Pajak Pertambahan Nilai (PPN) Guide: Navigating the wonderfully confusing world of Indonesian Value Added Tax doesn’t have to be a tax-ing experience! This guide promises to unravel the mysteries of PPN, from its fundamental principles to its quirky applications in the digital age. Prepare for a journey filled with illuminating examples, helpful tips, and maybe even a chuckle or two as we demystify this often-dreaded tax.

We’ll explore everything from registering for PPN and understanding your obligations to mastering the art of input and output tax calculations. We’ll even tackle the thorny issues of e-commerce transactions and special exemptions, leaving no PPN stone unturned. Get ready to become a PPN pro—or at least someone who can confidently file their taxes without hyperventilating.

Understanding Pajak Pertambahan Nilai (PPN)

Let’s dive into the fascinating world of Indonesia’s Value Added Tax (PPN), a tax so ubiquitous, it’s practically woven into the fabric of the nation’s economic tapestry. Think of it as the silent, ever-present tax collector, subtly influencing the price of everything from your morning kopi to your annual family vacation. Understanding PPN is key to navigating the Indonesian marketplace, whether you’re a savvy shopper or a seasoned entrepreneur.

PPN Fundamental Principles in Indonesia

PPN, or Pajak Pertambahan Nilai, is a consumption tax levied on the value added at each stage of the production and distribution chain. In simpler terms, it’s a tax on the *increase* in value of goods and services as they move through the supply chain. The beauty (or beast, depending on your perspective) of PPN is that it’s a multi-stage tax, meaning the tax is collected at each stage, with businesses able to claim credits for the PPN they’ve already paid on their inputs. This prevents double taxation and keeps things (relatively) fair. Imagine it as a game of tax-based pass-the-parcel – the final consumer ultimately bears the brunt of the PPN.

PPN Rates in Indonesia

Indonesia employs a tiered system of PPN rates, adding a delightful layer of complexity to the proceedings. The standard rate is 11%, but don’t let that fool you; there are exceptions. Certain goods and services enjoy reduced rates (e.g., 10% or even lower) while others are entirely exempt. This system allows the government to fine-tune its tax policy, offering tax breaks where deemed socially or economically beneficial. The system, while intricate, is ultimately designed to balance revenue generation with social considerations. It’s a delicate dance, truly.

Examples of PPN-Subject and PPN-Exempt Transactions

Let’s get practical. Transactions subject to PPN typically include the sale of most goods and services. Buying a new smartphone? PPN applies. Indulging in a luxurious spa treatment? PPN again. However, certain essential goods and services are exempt. Basic necessities like rice and essential medical services often escape the PPN net. Think of it as a tax system with a conscience (sort of). The government, in its infinite wisdom, has decided that some things are just too important to tax.

Comparison of PPN with Other Indonesian Taxes

PPN isn’t the only tax game in town. It shares the stage with other players like Pajak Penghasilan (PPh, Income Tax) and Pajak Bumi dan Bangunan (PBB, Land and Building Tax). While PPN focuses on consumption, PPh targets income, and PBB targets property ownership. They’re like three different flavors of tax ice cream – all delicious (in a twisted, tax-paying kind of way), but with distinct characteristics. Each tax plays a vital role in funding the Indonesian government’s activities, from infrastructure projects to social welfare programs.

PPN Rate Comparison Table

| PPN Rate | Description | Applicable Goods/Services | Example |

|---|---|---|---|

| 11% | Standard Rate | Most goods and services | Purchasing a new car |

| 10% | Reduced Rate | Certain essential goods and services | Basic food items (depending on specific regulations) |

| 0% | Zero Rate | Exports and specific goods/services | Export of Indonesian-made textiles |

| Exempt | No PPN | Specific goods and services as defined by law | Certain healthcare services |

PPN Registration and Obligations

Embarking on the thrilling journey of PPN registration might seem like navigating a labyrinth filled with tax codes and confusing regulations. Fear not, intrepid taxpayer! This section will illuminate the path, shedding light on the process, obligations, and (let’s be honest) the potential pitfalls of non-compliance. We’ll equip you with the knowledge to conquer the bureaucratic beast and emerge victorious, your tax returns sparkling like freshly-minted rupiah.

Registering for PPN in Indonesia involves a straightforward process (relatively speaking, of course). Think of it as joining an exclusive club – the club of Indonesian businesses contributing to the national coffers. The benefits? Well, besides avoiding the wrath of the taxman, you’ll gain access to various tax incentives and the warm fuzzy feeling of contributing to societal progress. But, like any exclusive club, there are rules.

PPN Registration Process

The registration process typically involves submitting an application form (Formulir Pendaftaran Pengusaha Kena Pajak – or PKP registration form) to the local tax office (Kantor Pelayanan Pajak – or KPP). This application requires various supporting documents, which we’ll detail later. Think of it as assembling a compelling case for your inclusion in the PPN club. Once your application is reviewed and approved, you’ll receive a Taxpayer Identification Number (NPWP) and a PPN registration number. This signifies your official induction into the PPN club, complete with membership card (metaphorically speaking, of course).

PPN Reporting and Payment Obligations

Once registered, you’re officially a member of the PPN club, and with membership comes responsibilities. This involves diligently filing PPN returns (Surat Pemberitahuan Pajak Pertambahan Nilai – or SPT PPN) and paying the taxes due. This isn’t a mere suggestion; it’s a legally binding obligation. Failure to comply, well, let’s just say the consequences can be… unpleasant.

These reports must be submitted periodically, usually monthly or annually depending on your turnover. The frequency is determined by the tax authority based on your business activities and turnover. Think of it as attending mandatory club meetings – attendance is mandatory.

Penalties for Non-Compliance

Let’s talk about the elephant in the room: penalties. Failing to meet your PPN obligations can result in a range of sanctions, from hefty fines to legal action. These penalties can significantly impact your business’s financial health. It’s far better to stay on the right side of the law and avoid any unpleasant encounters with the tax authorities. Let’s just say, it’s not a party you want to attend.

Step-by-Step Guide for Filing PPN Returns

- Gather all necessary documents (detailed below).

- Access the online tax portal (DJP Online).

- Log in using your NPWP and password.

- Select the “SPT PPN” option.

- Complete the form accurately and meticulously.

- Upload supporting documents.

- Submit the return electronically.

- Make the payment via designated channels.

- Print and keep a copy of the submission confirmation for your records.

Checklist of Documents Required for PPN Registration and Filing

Before you embark on your PPN journey, ensure you have the necessary documentation. This is crucial for a smooth and efficient registration and filing process. Think of it as packing your backpack for an adventure – you wouldn’t want to forget your essentials.

- Formulir Pendaftaran Pengusaha Kena Pajak (PKP Registration Form)

- Copy of your business registration certificate (e.g., Akte Pendirian Perusahaan)

- Copy of your Taxpayer Identification Number (NPWP) certificate

- Proof of business address

- Financial statements (for specific periods as required)

- Other relevant documents as requested by the tax office

Input Tax and Output Tax

Navigating the world of PPN can feel like trying to solve a particularly fiendish Sudoku puzzle, but fear not! Understanding input and output tax is the key to unlocking the secrets of PPN and avoiding a tax headache that would make a migraine seem like a pleasant tickle. Think of it as a financial game of give-and-take, where the government gets a slice, and you might just get a slice back.

Essentially, input tax and output tax are two sides of the same PPN coin. Output tax is the PPN you charge your customers when you sell goods or services. Input tax, on the other hand, is the PPN you pay when you purchase goods or services for your business. The beauty of it all (and the reason for all this calculation) is that you can often claim a credit for the input tax you’ve paid, reducing your overall PPN liability. It’s like getting a discount on your taxes – who doesn’t love a discount?

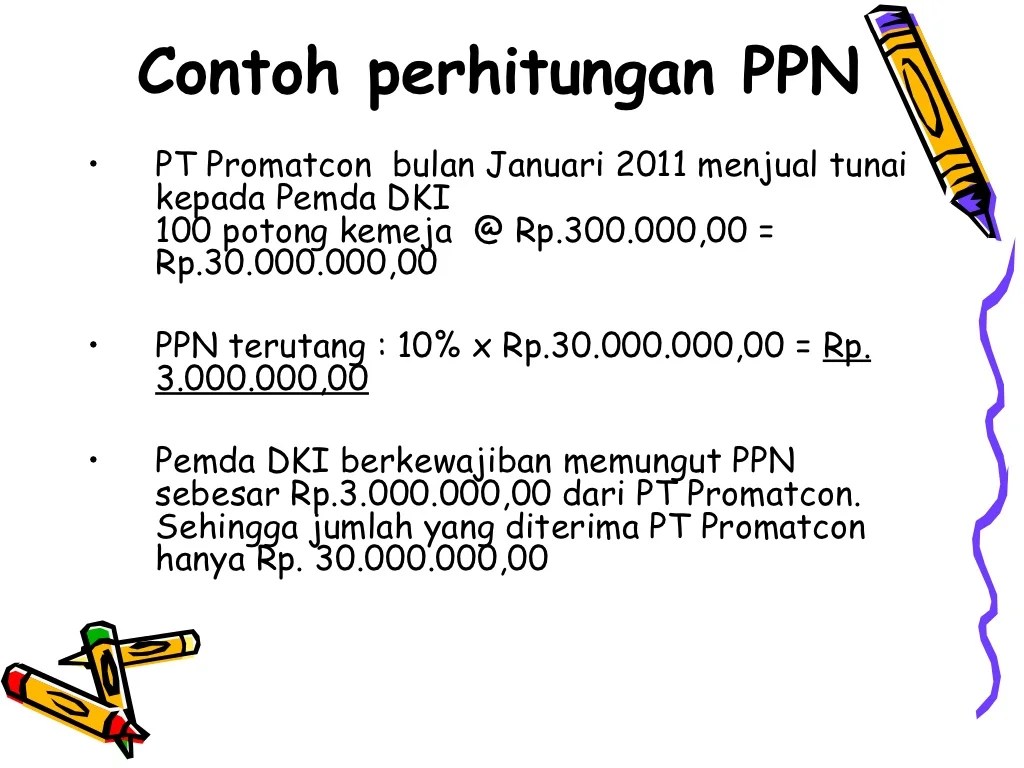

Input Tax Calculation

Calculating input tax is straightforward. It’s simply the PPN included in the price of goods and services you buy for your business. The formula is refreshingly simple:

Input Tax = (Purchase Price * PPN Rate) / (1 + PPN Rate)

Let’s say you bought office supplies for Rp 1,100,000, and the PPN rate is 11%. Your input tax would be (Rp 1,100,000 * 11%) / (1 + 11%) = Rp 100,000.

Output Tax Calculation

Calculating output tax is equally easy. It’s the PPN you charge your customers on your sales. The formula is:

Output Tax = Sales Price * PPN Rate

If you sold goods for Rp 5,000,000 with an 11% PPN rate, your output tax would be Rp 5,000,000 * 11% = Rp 550,000. Easy peasy, lemon squeezy!

Input Tax Credit Claiming

The real fun begins when we discuss claiming input tax credits. This is where you get to reduce your PPN liability by deducting the input tax you paid from the output tax you collected. This is where the “give-and-take” really shines. Imagine it as a delightful refund on your business expenses related to PPN.

To claim input tax credits, you’ll need to keep meticulous records of all your purchases and sales, including the PPN amount. These records will be your proof to the tax authorities, demonstrating that you deserve this well-earned credit.

Input Tax Credit Claiming Process

The process of claiming input tax credits involves several steps, and careful documentation is crucial. A clear understanding of these steps ensures a smooth process.

The following flowchart illustrates the process:

[Imagine a flowchart here. The flowchart would begin with “Record all purchases and sales with PPN details.” This would lead to “Calculate Input Tax and Output Tax.” This would then branch to “Prepare PPN Return.” This would lead to “Submit PPN Return to the Tax Office.” Finally, there would be a box indicating “Input Tax Credit Processed/Refund Received”.]

Examples of Input Tax Credit Calculations

Let’s illustrate with a couple of examples. Imagine a small business, “Amazing Widgets,” sells widgets and buys raw materials.

| Month | Output Tax (Rp) | Input Tax (Rp) | Net PPN Payable/Refundable (Rp) |

|---|---|---|---|

| January | 1,100,000 | 550,000 | 550,000 (Payable) |

| February | 700,000 | 900,000 | (200,000) Refundable |

In January, Amazing Widgets owed the government Rp 550,000. However, in February, after deducting the input tax from the output tax, they received a refund of Rp 200,000. See? It’s a balancing act, but with the potential for a rewarding outcome!

Special Cases and Exemptions

Navigating the world of PPN can feel like traversing a particularly tricky tax jungle, filled with unexpected vines of exemptions and thorny bushes of special cases. But fear not, intrepid taxpayer! This section will illuminate the path, revealing the secrets to successfully navigating these treacherous terrains. We’ll explore the exceptions to the rule, offering clarity on situations where PPN doesn’t apply or is handled differently. Prepare for some surprisingly delightful (and legally sound) loopholes!

The Indonesian PPN system, while generally straightforward, presents some unique challenges when dealing with international trade and specific service sectors. Understanding these nuances is crucial for compliance and, let’s be honest, for maximizing your tax benefits. Think of it as a treasure hunt, where the treasure is a lower tax bill.

PPN Treatment of Exports, Imports, and Financial Services

Exports generally enjoy a zero-rate PPN treatment. This means that while PPN is initially calculated, it’s subsequently refunded to the exporter. This encourages Indonesian businesses to compete globally, because who doesn’t love a tax refund? Imports, on the other hand, are subject to PPN upon entry into Indonesia. Think of it as a welcoming committee, albeit one that charges a fee. Financial services often receive special PPN treatment, with specific regulations applying depending on the type of service provided. For instance, certain banking transactions might be exempt, while others might be subject to a reduced rate. It’s a complex world, but we’re here to help you unravel it.

PPN Exemptions

Certain goods and services are entirely exempt from PPN. This isn’t a loophole, it’s a deliberate policy choice designed to promote specific sectors or address social needs. It’s the government’s way of saying, “We appreciate your contribution to society, so here’s a tax break!” These exemptions are clearly defined by law and are not open to interpretation (unless you’re a particularly creative tax lawyer, of course).

Conditions for Claiming PPN Refunds

Claiming a PPN refund requires meticulous record-keeping and adherence to strict procedures. It’s not a simple matter of sending a postcard; it involves submitting detailed documentation, proving eligibility, and navigating bureaucratic processes. Think of it as a quest, where the reward is a refund. But be warned, this quest requires preparation, patience, and possibly a strong cup of coffee.

Examples of Transactions with Special PPN Considerations

Let’s consider a few real-world scenarios: An Indonesian company exporting textiles will be able to claim a PPN refund on the exported goods. Conversely, an importer of luxury cars will pay PPN upon importation. A bank providing specific financial services, such as certain types of loans, might be exempt from PPN. These examples highlight the diversity of PPN treatment across different transactions. Each case requires careful consideration of the specific regulations.

Common PPN Exemptions and Their Conditions

Understanding the conditions for PPN exemptions is crucial for accurate tax calculation and compliance. Here’s a summary to guide you through the maze:

- Healthcare services: Generally exempt, but specific conditions may apply depending on the type of service and provider.

- Education services: Often exempt, subject to specific criteria relating to the educational institution and the type of service provided.

- Certain religious services: Specific religious activities may be exempt, contingent upon compliance with relevant regulations.

- Basic necessities (e.g., certain food items): Often exempt or subject to reduced rates, depending on the specific item and government policy.

PPN and E-Commerce: Pajak Pertambahan Nilai (PPN) Guide

Navigating the world of Indonesian e-commerce and PPN (Pajak Pertambahan Nilai, or Value Added Tax) can feel like trying to assemble IKEA furniture without the instructions – a mildly frustrating, potentially hilarious, and ultimately achievable task. This section will illuminate the surprisingly straightforward rules governing PPN in the digital marketplace. Let’s dive in!

The application of PPN to e-commerce transactions in Indonesia is governed by a specific set of regulations designed to ensure fairness and clarity, despite the inherent complexities of online marketplaces. These regulations primarily focus on establishing clear responsibilities for both the sellers and buyers, regardless of whether the goods or services are digital or physical. The key is understanding the location of the seller and buyer, and the nature of the goods or services being traded.

PPN Regulations for E-Commerce Transactions

Indonesian tax regulations classify e-commerce transactions similarly to traditional retail transactions. The crucial difference lies in the method of delivery and the potential for cross-border transactions. Domestic transactions generally follow the same rules as offline sales, with PPN applied to the sale price of goods and services. For international transactions, the place of supply and the tax residency of the seller become determining factors in the application of PPN. If the seller is a foreign entity without a permanent establishment in Indonesia and sells digital services to Indonesian consumers, a specific set of rules applies, often involving a withholding tax mechanism.

Responsibilities of Sellers and Buyers in E-Commerce PPN Transactions

Both sellers and buyers play crucial roles in ensuring compliance with PPN regulations in e-commerce. Sellers are responsible for correctly calculating and collecting PPN from buyers, issuing invoices that clearly state the PPN amount, and remitting the collected PPN to the Indonesian tax authorities. Buyers, in turn, are responsible for paying the PPN included in the price of goods and services purchased. Failure to comply with these responsibilities can lead to penalties and legal repercussions. Think of it as a digital tango; both partners need to know the steps.

Examples of PPN Application to Digital Products and Services

Let’s illustrate with some examples. Imagine purchasing a premium subscription to a popular Indonesian streaming service. The subscription fee will include PPN. Similarly, buying a digital book or software from an Indonesian e-commerce platform will also include PPN. The rate of PPN (currently 11%) is added to the price of the digital good or service. This is no different from buying a physical book or software from a physical store – just a different delivery method.

Comparison of PPN for Online and Offline Transactions

In essence, the PPN calculation for online and offline transactions is identical for domestic transactions. The core difference lies in the method of payment and the issuance of invoices. Online transactions typically involve digital payment methods and electronic invoices, while offline transactions rely on cash or card payments and paper invoices. The fundamental principle remains the same: PPN is levied on the value of the goods or services provided.

Calculating PPN for E-Commerce Transactions with Domestic and International Elements

Let’s consider a scenario involving both domestic and international aspects. Suppose an Indonesian e-commerce platform sells a physical product sourced from a foreign supplier. The platform will likely import the product and incur import duties and taxes. Then, the platform adds its margin and the 11% PPN to the final selling price to Indonesian consumers. The platform is responsible for remitting the PPN collected from the consumer to the Indonesian tax authorities. If the product is shipped directly from the foreign supplier to the Indonesian consumer, the scenario becomes more complex, often involving the foreign supplier registering for PPN in Indonesia or utilizing a withholding tax mechanism.

For domestic transactions, the PPN calculation is straightforward: Total Price = Price of Goods/Services + (Price of Goods/Services x 11%)

Illustrative Scenarios

Let’s ditch the dry theory and dive headfirst into some real-world PPN adventures! These scenarios will illuminate the often-bewildering world of Indonesian Value Added Tax, proving that even PPN can be… mildly entertaining. Prepare for some mildly thrilling calculations!

The following scenarios demonstrate PPN calculations in various business contexts. We’ll explore different transaction types, applicable rates, and the resulting implications for the taxpayers involved. Remember, these are simplified examples and professional advice should always be sought for complex situations. After all, even accountants need a vacation sometimes.

Scenario 1: A Thriving Bakery’s Sweet Success (and PPN)

Imagine a bakery, “Roti Raya,” selling delicious pastries. They sell a cake for IDR 100,000. The standard PPN rate in Indonesia is 11%. Let’s see how PPN impacts their sales.

| Transaction Details | PPN Calculation | Implications for Roti Raya |

|---|---|---|

| Sale of cake: IDR 100,000 | PPN = 11% of IDR 100,000 = IDR 11,000 | Roti Raya collects IDR 11,000 in PPN from the customer and must remit this to the government. Their total revenue including PPN is IDR 111,000. They can claim input tax if they purchased ingredients subject to PPN. |

In this scenario, Roti Raya’s PPN liability is straightforward. They simply calculate 11% of the sale price. The customer pays the final price inclusive of PPN (IDR 111,000). The bakery then pays the collected PPN to the government. Simple as pie… or cake, in this case.

Scenario 2: A Tech Startup’s Digital Delight (and PPN Headaches)

Now, let’s consider “Teknologi Terkini,” a tech startup selling software subscriptions. They offer a monthly subscription for IDR 500,000. The PPN rate for digital services is also 11%.

| Transaction Details | PPN Calculation | Implications for Teknologi Terkini |

|---|---|---|

| Monthly software subscription: IDR 500,000 | PPN = 11% of IDR 500,000 = IDR 55,000 | Teknologi Terkini collects IDR 55,000 in PPN per subscription and must remit this to the government. Their monthly revenue per subscription, including PPN, is IDR 555,000. They must comply with regulations concerning e-commerce PPN. |

While seemingly similar to the bakery scenario, this highlights the importance of understanding PPN regulations for digital services. The calculation remains the same (11% of the subscription fee), but the compliance requirements for e-commerce transactions add a layer of complexity. It’s not as simple as just baking a cake!

Scenario 3: A Construction Company’s Concrete Conundrum (and PPN Deductions)

Let’s meet “Bangunan Besar,” a construction company building a large office building. They purchase cement for IDR 2,000,000, subject to 11% PPN. This is an example of input tax.

| Transaction Details | PPN Calculation | Implications for Bangunan Besar |

|---|---|---|

| Purchase of cement: IDR 2,000,000 | Input PPN = 11% of IDR 2,000,000 = IDR 220,000 | Bangunan Besar can claim the IDR 220,000 input PPN as a credit against their output PPN (PPN collected from their construction services). This reduces their overall PPN payable. It’s like getting a discount on their taxes! |

This scenario demonstrates the concept of input tax. Bangunan Besar doesn’t pay the full IDR 220,000 PPN; they can deduct this amount from the PPN they collect on their construction services. This is a crucial aspect of PPN for businesses with significant input costs. It’s all about balancing the books, or in this case, the cement bags.

Resources and Further Information

Navigating the world of Pajak Pertambahan Nilai (PPN) can feel like traversing a jungle filled with tax-deductible vines and surprisingly thorny exemptions. Fear not, intrepid taxpayer! This section provides you with the tools and resources to conquer this verdant, yet potentially financially draining, landscape. We’ll arm you with the information you need to not only survive but thrive in the Indonesian PPN ecosystem.

Finding the right information is crucial for compliance and, let’s be honest, avoiding a rather unpleasant encounter with the tax authorities. The following resources offer a variety of ways to access the knowledge you need, from official government channels to helpful third-party guides. Remember, accurate information is your best defense against those pesky tax penalties!

Relevant Government Websites and Publications

The official Indonesian government websites are, naturally, your first port of call. These sites are the ultimate source of truth when it comes to PPN regulations. However, be warned: navigating government websites can sometimes feel like deciphering ancient hieroglyphs. But fear not, the reward for your perseverance is clarity (and potentially, a significant tax refund!).

- Directorate General of Taxes (DGT) Website: This website, typically in Indonesian, is the central hub for all things tax-related in Indonesia. Expect detailed regulations, forms, and announcements. Think of it as the PPN Rosetta Stone.

- Official Government Gazette (Lembaran Negara): Here you’ll find the official publications of new laws and regulations, including PPN updates. This is where you’ll find the most up-to-date, legally binding information. It’s the definitive source, even if it’s a bit… dense.

- Other Relevant Ministries’ Websites: Depending on your specific industry or business type, other ministries might have relevant publications or guidelines related to PPN implementation. This requires a bit of detective work, but the payoff can be significant.

Contact Information for Indonesian Tax Authorities

Knowing who to contact when you have a question or encounter a problem is essential. The Indonesian tax authorities offer various channels for communication. Remember, a polite and well-prepared inquiry is much more likely to yield a positive result than a frantic, last-minute plea for help.

- Phone Numbers: The DGT typically provides several phone numbers for inquiries, often categorized by region or topic. Expect potential wait times, but persistence pays off.

- Email Addresses: Many DGT offices offer email addresses for inquiries. This is a good option for less urgent questions or for submitting documents electronically.

- Physical Offices: While not always the most convenient, visiting a DGT office in person allows for face-to-face consultations. Be prepared to potentially spend some time waiting, but it can be beneficial for complex issues.

Other Helpful Resources for Understanding and Complying with PPN Regulations

While official government sources are paramount, other resources can significantly aid your understanding and compliance. These resources can provide interpretations, explanations, and practical guidance that supplement the official information.

- Tax Consulting Firms: Professional tax consultants can provide expert advice and assistance in navigating the complexities of PPN. They can be particularly helpful for businesses with complex tax situations.

- Tax Software and Applications: Several software applications are designed to assist with PPN calculations and filing. These tools can streamline the process and reduce the risk of errors.

- Industry Associations: Your industry association might offer resources and guidance specifically related to PPN in your sector. Networking within your industry can also provide valuable insights.

A Brief Guide on Finding Answers to Specific PPN Questions, Pajak Pertambahan Nilai (PPN) Guide

Finding the right answer to a specific PPN question requires a strategic approach. Think of it as a treasure hunt, with the treasure being tax compliance and peace of mind.

- Start with the official DGT website: Use their search function to find relevant s and regulations.

- Check the official government gazette: Look for recent updates and amendments to PPN laws.

- Consult other relevant resources: Explore industry associations, tax consultants, and software applications.

- Contact the DGT directly: If you’re still unsure, reach out to the tax authorities for clarification.

Frequently Asked Questions Regarding PPN in Indonesia

While this guide has covered many aspects of PPN, some questions frequently arise. We’ve compiled a few common queries to help clarify potential confusion.

- What is the standard PPN rate in Indonesia? The standard PPN rate is generally 11%, but there are exceptions and special rates for certain goods and services.

- When is a business required to register for PPN? Businesses generally need to register for PPN once their annual turnover exceeds a certain threshold, which is regularly updated.

- What are the penalties for non-compliance with PPN regulations? Penalties for non-compliance can range from fines to legal action, depending on the severity of the violation. It’s best to avoid these by being diligent!

- How often are PPN returns filed? PPN returns are typically filed on a monthly or quarterly basis, depending on the business’s turnover and registration status.

- Are there any PPN exemptions or special cases? Yes, there are several exemptions and special cases for specific goods and services. These are often detailed in the official regulations.

Concluding Remarks

So, there you have it! Hopefully, this Pajak Pertambahan Nilai (PPN) Guide has shed some light—or at least a flickering candle—on the complexities of Indonesian Value Added Tax. While PPN might seem daunting at first, with a little understanding and the right resources (like this guide!), navigating it can be surprisingly manageable, and even a bit…fun? Okay, maybe not *fun*, but definitely less terrifying. Remember to always consult official sources and seek professional advice when needed. Now go forth and conquer your PPN obligations!

Clarifying Questions

What happens if I don’t register for PPN?

Prepare for a hefty fine and potentially other unpleasant encounters with the Indonesian tax authorities. Registration is generally mandatory above a certain turnover threshold.

Can I deduct personal expenses from my PPN calculation?

Generally, no. Only business-related expenses are deductible. Mixing personal and business finances is a recipe for a tax audit headache.

What if I made a mistake on my PPN return?

Don’t panic! Correcting errors is usually possible, but it’s best to do so promptly and according to the prescribed procedures. Consult a tax professional if you’re unsure.

Where can I find the most up-to-date PPN regulations?

The official website of the Indonesian tax authority (DJP) is your best bet. Keep in mind that tax laws can change, so regular checks are essential.