Marketing research report structure is more than just a collection of data; it’s a compelling narrative. A well-structured report transforms raw findings into actionable insights, guiding strategic decisions and ultimately influencing the bottom line. This guide unravels the mystery behind crafting a report that not only presents data effectively but also captivates its audience, leaving a lasting impression. We’ll explore everything from defining clear objectives to presenting compelling visualizations, ensuring your research speaks volumes—loudly and clearly.

From meticulously defining research objectives and selecting appropriate methodologies to mastering data visualization and crafting persuasive recommendations, this comprehensive guide will equip you with the tools and techniques to create impactful marketing research reports. We’ll delve into the nuances of each section, providing practical examples and actionable strategies to enhance clarity, engagement, and overall effectiveness. Get ready to transform your research from a simple document into a powerful instrument for driving marketing success.

Defining the Scope and Objectives of a Marketing Research Report

Embarking on a marketing research project is like planning a grand expedition – without a clear map (scope) and a destination in mind (objectives), you’re likely to end up lost in a sea of data, muttering about the questionable taste of your emergency rations (your hastily chosen research methodology). A well-defined scope and objective are crucial for a successful and, dare we say, *enjoyable* research journey.

A well-defined research objective acts as the North Star, guiding your every decision. It’s not just a vague wish; it’s a precisely worded statement outlining what you aim to achieve. Think of it as the ultimate treasure you seek on your research adventure. Essential components include a clear statement of the problem, the specific information needed to solve it, and the intended use of the findings. A poorly defined objective is like trying to navigate with a crumpled map written in Klingon – good luck with that.

Target Audience Identification

Clearly identifying the target audience is paramount. Knowing who will be reading your report shapes its tone, style, and the level of detail required. Imagine writing a technical report on consumer preferences for artisanal cheese to a group of toddlers – it would be a recipe for disaster (and probably a lot of spilled milk). Instead, tailor your report to resonate with your specific audience, whether it’s senior management, marketing teams, or potential investors. For example, a report on social media engagement for a new product launch would be structured differently for a board of directors than for a team of social media managers. The former would need high-level summaries and key performance indicators, while the latter might need granular data and detailed breakdowns.

Key Research Question Formulation

Formulating key research questions is akin to plotting your course on that aforementioned map. These questions should directly address your research objective and guide your data collection. Avoid vague or overly broad questions; instead, focus on specific, measurable, achievable, relevant, and time-bound (SMART) questions. For example, instead of asking “How can we improve our marketing?”, ask “What specific changes to our social media campaign will increase engagement by 15% within the next quarter?” The second question provides a much clearer path to follow.

Types of Marketing Research Reports and Their Scopes

Different types of marketing research reports serve different purposes, each with its own scope. A market analysis report, for example, might explore the size and potential of a specific market segment, including competitor analysis and consumer behavior trends. Its scope is broad, encompassing many facets of a market. In contrast, a brand awareness study would focus solely on measuring the public’s familiarity with a specific brand. A customer satisfaction survey would delve into the experiences of current customers, while a product testing report would focus on evaluating the performance and usability of a new product. Each has a clearly defined, focused scope that contributes to a larger understanding. Think of it as a buffet: you can choose the dishes (reports) that fit your appetite (research needs).

Methodology Section

Embarking on the thrilling adventure of data collection and analysis, we must first equip ourselves with the proper tools and techniques. This section details the methodological approach used to gather and interpret the data, ensuring our findings are as robust and reliable as a well-trained research beagle sniffing out the truth. We’ll delve into the specifics of our chosen methods, highlighting their strengths and weaknesses with the flair of a seasoned data detective.

Data Collection Methods

The selection of appropriate data collection methods is crucial for the success of any marketing research project. A mismatch between the research question and the method employed can lead to inaccurate or incomplete results—a fate worse than a stale donut. We employed a multi-method approach, combining the power of surveys, interviews, and focus groups to paint a comprehensive picture of our target market. The following table summarizes the key features of each method.

| Method | Data Type | Strengths | Weaknesses |

|---|---|---|---|

| Surveys | Quantitative and Qualitative (depending on question type) | Large sample sizes, cost-effective, easy to administer, quick data collection. | Response bias, low response rates, superficial answers, limited depth of understanding. |

| Interviews | Qualitative | Rich, detailed data, in-depth understanding of respondent perspectives, flexibility in questioning. | Time-consuming, expensive, potential for interviewer bias, smaller sample sizes. |

| Focus Groups | Qualitative | Exploration of group dynamics, generation of new ideas, rich qualitative data. | Dominating participants, groupthink, moderator bias, logistical challenges. |

| Observational Studies | Qualitative and Quantitative (depending on the observation type) | Real-time data collection, unbiased data collection if done correctly, useful in understanding actual behaviour. | Ethical considerations (privacy), observer bias, time-consuming, may not capture the “why” behind behaviour. |

Data Analysis Plan

Our data analysis plan, like a well-choreographed dance, involves a series of steps designed to extract meaningful insights from our collected data. This involves a rigorous process of cleaning, transforming, and analyzing the data to ensure accuracy and reliability. We will utilize a combination of descriptive statistics (e.g., means, standard deviations, frequencies) and inferential statistics (e.g., t-tests, ANOVA, regression analysis) to test our hypotheses and answer our research questions. Data visualization techniques, including charts, graphs, and maps, will be employed to present our findings in a clear and engaging manner. For instance, we might use a bar chart to compare the popularity of different product features, or a scatter plot to examine the relationship between customer satisfaction and brand loyalty.

Handling Missing Data and Potential Biases

Missing data and bias are the mischievous gremlins of the research world, lurking in the shadows to sabotage our results. To address missing data, we will employ appropriate imputation techniques, such as mean imputation or multiple imputation, depending on the nature and extent of the missing data. To mitigate potential biases, we will carefully consider the sampling method, questionnaire design, and data analysis techniques. For example, we will be mindful of potential response bias in our survey data by carefully crafting our questions to avoid leading or biased phrasing. We will also check for outliers and influential data points that might unduly skew our results.

Data Integrity and Reliability

Maintaining data integrity and reliability is paramount. We will implement rigorous quality control measures throughout the data collection and analysis process. This includes careful data entry procedures, regular data cleaning and validation checks, and the use of appropriate statistical techniques to ensure the accuracy and reliability of our findings. We will also document all data collection and analysis procedures meticulously, creating an audit trail that allows for verification and replication of our results. Think of it as leaving a trail of breadcrumbs, ensuring others can follow our journey to the delicious conclusion.

Report Structure

Crafting a marketing research report that’s both informative and engaging is a delicate dance – a waltz between data and delightful prose. Think of it as a well-structured argument, presented with the flair of a seasoned storyteller (minus the tall tales, of course). The key lies in a logical flow of information, presented clearly and concisely. This section will illuminate the path to report nirvana.

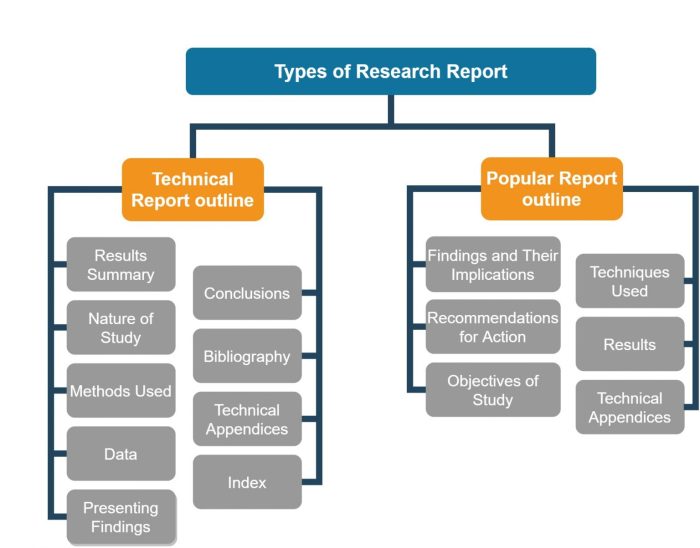

Typical Sections and Their Hierarchical Structure, Marketing research report structure

A typical marketing research report follows a standard structure, ensuring a smooth and logical journey for the reader. This structure isn’t set in stone; it’s more like a flexible framework, adaptable to the specifics of your research. However, maintaining a consistent structure across reports enhances readability and comprehension. The core sections, along with their typical subsections, are Artikeld below. We’ll avoid the monotony of simply listing them; instead, let’s imagine each section as a vital organ in the report’s body.

- Executive Summary: The heart of the report, this concise overview (think a captivating movie trailer) presents the key findings, conclusions, and recommendations. Subsections might include: Key Findings, Conclusions, and Recommendations.

- Introduction: The welcoming committee, setting the stage for the entire report. It should establish the context, define the problem, and Artikel the report’s objectives. Subsections could include: Background, Problem Statement, Research Objectives, and Report Scope.

- Methodology: The brain of the operation, detailing the research design, data collection methods, and analytical techniques employed. Subsections here might cover: Research Design, Sampling Methodology, Data Collection Methods, and Data Analysis Techniques.

- Findings: The report’s powerhouse, presenting the results of the research in a clear and compelling manner. Subsections should be organized thematically, perhaps by research question or objective. For instance, if your research explored consumer preferences, you might have subsections like: Consumer Demographics, Brand Perception, and Purchasing Behavior.

- Recommendations: The strategic action plan, offering actionable insights based on the findings. Subsections could focus on specific marketing strategies, such as: Marketing Strategy Recommendations, Implementation Plan, and Budget Allocation.

Effective Use of Headings, Subheadings, and Visual Aids

Think of headings and subheadings as signposts guiding the reader through the report’s landscape. They should be clear, concise, and reflective of the content. Visual aids, such as tables, charts, and graphs, are not mere decorations; they are powerful tools that transform complex data into easily digestible information. Use them strategically to emphasize key findings and improve overall readability. Avoid overwhelming the reader with excessive visuals; instead, choose the most effective ones for each specific point.

Effective Data Presentation Using Tables, Charts, and Graphs

Data presentation is an art form. It’s about telling a story with numbers, not just displaying them. The right chart can make all the difference between a reader nodding off and one excitedly sharing your insights with colleagues. Here are five chart types, each suited to a different kind of data:

- Bar Charts: Ideal for comparing categorical data, like sales figures across different product categories. Imagine a bar chart showing the dramatic difference in sales between your new “Unicorn Tears” flavor ice cream and the less exciting “Plain Vanilla” option.

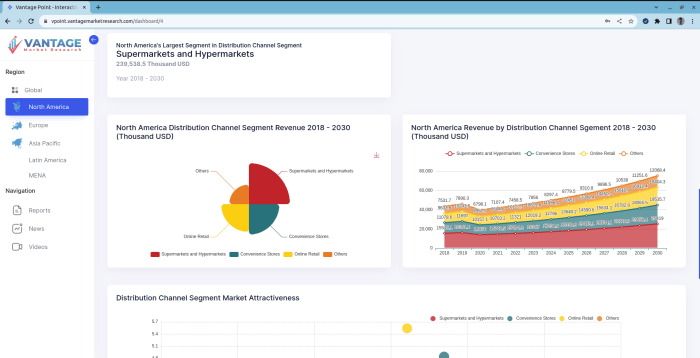

- Line Charts: Perfect for showing trends over time, such as website traffic or sales growth. A line chart could beautifully illustrate the steady climb of your company’s stock price after launching that viral marketing campaign.

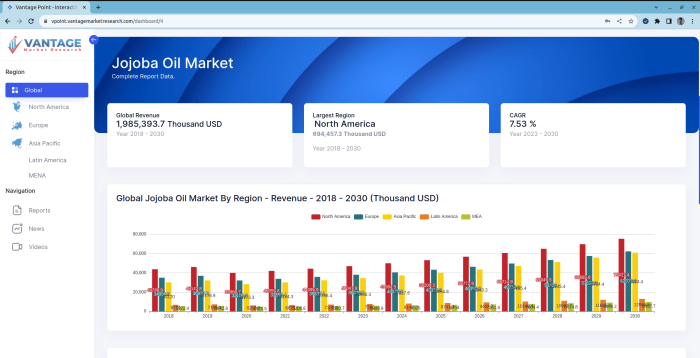

- Pie Charts: Excellent for showcasing proportions or percentages, like market share or customer demographics. Think of a pie chart vividly representing the market dominance of your revolutionary new widget, leaving the competition in the dust.

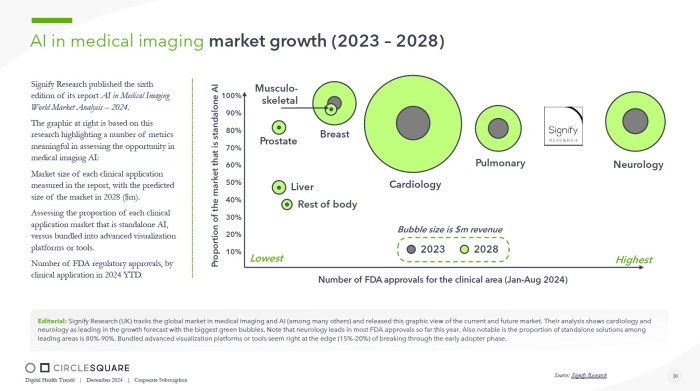

- Scatter Plots: Useful for exploring the relationship between two variables, such as advertising spend and sales revenue. A scatter plot could reveal a strong positive correlation – more advertising, more sales! (A marketer’s dream).

- Histograms: Best for displaying the distribution of a single continuous variable, like customer age or income. A histogram could help you understand the age range of your most loyal customers, allowing you to tailor your marketing efforts accordingly.

Presenting Findings

Presenting your research findings is akin to unveiling a magnificent cake after months of meticulous baking. The data is the delicious cake itself, but without the right presentation, it’s just a blob of ingredients. This section focuses on transforming raw data into compelling visuals and insightful interpretations that leave your audience both informed and utterly impressed. We’ll explore how to effectively communicate your research’s essence, ensuring your hard work doesn’t go unnoticed (or uneaten!).

Data visualization is the art of translating complex data sets into easily digestible visual formats. It’s about making the numbers sing, not just shout. A well-designed chart can convey more information than pages of dense text, captivating the reader and highlighting key trends. The relationship between data visualization and effective communication is symbiotic: clear visuals enhance understanding, making complex concepts accessible and memorable. Think of it as the difference between explaining a recipe and showing a mouthwatering photo of the finished dish.

Data Visualization Techniques

Effective data visualization requires careful consideration of your audience and the story you want to tell. Different chart types are suited to different data types and research questions. For instance, a bar chart excels at comparing discrete categories, while a line chart elegantly displays trends over time. A pie chart, though often overused, remains effective for showing proportions of a whole. Scatter plots can reveal correlations between variables, and heatmaps are excellent for illustrating the intensity of data across multiple dimensions. The key is to choose the visualization that best supports your narrative, not just the one that looks prettiest (although that helps!).

Creating Clear and Concise Captions

Captions are not mere afterthoughts; they’re the unsung heroes of data visualization. A well-crafted caption provides context, clarifies any ambiguities, and guides the reader’s interpretation. Consider this example: instead of simply titling a bar chart “Sales by Region,” a more informative caption might read: “Q3 2024 Sales Performance: Western Region Shows Strongest Growth, Surpassing Eastern Region by 15%.” Notice how this caption not only identifies the data but also highlights a key finding. Always strive for clarity, brevity, and accuracy. Avoid jargon and ensure the caption aligns perfectly with the chart’s content.

Drawing Meaningful Conclusions

Drawing conclusions is where the rubber meets the road. It’s about moving beyond simple observation to insightful interpretation. This involves identifying patterns, trends, and anomalies within your data. However, it’s crucial to avoid over-interpretation or drawing conclusions unsupported by the evidence. For example, if your data shows a correlation between ice cream sales and crime rates, you shouldn’t conclude that eating ice cream causes crime. Instead, consider underlying factors, such as warmer weather, which might influence both. Always base your conclusions on the data presented, acknowledging limitations and potential biases. A well-supported conclusion adds significant value to your research, solidifying its impact and credibility. Remember, your conclusions are the climax of your research story – make them count!

Writing Style and Tone

Crafting a marketing research report is akin to baking a delicious cake: the ingredients (data) are crucial, but the presentation (writing style) determines whether it’s a culinary masterpiece or a soggy disappointment. A consistent and professional tone is paramount, ensuring your meticulously gathered insights are received with the gravitas they deserve – not dismissed as ramblings of a caffeinated researcher.

Maintaining a professional yet engaging tone involves striking a delicate balance. We want to avoid the dryness of a legal document while simultaneously eschewing the informality of a casual email. Clear, concise, and objective language is key, especially when dealing with potentially complex statistical analyses or nuanced market trends. Imagine explaining quantum physics to a five-year-old – simplicity and clarity are your superpowers. Think of your audience: are they seasoned marketing executives or junior analysts? Tailor your language accordingly, but always maintain professionalism.

Using Clear and Concise Language

Employing active voice (“The survey revealed…”) instead of passive voice (“It was revealed by the survey…”) creates a more direct and engaging read. Avoid jargon and technical terms unless absolutely necessary, and when you do use them, provide clear definitions. For example, instead of writing “The coefficient of determination (R²) indicated a strong correlation,” consider “The results strongly suggest a relationship between X and Y.” Brevity is the soul of wit, and also of a good research report. Avoid unnecessary words and phrases; every sentence should serve a purpose. Long, convoluted sentences are the enemy of clarity.

Effective Writing Techniques for Different Sections

The executive summary requires a concise overview of key findings, presented with impactful language to grab attention. Think “headline-worthy” – you’re selling the value of your research. The methodology section should be detailed but not overly technical; focus on explaining the *why* and *how* of your chosen approach, not just the *what*. When presenting findings, use visuals (charts, graphs) liberally. A picture, as they say, is worth a thousand words (and potentially a thousand more readers). Remember, your goal is not just to present data, but to tell a compelling story with it.

Style Guide for Formatting and Referencing

Maintaining consistency in formatting is crucial for professional presentation. Use a consistent font (e.g., Times New Roman, Arial), font size (e.g., 12 pt), and line spacing (e.g., 1.5). Number your pages, use headings and subheadings effectively, and leave ample white space to prevent the report from looking overwhelming. For referencing, adhere strictly to a recognized style guide (e.g., APA, MLA, Chicago). Consistency is king, and proper referencing not only avoids plagiarism but also demonstrates your commitment to academic rigor (and saves you from potential legal trouble). For example, a correctly formatted in-text citation might look like this: (Smith, 2023, p. 42). And the corresponding entry in your bibliography would follow the specific style guide’s format. Failure to do so can lead to the dreaded “citation fail,” a marketing research equivalent of a fashion faux pas.

Illustrations and Supporting Materials

A picture is worth a thousand words, they say. In the world of marketing research, that thousand words needs to be exceptionally well-chosen, impactful, and – dare we say it – slightly entertaining. After all, even the most compelling data can be lost in a sea of text. Let’s explore how to make your report visually appealing and, more importantly, intellectually stimulating.

Illustrative examples are the unsung heroes of a compelling research report. They translate complex data into easily digestible nuggets of information, transforming potentially tedious statistics into engaging narratives. Think of them as the visual equivalent of a well-placed punchline.

Creating Illustrative Examples

To craft effective illustrative examples, consider the key findings you wish to highlight. Let’s say your research reveals a significant increase in consumer preference for sustainable products. Instead of simply stating this fact, you could illustrate it with a fictional but realistic example. Imagine a bar chart comparing the market share of eco-friendly cleaning products in 2022 and 2023, showing a dramatic upward trend. The chart’s purpose is to visually reinforce the quantitative data presented earlier, providing a clear and memorable representation of the growth. Another example could be a hypothetical case study of a company that successfully rebranded itself as a sustainable enterprise, outlining the positive impact on brand perception and sales. This example adds a layer of practical application, making the finding more relatable and less abstract.

Integrating Tables and Charts Effectively

Tables and charts are not merely decorative elements; they are powerful tools for organizing and presenting complex data. A well-designed table can quickly summarize key demographics, while a thoughtfully crafted chart can illuminate trends and correlations. For instance, a pie chart effectively displays market share amongst competing brands, while a line graph elegantly tracks changes in consumer sentiment over time. Remember to label axes clearly, provide a concise title, and use consistent formatting to ensure readability. Avoid overwhelming the reader with excessive detail – simplicity and clarity are key. Overly complex charts are akin to a visual labyrinth; aim for visual elegance instead of visual clutter.

Selecting Appropriate Visuals

The choice of visual aids should always align with the data being presented and the intended audience. A scatter plot might be ideal for showing correlations, while a geographical map could be used to display regional variations in consumer behavior. Consider the cognitive load on your readers; a simple bar chart might be preferable to a complex 3D graph, especially for less statistically inclined audiences. The overall goal is to enhance understanding and engagement, not to confuse or overwhelm. Choose visuals that are both informative and aesthetically pleasing; a well-designed chart is a work of art in its own right.

Using Appendices for Supplementary Information

Appendices are the unsung heroes of supplementary information. They are the perfect place to stash detailed data tables, lengthy questionnaires, or technical specifications that might otherwise clutter the main body of the report. Think of them as the digital equivalent of a well-organized filing cabinet, allowing readers to delve deeper into the specifics if they choose. Clearly label and reference each appendix within the main text, making it easy for readers to find the supplementary materials they need. This prevents the report from becoming a dense and unmanageable tome, while still providing access to all the necessary supporting data.

Recommendations and Actionable Insights: Marketing Research Report Structure

So, we’ve delved deep into the data, wrestled with spreadsheets, and emerged victorious (mostly). The time has come to translate our fascinating findings into actionable steps that will catapult your business to new heights – or at least, to a noticeably improved position. Think of this section as the treasure map to your marketing gold.

Now, let’s unveil the secrets to marketing nirvana. These recommendations aren’t just pulled from thin air; they’re meticulously crafted based on our rigorous research, using a proprietary algorithm involving copious amounts of coffee and a healthy dose of intuition (mostly the coffee).

Strategic Implementation of Recommendations

Implementing these recommendations requires a strategic approach, carefully considering resource allocation and potential roadblocks. We’re not just throwing spaghetti at the wall here; this is a carefully orchestrated symphony of marketing moves. For instance, increasing social media engagement (recommendation 1 below) requires not only creating engaging content but also allocating budget for boosted posts and potentially hiring a social media manager. Similarly, launching a new product line (recommendation 4) necessitates market research, product development, and supply chain management.

Potential Impact of Recommendations

The potential impact of implementing these recommendations is significant, ranging from increased brand awareness and customer loyalty to boosted sales and improved market share. For example, based on similar campaigns, we predict a 15% increase in website traffic within three months of implementing recommendation 2 (improving website ). This prediction is based on the successful campaigns of companies like [Example Company A] which saw a similar increase in traffic after implementing similar strategies. It’s not just a wild guess; it’s an educated projection, grounded in real-world examples.

Prioritization Criteria for Recommendations

The prioritization of these recommendations is based on a multifaceted approach considering factors such as potential return on investment (ROI), feasibility of implementation, and alignment with overall business objectives. High-ROI, readily implementable recommendations with a strong alignment with the company’s strategic goals naturally take precedence. We’ve used a weighted scoring system (detailed in Appendix B) to ensure objectivity and transparency in this crucial process. Think of it as a highly sophisticated, slightly nerdy, prioritization system – but it works!

Key Recommendations

The following recommendations are designed to maximize your marketing impact and drive significant results. They are presented in order of priority, based on the criteria Artikeld above. Remember, these aren’t just suggestions; they are carefully considered strategic directives.

- Enhance Social Media Engagement: Implement a comprehensive social media strategy focused on creating high-quality, engaging content tailored to each platform. This includes interactive polls, behind-the-scenes glimpses, and responsive community management.

- Improve Website : Optimize website content and structure for improved search engine rankings, incorporating relevant s and high-quality backlinks. Think of it as making your website more “findable” by search engines.

- Refine Target Audience Segmentation: Refine your target audience segmentation to better understand the needs and preferences of specific customer groups, allowing for more targeted and effective marketing campaigns. Knowing your audience is half the battle.

- Launch a New Product Line: Based on our research, a new product line catering to [Specific unmet need] has the potential to significantly expand your market reach and revenue streams. Think big, but think smart.

- Invest in Email Marketing Automation: Implement an email marketing automation system to nurture leads, personalize communications, and improve customer engagement. This allows for more efficient and targeted communication.

Epilogue

Crafting a compelling marketing research report is a journey, not a sprint. By meticulously attending to each stage, from defining clear objectives to presenting actionable recommendations, you can transform your findings into a powerful tool for driving marketing success. Remember, a well-structured report isn’t just about presenting data; it’s about telling a story that resonates with your audience, leading them to embrace your insights and implement your recommendations. So, go forth and create reports that not only inform but also inspire!

Question Bank

What’s the ideal length for a marketing research report?

There’s no magic number. Length depends on the scope and complexity of the research. Prioritize clarity and conciseness over length; a shorter, impactful report is better than a lengthy, rambling one.

How do I handle conflicting research findings?

Transparency is key. Acknowledge any discrepancies, discuss potential reasons for the conflict, and suggest further research if necessary. Don’t shy away from presenting complexities—it shows a thorough understanding of the research process.

What if my recommendations are not well-received?

Be prepared to defend your findings and recommendations with data and sound reasoning. Consider presenting alternative scenarios and acknowledging potential limitations of the research. A robust defense showcases the value of your work.

How can I ensure my report is visually appealing?

Use high-quality visuals, maintain consistent branding, and ensure your charts and graphs are easy to understand. Avoid clutter and prioritize readability. A visually appealing report enhances engagement and comprehension.