Online Payment Systems Comparison: Navigating the digital landscape of online payments can feel like traversing a jungle teeming with exotic (and sometimes dangerous!) payment methods. From the familiar comfort of credit cards to the futuristic allure of cryptocurrencies, the world of online transactions is a vibrant ecosystem. This comparison delves into the key players, exploring their strengths, weaknesses, and the often-overlooked nuances that can make or break your online business – or your personal finances.

We’ll examine a range of payment systems, comparing their security features, transaction fees, user interfaces, global reach, and customer support. We’ll also look ahead to the future of online payments, considering emerging technologies and their potential impact on the industry. Prepare for a wild ride through the fascinating world of digital money!

Introduction to Online Payment Systems

Remember the days of writing checks and hoping they didn’t bounce? Those were simpler times, or so we tell ourselves. The evolution of online payment systems has been a wild ride, transforming how we buy everything from artisanal cheeses to questionable internet widgets. From the early days of clunky dial-up connections and the hesitant adoption of credit cards online, we’ve arrived at a point where a tap of a phone can settle a transaction faster than you can say “digital wallet.” This journey has been fueled by innovation, security advancements (mostly), and the insatiable human desire for convenience.

Online payment systems have dramatically altered the landscape of commerce, facilitating seamless transactions across geographical boundaries. They’ve enabled the rise of e-commerce giants and empowered small businesses to reach global markets. But with this convenience comes complexity, a dizzying array of options that can leave even the most tech-savvy among us feeling a little bewildered.

Types of Online Payment Systems

The online payment world offers a vibrant ecosystem of options, each with its own strengths and quirks. Choosing the right system depends on your needs and preferences, much like selecting the perfect pair of socks (comfort versus style is a real dilemma, isn’t it?). Let’s explore some key players. Credit and debit cards remain workhorses, offering widespread acceptance and familiarity. E-wallets, such as PayPal and Apple Pay, streamline transactions by storing your payment information securely. Mobile payments, using technologies like Apple Pay and Google Pay, leverage the ubiquitous smartphone for quick and contactless payments. Finally, bank transfers, while slower, offer a secure and direct method for transferring funds.

Comparison of Online Payment Systems

This table compares five major online payment systems, highlighting their key features. Remember, the “best” system is subjective and depends on your individual priorities. Think of it as choosing a superhero – each has their unique powers, and some are better suited for certain missions than others.

| Payment System | Acceptance | Security Features | Fees |

|---|---|---|---|

| PayPal | Widely accepted globally | Buyer and seller protection, encryption | Transaction fees vary |

| Stripe | Popular among businesses, growing consumer acceptance | Robust security measures, PCI DSS compliance | Transaction fees, monthly fees for certain plans |

| Square | Widely accepted, strong in physical retail | Point-to-point encryption, fraud prevention tools | Transaction fees, monthly fees for certain plans |

| Apple Pay | Growing acceptance, primarily for in-app and contactless purchases | Tokenization, biometric authentication | Generally no fees for consumers |

| Google Pay | Similar to Apple Pay, strong in Android ecosystem | Tokenization, various security protocols | Generally no fees for consumers |

Security Features of Online Payment Systems: Online Payment Systems Comparison

Navigating the digital world of online payments can feel like traversing a minefield of potential pitfalls. Fortunately, a surprisingly robust arsenal of security measures exists to protect both merchants and consumers from the digital bandits lurking in the shadows. Let’s delve into the fascinating world of online payment security, where cryptography dances with fraud detection algorithms in a thrilling ballet of digital defense.

Different online payment systems employ a variety of security protocols, creating a fascinating patchwork of protective measures. While the specifics vary, common threads weave through the tapestry of security. Encryption, the art of scrambling sensitive data into an indecipherable mess, is a cornerstone of most systems. Think of it as wrapping your financial information in a highly sophisticated, unbreakable gift wrap that only the intended recipient can unravel. Fraud detection systems, on the other hand, act as vigilant guardians, constantly monitoring transactions for suspicious activity. These systems use sophisticated algorithms to identify anomalies, such as unusual spending patterns or transactions originating from high-risk locations. They’re like highly trained security dogs sniffing out trouble before it can escalate.

Tokenization

Tokenization is a clever technique that replaces sensitive data, such as credit card numbers, with unique, non-sensitive tokens. Imagine it as substituting your real address with a temporary, untraceable alias when ordering pizza online. This protects your actual financial information from exposure, even if a data breach occurs. The system remembers the token’s association with your actual card details, allowing for seamless transactions without revealing your sensitive data. This is a significant improvement over simply storing the actual credit card number, as a compromised token reveals nothing of value to cybercriminals. The use of tokens has greatly enhanced the security of many online payment platforms. For example, many major payment processors now utilize tokenization as a standard security practice.

Two-Factor Authentication

Two-factor authentication (2FA) adds an extra layer of security by requiring two distinct forms of verification before granting access to an account or authorizing a transaction. Think of it as having two keys to open a vault instead of just one. Common methods include a password (something you know) and a one-time code sent to your phone (something you have). This makes it significantly harder for unauthorized individuals to gain access, even if they manage to obtain your password. Implementing 2FA is akin to installing a state-of-the-art alarm system in your digital home. Many online banking and payment platforms now offer this as a standard security feature.

Potential Vulnerabilities and Mitigation Strategies

Despite the robust security measures employed, online payment systems are not invulnerable. Phishing scams, malware infections, and data breaches remain persistent threats. However, mitigation strategies exist to reduce these risks significantly. Regular software updates, strong passwords, and awareness of phishing tactics are crucial defensive measures. For businesses, investing in robust security infrastructure, including firewalls and intrusion detection systems, is paramount. Additionally, employing regular security audits and penetration testing can help identify and address vulnerabilities before they are exploited by malicious actors. The ongoing arms race between security professionals and cybercriminals necessitates a proactive and adaptive approach to security.

Fees and Charges Associated with Online Payment Systems

Navigating the world of online payment systems can feel like traversing a minefield of hidden fees. While the convenience is undeniable, understanding the cost structure is crucial to avoiding unpleasant surprises and maximizing your profits (or minimizing your losses, depending on your perspective). Let’s dissect the often-opaque pricing models of various payment processors. Think of this as your survival guide to the jungle of transaction fees.

Different online payment systems employ varying fee structures. These can include setup fees, monthly charges, and, of course, the ubiquitous transaction fees. The amounts vary wildly depending on the system, the type of transaction, and even the volume of transactions you process. It’s a complex landscape, but we’ll try to make it a little less daunting.

Transaction Fees

Transaction fees are the most common type of charge. These fees are levied each time a customer makes a payment using your online payment system. They are typically expressed as a percentage of the transaction value plus a fixed fee per transaction. For example, one system might charge 2.9% + $0.30 per transaction, while another might offer a tiered pricing model with lower rates for higher transaction volumes. This can lead to significant differences in the overall cost, particularly for businesses with high transaction volumes.

- System A: 2.9% + $0.30 per transaction. A $100 transaction would cost $3.20.

- System B: 2.5% + $0.20 per transaction (for volumes over $10,000 monthly). A $100 transaction would cost $2.70.

- System C: A flat rate of $0.50 per transaction (regardless of value – good for low-value, high-volume businesses).

Setup Fees and Monthly Charges

Beyond transaction fees, many systems charge setup fees to initiate the account and monthly fees for ongoing service. These can significantly impact the overall cost, especially for startups or businesses with low transaction volumes. Some systems waive setup fees as an incentive, while others offer different monthly plans with varying features and fees. It’s vital to compare these upfront costs to determine the most cost-effective solution.

- System A: $49 setup fee, $25 monthly fee.

- System B: No setup fee, $30 monthly fee.

- System C: $0 setup fee, $0 monthly fee (but higher per-transaction fees).

Hidden Costs and Additional Fees

Beware the lurking dangers of hidden fees! Many systems have additional charges that aren’t always prominently displayed. These can include charges for international transactions, chargebacks (when a customer disputes a payment), currency conversion fees, and even fees for accessing certain features or integrations. Always read the fine print carefully to avoid unexpected expenses.

- Chargebacks: The cost of handling a chargeback can vary widely, sometimes exceeding the original transaction value.

- International Transactions: Processing payments from other countries often incurs higher fees.

- Withdrawal Fees: Some systems charge fees for transferring funds from your payment account to your bank account.

User Experience and Interface Design

The user interface of an online payment system is more than just a pretty face; it’s the gatekeeper to a smooth and frustration-free transaction. A clunky, confusing interface can send customers running for the hills (and their credit cards with them!), while a well-designed system can inspire confidence and encourage repeat business. Let’s dive into the fascinating world of payment system aesthetics and usability, exploring how different platforms cater (or fail to cater) to the needs of both merchants and customers.

The ease of use for both merchants and customers is paramount. For merchants, a user-friendly interface translates to streamlined processes, reduced errors, and ultimately, increased efficiency. For customers, a simple and intuitive design means quicker checkout times, fewer abandoned carts, and a generally more pleasant online shopping experience. Imagine trying to navigate a website with a payment system that looks like it was designed in the early days of the internet – it’s enough to make anyone reach for their cash.

Comparison of User Interfaces

The user interface significantly impacts the overall experience. A poorly designed interface can lead to user frustration, cart abandonment, and ultimately, lost revenue. Conversely, a well-designed interface promotes ease of use, builds trust, and encourages repeat business. Below is a comparison of three prominent payment systems, highlighting their strengths and weaknesses in terms of user interface design.

| Payment System | Strengths | Weaknesses | Overall Usability |

|---|---|---|---|

| PayPal | Widely recognized and trusted brand; generally intuitive interface; robust mobile app; readily available customer support. | Can be slow to load at times; the interface can feel somewhat cluttered, especially for new users; some advanced features may be difficult to find. | Good – widely adopted and generally user-friendly, but could benefit from interface streamlining. |

| Stripe | Clean and modern design; highly customizable for merchants; robust API for integration with other systems; excellent documentation and support. | Can be less intuitive for non-technical users; requires some technical knowledge for optimal merchant setup; fewer readily available customer support options compared to PayPal. | Good to Excellent – excellent for developers and tech-savvy merchants, but a steeper learning curve for others. |

| Square | Simple and straightforward interface; excellent for small businesses; integrates well with point-of-sale systems; strong mobile app functionality. | Limited customization options compared to Stripe; fewer advanced features than PayPal or Stripe; some users report occasional glitches in the mobile app. | Good – particularly strong for ease of use for small businesses and in-person transactions. |

Integration with E-commerce Platforms

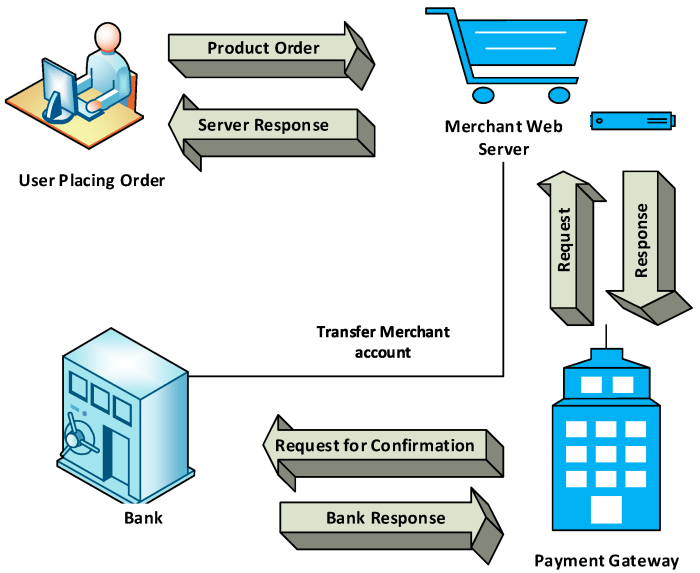

Integrating online payment systems into your e-commerce platform is like adding a high-speed checkout lane to your digital storefront – it’s crucial for a smooth and profitable customer experience. A poorly integrated system, however, can be akin to a checkout lane constantly malfunctioning, leading to frustrated customers and lost sales. The right integration ensures a seamless flow from browsing to purchase, significantly impacting conversion rates and overall business success.

The integration process itself varies depending on the specific e-commerce platform (like Shopify, WooCommerce, Magento, etc.) and the chosen payment gateway (Stripe, PayPal, Square, etc.). Some platforms offer native integrations, simplifying the process considerably, while others require custom coding or the use of third-party plugins. The level of technical expertise needed also fluctuates wildly, from simple configuration changes to complex API integrations. Regardless of the approach, successful integration hinges on clear documentation, robust testing, and a healthy dose of patience (and perhaps some caffeine).

Seamless Integration Examples and Challenges

Seamless integration, in the ideal world, means the customer never even notices the payment gateway is involved. They select their items, enter their details, and complete the purchase without friction. For example, a well-integrated Stripe checkout on a Shopify store might look completely native to the Shopify theme, offering a unified branding experience. Conversely, a poorly integrated system might redirect the customer to a completely different website for payment, disrupting the flow and potentially causing distrust. Challenges can include compatibility issues between the platform and gateway, API limitations, security concerns, and the need for ongoing maintenance and updates. Consider the nightmare scenario of a payment gateway outage during a peak sales period; the consequences can be financially devastating.

Technical Requirements for Integration

Integrating an online payment system typically involves several technical steps. First, you’ll need to select a suitable payment gateway and sign up for an account. This usually involves providing business information and undergoing a verification process. Next, you’ll need to obtain API credentials or access relevant plugin settings from your chosen payment provider. Depending on your e-commerce platform, you might need to install and configure a plugin or use the platform’s built-in integration tools. This often involves setting up webhook notifications to receive updates on transaction statuses. Finally, thorough testing is essential to ensure the system functions correctly and securely, covering various scenarios including successful transactions, failed transactions, and error handling. This phase is often overlooked, leading to unexpected issues post-launch. Remember, a robust testing strategy is crucial for avoiding costly mistakes.

Global Reach and International Transactions

Venturing into the wild world of international online payments can feel like navigating a jungle with a compass that points in three different directions at once. Different payment systems boast varying levels of global reach, each with its own unique quirks regarding currency conversions and fees. Let’s untangle this web of international finance, shall we?

The global reach of online payment systems varies dramatically. Some, like PayPal, enjoy widespread acceptance across numerous countries, while others might be more regionally focused. The ability to seamlessly transfer funds internationally hinges on a payment system’s network of partnerships with banks and financial institutions in different regions. A system with extensive international partnerships will naturally offer a smoother, more accessible experience for cross-border transactions. Conversely, a system with limited global reach may restrict users to specific countries or regions, potentially leading to frustrating limitations for businesses or individuals operating on a global scale.

Currency Conversion Rates and Fees, Online Payment Systems Comparison

Currency conversion is a key aspect of international transactions. Each payment system utilizes its own methods for determining exchange rates, and these rates can fluctuate based on various market factors. Crucially, most systems add fees to these conversions, often expressed as a percentage of the transaction amount or a flat fee. These fees can significantly impact the final cost of an international payment. For example, one system might offer a competitive exchange rate but charge a hefty percentage fee, while another might offer a less favorable rate but a lower fee. Consumers should carefully compare the total cost of the transaction, factoring in both the exchange rate and the associated fees, to determine the most cost-effective option. Ignoring the fine print here can lead to some seriously unpleasant surprises.

Limitations and Restrictions on International Transactions

Not all online payment systems are created equal when it comes to international transactions. Some systems might impose restrictions on the types of transactions allowed, the currencies supported, or the countries to which funds can be sent. These limitations can stem from regulatory compliance, risk management strategies, or simply the system’s own infrastructure. For instance, certain systems may restrict transactions to specific countries due to sanctions or anti-money laundering regulations. Others may limit the amount of money that can be transferred internationally in a given period. Understanding these limitations is crucial for anyone planning to make international payments. Failure to do so could lead to rejected transactions and significant delays.

Customer Support and Dispute Resolution

Navigating the sometimes-murky waters of online payments requires a reliable life raft – namely, robust customer support and a clear dispute resolution process. After all, nobody wants to find themselves adrift in a sea of unanswered emails and unresolved charges. Choosing a payment system with excellent support can be the difference between a smooth transaction and a frustrating ordeal.

The availability and quality of customer support vary wildly across different online payment systems. Factors like response time, accessibility (24/7 availability versus limited hours), and the range of contact methods (phone, email, live chat) all play a crucial role in determining a system’s overall user-friendliness. Similarly, the efficiency and fairness of dispute resolution mechanisms are critical for protecting both buyers and sellers from fraudulent activities or unintentional errors.

Customer Support Service Comparisons

A comparison of three major online payment systems reveals significant differences in their customer support offerings. System A boasts a 24/7 live chat function, alongside email and phone support, promising a response within one hour for urgent queries. System B offers email and phone support, but their response times are significantly slower, often exceeding 24 hours. System C, surprisingly, relies primarily on an extensive FAQ section and email support, with limited phone availability, making it less appealing to users needing immediate assistance. The differences highlight the importance of researching a system’s support capabilities before committing.

Dispute Resolution Procedures

The process for resolving disputes, such as chargebacks, varies depending on the payment system and the specific circumstances. Generally, it involves submitting a detailed dispute form, providing supporting documentation (e.g., purchase receipts, communication records), and waiting for the payment system to investigate. System A, for instance, utilizes a streamlined online portal for dispute resolution, providing users with regular updates on the progress of their case. System B, however, requires users to submit paperwork via mail, leading to longer processing times and a less transparent process. System C’s process is often criticized for its lack of clarity and infrequent updates to users.

Examples of Effective and Ineffective Customer Support

An example of effective customer support involves System A’s quick resolution of a fraudulent transaction. A user reported unauthorized charges, and within an hour, a support agent initiated a chargeback, providing regular updates until the issue was fully resolved and the funds were returned. Conversely, System B’s slow response to a billing error resulted in significant inconvenience for a user, as the error remained unresolved for over a week, delaying crucial payments. This illustrates the stark contrast between efficient and inefficient support systems and their impact on user experience.

Future Trends in Online Payment Systems

The world of online payments is a thrilling rollercoaster, constantly evolving at breakneck speed. Forget the slow, steady chug of a steam train; we’re talking warp speed, fueled by innovation and a healthy dose of caffeine (or maybe that’s just me). Emerging technologies are shaking things up, promising a future of payments that’s faster, safer, and frankly, a lot more interesting than swiping a plastic card.

Emerging technologies like blockchain, cryptocurrency, and biometrics are poised to revolutionize how we handle online transactions. These aren’t just incremental improvements; they represent a fundamental shift in the way we think about security, speed, and accessibility in the digital payment landscape. The implications are vast, potentially reshaping the entire financial ecosystem as we know it.

Blockchain and Cryptocurrency’s Impact on Online Payments

Blockchain technology, the backbone of cryptocurrencies like Bitcoin, offers a decentralized and transparent system for processing transactions. Imagine a global ledger, accessible to everyone, recording every payment securely and immutably. This eliminates the need for intermediaries like banks, potentially reducing fees and speeding up transaction times. While cryptocurrency adoption is still relatively nascent, its potential to disrupt traditional payment systems is undeniable. For example, the rise of stablecoins, cryptocurrencies pegged to the value of fiat currencies, is mitigating the volatility often associated with cryptocurrencies, making them a more attractive option for everyday transactions. Furthermore, the development of faster and more energy-efficient blockchain networks is addressing some of the initial concerns around scalability and environmental impact. This makes them a viable alternative for a wider range of online transactions.

Biometric Authentication and Enhanced Security

Forget passwords – the future of online security might lie in your fingerprints, your face, or even your unique heartbeat. Biometric authentication offers a more secure and convenient way to verify identity, reducing the risk of fraud and simplifying the checkout process. Imagine a world where logging into your online banking account is as simple as a quick facial scan, or making a payment is confirmed with a fingerprint. This not only enhances security but also improves the user experience, making online payments more seamless and user-friendly. Companies like Apple Pay and Google Pay already leverage biometric authentication, showcasing its practical applications and growing popularity. The increased adoption of biometrics will likely lead to a decrease in password-related security breaches and fraud attempts.

Innovative Payment Systems Under Development

The payment landscape is a vibrant hub of innovation, with numerous cutting-edge systems currently in development. Two stand out for their potential to transform online payments.

Real-Time Gross Settlement (RTGS) Systems

RTGS systems allow for the immediate transfer of funds between banks, eliminating the delays associated with traditional payment methods. This near-instantaneous settlement is particularly crucial for high-value transactions, ensuring that payments are processed quickly and efficiently. Many countries are already implementing or upgrading their RTGS systems to support the growing volume of digital transactions. The speed and efficiency of RTGS systems are critical for facilitating cross-border payments and streamlining international trade.

Decentralized Finance (DeFi) Platforms

Decentralized finance (DeFi) platforms are leveraging blockchain technology to create alternative financial services, including lending, borrowing, and payment processing. These platforms aim to offer greater transparency, accessibility, and control to users, cutting out intermediaries and reducing reliance on traditional financial institutions. DeFi platforms are still relatively new, but their potential to reshape the financial landscape is significant. The ability to access financial services without needing a bank account or traditional credit system opens up opportunities for millions of unbanked individuals worldwide. However, regulatory challenges and potential risks associated with DeFi platforms need careful consideration as they continue to evolve.

Last Recap

Ultimately, choosing the right online payment system is a crucial decision for both businesses and individuals. There’s no one-size-fits-all solution; the ideal system depends heavily on your specific needs and priorities. By carefully considering factors such as security, fees, user experience, and international capabilities, you can confidently select a payment system that will streamline your transactions and minimize risks. Remember, the right choice can make all the difference between a smooth, profitable online experience and a frustrating, costly headache. So choose wisely!

General Inquiries

What is the difference between a payment gateway and a payment processor?

A payment gateway is the technology that facilitates the transfer of payment information between a merchant’s website and the payment processor. The processor then handles the actual transaction with the card networks or banks.

Are there any legal considerations when choosing an online payment system?

Yes, compliance with regulations like PCI DSS (Payment Card Industry Data Security Standard) is crucial for merchants handling credit card information. Additionally, laws concerning data privacy and consumer protection vary by region and must be considered.

How can I protect myself from online payment fraud?

Use strong passwords, be wary of phishing scams, only shop on secure websites (look for “https”), and monitor your bank and credit card statements regularly for unauthorized activity. Enable two-factor authentication wherever possible.