Pajak, the Indonesian word for tax, is more than just a financial obligation; it’s a captivating saga of economic policy, bureaucratic wrangling, and the occasional hilarious attempt at tax evasion. This exploration delves into the intricacies of Indonesia’s tax system, from its historical roots to its modern-day challenges, offering a blend of insightful analysis and perhaps a chuckle or two along the way. We’ll unravel the mysteries of income tax, VAT, and property tax, comparing Indonesian rates to those of its Southeast Asian neighbors – a comparative analysis that’s sure to spark some interesting observations.

We’ll navigate the sometimes-treacherous waters of tax compliance, providing a step-by-step guide to filing your annual return (because nobody wants a visit from the DJP, the Indonesian tax authority, unless it’s for a tax refund party). We’ll also uncover the secrets of tax incentives, explore the impact of Pajak on the Indonesian economy, and investigate the creative (and often unsuccessful) methods employed in tax evasion. Prepare for a journey that’s both informative and, dare we say, entertaining.

Understanding “Pajak” (Tax) in Indonesia

Navigating the Indonesian tax system can feel like traversing a dense jungle, but fear not, intrepid taxpayer! This guide will illuminate the path, offering a surprisingly entertaining journey through the history and intricacies of Indonesian taxation. Prepare for a surprisingly insightful, and hopefully mildly amusing, exploration.

A Brief History of Indonesian Taxation

The Indonesian tax system, like the country itself, boasts a rich and complex history. Early forms of taxation existed long before Indonesian independence, often tied to agricultural production and trade under various colonial regimes. The modern system, however, began to take shape after independence in 1945, evolving through numerous reforms to address economic changes and societal needs. Early attempts at centralized tax collection faced significant challenges, including a vast archipelago and diverse economic structures. Over time, the system has become increasingly sophisticated, although challenges remain, particularly in ensuring compliance and addressing tax evasion. This evolution reflects the ongoing struggle to balance economic growth with equitable distribution of resources.

Types of Taxes in Indonesia

Indonesia levies a variety of taxes, each designed to tap into different aspects of the economy. These taxes are generally categorized as direct and indirect taxes. Direct taxes, such as income tax, directly target individuals and businesses, while indirect taxes, such as VAT, are levied on goods and services. Let’s delve into some key examples.

Income Tax in Indonesia (Pajak Penghasilan – PPh)

Income tax in Indonesia, or PPh, is a progressive tax, meaning higher earners pay a larger percentage of their income in taxes. The rates vary depending on income brackets and the type of income (e.g., salary, business income, capital gains). The Indonesian government regularly updates these rates, so consulting the official tax authority website is crucial for the most up-to-date information. This tax is a cornerstone of the Indonesian government’s revenue stream, funding crucial public services and infrastructure projects.

Value Added Tax (Pajak Pertambahan Nilai – PPN)

Value Added Tax (VAT), or PPN in Indonesia, is a consumption tax levied on the supply of goods and services. It’s a broadly applied tax, affecting most transactions within the economy. The standard rate is currently 11%, although certain goods and services may be exempt or subject to different rates. The PPN system aims to capture a portion of consumer spending, contributing significantly to government revenue. Understanding how PPN is applied to various purchases is vital for both businesses and consumers.

Property Tax (Pajak Bumi dan Bangunan – PBB)

Property tax, or PBB, is levied on the ownership of land and buildings. The tax rate varies depending on the location, size, and value of the property. This tax contributes to local government revenue, funding local infrastructure and services. Property owners are required to pay this tax annually, with payment deadlines typically set by local authorities.

Comparison of Indonesian Tax Rates with Other Southeast Asian Countries

Comparing Indonesian tax rates with those of its Southeast Asian neighbors requires careful consideration of various factors, including the specific tax type, applicable exemptions, and the overall economic context. A simple numerical comparison can be misleading without a comprehensive understanding of these nuances. However, general observations can be made. For example, Indonesia’s corporate income tax rate is often compared to those of neighboring countries like Singapore, Malaysia, and Vietnam, revealing variations that reflect each nation’s unique economic policies and priorities. Similarly, VAT rates across the region vary, impacting consumer prices and overall competitiveness. Detailed comparisons require consulting reputable economic data sources and taking into account specific legislative frameworks.

Indonesian Tax Rates: A Summary Table

| Tax Type | Tax Rate | Applicability | Calculation Method |

|---|---|---|---|

| Income Tax (PPh) | Progressive rates (vary by income bracket) | Individuals and businesses | Based on taxable income, with various deductions and allowances |

| Value Added Tax (PPN) | 11% (standard rate) | Most goods and services | Calculated on the value added at each stage of production and distribution |

| Property Tax (PBB) | Varies by location and property value | Land and building owners | Based on the assessed value of the property |

Tax Compliance in Indonesia

Navigating the Indonesian tax system can feel like a thrilling jungle adventure – exciting, potentially rewarding, but definitely requiring a map (and maybe a machete). This section sheds light on the procedures, penalties, and the ever-vigilant eye of the Directorate General of Taxes (DJP), ensuring your Indonesian tax journey is less “Indiana Jones and the Temple of Doom” and more “Indiana Jones and the Last Crusade” (successful treasure retrieval!).

Understanding tax compliance in Indonesia is crucial for both individuals and businesses. Failure to comply can lead to some rather unpleasant consequences, so let’s dive into the details, shall we?

Procedures for Filing Taxes in Indonesia

Filing taxes in Indonesia, for both individuals and businesses, involves a multi-step process that requires careful attention to detail and, let’s be honest, a good dose of patience. The specific forms and procedures vary depending on your tax status (individual or business) and the type of tax being filed (income tax, VAT, etc.). However, the overarching principle remains: accuracy and timeliness are key. Failing to meet deadlines or submitting inaccurate information can result in penalties that will make you wish you’d spent a little more time with your tax forms.

Penalties for Non-Compliance with Tax Regulations

Let’s talk penalties. Think of Indonesian tax regulations as a very serious game of Jenga. Each missed deadline, each inaccurate report, is like pulling out a block. Eventually, the whole tower (your financial stability) comes crashing down. Penalties can range from hefty fines (which can be substantial) to legal action, including potential imprisonment in severe cases of tax evasion. The DJP isn’t messing around. They’re like the ultimate tax Jenga masters, always watching for wobbly towers.

The Role of the Directorate General of Taxes (DJP)

The DJP, Indonesia’s tax authority, plays a vital role in enforcing tax laws. They are the guardians of the Indonesian tax system, ensuring fairness and compliance. They utilize a variety of methods to enforce tax laws, including audits, investigations, and legal action. The DJP is constantly working to improve its systems and processes to make tax compliance easier for taxpayers while simultaneously cracking down on tax evasion. Think of them as the highly trained tax commandos, ready to spring into action should any tax evasion occur.

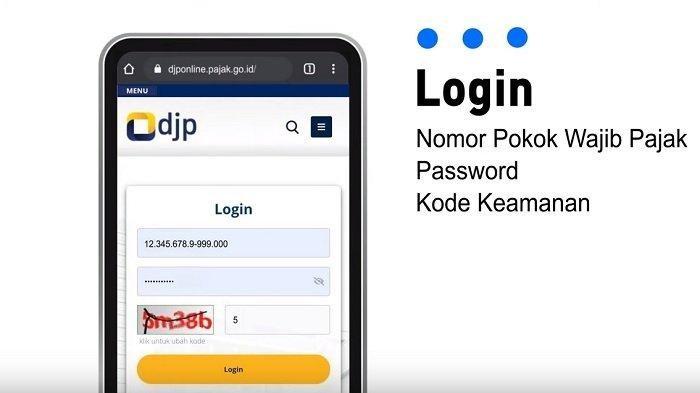

Filing an Annual Tax Return in Indonesia: A Step-by-Step Guide

Filing your annual tax return in Indonesia can seem daunting, but breaking it down into manageable steps makes the process far less intimidating. Remember, accuracy is paramount. One misplaced decimal point can lead to a world of tax-related headaches.

- Gather Necessary Documents: This includes your KTP (Indonesian ID card), NPWP (Taxpayer Identification Number), income statements, and any relevant supporting documents. Think of this as gathering your tax-fighting arsenal.

- Determine Your Taxable Income: Accurately calculate your taxable income based on Indonesian tax laws. This often involves deducting allowable expenses and allowances.

- Choose the Correct Tax Form: Select the appropriate tax form based on your income and tax status. Choosing the wrong form is like trying to fit a square peg into a round hole – it just won’t work.

- Fill Out the Tax Form Accurately: Double-check all entries for accuracy. A single error can lead to delays or penalties. Take your time and be meticulous.

- Submit Your Tax Return: Submit your completed tax return through the official DJP online portal or designated tax offices before the deadline. Missing the deadline is like missing your flight to paradise – you’ll be left behind.

- Retain Copies of Your Documents: Keep copies of all submitted documents for your records. This is crucial for future reference in case of audits or queries.

Tax Incentives and Benefits

Navigating the Indonesian tax system can feel like traversing a dense jungle, but fear not, intrepid business adventurer! Hidden within the lush foliage are valuable tax incentives, ripe for the picking. These incentives, offered by the Indonesian government, are designed to stimulate economic growth and attract foreign investment. Let’s explore the delicious fruits of this fiscal forest.

Understanding these incentives is crucial for businesses looking to establish or expand their operations in Indonesia. Properly leveraging these benefits can significantly reduce tax burdens, freeing up capital for reinvestment and expansion, ultimately leading to greater profitability and a more robust bottom line – who doesn’t love a healthy bottom line?

Tax Incentives for Specific Industries

Several industries in Indonesia receive preferential tax treatment to encourage development in strategic sectors. This targeted approach aims to bolster particular areas of the Indonesian economy, from renewable energy to advanced technology. The eligibility criteria often involve meeting specific investment thresholds, employing a certain number of local workers, or adhering to environmental regulations. For example, companies investing in renewable energy projects might qualify for a significant reduction in corporate income tax. This can dramatically reduce the initial financial outlay required for these ventures, making them more attractive to investors and accelerating the adoption of sustainable practices.

- Tax holidays: Complete or partial exemption from corporate income tax for a specified period, typically granted to companies investing in designated regions or industries.

- Investment allowances: Deductions from taxable income based on the amount invested in new equipment or facilities. This incentive encourages capital expenditure and modernization.

- Accelerated depreciation: Allows businesses to deduct a larger portion of the cost of assets in the early years of their useful life, reducing taxable income in the short term.

Tax Incentives for Small and Medium Enterprises (SMEs)

Indonesia recognizes the vital role SMEs play in the national economy and offers various tax incentives to support their growth. These incentives are designed to make it easier for smaller businesses to navigate the tax system and contribute to the overall economic landscape. Eligibility often hinges on meeting specific criteria regarding turnover, number of employees, and business type. These provisions are aimed at fostering entrepreneurship and creating a more inclusive economic environment.

- Simplified tax reporting: SMEs may qualify for streamlined tax reporting procedures, reducing administrative burdens and freeing up time for core business activities.

- Reduced tax rates: Lower corporate income tax rates are often applied to SMEs, easing their tax obligations and boosting their competitiveness.

- Access to tax counseling: Government programs often provide SMEs with access to free or subsidized tax counseling services, helping them understand their obligations and take advantage of available incentives.

Impact on Business Investment and Growth

The availability of tax incentives significantly influences business investment decisions. Reduced tax burdens translate directly into increased profitability, allowing businesses to reinvest earnings, expand operations, and create more jobs. This, in turn, stimulates economic growth, boosting both national GDP and improving the overall standard of living. Consider a hypothetical scenario: A company considering investing in a new manufacturing plant in Indonesia. The availability of investment allowances and tax holidays could significantly lower the project’s overall cost, making it financially viable and leading to the creation of hundreds of new jobs. This is a win-win situation – a thriving business and a stronger economy.

Impact of “Pajak” on the Indonesian Economy

The Indonesian economy, a vibrant tapestry woven with threads of agriculture, manufacturing, and services, relies heavily on the seemingly mundane yet critically important “Pajak” – taxes. Think of taxes as the invisible hand that guides economic growth, funding vital public services while simultaneously shaping economic behavior. Understanding its impact requires looking beyond the simple act of paying; it’s about the ripple effect across the entire economic ecosystem.

Tax revenue forms the lifeblood of the Indonesian government’s budget, funding essential public services like infrastructure development, healthcare, education, and social welfare programs. Without sufficient tax revenue, these crucial services would suffer, potentially hindering economic progress and impacting the well-being of Indonesian citizens. It’s a delicate balancing act – too little tax revenue, and vital services are starved; too much, and economic activity might be stifled.

Contribution of Tax Revenue to the Government’s Budget

The Indonesian government’s budget significantly relies on tax revenue, primarily from income tax, value-added tax (VAT), and excise duties. For instance, in recent years, VAT has consistently contributed a substantial portion, often exceeding 30%, of total tax revenue. This revenue stream directly fuels government spending on various projects and programs that aim to improve the quality of life and boost economic productivity. A significant decrease in tax revenue would directly impact the government’s ability to fund these essential initiatives, leading to potential cutbacks in public services and potentially hindering economic growth. Imagine a scenario where road maintenance projects are drastically reduced due to a shortfall in tax revenue; the resulting damage to infrastructure would negatively impact trade and economic efficiency.

Influence of Tax Policies on Economic Growth and Development

Tax policies act as powerful levers influencing economic growth and development. Well-designed tax policies can incentivize investment, promote entrepreneurship, and stimulate economic activity. For example, tax breaks for businesses investing in renewable energy could accelerate the transition to a more sustainable economy, while tax incentives for research and development can foster innovation. Conversely, poorly designed tax policies can discourage investment, stifle innovation, and lead to economic stagnation. High corporate tax rates, for instance, might deter foreign investment, limiting job creation and economic expansion. The government’s strategic use of tax incentives to attract foreign direct investment (FDI) showcases the direct impact of well-crafted tax policies on attracting capital and boosting economic activity. A successful example could be the tax incentives offered in specific economic zones to draw investments in manufacturing or technology.

Challenges and Opportunities in Tax Administration

The Indonesian tax administration faces ongoing challenges, including tax evasion and avoidance, limited tax capacity in certain regions, and complexities in the tax system itself. These challenges can lead to lower-than-expected tax revenue and hinder economic growth. However, opportunities exist to improve tax administration through digitalization, strengthening tax enforcement, and simplifying tax procedures. The recent advancements in digital tax systems, for example, are improving efficiency and transparency, making it easier for taxpayers to comply and for the government to collect revenue. Imagine a streamlined online tax filing system, reducing the burden on taxpayers and enabling quicker processing of tax returns. This is a significant step towards improving tax compliance and maximizing revenue collection.

Hypothetical Impact of Significant Tax Reform

Let’s imagine a hypothetical scenario: a significant tax reform that simplifies the tax system, reduces corporate tax rates, and introduces a broader-based consumption tax. Such a reform could potentially attract more foreign investment, boost business activity, and increase overall tax revenue in the long run. However, it could also lead to short-term revenue losses and potentially increased inequality if not carefully designed and implemented with adequate social safety nets. The success of such a reform would hinge on careful planning, effective communication, and a robust monitoring system to ensure its intended outcomes are achieved and potential negative impacts are mitigated. Similar tax reforms in other countries, such as the recent corporate tax cuts in several OECD nations, could serve as case studies to inform the design and implementation of such a reform in Indonesia. The impact would need to be carefully analyzed considering Indonesia’s unique economic context and social structure.

Tax Evasion and Avoidance in Indonesia

The Indonesian tax system, while striving for efficiency, sometimes finds itself playing a game of cat and mouse with taxpayers seeking to minimize their contributions. This isn’t always illegal, but the line between clever tax planning and outright evasion can be blurry, much like the distinction between a perfectly legal tax loophole and a cleverly disguised black hole swallowing your tax obligations. Let’s delve into the fascinating (and sometimes frustrating) world of tax evasion and avoidance in Indonesia.

Common Methods of Tax Evasion and Avoidance in Indonesia

Tax evasion and avoidance in Indonesia manifest in various forms, often reflecting the unique characteristics of the Indonesian economy and its informal sector. These methods range from the subtly deceptive to the brazenly illegal. The sheer creativity displayed by some taxpayers is, frankly, impressive – if only it were channeled into more productive ventures.

- Underreporting Income: This classic method involves declaring less income than actually earned, often through manipulating financial records or operating entirely in the cash economy. Think of it as a financial shell game, where the real money is hidden under a pile of cleverly disguised receipts.

- Inflating Expenses: Claiming business expenses that are either non-existent or significantly inflated is another common tactic. Imagine submitting receipts for a luxury yacht as a “necessary business expense” – while technically improbable, the principle remains the same.

- Misclassifying Income: This involves labeling income as something else entirely to lower the tax burden. Perhaps a high-earning individual might classify their income as capital gains instead of employment income, benefiting from lower tax rates (if they get away with it!).

- Failing to Register Businesses: Operating a business without proper registration allows individuals to avoid paying taxes altogether. It’s a bit like playing a game of hide-and-seek with the taxman, except the prize is a hefty fine (and possibly jail time).

Strategies Used by the DJP to Combat Tax Evasion, Pajak

The Directorate General of Taxes (DJP) employs a multifaceted approach to combat tax evasion, utilizing a blend of carrots and sticks. They are, essentially, tax ninjas, silently observing and strategically striking when necessary.

- Increased Tax Audits: The DJP conducts regular audits to verify the accuracy of tax returns. Think of it as a surprise inspection, ensuring that taxpayers are playing by the rules (or at least attempting to).

- Data Matching and Information Sharing: The DJP cross-references tax data with information from other sources, such as banking records and business registries. This allows them to identify discrepancies and inconsistencies in taxpayer declarations.

- Tax Amnesty Programs: Periodically, the government offers tax amnesty programs, encouraging taxpayers to voluntarily declare their previously undeclared assets. It’s a chance to come clean and avoid the more severe penalties of evasion.

- Enhanced Technology and Data Analytics: The DJP is increasingly leveraging advanced technologies and data analytics to detect patterns of tax evasion. This is akin to having a super-powered magnifying glass, capable of spotting even the smallest inconsistencies.

Effectiveness of Anti-Tax Evasion Measures

The effectiveness of anti-tax evasion measures in Indonesia is a complex issue, with ongoing debates and improvements constantly being implemented. While significant progress has been made, challenges remain, particularly in tackling the informal economy. The DJP’s efforts have resulted in increased tax revenue and a higher level of compliance, but complete eradication of tax evasion remains an ongoing battle.

Visual Representation of a Tax Evasion Scheme

Imagine a flowchart. The first box is labeled “Business Income” with a large sum of money flowing into it. An arrow leads to a second box, “Declared Income,” with a significantly smaller sum of money. Another arrow branches off from “Business Income” leading to a third box, “Undeclared Income,” containing the remaining, larger sum. From “Undeclared Income,” arrows branch off to various activities representing how the money is hidden or used – perhaps “Cash Transactions,” “Offshore Accounts,” or “Investment in Unregistered Assets.” Finally, a thin, almost invisible arrow leads from “Declared Income” to “Government Revenue,” illustrating the minimal tax contribution due to the evasion. This visual clearly demonstrates the substantial loss of government revenue due to the concealment of income.

The Future of “Pajak” in Indonesia

Indonesia’s tax system, much like a mischievous but lovable monkey, is constantly swinging between tradition and modernization. While the current system has its quirks (let’s just say filing taxes isn’t exactly a national pastime), significant reforms are underway, promising a more efficient and equitable future for “Pajak.” This journey towards a more streamlined tax system involves navigating complex challenges and embracing innovative solutions.

The Indonesian government is actively pursuing a multifaceted approach to tax reform. This involves not only updating legislation but also focusing on improving taxpayer services and bolstering enforcement capabilities. The aim is to create a system that is both simpler for taxpayers to navigate and more effective in collecting revenue.

Ongoing Reforms and Modernization Efforts

The Indonesian tax system is undergoing a significant transformation, driven by a desire for greater efficiency and transparency. Key initiatives include simplifying tax regulations, enhancing digitalization, and improving taxpayer services. For example, the implementation of e-filing systems has significantly reduced paperwork and processing times, making tax compliance more convenient for businesses and individuals. Furthermore, the government is investing heavily in training and education programs to enhance the skills and knowledge of tax officials, leading to more effective enforcement and a reduction in tax evasion. These initiatives are not merely cosmetic changes; they represent a fundamental shift towards a more modern and efficient tax administration. The long-term goal is to create a tax system that is both robust and user-friendly, fostering greater compliance and contributing to sustainable economic growth.

Predictions About Future Trends in Tax Policy and Administration

Predicting the future of tax policy is akin to predicting the weather in Jakarta – unpredictable, but with some observable patterns. We can expect a continued focus on digitalization, with further advancements in online tax filing and payment systems. The government might also explore broader implementation of value-added tax (VAT) to broaden the tax base and increase revenue collection. Furthermore, Indonesia might adopt more sophisticated tax policy instruments to address specific economic challenges, such as carbon taxes to encourage environmentally friendly practices. This might involve shifting towards a more progressive tax system, adjusting tax rates to ensure a fairer distribution of the tax burden. While these predictions are based on current trends, the specific policies will depend on evolving economic conditions and government priorities. The success of these predictions will hinge on the government’s ability to adapt to changing circumstances and effectively implement the necessary reforms. The recent introduction of more user-friendly tax portals and simplified tax forms offers a glimpse into this future.

Impact of Technological Advancements on Tax Collection

Technology is revolutionizing tax collection globally, and Indonesia is no exception. The widespread adoption of digital platforms for tax filing and payment has already significantly improved efficiency and transparency. Furthermore, data analytics and artificial intelligence (AI) are being increasingly utilized to identify tax evasion and improve risk assessment. Imagine a system that can automatically flag suspicious transactions or predict potential tax fraud – this is the potential of AI in tax administration. The use of blockchain technology could also enhance the security and transparency of tax transactions, making the system more resistant to fraud and manipulation. The future of tax collection in Indonesia is undoubtedly intertwined with technological advancements, promising a more efficient, transparent, and equitable tax system. The success of this digital transformation will depend on the government’s investment in infrastructure, training, and cybersecurity. One can envision a future where tax compliance is seamless and efficient, driven by technological innovation.

Comparison with a Developed Country’s Tax System

Comparing Indonesia’s tax system to that of a developed country like the United Kingdom reveals both similarities and stark differences. Both countries utilize a combination of direct and indirect taxes, but the UK’s system is generally considered more sophisticated and efficient. The UK boasts a more robust tax infrastructure, advanced digital systems, and a highly skilled tax administration workforce. This translates into higher tax compliance rates and greater revenue collection. Areas where Indonesia can learn from the UK include strengthening its tax administration capacity, improving data management, and enhancing taxpayer education. While Indonesia has made strides in digitalization, further investment in technology and infrastructure is crucial to close the gap. The UK’s emphasis on taxpayer services and proactive engagement also provides valuable lessons for Indonesia. Learning from the best practices of developed nations can accelerate Indonesia’s journey towards a world-class tax system. The goal is not simply to emulate, but to adapt and innovate, creating a system that is tailored to Indonesia’s unique economic and social context.

Closing Notes

So, there you have it – a whirlwind tour of Indonesia’s tax system, from its historical foundations to its digitally-driven future. While the complexities of Pajak might sometimes seem daunting, understanding its intricacies is crucial for navigating the Indonesian economic landscape. Whether you’re a seasoned business executive, a curious student, or simply someone who enjoys a good tax-related anecdote, we hope this exploration has shed light on the fascinating world of Indonesian taxation. Remember, while the taxman may always be watching, a little knowledge can go a long way. And who knows, maybe you’ll even find some humor amidst the numbers.

Top FAQs

What happens if I don’t file my taxes in Indonesia?

Prepare for penalties, interest charges, and potentially even legal action. It’s generally not a good idea to play hide-and-seek with the DJP.

Are there tax deductions for charitable donations in Indonesia?

Yes, but the specifics depend on the type of charity and the amount donated. Consult the DJP guidelines for precise details.

Can expats in Indonesia claim tax benefits?

Possibly, depending on their tax residency status and the applicable tax treaties. Professional advice is recommended.

How often are tax laws in Indonesia updated?

Regularly! Keep an eye on the DJP website for the latest changes; otherwise, you might find yourself unexpectedly out of compliance.