The digital age has revolutionized commerce, and at the heart of this transformation lies online payment processing. This intricate system, encompassing everything from merchant accounts to cutting-edge technologies like blockchain, facilitates the seamless transfer of funds across geographical boundaries and diverse platforms. Understanding its complexities—security protocols, integration methods, and user experience—is crucial for businesses aiming to thrive in the modern marketplace.

This guide delves into the multifaceted world of online payment processing, exploring various systems, security measures, integration strategies, and global considerations. We’ll examine the user experience, identify potential challenges, and look towards the future of this ever-evolving field, highlighting emerging technologies and their impact on the industry.

Types of Online Payment Processing Systems

Online payment processing is crucial for businesses of all sizes, enabling seamless transactions and enhancing customer experience. Understanding the different components involved is key to selecting the right system for your specific needs. This section will clarify the distinctions between merchant accounts, payment gateways, and payment processors, and provide a comparative overview of popular systems.

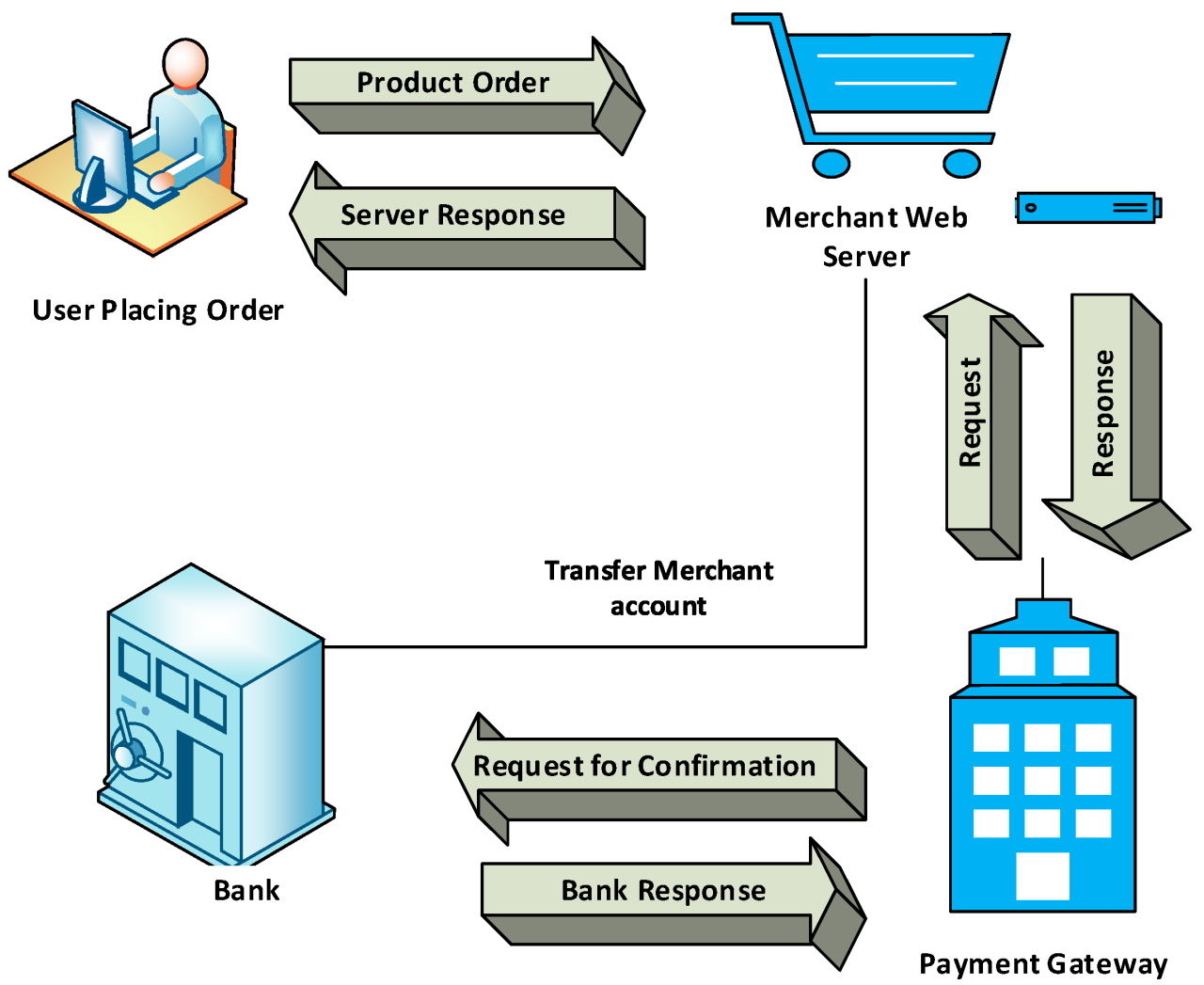

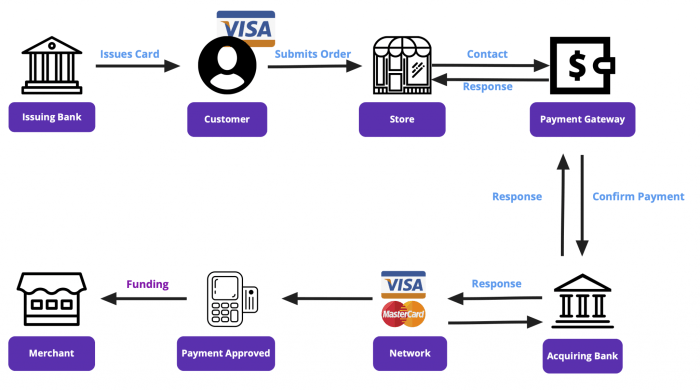

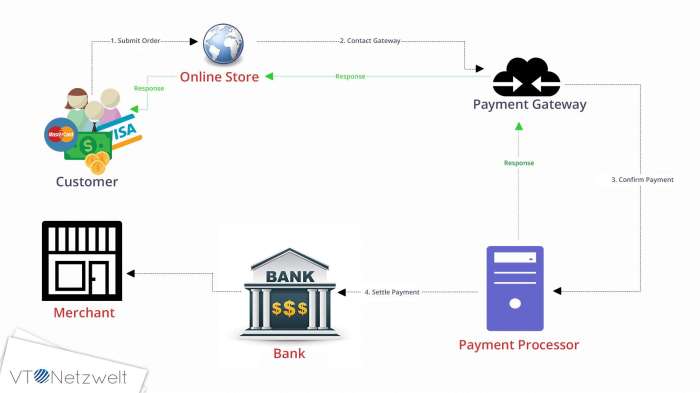

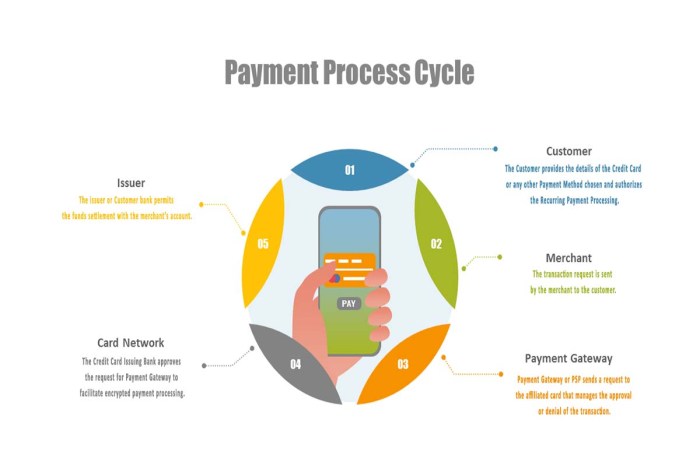

The three main components of online payment processing—merchant accounts, payment gateways, and payment processors—often work together, but they serve distinct functions. A merchant account is a business bank account that allows you to accept credit and debit card payments. A payment gateway acts as a secure connection between your website and the merchant account, processing the transaction details. Finally, a payment processor handles the actual transfer of funds between the customer’s bank and your merchant account.

Merchant Accounts, Payment Gateways, and Payment Processors: A Detailed Comparison

While often used interchangeably, these three components play distinct roles in online payment processing. Understanding their differences is essential for choosing the optimal solution for your business.

| System Name | Key Features | Fees | Security Protocols | Integration Options |

|---|---|---|---|---|

| Stripe | Easy integration, recurring billing, fraud prevention tools, global payment support | Transaction fees (variable), monthly fees (depending on plan), other potential fees | PCI DSS compliance, SSL encryption, fraud detection systems | API integration, plugins for various platforms (e.g., Shopify, WordPress) |

| PayPal | Widely accepted, buyer protection, seller protection, easy setup | Transaction fees (variable), monthly fees (depending on plan), potential additional fees | PCI DSS compliance, fraud detection, two-factor authentication | Website integration, buttons, checkout integration |

| Square | Point-of-sale (POS) system integration, mobile payment processing, invoicing features | Transaction fees (variable), monthly fees (depending on plan), hardware costs (if applicable) | PCI DSS compliance, encryption, fraud monitoring | API integration, plugins, POS hardware integration |

Examples of Payment Processing Systems in Different Industries

The choice of payment processing system often depends on the specific needs and scale of a business. Different industries utilize various systems based on their transaction volumes, customer demographics, and security requirements.

For instance, many e-commerce businesses rely on platforms like Shopify, which often integrate with payment gateways such as Stripe or PayPal to provide a seamless checkout experience for their customers. SaaS companies frequently use recurring billing solutions offered by platforms like Stripe or Recurly to manage subscriptions. Subscription-based services often leverage platforms specifically designed for recurring billing, focusing on features like automated payments and customer management.

Larger enterprises might utilize more comprehensive solutions that integrate with their existing ERP (Enterprise Resource Planning) systems, allowing for centralized management of financial transactions. Smaller businesses may opt for simpler solutions with lower setup costs and easier integration.

Security and Fraud Prevention in Online Payments

The security of online payment processing is paramount, given the sensitive nature of financial data involved. A robust security framework is crucial not only for protecting customer information but also for maintaining the trust and reputation of businesses handling online transactions. Breaches can lead to significant financial losses, legal repercussions, and irreparable damage to brand image. This section details common threats, preventative measures, and the role of industry standards in safeguarding online payments.

Common Security Threats in Online Payment Processing

Online payment systems face a multitude of threats, ranging from simple phishing attacks to sophisticated malware intrusions. These threats can target various stages of the payment process, from data entry to transaction authorization. Understanding these threats is the first step towards effective mitigation. Common threats include:

- Phishing and Social Engineering: Attackers use deceptive emails, websites, or messages to trick users into revealing their payment credentials.

- Malware and Keyloggers: Malicious software can secretly record keystrokes, capturing usernames, passwords, and credit card information.

- Man-in-the-Middle Attacks: Attackers intercept communication between the user and the payment gateway, stealing sensitive data.

- Data Breaches: Security vulnerabilities in a merchant’s systems can lead to the theft of large amounts of customer data, including payment information.

- Card-Not-Present Fraud: Fraudulent transactions occur without the physical presence of the credit card, often involving stolen or compromised card details.

Security Measures for Fraud Prevention

A multi-layered approach is necessary to effectively combat the various threats to online payment security. This involves employing a range of security measures to protect data at every stage of the transaction. These measures include:

- Encryption: Sensitive data is converted into an unreadable format using encryption algorithms, making it incomprehensible to unauthorized individuals. This protects data both in transit (between the user and the payment processor) and at rest (stored on servers).

- Tokenization: Instead of storing actual credit card numbers, payment processors often replace them with unique tokens. These tokens represent the card information but don’t reveal the actual sensitive data, reducing the risk of data breaches.

- Two-Factor Authentication (2FA): This adds an extra layer of security by requiring users to provide two forms of authentication, such as a password and a one-time code sent to their mobile phone. This significantly reduces the risk of unauthorized access even if a password is compromised.

- Address Verification System (AVS) and Card Verification Value (CVV): These security measures help verify that the cardholder is the legitimate owner of the credit card by checking the billing address and a three- or four-digit security code on the back of the card.

- Fraud Detection Systems: Sophisticated algorithms analyze transaction data to identify potentially fraudulent activities, flagging suspicious patterns for review.

PCI DSS Compliance and Online Payment Security

The Payment Card Industry Data Security Standard (PCI DSS) is a set of security requirements designed to protect credit card information. Compliance with PCI DSS is crucial for businesses that process, store, or transmit credit card data. Failure to comply can result in significant fines and reputational damage. PCI DSS covers a broad range of security controls, including network security, access control, and data encryption.

Flowchart of a Secure Online Payment Transaction

The following describes a typical secure online payment transaction:

The flowchart would visually represent the following steps:

- Customer Initiates Purchase: The customer adds items to their online shopping cart and proceeds to checkout.

- Payment Gateway Integration: The merchant’s website securely connects to a payment gateway.

- Encrypted Data Transmission: Customer’s payment information is encrypted before being sent to the payment gateway.

- Payment Gateway Processing: The payment gateway verifies the payment information with the card issuer.

- Authorization and Transaction Confirmation: The payment gateway authorizes the transaction and sends a confirmation to the merchant.

- Order Fulfillment: Upon successful authorization, the merchant fulfills the order.

- Secure Data Storage (if applicable): If the merchant needs to store payment information, it must comply with PCI DSS standards.

Integration of Online Payment Processing into Websites and Apps

Seamlessly integrating online payment processing is crucial for any e-commerce business, impacting both sales conversion rates and customer satisfaction. The method chosen significantly affects the development process, security, and overall user experience. This section details the various integration methods, provides a step-by-step guide for one approach, compares their strengths and weaknesses, and highlights key considerations for a successful implementation.

Methods for Integrating Online Payment Processing

E-commerce websites and mobile applications utilize several methods to integrate online payment processing. These methods offer varying levels of control, technical complexity, and cost. The most common include API integrations, plugins, and hosted payment pages. API integrations provide the highest level of customization but require significant development expertise. Plugins offer a simpler, often faster integration process, while hosted payment pages redirect customers to the payment provider’s secure environment, simplifying integration at the cost of some branding control.

Step-by-Step Integration of a Payment Gateway (Example: Stripe)

This guide Artikels the integration of Stripe, a popular payment gateway, into a simple website. Note that specific steps may vary depending on your chosen gateway and website platform.

1. Create a Stripe Account: Sign up for a Stripe account and obtain your API keys. These keys are crucial for secure communication between your website and Stripe’s servers. Keep these keys confidential and never expose them directly in your website’s code.

2. Include Stripe.js: Add the Stripe.js library to your website’s HTML. This JavaScript library provides the client-side functionality needed to process payments. This is typically done by adding a “ tag in the “ section of your HTML file, pointing to Stripe’s CDN.

3. Create a Payment Form: Develop a secure payment form on your website that collects necessary customer information such as card details, billing address, and potentially other relevant data. This form should be designed to comply with PCI DSS standards to ensure data security.

4. Implement Server-Side Code: Write server-side code (e.g., using PHP, Python, Node.js) to handle the payment processing. This code will securely send the payment information to Stripe’s API for processing. This involves using your API keys to authenticate the request and handle responses from Stripe’s servers.

5. Handle Responses: Your server-side code must properly handle successful and unsuccessful payment responses from Stripe. This includes updating your database with transaction details and notifying the customer of the payment outcome.

6. Testing and Deployment: Thoroughly test your integration in a staging environment before deploying it to your live website. This helps to identify and resolve any issues before they impact real customers.

Comparison of Integration Methods

| Method | Advantages | Disadvantages |

|---|---|---|

| API Integration | High customization, full control, enhanced security (if implemented correctly), potential for better user experience. | Requires significant development expertise, more time-consuming, higher initial cost. |

| Plugins | Easy and fast integration, often less expensive, readily available for popular platforms. | Limited customization options, potential compatibility issues, may compromise security if not properly vetted. |

| Hosted Payment Pages | Simplest integration, requires minimal development, often handles PCI compliance for you. | Less branding control, potential for a less seamless user experience, reliance on third-party provider’s infrastructure. |

Key Considerations for Successful Integration

Successful integration requires careful planning and attention to detail. The following considerations are crucial:

- User Experience: A smooth and intuitive checkout process is essential for maximizing conversion rates. Avoid complex forms or confusing steps.

- Security: Implement robust security measures to protect customer data and comply with relevant regulations (e.g., PCI DSS). This includes using HTTPS, input validation, and secure coding practices.

- Scalability: Choose a payment gateway and integration method that can handle your current and future transaction volume.

- Cost: Evaluate the fees and costs associated with different payment gateways and integration methods.

- Support: Select a payment gateway with reliable customer support in case of issues or questions.

- Compliance: Ensure compliance with all relevant regulations, including data privacy laws and PCI DSS standards.

The User Experience of Online Payment Processing

A positive user experience during online checkout is crucial for driving sales and building customer loyalty. A seamless and intuitive payment process significantly reduces cart abandonment and fosters trust, encouraging repeat business. Conversely, a frustrating or confusing checkout experience can lead to lost revenue and damage a company’s reputation. Understanding the factors that contribute to both positive and negative experiences is vital for optimizing online payment systems.

Factors Contributing to a Positive User Experience

Several key factors contribute to a positive online checkout experience. Speed and efficiency are paramount; users expect the process to be quick and straightforward. Clear and concise information, including total costs, shipping options, and payment methods, minimizes confusion and uncertainty. A visually appealing and easy-to-navigate interface enhances the overall experience, while secure payment gateways instill confidence and protect sensitive data. Furthermore, providing multiple payment options caters to diverse user preferences and increases the likelihood of a successful transaction. Finally, offering excellent customer support throughout the process addresses any potential issues and provides reassurance.

Common Pain Points in Online Payment Processing and Solutions

Common pain points in online payment processing frequently stem from a lack of clarity, excessive steps, or technical difficulties. For example, hidden fees or unexpected costs at the checkout stage often lead to cart abandonment. Complex forms requiring excessive personal information can be overwhelming and deter users. Slow loading times or website glitches can disrupt the flow and create frustration. To address these issues, businesses should prioritize transparency by clearly displaying all costs upfront, streamline the checkout process by minimizing required fields, and ensure a robust and responsive website infrastructure. Offering live chat or readily available FAQs can provide immediate support and address any technical problems or queries.

Impact of Design Choices on Conversion Rates

Design choices significantly impact online transaction conversion rates. A cluttered or confusing checkout page can overwhelm users and lead to abandonment. Conversely, a clean, minimalist design with clear calls to action can improve conversion rates. For instance, a checkout page with a single-column layout, large buttons, and progress indicators provides a straightforward and intuitive user experience. Using reassuring visuals, such as security badges and trust seals, can enhance user confidence and encourage completion of the transaction. Conversely, a multi-step checkout process with numerous distractions can increase cart abandonment. A single-page checkout minimizes friction and improves the overall experience. A/B testing different design elements allows businesses to optimize their checkout pages for maximum conversions.

Best Practices for a Seamless and Secure Online Payment Experience

Creating a seamless and secure online payment experience requires careful consideration of various aspects. The following best practices should be implemented:

- Prioritize Speed and Efficiency: Minimize the number of steps and fields required in the checkout process.

- Ensure Transparency and Clarity: Clearly display all costs, including taxes and shipping fees, upfront.

- Offer Multiple Payment Options: Provide a range of payment methods, including credit cards, debit cards, digital wallets, and other relevant options.

- Implement Robust Security Measures: Utilize secure payment gateways, SSL encryption, and fraud prevention tools.

- Provide Excellent Customer Support: Offer multiple channels for customer support, such as live chat, email, and phone.

- Optimize for Mobile Devices: Ensure the checkout process is responsive and functions seamlessly across all devices.

- Use Clear and Concise Language: Avoid jargon and use simple, straightforward language.

- Regularly Test and Optimize: Continuously monitor key metrics, such as conversion rates and cart abandonment rates, and make adjustments as needed.

Global Considerations for Online Payment Processing

Expanding online businesses internationally necessitates a deep understanding of the diverse payment landscape across different regions. Success hinges on adapting to local preferences, navigating regulatory hurdles, and ensuring secure and seamless transactions for customers worldwide. This involves more than simply translating your website; it requires a strategic approach to payment processing that accounts for cultural nuances and legal frameworks.

Different regions exhibit distinct preferences for online payment methods. While credit cards remain dominant in some areas, mobile wallets and bank transfers are increasingly popular in others. This variance necessitates a flexible payment gateway capable of supporting multiple payment options to maximize reach and conversion rates. Furthermore, the regulatory environment surrounding online payments varies significantly from country to country, requiring businesses to comply with diverse legal and security standards to operate legally and avoid penalties.

Regional Payment Method Preferences

A key challenge in global online payment processing lies in catering to diverse consumer preferences. In North America, credit and debit cards remain prevalent. However, in many parts of Asia, mobile wallets like Alipay and WeChat Pay dominate, while in Europe, bank transfers and real-time payment systems are gaining traction. Understanding these regional differences is critical for optimizing conversion rates. Offering only credit card processing in a market where mobile wallets are preferred will severely limit your customer base.

Challenges and Opportunities in International Online Payment Processing

Expanding internationally presents both significant challenges and exciting opportunities. Challenges include navigating varying regulatory landscapes, managing currency exchange rates and potential transaction fees, and dealing with varying levels of internet access and technological infrastructure. However, the opportunities are equally compelling: access to a vastly expanded customer base, diversification of revenue streams, and the potential to establish a strong global brand presence. Successfully navigating these challenges requires careful planning, strategic partnerships, and a robust payment processing infrastructure.

Regulatory Landscape of Online Payments

The regulatory landscape for online payments varies considerably across countries. Some regions have comprehensive regulations governing data security, consumer protection, and anti-money laundering (AML) compliance. Others have less stringent rules, leading to a patchwork of legal requirements that businesses must navigate. For example, the Payment Services Directive (PSD2) in Europe significantly impacts how businesses handle online payments, while the Payment Card Industry Data Security Standard (PCI DSS) is a globally recognized security standard for credit card processing. Failure to comply with relevant regulations can result in substantial fines and legal repercussions.

Comparison of Payment Method Popularity Across Countries

The following table compares the popularity of various payment methods across three countries, illustrating the diverse landscape of global online payments. Note that popularity is a relative measure and can vary based on factors such as demographics and industry.

| Country | Payment Method | Popularity | Associated Regulations |

|---|---|---|---|

| United States | Credit Cards (Visa, Mastercard, American Express) | High | PCI DSS, State-specific regulations on data security |

| United States | PayPal | High | Federal and state regulations related to financial transactions |

| China | Alipay | Very High | Regulations from the People’s Bank of China concerning third-party payment platforms |

| China | WeChat Pay | Very High | Regulations from the People’s Bank of China concerning third-party payment platforms |

| United Kingdom | Bank Transfers (Faster Payments) | High | PSD2, FCA regulations |

| United Kingdom | Debit Cards | High | PSD2, FCA regulations |

Future Trends in Online Payment Processing

The landscape of online payment processing is in constant flux, driven by rapid technological advancements and evolving consumer expectations. Emerging technologies are reshaping how we transact online, promising faster, more secure, and more convenient payment experiences. This section explores these key trends and their potential impact on the future of online payments.

Several powerful technologies are converging to revolutionize online payment processing. The integration of these technologies is not merely additive; it creates synergistic effects, leading to innovative solutions that were previously unimaginable.

Blockchain Technology’s Role in Secure Transactions

Blockchain technology, known for its decentralized and secure nature, offers significant potential for enhancing online payment security and transparency. By creating a tamper-proof record of transactions, blockchain minimizes the risk of fraud and reduces reliance on intermediaries. This increased transparency can lead to faster processing times and lower transaction fees. Examples include cryptocurrencies like Bitcoin and Ethereum, which already facilitate peer-to-peer transactions, and newer projects focusing on building blockchain-based payment platforms for businesses. The inherent security of blockchain could also streamline cross-border payments, reducing delays and costs associated with international transactions.

Biometric Authentication: Enhancing Security and Convenience

Biometric authentication methods, such as fingerprint scanning, facial recognition, and voice recognition, are becoming increasingly prevalent in online payment systems. These technologies offer a more secure and convenient alternative to traditional password-based authentication, reducing the risk of unauthorized access and simplifying the checkout process. Many mobile payment apps already incorporate biometric authentication, and we can expect this trend to expand to more online platforms. The improved security offered by biometrics can also lead to higher transaction limits and a greater sense of trust for consumers.

Artificial Intelligence (AI) and Machine Learning in Fraud Detection

AI and machine learning algorithms are playing a crucial role in enhancing fraud detection and prevention capabilities. These sophisticated systems can analyze vast amounts of transaction data in real-time to identify suspicious patterns and flag potentially fraudulent activities. This proactive approach helps reduce financial losses for businesses and consumers alike. For example, AI-powered systems can detect anomalies in transaction behavior, such as unusual purchase amounts or locations, which may indicate fraudulent activity. The ability of AI to learn and adapt over time also means that fraud detection systems are constantly improving their accuracy.

A Hypothetical Future Scenario: Online Payments in 2030

Imagine a world in 2030 where online payments are seamless and invisible. Biometric authentication is the norm, with purchases completed through a simple glance or voice command. Blockchain technology ensures secure and transparent transactions, eliminating the need for complex verification processes. AI-powered systems anticipate your needs, suggesting payments and managing your finances with personalized recommendations. Cross-border payments are instantaneous and cost-effective, facilitating global commerce. Decentralized payment systems offer increased choice and competition, driving down fees and improving overall efficiency. The concept of a traditional digital wallet is largely obsolete, replaced by a sophisticated, AI-driven financial management system integrated directly into your everyday life. This system automatically manages expenses, tracks spending habits, and even predicts future financial needs. This futuristic scenario represents a convergence of several technologies, making payments a background process rather than a focal point of online interactions.

Wrap-Up

Successfully navigating the landscape of online payment processing requires a multifaceted approach, encompassing robust security measures, a user-friendly interface, and a deep understanding of global regulations. By implementing best practices and staying abreast of emerging technologies, businesses can optimize their payment systems, enhance customer satisfaction, and ultimately drive growth in the increasingly digital economy. The future of online payments promises even greater innovation, offering exciting possibilities for both businesses and consumers alike.

Common Queries

What is the difference between a payment gateway and a payment processor?

A payment gateway is the technology that facilitates the transfer of payment information between a merchant and a payment processor. The payment processor then handles the actual transaction with the banks and card networks.

What are the common fees associated with online payment processing?

Common fees include transaction fees (a percentage of each transaction), monthly fees, setup fees, and potentially chargeback fees.

How can I choose the right payment gateway for my business?

Consider factors such as transaction fees, supported payment methods, integration options, security features, and customer support when selecting a payment gateway.

What is PCI DSS compliance, and why is it important?

PCI DSS (Payment Card Industry Data Security Standard) is a set of security standards designed to ensure the safe handling of credit card information. Compliance is crucial for protecting against data breaches and maintaining customer trust.