Microfinance Impact Analysis Report: Prepare yourselves, dear readers, for a rollercoaster ride through the surprisingly hilarious world of microfinance! We’ll unravel the mysteries of tiny loans, explore the surprisingly dramatic ups and downs of empowering entrepreneurs, and discover whether those who lend small sums truly make a big difference. Buckle up, it’s going to be a wild (and informative) ride!

This report delves into the multifaceted impact of microfinance initiatives, examining their economic, social, and environmental consequences. We’ll explore various methodologies for assessing impact, analyze case studies from around the globe, and even tackle the thorny issue of over-indebtedness (because let’s face it, even the most well-intentioned schemes can go awry). Get ready for charts, graphs, and maybe even a few witty footnotes.

Introduction to Microfinance

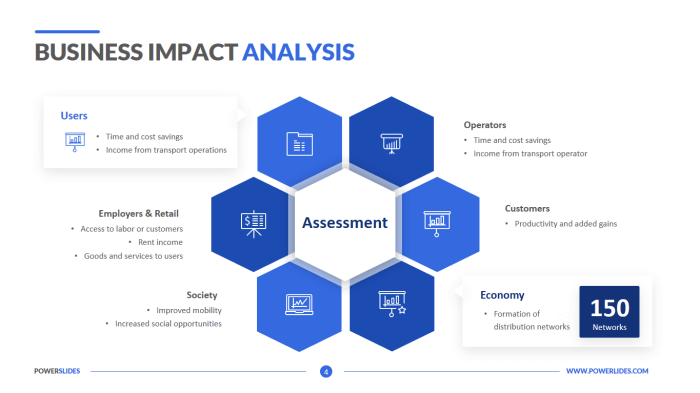

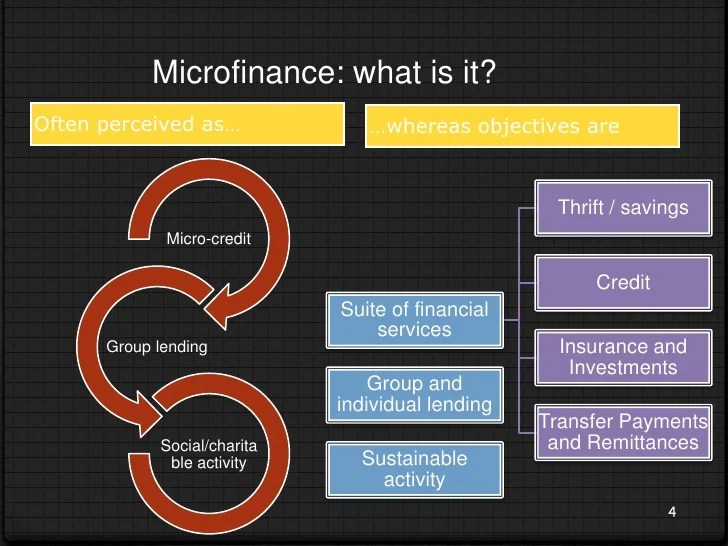

Microfinance, in its simplest form, is the provision of financial services to low-income individuals or groups who lack access to traditional banking systems. Think of it as banking for the bootstrappers, the entrepreneurs who are building their empires one tiny loan at a time. It’s built on the core principles of accessibility, affordability, and sustainability – a trifecta of financial empowerment that aims to lift people out of poverty.

Microfinance’s history is a surprisingly colorful tapestry woven from various threads of social activism and economic innovation. Early examples, while not explicitly labeled “microfinance,” existed for centuries in various forms of informal lending and community-based savings groups. However, the modern movement gained significant momentum in the latter half of the 20th century, spurred by pioneering initiatives like the Grameen Bank in Bangladesh, famously founded by Muhammad Yunus. His work, which focused on providing small loans to impoverished women, demonstrated the remarkable potential of microfinance to empower individuals and foster economic development. This success story quickly spread, inspiring similar initiatives across the globe.

Types of Microfinance Institutions and Operational Models

Microfinance institutions (MFIs) come in a variety of shapes and sizes, each with its own approach to delivering financial services. They range from large, internationally recognized NGOs to small, community-based organizations. The operational models vary significantly, reflecting the diverse needs of the communities they serve. Some MFIs focus solely on credit provision, offering small loans to individuals or groups. Others offer a wider range of services, including savings accounts, insurance, and money transfers. The choice of model often depends on factors such as the regulatory environment, the target clientele, and the availability of funding.

| Model Name | Target Client | Service Offerings | Funding Sources |

|---|---|---|---|

| Grameen Bank Model | Rural, impoverished women | Microloans, savings, insurance | Borrowings, grants, deposits |

| Solidarity Group Lending | Groups of individuals with joint liability | Microloans, savings | Revolving funds, grants |

| Village Banks | Rural communities | Savings, credit, money transfers | Member deposits, grants, loans |

| Microfinance Banks (MFBs) | Low-income individuals and SMEs | Loans, savings, other banking services | Deposits, loans, equity investments |

Methodology of Impact Assessment

Assessing the impact of microfinance programs isn’t just about crunching numbers; it’s a delightful dance between rigorous quantitative analysis and the nuanced art of qualitative understanding. Think of it as a detective story, where we’re trying to uncover the true impact of these tiny loans on the lives of borrowers, their families, and their communities. We need both the hard evidence and the compelling narratives to paint a complete picture.

Microfinance impact assessment employs a variety of approaches, each with its own strengths and (let’s be honest) quirks. The choice of methodology depends heavily on the specific goals of the evaluation, the resources available, and the level of detail desired. A simple snapshot might suffice for a small, local program, while a comprehensive, multi-year study might be needed for a large-scale national initiative. Let’s dive into the fascinating world of methods.

Quantitative Methods in Microfinance Impact Assessment

Quantitative methods focus on measuring and analyzing numerical data to establish statistical relationships between microfinance interventions and outcomes. This often involves comparing a treatment group (those who received microfinance services) with a control group (those who did not), using statistical techniques to isolate the impact of the program. Commonly used techniques include regression analysis and difference-in-differences estimations. These methods, while statistically powerful, sometimes miss the rich tapestry of human experience.

Qualitative Methods in Microfinance Impact Assessment

Qualitative methods, on the other hand, delve into the subjective experiences and perspectives of individuals involved in microfinance programs. This approach employs methods like in-depth interviews, focus group discussions, and case studies to gather rich, narrative data. Qualitative data can provide valuable insights into the social and psychological impacts of microfinance, which might be missed by quantitative methods alone. Think of it as adding vibrant colors to the black-and-white numbers.

Indicators for Measuring Impact

Choosing the right indicators is crucial for a successful impact assessment. We need indicators that are relevant, measurable, achievable, and, of course, interesting! Some common economic indicators include changes in income, savings, household expenditure, and business profitability. Social indicators might focus on changes in poverty levels, access to education, health outcomes, gender empowerment, and even levels of community participation (because microfinance isn’t just about money; it’s about building stronger communities!).

Data Collection Methods

The choice of data collection method depends on the research question, resources, and the nature of the information needed. Surveys, often conducted through questionnaires, allow for efficient collection of data from a large number of individuals. However, surveys can lack the depth and richness of qualitative data. Interviews, both structured and unstructured, allow for more in-depth exploration of individual experiences, while focus groups provide a platform for exploring shared perspectives and group dynamics. Each method offers unique advantages and limitations, and often a mixed-methods approach, combining both quantitative and qualitative data, is most effective.

Steps in Conducting a Rigorous Impact Evaluation

A rigorous impact evaluation requires a carefully planned and executed process. Think of it as a well-choreographed dance, with each step contributing to the overall performance.

- Define clear objectives and research questions: Knowing what you want to measure is the first, and most crucial, step.

- Develop a theory of change: Artikel the expected pathways through which microfinance is anticipated to create change.

- Select appropriate evaluation design: Choose a design that allows for a robust assessment of causality, such as randomized controlled trials (RCTs) or quasi-experimental designs.

- Develop data collection instruments: Create reliable and valid tools for collecting both quantitative and qualitative data.

- Collect and analyze data: This involves careful data management, cleaning, and analysis using appropriate statistical and qualitative methods.

- Disseminate findings: Share your findings with stakeholders in a clear and accessible manner.

Economic Impact Assessment: Microfinance Impact Analysis Report

Assessing the economic impact of microfinance is like trying to count grains of rice in a hurricane – chaotic, but ultimately rewarding if you manage to get a grip on the data. We’ll delve into the fascinating world of economic indicators, revealing how microfinance affects borrowers’ lives, from their daily bread to their long-term financial security.

Microfinance initiatives, while often lauded for their social impact, ultimately stand or fall on their economic effectiveness. Do they genuinely improve the livelihoods of borrowers? Does the influx of small loans translate to sustainable growth and prosperity? These are the crucial questions we’ll be addressing, armed with hard data and a healthy dose of economic analysis.

Key Economic Indicators for Microfinance Impact

Measuring the economic impact of microfinance requires a multi-faceted approach, much like a seasoned chef needs a variety of spices to create a delicious dish. We’ll examine key indicators that paint a comprehensive picture of the financial health and economic activity stimulated by microloans.

These indicators aren’t just numbers on a spreadsheet; they represent real changes in people’s lives. They tell the story of families moving from subsistence farming to small businesses, of children getting better education, and of communities thriving where previously there was only hardship. Key indicators include changes in household income, consumption expenditure, savings rates, business growth, and employment creation. Each indicator offers a unique lens through which to view the transformative power (or lack thereof) of microfinance.

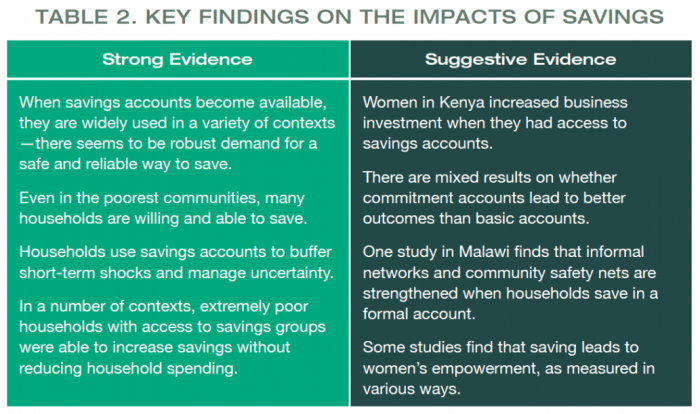

Microfinance’s Effect on Household Income, Consumption, and Savings

The impact of microfinance on household finances is, shall we say, multifaceted – a bit like a delicious, yet complex, financial soufflé. A successful microfinance program should lead to a noticeable increase in household income. This boost often translates to higher consumption levels, allowing families to improve their diet, access better healthcare, and afford educational opportunities for their children. Ideally, increased income also results in higher savings, building a financial buffer for unexpected events and fostering long-term financial stability. However, it’s crucial to note that not all microfinance initiatives result in such positive outcomes. Over-indebtedness can lead to reduced consumption and depletion of savings, highlighting the need for responsible lending practices and robust financial literacy programs.

Microfinance and the Promotion of Entrepreneurship and Business Development

Microfinance isn’t just about handing out small loans; it’s about fostering a spirit of entrepreneurship and nurturing the growth of small businesses. Think of it as a financial gardener, carefully cultivating the seeds of economic opportunity. Microloans provide the initial capital that many aspiring entrepreneurs need to launch their ventures, whether it’s a small shop, a farm, or a service-based business. Successful microfinance programs often include business training and support services, providing borrowers with the skills and knowledge they need to succeed. The impact extends beyond individual businesses, contributing to broader economic growth and job creation within the community.

Potential Economic Impacts of Microfinance

Let’s cut to the chase and present a table summarizing the potential economic impacts of microfinance, complete with potential downsides and strategies to mitigate them. This isn’t a crystal ball, but a realistic look at the possibilities, informed by numerous case studies and impact assessments.

| Indicator | Positive Impact | Negative Impact | Mitigation Strategies |

|---|---|---|---|

| Household Income | Increased income due to business growth and improved productivity. | Over-indebtedness leading to reduced income and inability to repay loans. | Responsible lending practices, thorough credit scoring, and financial literacy training. |

| Consumption | Increased consumption of essential goods and services, improved living standards. | Overspending due to lack of financial planning and management skills. | Financial education programs focusing on budgeting and debt management. |

| Savings | Increased savings for future investments and emergencies. | Depletion of savings due to loan defaults or unexpected expenses. | Savings mobilization programs, access to safe and affordable savings products. |

| Entrepreneurship | Increased business creation and job opportunities. | Business failures due to lack of skills, market competition, or economic downturns. | Business development services, mentorship programs, and access to market information. |

Social Impact Assessment

Microfinance, while often lauded for its economic benefits, also wields a significant – and sometimes surprisingly hilarious – influence on the social fabric of communities. Its impact extends far beyond mere monetary transactions, weaving itself into the very tapestry of social structures, empowerment, and, dare we say, drama. Let’s delve into the fascinating, and occasionally chaotic, social consequences of this global phenomenon.

Women’s Empowerment and Gender Equality

Microfinance initiatives frequently target women, recognizing their crucial role in household economies and community development. Access to credit and financial services can dramatically alter women’s lives, enabling them to start businesses, improve their livelihoods, and gain greater control over their financial resources. This newfound economic independence often translates into increased decision-making power within the household and community, challenging traditional gender roles and fostering a more equitable environment. For instance, a study in Bangladesh showed a significant correlation between microfinance participation and women’s increased involvement in community leadership roles, leading to some delightfully unexpected (and occasionally bewildering) shifts in village power dynamics. The newfound financial clout of women sometimes leads to entertaining negotiations over household expenditures – picture a previously unheard-of level of bargaining power at the weekly market!

Poverty Reduction and Social Inclusion

The impact of microfinance on poverty reduction is a complex and often debated topic. While it’s not a magic bullet, providing access to credit can significantly improve the livelihoods of low-income individuals and families. By facilitating business creation and income generation, microfinance can help lift families out of poverty and improve their overall well-being. This, however, is not without its comedic mishaps; imagine the delightful chaos of a sudden influx of entrepreneurial energy in a previously stagnant village economy! The resulting boom in local businesses, from innovative goat-herding strategies to unexpectedly popular artisanal pickle production, can be quite the spectacle. Microfinance can also contribute to social inclusion by reaching marginalized groups, such as rural communities or ethnic minorities, who often lack access to traditional banking services.

Negative Social Impacts of Microfinance

While the potential benefits are substantial, microfinance is not without its pitfalls. Over-indebtedness is a significant concern, particularly when borrowers lack adequate financial literacy or face unexpected economic shocks. The pressure to repay loans can lead to stressful situations, sometimes resulting in unexpected and humorous coping mechanisms. Imagine the village elder attempting to negotiate a loan extension using a surprisingly persuasive (and slightly off-key) rendition of a traditional folk song! Financial exclusion can also occur when stringent lending criteria inadvertently shut out vulnerable populations, creating a rather ironic and unintended consequence of the very system designed to help them.

Best Practices for Mitigating Negative Social Consequences

Mitigating the negative social impacts of microfinance requires a multi-pronged approach. Providing borrowers with comprehensive financial literacy training is crucial, empowering them to make informed decisions and manage their finances effectively. This training should ideally include practical, real-world scenarios and role-playing exercises to make the learning experience both engaging and effective. Implementing flexible repayment schedules and offering appropriate debt restructuring options can help prevent over-indebtedness. Finally, microfinance institutions should adopt transparent and ethical lending practices, ensuring that their services are accessible to all, regardless of background or social standing. This could involve, for example, employing local community members as loan officers, fostering a better understanding of local needs and preventing unintentionally comical cultural misunderstandings.

Environmental Impact Assessment

Microfinance, while aiming to alleviate poverty, isn’t immune to environmental consequences. Like a mischievous leprechaun, it can leave both a trail of glitter (positive impacts) and a few…well, less desirable things behind. Let’s delve into the surprisingly complex ecological footprint of these small loans.

Microfinance initiatives can have both positive and negative environmental effects, depending on how they’re implemented and the types of businesses they support. It’s a bit like a double-edged sword: used wisely, it can slay environmental dragons; wielded carelessly, it can inadvertently create new ones.

Positive Environmental Impacts of Microfinance

Microfinance can empower individuals and communities to adopt environmentally sustainable practices. For example, providing loans to farmers for water-efficient irrigation systems can reduce water consumption and improve crop yields. Similarly, supporting the development of renewable energy sources, such as solar-powered irrigation pumps or biogas digesters, can reduce reliance on fossil fuels and mitigate greenhouse gas emissions. Imagine a world where tiny loans lead to giant leaps in sustainable agriculture – it’s not just a dream, it’s a possibility.

Negative Environmental Impacts of Microfinance, Microfinance Impact Analysis Report

Conversely, poorly designed microfinance programs can inadvertently exacerbate environmental problems. For instance, loans for unsustainable logging practices or intensive agriculture can lead to deforestation and soil degradation. Similarly, if not carefully managed, microfinance can contribute to pollution from increased industrial activity. Think of it as the environmental equivalent of a poorly planned party – fun while it lasts, but leaves a mess to clean up.

Microfinance and Climate Change Adaptation and Mitigation

Microfinance plays a crucial role in helping communities adapt to and mitigate the effects of climate change. Loans for drought-resistant crops, flood-resistant housing, or climate-smart agricultural practices can enhance resilience to climate-related shocks. Furthermore, supporting businesses involved in renewable energy, carbon sequestration, or sustainable waste management can contribute to climate change mitigation. It’s a small loan’s contribution to a big global challenge. For example, a village in Bangladesh might receive microloans to invest in cyclone-resistant housing, directly mitigating the impacts of climate change. Similarly, a community in Kenya could use microloans to develop solar-powered irrigation systems, thus adapting to water scarcity.

Microfinance and Environmentally Sustainable Businesses

Microfinance can actively support the growth of environmentally sustainable businesses. This includes providing capital for businesses engaged in organic farming, eco-tourism, or the production of environmentally friendly goods. Imagine a vibrant ecosystem of businesses powered by microfinance, all working towards a greener future. For instance, a microloan could help a woman in rural India start a business producing organic cotton, reducing the environmental impact of conventional cotton farming.

Key Considerations for Incorporating Environmental Sustainability into Microfinance Programs: Environmental risk assessments are crucial. Loan officers need training on environmental sustainability. Environmental performance indicators should be included in loan monitoring. Partnerships with environmental NGOs can enhance program effectiveness. Finally, let’s not forget the importance of client education on sustainable practices.

Case Studies and Examples

Microfinance, like a particularly persistent and optimistic squirrel burying acorns, has left a trail of successes and, let’s be honest, a few less-than-successful attempts to improve lives across the globe. Examining these case studies allows us to understand the nuances of microfinance implementation and its varied impact. This section will delve into specific examples, highlighting both the triumphs and the tumbles, providing a more textured understanding of this complex financial tool.

Analyzing diverse microfinance initiatives reveals valuable lessons. Success isn’t simply a matter of handing out loans; it requires a thoughtful understanding of local contexts, client needs, and the potential pitfalls of well-intentioned but poorly executed programs. We’ll examine programs that have flourished and those that have faltered, uncovering the factors that contributed to their respective outcomes. This analysis will also consider the impact on various client groups, showcasing the differences in results when targeting, for example, women-led businesses versus agricultural cooperatives.

Successful Microfinance Initiatives: A Triumphant Tale

Several microfinance programs have demonstrated remarkable success in alleviating poverty and fostering economic growth. One compelling example is the Grameen Bank in Bangladesh, renowned for its pioneering work in providing microloans primarily to women. The Grameen Bank’s success is attributed to its focus on group lending, social collateral, and a commitment to empowering women economically. This model has been replicated (with varying degrees of success) across many developing nations. The success is not solely attributed to the loans themselves, but also to the accompanying training and support provided to the borrowers, fostering financial literacy and entrepreneurial skills. Another example is the successful implementation of microfinance programs in rural areas of India, where access to credit was previously extremely limited. These programs have enabled farmers to invest in improved agricultural techniques and equipment, leading to increased yields and improved livelihoods. The key here is often not just the money, but the holistic approach to supporting the borrowers.

Unsuccessful Microfinance Initiatives: Lessons Learned the Hard Way

It’s crucial to acknowledge that not all microfinance initiatives have yielded positive results. Some programs have struggled with high default rates, unsustainable business models, and even unintended negative consequences. For instance, in some regions, the rapid expansion of microfinance without adequate regulatory oversight led to over-indebtedness among borrowers. This highlights the importance of responsible lending practices and robust regulatory frameworks. Another example is the failure of some programs to adequately address the specific needs of particular client groups, leading to low repayment rates and ultimately, program failure. The lesson learned is that a “one-size-fits-all” approach rarely works in the diverse world of microfinance. Careful planning, understanding local realities, and consistent monitoring are crucial for success.

Comparative Analysis of Microfinance Programs Targeting Different Client Groups

Microfinance programs targeting different client groups often exhibit varying levels of success. For instance, programs focusing on women entrepreneurs have frequently shown higher repayment rates and greater positive impact on household welfare compared to programs targeting men. This is partly due to women’s tendency to prioritize family needs and invest in their children’s education. Conversely, programs aimed at agricultural cooperatives have shown mixed results, with success often dependent on factors such as climate, market conditions, and the availability of supporting infrastructure. Small business initiatives also demonstrate a varied success rate, highly influenced by market demand, business acumen, and access to other crucial resources beyond financing.

Summary of Key Findings from Case Studies

| Case Study Name | Location | Key Findings | Lessons Learned |

|---|---|---|---|

| Grameen Bank | Bangladesh | High repayment rates, significant impact on women’s empowerment and poverty reduction. | Importance of group lending, social collateral, and comprehensive support services. |

| Microfinance Initiative in Rural India (Example) | India | Increased agricultural yields and improved livelihoods among participating farmers. | Need for tailored programs addressing specific agricultural challenges and market access. |

| Failed Microfinance Program (Example) | Generic Developing Nation | High default rates, unsustainable business model, over-indebtedness among borrowers. | Importance of responsible lending practices, regulatory oversight, and thorough needs assessment. |

Challenges and Future Directions

The microfinance sector, while boasting impressive achievements in poverty alleviation, isn’t without its share of comedically frustrating challenges. Think of it as a well-meaning circus act – lots of potential for joy and uplift, but prone to occasional tumbles and mishaps. Let’s examine these hurdles, and how to turn those tumbles into triumphant trapeze acts.

The sector faces a complex web of interconnected issues, each demanding a multifaceted approach. Ignoring these challenges would be like trying to juggle chainsaws while riding a unicycle – not recommended.

Over-Indebtedness and Client Protection

Over-indebtedness remains a significant concern. Aggressive lending practices, coupled with unforeseen economic shocks (like a sudden influx of mime artists flooding the market), can leave borrowers struggling to repay loans. Robust client protection mechanisms, including clear loan contracts, financial literacy training, and accessible dispute resolution processes, are crucial. Imagine a well-trained financial advisor as the safety net in this high-wire act – catching borrowers before they fall into the abyss of debt. Improved data collection and risk assessment models can also help lenders make more informed decisions, reducing the likelihood of over-indebtedness.

Sustainability and Financial Viability

Many microfinance institutions (MFIs) struggle to achieve long-term financial sustainability. Operating costs, particularly in remote areas, can be high, and the reliance on donor funding can create dependency. Innovative business models, diversification of revenue streams (perhaps offering clown-school loans alongside traditional microloans), and improved operational efficiency are essential for ensuring the long-term viability of MFIs. This requires a delicate balancing act between social mission and financial prudence – a tightrope walk that requires skill and foresight.

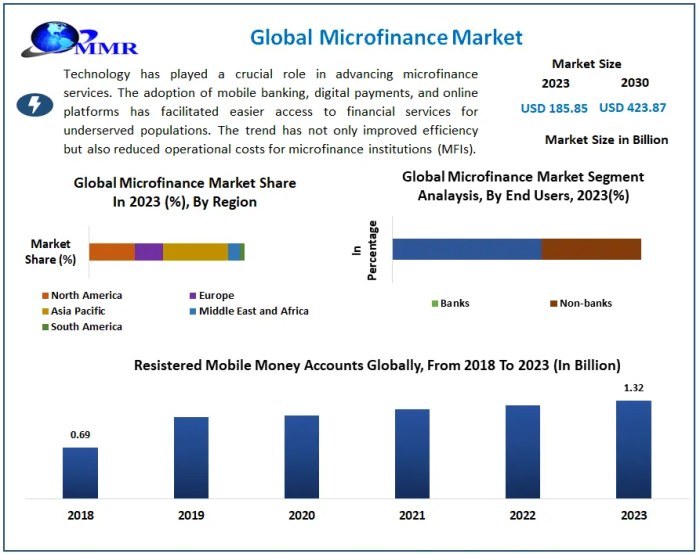

Technological Integration and Digital Finance

Technology presents both opportunities and challenges. While mobile banking and digital lending platforms can expand reach and reduce transaction costs, they also raise concerns about data privacy, cybersecurity, and the digital divide. Imagine a digital microfinance system as a high-speed train – efficient and potentially transformative, but requiring robust infrastructure and careful management to avoid derailment. Addressing these concerns requires careful planning, investment in infrastructure, and effective regulatory frameworks. The inclusion of digital literacy training within microfinance programs is paramount to empowering clients to navigate this new technological landscape.

Regulatory Frameworks and Policy Interventions

Effective regulatory frameworks are essential for promoting responsible lending practices, protecting borrowers, and ensuring the stability of the microfinance sector. However, overly burdensome regulations can stifle innovation and limit access to credit. The ideal regulatory environment is like a well-trained ringmaster – guiding the performance without hindering its dynamism and creativity. Future policy interventions should focus on striking a balance between promoting responsible growth and fostering innovation. This could include exploring innovative regulatory sandboxes to test new technologies and approaches, while ensuring consumer protection remains a top priority.

Future Research Directions

Future research should focus on developing more sophisticated impact assessment methodologies, exploring the effectiveness of different microfinance models in diverse contexts, and investigating the long-term effects of microfinance on poverty reduction and economic empowerment. This requires a rigorous, scientific approach, akin to a meticulously choreographed dance routine – each step carefully planned and executed to maximize impact. Further research into the intersection of microfinance and other development initiatives, such as access to education and healthcare, is crucial to understand the synergistic effects of these interventions.

Conclusive Thoughts

So, there you have it: a whirlwind tour of the world of microfinance impact. While the data may be serious, the implications are far-reaching and, dare we say, occasionally amusing. From the heartwarming stories of empowerment to the cautionary tales of unintended consequences, this report offers a comprehensive, if slightly quirky, look at a sector that is constantly evolving. We hope you’ve enjoyed the journey as much as we have – now go forth and change the world (responsibly, of course).

Question & Answer Hub

What are the ethical considerations in microfinance?

Ethical considerations are paramount, encompassing issues like fair lending practices, transparency, client protection from over-indebtedness, and ensuring environmental sustainability of funded projects. Think of it as the difference between a helpful hand and a predatory loan shark—we want the helpful hand.

How does microfinance compare to traditional banking?

Unlike traditional banks, microfinance targets underserved populations, often offering smaller loans with less stringent requirements. It’s like the David versus Goliath of the financial world, except David sometimes wins (and sometimes needs a better slingshot).

What role does technology play in modern microfinance?

Technology is revolutionizing microfinance, enabling mobile banking, streamlined loan applications, and improved data collection. It’s like giving David a high-tech slingshot—making him even more formidable.