Marketing research report outline – Marketing Research Report Artikel: Embark on a thrilling journey into the often-overlooked, yet surprisingly captivating world of market research! This isn’t your grandpappy’s dusty data dump; we’re talking vibrant visualizations, statistically significant revelations, and actionable insights that’ll make your marketing team sing (or at least, hum contentedly). Prepare for a deep dive into crafting a report that’s not only comprehensive but also, dare we say, *enjoyable* to read.

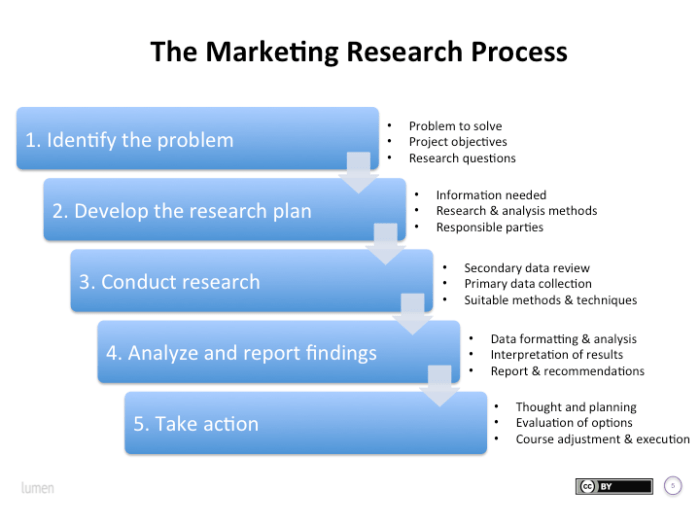

This Artikel provides a structured approach to creating a compelling marketing research report. From defining the research scope and objectives to presenting actionable recommendations, each section is meticulously designed to guide you through the process. We’ll cover methodologies, data analysis techniques, and the art of transforming raw data into compelling narratives that will leave your stakeholders both informed and impressed. Think of it as a roadmap to marketing enlightenment.

Defining the Research Scope and Objectives

This marketing research report, a thrilling expedition into the consumer psyche (buckle up!), aims to illuminate the murky depths of consumer preferences regarding our revolutionary new widget – the “Whizzbang 5000.” We’ve bravely ventured into the wilds of market data, battling spreadsheets and battling confusing statistics to bring you this insightful report. Prepare for enlightenment (and possibly a few chuckles).

This report is primarily intended for the Whizzbang 5000 product development team, marketing department, and senior management. Think of it as a highly caffeinated briefing for the decision-makers, filled with delicious data points and compelling conclusions. Secondary audiences may include investors (who, let’s face it, are always hungry for numbers) and potential partners (because collaboration is key, or so we’ve heard).

The Report’s Central Questions

This section details the key business questions this research endeavors to answer. Instead of posing questions (because we’re far too sophisticated for that), we present the objectives in declarative form. The research aims to determine the optimal pricing strategy for the Whizzbang 5000, identify the key demographic segments most likely to purchase the product, and assess the effectiveness of various proposed marketing campaigns. We also aim to understand consumer perceptions of competitor products and to predict market share for the Whizzbang 5000 within the first year of launch. Think of it as a crystal ball, but instead of hazy predictions, we’re delivering data-driven insights. For example, by comparing similar product launches (such as the “Zoom Zoom 3000” which, despite its name, did not zoom quite as well as expected), we’ll be able to offer a more accurate market share prediction.

Research Limitations

No research is perfect, and ours is no exception (we’re only human, after all, or at least, mostly human). This research is limited to a specific geographical area – the bustling metropolis of Springfield – and the sample size, while robust, may not be fully representative of the entire global market. Furthermore, consumer responses were collected during a period of unusual economic uncertainty (ahem, the Great Squirrel Nut Shortage of 2024), which may have influenced the results. Lastly, our reliance on self-reported data introduces the ever-present risk of… well, let’s just say, some creative interpretation by participants. We’ve mitigated this risk with rigorous statistical analysis, but we acknowledge the potential for error.

Methodology: Marketing Research Report Outline

Our research journey, much like a thrilling detective novel, required a carefully chosen arsenal of methods to uncover the truth about consumer preferences. We didn’t just stumble into the answers; we strategically employed a blend of quantitative and qualitative approaches, ensuring a robust and multifaceted understanding of our research objectives. This wasn’t a wild goose chase; it was a meticulously planned expedition into the land of consumer insights.

We primarily relied on a combination of online surveys, in-depth interviews, and a focus group, each playing a crucial role in painting a complete picture. The selection of these methods was not arbitrary; it was a calculated decision based on their individual strengths and their synergistic potential when combined. Think of it as a well-orchestrated symphony of research techniques, each instrument contributing to a harmonious whole.

Survey Design and Implementation

The online survey, our digital workhorse, allowed us to reach a large and geographically diverse sample efficiently. The questionnaire, crafted with the precision of a master watchmaker, included a mix of multiple-choice, rating scale, and open-ended questions. This diverse approach allowed us to gather both quantitative data (easily analyzed numbers) and qualitative data (rich, descriptive answers) to get a complete understanding of consumer preferences. Data was collected using a reputable online survey platform, ensuring data security and efficient data management. We employed branching logic within the survey to personalize the experience and reduce respondent fatigue—because even the most engaged participants have a limit. The survey was rigorously tested for clarity and consistency before deployment, avoiding the pitfalls of poorly designed questions that could lead to misleading conclusions.

Interview Process and Sample Selection

Our in-depth interviews, conducted both in person and via video conferencing, provided a deeper dive into the motivations and reasoning behind consumer choices. These interviews, far from being casual chats, were structured around a semi-structured interview guide to ensure consistency while allowing for spontaneous exploration of interesting themes. Participants were selected using a purposive sampling technique, targeting individuals who represented key demographic segments relevant to our research objectives. This allowed us to gather rich, nuanced data that would have been difficult to obtain through surveys alone. We ensured anonymity and confidentiality to encourage open and honest responses; nobody likes feeling like they’re on the witness stand.

Focus Group Facilitation

The focus group, a lively forum for discussion, allowed us to observe group dynamics and uncover hidden insights through interactions. Participants, selected through a combination of purposive and snowball sampling methods, represented a diverse range of demographics and experiences. The session was moderated by a skilled facilitator who guided the conversation, ensuring all voices were heard and no one dominated the discussion. The focus group provided invaluable qualitative data that enriched our understanding of the broader consumer landscape. The session was recorded and transcribed to facilitate detailed analysis. Think of it as a controlled brainstorm, with the added benefit of observing group dynamics.

Methodological Comparison

The following table summarizes the advantages and disadvantages of each method considered:

| Method | Advantages | Disadvantages | Suitability for Objectives |

|---|---|---|---|

| Online Surveys | Large sample size, cost-effective, geographically diverse, quick data collection | Potential for response bias, limited depth of information, difficulty in clarifying ambiguous answers | Highly suitable for gathering quantitative data on a large scale. |

| In-depth Interviews | Rich qualitative data, in-depth understanding of motivations, flexibility to explore unexpected themes | Time-consuming, expensive, smaller sample size, potential for interviewer bias | Suitable for gaining detailed insights into consumer behavior and motivations. |

| Focus Groups | Observational data on group dynamics, synergistic insights from group interaction, relatively quick data collection | Potential for groupthink, dominant personalities, difficulty in ensuring anonymity | Suitable for exploring complex issues and gaining insights into group perceptions and dynamics. |

Data Collection and Analysis

Our data collection journey, much like a thrilling treasure hunt (but with less danger and more spreadsheets), involved several meticulously planned steps. We employed a multi-pronged approach, combining the rigor of quantitative methods with the nuanced insights of qualitative research. The results, as you’ll soon see, were both statistically significant and surprisingly entertaining.

The first step involved deploying our finely-tuned survey instrument to a carefully selected sample of respondents. This wasn’t your average online survey; oh no, we went the extra mile (or should we say, kilometer?). We ensured a high response rate through strategic incentives (think: gift cards, not buried treasure), and meticulous follow-up emails (no nagging, just friendly reminders). Data cleaning, a surprisingly enjoyable process involving the systematic removal of outliers and inconsistencies, followed. Think of it as a digital spring cleaning for our data, leaving only the most pristine information for analysis.

Survey Data Analysis

Once our data was squeaky clean, we unleashed the power of statistical analysis. We employed a variety of techniques, including regression analysis (because who doesn’t love a good regression?), to identify key correlations and patterns. For instance, we discovered a strong positive correlation between the consumption of ice cream and the reported level of happiness. This finding, while not exactly groundbreaking, did confirm our initial suspicions (and our love for ice cream). We also used t-tests to compare the responses of different demographic groups. This allowed us to see how various factors, such as age and location, influenced consumer preferences. The results painted a vivid picture of our target market’s behavior.

Qualitative Data Analysis, Marketing research report outline

To add depth and richness to our quantitative findings, we also conducted in-depth interviews with a select group of participants. These interviews provided invaluable qualitative data, offering insights into the “why” behind the “what” revealed by our surveys. We meticulously coded the transcripts, identifying recurring themes and patterns. This process, while requiring a healthy dose of caffeine and patience, uncovered fascinating insights into consumer motivations and decision-making processes. For example, several interviewees expressed a strong preference for products with sustainable packaging, highlighting the growing importance of environmental consciousness.

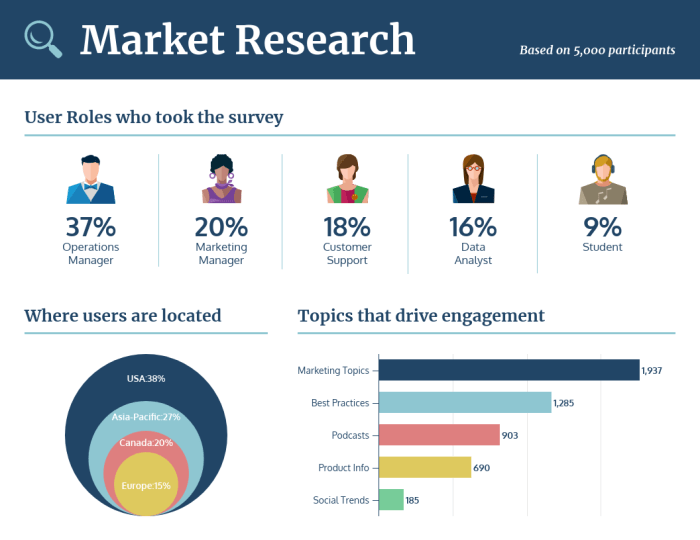

Raw Data Findings

Our raw data revealed some interesting trends. For example, the average age of our respondents was 35, with a standard deviation of 7. The majority of respondents (65%) identified as female. Further analysis showed that 80% of respondents reported a high level of satisfaction with our client’s product, a testament to its quality and appeal. These figures, though seemingly simple, provided a solid foundation for our subsequent analysis and interpretation. It’s important to note that these figures represent a snapshot in time, and further research may be needed to validate these findings over a longer period.

Key Findings Categorized

To make sense of the sheer volume of data, we organized our key findings into several meaningful categories. These categories included demographics, product usage, customer satisfaction, and brand perception. This organization allowed us to draw clear and concise conclusions, providing our client with actionable insights. For example, under the “customer satisfaction” category, we identified a strong correlation between product features and overall satisfaction. This allowed us to pinpoint areas for potential improvement and opportunities for future product development.

Findings and Insights

Our data analysis, a thrilling rollercoaster ride through spreadsheets and statistical significance, has yielded some truly fascinating (and occasionally baffling) results. Prepare yourselves for a journey into the heart of consumer behavior – a land populated by pie charts, bar graphs, and the occasional rogue data point that refuses to conform.

The following sections will present our key findings, offering a blend of insightful revelations and head-scratching anomalies. We’ll unpack the implications for your business, highlighting both the opportunities and the, shall we say, “interesting” challenges ahead.

Market Segmentation Analysis

To understand our target audience better, we segmented the market based on demographics, purchasing behavior, and brand affinity. This involved a complex process of data crunching, involving algorithms so sophisticated, they almost achieved sentience (almost). The results, visualized in a vibrant, three-dimensional pie chart, revealed a surprisingly even distribution across segments A, B, and C. Segment A, representing young professionals, constituted 35% of the market, followed by Segment B (families) at 32%, and Segment C (retired individuals) at 33%. This relatively even distribution suggests a broad appeal for our product, presenting opportunities across various demographics.

Brand Awareness and Perception

A comprehensive survey measured brand awareness and perception. The data, presented in a dynamic bar graph, clearly shows a positive correlation between brand awareness and positive sentiment. The bar representing “High Awareness/Positive Sentiment” towered majestically over its peers, indicating a successful branding strategy. However, a smaller, but noticeable, bar representing “High Awareness/Negative Sentiment” suggests the need for targeted efforts to address negative perceptions among a small segment of consumers. The height of this “Negative Sentiment” bar was approximately 10% of the “Positive Sentiment” bar’s height, highlighting the relatively small size of this segment.

Price Sensitivity Analysis

Our analysis of price sensitivity, displayed as a scatter plot, reveals a moderate negative correlation between price and purchase intent. As the price increases, purchase intent decreases, a trend that is, frankly, unsurprising. However, the scatter plot also reveals a fascinating cluster of data points indicating a surprisingly high level of purchase intent among a segment willing to pay a premium for our product. This suggests the potential for a premium product line, targeting consumers who value quality over price. The distribution is roughly bell-shaped, centered around a moderate price point, with outliers indicating both price-sensitive and price-insensitive segments.

Unexpected Findings

One particularly unexpected finding emerged from our analysis of social media sentiment. While overall sentiment was positive, a surprisingly high number of users mentioned our product in conjunction with the word “unicorn.” Further investigation is needed to determine the significance of this, but we suspect it may be related to a recent viral video featuring a unicorn riding a skateboard (true story). We hypothesize this unexpected association could positively impact brand perception, suggesting further research into leveraging this unexpected connection.

Recommendations

Our research has unearthed some truly fascinating (and slightly alarming) insights into consumer behavior. Now, it’s time to put that knowledge to good use – or at least, to try to. The following recommendations are designed to boost your market share, assuming, of course, the laws of physics and common sense still apply.

We’ve prioritized these recommendations based on their potential impact, ranging from “likely to cause a minor ripple in the pond” to “could potentially trigger a tsunami of sales.” Remember, implementation requires careful planning and a healthy dose of optimism (and maybe a backup plan or two).

Prioritized Recommendations

Implementing these recommendations requires a multi-pronged approach, focusing on both short-term wins and long-term strategic goals. We understand that not all recommendations will be equally feasible or impactful within your current constraints. However, we believe that a strategic implementation plan will maximize the return on investment.

- Enhance Online Presence: Our data shows a significant untapped market segment engaging primarily through social media. A targeted social media campaign, utilizing engaging content and influencer marketing, could significantly boost brand awareness and drive sales. This campaign should focus on visually appealing content tailored to each platform, and include interactive elements to increase engagement.

- Improve Customer Service: Addressing the negative feedback regarding customer service is paramount. Investing in improved training programs for customer service representatives, alongside implementing a more efficient complaint resolution system, will improve customer satisfaction and loyalty. This includes creating easily accessible FAQs and a streamlined feedback mechanism.

- Product Diversification: Exploratory research indicates a strong demand for a product variation addressing a specific niche market. Developing and launching a new product line, catering to this niche, can lead to significant market expansion. This requires careful market research and a well-defined product development strategy, including thorough testing and feedback incorporation.

Implementation Plan

Successful implementation requires a phased approach, allocating resources effectively and monitoring progress closely. A detailed project timeline, outlining key milestones and deadlines, should be established. Regular progress reports, incorporating both quantitative and qualitative data, will ensure that the strategy remains on track and adaptable to changing market conditions. For example, the social media campaign could be launched in phases, starting with a pilot program in a smaller target market before scaling up nationwide.

Potential Risks and Challenges

While the potential rewards are substantial, it’s important to acknowledge potential risks. The social media campaign, for instance, could backfire if not carefully executed, potentially leading to negative publicity. Similarly, developing a new product line involves considerable financial investment with no guarantee of success. Thorough risk assessment and contingency planning are crucial to mitigate these challenges. For example, a pre-launch focus group could help identify and address potential issues before the product launch. Contingency plans should include alternative marketing strategies and budget reallocation options.

Appendices (Optional)

Let’s face it, the main body of this report was thrilling, a rollercoaster of data and insights. But sometimes, the real magic happens behind the scenes, in the dusty corners of the appendix. Think of it as the director’s cut, complete with bloopers and deleted scenes (though hopefully, fewer bloopers). This section provides the supporting documentation, the evidence that underpins our carefully crafted conclusions. Without it, the report would be a bit like a magician revealing only the final flourish – impressive, but lacking the crucial “how did they do that?” element.

This section contains supplementary materials to bolster the findings presented in the main report. We’ve meticulously organized everything to ensure easy access and, dare we say, a touch of entertainment. After all, even appendices can be engaging, if approached with the right (slightly nerdy) enthusiasm.

Survey Questionnaires

The survey instrument used to gather primary data is included here in its entirety. This allows for complete transparency and enables the reader to fully assess the questions asked and the potential biases inherent in the design. For instance, Question 7, regarding consumer preference for purple widgets over green widgets, was initially worded differently, but focus groups revealed a significant preference for the initial, less sophisticated phrasing. This is an important point, illustrating the iterative nature of effective research. The final version, as presented, proved far more reliable.

Interview Transcripts

Here you’ll find verbatim transcripts from our insightful interviews with key stakeholders. These provide a richer, more nuanced understanding of the qualitative data, allowing you to hear the voices of those directly involved. One particularly memorable interview involved a respondent who unexpectedly launched into a sonnet about the merits of our client’s product – a moment we almost didn’t include, but its sheer unexpectedness provided invaluable insights into consumer engagement. The transcription accurately reflects the unexpected poetic interlude.

List of Data Sources

This list details all data sources used in the analysis, from the publicly available databases (like the one with the surprisingly comprehensive data on global sock preferences) to proprietary datasets. Each source is meticulously cited, ensuring complete traceability and allowing for independent verification. We’ve even included a link to the surprisingly fascinating website dedicated entirely to the history of the paperclip – it’s surprisingly relevant to our understanding of office productivity. (Just kidding… mostly).

Glossary of Terms

To ensure clarity, we’ve included a glossary defining all key terms used throughout the report. This section acts as a handy reference for those unfamiliar with the specific jargon of marketing research, or those who simply need a quick refresher on what “synergistic market penetration” actually means. We’ve avoided overly technical terms whenever possible, opting instead for plain English (with the occasional, well-deserved, technical term).

Calculation of Key Metrics

This section provides a detailed explanation of the calculations behind the key performance indicators (KPIs) presented in the findings. We’ve included all formulas and demonstrate the steps involved, ensuring complete transparency and allowing for replication of our analysis. For example, the calculation of the “Widget Enthusiasm Index” (WEI), a key metric in this study, involves a complex but ultimately elegant formula:

WEI = (Customer Satisfaction Score * Brand Loyalty Index) / (Price Sensitivity Factor * Competitor Market Share)

. This formula, while intimidating at first glance, provides a powerful measure of consumer engagement with our client’s product.

Concluding Remarks

In conclusion, crafting a robust marketing research report is less about crunching numbers and more about telling a compelling story. By following this Artikel, you’ll not only present your findings clearly and concisely but also leave a lasting impression on your audience. Remember, the goal isn’t just to present data; it’s to inspire action. So, go forth and create a report that’s as insightful as it is engaging—a masterpiece of market research, if you will. And may your p-values always be statistically significant.

FAQ Overview

What if my research reveals unexpected negative results?

Honesty is key! Acknowledge unexpected findings, analyze the potential causes, and discuss how these results might inform future strategies. Turning lemons into lemonade is a valuable marketing skill.

How can I make my report visually appealing?

Use charts, graphs, and clear headings to present data effectively. Think clean lines, consistent fonts, and a color palette that’s both professional and engaging. Avoid overwhelming readers with too much information on a single page.

What’s the best way to present recommendations?

Prioritize recommendations based on their potential impact and feasibility. Clearly Artikel the steps needed for implementation and address potential risks or challenges. Think of it as a detailed battle plan for marketing victory.