we asked the question: “How often do you eat pizza?” with options: Daily, Weekly, Monthly, Rarely. A pie chart would perfectly visualize the proportion of respondents who chose each frequency.

Sample Pie Chart:

The pie chart would be divided into segments, each representing one response option. The size of each segment would be proportional to the percentage of respondents who selected that option. A legend would clearly identify each segment (e.g., Daily: 25%, Weekly: 40%, etc.). The title might be “Pizza Consumption Frequency.” By looking at the relative sizes of the segments, we can quickly grasp the overall distribution of pizza eating habits. For example, a large segment for “Weekly” would indicate that many people eat pizza weekly.

Thematic Analysis of Open-Ended Responses: Uncovering Hidden Gems, Market research survey report sample

Open-ended questions allow respondents to express their opinions in their own words, providing rich qualitative data. However, analyzing this data can be time-consuming. Thematic analysis helps to organize and interpret these responses by identifying recurring themes or patterns.

Let’s assume we asked: “What do you like most about pizza?” After collecting the responses, we’d categorize them into themes like “Taste,” “Texture,” “Variety,” and “Convenience.” We then count how many responses fall under each theme. This data can be presented in a clear table:

| Theme | Frequency |

|---|---|

| Taste | 65 |

| Texture | 32 |

| Variety | 48 |

| Convenience | 25 |

This table summarizes the key themes identified in the open-ended responses and their frequency, making it easy to identify the most prevalent opinions.

Interpreting Survey Results

Unraveling the mysteries hidden within survey data can be a thrilling adventure, much like searching for buried treasure (except instead of gold doubloons, you find insights into consumer preferences). But beware, dear reader, for the path is fraught with peril – namely, potential biases and the occasional statistical swamp monster. Let’s navigate these treacherous waters together.

Interpreting survey results requires a keen eye for detail and a healthy dose of skepticism. Simply crunching numbers isn’t enough; we need to understand the context, the limitations, and the potential pitfalls that can lead us astray. Think of it as detective work, where the clues are percentages and the culprit is… well, sometimes it’s a poorly designed question, and sometimes it’s the sneaky influence of external factors.

Potential Biases in Market Research Surveys and Their Effects

Biases can significantly skew survey results, leading to inaccurate conclusions. For example, a survey conducted solely through social media might overrepresent younger demographics and those who are digitally savvy, while underrepresenting older populations who may prefer other communication methods. Similarly, leading questions – those phrased in a way that suggests a preferred answer – can heavily influence responses. Imagine asking, “Don’t you agree that our product is superior?” The subtle pressure can lead to a distorted view of actual consumer sentiment. A response bias could also occur if respondents feel pressured to answer in a socially desirable way, rather than honestly. For instance, respondents might underreport their alcohol consumption or overreport their charitable donations. These biases, if left unaddressed, can lead to faulty market analysis and ultimately, poor business decisions.

Comparison of Descriptive and Inferential Statistics in Survey Data Analysis

Descriptive statistics, like calculating the average age of respondents or the percentage who prefer a particular brand, summarize the data in a straightforward way. They’re like a snapshot of your survey’s results. Inferential statistics, on the other hand, take things a step further. They use sample data to make inferences about a larger population. For example, inferential statistics could help you determine, with a certain level of confidence, whether the preference for a particular product is statistically significant across the entire market, not just within your sample. While descriptive statistics provide a clear picture of your sample, inferential statistics allow you to generalize your findings to a broader audience – a crucial step in making informed business decisions.

Limitations of Using Only Survey Data to Understand Market Trends

Relying solely on survey data can be like trying to understand a complex novel by only reading the chapter summaries. Surveys provide valuable insights, but they don’t tell the whole story. They capture stated preferences, but not necessarily actual behavior. For example, a respondent might say they intend to buy a new car next year, but various factors could influence their actual purchasing decision. Furthermore, surveys are often limited by their sample size and representativeness, which can affect the generalizability of the results. Ignoring other data sources, like sales figures, market share data, or competitor analysis, creates an incomplete and potentially misleading picture of market trends.

Integrating Survey Data with Other Data Sources for Comprehensive Market Understanding

To gain a truly comprehensive understanding of the market, survey data should be integrated with other sources. Imagine a delicious market research stew: survey data is a key ingredient, but it needs other elements to be truly satisfying. Combining survey results with sales data, for example, can reveal the gap between stated intentions and actual purchasing behavior. Integrating this with social media analytics can highlight emerging trends and sentiment, while competitor analysis can place your findings within a broader competitive context. This integrated approach allows for a richer, more nuanced understanding of market dynamics and consumer behavior, leading to more effective marketing strategies and ultimately, greater business success.

Report Writing and Formatting: Market Research Survey Report Sample

Crafting a market research report isn’t just about crunching numbers; it’s about presenting those numbers in a way that’s both compelling and comprehensible. Think of it as translating the language of statistics into plain English (with maybe a dash of witty charm). A well-structured report is your key to unlocking insights and persuading your audience – be it board members, investors, or even your slightly skeptical cat.

The essential elements of a well-written market research survey report are like the building blocks of a magnificent (and slightly nerdy) castle. Without them, you’re left with a pile of rubble and a very disappointed king. These essential elements ensure your findings are clearly communicated and easily understood, avoiding the dreaded “data graveyard” where insightful information goes to die.

Essential Elements of a Market Research Report

A well-structured market research report typically includes an executive summary, a detailed methodology section, a presentation of findings, and finally, recommendations based on those findings. The executive summary acts as a concise overview, while the methodology section details how the data was collected and analyzed. The findings section presents the results, and the recommendations section suggests actionable steps based on the results. Think of it as a delicious three-course meal: appetizer (executive summary), main course (findings), and dessert (recommendations), all meticulously prepared using the recipe (methodology).

Sample Executive Summary

Executive Summary: Consumer Preferences for Artisanal Pickle Brands

This report details the findings of a market research survey conducted to assess consumer preferences for artisanal pickle brands in the greater metropolitan area. The survey, conducted in [Month, Year], involved [Number] respondents representing a diverse demographic. Key findings reveal a strong preference for locally sourced ingredients (85%), a growing demand for unique flavor profiles (72%), and a willingness to pay a premium for high-quality pickles (68%). The report concludes with recommendations for artisanal pickle brands to capitalize on these trends by focusing on sustainable sourcing, innovative flavor development, and premium pricing strategies. We predict that the artisanal pickle market will experience significant growth in the next five years, with a potential market expansion of [Percentage] based on current trends. This aligns with similar growth observed in the gourmet food industry, specifically the rise of artisanal jams and honey.

Table of Contents

| Section | Page |

|---|---|

| Executive Summary | 1 |

| Methodology | 2 |

| Findings: Consumer Demographics | 3 |

| Findings: Brand Preferences | 5 |

| Findings: Purchase Behavior | 7 |

| Recommendations | 9 |

| Appendix | 11 |

Communicating Complex Statistical Findings

Communicating complex statistical findings to a non-technical audience requires a delicate balance of precision and clarity. Avoid jargon and technical terms like they’re the plague. Instead, use clear, concise language, supported by visual aids such as charts and graphs. Think of it like explaining quantum physics to your grandma – you want to convey the essence of the information without losing her in a sea of complex equations. Analogies and real-world examples are your best friends here. For instance, instead of saying “The standard deviation was 2.5,” you might say “Most people’s responses clustered around the average, with only a small spread of differing opinions.” Visualizations like bar charts or pie charts can effectively communicate proportions and distributions. A well-placed image of a friendly pie chart can often be more effective than a page of complex statistical data.

Wrap-Up

So, there you have it – a whirlwind tour of market research survey reports! We’ve journeyed from the initial spark of an idea to the triumphant unveiling of insightful conclusions. Remember, a well-crafted survey report isn’t just a collection of numbers; it’s a compelling narrative that reveals valuable market insights. Armed with this knowledge, you can now confidently navigate the fascinating (and sometimes funny) world of market research, armed with the power of data and a healthy dose of humor. Go forth and conquer those spreadsheets!

Key Questions Answered

What’s the difference between quantitative and qualitative research?

Quantitative research uses numbers and statistics to measure things objectively, while qualitative research explores opinions and experiences in a more subjective way. Think numbers vs. narratives.

How do I avoid bias in my survey?

Carefully word your questions to avoid leading respondents, use a diverse sample group, and be aware of your own biases. Pretend you’re a judge in a baking competition – fairness is key!

What if my survey results are inconclusive?

Don’t panic! Inconclusive results are sometimes just a sign that more research is needed. It’s an opportunity to refine your approach and dig deeper. Consider it a thrilling cliffhanger for your next research endeavor.