Pajak Penghasilan Pasal 21: Ah, yes, the bane of many a salaryman’s existence (and the delight of the Indonesian taxman!). This seemingly dry topic of Indonesian income tax actually holds a surprising amount of comedic potential, think of it as a thrilling adventure through a labyrinth of tax brackets and deductions, a journey where the ultimate prize is… not going to jail for tax evasion. Let’s dive into the wonderfully complex world of Pasal 21, where laughter and tax forms collide!

This guide will dissect the intricacies of Pasal 21, explaining its legal basis, calculation methods, reporting procedures, and the myriad of deductions that can either make or break your financial year. We’ll explore the impact on both employees and employers, delve into recent amendments, and even present some illustrative scenarios – because let’s face it, tax scenarios can be surprisingly dramatic. Prepare for a wild ride!

Definition and Scope of Pajak Penghasilan Pasal 21

Pajak Penghasilan Pasal 21 (PPh Pasal 21), or Article 21 Income Tax, is Indonesia’s way of ensuring that income earned by employees and certain other individuals gets its fair share of contributing to the nation’s coffers. Think of it as a preemptive strike against tax evasion – the government gets a cut *before* the money even hits your bank account! It’s a system designed with efficiency (for the government, mostly) and a touch of dramatic flair (for the accountants).

Legal Basis of Pajak Penghasilan Pasal 21

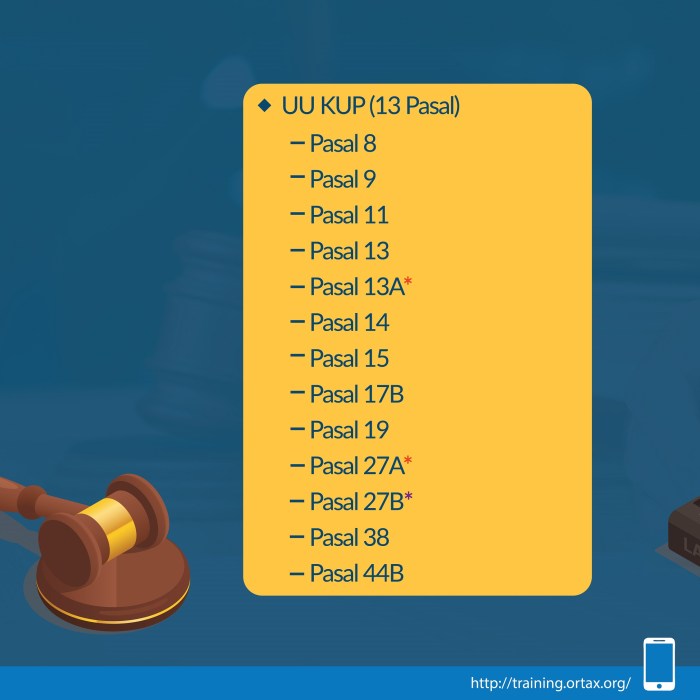

The legal bedrock of PPh Pasal 21 is primarily Law Number 7 of 2021 concerning Harmonization of Tax Regulations. This law, along with its implementing regulations, meticulously Artikels the rules, rates, and procedures for withholding this particular tax. Let’s just say, there’s a lot of fine print. But don’t worry, we’ll keep it simple (relatively). Think of it as a legal thriller, but instead of a detective, you have a tax officer, and instead of a criminal, you have… well, you. Just kidding (mostly).

Types of Income Subject to Pasal 21 Withholding Tax

PPh Pasal 21 targets income from employment, including salaries, wages, bonuses, and other forms of compensation received by employees. This also extends to certain other income sources, such as fees paid to directors and commissioners of companies, as well as compensation paid to non-employees for specific services. Essentially, if you’re receiving money for work done, there’s a good chance PPh Pasal 21 is involved. It’s a tax that’s surprisingly versatile, almost like a Swiss Army knife, but instead of tools, you have tax brackets.

Individuals and Entities Liable for Pasal 21

The responsibility for withholding and remitting PPh Pasal 21 usually falls on the employer or the payer of the income. So, if you’re an employer, congratulations, you’re now a tax collector! (Don’t worry, you’ll get a thank-you note… eventually). Individuals who receive income subject to PPh Pasal 21 are the ones who ultimately bear the tax burden. This includes employees, directors, commissioners, and other individuals receiving compensation for services rendered. Think of it as a well-orchestrated tax ballet, with employers and employees gracefully pirouetting around the tax code.

Comparison of Pasal 21 with Other Income Tax Articles

This table compares PPh Pasal 21 with other relevant articles. Remember, tax laws are complex and can change, so always consult the latest official regulations. (We’re not responsible if your tax return gets audited!)

| Tax Article | Tax Subject | Withholding Agent | Taxpayer |

|---|---|---|---|

| Pasal 21 | Employment Income, Director/Commissioner Fees | Employer/Payer | Employee/Recipient |

| Pasal 23 | Income from royalties, interest, rent | Payer of income | Recipient of income |

| Pasal 25 | Final income tax for certain businesses | Business owner | Business owner |

Calculation and Withholding Procedures: Pajak Penghasilan Pasal 21

Calculating and withholding Pajak Penghasilan Pasal 21 might sound like navigating a tax jungle, but fear not! With a little understanding, it’s surprisingly straightforward (or at least, less terrifying than it initially appears). This section will demystify the process, guiding you through the calculations and the employer’s crucial role in withholding this tax.

Tax Brackets and Rates

Indonesia’s progressive tax system means the tax rate depends on the employee’s taxable income. Higher earners pay a higher percentage. Think of it as a tiered system rewarding frugality… or at least, penalizing extravagance proportionately. The tax brackets and rates are adjusted periodically, so always refer to the most up-to-date official regulations from the Indonesian tax authorities (DJP). For illustrative purposes, let’s assume the following simplified brackets for a given year:

| Taxable Income (IDR) | Tax Rate (%) |

|---|---|

| 0 – 50,000,000 | 5 |

| 50,000,001 – 250,000,000 | 15 |

| 250,000,001 – 500,000,000 | 25 |

| > 500,000,000 | 30 |

Note: This is a simplified example. Actual tax brackets and rates can be more complex and should be obtained from official sources.

Calculating Pasal 21 Tax

The calculation involves several steps. First, determine the employee’s gross income. Then, subtract any allowable deductions to arrive at the taxable income. Finally, apply the appropriate tax rate based on the tax brackets.

Let’s illustrate with examples:

Example 1: Low Income

Employee A earns a monthly gross income of IDR 40,000,000. Assuming no deductions, their taxable income is also IDR 40,000,000. Using our simplified brackets, the tax rate is 5%. Therefore, their monthly Pasal 21 tax is:

IDR 40,000,000 x 5% = IDR 2,000,000

Example 2: Higher Income

Employee B earns a monthly gross income of IDR 300,000,000. Again, assuming no deductions, their taxable income is IDR 300,000,000. This falls into the 25% tax bracket. However, remember the progressive nature. The calculation is more nuanced:

(IDR 50,000,000 x 5%) + (IDR 200,000,000 x 15%) + (IDR 50,000,000 x 25%) = IDR 42,500,000

Withholding Procedures for Employers

Employers are legally obligated to withhold Pasal 21 tax from their employees’ salaries. This involves a series of steps:

- Calculate Taxable Income: Determine each employee’s gross income and subtract any allowable deductions (as per regulations).

- Determine Tax Rate: Use the applicable tax brackets and rates to calculate the tax amount.

- Withhold Tax: Deduct the calculated Pasal 21 tax from the employee’s salary.

- Remit to DJP: Employers must remit the withheld taxes to the DJP by the specified deadlines. Failure to do so can result in penalties.

- Provide Tax Statements: Provide employees with the necessary tax statements for their annual tax returns.

Accurate and timely withholding is crucial for both the employer and employee to avoid tax-related issues. Consider using payroll software to simplify the process and ensure compliance. It’s also wise to consult with a tax professional for any complex situations.

Tax Reporting and Compliance

Navigating the world of Indonesian Pasal 21 tax reporting might seem like trying to assemble IKEA furniture without instructions – challenging, potentially frustrating, but ultimately achievable with the right guidance. This section provides a clear path through the reporting jungle, ensuring your compliance is as smooth as a freshly-polished mahogany desk (or at least, less stressful).

Reporting Pasal 21 tax payments to the Indonesian tax authorities, Direktorat Jenderal Pajak (DJP), is a crucial step in maintaining your business’s fiscal health and avoiding the wrath of the taxman. Failure to do so can lead to consequences far more unpleasant than a sudden audit. Let’s get this right.

Methods for Reporting Pasal 21 Tax Payments

The primary method for reporting Pasal 21 tax payments is through the online system provided by the DJP, known as e-Filing. This electronic system streamlines the process, eliminating the need for physical paperwork and allowing for quick and efficient submission. While some might still cling to the nostalgic charm of paper filing, e-Filing is the modern, efficient, and frankly, less headache-inducing method. Think of it as upgrading from a rotary phone to a smartphone – progress! The DJP also offers various support channels and tutorials to assist taxpayers in utilizing e-Filing effectively.

Required Documentation and Forms for Tax Reporting

Accurate and complete documentation is the bedrock of successful tax reporting. This typically includes the monthly tax return form (form varies based on the specific reporting period and the tax system), which summarizes all Pasal 21 withholdings during the reporting period. Supporting documentation, such as employee payroll records, contracts, and payment receipts, must be kept for audit purposes. These documents act as your defense in case of any discrepancies or inquiries. Remember, organized records are your best friend – think of them as your personal tax shield. Failing to maintain proper documentation is like going into battle without a weapon.

Compliance Checklist for Businesses

Preparing a checklist is a proactive step to ensure compliance. A comprehensive checklist should include:

- Accurate calculation of monthly Pasal 21 withholding tax.

- Timely submission of monthly tax returns through e-Filing.

- Maintaining up-to-date employee records and payroll data.

- Secure storage of all supporting documentation for at least five years (as per Indonesian tax regulations).

- Regular review of internal tax procedures to ensure accuracy and compliance.

This checklist, while not exhaustive, provides a framework for ensuring your business is on the right track. Proactive compliance is far more cost-effective than reactive problem-solving.

Penalties for Non-Compliance with Pasal 21 Regulations

Non-compliance with Pasal 21 regulations can result in a range of penalties, from hefty fines to legal action. These penalties are designed to deter non-compliance and ensure the smooth functioning of the tax system. The severity of the penalty often depends on the nature and extent of the non-compliance, ranging from late filing fees to interest charges and, in severe cases, potential legal repercussions. Remember, procrastination in tax matters is far more expensive than prompt compliance. Think of it as a very expensive game of hide-and-seek, one you don’t want to play.

Deductions and Allowances

Navigating the world of Pajak Penghasilan Pasal 21 deductions can feel like a tax-themed escape room – challenging, but with a potentially rewarding exit. Understanding what you can deduct is key to minimizing your tax burden and keeping more of your hard-earned Rupiah. Let’s unlock the secrets to these allowable reductions.

Allowable deductions under Pasal 21 are designed to provide some relief from the tax bite. Think of them as legitimate loopholes, perfectly legal ways to reduce your taxable income. These deductions aren’t arbitrary; they’re based on expenses directly related to your employment and recognized by Indonesian tax law. Improperly claiming deductions, however, can lead to penalties – so proceed with caution and proper documentation.

Allowable Deductions under Pasal 21

The Indonesian tax code allows for several deductions, each requiring specific supporting documentation. These deductions are not a free-for-all; they need to be substantiated. Think of it as presenting your case to a very serious, but fair, accountant.

Documentation Requirements for Deduction Claims

Proper documentation is paramount. Without the right paperwork, your deductions are just wishful thinking. This means keeping meticulous records of all expenses. Imagine your documentation as your shield against any tax-related scrutiny. Necessary documents vary depending on the type of deduction claimed, but generally include official receipts, invoices, and proof of payment. For larger deductions, additional supporting evidence might be required. The general rule of thumb is: if you can’t prove it, you can’t deduct it.

Comparison of Allowable Deductions

Different deductions have different requirements and impact your taxable income in various ways. Let’s examine some common examples. The key is understanding which deductions apply to your specific circumstances and how they interact with each other. It’s not a simple “one size fits all” situation.

Summary of Common Deductions and Their Impact

The following table summarizes common deductions and their effect on your tax liability. Remember, these are simplified examples, and the actual calculation can be more complex depending on individual circumstances and the latest tax regulations. Always consult with a tax professional for personalized advice.

| Deduction Type | Description | Documentation Required | Impact on Tax Calculation |

|---|---|---|---|

| Health Insurance Premiums | Premiums paid for health insurance for yourself and dependents. | Insurance policy and payment receipts. | Reduces taxable income, lowering the overall tax liability. |

| Life Insurance Premiums | Premiums paid for life insurance policies. | Insurance policy and payment receipts. | Reduces taxable income, lowering the overall tax liability. |

| Pension Fund Contributions | Contributions to a recognized pension fund. | Contribution statements from the pension fund. | Reduces taxable income, lowering the overall tax liability. |

| Other Allowable Deductions (e.g., Education, Housing) | Other deductions permitted under Indonesian tax law (Specific rules apply). | Relevant supporting documentation (varies greatly). | Reduces taxable income, lowering the overall tax liability (subject to specific limits and regulations). |

Impact on Employees and Employers

Pajak Penghasilan Pasal 21, or Article 21 Income Tax, might sound like a bureaucratic beast, but understanding its impact on both employees and employers is crucial for a financially healthy and legally compliant working environment. It’s a bit like a well-oiled (though sometimes slightly creaky) machine – once you understand the gears, it all makes sense. This section will delve into the practical effects of this tax on your hard-earned rupiah.

Impact of Pasal 21 on Employee Net Income

Pasal 21 directly affects an employee’s net income, the amount they actually receive in their bank account after all deductions. The tax is withheld monthly by the employer, meaning less money in your pocket each month. However, this is not entirely bad news; the withheld amount is a payment towards your annual income tax liability. Think of it as a structured savings plan for Uncle Sam (or, in this case, the Indonesian government). Proper planning can minimize the surprise at tax season. The amount withheld depends on the employee’s gross income and the applicable tax brackets. Higher income generally means a larger tax deduction.

Employer Responsibilities Regarding Pasal 21 Withholding

Employers are not just responsible for paying salaries; they’re also the tax collectors in this scenario. They have the legal obligation to accurately calculate and withhold Pasal 21 tax from their employees’ salaries. This involves keeping meticulous records of employee income, allowances, and deductions. Failing to comply with these responsibilities can lead to significant penalties, which is definitely not a fun way to spend company funds. It’s a bit like being a mini tax office within your own organization. Accurate and timely tax withholding is paramount for maintaining a smooth relationship with the tax authorities.

Comparison of Tax Burden Across Different Income Levels

The tax burden under Pasal 21 is progressive, meaning higher earners pay a larger percentage of their income in taxes. For instance, an employee earning 5 million rupiah per month will face a higher tax rate than someone earning 2 million rupiah. This progressive system aims for a fairer distribution of the tax burden. Let’s illustrate with a simple example: imagine two employees, Budi and Ani. Budi earns 10 million rupiah monthly, while Ani earns 5 million. Budi’s Pasal 21 deduction will be significantly higher than Ani’s, reflecting the progressive nature of the tax system.

Effect of Tax Changes on Employee Take-Home Pay

Changes in tax regulations directly impact an employee’s take-home pay. For example, an increase in tax rates will reduce the net income received, while a decrease will have the opposite effect. Consider this scenario: If the government decides to increase tax rates, Budi and Ani would both see a reduction in their net income, although the percentage reduction would be larger for Budi due to the progressive nature of the tax system. Conversely, a tax rate decrease would result in an increase in their net take-home pay. These changes, while potentially small in the short term, can accumulate to a noticeable difference over time. It’s always advisable to stay updated on any changes in tax regulations to better manage your finances.

Amendments and Updates to Pasal 21 Regulations

Navigating the ever-shifting sands of Indonesian tax law can feel like a thrilling treasure hunt – except the treasure is a smaller tax bill, and the traps are confusing regulations. Fortunately, while the rules can be complex, understanding the amendments to Pasal 21 regulations is crucial for both employers and employees to avoid any unwanted surprises (like a sudden audit from the taxman!). Let’s delve into the fascinating world of recent changes.

The Indonesian government periodically updates its tax regulations to reflect economic changes, simplify processes, or increase tax revenue. These amendments often involve adjustments to tax brackets, allowable deductions, and reporting procedures. While these changes can sometimes cause initial headaches, they ultimately aim to create a fairer and more efficient tax system. Think of it as a game of tax Jenga – removing one block might seem risky, but it often leads to a more stable (and hopefully, less taxing) structure.

Recent Changes to Pasal 21 Tax Brackets

The tax brackets for Pasal 21 are adjusted periodically, usually annually, based on inflation and economic growth. These adjustments influence the amount of tax withheld from an employee’s salary. For instance, let’s say in 2022, the tax bracket for a certain income range was 15%, but due to inflation and a government initiative to stimulate the economy, it was reduced to 12% in 2023. This would directly impact the amount of tax withheld from employees falling within that income bracket, resulting in a higher net salary. This change isn’t just about numbers; it’s about adjusting the tax burden to reflect the changing economic landscape.

Amendments to Allowable Deductions

Over the years, there have been several modifications to the types and amounts of deductions allowed under Pasal 21. These changes often aim to provide tax relief for specific expenses, such as health insurance premiums, education costs, or contributions to pension funds. For example, an amendment might increase the maximum deductible amount for health insurance premiums, allowing employees to reduce their taxable income and thus their tax liability. This is like finding a secret passage in the tax maze – a clever way to lower your tax bill legally!

Timeline of Significant Changes to Pasal 21

Understanding the evolution of Pasal 21 regulations helps illustrate the dynamic nature of Indonesian tax law. Here’s a simplified timeline highlighting some key amendments:

- 1980s – Early Implementation: The initial regulations were established, laying the groundwork for the current system. These were simpler times, relatively speaking.

- Mid-1990s – Economic Crisis Adjustments: Following the Asian financial crisis, several amendments were made to address economic realities and support taxpayers.

- 2000s – Simplification Efforts: Several reforms focused on streamlining the process and making it easier for both employers and employees to comply.

- 2010s – Increased Tax Compliance Measures: Amendments introduced stricter reporting requirements and penalties for non-compliance, aiming to enhance tax collection.

- 2020s – Digital Economy Integration: Recent changes reflect the growth of the digital economy and address tax implications for online businesses and digital transactions. This is where things get really interesting – navigating the digital tax frontier!

Impact of Amendments on Tax Calculations

Let’s consider a hypothetical example. Suppose an employee’s gross salary is IDR 10,000,000 per month. In 2022, their taxable income might have been IDR 8,000,000 after deductions, resulting in a tax liability of IDR 1,200,000. However, if a new deduction of IDR 1,000,000 was introduced in 2023, their taxable income would reduce to IDR 7,000,000, potentially lowering their tax liability to IDR 840,000. This demonstrates how amendments can directly influence the final tax calculation, leading to significant changes in an employee’s net income. This shows how understanding these changes can be financially rewarding.

Illustrative Scenarios

Let’s delve into some real-world (or at least, realistically imagined) scenarios to illustrate the sometimes-bewildering world of Pasal 21. Prepare for some mildly amusing financial acrobatics!

High-Income Earner’s Pasal 21 Liability

Imagine Ms. Anya, a highly successful software engineer earning a gross monthly salary of 50,000,000 IDR. Her hefty income translates to a significant Pasal 21 tax liability. The calculation involves applying the progressive tax brackets, taking into account various deductions and allowances permitted under the law. The final withheld amount will be substantially higher than that of a lower-income earner, likely resulting in a considerable amount deducted from her monthly paycheck. This highlights the progressive nature of the Indonesian tax system, where higher earners contribute a larger percentage of their income in taxes. The exact amount will depend on the applicable tax year’s rates and any additional deductions she’s eligible for.

Low-Income Earner’s Pasal 21 Liability, Pajak Penghasilan Pasal 21

Now, let’s meet Mr. Budi, a diligent barista earning a modest 5,000,000 IDR per month. His Pasal 21 tax liability is significantly lower due to his income falling into a lower tax bracket. He might even find that his withheld tax is minimal or even zero, depending on the applicable tax thresholds and allowances. This demonstrates how Pasal 21 aims to balance tax collection with consideration for lower-income individuals. His lower tax burden reflects the government’s attempt to create a fairer tax system.

Company’s Responsibilities in Withholding Pasal 21

PT. Maju Jaya, a thriving manufacturing company, has a responsibility to accurately withhold and remit Pasal 21 taxes for all its employees. This involves calculating each employee’s tax liability based on their individual salaries and deductions. The company then deducts the calculated tax from their employees’ salaries and remits the collected amount to the tax authorities on a regular basis (usually monthly). Failure to accurately withhold and remit these taxes can lead to significant penalties for PT. Maju Jaya, including hefty fines and potential legal repercussions. Therefore, accurate payroll processing and meticulous record-keeping are paramount for companies like PT. Maju Jaya.

Detailed Description of the Pasal 21 Tax Form

The Pasal 21 tax form, while not visually exciting, is a crucial document. It’s designed to ensure accurate reporting of withheld taxes. Let’s break down its key sections. Firstly, there’s a section for identifying the company, including its NPWP (Taxpayer Identification Number) and complete business address. Then comes a section detailing the employee’s information: name, NPWP (if applicable), address, and employment details. Crucially, the form demands precise details on the employee’s gross salary, deductions, and allowances, allowing for the calculation of the net taxable income. This is followed by a detailed breakdown of the tax calculation itself, showing the applied tax rates and the final amount of tax withheld. Finally, the form requires the company’s authorized signature and date, confirming the accuracy and validity of the reported information. Any discrepancies can lead to delays in processing and potential penalties. The form also includes a section for the tax period covered by the report.

Ending Remarks

So, there you have it – a whirlwind tour through the surprisingly entertaining world of Pajak Penghasilan Pasal 21. While navigating the complexities of Indonesian income tax might not be everyone’s idea of a good time, hopefully, this guide has shed some light (and perhaps a chuckle or two) on the process. Remember, understanding your tax obligations is crucial, but it doesn’t have to be a soul-crushing experience. With a little knowledge and maybe a dark sense of humor, you can conquer even the most daunting tax forms. Now go forth and file! (But maybe have a stiff drink first).

Detailed FAQs

What happens if I don’t pay my Pasal 21 taxes?

Expect penalties, interest charges, and possibly a visit from a very serious tax official. Let’s just say it’s not a fun time.

Can I deduct my pet hamster’s medical expenses?

Sadly, no. Unless your hamster is a registered business expense (and if that’s the case, you need a better accountant).

Where can I find the official tax forms?

The official website of the Indonesian tax authority (DJP) is your best bet. Be prepared for a lot of Indonesian-language bureaucracy.

What if my income fluctuates throughout the year?

The tax calculation will adjust accordingly. Consult a tax professional for advice on managing fluctuating income.