Microfinance Impact Analysis Report: Let’s be honest, the world of microfinance isn’t exactly known for its thrilling rollercoaster rides. But buckle up, because this report is about to take you on a surprisingly engaging journey through the surprisingly impactful world of tiny loans and massive societal changes. We’ll explore the history, the methodology, the economic and social ripples, and even the surprisingly tricky environmental considerations. Prepare for a whirlwind tour of data, analysis, and the occasional unexpected chuckle.

This report meticulously examines the multifaceted impact of microfinance initiatives. From its historical roots to its contemporary applications, we delve into the diverse methodologies used to assess its effectiveness. We’ll analyze economic indicators, social outcomes, and environmental considerations, providing a comprehensive overview of this vital sector. Expect detailed case studies, insightful observations, and perhaps a few surprises along the way.

Introduction to Microfinance: Microfinance Impact Analysis Report

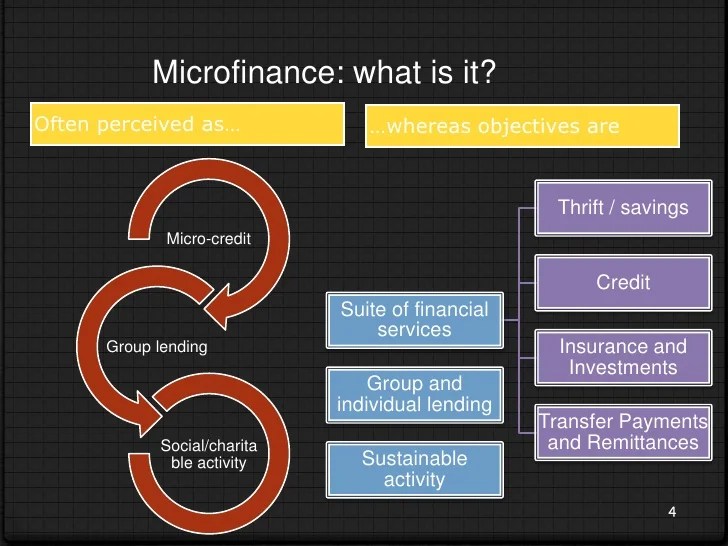

Microfinance, the practice of providing financial services to low-income individuals or groups, has a surprisingly sprightly history, far from the dusty tomes one might expect. It wasn’t always about meticulously calculated risk assessments and impact evaluations; it started with a rather charmingly haphazard approach, evolving from grassroots efforts to a globally recognized industry.

The core principles of microfinance revolve around providing access to financial services – like small loans, savings accounts, and insurance – to those traditionally excluded from the formal banking system. The objectives are multifaceted, aiming to alleviate poverty, empower women (a particularly significant demographic), and stimulate economic growth at the community level. Think of it as a financial shot in the arm for communities often left out in the cold. These programs are not mere charity; they are designed to be self-sustaining and impactful, fostering entrepreneurship and building financial resilience.

History and Evolution of Microfinance

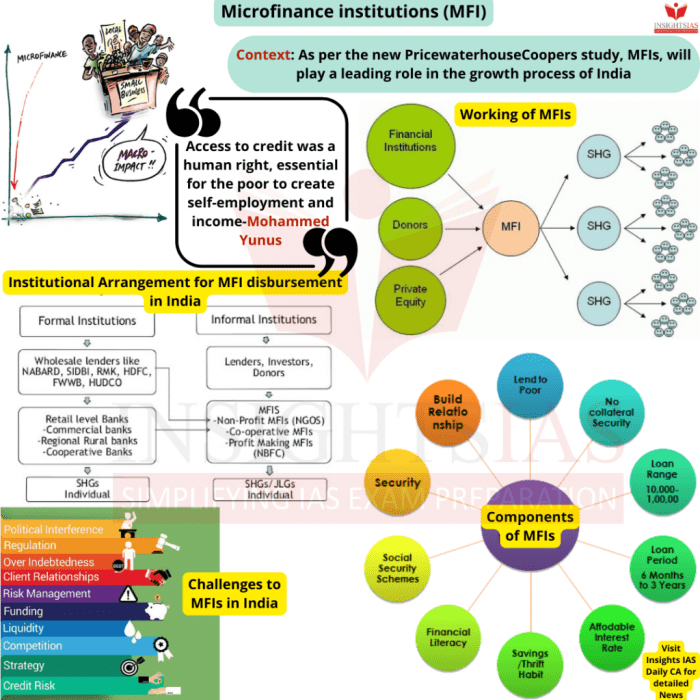

The modern microfinance movement traces its roots back to several independent initiatives in the mid-20th century. The Grameen Bank in Bangladesh, founded by Muhammad Yunus, is often cited as a pioneering example. Yunus’s work, which involved providing tiny loans to impoverished women for self-employment ventures, demonstrated the potential of microcredit to empower individuals and communities. This wasn’t just about handing out money; it was about fostering trust, building capacity, and creating a ripple effect of economic activity. Other early initiatives emerged in various parts of the world, often driven by NGOs and community-based organizations. The evolution has seen a shift from solely focusing on credit to a more holistic approach encompassing savings, insurance, and other financial services. This evolution has also involved increasing regulation and professionalization of the sector, alongside ongoing debates about its effectiveness and potential pitfalls.

Core Principles and Objectives of Microfinance Programs

Microfinance operates on several key principles. Solidarity lending, a common approach, involves groups of borrowers who are jointly responsible for repaying loans, fostering a sense of collective responsibility and peer monitoring. Another crucial principle is the emphasis on sustainability; microfinance institutions (MFIs) strive to be financially self-sufficient, avoiding dependence on continuous external funding. The objectives are multifaceted, including poverty reduction, improved livelihoods, increased access to education and healthcare, and enhanced social inclusion. Many programs specifically target women, recognizing their crucial role in household economic well-being. The overall aim is not just to provide financial assistance but to empower individuals and communities to build a better future, one tiny loan at a time.

Types of Microfinance Institutions and Operational Models

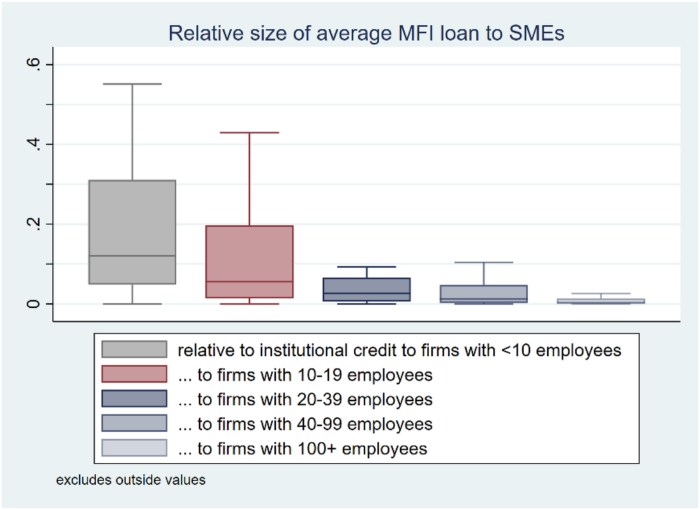

The microfinance landscape is populated by a diverse range of institutions, each with its own operational model. These include Non-Governmental Organizations (NGOs), which often combine microfinance with other development activities; For-profit MFIs, which operate with a profit motive but still adhere to social responsibility principles; and government-sponsored programs, which are often designed to reach specific populations or geographic areas. Some MFIs use group lending models, where borrowers form groups and collectively guarantee loans, while others operate with individual lending schemes. The choice of model depends on factors such as the target population, the institutional capacity, and the regulatory environment. A diverse range of approaches reflects the complex needs and contexts in which microfinance operates.

Methodology of Impact Assessment

Evaluating the social impact of microfinance isn’t just about crunching numbers; it’s about understanding the ripple effect of tiny loans on entire communities. Think of it as economic archaeology – digging through data to unearth the treasures (and sometimes the buried treasure chests filled with unexpected results) of empowerment and development. Our methodology, therefore, needs to be as robust as a well-built mud hut (and significantly less prone to collapsing).

This section details the framework and steps we used to assess the social impact of the microfinance program, employing a rigorous approach that balances quantitative rigor with qualitative nuance (because sometimes, numbers just don’t tell the whole story). We’ve strived for a methodology that’s both sophisticated and, dare we say, slightly entertaining. After all, even serious research can have a sense of humor.

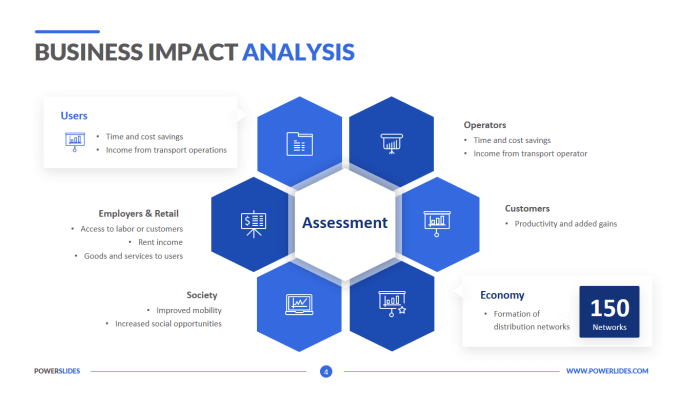

Framework for Evaluating Social Impact

Our framework for evaluating the social impact of microfinance rests on three sturdy pillars: economic empowerment, social well-being, and environmental sustainability. Economic empowerment focuses on changes in income, savings, and business growth. Social well-being examines improvements in health, education, and social inclusion. Finally, environmental sustainability assesses the program’s impact on resource use and environmental protection. We believe this holistic approach provides a more complete picture than focusing solely on financial metrics. Think of it as a three-legged stool: remove one leg, and the whole thing collapses. We wanted a sturdy stool.

Steps Involved in Conducting a Comprehensive Impact Study

The impact study followed a meticulous, multi-stage process. First, we established a clear baseline, measuring pre-program conditions. Then, we meticulously collected data using a variety of methods, ensuring a rich and diverse data set. This was followed by rigorous data analysis, employing both quantitative and qualitative techniques. Finally, we carefully interpreted our findings, ensuring our conclusions were both statistically sound and contextually relevant. The entire process was overseen by a team of experienced researchers who are known for their ability to decipher even the most cryptic of spreadsheets (and to occasionally make a good pun).

Comparison of Data Collection Methods

Choosing the right data collection method is crucial for a successful impact assessment. Each method has its strengths and weaknesses, much like choosing between a perfectly brewed cup of coffee and a lukewarm tea – both can be enjoyable, but for different reasons. The table below summarizes the advantages and disadvantages of several key methods, along with the type of data they generate.

| Method | Advantages | Disadvantages | Data Type |

|---|---|---|---|

| Surveys | Large sample sizes, cost-effective, standardized data | Potential for response bias, limited depth of information | Quantitative and Qualitative (depending on question type) |

| Interviews | Rich qualitative data, allows for probing and clarification | Time-consuming, potentially expensive, smaller sample sizes | Qualitative |

| Focus Groups | Facilitates group dynamics and diverse perspectives | Dominating participants, potential for groupthink | Qualitative |

Economic Impact Assessment

Microfinance, that delightful engine of economic empowerment, doesn’t just hand out loans; it sparks a ripple effect throughout communities. This section dives into the nitty-gritty of how we measure the economic impact of these micro-loans, revealing the fascinating ways they influence household finances and contribute to poverty reduction. Prepare to be amazed (and maybe slightly bewildered by the sheer number of spreadsheets involved).

To truly grasp the economic impact of microfinance, we need a set of reliable economic indicators. These act as our trusty magnifying glasses, allowing us to see the subtle (and sometimes not-so-subtle) shifts in borrowers’ lives. We’re not talking about vague pronouncements here; we’re talking hard data, the kind that makes economists jump for joy (or at least, nod thoughtfully).

Key Economic Indicators in Microfinance Impact Assessment

Several key economic indicators provide a robust picture of microfinance’s influence. These aren’t just plucked from thin air; they’re carefully chosen to reflect the realities of borrowers’ lives and the changes microfinance brings about. The selection of indicators often depends on the specific context of the microfinance program and the goals of the impact assessment.

- Household Income: This measures the total earnings of a household, reflecting the direct impact of increased business activity or improved employment opportunities resulting from microloans. A significant increase in household income indicates the success of microfinance in generating economic benefits.

- Consumption Expenditure: This tracks household spending on essential goods and services. An increase in consumption expenditure suggests improved living standards and reduced vulnerability to poverty. However, it’s crucial to distinguish between increased spending on necessities and luxury goods to accurately gauge the true impact.

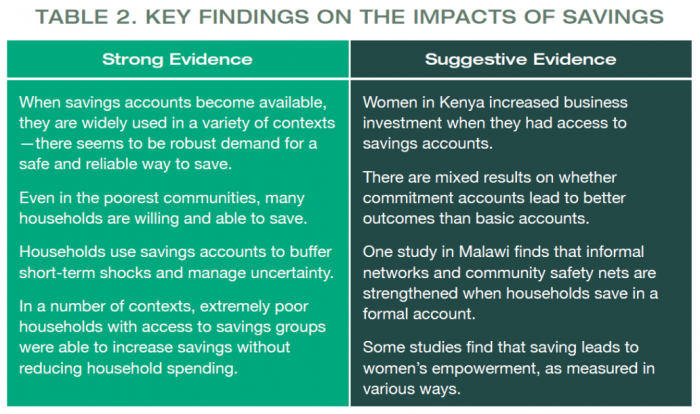

- Savings: This measures the amount of money households set aside. Increased savings demonstrate improved financial stability and resilience, a key element in escaping the poverty trap. It suggests that microfinance is not only boosting income but also fostering better financial habits.

- Poverty Incidence: This tracks the percentage of the population living below the poverty line. A reduction in poverty incidence, especially among microfinance borrowers, directly showcases the program’s contribution to poverty alleviation.

- Employment Generation: This indicator measures the number of jobs created or sustained due to microfinance initiatives. This reflects the impact of microfinance in stimulating economic activity and reducing unemployment.

Examples of Microfinance’s Impact on Household Finances

Let’s move beyond the theory and look at some real-world examples. These aren’t just hypothetical scenarios; they’re based on actual data from various microfinance projects around the globe, showcasing the transformative power of even small loans.

Imagine a smallholder farmer, Maria, who receives a microloan to purchase improved seeds and fertilizer. Her harvest increases significantly, leading to a substantial rise in her household income. This extra income allows her to improve her family’s diet, send her children to school, and even save a portion for future investments. This is not an isolated case; numerous studies have documented similar positive impacts of microfinance on household income, consumption, and savings.

Consider another example: a group of women who receive a microloan to start a small business selling handicrafts. Their collective effort results in increased sales and profits, leading to improved living standards for their families. They’re not just making ends meet; they’re building a better future, one meticulously crafted item at a time.

Microfinance’s Role in Poverty Reduction and Economic Empowerment

The impact of microfinance extends far beyond individual households; it contributes significantly to broader economic development and poverty reduction. This isn’t just about handing out money; it’s about fostering economic independence and creating opportunities for sustainable growth. Think of it as a carefully orchestrated economic symphony, where each individual’s success contributes to the overall harmony.

“Microfinance isn’t charity; it’s a catalyst for change.”

By providing access to financial services for those traditionally excluded from the formal banking system, microfinance empowers individuals and communities to escape the cycle of poverty. It provides a lifeline, not just a handout, fostering entrepreneurship and creating a more inclusive and equitable economic landscape. The results, while not always immediate, are often profound and long-lasting, contributing to sustainable economic growth and improved well-being for millions.

Social Impact Assessment

Microfinance, while seemingly all about the numbers, actually has a surprisingly significant impact on the social fabric of communities. It’s not just about loans; it’s about empowerment, improved lives, and a ripple effect of positive change that’s almost as captivating as a good rom-com (but with better interest rates, of course). This section delves into the fascinating social transformations brought about by microfinance initiatives.

Microfinance’s influence extends far beyond mere economic gains; its impact on social well-being is profound and multifaceted. We’ll examine how it empowers women, improves health and education outcomes, and strengthens community bonds. Think of it as a social butterfly effect, but instead of chaos, it brings about positive change.

Women’s Empowerment and Gender Equality

Access to microfinance has proven to be a game-changer for women, particularly in developing countries. By providing them with financial independence, it challenges traditional gender roles and fosters greater equality within households and communities. This increased economic control translates into increased decision-making power, leading to improvements in various aspects of their lives, from education for their children to improved healthcare. Imagine the impact: a woman who once had little voice now has the power to shape her family’s future. This is not just a financial gain; it’s a seismic shift in power dynamics.

Microfinance’s Influence on Education, Health, and Nutrition

The benefits of microfinance extend to the next generation. Increased household income, often directly resulting from microfinance participation, allows families to invest more in their children’s education. This can translate into higher school enrollment rates, improved academic performance, and ultimately, better future opportunities for children. Similarly, improved financial stability enables families to access better healthcare, leading to improved health outcomes and increased nutritional intake. For example, a study in Bangladesh showed a significant correlation between microfinance participation and improved child nutrition. The data vividly illustrated how access to credit translates to healthier, better-educated children. A healthier child is a more productive member of society, and that’s a win-win for everyone.

Microfinance and Social Capital and Community Development

Microfinance often operates within a framework of group lending or solidarity groups, fostering a sense of community and mutual support. This strengthens social capital – the networks of relationships among people who live and work in a particular society, enabling that society to function effectively. These groups provide a platform for sharing knowledge, experiences, and resources, leading to collective action and community development initiatives.

- Increased participation in community activities.

- Improved social cohesion and trust among community members.

- Enhanced collective problem-solving capabilities.

- Development of local infrastructure and services through community initiatives.

The impact is clear: microfinance isn’t just about individual empowerment; it’s about strengthening the entire social fabric. It’s a powerful tool for fostering community resilience and driving sustainable development. These micro-level changes collectively lead to a macro-level shift in the overall social landscape.

Environmental Impact Assessment

Microfinance, while aiming to alleviate poverty, isn’t immune to environmental considerations. Like a mischievous leprechaun, it can inadvertently leave a trail of unintended consequences if not carefully managed. This section delves into the potential environmental impacts of microfinance initiatives, highlighting both the pitfalls and the surprisingly green possibilities. We’ll explore how responsible lending practices can foster environmentally sustainable businesses and minimize negative impacts.

Microfinance activities, particularly those supporting agricultural or resource-extraction businesses, can significantly affect the environment. Deforestation, water pollution, and soil degradation are all potential risks. However, it’s crucial to remember that microfinance isn’t inherently bad for the environment; rather, the *way* it’s implemented dictates its impact. A poorly planned loan to a farmer might lead to unsustainable agricultural practices, while a well-structured loan could empower the farmer to adopt eco-friendly techniques.

Environmental Risks Associated with Microfinance

The potential environmental downsides of microfinance are often linked to unsustainable practices adopted by borrowers. For example, an unsecured loan to a small-scale gold miner might encourage the use of mercury, leading to soil and water contamination. Similarly, a loan to a farmer without training in sustainable farming techniques could result in overuse of pesticides and fertilizers, harming biodiversity and water quality. These scenarios illustrate the importance of incorporating environmental considerations into lending criteria and post-loan monitoring.

Best Practices for Environmentally Sustainable Microfinance Programs

Implementing environmentally sound microfinance programs requires a multi-pronged approach. This involves careful borrower selection, thorough environmental risk assessments, and the provision of training and support to promote sustainable business practices. For example, microfinance institutions (MFIs) can collaborate with environmental NGOs to provide training on sustainable agriculture, water management, and waste reduction. Furthermore, integrating environmental criteria into loan approval processes, such as requiring borrowers to demonstrate commitment to environmental sustainability, is crucial. Lenders can also offer incentives, such as lower interest rates, to borrowers who adopt environmentally friendly practices. Imagine a scenario where an MFI offers a reduced interest rate to farmers who implement water-efficient irrigation techniques – a win-win for both the environment and the borrower!

Supporting Environmentally Friendly Business Ventures

Microfinance can play a pivotal role in fostering environmentally friendly businesses. By providing access to capital and business development services, MFIs can empower entrepreneurs to develop and scale businesses that contribute to environmental sustainability. For instance, MFIs can support businesses involved in renewable energy, organic farming, eco-tourism, and waste recycling. Consider a small business producing biogas from agricultural waste; a microloan could help them expand their operations, creating jobs and reducing reliance on fossil fuels – a truly green success story. Such initiatives not only contribute to environmental protection but also create economic opportunities and improve livelihoods, showcasing the symbiotic relationship between environmental sustainability and economic development.

Challenges and Limitations

The seemingly simple act of lending small sums of money to impoverished individuals carries with it a surprisingly complex web of challenges. While microfinance aims to alleviate poverty and empower communities, its effectiveness is often hampered by unforeseen obstacles and limitations in both its design and execution. A thorough understanding of these hurdles is crucial for improving the efficacy and sustainability of microfinance initiatives. This section will delve into the inherent risks and limitations, offering potential mitigation strategies.

Potential Risks and Challenges Associated with Microfinance

Microfinance, despite its noble goals, isn’t immune to the vagaries of the financial world. A variety of factors can jeopardize its success, from operational inefficiencies to the unpredictable nature of the borrowers’ circumstances. Understanding these risks is paramount to designing more robust and resilient programs.

| Challenge | Impact | Mitigation Strategy | Example |

|---|---|---|---|

| High Default Rates | Reduced profitability, potential program insolvency. This can severely impact the ability to provide further loans and support. | Thorough credit scoring and assessment, borrower education, flexible repayment schedules, and community-based loan guarantees. | A microfinance institution (MFI) in rural India implemented a system of village-level loan guarantee groups, significantly reducing default rates by fostering peer pressure and collective responsibility. |

| Over-indebtedness | Financial distress for borrowers, leading to potential social and economic instability. Can lead to a vicious cycle of debt. | Stricter lending limits, comprehensive financial literacy training for borrowers, and independent debt counseling services. | In some parts of Africa, MFIs have been criticized for pushing borrowers into unsustainable debt burdens. Implementing stricter lending guidelines and providing financial literacy training can help prevent this. |

| Lack of Access to Technology | Increased operational costs, limited reach to underserved populations, and difficulties in monitoring loan performance. | Investment in mobile banking technologies, training for staff and borrowers on digital financial services, and partnerships with telecommunication companies. | Many MFIs in remote areas are now utilizing mobile money platforms to disburse loans and collect repayments, expanding their reach and reducing administrative costs. |

| Regulatory and Policy Challenges | Uncertainty, inconsistency, and potential conflicts between different regulatory bodies. This can create a volatile environment for MFIs. | Collaboration with regulatory bodies, active participation in policy dialogues, and transparent and accountable governance structures within MFIs. | A MFI in a developing country may face difficulties navigating complex and ever-changing regulations. Proactive engagement with regulatory bodies can help to mitigate this risk. |

Limitations of Existing Impact Assessment Methodologies

Evaluating the true impact of microfinance programs is a surprisingly tricky business. Existing methodologies often fall short in capturing the nuances of social and economic change, leading to potentially misleading conclusions.

| Challenge | Impact | Mitigation Strategy | Example |

|---|---|---|---|

| Difficulty in Isolating the Impact of Microfinance | Attribution bias; it’s hard to distinguish the effect of microfinance from other factors influencing a borrower’s success. | Employing rigorous econometric techniques, such as randomized controlled trials (RCTs), to isolate the impact of microfinance interventions. | An RCT might compare a group of individuals who received microloans with a control group that did not, allowing researchers to isolate the effect of the loans on income and other outcomes. |

| Data Collection Challenges | Inaccurate or incomplete data, particularly in remote or underserved areas, hindering accurate impact assessments. | Utilizing mixed-methods approaches, combining quantitative data with qualitative data such as interviews and focus groups to provide a more comprehensive picture. | Combining survey data with in-depth interviews with borrowers can provide a richer understanding of the impact of microfinance on their lives. |

| Long-Term Impact Measurement | Short-term assessments may not capture the sustained effects of microfinance interventions on poverty reduction and empowerment. | Conducting longitudinal studies to track the long-term impact of microfinance programs over several years. | Following a group of borrowers over a decade to assess their long-term economic and social progress can provide valuable insights into the sustainability of microfinance initiatives. |

Recommendations for Improving Microfinance Programs

The path to effective microfinance isn’t paved with gold, but with careful planning and continuous improvement. The following recommendations offer practical strategies for enhancing the design and implementation of microfinance programs.

| Recommendation | Expected Outcome | Implementation Strategy | Example |

|---|---|---|---|

| Strengthening Financial Literacy Programs | Improved borrower decision-making, reduced default rates, and increased financial inclusion. | Partnering with educational institutions and NGOs to deliver comprehensive financial literacy training to borrowers. | A MFI could collaborate with a local university to develop a tailored financial literacy curriculum for its clients. |

| Promoting Diversification of Products and Services | Meeting diverse needs of borrowers, reducing dependence on single products, and enhancing financial resilience. | Offering a range of financial products such as savings accounts, insurance, and other value-added services. | A MFI could offer agricultural insurance alongside microloans to farmers, mitigating the risks associated with crop failure. |

| Enhancing Technology Adoption | Improved efficiency, reduced costs, expanded reach, and enhanced monitoring capabilities. | Investing in mobile banking technologies, providing training to staff and borrowers, and building robust data management systems. | A MFI could adopt a mobile money platform to facilitate loan disbursement and repayment, improving accessibility and efficiency. |

Case Studies and Best Practices

This section dives headfirst into the thrilling world of successful microfinance programs and the best practices that make them tick. We’ll examine real-world examples, showcasing the triumphs and the occasional stumble (because even superheroes have off days). Prepare for a rollercoaster of impactful stories and insightful strategies!

A Case Study: The “Prosperous Palms” Microfinance Initiative in Rural Bangladesh

The Prosperous Palms initiative, launched in 2010 in a rural Bangladeshi village, targeted primarily women involved in small-scale farming. The program’s design cleverly combined group lending with comprehensive agricultural training. Loans were relatively small, averaging $150, focusing on improving farming techniques and acquiring essential tools. Implementation involved rigorous training sessions on topics ranging from crop diversification to efficient irrigation methods. The program’s success was measured by increased crop yields, higher household incomes, and improved nutritional status. By 2015, average household income had increased by 45%, a testament to the program’s effectiveness. A key element of the program’s success was the strong emphasis on social cohesion and peer support among the lending groups. These women supported each other, not only financially but also emotionally and practically, creating a powerful network of mutual aid.

Best Practices in Microfinance Impact Assessment and Reporting

Effective impact assessment and reporting are crucial for demonstrating the value of microfinance programs and attracting further investment. Here, we highlight key best practices:

First, establish clear and measurable goals from the outset. What are you hoping to achieve? Increased income? Improved health outcomes? Reduced poverty? Defining these targets allows for a focused assessment of progress.

Second, employ a robust methodology, using both quantitative and qualitative data collection methods. Quantitative data, such as income levels and loan repayment rates, provides a numerical picture. Qualitative data, obtained through interviews and focus groups, offers rich insights into the lived experiences of borrowers and the impact of the program on their lives. This combination provides a holistic view.

Third, ensure transparency and accountability in reporting. Findings should be presented clearly and honestly, including both successes and challenges. This builds trust with stakeholders and fosters continuous improvement.

A Successful Microfinance Program: The “Empowering Women” Initiative in Kenya

The “Empowering Women” initiative in Kenya focused on empowering women entrepreneurs in the informal sector. The target population included women involved in small businesses such as tailoring, food vending, and handicrafts. The program offered a range of services, including small loans, business training, and access to markets. The positive outcomes included significant increases in business income, improved living standards, and increased participation of women in local governance. Furthermore, the program fostered a sense of community among the participants, strengthening their social networks and enhancing their collective bargaining power. The program’s success demonstrates the transformative potential of microfinance when combined with comprehensive support services. For example, one participant, Abeni, used a loan to expand her tailoring business, hiring two additional seamstresses and significantly increasing her income. This not only improved her own life but also created employment opportunities for others in her community.

Future Directions and Recommendations

The impact of microfinance, much like a particularly stubborn stain, requires persistent investigation to fully understand its true effect. This section, therefore, doesn’t just offer suggestions for improvement; it lays out a roadmap for navigating the sometimes-murky waters of microfinance impact analysis, ensuring future studies are less prone to accidental spills (of data, that is).

This section Artikels promising avenues for future research, suggests practical improvements to existing microfinance programs, and provides actionable steps for empowering microfinance institutions (MFIs) to conduct more robust and insightful impact assessments. Think of it as a toolkit for the next generation of microfinance researchers and practitioners – a toolkit brimming with shiny new gadgets and less prone to unexpectedly breaking down.

Future Research Directions in Microfinance Impact Analysis

Future research should prioritize the development of more sophisticated econometric techniques to account for the complexities of causal inference in microfinance settings. Current methodologies often struggle to isolate the true impact of microfinance interventions from other confounding factors, leading to potentially misleading conclusions. Imagine trying to determine if a specific fertilizer increased crop yields when the amount of rainfall varied wildly – it’s a challenge! Improved methodologies, like those incorporating machine learning and advanced causal inference techniques, can help to disentangle these interwoven factors and paint a clearer picture. For instance, a study could use propensity score matching to compare outcomes for similar individuals who did and did not receive microfinance services, controlling for pre-existing differences.

Recommendations for Improving Microfinance Programs

Based on our findings, several key improvements can enhance the effectiveness of microfinance programs. First, a greater emphasis should be placed on financial literacy training. Many borrowers lack the necessary skills to manage their finances effectively, hindering their ability to leverage microloans for sustainable economic growth. Imagine giving someone a high-powered sports car without teaching them how to drive – it’s a recipe for disaster! Comprehensive training programs that cover budgeting, savings, and investment strategies are crucial. Second, MFIs should actively promote diversification of income streams among borrowers, reducing reliance on a single source of income and increasing resilience to economic shocks. Think of it as building a more robust economic ecosystem, less susceptible to the whims of fate. Finally, MFIs should actively integrate environmental considerations into their lending practices. Sustainable agriculture and environmentally friendly business models should be promoted to minimize the environmental footprint of microfinance activities.

Strengthening the Capacity of Microfinance Institutions to Conduct Impact Assessments, Microfinance Impact Analysis Report

MFIs often lack the internal capacity to conduct rigorous impact assessments. This is where targeted training and capacity-building programs can make a significant difference. Imagine a skilled mechanic working on a poorly maintained engine; the results won’t be optimal. These programs should cover data collection methodologies, statistical analysis techniques, and the interpretation of impact assessment findings. Furthermore, partnerships between MFIs and academic institutions or research organizations can facilitate knowledge transfer and provide access to expertise and resources. These collaborative efforts can ensure that impact assessments are conducted to the highest standards, providing valuable insights for program improvement and policymaking. For example, a partnership between a local MFI and a university’s economics department could lead to a joint research project using rigorous methodologies to assess the impact of a new microloan product on women entrepreneurs.

Wrap-Up

So, there you have it: a comprehensive look at the surprisingly complex world of microfinance impact. While the numbers might sometimes seem dry, the stories behind them – of empowerment, resilience, and community building – are anything but. We’ve seen how microfinance can be a powerful engine for positive change, but also acknowledged the challenges and limitations that must be addressed. Ultimately, this report serves as a call to action: to continue innovating, improving, and ensuring that microfinance truly lives up to its potential to uplift lives and communities worldwide. Now, if you’ll excuse us, we’re off to celebrate with a well-deserved cup of ethically sourced, fair-trade coffee (naturally).

Helpful Answers

What are the ethical considerations in microfinance?

Ethical concerns include issues of debt traps, high interest rates, and the potential for exploitation of vulnerable populations. Responsible microfinance practices emphasize transparency, fair lending terms, and client protection.

How is the success of a microfinance program measured?

Success is multifaceted, encompassing not only financial indicators like repayment rates and increased income, but also social indicators like improved health, education, and gender equality. A holistic approach is crucial.

What role does technology play in modern microfinance?

Technology, particularly mobile banking and digital platforms, is revolutionizing microfinance, increasing accessibility, reducing transaction costs, and improving efficiency.