Navigating the financial landscape of a microbusiness can feel like charting uncharted waters. This guide provides a roadmap, equipping aspiring and existing microbusiness owners with the essential tools and knowledge to build a solid financial foundation. From understanding unique financial challenges to mastering cash flow management and securing funding, we explore every aspect of ensuring your microbusiness thrives.

We delve into the intricacies of creating comprehensive financial plans, analyzing key financial statements, and implementing effective tax strategies. Practical examples, clear explanations, and actionable advice are woven throughout, making this guide an indispensable resource for anyone seeking to achieve financial success in the dynamic world of microbusinesses.

Defining Microbusinesses and Their Financial Needs

Microbusinesses form the backbone of many economies, contributing significantly to job creation and innovation. Understanding their unique financial characteristics is crucial for effective support and growth strategies. This section will define microbusinesses, differentiate them from other business sizes, and explore the specific financial challenges they face. We will also examine the diverse financial needs across various industries.

Microbusinesses are typically defined by their size, measured by factors like revenue, number of employees, and assets. Unlike small and medium-sized enterprises (SMEs), which often have more established structures and resources, microbusinesses are usually characterized by their small scale and often operate with limited resources and a high degree of owner involvement. The precise definition can vary slightly depending on the country and the specific regulatory framework, but generally, a microbusiness is a very small business with limited capital and a few employees, frequently operated by the owner(s). It is typically independent and not part of a larger corporate structure.

Microbusiness Financial Challenges

Microbusinesses face unique financial hurdles that often differ significantly from larger enterprises. Access to capital is frequently a major obstacle. Securing loans or attracting investment can be difficult due to perceived higher risk and limited collateral. Cash flow management is another critical challenge; inconsistent revenue streams can lead to difficulties in meeting operational expenses and payroll. Furthermore, many microbusiness owners lack formal financial training and struggle with accurate bookkeeping, budgeting, and financial forecasting. The lack of resources and expertise can hinder effective financial management and strategic planning. Finally, the personal financial situation of the owner is often inextricably linked to the business’s financial health, creating significant personal financial risk.

Financial Needs Across Industries

The financial needs of microbusinesses vary considerably depending on their industry. For example, a food truck requires different capital investments and operating expenses compared to a freelance graphic design business. The following table illustrates some of these differences:

| Industry | Initial Capital Investment | Ongoing Operational Costs | Key Financial Needs |

|---|---|---|---|

| Food Truck | High (vehicle purchase, equipment, permits) | High (food supplies, fuel, staffing) | Working capital, loan for vehicle purchase, inventory management |

| Freelance Graphic Design | Low (computer, software) | Low (internet, software subscriptions) | Marketing and client acquisition, cash flow management, invoicing system |

| Online Retail (Etsy Shop) | Moderate (website development, inventory) | Moderate (marketing, shipping, website maintenance) | Inventory financing, marketing budget, e-commerce platform fees |

| Home Cleaning Service | Low (cleaning supplies, transportation) | Low (cleaning supplies, marketing) | Client acquisition, scheduling software, reliable transportation |

Creating a Financial Plan for a Microbusiness

Developing a robust financial plan is crucial for the success and longevity of any microbusiness. A well-structured plan provides a roadmap for managing finances, making informed decisions, and achieving long-term goals. It allows for proactive management of resources, minimizing risks, and maximizing opportunities for growth. Without a financial plan, microbusinesses often struggle with cash flow, leading to potential instability and even failure.

Step-by-Step Guide to Creating a Microbusiness Financial Plan

Creating a comprehensive financial plan involves a series of sequential steps, each building upon the previous one. A methodical approach ensures all essential aspects are considered and incorporated effectively. Ignoring any of these steps can compromise the overall effectiveness of the plan.

- Define Your Business Goals: Clearly articulate your short-term and long-term objectives. This could include revenue targets, market share goals, expansion plans, or profit margins. For example, a bakery might aim to increase sales by 15% in the next year and open a second location within three years.

- Conduct a Thorough Market Analysis: Understand your target market, competition, and industry trends. This will help you make realistic projections and adapt your strategy as needed. Researching competitor pricing and analyzing customer demographics are vital components of this step.

- Develop Financial Projections: Create realistic financial projections, including cash flow statements, profit and loss statements, and balance sheets (detailed below). These projections should be based on your market analysis and business goals.

- Secure Funding (if needed): Determine your funding needs and explore potential sources, such as small business loans, grants, or personal investment. A detailed financial plan is essential for securing funding from external sources.

- Monitor and Adjust: Regularly review your financial plan and make adjustments as needed based on actual performance and changing market conditions. This iterative process is critical for adapting to unexpected challenges and opportunities.

Key Components of a Microbusiness Financial Plan

Several core financial statements form the foundation of a comprehensive microbusiness financial plan. Understanding their individual contributions and how they interrelate is essential for effective financial management.

- Cash Flow Projections: This statement forecasts your incoming and outgoing cash over a specific period. It’s crucial for managing short-term liquidity and avoiding cash shortages. Example: A monthly cash flow projection might show anticipated sales revenue, operating expenses (rent, salaries, supplies), and loan repayments, resulting in a net cash flow figure for each month.

- Profit and Loss Statement (P&L): This statement summarizes your revenues and expenses over a specific period, revealing your net profit or loss. It provides a snapshot of your business’s financial performance. Example: A quarterly P&L might show total sales revenue, cost of goods sold, operating expenses, and resulting net profit (or loss).

- Balance Sheet: This statement shows your business’s assets, liabilities, and equity at a specific point in time. It provides a picture of your financial position. Example: A year-end balance sheet might list cash on hand, inventory, equipment (assets), accounts payable, loans (liabilities), and owner’s equity.

Interrelation of Financial Plan Components

The cash flow projection, profit and loss statement, and balance sheet are interconnected. The P&L informs the cash flow projection by providing data on revenue and expenses. The balance sheet reflects the cumulative impact of the cash flow and P&L over time. For instance, a profitable P&L (positive net profit) will generally lead to an increase in retained earnings on the balance sheet and a positive net cash flow. Conversely, losses on the P&L will likely result in negative cash flow and a decrease in equity. Accurate and consistent data across all three is vital for a reliable financial picture.

Managing Cash Flow in a Microbusiness

Effective cash flow management is crucial for the survival and growth of any microbusiness. A consistent positive cash flow ensures the business can meet its financial obligations, invest in growth opportunities, and ultimately thrive. Neglecting cash flow can lead to missed payments, strained supplier relationships, and even business closure. This section will explore strategies for proactively managing your microbusiness’s cash flow.

Maintaining a healthy cash flow involves a combination of careful budgeting, accurate forecasting, and the diligent use of financial tools. By understanding where your money is coming from and where it’s going, you can identify areas for improvement and make informed decisions to optimize your financial health.

Budgeting and Forecasting Techniques

Budgeting and forecasting are fundamental to effective cash flow management. A budget Artikels your planned income and expenses over a specific period, typically monthly or quarterly. Forecasting, on the other hand, projects future cash inflows and outflows based on historical data, sales projections, and anticipated expenses. Combining these two provides a comprehensive view of your expected cash position. Regularly reviewing and adjusting your budget and forecast based on actual performance is essential for staying on track. For example, a microbusiness selling handmade crafts might budget for a specific number of sales per month, factoring in material costs, marketing expenses, and potential fluctuations in demand. Their forecast might then project sales growth based on seasonal trends or planned marketing campaigns.

Utilizing Financial Tools and Software

Numerous financial tools and software applications can significantly simplify cash flow management. Spreadsheet software like Microsoft Excel or Google Sheets allows for the creation of detailed budgets and cash flow projections. More sophisticated accounting software packages offer features such as automated invoicing, expense tracking, and bank reconciliation, providing a real-time overview of your financial position. Many mobile apps also provide basic budgeting and expense tracking capabilities, offering convenient access to your financial data on the go. For instance, using accounting software, a microbusiness owner can automatically track invoices sent and received, reconcile bank statements, and generate reports showing their cash flow trends over time. This enables them to quickly identify potential shortfalls or surpluses and adjust their spending accordingly.

Sample Cash Flow Projection

The following table illustrates a sample cash flow projection for “Cozy Candles,” a hypothetical microbusiness selling handmade candles:

| Month | Beginning Cash | Sales Revenue | Expenses | Ending Cash |

|---|---|---|---|---|

| January | $500 | $1500 | $800 | $1200 |

| February | $1200 | $1800 | $900 | $2100 |

| March | $2100 | $2000 | $1000 | $3100 |

Funding Options for Microbusinesses

Securing sufficient capital is crucial for the success of any microbusiness. The initial funding stage significantly impacts the trajectory of the venture, influencing its growth potential and longevity. Understanding the diverse funding options available and their respective strengths and weaknesses is paramount for entrepreneurs. This section explores various avenues for obtaining funding, enabling microbusiness owners to make informed decisions based on their specific needs and circumstances.

Bootstrapping

Bootstrapping involves funding a business using personal savings, revenue generated from the business itself, and the reinvestment of profits. It’s a common approach for microbusinesses due to its accessibility and avoidance of external debt or equity dilution. This method emphasizes resourcefulness and careful financial management.

Advantages and Disadvantages of Bootstrapping

Bootstrapping offers significant advantages, primarily the retention of complete ownership and control. It avoids the complexities and potential downsides of external financing, such as interest payments or investor interference. However, it can severely limit growth potential due to restricted capital, and the founder may face significant personal financial risk. Furthermore, relying solely on bootstrapping can slow down expansion plans and potentially miss out on timely opportunities.

Small Business Loans

Small business loans from banks or credit unions are a common source of funding for microbusinesses. These loans provide a lump sum of capital that can be used for various business purposes, such as purchasing equipment, covering operating expenses, or expanding operations. The terms and conditions of these loans vary widely depending on the lender and the borrower’s creditworthiness.

Advantages and Disadvantages of Small Business Loans

The main advantage of small business loans is the access to a substantial amount of capital. This can accelerate business growth and allow for strategic investments. However, loans require regular repayments with interest, potentially straining cash flow, especially during lean periods. Furthermore, securing a loan often involves a rigorous application process and requires strong credit history. Failure to meet repayment obligations can have severe consequences.

Grants

Grants are non-repayable funds provided by government agencies, foundations, or private organizations. They typically support businesses that align with specific social or economic objectives. Securing grants can be highly beneficial as they provide crucial funding without the burden of debt.

Advantages and Disadvantages of Grants

The primary advantage of grants is that they are essentially free money. This can significantly alleviate financial pressure and allow for investment in critical areas. However, the competition for grants can be intense, and the application process is often complex and time-consuming. Furthermore, grants usually come with specific requirements and restrictions on how the funds can be used.

Crowdfunding

Crowdfunding involves raising capital from a large number of individuals through online platforms. This approach can be particularly effective for businesses with a strong online presence and a compelling story to tell potential investors. Various crowdfunding models exist, including rewards-based, equity-based, and donation-based campaigns.

Advantages and Disadvantages of Crowdfunding

Crowdfunding offers a way to reach a broad audience and generate significant buzz around the business. It can also provide valuable market validation. However, success is not guaranteed, and campaigns can fail to reach their funding goals. Furthermore, equity-based crowdfunding dilutes ownership, and rewards-based crowdfunding requires delivering on promises to backers.

Comparison of Funding Options

| Funding Option | Advantages | Disadvantages |

|---|---|---|

| Bootstrapping | Retains full ownership, avoids debt, simple to implement | Limited capital, slow growth, high personal risk |

| Small Business Loans | Access to substantial capital, established funding source | Requires repayment with interest, stringent credit requirements |

| Grants | Non-repayable funds, can significantly boost resources | Highly competitive, complex application process, restrictions on use |

| Crowdfunding | Broad reach, generates buzz, market validation | Success is not guaranteed, potential for ownership dilution |

Financial Record Keeping for Microbusinesses

Maintaining meticulous financial records is crucial for the success and longevity of any microbusiness. Accurate and up-to-date records provide a clear picture of your financial health, enabling informed decision-making, attracting investors, and ensuring compliance with tax regulations. Neglecting this vital aspect can lead to inaccurate financial reporting, missed tax deadlines, and ultimately, business failure.

Importance of Accurate and Timely Financial Record-Keeping

Accurate and timely financial record-keeping is essential for several reasons. It allows business owners to track income and expenses, monitor profitability, identify areas for improvement, and prepare accurate financial statements. This information is vital for securing loans, attracting investors, and making informed decisions about the future of the business. Furthermore, maintaining accurate records ensures compliance with tax laws and prevents potential penalties or legal issues. Regularly reviewing financial records also helps in detecting errors or fraudulent activities early on, minimizing potential losses. For example, a small bakery owner who diligently tracks their ingredient costs can quickly identify price increases and adjust their pricing strategy accordingly. Similarly, a freelance graphic designer who keeps accurate records of their invoices and payments can easily calculate their annual income for tax purposes.

Best Practices for Organizing and Storing Financial Records

Efficient organization and storage of financial records are critical for easy access and analysis. Utilizing accounting software is highly recommended, as it automates many tasks, reduces errors, and provides valuable reporting features. Software like QuickBooks Self-Employed or Xero offers user-friendly interfaces and are tailored to the needs of small businesses. Cloud-based solutions offer the added benefit of accessibility from anywhere with an internet connection and enhanced data security through backups and robust security protocols. A well-organized filing system, either physical or digital, is also essential. This system should categorize documents by type (invoices, receipts, bank statements, etc.) and date, making it easy to locate specific information when needed. Regular backups of all financial data are crucial to prevent data loss due to hardware failure or other unforeseen circumstances.

Examples of Different Record-Keeping Methods

Choosing the right record-keeping method depends on the size and complexity of the microbusiness and the owner’s technological proficiency.

- Spreadsheet Software (e.g., Microsoft Excel, Google Sheets): Suitable for very small businesses with minimal transactions. Allows for basic tracking of income and expenses but lacks advanced features of accounting software.

- Accounting Software (e.g., QuickBooks Self-Employed, Xero): Offers comprehensive features for tracking income and expenses, generating financial reports, managing invoices, and reconciling bank accounts. More suitable for businesses with a moderate to high volume of transactions.

- Manual Record-Keeping: Involves using journals, ledgers, and other physical documents to record financial transactions. This method is less efficient and more prone to errors but may be suitable for very small businesses with limited transactions.

- Hybrid Approach: Combines aspects of manual and digital record-keeping. For instance, a business might use a spreadsheet to track daily transactions and then transfer the data to accounting software at the end of the month.

Analyzing Financial Statements for Microbusinesses

Understanding your microbusiness’s financial health is crucial for success. Analyzing financial statements allows you to track performance, identify potential problems early, and make informed decisions about the future. This involves interpreting key statements like the income statement, balance sheet, and cash flow statement to gain a holistic view of your business’s financial position.

Analyzing these statements reveals trends and patterns that might not be immediately apparent from simply looking at individual numbers. This process allows for proactive adjustments to your business strategy, preventing potential crises and maximizing profitability.

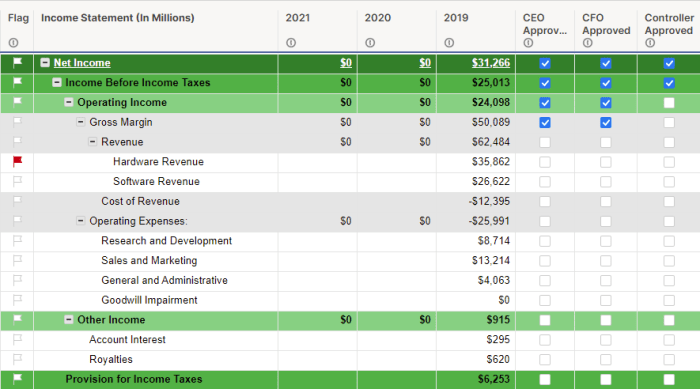

Income Statement Analysis

The income statement, also known as the profit and loss (P&L) statement, summarizes your revenue and expenses over a specific period. It shows your net income (profit) or net loss. Key metrics to analyze include gross profit margin (revenue minus cost of goods sold, divided by revenue), operating expenses as a percentage of revenue, and net profit margin (net income divided by revenue). A declining gross profit margin, for example, might indicate rising input costs or falling prices for your products or services. High operating expenses relative to revenue might suggest areas for cost-cutting.

Balance Sheet Analysis

The balance sheet provides a snapshot of your microbusiness’s assets, liabilities, and equity at a specific point in time. It follows the fundamental accounting equation: Assets = Liabilities + Equity. Analyzing the balance sheet helps determine your business’s solvency (ability to pay debts) and liquidity (ability to meet short-term obligations). Key ratios to examine include the current ratio (current assets divided by current liabilities), which measures short-term liquidity, and the debt-to-equity ratio (total debt divided by total equity), which indicates the proportion of financing from debt versus equity. A low current ratio might signal potential difficulties in meeting short-term payments, while a high debt-to-equity ratio suggests a higher level of financial risk.

Cash Flow Statement Analysis

The cash flow statement tracks the movement of cash in and out of your microbusiness over a period. It categorizes cash flows into operating activities (day-to-day business), investing activities (capital expenditures), and financing activities (debt and equity). Analyzing this statement is vital for understanding your cash position and identifying potential cash flow problems. Negative cash flow from operating activities, even with a positive net income, could indicate issues with accounts receivable or inventory management.

Scenario: Diagnosing Financial Difficulties

Imagine a bakery, “Sweet Success,” experiencing declining profits. Their income statement shows a decreasing net profit margin despite stable revenue. The balance sheet reveals a rising debt-to-equity ratio and a low current ratio. The cash flow statement indicates negative cash flow from operating activities, primarily due to high accounts receivable (customers owing money). Analyzing these statements suggests Sweet Success is facing challenges in collecting payments from customers, leading to cash flow shortages and increased reliance on debt. This analysis highlights the need for improved credit policies and potentially more aggressive collection efforts. The declining profit margin may also indicate rising ingredient costs, requiring adjustments to pricing or sourcing strategies.

Tax Planning for Microbusinesses

Effective tax planning is crucial for the long-term financial health of any microbusiness. Understanding your tax obligations and employing sound strategies can significantly impact your profitability and allow for reinvestment in growth. Ignoring tax planning can lead to unexpected liabilities and hinder your business’s potential.

Tax obligations for microbusinesses vary depending on several factors, including the business structure (sole proprietorship, partnership, LLC, etc.), location, and type of income generated. However, all microbusinesses are generally responsible for paying income taxes on their profits, and may also face other taxes such as sales tax, property tax, and employment taxes if applicable. Accurate and timely filing is essential to avoid penalties.

Tax Obligations and Responsibilities of Microbusiness Owners

Microbusiness owners, regardless of their chosen business structure, are responsible for understanding and complying with all applicable federal, state, and local tax laws. This includes accurately reporting all income, deducting eligible expenses, and paying taxes on time. Failure to do so can result in penalties, interest charges, and even legal action. For sole proprietors and single-member LLCs, business income and expenses are reported on Schedule C of Form 1040. Partnerships and LLCs with multiple members file a partnership return (Form 1065) and each partner reports their share of income or loss on their individual tax returns. Corporations file Form 1120. The specific forms and deadlines vary by jurisdiction.

Tax Strategies to Minimize Tax Burden

Several legal tax strategies can help microbusinesses minimize their tax liability. These strategies should be implemented in consultation with a tax professional to ensure compliance and optimize their effectiveness based on individual circumstances.

Tax Deductions for Microbusinesses

A wide range of deductions can significantly reduce a microbusiness’s taxable income. Careful record-keeping is essential to claim all allowable deductions. Many deductions are directly tied to business expenses. Failing to track and claim these deductions can result in paying more taxes than legally necessary.

- Home Office Deduction: If a portion of your home is exclusively used for business, you may be able to deduct a percentage of your home-related expenses, such as mortgage interest, property taxes, utilities, and insurance.

- Vehicle Expenses: Costs associated with using a vehicle for business purposes, including gas, oil, repairs, and depreciation, are deductible. Accurate mileage records are crucial.

- Office Supplies and Equipment: The cost of office supplies, computers, software, and other equipment used for business is generally deductible. This can include the cost of subscriptions to business software or online services.

- Marketing and Advertising: Expenses related to promoting your business, such as advertising, marketing materials, and website development, are deductible.

- Professional Fees: Fees paid to accountants, lawyers, and other professionals for business-related services are deductible.

- Travel Expenses: Travel expenses incurred for business purposes, such as airfare, lodging, and meals, are deductible (subject to limitations).

- Health Insurance Premiums (Self-Employed): Self-employed individuals can deduct the cost of their health insurance premiums.

- Qualified Business Income (QBI) Deduction: This deduction allows eligible self-employed individuals and small business owners to deduct up to 20% of their qualified business income.

Financial Forecasting and Budgeting for Microbusinesses

Financial forecasting and budgeting are crucial for the long-term health and success of any microbusiness. They provide a roadmap for managing finances, identifying potential problems, and making informed decisions about growth and resource allocation. A well-structured budget acts as a control mechanism, ensuring that spending aligns with income projections and strategic goals. Accurate forecasting allows for proactive adjustments to mitigate risks and capitalize on opportunities.

Creating realistic financial forecasts and budgets involves a systematic approach that considers both historical data and future projections. This process begins with a thorough understanding of the microbusiness’s current financial position, including revenue streams, expenses, and assets. From there, realistic estimates are made for future periods, taking into account market trends, seasonal variations, and planned investments. Regular monitoring and comparison of actual results against the budget are essential to identify variances and make necessary corrections.

Budgeting Process for Microbusinesses

The process of creating a budget involves several key steps. First, gather historical financial data to establish baselines for revenue and expenses. Then, research market trends and make informed projections for future sales. Next, detail all anticipated expenses, categorizing them for better management. Finally, create a comprehensive budget that balances projected income and expenses, ensuring profitability and sufficient cash flow. Regular review and adjustment of the budget are crucial to maintain its relevance and accuracy throughout the year.

Using Forecasting and Budgeting for Informed Business Decisions

Forecasting and budgeting empower microbusiness owners to make data-driven decisions. By analyzing projected income and expenses, they can identify areas for cost reduction, prioritize investments, and assess the financial feasibility of new initiatives. For example, a comparison of projected sales against anticipated expenses can reveal whether a planned marketing campaign is likely to generate a positive return on investment. Similarly, forecasting cash flow allows for proactive management of working capital, preventing potential shortfalls and ensuring timely payments to suppliers and employees. This proactive approach minimizes financial risks and enhances the chances of long-term success.

Hypothetical Microbusiness Budget

The following table illustrates a hypothetical annual budget for a freelance graphic design microbusiness. Note that this is a simplified example and actual budgets will vary significantly depending on the specific nature of the business and its market conditions.

| Income | Amount ($) | Expenses | Amount ($) |

|---|---|---|---|

| Design Services | 30,000 | Software Licenses | 1,200 |

| Branding Packages | 15,000 | Marketing & Advertising | 2,000 |

| Website Design | 5,000 | Office Supplies | 500 |

| Total Income | 50,000 | Rent (Home Office) | 1,000 |

| Professional Development | 1,000 | ||

| Taxes & Fees | 5,000 | ||

| Insurance | 500 | ||

| Utilities | 300 | ||

| Total Expenses | 11,500 | ||

| Net Profit | 38,500 |

Seeking Professional Financial Advice for Microbusinesses

Navigating the financial complexities of a microbusiness can be challenging, even for experienced entrepreneurs. Seeking professional financial advice offers invaluable support, providing clarity and potentially saving significant time and money in the long run. A knowledgeable advisor can offer insights and strategies that might not be readily apparent to someone solely focused on the day-to-day operations of their business.

Professional financial guidance offers a range of benefits for microbusinesses, from improved financial management to strategic planning for growth. Access to expert knowledge can help owners make informed decisions, mitigate risks, and ultimately increase the likelihood of long-term success. This support extends beyond simply managing finances; it can encompass broader business strategies, contributing to a more robust and resilient enterprise.

Types of Beneficial Financial Advice for Microbusinesses

Microbusiness owners can benefit from a wide array of financial advice tailored to their specific needs. This can include assistance with budgeting and forecasting, cash flow management, securing funding, tax planning, and analyzing financial statements. More specialized advice might also be beneficial, depending on the industry and business model. For example, advice on pricing strategies, inventory management, or understanding industry-specific regulations can significantly impact profitability and long-term viability.

Questions to Ask a Potential Financial Advisor

Before engaging a financial advisor, it’s crucial to thoroughly vet potential candidates. A clear understanding of their qualifications, experience, and fee structure is paramount. The following points represent key areas of inquiry for a prospective client.

Understanding the advisor’s experience and expertise is crucial. This involves inquiring about their background, the types of businesses they have previously advised, and their familiarity with the specific challenges faced by microbusinesses in your industry. Asking about their professional certifications and memberships in relevant organizations will also provide assurance of their competence and adherence to professional standards. It’s also important to understand their approach to financial planning and how they tailor their services to meet the unique needs of each client.

Transparency in fees and services is essential. Inquiring about their fee structure, including any potential additional charges, will allow for accurate budgeting and informed decision-making. Understanding the scope of services included in their fees, such as the frequency of meetings, types of reports provided, and accessibility for consultation, will ensure alignment with your needs and expectations. Asking for references or testimonials from previous clients can provide valuable insights into their work ethic and the quality of their services.

Finally, clarifying the advisor’s communication style and responsiveness is crucial for a productive working relationship. Understanding how they maintain client communication, the methods they use to provide updates and reports, and their availability for questions or concerns will ensure a smooth and efficient collaboration. Asking about their availability and preferred methods of communication will help determine if their style aligns with your preferences and work habits.

Closing Summary

Ultimately, successful microbusiness financial planning hinges on proactive management, informed decision-making, and a commitment to continuous learning. By understanding your financial needs, developing a robust plan, and seeking professional guidance when necessary, you can significantly increase your chances of building a sustainable and profitable microbusiness. This guide serves as a starting point, empowering you to take control of your financial future and confidently navigate the path to entrepreneurial success.

FAQ Resource

What is the difference between a microbusiness and a small business?

The distinction often lies in revenue, number of employees, and overall scale of operations. Microbusinesses generally have lower revenue thresholds and fewer employees than small businesses. Specific definitions vary by region and government regulations.

How often should I review my financial plan?

Regular review is crucial, ideally monthly or quarterly, to track progress, identify potential issues, and make necessary adjustments. Annual reviews are essential for long-term strategic planning.

What accounting software is best for microbusinesses?

Many excellent options exist, including Xero, QuickBooks, and FreshBooks. The best choice depends on your specific needs, budget, and technical skills. Consider features like invoicing, expense tracking, and reporting capabilities.

Where can I find free resources for microbusiness financial planning?

Numerous government agencies, non-profit organizations, and online resources offer free guides, templates, and workshops. Searching for “[your location] small business resources” is a good starting point.