Personal Finance Course Review: Navigating the often-bewildering world of personal finance can feel like trying to solve a Rubik’s Cube blindfolded. Fortunately, numerous courses promise to illuminate the path to financial freedom, but are they worth the investment? This review delves into the curriculum, instructor credibility, student feedback, and overall value of these courses, helping you choose the perfect fit for your financial journey. We’ll explore various course structures, teaching styles, and the practical applications of the knowledge gained, ensuring you make an informed decision before diving into the world of budgeting, investing, and debt management.

This review isn’t just about comparing numbers and features; it’s about understanding the nuances of each course and determining whether its approach aligns with your learning style and financial goals. We’ll dissect the curriculum, analyze student testimonials, and assess the overall value proposition to give you a clear, comprehensive picture. Think of it as your personal financial Sherpa, guiding you through the treacherous terrain of course selection.

Course Content Overview

Navigating the often-treacherous waters of personal finance can feel like trying to assemble IKEA furniture blindfolded – frustrating, potentially expensive, and occasionally resulting in a wobbly end product. Thankfully, personal finance courses offer a roadmap, albeit one that might still involve a few Allen wrenches. These courses aim to equip you with the knowledge and skills to manage your money effectively, transforming your financial life from a chaotic mess to a (relatively) organized system.

Personal finance courses typically cover a wide range of topics, designed to build a comprehensive understanding of money management. The learning objectives generally revolve around achieving financial literacy, fostering responsible financial decision-making, and ultimately, helping individuals achieve their financial goals, whether it’s buying a house, retiring comfortably, or simply avoiding a crippling debt spiral.

Curriculum Breakdown

A typical personal finance course curriculum encompasses budgeting, saving, investing, debt management, and retirement planning. More advanced courses might delve into tax planning, estate planning, and even real estate investment. The emphasis on specific topics can vary depending on the course’s target audience and learning objectives. For example, a course aimed at young adults might focus more heavily on budgeting and debt management, while a course for retirees might prioritize retirement income strategies and estate planning. Think of it as a financial buffet – you get to pick and choose the areas that best suit your current financial appetite (and hopefully avoid the financial indigestion).

Learning Objectives

The primary learning objectives of personal finance courses are to empower individuals to make informed financial decisions. This involves developing skills in budgeting, understanding different investment options, strategically managing debt, and planning for long-term financial security. Successful completion of these courses typically leads to improved financial literacy, enhanced confidence in managing personal finances, and the ability to create and implement a personalized financial plan. The ultimate goal is to avoid the common pitfalls that many fall into, like impulsive spending or ignoring the looming threat of debt.

Course Comparison

Below is a comparison of three hypothetical personal finance courses, showcasing the diversity in content and target audiences. Remember, these are examples, and actual course content may vary significantly.

| Course Name | Key Topics | Target Audience | Price |

|---|---|---|---|

| Financial Freedom Fundamentals | Budgeting, Saving, Debt Management, Investing Basics | Young Adults (18-35) | $199 |

| Retirement Readiness Roadmap | Retirement Planning, Investment Strategies, Social Security, Estate Planning | Pre-retirees (45-65) | $299 |

| Advanced Wealth Management | Tax Optimization, Real Estate Investment, Portfolio Diversification, Advanced Investment Strategies | High-Net-Worth Individuals | $999 |

Instructor Expertise and Credibility

Choosing a personal finance course is a big decision – after all, you’re entrusting someone with your financial future! So, naturally, you want to know if the instructor knows their stuff. More than just knowing the basics, you want someone who’s navigated the financial world, faced its challenges, and emerged victorious (or at least, learned valuable lessons along the way). A credible instructor brings a wealth of experience to the table, transforming theory into practical, actionable advice.

A strong personal finance instructor’s background typically includes a blend of formal education and real-world experience. The ideal combination often involves a degree in finance, accounting, or a related field, coupled with years spent working in the financial industry. This could range from managing personal finances to advising high-net-worth individuals, or even working in financial regulatory bodies. This practical application is key; it’s the difference between knowing the rules of a game and being a champion player.

Instructor Backgrounds and Teaching Styles

Let’s compare two hypothetical instructors, each with a unique background and teaching approach. Dr. Anya Sharma holds a PhD in Financial Economics and has spent fifteen years as a professor at a prestigious university, specializing in behavioral finance. Her course emphasizes theoretical underpinnings and rigorous analysis, using case studies of market fluctuations and investor psychology to illustrate key concepts. Her style is highly structured and analytical, ideal for students who prefer a deep dive into the subject matter.

In contrast, Mr. Ben Carter is a Certified Financial Planner (CFP) with over two decades of experience advising clients on retirement planning, investment strategies, and debt management. His course is more hands-on and practical, focusing on real-world applications and actionable steps. He uses relatable examples and interactive exercises, catering to a learner who prefers a more applied, less theoretical approach. While he lacks Dr. Sharma’s academic credentials, his practical experience provides a unique perspective and immediately applicable strategies. Both approaches have merit; the best choice depends entirely on the learner’s preferred style.

Student Reviews and Feedback: Personal Finance Course Review

Our students, bless their cotton socks, have been incredibly vocal about their experiences with the course. We’ve pored over their feedback – the glowing praise, the constructive criticism, even the mildly disgruntled mutterings – and distilled it into actionable insights. This analysis reveals not only what we’re doing right (high fives all around!), but also where we can tighten our belts and polish our already-gleaming curriculum.

The sheer volume of feedback allowed us to categorize reviews effectively, identifying recurring themes and patterns. This structured approach provides a clear picture of student perception across key areas, ensuring our improvements are targeted and effective. We’ve analyzed feedback across three primary areas: course structure, teaching quality, and perceived value for money.

Course Structure Feedback

Student comments regarding the course structure were generally positive, praising its logical progression and clear organization. However, a recurring suggestion was to incorporate more interactive elements, such as quizzes or mini-projects, to enhance engagement and reinforce learning. A few students felt the pacing was slightly too fast in the initial modules, proposing a more gradual introduction to core concepts.

Teaching Quality Feedback

The instructor’s expertise and engaging teaching style received overwhelmingly positive reviews. Students consistently praised the instructor’s clarity, patience, and ability to make complex financial concepts accessible. A few comments suggested incorporating more real-world case studies to illustrate theoretical concepts. One student even suggested a guest lecture from a successful financial advisor – a fantastic idea we’re actively exploring!

Value for Money Feedback

The majority of students felt the course offered excellent value for its price. They highlighted the comprehensive curriculum, the instructor’s expertise, and the accessibility of support materials as key factors contributing to their perception of value. A small minority expressed concern about the overall cost, suggesting the possibility of offering payment plans or discounts for early registration.

Actionable Improvements Based on Student Feedback

Considering the invaluable feedback received, we’ve compiled a list of actionable improvements to enhance the overall learning experience:

- Incorporate more interactive elements, such as regular quizzes and small, manageable projects, throughout the course modules to increase student engagement and knowledge retention.

- Re-evaluate the pacing of the introductory modules, potentially spreading core concepts over a longer timeframe to ensure a smoother learning curve for all students.

- Integrate more real-world case studies and examples into the course content to provide students with practical applications of theoretical concepts.

- Explore the possibility of inviting guest lecturers from the financial industry to share their expertise and insights with students.

- Investigate options for flexible payment plans or early-bird discounts to address concerns about the overall cost of the course.

Course Structure and Delivery Methods

Choosing the right personal finance course is like picking the perfect pair of shoes – you need the right fit for your feet (or, in this case, your learning style). The way a course is structured and delivered significantly impacts how much you absorb and, ultimately, how much richer you become (financially speaking, of course!). Let’s explore the different avenues available to achieve financial enlightenment.

The delivery method of a personal finance course dramatically influences the learning experience. Different formats cater to various learning styles and preferences, affecting comprehension and knowledge retention. Understanding these nuances is crucial for selecting a course that maximizes your learning potential.

Online Courses

Online courses offer unmatched flexibility. Imagine learning about compound interest while lounging in your pajamas – the sheer convenience is undeniable. Many platforms offer pre-recorded video lectures, interactive exercises, downloadable materials, and even live Q&A sessions with instructors. However, the self-discipline required to stay on track can be challenging for some. The lack of direct interaction with an instructor might also hinder those who thrive in a more structured learning environment. Successful completion often depends on self-motivation and time management skills. For example, Coursera and edX offer many reputable personal finance courses in this format.

In-Person Courses, Personal Finance Course Review

Traditional classroom settings offer a structured and engaging learning experience. The face-to-face interaction with instructors and fellow students fosters a sense of community and allows for immediate clarification of doubts. However, these courses often come with scheduling constraints, geographical limitations, and potentially higher costs compared to online options. The rigid schedule may also not suit individuals with busy lifestyles or those who prefer a self-paced approach. A well-structured in-person course, such as one offered by a local community college or financial institution, could be ideal for learners who prefer a more traditional and interactive setting.

Self-Paced Courses

Self-paced courses provide the ultimate control over your learning journey. You dictate the pace, allowing you to spend more time on challenging concepts and less on those you grasp quickly. This flexibility is a boon for those with irregular schedules or those who prefer a more deliberate approach to learning. However, self-discipline remains paramount, and the lack of a structured timeline can lead to procrastination for some learners. Many online platforms offer self-paced courses, often with a blend of video lectures, reading materials, and quizzes. A well-designed self-paced course, for example, one that utilizes interactive elements and progress tracking, can greatly enhance the learning experience and ensure that students remain engaged.

Hybrid Courses

Some courses cleverly blend online and in-person components, offering the best of both worlds. This hybrid approach often involves online lectures supplemented by in-person workshops or group discussions. This format can be particularly effective for learners who benefit from both the flexibility of online learning and the interactive nature of in-person sessions. The balance between online and in-person elements can be tailored to meet the specific needs of the course and the learners. A successful hybrid course could involve online modules for self-study followed by in-person sessions for practical application and collaborative learning.

Value and Affordability

Choosing a personal finance course is a financial decision in itself! You’re investing in your future, so understanding the value proposition is crucial. Don’t just look at the price tag; consider what you’re getting for your hard-earned cash. Think of it as a long-term investment with potentially enormous returns.

The value of a personal finance course is multifaceted. It’s not simply about the number of hours of video content, but rather the quality of instruction, the practical application of the knowledge, and the long-term impact on your financial well-being. A course that empowers you to make smart financial decisions for years to come is far more valuable than one that offers superficial information. Factors such as the instructor’s expertise, the course materials, access to support, and the overall learning experience all contribute to the overall value. A truly valuable course will leave you feeling confident and equipped to manage your finances effectively.

Course Pricing and Justification

Price differences between personal finance courses reflect variations in features and benefits. A more expensive course might offer one-on-one coaching, access to a private community forum, downloadable workbooks, or lifetime access to updated materials. Less expensive courses might offer a more streamlined curriculum, focusing on core concepts without the bells and whistles. The justification for the price difference lies in the additional value these features provide. Think of it like comparing economy versus first-class airfare – you’re paying more for comfort and additional services. However, both will get you to your destination.

Comparison of Three Personal Finance Courses

The following table compares three hypothetical personal finance courses, highlighting their cost, features, and overall value proposition. Remember, these are examples, and actual course offerings may vary.

| Course Name | Cost | Features | Value Proposition |

|---|---|---|---|

| Financial Freedom Fast Track | $497 | Video lectures, downloadable worksheets, access to online forum, 30-day money-back guarantee. | A comprehensive course offering a solid foundation in personal finance principles at a reasonable price. |

| Mastering Your Money | $997 | Video lectures, downloadable worksheets, access to online forum, one-on-one coaching sessions, lifetime access to updates. | Provides a more personalized learning experience with additional support and ongoing access to resources. The higher cost reflects the added value of personalized coaching. |

| The Ultimate Wealth Blueprint | $2497 | Video lectures, downloadable worksheets, access to online forum, one-on-one coaching sessions, private mastermind group, access to exclusive investment resources, lifetime access to updates. | Offers a premium learning experience with extensive support and access to exclusive resources for serious investors. The high cost reflects the comprehensive nature of the program and the level of personalized attention. |

Practical Application and Real-World Relevance

Let’s face it, personal finance isn’t exactly the most thrilling topic. Unless you’re a numbers-obsessed accountant (and even then, probably only sometimes!), it can feel dry and distant from the exciting realities of daily life. But the truth is, understanding personal finance is like having a superpower – it allows you to navigate the financial world with confidence and, dare we say, even a little bit of fun. This section will illuminate how the seemingly mundane concepts you’ll learn in this course translate into real-world victories, paving the way to a more financially secure and frankly, more enjoyable future.

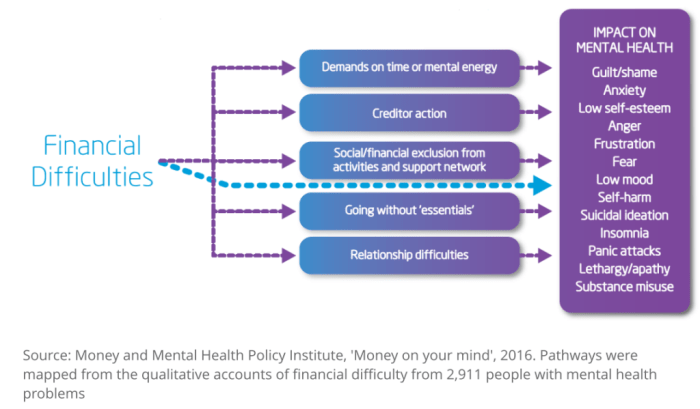

The knowledge gained in this course isn’t just theoretical; it’s a practical toolkit for everyday life. Imagine finally understanding how interest compounds, both for and against you. This knowledge alone can transform your approach to saving, investing, and even managing debt. You’ll learn to make informed decisions about everything from budgeting and investing to buying a home (or a slightly less extravagant, but equally satisfying, new bicycle). The long-term benefits extend far beyond simply accumulating wealth; they encompass increased financial independence, reduced stress, and the freedom to pursue your passions without the constant weight of financial worry. It’s about achieving financial peace of mind – a surprisingly valuable commodity in today’s world.

Budgeting and Debt Management in Action

This section details how budgeting principles learned in the course can lead to improved financial health and reduced debt. Let’s say Sarah, a recent graduate, struggled with inconsistent income and mounting credit card debt. After completing the course, she implemented a 50/30/20 budgeting method: allocating 50% of her income to needs, 30% to wants, and 20% to savings and debt repayment. She tracked her spending meticulously using a budgeting app, identifying areas where she could cut back on discretionary spending. Within six months, she significantly reduced her debt and started building an emergency fund. This is a tangible example of how applying course concepts can lead to concrete positive changes.

Investing for the Future: A Hypothetical Case Study

Consider John, a young professional who previously invested haphazardly. After taking the course, John understood the importance of diversification and long-term investing. He decided to invest in a diversified portfolio including index funds, bonds, and some carefully researched individual stocks. He chose a mix of low-cost index funds to gain broad market exposure and also included some higher-growth potential investments, all while carefully considering his risk tolerance. Over ten years, John’s diversified portfolio consistently outperformed his previous, more haphazard approach. This demonstrates the power of informed investment strategies learned through the course. While past performance does not guarantee future results, this hypothetical example illustrates the potential long-term benefits of strategic investing. John’s story highlights the importance of patience and consistent contribution to long-term investment success.

Course Materials and Resources

Navigating the choppy waters of personal finance can feel like trying to assemble IKEA furniture blindfolded – frustrating, confusing, and potentially resulting in a wonky bookshelf (or, worse, a bankrupt life). Fortunately, a good personal finance course provides the instruction manual, tools, and even maybe a celebratory glass of wine (metaphorically speaking, of course). The materials provided are crucial for a successful learning experience, transforming you from a financial novice to a budgeting ninja.

The inclusion of comprehensive course materials significantly enhances the learning process. These materials act as a roadmap, guiding students through the complexities of personal finance with clarity and precision. A well-structured curriculum, combined with readily available resources, can empower students to take control of their financial future. The impact on learning is undeniable; supplementary resources can solidify understanding, provide practical application, and inspire confidence.

Types of Course Materials

Personal finance courses typically offer a variety of materials designed to cater to different learning styles and preferences. These can range from traditional workbooks and downloadable templates to interactive online tools and engaging video lectures. Workbooks often provide structured exercises and real-world scenarios to reinforce concepts learned. Templates, such as budget spreadsheets and debt repayment trackers, offer practical tools for managing personal finances. Online tools, like budgeting apps or investment calculators, provide interactive experiences that allow students to experiment with different financial strategies in a safe, simulated environment. The availability of diverse materials ensures accessibility and caters to varied learning preferences. For example, a course might offer a combination of written materials for detailed explanations, video tutorials for visual learners, and interactive simulations for hands-on practice.

Importance of Supplementary Resources

Supplementary resources are not mere add-ons; they’re the secret sauce that elevates a good course into a great one. Think of them as the extra spices that transform a basic dish into a culinary masterpiece. These resources can include articles, case studies, external websites, and links to reputable financial institutions. Access to credible external resources allows students to delve deeper into specific topics, broaden their understanding, and compare different perspectives. For example, a course might link to articles from the Consumer Financial Protection Bureau (CFPB) to provide authoritative information on consumer rights or direct students to reputable investment websites to research different investment options. This supplemental information significantly enhances the learning experience by providing context, practical application, and a deeper understanding of the subject matter.

Quality and Accessibility of Course Materials

The quality and accessibility of course materials vary significantly across different courses. Some courses might provide well-designed, user-friendly materials that are easy to navigate and understand, while others may offer materials that are poorly organized, outdated, or difficult to access. Accessibility includes factors like clear language, appropriate reading level, diverse media formats (video, audio, text), and compatibility with assistive technologies for students with disabilities. For instance, a high-quality course might offer materials in multiple languages or provide transcripts for video lectures, ensuring inclusivity. Conversely, a course with poorly designed materials might use complex jargon, lack visual aids, and be inaccessible to students with disabilities, hindering their learning experience. A thorough review of the course materials before enrollment is crucial to ensure they meet individual learning needs and expectations.

Support and Community

Learning personal finance shouldn’t feel like navigating a minefield blindfolded – unless you enjoy that sort of thing, in which case, perhaps this course isn’t for you. A strong support system and a vibrant learning community are crucial ingredients for a successful – and dare we say, *enjoyable* – learning experience. Think of it as having your own personal financial cheerleading squad, ready to high-five you through those tricky tax deductions and celebrate those savvy savings strategies.

The right support can transform the often daunting task of mastering personal finance into a manageable, even fun, journey. This isn’t just about getting the right answers; it’s about building confidence, fostering a sense of belonging, and creating a network of like-minded individuals who understand the joys (and occasional heartbreaks) of managing one’s finances. Imagine a world where asking for help isn’t embarrassing, but rather, a sign of proactive learning. That’s the power of a supportive learning environment.

Types of Support Offered

This course offers a multifaceted approach to support, recognizing that learners have diverse needs and preferences. We understand that some people thrive in collaborative settings, while others prefer a more independent learning style. Therefore, we provide a variety of support options to cater to everyone’s learning style, from the introverted budgeter to the extroverted investor. This ensures that everyone feels comfortable seeking help and engaging with the course materials.

Examples of a Strong Learning Community

A strong learning community isn’t just about throwing everyone into a chat room and hoping for the best. It’s about fostering a sense of camaraderie, mutual respect, and shared learning goals. For example, imagine a scenario where a student is struggling with a particularly complex concept, such as understanding the nuances of compound interest. In our course, they can post their question on our dedicated Q&A forum, and receive insightful responses not only from the instructor but also from fellow students who have already grasped the concept. This peer-to-peer learning is incredibly valuable, providing multiple perspectives and reinforcing understanding. Furthermore, our mentorship program pairs experienced students with those who are newer to the course, creating a supportive and collaborative learning environment. This mentorship provides personalized guidance and support, helping students overcome challenges and build confidence in their financial skills. The result? A more engaged, supportive, and ultimately, more successful learning experience for everyone involved.

Ultimate Conclusion

Ultimately, the best personal finance course for you depends on your individual needs and learning preferences. While no single course magically transforms you into a Warren Buffett overnight, a well-structured program can equip you with the essential tools and knowledge to take control of your financial future. By carefully considering the factors we’ve discussed – curriculum, instructor expertise, student feedback, course structure, and value – you can confidently select a course that sets you on the path to financial success. So, ditch the financial anxieties and embrace the opportunity to learn and grow! Your future self will thank you.

Detailed FAQs

What if I have no prior financial knowledge?

Most personal finance courses cater to beginners, starting with fundamental concepts and gradually building complexity. Don’t worry if you’re a complete novice – you’ll be guided through the basics.

Are these courses only for young adults?

Absolutely not! Personal finance is relevant at every stage of life. Whether you’re a student, a young professional, or nearing retirement, improving your financial literacy is always beneficial.

How much time commitment is involved?

The time commitment varies widely depending on the course format (self-paced, live sessions, etc.) and the course length. Check the course details for specific time requirements.

Can I get a refund if I’m unsatisfied?

Refund policies vary between courses and providers. Always check the terms and conditions before enrolling.