Pendidikan Finansial: Let’s face it, money talks – and sometimes it screams. This isn’t your grandma’s home economics class (unless your grandma was a financial whiz, in which case, hats off to her!). We’re diving deep into the world of Indonesian personal finance, exploring everything from budgeting like a boss to navigating the thrilling (and sometimes terrifying) world of investment. Prepare for a journey that’s both enlightening and, dare we say, entertaining.

We’ll unpack the cultural nuances of financial literacy in Indonesia, examining the challenges and triumphs of educating Indonesians about responsible money management. From the impact of socioeconomic factors to the role of government policies, we’ll leave no rupiah unturned in our quest to understand how Indonesians can achieve financial freedom. Get ready for a rollercoaster ride of financial knowledge!

Defining “Pendidikan Finansial” (Financial Literacy in Indonesia)

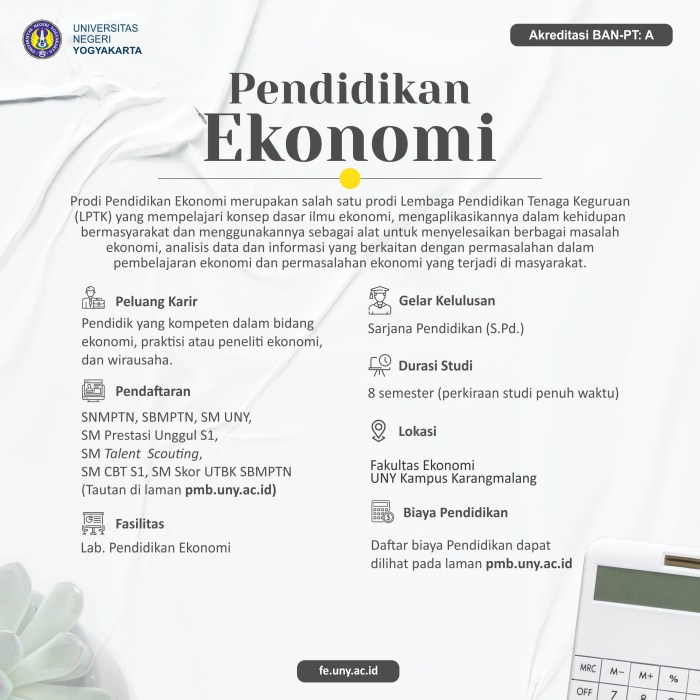

Pendidikan Finansial, or financial literacy in Indonesia, isn’t just about balancing a checkbook (though that’s helpful!). It’s a much broader concept, deeply intertwined with Indonesian culture and the unique economic landscape of the archipelago. It encompasses the knowledge, skills, and confidence needed to make informed financial decisions, ensuring economic well-being across all strata of society, from the bustling streets of Jakarta to the tranquil rice paddies of Bali.

Indonesia’s vibrant and diverse culture plays a significant role in shaping financial attitudes and behaviors. Traditional values, such as strong family ties and communal support, often influence financial planning and risk tolerance. Understanding these cultural nuances is crucial for effective financial literacy programs. For example, a program focused solely on individual savings might overlook the vital role of communal financial practices, like rotating savings and credit associations (Arisan), which are deeply embedded in Indonesian society.

Key Components of a Robust Financial Literacy Program in Indonesia, Pendidikan Finansial

A successful financial literacy program in Indonesia must address several key areas. It needs to go beyond simply teaching budgeting and saving; it needs to integrate cultural context and practical applications. This includes comprehensive education on topics like managing debt, understanding insurance, investing wisely (perhaps in local businesses or cooperatives), and planning for retirement. Furthermore, the program must be accessible and engaging, using various media and methods to reach diverse communities across the Indonesian archipelago. A one-size-fits-all approach simply won’t work.

Comparison of Financial Literacy Understanding Across Age Groups in Indonesia

Younger generations (Millennials and Gen Z) in Indonesia, having grown up with more exposure to technology and global trends, often demonstrate a higher level of comfort with online banking and digital financial tools. However, they may lack experience in managing long-term financial goals, such as retirement planning. Older generations, on the other hand, may possess strong traditional financial practices but lack the knowledge and confidence to navigate the complexities of the modern financial system. This generational gap highlights the need for tailored programs that cater to the specific needs and experiences of different age groups. For example, older generations might benefit from programs focusing on practical skills like navigating pension systems, while younger generations might benefit from programs emphasizing long-term financial planning and responsible debt management.

Current State of Financial Literacy in Indonesia: Strengths and Weaknesses

While Indonesia has made strides in promoting financial literacy, significant challenges remain. A notable strength is the widespread adoption of digital financial services, which has expanded access to banking and financial tools, particularly in rural areas. Mobile banking and e-wallets have become increasingly popular, providing opportunities for financial inclusion. However, a significant weakness is the relatively low level of financial literacy among the general population, particularly in understanding complex financial products and managing risk. This vulnerability makes many Indonesians susceptible to financial scams and predatory lending practices. Furthermore, the informal sector, which constitutes a significant portion of the Indonesian economy, often operates outside the formal financial system, leaving many individuals with limited access to financial education and formal banking services. Effective financial literacy programs must address these gaps and promote responsible financial behavior across all sectors of the Indonesian economy.

Challenges and Barriers to Pendidikan Finansial

Navigating the world of personal finance can be tricky, even for seasoned experts. In Indonesia, where a vibrant and rapidly growing economy coexists with significant socioeconomic disparities, the challenges to effective financial education are particularly pronounced. Let’s delve into the fascinating (and sometimes frustrating) obstacles that stand in the way of widespread financial literacy.

Socioeconomic Factors and Access to Pendidikan Finansial

Indonesia’s diverse socioeconomic landscape plays a significant role in determining access to and understanding of financial education. Individuals in lower socioeconomic brackets often face multiple barriers, including limited access to technology, formal education, and reliable financial services. For example, a rural farmer with limited internet access might struggle to access online financial literacy resources, while someone with low literacy levels might find complex financial documents intimidating and confusing. This disparity creates a significant gap in financial knowledge and opportunities, perpetuating a cycle of financial vulnerability. The lack of financial literacy can also contribute to over-reliance on high-interest informal lenders, trapping individuals in a debt cycle.

Government Policies and Regulations’ Influence on Financial Literacy

The Indonesian government’s role in promoting financial literacy is crucial. While various initiatives exist, their effectiveness varies. For instance, government-led campaigns might lack sufficient resources or targeted outreach to effectively reach diverse populations. Conversely, regulations aimed at protecting consumers from predatory lending practices can significantly improve financial well-being, though enforcement and awareness of these regulations remain key challenges. The interplay between supportive policies and effective implementation is critical to fostering a financially literate populace. Inconsistency in government messaging and a lack of coordinated efforts across different ministries can also hinder progress.

Effectiveness of Different Educational Approaches

A variety of approaches to financial education are employed in Indonesia, each with varying degrees of success. The effectiveness often depends on factors such as the target audience, the method of delivery, and the quality of the educational materials. Below is a table comparing the effectiveness of some common approaches:

| Educational Approach | Strengths | Weaknesses | Effectiveness Rating (1-5, 5 being highest) |

|---|---|---|---|

| Formal School Curriculum | Wide reach, structured learning | May lack practical relevance, inconsistent implementation across schools | 3 |

| Community-Based Workshops | Interactive, tailored to specific needs | Limited reach, requires significant resource mobilization | 4 |

| Online Resources and Apps | Accessibility, flexibility | Digital literacy requirements, potential for misinformation | 3 |

| Financial Counseling Services | Personalized guidance, addresses individual needs | Costly, limited availability | 4 |

Effective Educational Methods and Programs

Let’s face it, teaching personal finance isn’t exactly known for its thrilling rollercoaster rides. But fear not, fellow educators! With the right approach, we can transform the seemingly mundane world of budgeting and saving into an engaging and empowering experience for young Indonesian adults. This section explores effective methods and programs designed to make financial literacy not just understandable, but actually…fun! (Yes, it’s possible!)

Curriculum Design for Young Adults

A successful Pendidikan Finansial curriculum for young adults in Indonesia needs to be relevant, relatable, and, dare we say, *cool*. It should move beyond the dry recitation of facts and figures and instead focus on practical application and real-world scenarios. Imagine a curriculum that starts with understanding the Indonesian economy’s current state, followed by modules on budgeting, saving, investing (including low-risk options like peer-to-peer lending popular in Indonesia), debt management, and even navigating the digital financial landscape – think e-wallets and online banking security. Interactive case studies, role-playing exercises (think “managing your first salary” simulations), and guest speakers from various financial sectors would make learning both engaging and insightful. Crucially, the curriculum must address the unique financial challenges faced by young Indonesians, such as navigating informal employment and managing family expectations.

Examples of Successful Financial Literacy Programs

Several successful programs highlight the power of creative teaching. For instance, “Sekolah Pintar Keuangan” (Smart Finance School) – a hypothetical program – could incorporate interactive workshops focusing on practical skills like creating a budget using popular Indonesian budgeting apps. Another successful model could mirror programs seen in other developing nations. Programs like those implemented by microfinance institutions in Bangladesh, which often integrate financial education with lending services, demonstrate the effectiveness of a holistic approach. These programs often use storytelling and community-based learning, adapting to local contexts and leveraging existing social networks to maximize impact. The success of these programs lies in their understanding of the target audience’s needs and their ability to deliver information in an accessible and culturally relevant manner.

Practical Tools and Resources for Enhancing Effectiveness

To truly make a difference, we need to equip educators with the right tools. This includes providing access to updated, locally relevant financial data and resources. A comprehensive online platform, perhaps developed in collaboration with Indonesian financial institutions, could offer interactive modules, downloadable budgeting templates in Bahasa Indonesia, and even access to financial calculators tailored to Indonesian contexts. Furthermore, providing educators with training on effective teaching methodologies, particularly those designed to engage young adults, is essential. This could include training in gamification techniques, storytelling, and interactive learning strategies. Finally, partnerships with local businesses and community organizations can provide valuable real-world context and opportunities for practical application.

Gamification for Improved Engagement

Let’s face it, lecturing about interest rates can be about as exciting as watching paint dry. Gamification transforms this. Imagine a mobile app where users earn points for completing budgeting exercises, making smart financial decisions in simulated scenarios, and even engaging in friendly competitions with peers. Leaderboards, badges, and virtual rewards can create a fun and engaging learning experience. The app could also incorporate interactive quizzes and challenges, transforming learning into a game that users actively want to play. This gamified approach, combined with a strong focus on practical application and real-world relevance, can significantly increase engagement and retention of financial literacy knowledge. Successful gamified financial literacy programs have shown significantly higher engagement rates and knowledge retention compared to traditional lecture-based methods.

Specific Financial Topics within Pendidikan Finansial

Let’s face it, talking about money in Indonesia isn’t always a picnic. From navigating bustling markets to understanding complex investment schemes, financial literacy is crucial for navigating the vibrant (and sometimes chaotic!) Indonesian economy. This section dives into the nitty-gritty of specific financial topics, aiming to equip you with the knowledge to make smart financial decisions, avoiding the pitfalls and embracing the opportunities. Think of it as your personal financial survival guide in the archipelago!

Budgeting and Saving in the Indonesian Context

Budgeting and saving are fundamental to financial health, especially in a country like Indonesia where economic fluctuations can be significant. A well-structured budget helps families allocate resources effectively, ensuring essential needs are met while still allowing for savings and investments. The Indonesian context requires considering factors like fluctuating food prices, family-oriented spending habits, and the prevalence of informal income streams. A robust budget acts as a financial compass, guiding families towards stability and prosperity, preventing them from being swept away by unexpected expenses or economic downturns. Saving, on the other hand, forms a safety net against unforeseen circumstances, be it a medical emergency or a sudden job loss. It’s the financial equivalent of a sturdy life raft in a sometimes turbulent sea.

Creating a Personal Budget for Indonesian Families: A Step-by-Step Guide

Creating a budget isn’t rocket science, but it does require discipline and a bit of organization. Here’s a practical approach tailored for Indonesian families:

- Track your income: List all sources of income, including salaries, business profits, and any other regular inflows. Be thorough! Even that extra cash from selling homemade cakes counts.

- Categorize your expenses: Divide your expenses into essential (food, housing, utilities), non-essential (entertainment, dining out), and irregular (medical bills, car repairs). Use a spreadsheet or budgeting app for easier tracking. Think of this as a financial archaeological dig – uncovering all those hidden spending habits.

- Allocate your funds: Assign a percentage of your income to each category. Prioritize essentials, then allocate funds for savings and investments. A common rule of thumb is the 50/30/20 rule: 50% for needs, 30% for wants, and 20% for savings and debt repayment. Adjust this according to your family’s specific needs.

- Monitor and adjust: Regularly review your budget to ensure it aligns with your spending habits. Life throws curveballs; be prepared to adjust your budget accordingly. Think of your budget as a living document, not a rigid contract.

Investment Options in Indonesia: Risks and Benefits

Indonesia offers a diverse range of investment options, from traditional savings accounts to more sophisticated instruments. Each option carries its own set of risks and benefits. Understanding these nuances is crucial for making informed investment decisions. Ignoring this can lead to significant financial losses. It’s like choosing a hiking trail without checking the map – you might end up lost and exhausted.

Debt Management and Avoiding Predatory Lending

Debt is a reality for many Indonesian families, but it’s crucial to manage it responsibly. Predatory lending practices, unfortunately, are prevalent in some areas, trapping vulnerable individuals in cycles of debt. Understanding interest rates, loan terms, and the warning signs of predatory lenders is paramount. Remember, a little knowledge can save you from a mountain of debt. Think of it as financial self-defense – equipping yourself with the knowledge to avoid being taken advantage of.

Measuring the Impact of Pendidikan Finansial

Assessing the effectiveness of financial literacy programs in Indonesia isn’t just about handing out pamphlets and hoping for the best; it’s a serious (and sometimes hilarious) endeavor involving clever methods and insightful analysis. We need to know if our efforts are actually making a dent in the national financial landscape, or if we’re just inadvertently creating a nation of slightly more informed but equally broke individuals.

Various methods exist to gauge the success of Pendidikan Finansial programs, each with its own strengths and weaknesses. Think of it as a financial detective story, where we use different clues to solve the mystery of whether our programs are working.

Methods for Assessing Program Effectiveness

A multi-faceted approach is crucial. We can’t rely on a single metric; it’s like trying to understand a complex Indonesian dish by only tasting one ingredient! A robust evaluation requires a combination of quantitative and qualitative data. Quantitative methods, like pre- and post-program surveys measuring changes in knowledge and behavior, provide concrete numbers. Qualitative methods, such as focus groups and interviews, offer richer insights into the lived experiences of participants. Imagine comparing survey results showing improved savings habits with testimonials from participants detailing their newfound confidence in managing their finances – a truly delicious data buffet!

Key Indicators of Improved Financial Knowledge and Behavior

Several key indicators signal success. Increased knowledge scores on financial literacy tests are a straightforward measure. But true success goes beyond simple knowledge recall; it’s about behavioral changes. We’re looking for increases in savings rates, responsible debt management, and informed investment choices. For instance, a significant drop in the number of individuals falling prey to predatory lending schemes would be a major victory. Furthermore, an increase in the use of financial planning tools and a reduction in financial stress are also strong indicators of positive impact.

Visual Representation of Long-Term Economic Benefits

Imagine a graph. The X-axis represents time, stretching from “Low Financial Literacy” to “High Financial Literacy.” The Y-axis shows economic indicators like GDP growth, poverty reduction, and entrepreneurship rates. The line representing the economy starts relatively flat under “Low Financial Literacy,” then sharply ascends as financial literacy increases. We see a clear upward trend, with the slope steepening as more Indonesians become financially savvy. This visual dramatically illustrates how improved financial literacy contributes to a more robust and resilient economy, leading to higher overall national prosperity and a reduction in income inequality. Think of it as a financial rollercoaster, but instead of stomach-churning drops, we have a smooth, upward climb towards economic success!

Impact of Financial Literacy on Different Demographic Groups

The impact of Pendidikan Finansial varies across demographic groups. For example, women often face unique financial challenges, and programs tailored to their specific needs may yield significantly different results compared to those targeting men. Similarly, the impact on rural communities might differ from that in urban areas, given varying access to financial services and resources. Analyzing data disaggregated by age, gender, location, and socioeconomic status is crucial to understanding the program’s overall effectiveness and identifying areas requiring targeted interventions. It’s like crafting a bespoke batik – each piece requires unique attention to detail to create a truly beautiful and effective design.

Future Directions and Recommendations for Pendidikan Finansial

The journey towards widespread financial literacy in Indonesia is a marathon, not a sprint. While significant strides have been made, the path ahead requires strategic planning, innovative approaches, and a collaborative spirit. We need to move beyond simply imparting knowledge and delve into fostering genuine financial empowerment among the Indonesian population. This section Artikels key areas for improvement and proposes actionable recommendations to accelerate progress.

Areas Requiring Further Research and Development

Understanding the nuances of financial behavior within diverse Indonesian communities is crucial for crafting effective programs. Further research should focus on identifying specific knowledge gaps across different demographic groups, socioeconomic strata, and geographical locations. This includes investigating the influence of cultural factors on financial decision-making, such as the prevalence of informal financial systems and differing attitudes towards risk and saving. For example, research could explore the effectiveness of tailored financial literacy programs designed for specific groups, such as women entrepreneurs or rural farmers, who face unique financial challenges. This granular approach will ensure that interventions are both relevant and impactful.

Improving Accessibility and Effectiveness of Financial Literacy Programs

Currently, the reach of many financial literacy programs is limited by factors such as language barriers, geographical constraints, and a lack of awareness. To improve accessibility, programs should be delivered through multiple channels, including mobile applications, online platforms, and community-based workshops. Furthermore, incorporating interactive elements, gamification, and storytelling techniques can significantly enhance engagement and knowledge retention. For instance, a mobile app could provide personalized financial advice based on individual circumstances, while community workshops could facilitate peer-to-peer learning and build social support networks around financial management. Regular evaluations and feedback mechanisms are vital to ensure ongoing program improvement.

The Role of Technology in Expanding Access to Financial Education

Technology offers unparalleled opportunities to democratize access to financial education. Mobile banking and digital payment platforms have already become ubiquitous in Indonesia, creating fertile ground for integrating financial literacy modules directly into these existing systems. For example, a bank could incorporate short financial literacy quizzes within its mobile app, rewarding users with small incentives for participation. Furthermore, online learning platforms can provide flexible and scalable access to educational resources, overcoming geographical barriers and catering to diverse learning styles. The use of interactive simulations and virtual reality can enhance the learning experience, making financial concepts more engaging and easier to grasp. This needs to be coupled with efforts to ensure digital literacy among the target population.

Promoting Collaboration Between Government, Private Sector, and NGOs

A truly effective approach to Pendidikan Finansial necessitates a collaborative effort involving all stakeholders. The government can play a crucial role in setting national standards, providing funding, and regulating the financial literacy industry. The private sector, with its resources and expertise, can develop innovative educational tools and programs. NGOs, with their deep community connections, can ensure effective program delivery and address specific needs within vulnerable populations. A coordinated national strategy, perhaps modeled on successful international collaborations, could foster synergy and avoid duplication of effort. This could involve establishing a national financial literacy council that brings together representatives from all sectors to coordinate activities and monitor progress. For example, a joint initiative could see a bank partnering with an NGO to deliver financial literacy training to women entrepreneurs in rural areas.

Ultimate Conclusion

So, there you have it – a whirlwind tour of Pendidikan Finansial! We’ve explored the landscape of Indonesian personal finance, from the foundational principles of budgeting to the complexities of investment strategies. While the path to financial wellness may be paved with unexpected twists and turns, remember that knowledge is power. By understanding the intricacies of personal finance, Indonesians can empower themselves to build a secure and prosperous future. Now go forth and conquer your finances!

Quick FAQs

What are some common mistakes Indonesians make with their finances?

Common pitfalls include impulsive spending, lack of emergency funds, and insufficient retirement planning. Many also struggle with understanding complex financial products.

How can I find reliable financial advice in Indonesia?

Seek advice from reputable financial advisors, banks with strong reputations, and government-backed financial literacy programs. Always verify credentials and be wary of schemes promising unrealistic returns.

Are there any government initiatives supporting financial literacy in Indonesia?

Yes, the Indonesian government has several programs aimed at improving financial literacy, often targeting specific demographics. Check with relevant government agencies for details.