Personal Finance Course Review: Navigating the often-murky waters of personal finance can feel like trying to assemble IKEA furniture blindfolded. But fear not, intrepid saver! This review dives deep into the world of personal finance courses, examining curriculum, instructor credibility, student feedback, and overall value. We’ll uncover the hidden gems (and avoid the financial fiascos) to help you find the perfect course to boost your financial literacy and finally conquer that overflowing spreadsheet.

From online behemoths to intimate in-person workshops, we’ll dissect various course formats, exploring their strengths and weaknesses. We’ll also analyze the cost-effectiveness of these courses, ensuring you get the most bang for your buck (or should we say, your budget?). Prepare for a whirlwind tour of budgeting worksheets, investment case studies, and engaging video lessons – all in the name of financial enlightenment.

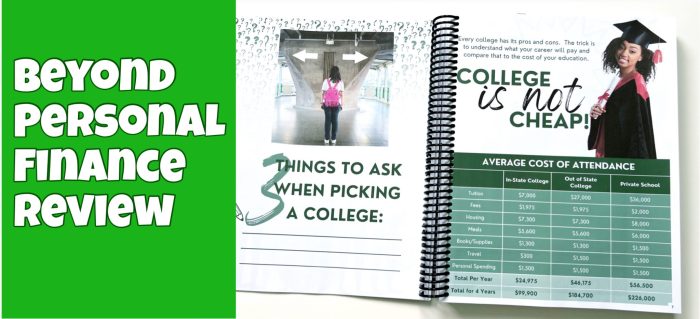

Course Content Overview

Navigating the sometimes-treacherous waters of personal finance can feel like trying to assemble IKEA furniture blindfolded – frustrating, confusing, and potentially leading to a pile of regret. But fear not, intrepid budgeters! A good personal finance course can be your instruction manual, complete with diagrams (probably not involving Allen wrenches, though). These courses offer a structured approach to managing your money, transforming you from a financial novice to a savvy spender (or at least, a slightly less clueless one).

A typical personal finance course follows a logical progression, building upon foundational concepts to reach more advanced strategies. This often involves a blend of theoretical knowledge and practical application, ensuring you not only understand the *why* but also the *how*. The overall goal is to equip students with the tools and confidence to make informed financial decisions.

Key Topics Covered in Personal Finance Courses

Most personal finance courses cover a core set of essential topics. These typically include budgeting and expense tracking, debt management (including strategies for tackling high-interest debt), saving and investing, understanding credit scores and credit reports, and planning for the future (retirement, education, etc.). Some courses may also delve into more specialized areas, such as real estate investment or tax planning. The specific topics and their depth will vary depending on the course level and target audience.

Learning Materials Used in Effective Personal Finance Courses

Effective personal finance courses don’t just rely on lectures; they employ a variety of engaging learning materials. Worksheets help students practice budgeting and tracking expenses, applying theoretical concepts to their own financial situations. Case studies present real-world scenarios, illustrating the consequences of good and bad financial decisions – think of it as financial reality TV, but hopefully with less drama. Videos can break down complex topics into easily digestible chunks, adding a visual element to enhance understanding. Interactive exercises and quizzes further reinforce learning and provide immediate feedback. Think of them as the “level complete” messages in the game of personal finance.

Comparison of Three Personal Finance Courses

The following table compares the content of three hypothetical personal finance courses, each catering to a slightly different audience and learning style. Note that these are examples and actual course content may vary.

| Course Name | Target Audience | Key Topics Covered | Learning Materials |

|---|---|---|---|

| Budgeting Basics | Young adults, beginners | Budgeting, saving, debt basics, understanding credit scores | Worksheets, videos, quizzes |

| Investing for the Future | Individuals with some financial knowledge | Investing strategies, retirement planning, risk management, portfolio diversification | Case studies, interactive exercises, guest lectures |

| Advanced Financial Planning | Experienced investors, professionals | Tax optimization, estate planning, advanced investment strategies, real estate investment | Simulations, in-depth case studies, financial modeling software |

Instructor Expertise and Credibility

Choosing a personal finance course is a big decision – you’re entrusting someone with your financial future, after all! So, naturally, you want to make sure your instructor isn’t just some random person who decided to monetize their budgeting spreadsheet. Let’s delve into what makes a truly qualified personal finance guru.

Knowing the instructor’s background and qualifications is paramount. A well-structured course isn’t just about the content; it’s about the credibility and experience of the person delivering it. Think of it like this: would you trust a self-proclaimed chef to teach you Michelin-star cooking techniques, or would you prefer someone with actual Michelin stars? The same principle applies to personal finance.

Credentials Demonstrating Expertise

The qualifications of a personal finance instructor can significantly impact the quality of the course. A robust background often includes a combination of formal education and practical experience. For instance, a Certified Financial Planner (CFP) designation signifies a high level of competency and adherence to ethical standards. Other relevant credentials might include a Chartered Financial Analyst (CFA) designation, a Master’s degree in Financial Planning, or even a relevant professional license like a CPA (Certified Public Accountant), particularly if the course delves into tax implications. These credentials demonstrate a commitment to professional development and a deep understanding of financial principles.

Practical Experience Versus Theoretical Knowledge

While theoretical knowledge is essential, practical experience is the seasoning that makes a personal finance course truly delicious. Someone with years of experience working with clients, managing investments, or navigating complex financial situations brings a wealth of real-world insights that textbooks simply can’t replicate. They can share anecdotes, case studies, and practical tips that make the learning process more engaging and relevant. Imagine learning about investing solely from a textbook versus learning from someone who has successfully navigated market crashes and built a diversified portfolio. The difference is night and day.

Hypothetical Instructor Bio

Let’s meet Amelia Hernandez, CFP®, a hypothetical instructor whose bio exemplifies the ideal blend of education and experience. Amelia holds a Master’s degree in Financial Planning from a prestigious university and has over 15 years of experience as a financial advisor, working with diverse clientele, from young professionals to retirees. Her expertise lies in retirement planning, investment strategies, and debt management. She’s also a sought-after speaker at financial literacy events and has authored a best-selling book on personal finance. Amelia’s passion is empowering individuals to take control of their finances, and her experience shines through in her engaging and informative teaching style. She’s not just teaching theory; she’s sharing the wisdom gleaned from years of practical application.

Student Reviews and Feedback

The chorus of voices singing the praises (and occasionally, the woes) of our personal finance course provides invaluable insight. Analyzing student feedback, both positive and negative, allows us to fine-tune the course and ensure it’s as effective and enjoyable as a perfectly balanced budget. Let’s delve into the symphony of opinions!

Student reviews offer a unique perspective, reflecting the diverse learning experiences and financial backgrounds of our participants. By examining common themes, we can identify areas of strength and areas ripe for improvement. It’s like a financial performance review, but instead of us reviewing the students, the students review us – a delightfully meta experience!

Positive Review Themes

Positive reviews consistently highlighted the course’s clarity, practicality, and engaging teaching style. Students frequently praised the instructor’s ability to simplify complex financial concepts, making them accessible even to those with limited prior knowledge. Many lauded the real-world examples and case studies, which helped to illustrate the relevance of the material. The interactive exercises and opportunities for personalized feedback were also frequently cited as significant contributors to a positive learning experience. One student described the course as “a financial wake-up call delivered with humor and heart!”

Constructive Criticism from Negative Reviews

While overwhelmingly positive, some negative reviews offered valuable constructive criticism. A common complaint centered on the pace of the course, with some students feeling it moved too quickly. Others suggested that more advanced topics could be explored, catering to those with a more established understanding of personal finance. A few reviews mentioned a lack of sufficient interaction with the instructor, implying that opportunities for personalized feedback could be improved. One student, while acknowledging the course’s overall value, suggested, “More real-time, interactive problem-solving sessions would make this even better.”

Feedback Comparison Across Financial Literacy Levels

Students with higher levels of existing financial literacy often expressed a desire for more challenging content and deeper dives into specific areas, such as advanced investment strategies or tax optimization. They appreciated the course’s foundational elements but yearned for a more rigorous exploration of sophisticated financial instruments. In contrast, students with lower levels of financial literacy emphasized the importance of clear explanations, simplified terminology, and ample opportunities for practice and reinforcement. They valued the course’s accessibility and ability to build a solid foundation. This highlights the importance of catering to a broad range of financial backgrounds and adapting the teaching approach accordingly.

Key Takeaways from Student Reviews

The following bullet points summarize the key insights gleaned from our comprehensive analysis of student reviews:

- Maintain a clear and engaging teaching style.

- Continue incorporating real-world examples and case studies.

- Consider offering different pacing options to accommodate various learning styles.

- Explore opportunities to enhance interaction and personalized feedback.

- Develop advanced modules for students seeking more challenging content.

- Ensure the course remains accessible to students with varying levels of financial literacy.

Course Delivery Methods and Effectiveness

Choosing the right delivery method for a personal finance course is like choosing the right investment strategy – it requires careful consideration of your goals and risk tolerance. While both online and in-person options offer unique advantages, the ideal method depends on individual learning styles and preferences. Let’s dive into the nitty-gritty.

The effectiveness of a personal finance course hinges not just on the content, but also on how that content is delivered. A well-designed course, regardless of its format, should engage students, encourage interaction, and facilitate a deeper understanding of complex financial concepts. We’ll explore various teaching methods and examine how effective course design can make the difference between a financially-literate graduate and someone still scratching their head over compound interest.

Online Versus In-Person Course Delivery

Online courses offer flexibility and accessibility, allowing students to learn at their own pace and from anywhere with an internet connection. However, the lack of face-to-face interaction can hinder engagement and create a sense of isolation. In-person courses provide a more interactive learning environment, fostering collaboration and immediate feedback from instructors. The downside? They lack the flexibility of online options and often require a significant time commitment due to fixed schedules and locations. Think of it as choosing between a meticulously planned robo-advisor and a highly personalized financial consultant – both have their merits.

Teaching Methods in Personal Finance Courses

Effective personal finance courses employ a variety of teaching methods to cater to diverse learning styles. Lectures provide a structured overview of key concepts, while group discussions encourage collaborative learning and critical thinking. Interactive exercises, such as budgeting simulations and investment games, help students apply theoretical knowledge to real-world scenarios. Case studies offer insights into real-life financial decisions, both good and bad, illustrating the practical application of learned concepts. Imagine learning about stocks and bonds through a captivating lecture, then solidifying your understanding by participating in a mock stock market competition – that’s the power of diverse teaching methods.

Effective Course Design for Enhanced Engagement and Learning Outcomes

Effective course design plays a crucial role in boosting student engagement and improving learning outcomes. Clear learning objectives, well-structured modules, and regular assessments ensure students stay on track and understand the material. Incorporating real-world examples, interactive elements, and opportunities for peer-to-peer learning can significantly enhance engagement. Think of it as building a well-diversified investment portfolio – a mix of different assets that reduces risk and maximizes returns. Similarly, a diverse teaching approach reduces the risk of students losing interest and maximizes their learning potential.

Comparison of Course Delivery Methods

The following table compares three different course delivery methods: fully online, blended learning (a mix of online and in-person), and fully in-person.

| Course Delivery Method | Flexibility | Interaction | Cost |

|---|---|---|---|

| Fully Online | High: Learn anytime, anywhere. | Low: Limited face-to-face interaction. | Potentially Lower: Reduced overhead costs for the institution. |

| Blended Learning | Moderate: Combines online flexibility with in-person interaction. | Moderate: Balances online and face-to-face engagement. | Moderate: Costs vary depending on the balance of online and in-person components. |

| Fully In-Person | Low: Fixed schedule and location. | High: Rich face-to-face interaction and immediate feedback. | Potentially Higher: Includes costs associated with physical classroom space and instructor travel. |

Course Value and Cost-Effectiveness

Navigating the world of personal finance courses can feel like wading through a swamp of promises – some shimmering with gold, others… less so. The truth is, the value of a personal finance course isn’t just about the shiny certificate at the end; it’s about the tangible impact on your financial well-being. This section will dissect the cost, the benefits, and ultimately, help you determine if a particular course is worth its weight in… well, let’s say, gold.

The price of personal finance courses varies wildly, influenced by several key factors. Instructor reputation plays a significant role; a course taught by a renowned financial guru will naturally command a higher price than one from a less established educator. Course length and content depth also contribute; comprehensive, multi-module courses are typically pricier than shorter, more focused ones. Finally, the inclusion of additional resources, like personalized coaching or access to exclusive tools, can significantly inflate the cost. Think of it like buying a car – a basic model is cheaper, but a luxury version with all the bells and whistles will cost considerably more.

Factors Influencing Personal Finance Course Prices

Several factors contribute to the price variation among personal finance courses. These include the instructor’s expertise and reputation, the comprehensiveness of the course curriculum, the duration of the program, and the inclusion of supplementary materials or personalized support. For instance, a course developed by a certified financial planner with years of experience will likely be more expensive than one created by a novice. Similarly, a longer, more detailed course offering a wider range of topics will generally command a higher price than a shorter, more focused program.

Return on Investment (ROI) Calculation for Personal Finance Courses

Determining the ROI of a personal finance course requires a thoughtful approach. First, calculate the total cost, including tuition fees, materials, and any additional expenses. Then, estimate the potential financial benefits. This could include increased savings due to improved budgeting, higher investment returns from learning better strategies, or reduced debt from implementing effective debt management techniques. Let’s say a course costs $500, and you estimate saving $1,000 annually due to improved budgeting – your ROI after the first year is 100%. The longer-term benefits could be even more significant.

Comparison of Cost and Value Across Different Personal Finance Courses

Direct comparison is tricky without specific course details. However, we can illustrate the concept. Imagine Course A, a $200 online course focusing on budgeting, costs significantly less than Course B, a $2000 intensive, in-person workshop with personalized coaching spanning several months. While Course B is significantly more expensive, the personalized attention and in-depth learning may lead to a higher long-term ROI, especially for individuals with complex financial situations. The value proposition is different for each.

Cost-Benefit Analysis of Two Hypothetical Personal Finance Courses

The following table provides a simplified cost-benefit analysis comparing two hypothetical personal finance courses:

| Feature | Course A (Online, Self-Paced) | Course B (In-Person, Intensive) | Analysis |

|---|---|---|---|

| Cost | $200 | $2000 | Course A is significantly cheaper. |

| Duration | 4 weeks | 3 months | Course B offers more in-depth learning. |

| Instructor Interaction | Limited | High (personalized coaching) | Course B offers more personalized support. |

| Projected Annual Savings (Estimate) | $500 | $2000 | Course B’s higher cost is potentially offset by greater savings. |

Course Accessibility and Inclusivity

Making personal finance education accessible and inclusive isn’t just a nice-to-have; it’s a must-have, like a well-stocked emergency fund. After all, financial literacy benefits everyone, regardless of their background, learning style, or abilities. This course strives to break down barriers and ensure everyone has a fair shot at achieving financial well-being.

This section details how the course materials are designed to cater to a diverse range of learners and addresses the crucial role of inclusivity in personal finance education. We’ll explore how accessibility features benefit students with disabilities and how we’re working to bridge the financial literacy gap in underserved communities. Think of it as a financial buffet, with options for everyone.

Diverse Learning Styles and Needs

The course employs a multifaceted approach to learning, recognizing that everyone absorbs information differently. We offer a variety of formats including video lectures, interactive quizzes, downloadable worksheets, and supplementary readings. This allows students to choose the methods that best suit their learning preferences, whether they are visual learners who thrive on videos, auditory learners who prefer podcasts, or kinesthetic learners who benefit from hands-on activities. We even include a healthy dose of humor to keep things engaging, because let’s face it, personal finance doesn’t have to be a snooze-fest.

Inclusive Language and Practices in Personal Finance Education

Using inclusive language is paramount. We avoid jargon and overly technical terms, opting for clear and concise explanations. We also actively promote diversity in examples and case studies, showcasing a wide range of financial situations and backgrounds. For instance, instead of solely focusing on high-income earners, we include examples relevant to low-to-moderate income families, single parents, and individuals from various cultural backgrounds. We believe that everyone deserves to feel represented and understood in their financial journey. We avoid gendered language and use person-first language when discussing disabilities. For example, instead of saying “the disabled student,” we say “the student with a disability.”

Accessibility for Students with Disabilities

The course is designed with accessibility in mind. All video lectures include closed captions, and transcripts are provided for all written materials. Furthermore, the course platform is compatible with screen readers and other assistive technologies, ensuring that students with visual, auditory, or motor impairments can fully participate. We’ve also ensured that color contrast is sufficient throughout the course materials, making it easier for those with visual sensitivities to navigate the content. Our commitment is to create a truly barrier-free learning environment.

Addressing Financial Literacy Gaps in Underserved Communities

Bridging the financial literacy gap in underserved communities is a crucial aspect of our mission. We’ve partnered with local organizations to offer the course at reduced or no cost to individuals in these communities. Furthermore, the course content explicitly addresses the unique financial challenges faced by these populations, such as access to credit, predatory lending practices, and systemic inequalities. We provide resources and support tailored to their specific needs, ensuring that everyone has the opportunity to build a secure financial future. We believe that financial empowerment is a key step towards social justice.

Post-Course Support and Resources: Personal Finance Course Review

So, you’ve conquered the thrilling world of personal finance! Congratulations, you magnificent money manager! But the journey doesn’t end with the final exam – think of it more like graduating from budgeting boot camp and entering the real-world arena. Ongoing support is crucial for maintaining those hard-won financial muscles and avoiding a relapse into impulsive spending habits. After all, even seasoned financial gurus need a little (or a lot!) of help sometimes.

The benefits of continued support after completing a personal finance course are multifaceted, offering a lifeline in the sometimes turbulent waters of financial planning. Imagine it as having a financial sherpa guiding you through the treacherous peaks and valleys of your money mountain. Access to ongoing resources provides a safety net, preventing costly mistakes and fostering confident financial decision-making. This isn’t just about avoiding pitfalls; it’s about proactively building a strong, resilient financial future.

Post-Course Resources: A Treasure Trove of Financial Wisdom

Access to valuable post-course resources can significantly impact long-term financial success. These resources act as a personalized financial toolbox, equipping students with the tools they need to navigate various financial situations with confidence. A robust post-course support system shouldn’t be an afterthought; it’s a critical component of a comprehensive learning experience.

Examples of such resources include:

- Online Forums: A lively online community where students can connect, share experiences, ask questions, and celebrate successes (and commiserate over setbacks). Imagine a digital water cooler where the main topic is smart investing, not the latest office gossip. This collaborative environment fosters a sense of camaraderie and provides a valuable support network.

- Mentorship Programs: Pairing students with experienced financial professionals for personalized guidance. This one-on-one support provides tailored advice and helps students apply their newly acquired knowledge to their unique financial situations. It’s like having a personal financial guru in your corner.

- Regular Webinars and Workshops: Continuing education opportunities that delve deeper into specific topics or address emerging financial trends. Think of them as refreshers, keeping your financial knowledge sharp and up-to-date.

- Access to Updated Course Materials: Ensuring students have access to the most current information and resources, reflecting changes in laws, regulations, and market conditions. Because the world of finance is ever-changing, and your resources should be too.

The Power of Community in Financial Success

Community building plays a pivotal role in achieving long-term financial well-being. It’s about more than just acquiring knowledge; it’s about creating a supportive network that encourages accountability, shared learning, and mutual support. A strong sense of community can be the difference between sticking to your financial goals and succumbing to temptation.

Imagine a group of like-minded individuals, all striving towards financial freedom, sharing tips, celebrating milestones, and offering encouragement during challenging times. This shared journey fosters a sense of belonging and accountability, making the process of financial planning more enjoyable and sustainable. It’s like having a team of cheerleaders (and maybe a few tough-love coaches) rooting for your financial success.

Sample Post-Course Support Email

Subject: Congratulations! Your Financial Journey Continues!

Dear [Student Name],

Congratulations on completing our Personal Finance course! We’re incredibly proud of your accomplishment. To help you continue your financial success, we’re excited to offer you access to a range of exclusive post-course resources:

* Access to our vibrant online forum: [Link to forum]

* Invitation to our exclusive mentorship program: [Link to mentorship program sign-up]

* Registration for our upcoming webinar on [Webinar Topic]: [Link to webinar registration]

* Continued access to updated course materials: [Link to updated materials]

Remember, financial success is a marathon, not a sprint. We’re here to support you every step of the way.

Sincerely,

The [Course Name] Team

Illustrative Examples of Course Materials

This section dives headfirst into the juicy details of the course materials, showcasing the practical tools and engaging examples used to bring personal finance to life. We’re not just talking theory here; we’re talking spreadsheets, case studies, and videos so captivating, you’ll actually *enjoy* learning about your money.

Budgeting Worksheet Example

The course includes a downloadable budgeting worksheet designed with a playful yet practical approach. Imagine a vibrant spreadsheet, not your typical drab accounting document. The top section features a whimsical title like “Your Money, Your Adventure!” Below, clearly labeled columns categorize income sources (Salary, Side Hustle, Grandma’s Generous Gift, etc.) and expenses (Rent, Groceries, Avocado Toast – because we all have our priorities). Each expense category is further broken down into subcategories. For instance, “Groceries” might be divided into “Produce,” “Dairy,” “Prepared Foods,” and “Unnecessary Snack Purchases (we’ve all been there).” The worksheet incorporates color-coding: green for income, various shades of orange for essential expenses, and a fiery red for discretionary spending (think concert tickets or that limited-edition Lego set). At the bottom, a simple formula automatically calculates the monthly surplus or deficit, providing a clear picture of your financial health. The worksheet also includes a section for setting financial goals, complete with space for tracking progress and celebrating milestones – perhaps with a celebratory purchase from your “discretionary” fund.

Investing Case Study: The Perils (and Triumphs) of Penny Pickles

This case study follows the fictional journey of Penny Pickles, a young entrepreneur who inherits a small sum of money and must decide how to invest it. The case study presents several investment options, each with its own level of risk and potential return: a low-risk savings account, a moderately risky index fund, and a high-risk investment in a fledgling pickle-flavored ice cream company (Penny’s true passion). The learning objectives are to understand risk tolerance, diversification, and the importance of long-term investment strategies. Students analyze Penny’s choices, considering factors like her age, financial goals, and risk appetite. The case study concludes with a simulated outcome based on various market scenarios, illustrating how different investment strategies can lead to vastly different results. The scenario demonstrates that while high-risk investments can yield high rewards, they also come with a greater chance of significant losses. Penny’s journey, while fictional, teaches valuable lessons about responsible investing and the importance of carefully considering one’s financial situation before making investment decisions.

Video Lesson: Emergency Funds – Your Financial Safety Net (and Why It’s Not a Hammock), Personal Finance Course Review

This video lesson uses a dynamic and engaging approach to explain the crucial role of emergency funds. The video opens with a lighthearted, yet relatable, scenario: a sudden car repair, a surprise medical bill, or a job loss. The video then transitions into a clear explanation of what constitutes an emergency fund, emphasizing the importance of having 3-6 months’ worth of living expenses readily available. The lesson utilizes simple graphics and animations to illustrate the concept of building an emergency fund gradually, like constructing a sturdy castle, brick by brick (rather than a flimsy hammock). The video employs real-life examples, including personal anecdotes and interviews with financial advisors, to reinforce the importance of preparedness. It debunks common myths surrounding emergency funds and offers practical tips on how to start building one, even on a tight budget. The lesson concludes with a call to action, encouraging viewers to create a personalized plan for building their own emergency fund, and reminding them that financial security is not a luxury, but a necessity.

Final Wrap-Up

Ultimately, the best personal finance course for you depends on your individual needs and learning style. However, by carefully considering the factors Artikeld in this review – curriculum, instructor expertise, student feedback, delivery methods, cost, and accessibility – you can confidently choose a program that empowers you to take control of your financial future. So ditch the financial anxieties, embrace the learning, and embark on your journey to financial freedom! You deserve it (and your future self will thank you).

FAQ

What if I already have some financial knowledge? Are these courses still relevant?

Absolutely! Even those with existing financial knowledge can benefit from structured courses. They often provide a comprehensive overview, filling gaps and offering advanced strategies you might not have considered.

How much time commitment should I expect?

Course durations vary greatly, ranging from short, focused workshops to extensive programs spanning several months. Carefully review the course description for details on the time commitment involved.

Are there courses specifically for beginners?

Yes, many personal finance courses cater specifically to beginners, starting with fundamental concepts and gradually building upon them. Look for courses that explicitly mention beginner-friendliness in their descriptions.

What kind of support is offered after the course ends?

Post-course support varies, from online forums and access to course materials to mentorship programs and alumni networks. Check the course details for specifics on ongoing support.