Market Trend Analysis Review: Prepare yourself for a rollercoaster ride through the exhilarating world of market trends! We’ll navigate the thrilling ups and downs, the unexpected twists and turns, and ultimately, help you decipher the cryptic clues hidden within the data. Buckle up, because understanding market trends isn’t just about spreadsheets; it’s about predicting the future (or at least making a really educated guess).

This review will dissect the art and science of market trend analysis, from identifying nascent trends to predicting the next big thing (or the next big flop). We’ll explore various methodologies, tools, and techniques, all while maintaining a healthy dose of humor to keep things interesting. After all, who says market analysis can’t be fun?

Defining Market Trends

Market trends, my friends, are the fickle yet fascinating currents that sweep through the vast ocean of commerce. They’re the collective behaviors of consumers, investors, and businesses, creating waves of popularity, profitability, or, sometimes, utter shipwreck. Understanding these trends is like having a crystal ball (a slightly cloudy one, perhaps, but still helpful) that offers a glimpse into the future of various markets. Let’s dive in, shall we?

Market trends are essentially sustained patterns of change in market activity. These aren’t fleeting whims; they represent a significant shift in consumer demand, technological advancements, or economic conditions, lasting for a measurable period. Think of them as the underlying currents beneath the surface of daily market fluctuations. These patterns can manifest in various ways, from a gradual increase in demand for a particular product to a sudden surge in investment in a specific sector. They’re shaped by a complex interplay of factors, making them both captivating and challenging to predict with perfect accuracy.

Market Trend Examples Across Sectors

The tech sector, for instance, has witnessed a dramatic trend towards cloud computing, transforming how businesses store and access data. In fashion, sustainable and ethically sourced clothing has become increasingly popular, reflecting a growing consumer awareness of environmental and social issues. The finance sector has seen a rise in the popularity of cryptocurrency and decentralized finance (DeFi), challenging traditional banking models. These examples illustrate the diverse nature of market trends and their impact across various industries. The key is to identify these shifts early, because as we all know, the early bird gets the worm (and the early investor gets the hefty returns).

Lifespan of a Market Trend

The lifespan of a market trend is highly variable, ranging from a few months to several decades. Some trends, like the current popularity of certain social media platforms, might burn brightly but fade quickly. Others, such as the ongoing growth of e-commerce, show remarkable longevity. Several factors influence a trend’s lifespan, including technological advancements, changing consumer preferences, economic conditions, and competitive pressures. A trend’s lifespan isn’t just a matter of time; it’s also a matter of intensity and influence. A short-lived trend might have a huge impact while a long-term trend might evolve slowly. Predicting a trend’s lifespan requires a keen eye and a healthy dose of educated guesswork.

Comparison of Short-Term and Long-Term Market Trends

Let’s illuminate the differences between short-term and long-term trends with a handy table. Remember, these are generalizations; the reality is often messier and more exciting.

| Trend Type | Duration | Identification Methods | Example |

|---|---|---|---|

| Short-Term | Less than 1 year | Social media monitoring, sales data analysis, news sentiment | Seasonal demand for winter coats |

| Long-Term | More than 5 years | Demographic analysis, technological advancements, macroeconomic indicators | The rise of renewable energy |

Identifying Market Trend Indicators

Predicting market movements is like trying to catch a greased pig – exhilarating, messy, and often unsuccessful. However, with the right tools and a healthy dose of skepticism, we can significantly improve our odds. Understanding market trend indicators is the first step towards navigating this slippery slope to financial success (or at least, not complete financial ruin). Let’s dive into the fascinating world of market prediction, where data dances and fortunes are made (or lost).

Key economic indicators often act as harbingers of market shifts, providing valuable clues about the overall health and direction of the economy. These indicators, much like the canary in the coal mine, offer early warnings of potential trouble or prosperity. Ignoring them is akin to ignoring a flashing red light – potentially disastrous.

Economic Indicators and Market Trends

Economic indicators are not just numbers on a spreadsheet; they’re the heartbeat of the economy. Changes in these indicators can signal upcoming market trends. For instance, a consistent rise in inflation, as measured by the Consumer Price Index (CPI), might foreshadow a tightening of monetary policy by central banks, potentially leading to a stock market correction. Conversely, a significant drop in unemployment rates, as reported by the Bureau of Labor Statistics (BLS), could suggest robust economic growth and a bullish stock market. Other key indicators include Gross Domestic Product (GDP) growth, consumer confidence indices, and manufacturing purchasing managers’ indices (PMI). A strong and consistent upward trend in these indicators often correlates with a healthy and growing market. Conversely, a downward trend can signal impending challenges.

Consumer Behavior as a Market Predictor

Consumer behavior is the ultimate leading indicator. After all, markets exist to serve consumers. Understanding shifts in consumer spending habits, preferences, and attitudes can provide invaluable insights into future market trends. For example, a sudden surge in demand for electric vehicles, as reflected in sales data and online searches, could indicate a shift in consumer preference away from gasoline-powered cars, impacting the automotive industry significantly. Similarly, a noticeable increase in online shopping, as tracked by e-commerce platforms, points to a changing retail landscape, favoring businesses with a strong online presence. Analyzing consumer reviews, social media discussions, and surveys can further enhance this understanding.

Qualitative and Quantitative Methods for Trend Identification

The world of market trend identification employs two main approaches: qualitative and quantitative methods. Think of it as the difference between listening to whispers and analyzing a symphony score. Qualitative methods, such as focus groups, interviews, and expert opinions, provide rich, nuanced insights into consumer attitudes and perceptions. These methods are particularly useful for understanding the “why” behind market shifts. Quantitative methods, on the other hand, focus on hard numbers – sales figures, market share data, and economic statistics. They provide a more objective and measurable assessment of market trends. While quantitative data offers a clear picture of “what” is happening, qualitative data provides crucial context and understanding of the underlying motivations.

Social Media Sentiment Analysis

Social media has become a treasure trove of consumer opinions, offering a real-time pulse on public sentiment towards products, brands, and even entire industries. Social media sentiment analysis uses sophisticated algorithms to analyze the emotional tone of social media posts, comments, and tweets. A positive sentiment surrounding a particular stock, for example, might suggest increasing investor confidence and potential price appreciation. Conversely, a surge in negative sentiment could indicate growing concerns and potential price drops. This technique, while not foolproof, can provide valuable supplementary information to other methods of trend identification. For instance, analyzing social media chatter around a new product launch can provide early insights into consumer reception and potential market success.

Analyzing Market Trend Data

Analyzing market trend data is like being a detective in a thrilling financial mystery – except instead of solving crimes, you’re uncovering lucrative opportunities (or avoiding potential pitfalls!). It’s a process that requires a keen eye for detail, a healthy dose of skepticism, and the right tools to decipher the clues hidden within the numbers. Let’s delve into the methods and tools that will help you crack the code of market trends.

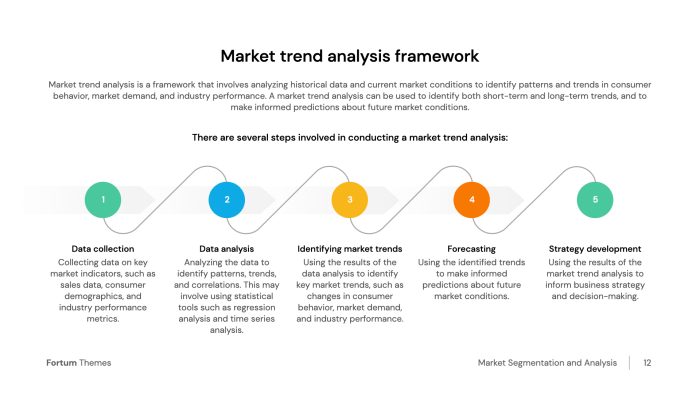

Data Collection and Organization Methods

Gathering and organizing market trend data is the foundation upon which all further analysis rests. Think of it as building a sturdy skyscraper – if the foundation is weak, the whole structure crumbles. Effective data collection involves identifying reliable sources and employing consistent methods to ensure accuracy and avoid that dreaded feeling of “garbage in, garbage out.”

Various methods exist for collecting market trend data. These include accessing publicly available data from government agencies (like the Bureau of Labor Statistics), utilizing financial databases (like Bloomberg or Refinitiv), scraping data from company websites, and employing market research firms. The choice depends on your specific needs and resources. Once collected, data needs to be meticulously organized into a format conducive to analysis – usually spreadsheets or specialized databases. Proper labeling and consistent formatting are crucial to prevent later headaches (and potential misinterpretations that could cost you money!).

Statistical Tools for Market Trend Analysis

Now that we’ve gathered our data, it’s time to unleash the power of statistics! Statistical tools provide the quantitative muscle needed to extract meaningful insights from raw data. These tools aren’t just for nerds in lab coats; they are your secret weapons in understanding market trends.

Simple moving averages (SMAs) and exponential moving averages (EMAs) are fundamental tools for smoothing out price fluctuations and identifying trends. Regression analysis helps uncover relationships between variables, such as the correlation between advertising spending and sales. Correlation analysis helps quantify the strength of relationships between different data points. Statistical significance testing ensures that any observed trends are not simply random fluctuations. These tools allow you to move beyond simple observation and delve into the underlying dynamics of the market.

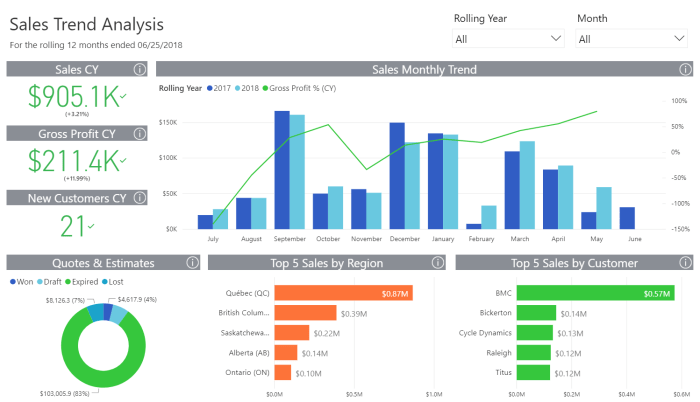

Visualizations of Market Trend Data

Let’s face it, staring at spreadsheets all day can be mind-numbingly boring. That’s where data visualization comes to the rescue! Visualizations transform complex datasets into easily digestible and insightful graphics. They’re the equivalent of a well-crafted infographic, making your analysis accessible and compelling.

Line Graph Example: Imagine a line graph depicting the monthly sales of a new gadget over a year. The x-axis represents the months (Jan-Dec), and the y-axis represents sales figures (in thousands). The line shows a steady upward trend, with a slight dip in July (likely due to a summer vacation slump) before resuming its upward trajectory. Data points could include: January (5,000), February (6,000), March (7,500), etc., clearly illustrating growth.

Bar Chart Example: Now consider a bar chart comparing the market share of three competing companies (Company A, B, and C) over the same year. The x-axis represents the companies, and the y-axis represents market share (as a percentage). The bars show that Company A maintains a dominant position, while Company B experiences a slight decline and Company C shows consistent, moderate growth. Specific data points could be: Company A (45%, 48%, 50%), Company B (30%, 28%, 25%), and Company C (25%, 24%, 25%). This clearly illustrates market dominance and competitive dynamics.

Limitations of Data Analysis Techniques

While statistical tools are powerful, they’re not magic wands. It’s crucial to understand their limitations to avoid drawing inaccurate conclusions – or even worse, making disastrous investment decisions based on flawed analyses.

One major limitation is the reliance on past data. Past performance is not necessarily indicative of future results, and market trends can shift dramatically due to unforeseen circumstances (like global pandemics or unexpected technological breakthroughs). Furthermore, the accuracy of any analysis is only as good as the data it’s based on. Inaccurate, incomplete, or biased data will inevitably lead to flawed conclusions. Finally, statistical models often simplify complex real-world situations, potentially overlooking crucial nuances and interdependencies. Therefore, critical thinking and a healthy dose of skepticism are essential when interpreting the results of any market trend analysis.

Interpreting Market Trend Reviews

Interpreting market trend reviews is like deciphering an ancient scroll – rewarding, but potentially fraught with peril if you don’t know the language. The key is to understand not just the data presented, but also the context surrounding it. A seemingly dire prediction might be perfectly reasonable given a specific economic climate, while a rosy outlook could be masking some uncomfortable truths.

Market Trend Review Presentation Formats

Market trend reviews aren’t confined to dusty reports gathering cobwebs in a filing cabinet. They come in various guises, each with its own strengths and weaknesses. A concise presentation, for example, might highlight key trends visually using charts and graphs, ideal for grabbing attention in a boardroom. Conversely, a detailed report allows for a deeper dive into the methodology and supporting data, providing a more robust analysis for long-term strategic planning. Think of a presentation as a snapshot and a report as a full-length movie – both serve different purposes. Imagine a PowerPoint presentation using compelling visuals like bar charts showing sales growth over time, alongside pie charts demonstrating market share. Contrast this with a comprehensive report detailing the methodology, including data sources, statistical models employed, and the limitations of the analysis.

The Importance of Considering External Factors

Ignoring external factors when interpreting market trend reviews is akin to navigating by the stars while wearing a blindfold. Geopolitical events, changes in government regulations, technological disruptions – these all have the potential to dramatically impact market trends. For example, a positive trend in a specific industry might be severely hampered by a sudden increase in import tariffs, or conversely, benefit from a groundbreaking technological advancement. Consider the impact of the COVID-19 pandemic on global supply chains – a perfect example of an external factor drastically altering market trends across numerous sectors.

Identifying Biases and Inaccuracies in Market Trend Reviews

Spotting biases and inaccuracies is like being a detective in the world of market analysis. Look for red flags such as a lack of transparency in the methodology, selective use of data, or overly optimistic (or pessimistic) conclusions that don’t quite align with the presented evidence. For instance, a review funded by a specific company might subtly favor that company’s products or services. Always check the source of the review and look for potential conflicts of interest. Consider comparing multiple reviews from different sources to gain a more balanced perspective – a bit like cross-referencing information from multiple witnesses in a criminal investigation.

Structure of a Market Trend Review Report

A well-structured market trend review report should be clear, concise, and comprehensive. A suggested structure includes:

| Section | Content |

|---|---|

| Executive Summary | A brief overview of the key findings and implications. |

| Methodology | A detailed description of the data sources, analytical techniques, and limitations of the study. This section should be transparent and allow for reproducibility. |

| Findings | A presentation of the key market trends identified, supported by relevant data and visualizations. This section should avoid speculation and stick to the facts. |

| Implications | An analysis of the potential impact of the identified trends on businesses and stakeholders. This section might include recommendations for action. |

| Appendix (Optional) | Supporting data, detailed methodology, and other supplementary information. |

Applying Market Trend Insights

Market trend analysis isn’t just a crystal ball for predicting the future; it’s a powerful tool for shaping your business destiny. Think of it as your business’s personal fortune teller, but instead of vague pronouncements about love and money, it provides actionable intelligence to navigate the often-whimsical world of commerce. By understanding the trends, you can proactively adapt, innovate, and ultimately, conquer the market. Ignoring them? Well, let’s just say that’s a recipe for a very expensive cup of tea.

Market trend insights directly inform business strategy by providing a clear picture of the evolving landscape. This understanding allows businesses to make informed decisions about product development, marketing campaigns, and resource allocation. For example, a company noticing a rising trend in sustainable products can shift its focus to eco-friendly options, tapping into a growing market segment and gaining a competitive edge. Conversely, ignoring a shift towards digitalization could leave a company stranded in the analog past, a place where customers are increasingly scarce.

Using Market Trend Analysis to Identify Opportunities and Risks, Market Trend Analysis Review

Market trend analysis is a double-edged sword – it reveals both opportunities ripe for the picking and potential pitfalls best avoided. By analyzing data, businesses can identify emerging niches, unmet needs, and potential disruptions. A rise in demand for personalized experiences, for instance, could open doors for businesses offering customized products or services. Conversely, a decline in the popularity of a specific product category signals a potential risk, requiring proactive adjustments to avoid losses. Consider the decline of physical media sales, which presented significant risks to businesses that failed to adapt to digital distribution. Those that did not diversify and embrace digital platforms suffered substantial losses.

Developing a Marketing Plan Based on Market Trend Analysis

A marketing plan built on solid market trend analysis is like having a GPS for your marketing efforts. It ensures your campaigns are targeted, relevant, and effective. The process begins with identifying key trends and analyzing their implications for your business. Next, define your target audience within the context of these trends. Then, craft a compelling message that resonates with their needs and aspirations, utilizing channels where your target audience is most active. Finally, meticulously track your progress and make data-driven adjustments as needed. This iterative process ensures your marketing efforts remain aligned with the ever-shifting sands of the market.

Hypothetical Marketing Campaign: The Rise of “Experiential Retail”

Let’s say we’re launching a new line of artisanal coffee. The market trend we’re leveraging is the rise of “experiential retail,” where consumers seek more than just a product; they want an experience.

Target Audience: Millennials and Gen Z coffee enthusiasts who value quality, unique experiences, and social media sharing.

Messaging: Focus on the craft, the story behind the coffee beans, and the overall sensory experience of visiting our cafe – think Instagrammable moments and community building. Our tagline: “Brewed for Connection, Roasted for Perfection.”

Channels: Instagram and TikTok for visually appealing content, local partnerships with influencers and community events, and a well-designed physical cafe that encourages interaction and sharing. We’d host coffee tasting events, latte art workshops, and open mic nights to build a community around our brand. The physical space would be designed to be visually stunning and highly shareable on social media.

Predicting Future Market Trends

Predicting the future of markets is a bit like predicting the weather in a parallel universe – it’s possible, but often wildly inaccurate. While we can’t peer into a crystal ball to see tomorrow’s stock prices, we can employ various techniques to make educated guesses, hoping to avoid the embarrassing spectacle of a spectacularly wrong forecast. The inherent uncertainty, however, is a constant companion.

The challenges and limitations of predicting future market trends are numerous and often humbling. Markets are complex, chaotic systems influenced by a bewildering array of factors – from global geopolitical events and technological breakthroughs to consumer sentiment and the whims of central banks. Unforeseen “black swan” events, those highly improbable occurrences with significant impact, can completely derail even the most sophisticated models. Furthermore, the very act of predicting can influence the market, creating a self-fulfilling or self-defeating prophecy. Essentially, trying to predict the future can sometimes become a bit of a self-sabotaging circus act.

Forecasting Techniques for Market Trend Prediction

Several forecasting techniques exist, each with its own strengths and weaknesses. Quantitative methods, such as time series analysis (using historical data to identify patterns), econometric modeling (using statistical relationships between economic variables), and technical analysis (using chart patterns and indicators), attempt to find objective, data-driven predictions. Qualitative methods, on the other hand, rely on expert opinions, surveys, and Delphi techniques (gathering and synthesizing expert opinions anonymously), adding a subjective element to the mix. Each approach has its place, and often a combination of methods provides a more robust forecast, much like a well-balanced portfolio.

Examples of Successful and Unsuccessful Market Trend Predictions

A successful prediction might be a firm correctly anticipating the rise of a particular technology sector, like the boom in the late 1990s dot-com era (though many missed the subsequent bust). This was driven by a confluence of factors: increasing internet penetration, technological advancements, and a surge in venture capital. Conversely, the widespread underestimation of the 2008 financial crisis serves as a cautionary tale of the limitations of predictive modeling. Many models failed to account for the interconnectedness of the global financial system and the cascading effects of subprime mortgage defaults. The lesson here is that even the most sophisticated models can fail spectacularly when faced with unprecedented events or systemic flaws.

Key Factors to Consider When Making Predictions

Before attempting to predict the future, consider these key factors:

- Economic indicators: GDP growth, inflation rates, unemployment figures, and interest rates provide a macroeconomic context for market movements.

- Geopolitical events: Wars, trade disputes, and political instability can significantly impact market sentiment and investment flows.

- Technological advancements: Disruptive technologies can create entirely new markets and render existing ones obsolete.

- Consumer behavior and sentiment: Consumer spending and confidence are key drivers of economic activity and market performance.

- Regulatory changes: Government regulations and policies can shape market dynamics and create opportunities or challenges for businesses.

- Competitive landscape: The actions of competitors, mergers, and acquisitions can all influence market trends.

Final Wrap-Up: Market Trend Analysis Review

So, there you have it – a whirlwind tour of market trend analysis! We’ve journeyed from the humble beginnings of trend identification to the dizzying heights of future forecasting. Remember, while predicting the future is an inherently imperfect science, a solid understanding of market trends can significantly improve your chances of success. Now go forth and conquer the market… or at least, make a well-informed investment decision.

FAQ Guide

What’s the difference between a fad and a long-term market trend?

A fad is a short-lived, often intensely popular phenomenon, while a long-term trend represents a sustained shift in consumer behavior or market dynamics.

How can I avoid bias in my market trend analysis?

Employ rigorous methodologies, use diverse data sources, and actively seek out contradictory evidence. Also, be aware of your own preconceived notions – they can be sneaky!

What are some common pitfalls to avoid when predicting future trends?

Overreliance on past data, neglecting qualitative factors, and failing to account for unforeseen events (like, say, a global pandemic) are common traps for the unwary trend predictor.