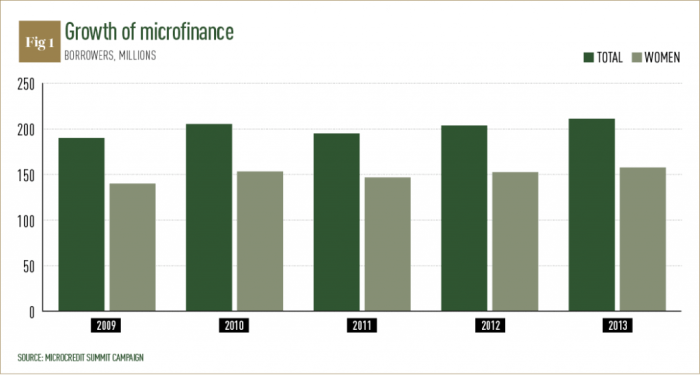

Microfinance, the provision of financial services to low-income individuals and groups, has witnessed a surge in popularity globally. Its impact, however, remains a subject of ongoing debate and rigorous analysis. This exploration delves into the multifaceted effects of microfinance, examining its economic, social, and environmental consequences. We will investigate various methodologies used to measure its impact and explore compelling case studies that illustrate both its successes and limitations.

Understanding the true impact of microfinance requires a nuanced approach, considering factors like the specific context of implementation, the characteristics of the target population, and the design of the microfinance programs themselves. This analysis will examine these crucial elements to provide a balanced and comprehensive understanding of the field.

Defining Microfinance and its Scope

Microfinance encompasses a range of financial services directed at low-income individuals and communities, often lacking access to traditional banking systems. These services aim to empower individuals economically, fostering self-reliance and improved livelihoods. The scope extends beyond simply providing credit; it includes savings accounts, insurance, and money transfer services, creating a holistic financial ecosystem for underserved populations.

Microfinance institutions (MFIs) typically target individuals and groups excluded from mainstream financial services. This demographic often includes women, rural populations, small business owners, and those living in poverty. The focus is on providing accessible and affordable financial tools to help them build assets, create businesses, and improve their overall financial well-being. The success of microfinance hinges on its ability to reach and effectively serve these often marginalized communities.

Target Demographics of Microfinance

The primary beneficiaries of microfinance are individuals and groups typically underserved by traditional financial institutions. This often includes women, who frequently represent a significant portion of microfinance clients due to their crucial role in household economics and their often-limited access to credit. Rural populations, often geographically isolated and lacking access to banks, are another key target group. Small business owners, forming the backbone of many developing economies, rely heavily on microfinance for capital and operational support. Finally, individuals living in poverty, lacking collateral or a formal credit history, find in microfinance a pathway to economic inclusion. These groups share a common characteristic: limited access to traditional banking services.

Microfinance Delivery Models

Microfinance utilizes various models to deliver its services effectively to its target clientele. Two prominent models are group lending and individual lending. Group lending involves extending loans to a group of individuals who are jointly liable for repayment. This approach leverages peer pressure and social capital to encourage timely repayment, reducing the risk for the MFI. Individual lending, on the other hand, provides loans directly to individuals based on their creditworthiness and repayment capacity, often requiring more rigorous credit assessment procedures. Each model has its strengths and weaknesses, with the optimal choice often depending on the specific context and client characteristics.

Comparison of Microfinance Products

The following table compares and contrasts several common microfinance products, highlighting their key features:

| Loan Type | Interest Rate | Repayment Schedule | Target Client |

|---|---|---|---|

| Microloan | Variable, typically higher than traditional loans but often lower than informal lenders | Weekly, bi-weekly, or monthly installments, depending on the loan amount and terms | Small business owners, individuals with limited credit history |

| Group Loan | Variable, often similar to microloans | Weekly, bi-weekly, or monthly installments, jointly responsible | Groups of individuals, often women’s self-help groups |

| Agricultural Loan | Variable, may be subsidized in some cases | Seasonal, aligned with agricultural cycles | Farmers, agricultural entrepreneurs |

| Housing Microloan | Variable, typically longer repayment terms | Monthly installments over several years | Low-income families seeking to improve housing conditions |

Impact Measurement Methodologies

Accurately measuring the impact of microfinance programs is crucial for understanding their effectiveness and improving future initiatives. A range of methodologies, both quantitative and qualitative, are employed to assess the diverse economic and social effects on borrowers and their communities. Choosing the appropriate method depends on the specific goals of the impact assessment, the resources available, and the context of the microfinance program.

Impact assessments often combine quantitative and qualitative approaches to gain a comprehensive understanding. Quantitative methods provide numerical data, allowing for statistical analysis and comparisons, while qualitative methods offer rich contextual insights into the lived experiences of individuals and communities. The integration of both provides a more robust and nuanced evaluation of program effectiveness.

Quantitative Indicators in Microfinance Impact Assessment

Quantitative methods rely on numerical data to measure changes resulting from microfinance interventions. These indicators provide a measurable assessment of program success. For example, changes in income levels, business growth, savings rates, and asset ownership are frequently tracked. Specific examples include:

- Increase in household income: Measured by comparing pre- and post-loan income levels. A successful program would show a statistically significant increase.

- Business growth indicators: These could include changes in revenue, profits, number of employees, or expansion of business operations. For example, a micro-loan recipient’s business might grow from a small street stall to a larger shop with several employees.

- Savings rates: Monitoring the increase in savings among borrowers indicates improved financial stability and capacity for future investments. A successful program would demonstrate an increase in the average savings balance.

- Asset ownership: Tracking changes in ownership of productive assets (e.g., livestock, land, equipment) reflects the program’s contribution to wealth creation. This might be measured by a survey asking about the acquisition of new assets since receiving the loan.

- Poverty reduction measures: Indicators such as the poverty headcount ratio or the poverty gap can assess the program’s impact on poverty reduction within the target community. These require broader data collection beyond individual borrowers.

Qualitative Methods for Evaluating Microfinance

Qualitative methods provide in-depth understanding of the social and economic impacts of microfinance, offering insights that quantitative data alone cannot capture. These methods focus on the experiences and perspectives of borrowers and their communities. Examples include:

- In-depth interviews: These provide rich narrative data on borrowers’ experiences, challenges, and changes in their lives as a result of accessing microfinance. This can reveal the emotional and psychological impacts of the program, beyond just financial outcomes.

- Focus group discussions: These group interviews allow for the exploration of shared experiences and perspectives among borrowers, providing insights into the social dynamics and community impacts of the program.

- Case studies: Detailed analysis of individual borrowers’ journeys can illustrate the diverse ways in which microfinance impacts different people in different circumstances.

- Participatory rural appraisal (PRA) techniques: These methods involve community members in the data collection and analysis process, ensuring local knowledge and perspectives are incorporated into the assessment.

Comparison of Impact Assessment Frameworks

Several frameworks are used to evaluate microfinance impact. These frameworks differ in their scope, methodologies, and the types of data they prioritize. Examples include the logic model, theory of change, and outcome mapping. Each has strengths and weaknesses.

A detailed comparison requires a more extensive analysis beyond the scope of this section, but a general comparison of the advantages and disadvantages is provided below:

- Logic Model: This framework visually represents the causal links between program activities, outputs, outcomes, and impacts. It helps to clarify the program’s theory of change.

- Advantages: Simple to understand and visually appealing, facilitates clear communication of program goals and activities.

- Disadvantages: Can be overly simplistic, may not capture complex causal relationships or unintended consequences.

- Theory of Change: This framework Artikels the underlying assumptions and mechanisms through which a program is expected to achieve its goals. It’s more detailed than a logic model.

- Advantages: Provides a more nuanced understanding of the program’s logic and potential pathways to impact.

- Disadvantages: Can be complex to develop and may require extensive stakeholder consultation.

- Outcome Mapping: This framework focuses on measuring changes in the program’s contribution to long-term outcomes, rather than directly attributing specific changes to the program.

- Advantages: Useful for complex programs with multiple stakeholders and indirect impacts.

- Disadvantages: Can be challenging to attribute specific outcomes to the program, may require long-term monitoring.

Economic Impacts of Microfinance

Microfinance initiatives, by providing access to small loans and financial services, exert a significant influence on the economic well-being of individuals and communities, particularly in developing countries. This section explores the multifaceted economic impacts of microfinance, focusing on its effects on household income, poverty reduction, employment, entrepreneurship, savings, and investment behaviors. The analysis considers both positive and potential negative consequences to present a comprehensive overview.

Household Income and Poverty Reduction

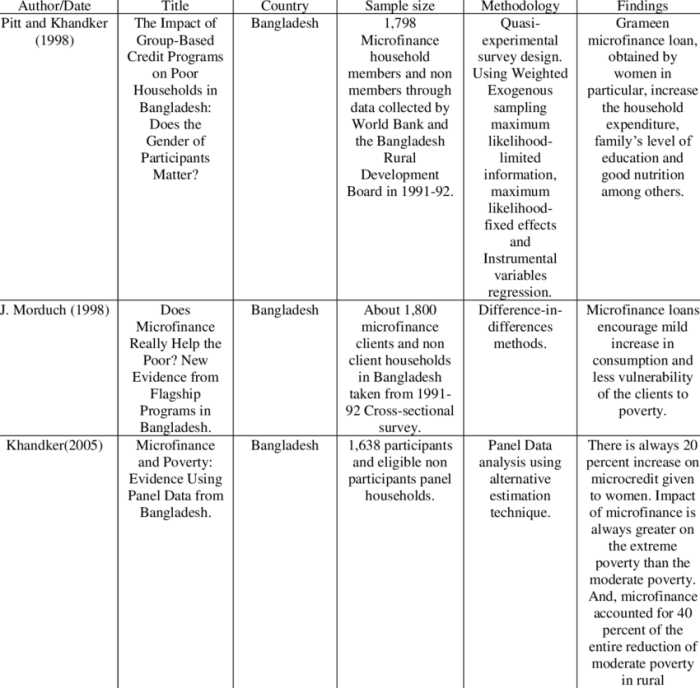

Microfinance demonstrably impacts household income. Access to credit allows individuals to invest in income-generating activities, such as starting or expanding small businesses, improving agricultural practices, or acquiring essential assets. This increased income contributes directly to poverty reduction by enabling households to afford basic necessities, improve their living standards, and invest in their children’s education and health. Studies have shown a consistent positive correlation between microfinance access and reduced poverty incidence, although the magnitude of the effect varies depending on factors such as the specific microfinance program design, the socio-economic context, and the characteristics of the borrowers. For example, a study in Bangladesh demonstrated a significant increase in household income among women who received microloans compared to a control group.

Employment and Entrepreneurship

Microfinance plays a crucial role in fostering employment and entrepreneurship. By providing access to capital, microfinance empowers individuals to start their own businesses, creating jobs for themselves and potentially for others. This is particularly important in developing countries where formal employment opportunities are often limited. Microfinance clients often engage in diverse entrepreneurial activities, ranging from small-scale retail businesses to agricultural production and service provision. The resulting increase in self-employment contributes to economic growth and reduces unemployment at a local level. The success of these ventures, however, depends on factors such as business acumen, market demand, and access to support services beyond just credit.

Savings and Investment Behaviors

Microfinance institutions frequently encourage savings alongside lending. The integration of savings products into microfinance programs promotes a culture of financial responsibility and planning. By encouraging regular savings, microfinance helps clients build financial resilience and accumulate capital for future investments or to cope with unexpected expenses. This disciplined approach to saving can lead to improved household financial security and reduce vulnerability to economic shocks. Furthermore, the accumulated savings can serve as collateral for larger loans, allowing clients to expand their businesses or invest in more substantial projects. The impact on savings behavior varies depending on the design of the microfinance program and the cultural context.

Geographical Variations in Economic Impacts

The economic impacts of microfinance are not uniform across geographical contexts. Factors such as the regulatory environment, the level of financial inclusion, the prevalence of poverty, and the specific characteristics of the microfinance institutions influence the outcomes.

| Region | Income Change (%) | Employment Change (%) | Savings Change (%) |

|---|---|---|---|

| Sub-Saharan Africa | 15-25 (average, varies widely) | 5-15 (primarily self-employment) | 10-20 (significant variation depending on program design) |

| South Asia | 20-30 (higher in some areas) | 10-20 (significant impact on women’s employment) | 15-25 (stronger savings culture in some regions) |

| Latin America | 10-20 (relatively lower compared to other regions) | 5-10 (more established formal sector in some areas) | 5-15 (varies based on existing financial infrastructure) |

| Southeast Asia | 15-25 (significant growth in certain sectors) | 10-15 (positive impact on small and medium enterprises) | 10-20 (stronger impact in areas with well-designed programs) |

Social Impacts of Microfinance

Microfinance, while primarily focused on economic development, exerts significant influence on various social aspects of borrowers’ lives. Its impact extends beyond financial gains, shaping social structures, health outcomes, and overall well-being within communities. This section will explore the multifaceted social impacts of microfinance, examining both positive and negative consequences.

Women’s Empowerment and Gender Equality

Microfinance initiatives frequently target women, recognizing their crucial role in household economic management and community development. Access to credit and financial services empowers women economically, allowing them to participate more fully in the formal economy, generate income, and improve their bargaining power within the household. This increased financial independence often translates to greater decision-making authority in family matters, improved educational opportunities for their children, and enhanced overall well-being. For example, studies in Bangladesh have shown a correlation between microfinance participation and increased women’s control over household resources and spending. Conversely, some studies have raised concerns about increased workload for women due to the demands of managing both micro-businesses and household responsibilities.

Impact on Health Outcomes and Access to Healthcare

The economic empowerment facilitated by microfinance can positively influence health outcomes. Increased income allows families to afford better nutrition, improved sanitation, and necessary healthcare services. Microfinance programs sometimes integrate health-related components, such as health insurance or educational initiatives promoting hygiene and preventative care. For instance, a program in rural India integrated health awareness workshops alongside microfinance lending, leading to improved vaccination rates and reduced instances of preventable diseases among participating families. However, the indirect impact on health is complex and depends on various contextual factors. For example, if the increased workload from the micro-business negatively affects the woman’s health, this would negate the positive impact.

Potential Social Risks and Challenges Associated with Microfinance Programs

While microfinance offers considerable potential, it also presents potential social risks. High interest rates and repayment pressures can lead to debt traps, particularly for vulnerable individuals. Over-indebtedness can strain family relationships and negatively impact mental health. Furthermore, the lack of financial literacy among borrowers can lead to poor financial decision-making and unsustainable borrowing practices. For instance, the Grameen Bank in Bangladesh, while highly successful, has also faced criticism regarding its repayment rates and the impact of debt on some borrowers.

Strategies to Mitigate Negative Social Impacts of Microfinance

Several strategies can mitigate the potential negative social impacts of microfinance. These include promoting financial literacy programs to equip borrowers with the skills to manage their finances effectively. Implementing responsible lending practices, such as thorough credit assessments and flexible repayment schedules, can help prevent over-indebtedness. Furthermore, strengthening social safety nets and providing access to alternative sources of support can reduce the vulnerability of borrowers facing financial hardship. For example, integrating microfinance programs with social support networks or community-based organizations can provide additional assistance and guidance to borrowers. Another strategy involves providing access to affordable insurance products, mitigating financial risks associated with unforeseen events like illness or crop failure.

Environmental Impacts of Microfinance

Microfinance, while primarily focused on economic empowerment, possesses a significant, albeit often overlooked, potential to influence environmental sustainability. Its impact on the environment is multifaceted, encompassing both positive contributions towards green initiatives and potential negative consequences if not carefully managed. Understanding these dual aspects is crucial for maximizing the positive and mitigating the negative effects of microfinance programs.

Microfinance’s Contribution to Environmental Sustainability

Microfinance can actively support environmental sustainability by channeling funds towards environmentally friendly businesses and practices. By providing access to credit and financial services, microfinance institutions (MFIs) empower individuals and communities to invest in sustainable technologies and practices, contributing to broader environmental protection efforts. This support can range from providing capital for renewable energy projects to funding sustainable agricultural practices. The resulting environmental benefits are often significant and far-reaching.

Support for Green Businesses and Environmental Protection

Microfinance plays a vital role in fostering the growth of green businesses. Access to credit allows entrepreneurs to invest in cleaner technologies, reducing their environmental footprint. For instance, small-scale farmers might use microloans to purchase water-efficient irrigation systems, reducing water consumption and improving crop yields. Similarly, businesses involved in recycling or waste management can leverage microfinance to expand their operations, contributing to waste reduction and resource conservation. The cumulative effect of numerous such initiatives can lead to substantial environmental improvements at a local and even regional level. A successful example could be a community in rural India receiving microloans to establish a biogas plant, reducing reliance on firewood and minimizing deforestation.

Potential Negative Environmental Impacts of Microfinance

Despite its potential benefits, microfinance can inadvertently contribute to environmental degradation if not implemented responsibly. One significant concern is the potential for deforestation resulting from increased agricultural activities fueled by microloans. If borrowers use the funds for unsustainable farming practices, such as clearing forests for farmland, the environmental consequences can be severe. Overexploitation of natural resources, driven by increased economic activity without adequate environmental safeguards, is another potential negative impact. For example, if a microloan is used to expand fishing operations without considering sustainable fishing practices, it could lead to overfishing and depletion of fish stocks.

Promoting Environmentally Responsible Practices Among Borrowers

MFIs can actively promote environmentally responsible practices among borrowers through several strategies. This includes providing training and education on sustainable agriculture, resource management, and environmental protection. Integrating environmental considerations into loan appraisal processes is also crucial. This might involve assessing the environmental impact of proposed projects and incorporating environmental safeguards into loan agreements. Furthermore, MFIs can collaborate with environmental organizations to develop and implement environmental management plans for their borrowers. For instance, an MFI might partner with a non-governmental organization (NGO) to provide training on sustainable farming techniques to its borrowers, thereby reducing the risk of deforestation and promoting environmentally sound agricultural practices. Incentivizing environmentally friendly practices through preferential loan terms or other incentives can also be an effective approach. A real-world example could be an MFI offering lower interest rates to borrowers who adopt water-efficient irrigation methods.

Data Collection and Analysis Techniques

Rigorous data collection and analysis are crucial for accurately assessing the impact of microfinance initiatives. The methods employed significantly influence the reliability and validity of the findings, ultimately shaping policy recommendations and program improvements. A well-designed impact evaluation requires a multifaceted approach, combining quantitative and qualitative data to provide a comprehensive understanding.

Data collection methods in microfinance impact studies are diverse, each offering unique strengths and limitations. The choice of method depends on the research question, available resources, and the context of the microfinance program.

Data Collection Methods

Several primary methods are commonly used to gather data for microfinance impact evaluations. Surveys are efficient for collecting quantitative data from a large sample size, allowing for statistical analysis and generalization of findings. Structured questionnaires ensure consistency and comparability across respondents. Interviews, on the other hand, provide richer qualitative data through in-depth conversations with individuals, offering insights into experiences and perspectives that surveys might miss. Focus groups, involving group discussions, can reveal shared experiences and social dynamics within a community affected by microfinance. Finally, administrative data, such as loan disbursement records and repayment rates, offers valuable quantitative insights into the program’s operational aspects and client behavior.

Statistical Techniques for Data Analysis

Analyzing microfinance data requires appropriate statistical techniques to draw meaningful conclusions. Descriptive statistics, such as means, medians, and standard deviations, summarize the collected data. Inferential statistics, including t-tests, ANOVA, and regression analysis, help determine the statistical significance of observed differences or relationships between variables. For example, regression analysis can be used to assess the impact of microfinance access on household income, controlling for other relevant factors like education level and initial household wealth. Propensity score matching can help mitigate selection bias, ensuring a fair comparison between treatment and control groups.

Data Collection, Cleaning, and Analysis Flowchart

A typical flowchart would depict a sequential process. It would begin with defining the research question and objectives, followed by the selection of appropriate data collection methods. The next step involves data collection itself, encompassing surveys, interviews, and data extraction from administrative records. Subsequently, data cleaning is crucial, involving checking for inconsistencies, missing values, and outliers. This stage often requires data coding and transformation to prepare the data for analysis. The cleaned data is then subjected to statistical analysis, using appropriate techniques depending on the research questions. Finally, the results are interpreted and presented, often through data visualization techniques. The entire process should be meticulously documented to ensure transparency and reproducibility.

Data Visualization Techniques

Effective data visualization is essential for communicating complex microfinance impact findings to diverse audiences. Bar charts and pie charts are useful for showing the distribution of categorical variables, such as the proportion of clients achieving different income levels. Line graphs can illustrate trends over time, such as changes in loan repayment rates or household savings. Scatter plots can reveal relationships between variables, such as the correlation between loan amount and business growth. Maps can visually display geographical variations in microfinance program impact. Finally, dashboards, which combine multiple visualizations, can provide a comprehensive overview of the findings. For instance, a dashboard might show the distribution of loan amounts, repayment rates, and income levels across different regions.

Case Studies of Microfinance Impact

This section presents three distinct case studies illustrating the multifaceted impacts of microfinance initiatives. These examples highlight both the successes and challenges encountered, offering valuable insights into the complexities of designing and implementing effective microfinance programs. Analyzing these case studies allows for a deeper understanding of the factors contributing to successful outcomes and the obstacles that need to be overcome for broader positive impact.

Grameen Bank, Bangladesh

The Grameen Bank, founded in Bangladesh by Muhammad Yunus, is arguably the most famous microfinance institution globally. Its pioneering approach of providing small loans to impoverished individuals, primarily women, without requiring collateral, has been widely replicated.

The program’s impact has been extensively studied. Key aspects of the Grameen Bank model include group lending, regular meetings for social support and training, and a focus on empowering women economically and socially.

- Location: Bangladesh

- Program Implemented: Group lending of small loans to primarily women, emphasizing entrepreneurship and financial literacy training.

- Observed Impacts: Significant poverty reduction, increased household income, improved women’s empowerment, enhanced access to education and healthcare, and positive community development. However, challenges include high interest rates for some borrowers and concerns about the sustainability of the model in certain contexts.

Compartamos Banco, Mexico

Compartamos Banco is a large Mexican microfinance institution that has experienced considerable growth and success. Its strategy involves a more commercial approach compared to the Grameen Bank model, focusing on profitability and scalability.

While profitable, Compartamos Banco has faced criticism regarding its interest rates and its impact on the most vulnerable populations. The institution’s growth demonstrates the potential for microfinance to become a significant financial sector player, but also raises questions about its social mission and ethical considerations.

- Location: Mexico

- Program Implemented: Commercial microfinance services, including loans and savings products, targeting a broader range of clients.

- Observed Impacts: Significant expansion of access to financial services, increased entrepreneurship, and job creation. However, concerns remain about high interest rates for some borrowers and potential for over-indebtedness, particularly amongst vulnerable populations. The focus on profitability has sometimes been criticized as potentially detracting from the social mission.

FINCA International

FINCA International is a global non-profit organization that operates microfinance institutions in numerous developing countries. Its approach emphasizes sustainable development and community engagement.

FINCA’s diverse operational context allows for a comparative analysis of microfinance’s impact across different settings and cultures. The organization’s focus on community development and holistic approaches provides insights into strategies that promote long-term sustainability and broader social impact.

- Location: Multiple countries across Africa, Latin America, and Asia

- Program Implemented: A variety of microfinance services, including loans, savings, insurance, and training programs, tailored to local contexts and needs.

- Observed Impacts: Positive impacts on poverty reduction, income generation, and community development have been documented in various locations. However, challenges include adapting programs to diverse cultural and economic contexts, ensuring financial sustainability, and addressing potential risks such as over-indebtedness and environmental concerns.

Last Point

In conclusion, the impact of microfinance is complex and context-dependent. While it has demonstrably empowered many individuals and communities, leading to improved livelihoods and economic growth, challenges remain. Careful consideration of both positive and negative impacts, robust impact assessment methodologies, and adaptive program design are crucial for maximizing the benefits and mitigating potential risks of microfinance initiatives. Continued research and transparent evaluation are vital to ensuring its responsible and sustainable development.

FAQ Insights

What are the ethical considerations in microfinance?

Ethical considerations include ensuring fair interest rates, transparency in lending practices, protecting borrowers from over-indebtedness, and promoting financial literacy.

How does microfinance compare to traditional banking?

Microfinance targets underserved populations often excluded by traditional banks, offering smaller loans with flexible repayment options and often incorporating social support.

What role does technology play in modern microfinance?

Technology, such as mobile banking and digital lending platforms, significantly improves access, efficiency, and reach of microfinance services.