Peraturan Bank Indonesia (BI), or Bank Indonesia Regulations, are the lifeblood of Indonesia’s financial system – a complex web of rules governing everything from interest rates to the legality of using your grandma’s recipe for instant wealth. This isn’t your average bake sale; we’re talking about the financial stability of a nation! Understanding these regulations is crucial, whether you’re a seasoned banker, a curious student, or someone who simply wants to avoid accidentally triggering a national economic meltdown.

From its humble beginnings (we won’t bore you with the historical minutiae, unless you really, really want us to), BI has evolved into a regulatory powerhouse, wielding considerable influence over the Indonesian Rupiah and the overall health of the economy. We’ll explore the key areas of BI regulation, delve into its impact on financial stability, and even peek into the crystal ball to predict the future of regulation in a world increasingly dominated by fintech and digital currencies. Buckle up, it’s going to be a wild ride!

Introduction to Peraturan Bank Indonesia (BI)

Bank Indonesia (BI), Indonesia’s central bank, wasn’t always the impeccably organized financial maestro it is today. Its regulatory journey, like a particularly dramatic Indonesian soap opera, has involved twists, turns, and more than a few tense boardroom meetings. From its humble beginnings, BI’s regulations have evolved to reflect the dynamic landscape of the Indonesian economy, striving to maintain stability amidst the inevitable financial storms.

The overarching goals of BI’s regulations are, in a nutshell, to keep the Indonesian financial system from spontaneously combusting. This involves maintaining price stability, fostering a sound and efficient financial system, and ultimately, contributing to sustainable economic growth. Think of it as a complex financial balancing act, performed on a unicycle, while juggling flaming torches. The stakes are high, the pressure immense, but someone’s gotta do it.

The Legal Basis of BI’s Regulatory Power

BI’s regulatory authority stems primarily from Law Number 23 of 1999 concerning Bank Indonesia, as amended by Law Number 6 of 2009. This legislation grants BI a significant degree of autonomy, allowing it to independently formulate and implement monetary policy and supervise the financial system. It’s a legal framework that grants BI considerable power, but also places upon it a weighty responsibility to act judiciously and in the best interests of the Indonesian economy. Imagine it as a powerful superhero, but instead of fighting crime, it’s battling inflation and preventing financial meltdowns. The cape is metaphorical, of course.

Historical Overview of BI Regulations

Initially, BI’s regulations focused primarily on managing monetary policy and overseeing commercial banks. However, as the Indonesian economy grew in complexity, so too did the scope of BI’s regulatory responsibilities. The Asian Financial Crisis of 1997-98 served as a significant catalyst for regulatory reform, highlighting the need for a more robust and comprehensive framework to prevent future crises. The subsequent years witnessed a considerable expansion of BI’s regulatory purview, encompassing a wider range of financial institutions and instruments. This evolution has involved not only strengthening existing regulations but also introducing new ones to address emerging challenges, such as the rise of digital finance and the increasing integration of the Indonesian economy into the global financial system. It’s a constant game of regulatory catch-up, a never-ending quest to stay ahead of the curve.

Objectives of BI Regulations Concerning the Indonesian Financial System

BI’s regulations aim to achieve several key objectives related to the Indonesian financial system. These include promoting financial stability, maintaining the integrity of the payment system, protecting consumers, and fostering financial inclusion. Each objective is crucial to ensuring the overall health and resilience of the Indonesian financial system. Consider it a multi-faceted approach to safeguarding the financial well-being of Indonesia. It’s a delicate ecosystem that requires constant monitoring and careful management to prevent any unforeseen disruptions.

Key Areas of BI Regulation

Navigating the intricate world of Indonesian finance requires understanding Bank Indonesia’s (BI) regulatory prowess. Think of BI as the financial referee, ensuring fair play and a stable economic field. Their regulations aren’t just dusty tomes; they’re the dynamic rules governing everything from your everyday transactions to the stability of the Rupiah. Let’s delve into the key areas where BI’s regulatory hand shapes Indonesia’s economic landscape.

Major Sectors Regulated by Bank Indonesia

BI’s regulatory reach extends across several crucial sectors of the Indonesian economy. This isn’t just about keeping banks in line; it’s about maintaining a stable and efficient financial system that supports economic growth. The following table provides a snapshot of these key sectors and the regulations governing them. Consider it your cheat sheet to understanding BI’s influence.

| Sector | Key Regulations | Impact on the Indonesian Economy | Recent Amendments |

|---|---|---|---|

| Banking | PBI 17/21/PBI/2021 (Capital Adequacy Ratio), various regulations on lending practices, risk management | Ensures financial stability, promotes responsible lending, supports economic activity through credit availability. A stable banking sector is crucial for investment and growth. | Ongoing adjustments to capital adequacy requirements to align with international standards and address emerging risks, such as those related to climate change. |

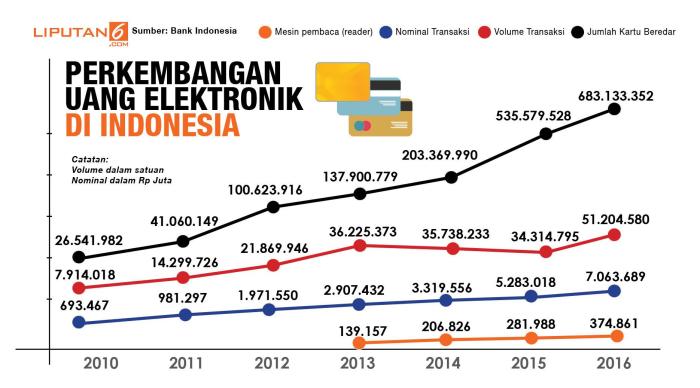

| Payments | Regulations on electronic payment systems, digital banking, and financial technology (fintech) | Facilitates efficient and secure transactions, promotes financial inclusion, drives innovation in the payments landscape, and supports the growth of the digital economy. | Recent amendments focus on enhancing cybersecurity and data protection in digital payment systems, alongside regulating the burgeoning fintech sector. |

| Foreign Exchange | Regulations on foreign exchange transactions, hedging, and capital controls | Maintains the stability of the Rupiah exchange rate, manages foreign exchange reserves, and supports international trade and investment. A stable exchange rate is vital for macroeconomic stability. | Adjustments to regulations often reflect changes in global economic conditions and Indonesia’s position within the global financial system. These adjustments can involve relaxing or tightening capital controls, depending on economic circumstances. |

| Monetary Policy | Regulations on interest rates, reserve requirements, and open market operations | Influences inflation, employment, and economic growth. Monetary policy tools are used to manage inflation and maintain price stability, which is essential for long-term economic health. | The BI rate (7-day Reverse Repo Rate) is adjusted frequently based on economic indicators and global market conditions. These adjustments aim to balance inflation control with supporting economic growth. |

Monetary Policy Regulations and Mechanisms

BI’s monetary policy is the orchestra conductor of Indonesia’s economy. By adjusting interest rates, reserve requirements, and engaging in open market operations, BI aims to maintain price stability and support sustainable economic growth. This delicate balancing act requires careful consideration of various economic indicators and global market trends. For instance, raising interest rates can curb inflation by making borrowing more expensive, but it can also slow down economic activity. The opposite is true for lowering interest rates. BI’s challenge lies in finding the optimal balance.

Banking Supervision and Risk Management

BI acts as the stern but fair guardian of Indonesia’s banking system. Through rigorous supervision and risk management regulations, BI ensures the stability and soundness of banks. Capital adequacy requirements, for example, mandate banks to maintain a minimum level of capital relative to their risk-weighted assets. This acts as a buffer against potential losses, protecting depositors and maintaining financial stability. Think of it as a financial safety net – the higher the capital, the more resilient the bank is to economic shocks. Failure to meet these requirements can result in sanctions, ranging from warnings to restrictions on operations. This ensures banks operate responsibly and minimizes the risk of systemic failures. The consequences of inadequate risk management are far-reaching, potentially impacting the entire financial system.

Impact of BI Regulations on Financial Stability

Maintaining Indonesia’s financial stability is a bit like juggling chainsaws – exhilarating, terrifying, and requiring a truly steady hand. The Bank Indonesia (BI) regulations play a crucial role in this high-stakes act, aiming to prevent financial meltdowns and keep the Indonesian rupiah from doing the tango with the abyss. Their effectiveness, however, is a complex and fascinating story, filled with both triumphs and near-misses.

The effectiveness of BI regulations in maintaining financial stability is a multifaceted issue, best understood through examining specific successes and challenges. The inherent tension between promoting economic growth and mitigating risk is constantly negotiated, creating a dynamic regulatory landscape.

BI Regulatory Successes and Challenges

BI’s regulatory efforts have demonstrably contributed to Indonesia’s improved financial resilience. However, the path hasn’t been without its bumps and near-misses. Understanding both the successes and challenges is crucial for evaluating the overall effectiveness of the regulatory framework.

- Success: Macroprudential Policies: BI’s implementation of macroprudential policies, such as loan-to-value (LTV) ratios for mortgages and the strengthening of capital adequacy requirements for banks, has helped to mitigate systemic risks associated with asset bubbles and excessive credit growth. This proactive approach has helped prevent a repeat of the Asian Financial Crisis’ devastating effects on Indonesia.

- Success: Inflation Control: BI’s commitment to maintaining price stability through effective monetary policy tools has been largely successful. This stability provides a crucial foundation for economic growth and investor confidence. While inflation fluctuates, it has generally remained within manageable levels, showcasing the impact of well-executed monetary policy.

- Challenge: Informal Financial Sector: A significant challenge lies in regulating the vast and often opaque informal financial sector. This sector operates outside the formal regulatory framework, making it difficult to monitor and control risks. This presents a considerable challenge to comprehensive financial stability.

- Challenge: Cybersecurity Threats: The increasing reliance on digital financial services exposes the system to cyber threats and vulnerabilities. Developing and enforcing robust cybersecurity regulations is crucial to safeguarding the integrity of the financial system. A single major cyberattack could have cascading effects on the entire system.

Comparison with Other Southeast Asian Central Banks

BI’s approach to financial regulation can be compared and contrasted with those of other central banks in Southeast Asia, revealing both commonalities and unique characteristics. While each country faces its own specific challenges, there are valuable lessons to be learned from regional best practices and pitfalls.

Generally, Southeast Asian central banks share a focus on maintaining price stability and promoting financial sector development. However, the specific tools and approaches vary based on each country’s unique economic structure and regulatory capacity. For instance, Singapore’s central bank, the Monetary Authority of Singapore (MAS), has a strong emphasis on innovation and fintech regulation, reflecting its highly developed financial sector. In contrast, central banks in less developed economies might prioritize financial inclusion and addressing issues related to poverty and access to credit.

Hypothetical Scenario: Ineffective BI Regulations

Imagine a scenario where BI regulations are inadequate or poorly enforced. Let’s say, for instance, that capital adequacy requirements for banks are significantly weakened, and macroprudential policies are neglected. This could lead to a rapid expansion of credit, fueling an unsustainable asset bubble, particularly in the property market. As interest rates rise, defaults would increase dramatically, potentially triggering a banking crisis and a sharp contraction in economic activity. The rupiah would likely depreciate significantly, leading to higher inflation and widespread economic hardship. This scenario highlights the critical role of robust and effective BI regulations in preventing such a catastrophic outcome. The 1997-98 Asian Financial Crisis serves as a stark reminder of the devastating consequences of insufficient regulatory oversight.

BI Regulations and Technological Advancements

The rapid rise of fintech and digital banking has presented Bank Indonesia (BI) with a thrilling regulatory rollercoaster – a wild ride filled with unexpected twists and turns, but ultimately aimed at ensuring financial stability in this brave new digital world. Adapting to this ever-changing landscape requires a regulatory framework that’s both agile and robust, capable of fostering innovation while mitigating risks. Think of it as herding digital cats, but with far higher stakes.

BI’s regulatory response to this technological tsunami has been, shall we say, impressively proactive. They haven’t just reacted; they’ve anticipated, adapted, and even sometimes preempted the curve, demonstrating a remarkable ability to navigate the complexities of a rapidly evolving digital ecosystem. This proactive approach isn’t just about keeping up; it’s about shaping the future of Indonesian finance.

Adaptation of BI Regulations to Fintech and Digital Banking

BI has shown a commendable willingness to embrace the opportunities presented by fintech, while simultaneously addressing the associated risks. For example, the implementation of regulatory sandboxes allows fintech companies to test innovative products and services in a controlled environment, minimizing potential disruptions to the broader financial system. This approach allows for experimentation and learning, a crucial aspect of navigating the uncharted waters of fintech. Imagine it as a carefully controlled laboratory experiment, but instead of beakers and test tubes, we have digital wallets and peer-to-peer lending platforms. Another example is the development of specific regulations for digital payments and e-money, providing a clear legal framework for these emerging technologies while ensuring consumer protection. These regulations, while detailed, aim to strike a balance between promoting innovation and safeguarding the financial system’s integrity.

Challenges and Opportunities Presented by Technological Advancements

The rapid pace of technological change presents both exciting opportunities and significant challenges for BI’s regulatory framework. One key challenge lies in keeping pace with the constant evolution of fintech products and services. It’s a bit like trying to catch a greased pig – fast, slippery, and requiring constant vigilance. Another challenge involves ensuring the effectiveness of regulations in a borderless digital world, where transactions can occur across geographical boundaries with relative ease. However, this digital landscape also presents exciting opportunities. For instance, technology can enhance the efficiency and effectiveness of BI’s regulatory processes, allowing for better monitoring and supervision of the financial system. Imagine a regulatory dashboard, providing real-time insights into the health and stability of the Indonesian financial system – a futuristic, data-driven approach to financial oversight.

The Future of BI Regulations in a Digital Landscape

Predicting the future is always a risky business, but based on current trends, we can anticipate a continued focus on enhancing regulatory agility and collaboration. BI is likely to leverage technological advancements, such as artificial intelligence and big data analytics, to improve its supervisory capabilities. This might involve the use of sophisticated algorithms to detect and prevent financial crimes, enhancing the overall resilience of the financial system. Furthermore, international collaboration will become increasingly important in addressing cross-border regulatory challenges. The future of BI regulations will likely involve a more dynamic and adaptive approach, continuously evolving to meet the demands of the ever-changing digital landscape. It’s a future where technology and regulation dance a delicate but essential waltz, ensuring the stability and prosperity of Indonesia’s financial system.

International Cooperation and BI Regulations

Bank Indonesia (BI), like a diligent but slightly eccentric conductor of a global financial orchestra, doesn’t operate in a vacuum. Its regulatory approach is significantly shaped by its participation in a complex web of international collaborations, constantly navigating the sometimes-chaotic symphony of global financial markets. Understanding this interplay is crucial to grasping the nuances of BI’s domestic policies and their effectiveness.

International cooperation plays a pivotal role in informing BI’s regulatory strategy. Membership in organizations like the Financial Stability Board (FSB) and the Bank for International Settlements (BIS) provides access to a wealth of information, best practices, and collaborative efforts to address emerging challenges. This isn’t just about exchanging polite pleasantries; it’s about learning from the successes (and, let’s be honest, the spectacular failures) of other central banks worldwide. The sharing of data and analytical frameworks helps BI proactively identify and mitigate risks before they become full-blown crises.

The Influence of Global Financial Regulations on BI’s Domestic Policies

Global financial regulations, often born from international agreements and collaborative initiatives, exert considerable influence on BI’s domestic policies. For example, the Basel Accords, a set of international banking regulations, have profoundly impacted BI’s approach to capital adequacy requirements for Indonesian banks. Compliance with these accords is not merely a box-ticking exercise; it’s about ensuring the stability of the Indonesian banking system within the larger global financial architecture. Failure to adhere to international standards can lead to reduced investor confidence and potentially limit access to international capital markets. Think of it as following the recipe carefully to bake a delicious cake – deviate too much, and you might end up with a culinary catastrophe.

Alignment of BI Regulations with International Best Practices

BI’s regulatory framework generally strives for alignment with international best practices, although the specifics of implementation often reflect the unique characteristics of the Indonesian economy and financial system. This isn’t always a perfect harmony; context matters. What works in one country might not be directly transferable to another. BI often adapts and modifies international standards to suit the Indonesian context, balancing the need for global harmonization with the realities of its domestic environment. For instance, while BI adheres to principles of transparency and disclosure in line with international standards, the specific methods and timelines might differ slightly to accommodate local circumstances. It’s like adapting a popular song – the melody remains the same, but the arrangement is tailored to the local audience.

Enforcement and Compliance of BI Regulations

Bank Indonesia (BI) doesn’t mess around when it comes to enforcing its regulations. Think of them as the financial world’s most serious, yet surprisingly witty, traffic police. They have a range of tools to ensure everyone plays by the rules, and believe me, the penalties for breaking those rules can be… impactful.

BI employs a multi-pronged approach to enforcement, combining proactive monitoring with reactive measures. This isn’t your grandma’s regulatory body; they’re using sophisticated technology and data analysis to identify potential violations before they even become a problem. It’s a bit like having a financial system-wide early warning system, constantly scanning for anomalies and suspicious activity.

Mechanisms for Enforcement

BI’s enforcement arsenal is surprisingly diverse. It includes on-site inspections of financial institutions, thorough reviews of financial reports, and the use of advanced data analytics to detect irregularities. They even conduct regular training programs for financial institutions to ensure everyone is up to speed on the latest regulations. It’s a continuous cycle of monitoring, education, and enforcement, designed to foster a culture of compliance. Think of it as a constant game of regulatory whack-a-mole, but with far less screaming and significantly more spreadsheets.

Penalties for Non-Compliance

Let’s be clear: ignoring BI’s regulations isn’t a game. Penalties can range from hefty fines – think “hefty” as in, “you might need to sell a few yachts” hefty – to temporary suspensions of licenses, and even the ultimate sanction: revocation of a license to operate. The severity of the penalty depends on the nature and extent of the violation. For example, a minor oversight might result in a warning, while a serious breach could lead to a significant financial penalty and potential legal action. One could say that BI’s approach is a carefully calibrated blend of carrot and stick, encouraging compliance while swiftly punishing those who choose to ignore the rules.

Handling Regulatory Violations: A Flowchart

Imagine a flowchart. It starts with a potential violation being detected – either through BI’s proactive monitoring or a reported incident. This leads to an investigation, which might involve interviews, document reviews, and on-site inspections. Based on the findings, BI determines the severity of the violation. If it’s minor, a warning might suffice. For more serious breaches, formal sanctions are imposed, which could include fines, license suspension, or license revocation. Throughout the process, the institution in question has the opportunity to respond and present its case. The final decision is documented and communicated, ensuring transparency and accountability. The entire process is meticulously documented, leaving a clear audit trail. Think of it as a highly organized, and somewhat thrilling, game of regulatory paperwork.

Public Awareness and Understanding of BI Regulations

Let’s be honest, understanding financial regulations isn’t exactly everyone’s idea of a thrilling Saturday night. But Bank Indonesia (BI) knows that public awareness is crucial for a healthy and stable financial system. After all, a well-informed public is a less likely target for financial shenanigans. So, how does BI tackle this monumental task of making financial regulations engaging and understandable? Let’s dive in.

BI employs a multi-pronged approach to ensure its regulations are not only known but also understood. This involves a blend of traditional and modern communication strategies, aiming to reach a diverse audience across different levels of financial literacy. The success of these strategies relies on the principle of clear, concise, and accessible information dissemination. Think of it as translating complex financial jargon into everyday language – a noble pursuit indeed!

BI’s Educational Initiatives

BI’s educational efforts are far from a dry recitation of regulations. They cleverly utilize various platforms to reach a broad spectrum of the Indonesian population. For example, they’ve developed interactive online modules, engaging videos explaining complex financial concepts in simple terms, and even infographics that could make even the most complicated regulation look appealing. Imagine a colourful infographic explaining the intricacies of interest rate adjustments – a visual feast for the eyes and a surprisingly effective learning tool! These initiatives are not just designed for financial professionals; they cater to the everyday citizen, empowering them to make informed financial decisions. They even have workshops and seminars targeting specific groups, such as small business owners and students, ensuring that the information is relevant and tailored to their needs.

The Importance of Transparent Communication, Peraturan Bank Indonesia (BI)

Transparency is the bedrock of public trust. BI understands this perfectly. They’ve established multiple channels for public engagement, ensuring that information regarding regulations is readily available and easily accessible. Their website, for example, provides a comprehensive repository of regulations, explanations, and frequently asked questions. This is not just a static website; it’s a dynamic hub for information updates, ensuring that the public has access to the most current information. Furthermore, BI actively participates in public forums, engages with the media, and utilizes social media to disseminate information and address public concerns. Think of it as BI having a very active and informative social media presence, proactively addressing any queries and concerns in a clear and engaging manner. This proactive approach fosters a sense of openness and accountability, which is essential for building and maintaining public trust. It’s like having a friendly financial advisor always on call, ready to answer your questions without the hefty fees!

Ultimate Conclusion

So, there you have it: a whirlwind tour of Peraturan Bank Indonesia (BI). While navigating the intricacies of these regulations might feel like trying to solve a Rubik’s Cube blindfolded, understanding their importance is paramount. BI’s role in maintaining financial stability is undeniable, and its ongoing adaptation to technological advancements ensures Indonesia’s financial system remains resilient and relevant in the ever-changing global landscape. Remember, knowledge is power, and in the world of finance, that power can be surprisingly lucrative (or at least, less prone to financial ruin).

FAQ Compilation

What happens if a bank doesn’t comply with BI regulations?

Consequences can range from hefty fines to license revocation, depending on the severity of the violation. It’s not a game you want to play.

How does BI promote financial literacy among the public?

BI employs various strategies, including educational campaigns, workshops, and easily accessible online resources. They’re trying their best to make finance less terrifying!

Can I directly appeal a BI regulatory decision?

Yes, there are established channels for appealing decisions, though the process might be as thrilling as watching paint dry. But hey, at least it’s structured.