Effective financial performance management is the cornerstone of any thriving organization. It’s more than just tracking numbers; it’s about strategically aligning financial goals with overarching business objectives, fostering a culture of accountability, and proactively mitigating risks. This exploration delves into the key principles and practical applications of performance management within a financial context, examining everything from defining key performance indicators (KPIs) to leveraging technology for enhanced decision-making.

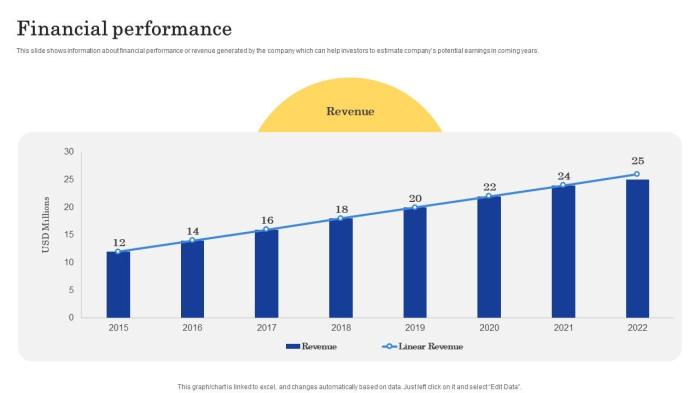

We’ll navigate the intricacies of budgeting, forecasting, and variance analysis, demonstrating how these tools provide crucial insights into financial health. Furthermore, we’ll explore the role of data visualization in effectively communicating complex financial information and highlight strategies for improving cost efficiency and resource allocation. Ultimately, our goal is to equip you with the knowledge and strategies to optimize financial performance and drive sustainable growth.

Defining Performance in Finance

Effective financial performance management hinges on a clear understanding of what constitutes “good” performance. This involves establishing relevant Key Performance Indicators (KPIs) and employing suitable measurement approaches to track progress towards strategic goals. Ultimately, the aim is to create a robust system that provides actionable insights and facilitates informed decision-making.

Key Performance Indicators (KPIs) in Financial Performance Management

Numerous KPIs exist, each offering a unique perspective on financial health. The selection of appropriate KPIs depends heavily on the specific business context, industry norms, and overall strategic objectives. However, some consistently valuable KPIs include:

- Return on Investment (ROI): This classic metric measures the profitability of an investment relative to its cost. A higher ROI indicates greater efficiency and profitability. For example, an ROI of 20% signifies that for every $1 invested, the company earned $0.20 in profit.

- Return on Equity (ROE): ROE gauges how effectively a company uses shareholder investments to generate profit. A higher ROE suggests better management of shareholder capital. A company with an ROE of 15% is generating $0.15 in profit for every $1 of shareholder equity.

- Earnings Per Share (EPS): EPS shows the portion of a company’s profit allocated to each outstanding share. It’s a crucial metric for evaluating the profitability from an investor’s perspective. A consistent increase in EPS typically indicates positive growth and profitability.

- Debt-to-Equity Ratio: This ratio reflects the proportion of a company’s financing that comes from debt versus equity. A high ratio indicates greater financial risk, as the company relies heavily on borrowed funds. A debt-to-equity ratio of 1.5 suggests that the company has $1.5 of debt for every $1 of equity.

- Current Ratio: The current ratio assesses a company’s ability to meet its short-term obligations. A ratio above 1 suggests sufficient liquidity to cover immediate liabilities. A current ratio of 2.0 implies that the company possesses twice the current assets compared to its current liabilities.

Comparing Approaches to Measuring Financial Performance

Different approaches provide distinct insights into a company’s financial standing. Profitability, liquidity, and solvency represent three crucial perspectives.

- Profitability: This focuses on a company’s ability to generate profit from its operations. KPIs such as ROI, ROE, and EPS are central to this assessment. Profitability measures answer the question: “How much profit is the company making?”

- Liquidity: Liquidity evaluates a company’s capacity to meet its short-term financial obligations. The current ratio and quick ratio are key indicators. Liquidity measures address the question: “Does the company have enough readily available cash to pay its bills?”

- Solvency: Solvency assesses a company’s long-term financial stability and its ability to meet its long-term obligations. The debt-to-equity ratio and interest coverage ratio are commonly used. Solvency measures answer the question: “Can the company survive in the long run?”

Aligning Financial Performance Metrics with Business Objectives

Financial performance metrics should not exist in isolation. They must be directly linked to the overarching strategic goals of the business. For instance, a company aiming for rapid expansion might prioritize revenue growth and market share, while a company focused on stability might prioritize profitability and efficient cost management. This alignment ensures that financial performance monitoring contributes directly to achieving the overall business vision.

Framework for Setting Realistic and Measurable Financial Performance Goals

Setting effective financial goals requires a structured approach. A suitable framework involves:

- Define clear objectives: Begin by outlining specific, measurable, achievable, relevant, and time-bound (SMART) objectives. For example, instead of “increase profitability,” aim for “increase net profit margin by 10% within the next fiscal year.”

- Identify key performance indicators (KPIs): Select relevant KPIs that directly reflect progress towards the defined objectives. For example, to achieve the 10% net profit margin increase, KPIs might include sales growth, cost reduction targets, and inventory management efficiency.

- Establish targets and timelines: Set realistic yet challenging targets for each KPI, coupled with specific deadlines. This provides clear milestones and accountability.

- Implement monitoring and reporting mechanisms: Establish regular monitoring and reporting systems to track progress against targets. This allows for timely adjustments and course correction if necessary.

- Conduct regular reviews and adjustments: Periodically review performance against goals, identify areas needing improvement, and make necessary adjustments to the plan.

Financial Performance Measurement Tools and Techniques

Effective financial performance management relies on robust tools and techniques to track, analyze, and improve financial outcomes. This section explores key methods for measuring financial performance, including budgeting and forecasting, variance analysis, and the use of dashboards and data visualization. Understanding these tools is crucial for making informed financial decisions and achieving organizational goals.

Budgeting and Forecasting Methods

Various budgeting and forecasting methods exist, each with its own strengths and weaknesses. The choice of method depends on factors such as the organization’s size, industry, and strategic objectives. Below is a comparison of five common budgeting methods.

| Budgeting Method | Description | Advantages | Disadvantages |

|---|---|---|---|

| Zero-Based Budgeting (ZBB) | Each budget cycle starts from zero; every expense must be justified. | Promotes efficiency, identifies unnecessary spending. | Time-consuming, resource-intensive, can be disruptive. |

| Incremental Budgeting | Uses the previous year’s budget as a base, with adjustments for inflation and anticipated changes. | Simple, quick, requires less effort. | Can perpetuate inefficient spending, lacks strategic focus. |

| Activity-Based Budgeting (ABB) | Allocates resources based on activities and their costs. | Improved cost control, better understanding of cost drivers. | Complex, requires detailed activity analysis. |

| Value-Based Budgeting (VBB) | Prioritizes funding based on strategic value and expected returns. | Focuses on strategic goals, improved resource allocation. | Requires strong strategic planning, can be subjective. |

| Rolling Forecast | Continuously updates the budget over a moving horizon (e.g., 12 months). | Provides a more dynamic and adaptable budget, reflects current market conditions. | Requires ongoing monitoring and adjustments, can be complex to manage. |

Variance Analysis

Variance analysis is a crucial tool for identifying deviations between actual and budgeted or planned financial performance. By systematically analyzing these differences, organizations can pinpoint areas needing improvement and take corrective action. The steps involved are:

- Establish a baseline budget or forecast.

- Gather actual financial data.

- Calculate the difference (variance) between actual and budgeted/forecasted figures.

- Analyze the variances to identify their causes (e.g., price changes, volume changes, efficiency changes).

- Investigate significant variances to determine root causes.

- Develop and implement corrective actions.

- Monitor the effectiveness of corrective actions.

Financial Dashboards and Reporting

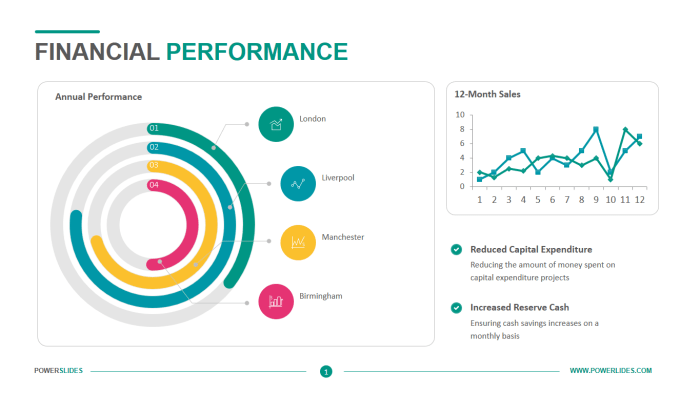

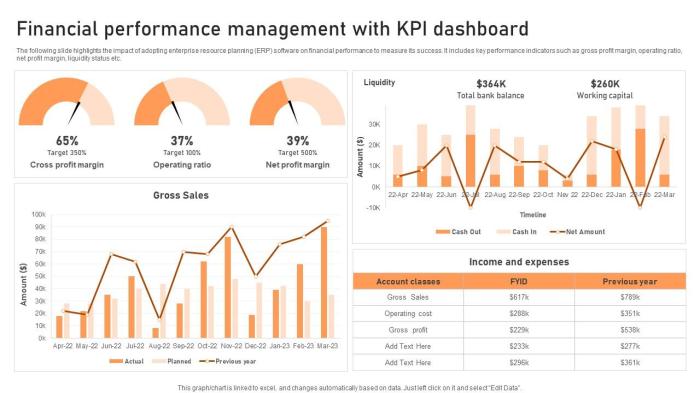

Financial dashboards and reports provide a centralized view of key financial performance indicators (KPIs). They facilitate timely monitoring and decision-making. A well-designed dashboard might include:

A financial dashboard could display metrics such as revenue, expenses, profit margin, cash flow, key ratios (e.g., return on investment, debt-to-equity ratio), and working capital. These metrics would be visually represented using charts and graphs (e.g., line graphs for trends, bar charts for comparisons, and gauges for key ratios). The dashboard should be interactive, allowing users to drill down into the details of specific metrics. For example, clicking on the revenue figure might reveal a breakdown by product line or region.

Data Visualization Techniques

Data visualization effectively communicates complex financial information. Different chart types suit different data and purposes.

- Line charts: Excellent for showing trends over time. Strengths: Easy to understand, clearly illustrates trends. Weaknesses: Can be cluttered with many data series.

- Bar charts: Ideal for comparing different categories or groups. Strengths: Simple to interpret, facilitates comparisons. Weaknesses: Not suitable for showing trends over time.

- Pie charts: Useful for showing proportions or percentages of a whole. Strengths: Visually appealing, clearly shows proportions. Weaknesses: Difficult to compare small segments accurately, not suitable for large numbers of categories.

Improving Financial Performance

Achieving optimal financial performance requires a proactive and strategic approach. It involves identifying and addressing challenges, implementing efficient strategies, and fostering a culture that prioritizes excellence. This section Artikels key strategies and best practices for enhancing financial performance within an organization.

Common Challenges and Obstacles to Optimal Financial Performance

Several factors can hinder a financial organization’s ability to reach its full potential. These include internal inefficiencies, external market pressures, and a lack of strategic alignment. Internal challenges might involve outdated technology, inadequate data analysis capabilities, or a lack of skilled personnel. External factors could include economic downturns, increased competition, or regulatory changes. A lack of clear strategic goals and effective communication can also significantly impact performance. For example, a lack of investment in updated accounting software can lead to significant time delays and increased risk of human error, impacting overall efficiency and profitability. Similarly, failure to adapt to changes in market regulations can result in substantial fines and reputational damage.

Strategies for Improving Cost Efficiency and Resource Allocation

Improving cost efficiency and resource allocation are crucial for enhancing financial performance. Strategies include streamlining processes, automating tasks, negotiating better deals with suppliers, and optimizing the use of technology. For instance, implementing robotic process automation (RPA) can significantly reduce manual data entry errors and free up staff for more strategic tasks. Negotiating favorable payment terms with suppliers can improve cash flow. Investing in advanced analytics tools can improve forecasting accuracy and aid in more effective resource allocation. A well-defined budget, coupled with regular monitoring and adjustments, is also essential for optimal resource management. For example, a company might analyze its spending on travel and identify areas where it can consolidate trips or utilize cheaper options, thereby reducing expenses without impacting productivity.

Step-by-Step Plan for Implementing a Performance Improvement Initiative

Implementing a performance improvement initiative requires a structured approach. A step-by-step plan should include:

- Assessment: Conduct a thorough assessment of the current financial performance, identifying areas for improvement.

- Goal Setting: Define specific, measurable, achievable, relevant, and time-bound (SMART) goals for improvement.

- Strategy Development: Develop a detailed strategy outlining the steps needed to achieve the goals.

- Implementation: Implement the strategy, monitoring progress closely and making adjustments as needed.

- Evaluation: Regularly evaluate the results and make necessary adjustments to ensure the initiative remains on track.

For example, a bank might aim to reduce its operational costs by 10% within the next year. Their strategy might involve automating certain processes, negotiating better deals with vendors, and streamlining internal workflows. Regular monitoring of progress would involve tracking key metrics such as cost per transaction and employee productivity.

Best Practices for Fostering a Culture of Performance Excellence in Finance

Cultivating a culture of performance excellence requires a commitment to continuous improvement and employee engagement. Best practices include:

- Clear Communication: Ensure transparent communication of goals, expectations, and performance metrics.

- Employee Empowerment: Empower employees to take ownership of their work and contribute to performance improvement.

- Training and Development: Invest in training and development programs to enhance employees’ skills and knowledge.

- Recognition and Rewards: Recognize and reward employees for their contributions to achieving performance goals.

- Data-Driven Decision Making: Encourage data-driven decision making based on accurate and timely information.

For example, regular team meetings focusing on performance data and open discussions about challenges and solutions can foster a culture of transparency and collaboration. Implementing a performance-based bonus system can incentivize employees to contribute to overall financial success.

Risk Management and Financial Performance

Effective risk management is not merely a compliance exercise; it’s a crucial driver of enhanced financial performance. A proactive approach to identifying, assessing, and mitigating financial risks directly contributes to a company’s profitability, stability, and long-term sustainability. By understanding and managing potential threats, organizations can protect their assets, optimize resource allocation, and ultimately achieve their financial objectives more reliably.

Effective risk management strategies contribute to improved financial outcomes by reducing the likelihood and impact of negative events. This leads to greater predictability in financial results, allowing for more accurate forecasting and planning. Moreover, a robust risk management framework fosters a culture of accountability and informed decision-making, promoting efficiency and preventing costly mistakes. A well-managed risk profile enhances investor confidence, potentially leading to improved access to capital at favorable terms.

Financial Risks and Mitigation Strategies

Understanding the types of financial risks a company faces is the first step towards effective mitigation. A comprehensive approach involves identifying potential threats across various aspects of the business. Failing to address these risks can lead to significant financial losses and even business failure.

- Credit Risk: The risk that borrowers will fail to repay their debts. Mitigation strategies include thorough credit checks, diversification of lending portfolios, and the use of credit insurance.

- Market Risk: The risk of losses due to fluctuations in market prices, such as interest rates, exchange rates, or commodity prices. Hedging strategies, such as using derivatives, can effectively mitigate market risk. Diversification of investments across different asset classes can also help to reduce exposure.

- Liquidity Risk: The risk that a company will not have sufficient cash on hand to meet its short-term obligations. Maintaining adequate cash reserves, establishing lines of credit, and managing working capital effectively are key mitigation strategies.

- Operational Risk: The risk of losses due to failures in internal processes, people, or systems. Implementing robust internal controls, investing in technology and employee training, and developing comprehensive business continuity plans can help to minimize operational risks.

- Reputational Risk: The risk of damage to a company’s reputation due to negative publicity or events. Building a strong corporate social responsibility program, proactively managing public relations, and responding swiftly and transparently to crises are crucial for mitigating reputational risk. This includes establishing clear ethical guidelines and compliance procedures.

Risk Assessment Framework

A structured risk assessment framework is essential for effectively evaluating and prioritizing financial risks. This framework should provide a consistent and repeatable process for identifying, analyzing, and responding to potential threats. The framework should also facilitate communication and collaboration across different departments and levels of the organization. A well-designed framework will enable a company to focus its resources on the most critical risks, maximizing the impact of mitigation efforts.

A typical framework would involve the following steps:

- Risk Identification: A systematic process of identifying all potential financial risks facing the organization, considering internal and external factors. Brainstorming sessions, checklists, and scenario planning can be used.

- Risk Analysis: Assessing the likelihood and potential impact of each identified risk. This often involves qualitative assessments (e.g., high, medium, low) or quantitative analysis (e.g., using probability and impact matrices).

- Risk Evaluation: Prioritizing risks based on their likelihood and potential impact. This helps focus resources on the most critical risks.

- Risk Response: Developing and implementing strategies to mitigate or manage identified risks. These strategies may include risk avoidance, reduction, transfer (e.g., insurance), or acceptance.

- Risk Monitoring and Review: Regularly monitoring the effectiveness of risk management strategies and updating the risk assessment as needed. This ensures that the framework remains relevant and effective over time.

Technology and Financial Performance Management

Technology has revolutionized financial performance management, offering unprecedented opportunities to enhance efficiency, accuracy, and strategic decision-making. The integration of sophisticated software, automation, and data analytics empowers finance teams to move beyond basic reporting and delve into predictive analysis, fostering proactive strategies for improved profitability and risk mitigation.

The Role of Technology in Enhancing Financial Performance Management

Modern financial management relies heavily on technology to streamline processes and improve accuracy. Software solutions automate repetitive tasks such as data entry and reconciliation, freeing up valuable time for financial analysts to focus on higher-level strategic initiatives. Real-time data dashboards provide immediate visibility into key performance indicators (KPIs), enabling faster identification of trends and potential problems. Furthermore, advanced analytics tools allow for deeper insights into financial data, uncovering hidden patterns and relationships that can inform better decision-making. This proactive approach, facilitated by technology, significantly contributes to improved financial performance.

Financial Management Software Solutions and Their Capabilities

A variety of financial management software solutions cater to different organizational needs and sizes. These range from simple accounting software suitable for small businesses to comprehensive enterprise resource planning (ERP) systems designed for large multinational corporations. Key features often include general ledger management, accounts payable and receivable automation, budgeting and forecasting tools, and reporting and analytics dashboards. The choice of software depends on factors such as the organization’s size, complexity, and specific requirements. For instance, a small business might find sufficient functionality in cloud-based accounting software like Xero or QuickBooks, while a large corporation might require a more robust ERP system such as SAP or Oracle Financials.

Automation and Data Analytics in Financial Processes

Automation and data analytics are transforming financial processes, leading to significant improvements in efficiency and decision-making. Automation streamlines tasks like invoice processing, expense reporting, and bank reconciliation, reducing manual effort and minimizing errors. Data analytics allows for the identification of trends and patterns in financial data, enabling proactive risk management and improved forecasting accuracy. For example, predictive analytics can forecast cash flow more accurately, allowing businesses to optimize their working capital management. Real-time dashboards provide immediate visibility into key financial metrics, facilitating quicker responses to market changes and opportunities.

Comparison of Financial Management Software Features

The following table compares three different financial management software solutions across key features:

| Feature | Software A (e.g., Xero) | Software B (e.g., QuickBooks) | Software C (e.g., SAP) |

|---|---|---|---|

| Automation Capabilities | Basic invoice processing, bank feeds | Advanced invoice processing, expense tracking | Comprehensive automation across all financial processes |

| Reporting and Analytics | Standard financial reports, basic dashboards | Customizable reports, interactive dashboards | Advanced analytics, predictive modeling, real-time dashboards |

| Integration Capabilities | Limited integration with other applications | Good integration with popular business applications | Seamless integration with other ERP modules |

| Scalability | Suitable for small to medium-sized businesses | Scalable to larger businesses | Highly scalable for large enterprises |

Benefits and Challenges of Implementing New Technologies

Implementing new technologies in financial performance management offers significant benefits, including increased efficiency, improved accuracy, better decision-making, and enhanced risk management. However, challenges include the initial investment costs, the need for employee training, potential integration issues with existing systems, and the risk of data security breaches. Careful planning, thorough due diligence, and a phased implementation approach can mitigate these challenges and maximize the return on investment. Successful implementation often requires a strong commitment from leadership, a well-defined project plan, and ongoing support from IT and finance teams.

Concluding Remarks

Mastering financial performance management requires a holistic approach that encompasses robust measurement, proactive risk mitigation, and the strategic utilization of technology. By defining clear KPIs, implementing effective budgeting and forecasting techniques, and fostering a culture of performance excellence, organizations can unlock significant improvements in financial outcomes. This exploration has provided a framework for understanding and implementing these critical strategies, empowering financial professionals to drive sustainable growth and achieve lasting success.

Popular Questions

What are some common pitfalls to avoid in financial performance management?

Common pitfalls include failing to align financial goals with overall business strategy, neglecting regular performance monitoring, insufficiently addressing identified risks, and resisting the adoption of new technologies.

How can I ensure buy-in from all levels of the organization for a performance improvement initiative?

Effective communication, clear articulation of goals and benefits, and active involvement of stakeholders at all levels are crucial for securing buy-in. Transparency and demonstrating early successes are also important.

What are the ethical considerations in financial performance management?

Ethical considerations include maintaining data integrity, avoiding manipulation of results, ensuring transparency in reporting, and adhering to relevant regulations and accounting standards.