Online Payment Processing Fees: Prepare yourself for a rollercoaster ride through the wild world of online transactions! We’ll unravel the mysteries of transaction fees, monthly charges, and those sneaky setup fees that seem to appear from thin air. Get ready to navigate the labyrinthine world of payment gateways, where every click could cost you a king’s ransom (or at least a few pennies). This isn’t your grandma’s checkbook – it’s a digital Wild West, and we’re your trusty guide.

This exploration will cover various fee types, factors influencing costs, negotiation strategies, hidden expenses, and the ultimate impact on your business’s bottom line. We’ll compare popular payment gateways, offering a clear picture of their pricing structures and features, empowering you to make informed decisions that will leave your wallet feeling a little less… light.

Types of Online Payment Processing Fees

Navigating the world of online payment processing fees can feel like traversing a minefield of hidden costs. But fear not, intrepid entrepreneur! We’re here to illuminate the path, shedding light on the various charges that might pop up and, dare we say, even make you chuckle along the way. Think of it as a financial adventure, with a slightly less thrilling ending than “Indiana Jones and the Last Crusade.”

Online payment processing fees aren’t just one monolithic charge; they’re a delightful (yes, delightful!) medley of different costs. Understanding these fees is crucial to budgeting effectively and avoiding any unpleasant surprises. Failing to do so could lead to a situation where your profits are thinner than a supermodel’s eyebrow.

Transaction Fees, Online Payment Processing Fees

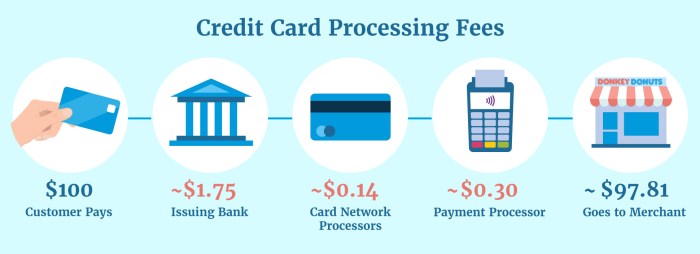

Transaction fees are the bread and butter (or perhaps the avocado toast and kale smoothie) of payment processing fees. These are charges levied for each successful transaction processed through your chosen payment gateway. They’re typically expressed as a percentage of the transaction amount plus a small per-transaction fee. For example, a fee might be 2.9% + $0.30 per transaction. The higher the transaction volume, the more significant these fees become. Think of them as tiny, persistent leprechauns stealing a bit of gold from your pot of digital riches.

Monthly Fees

Some payment gateways charge a recurring monthly fee, regardless of whether you process any transactions. This is like paying rent for your online storefront, even if you haven’t sold a single thing that month. It’s a fixed cost you need to factor into your budget, and it can be particularly painful if you experience a slow month. However, these fees often come with perks like enhanced features or customer support. So, consider it a trade-off – a slightly more expensive, but potentially more convenient, office space.

Setup Fees

Setup fees are one-time charges associated with setting up your payment processing account. These are akin to the initial investment you make when opening a new business. They might cover the costs of account creation, integration with your website, and initial training. While a one-time payment, it’s a crucial initial expense that shouldn’t be overlooked. Think of it as a small price to pay for the privilege of accepting online payments.

Chargeback Fees

Ah, chargebacks – the bane of any online merchant’s existence. These are fees incurred when a customer disputes a transaction and successfully reverses the charge. Chargebacks can be a significant financial burden, as they involve not only the refunded amount but also a hefty processing fee. Preventing chargebacks through robust fraud prevention measures is paramount. It’s like avoiding a visit from the payment processing fee goblins.

Comparison of Payment Gateway Fee Structures

The following table compares the fee structures of some popular payment gateways. Remember that these fees can vary based on factors such as transaction volume, chosen plan, and specific features. Always check the latest pricing information directly with the provider.

| Gateway Name | Transaction Fee | Monthly Fee | Setup Fee | Chargeback Fee |

|---|---|---|---|---|

| Stripe | 2.9% + $0.30 | $0 | $0 | $15 |

| PayPal | 2.9% + $0.49 | Varies by plan | $0 | Varies |

| Square | 2.9% + $0.30 | $0 | $0 | $15 |

| Shopify Payments | 2.9% + $0.30 | Varies by plan | $0 | Varies |

Factors Influencing Overall Cost

The overall cost of online payment processing isn’t a simple equation; it’s a complex interplay of several factors. Transaction volume is a major player; high-volume businesses will pay significantly more in transaction fees than those with low volumes. The chosen payment gateway also significantly impacts costs, as fees vary widely between providers. Finally, the type of business influences the costs; high-risk businesses, for example, often face higher fees due to increased chargeback risks. A small bakery likely faces different fees than an online casino, and rightly so!

Factors Affecting Online Payment Processing Fees

Ah, the mysterious world of online payment processing fees! It’s a realm where seemingly simple transactions can become surprisingly complex, a financial labyrinth where even seasoned entrepreneurs occasionally find themselves lost. Let’s shed some light on the factors that influence these often-bewildering charges. Think of it as a detective story, where we unravel the clues to understand why your processing fees might be higher (or lower!) than expected.

Payment processors, those unsung heroes (or villains, depending on your perspective) of the digital economy, use a variety of factors to determine your fees. It’s not a random number generator; rather, it’s a carefully calculated assessment based on your business and its payment habits. These factors work together to create a unique fee structure for each merchant.

Transaction Volume and Average Transaction Value

The sheer volume of transactions you process is a major player in determining your fees. Think of it like a bulk discount at your local grocery store – the more you buy, the lower the price per item (usually!). Similarly, processing a high volume of transactions often translates to lower per-transaction fees. Conversely, processing a small number of transactions can result in higher fees. Furthermore, the average value of each transaction matters. Processing many small transactions might cost more overall than processing fewer, larger ones, due to the fixed fees involved. For example, a business processing 1000 transactions of $1 each will likely pay more in fees than a business processing 100 transactions of $10 each, even if the total revenue is the same.

Industry and Risk Level

Your industry plays a significant role. Businesses considered high-risk, such as those dealing with adult content, gambling, or international transactions, generally face higher fees due to the increased likelihood of chargebacks and fraud. This is the payment processor’s way of hedging their bets, so to speak. Imagine the payment processor as an insurance company – higher risk means higher premiums. Conversely, businesses in lower-risk industries, such as those selling books or stationary, often benefit from lower fees.

Payment Methods

Different payment methods carry different fees. Credit card transactions, especially those using premium cards like American Express, often come with higher processing fees compared to debit cards. This is because credit card companies charge the payment processor a higher interchange fee, which is then passed on to the merchant. Mobile wallets like Apple Pay and Google Pay usually fall somewhere in between, offering a balance of convenience and cost. The fees associated with each method vary depending on factors such as the card network (Visa, Mastercard, American Express, Discover), card type (credit, debit, prepaid), and even the specific mobile wallet used.

Payment Gateway Integrations

The payment gateway you choose also impacts your fees. Some gateways offer more competitive pricing than others, and the integration process itself can influence costs. Choosing a complex, custom-built integration might be more expensive upfront than using a readily available, pre-built solution. The level of customer support and features offered by the gateway also affect the overall cost, as these factors influence the pricing strategy of the gateway provider. A simple analogy: choosing a basic, off-the-shelf software solution might be cheaper than custom-developing a bespoke application.

Hidden Costs and Unexpected Fees: Online Payment Processing Fees

Ah, the joys of online payment processing! So simple, so convenient… until the unexpected fees arrive like uninvited guests at your quarterly board meeting, demanding their share of the profits. Let’s delve into the shadowy world of hidden costs, where the fine print lurks and the surprises never cease. Prepare for a thrilling exposé of the less-than-transparent aspects of this otherwise delightful digital dance.

The seemingly straightforward world of online payment processing often hides a plethora of additional charges that can significantly impact your bottom line. These extra fees, often buried deep within lengthy contracts or presented as minor details, can quickly add up, leaving your business feeling a little… lighter in the wallet. It’s like finding out your “all-inclusive” vacation package doesn’t actually include the mini-bar – except instead of disappointment, it’s a significant dent in your revenue.

Chargeback Fees

Chargebacks occur when a customer disputes a transaction, prompting their bank to reverse the payment. While understandable in cases of fraud or legitimate errors, chargebacks represent a substantial financial burden for businesses. Processing a single chargeback involves a hefty fee, and repeated occurrences can quickly escalate into a significant expense. Imagine a scenario where a customer claims they didn’t authorize a purchase – a legitimate claim, perhaps, or perhaps not. Either way, you’re stuck paying the chargeback fee, plus the cost of the original transaction. The process can be time-consuming and frustrating, adding to the overall financial impact.

International Transaction Fees

Expanding your business globally? Fantastic! But be prepared for the potential sting of international transaction fees. These fees are levied on transactions processed in foreign currencies and can significantly impact your profit margins if not carefully considered. Think of it as a global travel tax, except instead of paying for baggage allowance, you’re paying for the privilege of accepting payments from overseas customers. The fees vary depending on the payment processor and the specific countries involved, so diligent research is essential to avoid unwelcome surprises. For example, a seemingly small percentage added to each international transaction can accumulate rapidly, particularly for businesses with a large international customer base.

- Currency Conversion Fees: Converting foreign currencies can involve additional charges, adding to the overall cost of international transactions.

- Cross-border Transaction Fees: These fees are specific to transactions that cross national borders.

- Foreign Transaction Fees (from the customer’s bank): Don’t forget, the customer’s bank might also levy fees on international transactions, impacting their willingness to purchase.

Monthly or Annual Fees

Many payment processors impose monthly or annual fees, irrespective of the volume of transactions processed. These fees can be a significant ongoing expense, particularly for businesses with low transaction volumes. Think of it as a membership fee for the privilege of accepting online payments. Some processors may offer tiered pricing, with higher monthly fees unlocking lower transaction fees, so businesses need to carefully assess their transaction volume to determine the most cost-effective option.

PCI Compliance Fees

Maintaining Payment Card Industry Data Security Standard (PCI DSS) compliance is crucial for businesses handling credit card information. Failure to comply can result in hefty fines. While not directly a payment processing fee, the costs associated with achieving and maintaining PCI DSS compliance (such as software updates, security audits, and employee training) can add up, creating an indirect but significant expense. This is like paying for insurance – you hope you never need it, but the consequences of not having it are far more severe.

Impact of Payment Processing Fees on Profitability

Payment processing fees might seem like a small detail, a mere rounding error in the grand scheme of running a business. But let me tell you, my friend, these seemingly insignificant charges can stealthily nibble away at your profits like a horde of miniature, financially-motivated piranhas. Ignoring their impact is akin to ignoring a slow leak in your business’s financial life raft – eventually, you’ll find yourself sinking.

High payment processing fees directly reduce a business’s net profit margin. Every transaction processed incurs a cost, which is subtracted from the revenue generated. The higher the fee percentage or the fixed fee per transaction, the lower the profit for each sale. This effect is amplified with a high volume of transactions, turning a small percentage into a substantial loss over time. Think of it as a silent tax on your sales, one that can dramatically affect your bottom line, especially for businesses operating on thin margins.

Methods for Mitigating the Impact of Payment Processing Fees

Understanding the impact of payment processing fees allows businesses to implement strategies to minimize their financial burden. One of the most effective approaches is careful selection of a payment gateway. Shopping around and comparing fees is crucial. Consider negotiating lower rates with processors based on transaction volume. Optimizing pricing strategies, such as absorbing a portion of the fee to increase the perceived value to the customer, can also help maintain profit margins.

Hypothetical Scenario: High-Fee vs. Low-Fee Payment Gateway

Let’s imagine two e-commerce businesses, “Widgets Galore” and “Gizmos & Gadgets.” Both generate $100,000 in annual online sales. Widgets Galore uses a high-fee payment gateway charging a 3.5% processing fee plus $0.30 per transaction. Gizmos & Gadgets opts for a low-fee gateway charging 2.5% plus $0.20 per transaction. Assuming an average transaction value of $50 and 2000 transactions annually, let’s see the difference:

| Company | Processing Fee Percentage | Fixed Fee per Transaction | Total Processing Fees |

|---|---|---|---|

| Widgets Galore | 3.5% | $0.30 | $100,000 * 0.035 + (2000 * $0.30) = $5000 |

| Gizmos & Gadgets | 2.5% | $0.20 | $100,000 * 0.025 + (2000 * $0.20) = $3500 |

The difference in processing fees is $1500 annually. This seemingly small difference can significantly impact profitability, especially for businesses operating on tight margins. For Widgets Galore, this represents a 1.5% reduction in their profit margin compared to Gizmos & Gadgets. Over time, this can be the difference between healthy growth and struggling to stay afloat. Choosing the right payment gateway is a critical decision impacting long-term profitability.

Choosing the Right Payment Gateway

Selecting the perfect payment gateway is like choosing a superhero sidekick – you need someone reliable, powerful, and ideally, not prone to spontaneous combustion. The wrong choice can leave your business scrambling for loose change, while the right one can supercharge your sales. This section explores how to navigate the surprisingly exciting world of payment gateway selection.

The payment gateway landscape is a vibrant jungle of options, each promising a unique blend of features and fees. Understanding the nuances of these offerings is crucial for businesses of all sizes. A small online boutique will have different needs than a multinational corporation, and choosing a gateway that aligns with your specific transaction volume and business model is paramount.

Payment Gateway Comparison

The following table compares several popular payment gateways, highlighting their strengths and weaknesses. Remember, the “best” gateway depends entirely on your individual business requirements. Don’t let the shiny features distract you from the core functionality and reliability you need.

| Gateway Name | Key Features | Pricing Model | Security Features | Customer Support |

|---|---|---|---|---|

| Stripe | Simple integration, robust API, global reach, recurring billing, fraud prevention tools. | Transaction-based fees, varying by country and payment method. Often includes a percentage plus a fixed fee per transaction. | PCI DSS compliance, advanced fraud detection, two-factor authentication. | Extensive online documentation, email support, phone support for enterprise plans. |

| PayPal | Widely recognized brand, buyer protection, global reach, easy integration for e-commerce platforms. | Transaction-based fees, varying by payment method and country. Typically includes a percentage plus a fixed fee. | PCI DSS compliance, buyer and seller protection programs, fraud monitoring. | Extensive online help center, email and phone support (availability varies by region). |

| Square | Point-of-sale (POS) integration, mobile payment processing, invoicing features, simple interface. | Transaction-based fees, varying by payment method. Generally includes a percentage per transaction. | PCI DSS compliance, fraud prevention tools, EMV chip card reader support. | Online help center, email and phone support. |

| Shopify Payments | Seamless integration with Shopify platform, simplified checkout process, real-time reporting. | Transaction-based fees, integrated directly into Shopify’s pricing structure. Rates vary by plan and location. | PCI DSS compliance, Shopify’s built-in security features. | Shopify’s extensive support network, including documentation, email and phone support. |

Beyond the Price Tag: Crucial Considerations

While pricing is a significant factor, focusing solely on the cheapest option can be a costly mistake. Think of it like buying a car – you wouldn’t choose the cheapest model if it lacked safety features or had a terrible reputation for reliability, would you? Consider these factors alongside pricing:

Security: Protecting your customers’ sensitive financial data is paramount. Look for gateways that are PCI DSS compliant and offer robust fraud prevention measures. A breach can cost far more than any savings you might achieve by choosing a cheaper, less secure option. Imagine the PR nightmare!

Customer Support: When things go wrong (and they inevitably will), responsive and helpful customer support is invaluable. Consider the availability of different support channels (phone, email, chat) and the responsiveness of the support team. Nobody wants to be left hanging when a critical payment issue arises.

Integration Capabilities: Seamless integration with your existing e-commerce platform, CRM, or accounting software is crucial for efficiency. A complex or difficult integration process can lead to frustration and lost time. Check for compatibility with your current systems before committing to a gateway.

Summary

So, there you have it – a whirlwind tour through the often-confusing world of online payment processing fees. While the initial complexity might seem daunting, armed with the knowledge gleaned from this exploration, you can now confidently navigate the treacherous terrain of transaction costs, negotiate favorable rates, and ultimately, protect your precious profits. Remember, knowledge is power – and in the world of online payments, power translates directly into a healthier bank balance. Happy processing!

Helpful Answers

What are chargeback fees, and how can I avoid them?

Chargeback fees are levied when a customer disputes a transaction. Minimizing chargebacks involves clear order details, excellent customer service, and robust fraud prevention measures.

Are there any free payment gateways?

While some gateways offer free plans with limitations, most charge fees based on transaction volume or offer tiered pricing. “Free” often means hidden costs or restricted functionality.

How often are payment processing fees reviewed?

Frequency varies by provider; some review annually, while others offer more flexible contracts. Negotiation is key to securing favorable terms.