Understanding and managing market risk is paramount for any organization operating in today’s dynamic financial landscape. This analysis delves into the core concepts of market risk, exploring various types, measurement techniques, and mitigation strategies. From identifying exposures within diverse portfolios to employing sophisticated tools like Value at Risk (VaR), we navigate the complexities of navigating market volatility and safeguarding financial assets. We’ll examine real-world case studies, highlighting the devastating consequences of unchecked market risk and showcasing successful risk management approaches.

This guide provides a practical framework for assessing, measuring, and mitigating market risk, equipping readers with the knowledge and tools necessary to make informed decisions and protect their investments. We’ll cover key methodologies, regulatory frameworks, and best practices, offering a comprehensive understanding of this critical aspect of financial management.

Defining Market Risk

Market risk encompasses the potential for losses in financial instruments due to fluctuations in market prices. These fluctuations are driven by various factors, both macroeconomic and microeconomic, impacting the overall value of an asset or portfolio. Understanding and managing market risk is crucial for any investor or financial institution to ensure stability and profitability.

Market risk is inherently unpredictable, but its potential impact can be significant. Effective risk management strategies involve identifying potential exposures, quantifying the risk, and implementing measures to mitigate potential losses. This involves a combination of analytical tools, diversification strategies, and hedging techniques.

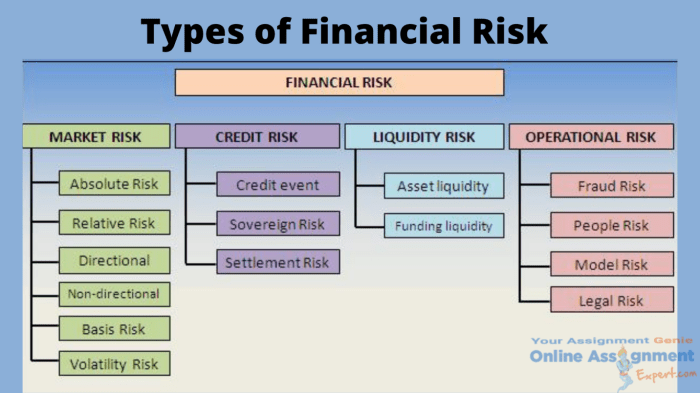

Types of Market Risk

Market risk manifests in several forms, each with its own characteristics and potential impact. Understanding these different types allows for a more nuanced approach to risk management.

| Risk Type | Source | Potential Impact | Example |

|---|---|---|---|

| Interest Rate Risk | Changes in prevailing interest rates | Fluctuations in the value of fixed-income securities; increased borrowing costs | Rising interest rates can decrease the value of bonds, while falling rates can increase the value. The 2022 increase in interest rates led to significant losses in the bond market. |

| Equity Risk | Changes in stock prices | Losses in equity investments; impact on company valuations | The dot-com bubble burst in 2000 and the 2008 global financial crisis both demonstrated significant equity risk, with widespread declines in stock market values. |

| Currency Risk (Foreign Exchange Risk) | Fluctuations in exchange rates between currencies | Losses on international transactions; changes in the value of foreign assets | A weakening US dollar against the Euro would negatively impact US companies with Euro-denominated liabilities. Conversely, it would benefit European companies selling goods in the US. |

| Commodity Risk | Price fluctuations in raw materials and other commodities | Changes in the cost of production; impact on profitability of commodity-related businesses | The price volatility of oil significantly impacts energy companies and consumers. Sharp increases in oil prices, as seen in 2008 and 2022, can lead to inflation and economic slowdown. |

Real-World Examples of Market Risk Exposures

Several significant real-world events highlight the potential for substantial losses due to market risk. These events underscore the importance of proactive risk management strategies.

The 1987 Black Monday stock market crash, for instance, saw a dramatic single-day decline in stock prices worldwide, demonstrating the potential for sudden and significant market downturns. The 2008 global financial crisis, triggered by the collapse of the US housing market and subsequent credit crunch, showcased the interconnectedness of various market risks and their cascading effects on the global economy. The COVID-19 pandemic in 2020 caused significant market volatility across various asset classes, highlighting the impact of unforeseen global events.

Identifying Market Risk Exposures

Understanding and quantifying market risk exposures is crucial for effective risk management. This involves identifying the specific factors that can negatively impact an organization’s financial performance and developing methods to measure the potential losses associated with these factors. This section will explore key influencing factors, measurement methods, sensitivity analysis, and illustrate the process with a hypothetical portfolio example.

Key Factors Influencing Market Risk Across Industries

Market risk manifests differently across various industries. For example, the financial services sector faces interest rate risk and credit risk, while energy companies are significantly exposed to commodity price volatility. Technology firms, on the other hand, might be heavily impacted by changes in consumer demand and technological disruption. Understanding these industry-specific vulnerabilities is paramount for effective risk management. A company’s specific market risk profile will depend on its business model, geographical location, and the types of assets it holds. For instance, a manufacturing company with significant raw material costs will be heavily exposed to commodity price fluctuations, whereas a real estate investment trust (REIT) will be more sensitive to interest rate changes and fluctuations in property values.

Methods for Identifying and Measuring Market Risk Exposures

Several methods exist for identifying and measuring market risk exposures within a portfolio. Value-at-Risk (VaR) is a widely used approach that quantifies the potential loss in value of a portfolio over a specific time horizon and confidence level. Another method is scenario analysis, which involves simulating various market conditions and evaluating the portfolio’s performance under each scenario. Stress testing, a more extreme form of scenario analysis, focuses on evaluating the portfolio’s resilience under severe market shocks. The choice of method depends on the complexity of the portfolio and the level of detail required. For example, a simple portfolio might be adequately assessed using VaR, while a more complex portfolio may require a combination of VaR, scenario analysis, and stress testing.

Sensitivity Analysis in Assessing Market Risk

Sensitivity analysis is a valuable tool for understanding the impact of changes in market factors on a portfolio’s value. It involves calculating the change in portfolio value for a given change in a specific market variable, such as interest rates or equity prices. This provides insights into the portfolio’s sensitivity to different market risks. For instance, a sensitivity analysis might reveal that a portfolio is highly sensitive to changes in interest rates, indicating a significant interest rate risk exposure. This information can then be used to develop hedging strategies or adjust the portfolio’s composition to mitigate the risk. The results are often presented as a sensitivity matrix, showing the change in portfolio value for a unit change in each market factor.

Hypothetical Portfolio and Market Risk Exposure Identification

Let’s consider a hypothetical portfolio consisting of three assets: $50,000 invested in a stock with a beta of 1.2, $30,000 in a bond with a duration of 5 years, and $20,000 in a commodity with a historical volatility of 20%. To identify the market risk exposures, we can use several approaches. Firstly, the stock’s beta indicates its sensitivity to market movements. A beta of 1.2 suggests that the stock’s price is expected to move 1.2 times more than the overall market. The bond’s duration reflects its sensitivity to interest rate changes; a higher duration means greater sensitivity. Finally, the commodity’s volatility provides a measure of its price fluctuations. By analyzing the historical data and correlations between these assets and market indices, we can estimate the potential losses under different market scenarios. For example, a market downturn might significantly impact the stock’s value, while a rise in interest rates could negatively affect the bond’s value. This analysis highlights the portfolio’s exposure to equity market risk, interest rate risk, and commodity price risk. Further analysis, such as scenario analysis or VaR calculations, would provide a more quantitative assessment of these risks.

Measuring Market Risk

Measuring market risk involves quantifying the potential losses a portfolio might experience due to adverse movements in market factors like interest rates, exchange rates, and equity prices. Several quantitative methods exist, each with its strengths and weaknesses. A key metric is Value at Risk (VaR), which estimates the maximum potential loss over a specific time horizon with a given confidence level. Other methods, such as stress testing, complement VaR by assessing resilience under extreme scenarios.

Value at Risk (VaR) Methodologies

VaR is a widely used tool for measuring market risk. Different methodologies exist for calculating VaR, each relying on different assumptions and data requirements. The three primary approaches are parametric VaR, historical simulation VaR, and Monte Carlo simulation VaR. The choice of method depends on factors such as data availability, computational resources, and the desired level of sophistication.

Parametric VaR

Parametric VaR, also known as the variance-covariance method, is a relatively simple approach that assumes the returns of portfolio assets follow a normal distribution. It utilizes historical data to estimate the mean and standard deviation of portfolio returns. This information, along with the desired confidence level and time horizon, is then used to calculate the VaR. A key limitation is the assumption of normality, which may not always hold true in real-world markets. The formula for parametric VaR is:

VaR = μ – σ * Zα

where: μ is the mean portfolio return, σ is the portfolio standard deviation, and Zα is the Z-score corresponding to the desired confidence level (α). For example, a 95% confidence level corresponds to a Z-score of approximately 1.645.

Historical Simulation VaR

Historical simulation VaR avoids the assumption of normality by directly using historical portfolio returns to estimate the VaR. The method involves sorting historical returns in ascending order and selecting the return at the desired percentile. For a 95% confidence level, the 5th percentile return is selected. This return represents the VaR. While this approach is straightforward, it is sensitive to the length and quality of the historical data used. Furthermore, it assumes that past market behavior is a good predictor of future behavior, which may not always be the case.

Monte Carlo Simulation VaR

Monte Carlo simulation offers a more flexible approach. It involves generating a large number of random portfolio return scenarios based on the assumed distribution of market factors. These scenarios are used to estimate the distribution of potential portfolio losses, from which the VaR can be determined. This method allows for the incorporation of more complex relationships between assets and market factors, but it requires significant computational resources and relies heavily on the accuracy of the input distributions.

Calculating VaR Using Historical Data: A Step-by-Step Procedure

Let’s illustrate calculating VaR using historical simulation. Assume we have daily returns for a portfolio over the past 250 trading days.

1. Gather Data: Collect the daily portfolio returns (e.g., percentage changes in portfolio value) for the past 250 days.

2. Sort Returns: Sort the returns in ascending order.

3. Determine Percentile: For a 95% confidence level, identify the return at the 5th percentile (5% of 250 days is approximately 12.5, so we can round to the 13th lowest return).

4. Calculate VaR: This 13th lowest return represents the 95% VaR over one day. For example, if the 13th lowest return is -2%, the one-day 95% VaR is 2%. To obtain the VaR for a longer time horizon (e.g., 10 days), one can scale the daily VaR by the square root of the time horizon (√10 ≈ 3.16). In this case, the 10-day 95% VaR would be approximately 6.32%.

Stress Testing

Stress testing assesses the resilience of a portfolio to extreme market events. Unlike VaR, which focuses on a specific confidence level, stress testing involves simulating the impact of various extreme scenarios, such as a sudden sharp decline in market indices or a significant increase in interest rates. This can involve adjusting key market variables (e.g., equity prices, interest rates, exchange rates) to reflect extreme, but plausible, events. The results provide insights into the potential losses under these scenarios, helping to identify vulnerabilities and inform risk management strategies. For example, one might stress test a portfolio by simulating a 20% drop in all equity holdings simultaneously, assessing the portfolio’s resulting value and potential losses. Another example could involve simulating a sudden and substantial increase in interest rates, observing the impact on fixed-income securities.

Managing Market Risk

Effective market risk management is crucial for the financial health and stability of any organization exposed to market fluctuations. A robust strategy involves a multifaceted approach encompassing proactive risk identification, precise measurement, and the implementation of suitable mitigation techniques. Ignoring market risk can lead to significant financial losses and reputational damage.

Market Risk Mitigation Strategies

Organizations employ various strategies to manage and mitigate market risk. These strategies aim to reduce the potential for losses stemming from adverse movements in market variables like interest rates, exchange rates, and equity prices. The choice of strategy depends on the specific risk profile of the organization, its risk appetite, and the nature of its market exposures. Diversification, for instance, spreads risk across multiple asset classes, reducing the impact of any single market downturn. Similarly, limiting exposure to specific markets or asset classes can significantly reduce vulnerability. Furthermore, active risk management involves continuous monitoring of market conditions and adjusting positions as needed to minimize potential losses.

Hedging Techniques

Hedging involves using financial instruments to offset potential losses from adverse market movements. Derivatives, such as futures, options, and swaps, are commonly used hedging tools. For example, a company expecting to receive a large sum of foreign currency in the future might use currency futures contracts to lock in a favorable exchange rate, mitigating the risk of currency depreciation. Options provide flexibility, allowing the holder to buy or sell an underlying asset at a predetermined price (the strike price) within a specified timeframe. This flexibility can be particularly valuable in managing uncertainty about future market movements. The effective use of hedging requires a deep understanding of the market dynamics and the characteristics of the hedging instruments employed.

Risk Management Frameworks

Several risk management frameworks provide guidelines and standards for managing market risk. The Basel Accords, a set of international banking regulations, are a prominent example. These accords establish minimum capital requirements for banks based on their risk exposures, encouraging banks to implement robust risk management systems. The framework focuses on various aspects of risk management, including internal controls, stress testing, and the use of sophisticated risk models. Compliance with these frameworks helps to ensure the stability and soundness of the financial system. Other frameworks, such as those developed by industry associations and regulatory bodies, offer further guidance on best practices for managing market risk across different sectors.

Best Practices for Effective Market Risk Management

Effective market risk management requires a holistic and proactive approach. A robust system includes the following best practices:

- Regular and comprehensive risk assessments to identify and quantify market risk exposures.

- Implementation of a clear risk management policy outlining the organization’s risk appetite and tolerance.

- Development and use of sophisticated risk models to measure and monitor market risk.

- Regular stress testing to assess the organization’s resilience to extreme market events.

- Effective internal controls to prevent and detect market risk-related fraud and errors.

- Continuous monitoring of market conditions and adjustments to risk management strategies as needed.

- Regular reporting and communication of market risk information to senior management and relevant stakeholders.

- Ongoing training and development of personnel involved in market risk management.

Market Risk Reporting and Monitoring

Effective market risk reporting and monitoring are crucial for maintaining a healthy financial position and ensuring regulatory compliance. A robust system provides timely insights into evolving market conditions and the organization’s exposure, enabling proactive risk management. This allows for informed decision-making and the implementation of appropriate mitigation strategies.

Key Components of a Comprehensive Market Risk Report

A comprehensive market risk report should include a clear and concise overview of the organization’s market risk exposures across various asset classes. This involves a detailed analysis of potential losses, considering different market scenarios and the organization’s risk appetite. The report should be easily understandable for both risk management professionals and senior management, regardless of their specific financial expertise. Key elements include a summary of current market conditions, a detailed breakdown of exposures, and a forward-looking assessment of potential risks. Quantitative metrics such as Value at Risk (VaR) and stress testing results should be presented alongside qualitative assessments of the broader market environment.

Importance of Regular Market Risk Monitoring and Surveillance

Regular monitoring and surveillance are essential for identifying emerging risks and assessing the effectiveness of implemented mitigation strategies. Continuous monitoring allows for early detection of changes in market conditions or internal processes that could significantly impact risk exposures. This proactive approach enables timely adjustments to risk management strategies, minimizing potential losses and protecting the organization’s financial stability. Without consistent monitoring, organizations risk missing critical shifts in the market, leading to unexpected losses and regulatory issues. Furthermore, regular review helps refine risk models and procedures, leading to improved accuracy and effectiveness over time.

Sample Market Risk Report

This sample report focuses on a hypothetical investment portfolio. Assume the portfolio consists primarily of equities and fixed-income securities.

| Metric | Value | Visualization |

|---|---|---|

| Value at Risk (VaR) – 99% Confidence, 10-Day Horizon | $1,000,000 | A bar chart showing the VaR value and confidence intervals. The bar would extend to $1,000,000, with shaded areas indicating the confidence intervals. |

| Maximum Potential Loss (MPL) | $2,500,000 | A line graph illustrating potential losses under different stress scenarios (e.g., market crash, interest rate spike). The graph would show a steep increase in losses under extreme stress scenarios. |

| Exposure by Asset Class | Equities: 60%, Fixed Income: 40% | A pie chart illustrating the proportion of the portfolio invested in each asset class. The pie would be divided into two segments, with 60% representing equities and 40% fixed income. |

| Stress Test Results (Market Crash Scenario) | Portfolio Value Decline: 20% | A table detailing the impact of a simulated market crash on different portfolio components. The table would show the percentage decline in value for equities and fixed income. |

System for Tracking Key Risk Indicators (KRIs) and Escalating Significant Changes

A robust system for tracking KRIs involves establishing clear thresholds for each indicator and defining escalation procedures for when these thresholds are breached. This typically involves a combination of automated alerts and regular manual reviews. For example, if the VaR exceeds a predefined limit, an automated alert would be triggered, notifying relevant personnel. Similarly, significant changes in market volatility or credit spreads would be flagged, triggering a review of the organization’s risk profile and potential adjustments to its risk management strategies. This system should clearly define responsibilities and communication channels for escalating significant risk events. Regular reporting and reviews of the KRI system are crucial to ensure its effectiveness and relevance. A well-defined escalation matrix, outlining the appropriate actions and responsible parties for different risk levels, would be integral to this system.

Illustrative Examples of Market Risk Events

Understanding market risk requires examining real-world events that highlight its impact. The following examples illustrate the devastating consequences of significant market fluctuations and the importance of robust risk management strategies.

The 1987 Black Monday Stock Market Crash

Black Monday, October 19, 1987, witnessed the largest one-day percentage drop in stock market history for the United States. The Dow Jones Industrial Average plummeted 22.6%, a catastrophic event that sent shockwaves through global financial markets. While the exact causes remain debated, contributing factors included program trading (algorithmic trading strategies), concerns about rising interest rates, and a general overvaluation of the market. The crash exposed vulnerabilities in the financial system and led to increased regulatory scrutiny of market mechanisms and trading practices. The consequences were widespread, including significant losses for investors, increased market volatility for years following the event, and a reassessment of risk management techniques within financial institutions. Many companies experienced substantial declines in their market capitalization, impacting investment decisions and future growth prospects.

The 2008 Global Financial Crisis

The 2008 global financial crisis, triggered by the collapse of the US housing market, serves as a stark example of systemic market risk. The subprime mortgage crisis, characterized by the widespread issuance of high-risk mortgages to borrowers with poor credit, led to a cascade of defaults and the collapse of major financial institutions. The interconnectedness of global financial markets amplified the crisis, resulting in a credit crunch, a sharp decline in asset values across various asset classes (including stocks, bonds, and real estate), and a severe global recession. The crisis highlighted the dangers of excessive leverage, inadequate risk management practices, and the systemic risks associated with complex financial instruments like mortgage-backed securities. The interconnected nature of the global financial system ensured that the crisis was not confined to the United States; its impact rippled throughout the world, leading to government bailouts, increased regulation, and a significant shift in the financial landscape.

Case Study: Long-Term Capital Management (LTCM)

Long-Term Capital Management (LTCM) was a hedge fund employing sophisticated quantitative models for investment strategies. In 1998, LTCM suffered massive losses due to unforeseen market events, specifically the Russian financial crisis. Their models, while complex and seemingly robust, failed to account for the extreme correlation between different asset classes during the crisis. This led to substantial losses, ultimately requiring a bailout by a consortium of major banks to prevent a broader financial meltdown. The LTCM case study illustrates the limitations of even sophisticated quantitative models in predicting extreme market events and the importance of considering tail risk – the risk of extreme, low-probability events. The failure of LTCM highlighted the dangers of excessive leverage and the need for robust risk management frameworks that account for unforeseen circumstances and market correlations.

Hypothetical Scenarios Illustrating Market Risk Impact

Scenario 1: Interest Rate Risk on Bonds: A bond portfolio heavily weighted towards long-term, fixed-income securities experiences a significant and unexpected increase in interest rates. The value of the bonds declines sharply, leading to substantial losses for the portfolio holder. This highlights the inverse relationship between bond prices and interest rates and the importance of managing duration risk in fixed-income portfolios.

Scenario 2: Equity Market Volatility Impacting a Tech Startup: A newly public technology company, heavily reliant on investor sentiment and market valuations, experiences a sharp downturn in the broader equity market. The company’s stock price plummets, making it difficult to raise further capital and impacting its ability to pursue growth opportunities. This illustrates the vulnerability of growth companies with high valuations to market volatility.

Scenario 3: Currency Risk Affecting an International Business: A multinational corporation with significant operations in multiple countries experiences a sudden and unexpected depreciation of its home currency against the currencies of its major export markets. This reduces the value of its foreign earnings when converted back into its home currency, leading to a decline in profitability and shareholder value. This emphasizes the importance of managing currency risk through hedging strategies for companies engaged in international trade.

Summary

Effective market risk management is not merely a compliance exercise; it’s a proactive strategy for ensuring long-term financial stability and success. By understanding the various types of market risk, employing robust measurement techniques, and implementing appropriate mitigation strategies, organizations can navigate uncertainty, protect their assets, and achieve sustainable growth. This analysis provides a foundation for building a resilient and adaptable approach to risk management, enabling businesses to thrive even in the face of market volatility.

General Inquiries

What is the difference between systematic and unsystematic risk?

Systematic risk (market risk) affects the entire market, while unsystematic risk (specific risk) is unique to a particular asset or company.

How often should market risk be monitored?

Frequency depends on the organization and its risk profile, but regular monitoring (daily or weekly) is generally recommended.

What are some limitations of VaR?

VaR relies on historical data and assumptions, which may not accurately predict future events; it also doesn’t capture tail risk effectively.

What role do stress tests play in market risk management?

Stress tests simulate extreme market scenarios to assess the resilience of a portfolio and identify potential vulnerabilities.