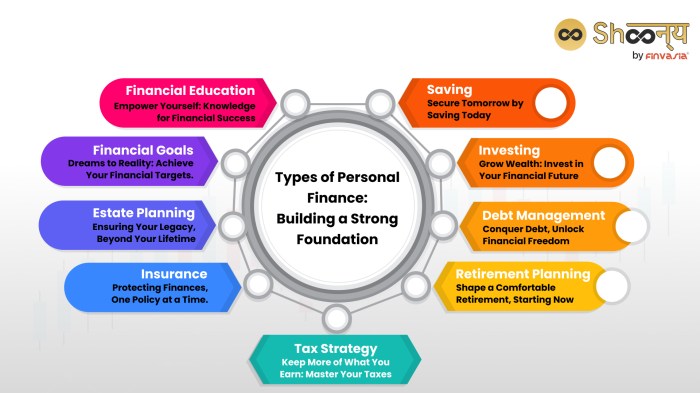

Mastering personal finance is crucial for building a secure financial future. This guide delves into key areas, from budgeting and debt management to saving, investing, and protecting your financial well-being. We’ll explore practical strategies and tools to help you navigate various life stages and achieve your financial goals, empowering you to make informed decisions and take control of your money.

Through detailed examples and clear explanations, we’ll examine effective budgeting techniques, explore various debt reduction strategies, and illuminate the path towards smart saving and investing. We will also address crucial aspects of financial planning across different life stages, offering guidance on protecting your financial information and securing your future.

Budgeting and Expense Tracking

Effective budgeting and expense tracking are fundamental to achieving your financial goals. Understanding where your money goes is the first step towards controlling spending and building a secure financial future. This section will guide you through creating a personal budget, utilizing budgeting apps, and exploring different budgeting methodologies.

Sample Monthly Budget Template

A well-structured budget provides a clear overview of your income and expenses. This allows you to identify areas where you can save and allocate funds towards your priorities. The following template can be adapted to your specific needs. Remember to adjust categories and amounts to reflect your personal financial situation.

| Income | Amount | Expenses | Amount |

|---|---|---|---|

| Salary/Wages | Housing (Rent/Mortgage) | ||

| Other Income (e.g., Investments) | Utilities (Electricity, Water, Gas) | ||

| Transportation (Car Payment, Gas, Public Transit) | |||

| Total Income | Groceries | ||

| Dining Out/Entertainment | |||

| Clothing | |||

| Debt Payments (Loans, Credit Cards) | |||

| Savings & Investments | |||

| Other Expenses | |||

| Total Expenses | |||

| Net Income (Income – Expenses) |

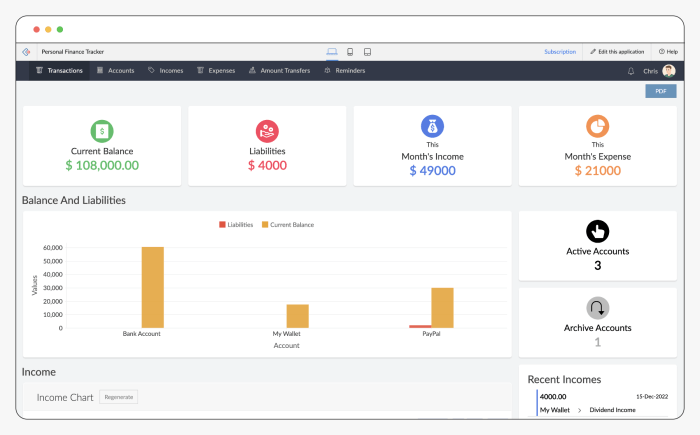

Using Budgeting Apps for Expense Tracking

Budgeting apps automate many aspects of expense tracking, simplifying the process significantly. Most apps connect to your bank accounts and credit cards, automatically categorizing transactions. This eliminates the manual entry of each expense, saving considerable time and effort.

A step-by-step guide for using such apps typically involves:

- Downloading and installing the chosen app.

- Connecting your bank accounts and credit cards securely.

- Reviewing and correcting any miscategorized transactions.

- Setting up budget categories and allocating funds accordingly.

- Regularly monitoring spending and adjusting your budget as needed.

Different Budgeting Methods

Several budgeting methods exist, each with its own advantages and disadvantages. Choosing the right method depends on individual preferences and financial circumstances.

The 50/30/20 rule suggests allocating 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. This provides a simple framework for managing spending. Zero-based budgeting, on the other hand, requires assigning every dollar of your income to a specific category, ensuring all spending is intentional. While more meticulous, it can offer greater control over finances.

Comparison of Budgeting Apps

The following table compares three popular budgeting apps based on their features, pricing, and user ratings (Note: User ratings are illustrative and may vary based on user reviews and app store data):

| App Name | Key Features | Pricing | User Rating |

|---|---|---|---|

| Mint | Automatic transaction categorization, budgeting tools, financial goals tracking, credit score monitoring | Free | 4.5 stars |

| YNAB (You Need A Budget) | Zero-based budgeting, goal setting, debt reduction tools, detailed reporting | Subscription based (monthly or yearly fee) | 4.7 stars |

| Personal Capital | Comprehensive financial dashboard, investment tracking, retirement planning tools, budgeting features | Free (with premium options available) | 4.3 stars |

Debt Management

Effective debt management is crucial for achieving long-term financial stability. Understanding different debt types, employing strategic repayment methods, and exploring options for reducing interest rates are key components of a successful debt reduction plan. Ignoring debt can lead to serious financial consequences, impacting credit scores and overall financial well-being.

Prioritizing and Paying Off High-Interest Debt

Several methods exist for strategically tackling high-interest debt. The debt snowball method focuses on paying off the smallest debts first, regardless of interest rate, to build momentum and motivation. The debt avalanche method prioritizes paying off the debts with the highest interest rates first, minimizing the total interest paid over time. Both methods require discipline and commitment, but choosing the right approach depends on individual preferences and financial circumstances. For example, the debt snowball might be more psychologically beneficial for some, while the debt avalanche offers greater long-term financial savings.

Negotiating Lower Interest Rates with Creditors

Negotiating lower interest rates can significantly reduce the total amount paid on debt. This often involves contacting creditors directly, explaining your financial situation, and proposing a lower interest rate. Presenting a history of on-time payments and demonstrating your commitment to repaying the debt strengthens your negotiating position. Success often depends on your credit history and the creditor’s willingness to compromise. For instance, you could propose a plan to pay a larger lump sum upfront in exchange for a lower interest rate.

Consequences of Various Types of Debt

Different types of debt carry varying consequences. High-interest debt, such as credit card debt, can quickly accumulate significant interest charges, leading to a snowball effect. Unsecured loans, like personal loans, are not backed by collateral, making default more impactful on credit scores. Secured loans, such as mortgages or auto loans, involve collateral, and default can lead to asset repossession. Understanding these consequences helps in making informed borrowing decisions and developing a responsible repayment strategy. For example, defaulting on a student loan can lead to wage garnishment, while defaulting on a mortgage can result in foreclosure.

Resources for Individuals Struggling with Debt

Numerous resources are available for individuals facing debt challenges. Credit counseling agencies offer guidance on budgeting, debt management plans, and negotiating with creditors. Government programs, such as the National Foundation for Credit Counseling (NFCC), provide assistance and resources for debt consolidation and management. These organizations offer valuable support and education to help individuals regain control of their finances. It is crucial to research and choose reputable organizations to avoid scams and fraudulent activities. For example, the NFCC offers free financial counseling and debt management programs.

Savings and Investing

Building a secure financial future requires a strategic approach to both saving and investing. Saving provides a foundation of financial stability, while investing allows your money to grow over time, potentially outpacing inflation and building wealth. This section will explore how to set realistic savings goals, understand various investment vehicles, and utilize diversification strategies.

Setting Realistic Savings Goals

Establishing clear, achievable savings goals is crucial for financial success. These goals should align with your broader financial objectives, providing a roadmap for your savings journey. Consider categorizing your savings into distinct goals: an emergency fund (typically 3-6 months of living expenses), a down payment for a house or car, and long-term retirement savings. For example, if your monthly expenses are $3,000, an emergency fund would aim for $9,000 – $18,000. For a $200,000 down payment, you might save $1,000 per month for 167 months (approximately 14 years). Retirement savings will vary significantly depending on desired lifestyle and retirement age, often requiring consistent contributions over several decades. Breaking down large goals into smaller, manageable steps makes the process less daunting and increases your chances of success.

Investment Vehicles and Associated Risks and Rewards

Several investment vehicles offer diverse risk-reward profiles. Understanding these profiles is essential for making informed investment decisions.

- Stocks: Represent ownership in a company. Higher potential returns but also higher risk due to market volatility. Returns are not guaranteed, and losses are possible.

- Bonds: Represent a loan to a company or government. Generally lower risk than stocks, offering fixed income streams and lower potential for capital appreciation.

- Mutual Funds: Pools money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. Offers diversification benefits but may involve management fees.

- Real Estate: Involves investing in properties, either for rental income or appreciation in value. Can offer significant returns but requires substantial capital investment and involves ongoing management responsibilities.

The risk and reward of each investment vehicle are inversely related; higher potential returns generally come with higher risk. Your investment strategy should align with your risk tolerance and financial goals.

Diversification in Investing

Diversification is a fundamental investment principle that involves spreading your investments across various asset classes to reduce overall risk. By diversifying, you lessen the impact of poor performance in one area by the positive performance in another. For example, instead of investing all your money in a single stock, you could diversify by investing in several stocks across different sectors, bonds, and potentially real estate. This approach aims to minimize losses and potentially increase overall returns. The level of diversification depends on individual risk tolerance and financial goals.

The Compounding Effect of Interest

Compounding is the process where interest earned on an investment is added to the principal amount, and subsequent interest is calculated on the combined total. This snowball effect leads to exponential growth over time.

The formula for compound interest is: A = P (1 + r/n)^(nt)

Where: A = the future value of the investment/loan, including interest

P = the principal investment amount (the initial deposit or loan amount)

r = the annual interest rate (decimal)

n = the number of times that interest is compounded per year

t = the number of years the money is invested or borrowed for

Let’s illustrate: Imagine investing $1,000 at an annual interest rate of 7%, compounded annually. After 10 years, the investment would grow to approximately $1,967. After 20 years, it would grow to approximately $3,870. This illustrates how the power of compounding increases significantly over longer time periods. The longer your money is invested and the higher the interest rate, the greater the impact of compounding. This visual representation shows the exponential growth:

Year | Investment Value

——- | ——–

0 | $1000

5 | $1403

10 | $1967

15 | $2759

20 | $3870

This simple table demonstrates how the investment grows at an accelerating rate due to compounding. The growth is not linear but exponential, highlighting the long-term benefits of consistent investment and the power of compounding.

Financial Planning for Life Stages

Financial planning is a lifelong journey, adapting to the changing needs and priorities at each stage of life. A well-structured plan, adjusted regularly, ensures financial security and allows for the achievement of personal and financial goals. Understanding the unique financial challenges and opportunities presented by different life stages is crucial for effective financial management.

Financial Planning for Young Adults

This stage focuses on building a solid financial foundation. Young adults typically prioritize establishing credit, saving for short-term and long-term goals, and managing early career finances. A key aspect is minimizing debt while maximizing savings potential.

A sample plan might include:

- Credit Building: Obtain a secured credit card or become an authorized user on a trusted individual’s account to establish a credit history. Pay all bills on time and keep credit utilization low (ideally under 30%).

- Emergency Fund: Aim to save 3-6 months’ worth of living expenses in a readily accessible account. This provides a financial safety net for unexpected events.

- Retirement Savings: Start contributing to a retirement account such as a 401(k) or IRA, even if it’s a small amount. Take advantage of employer matching contributions if offered. The power of compounding returns will significantly benefit long-term savings.

- Goal-Oriented Savings: Set specific savings goals, such as a down payment on a car or a house, and create a plan to achieve them. Use budgeting tools to track progress and make adjustments as needed.

Financial Planning for Families with Young Children

This stage involves managing increased expenses while balancing saving for the future. Major considerations include childcare, education, and housing. Effective budgeting and financial planning are essential to navigate these significant costs.

Key elements of a financial plan for this life stage include:

- Childcare Costs: Budget for childcare expenses, exploring options like daycare centers, in-home care, or family assistance. Consider the cost of childcare as a significant ongoing expense.

- Education Savings: Start saving early for your children’s education using 529 plans or other education savings accounts. Even small, consistent contributions can accumulate significantly over time due to tax advantages and compounding interest.

- Mortgage Planning: If planning to purchase a home, carefully consider mortgage options, ensuring the monthly payments are manageable within the family’s budget. Factor in property taxes, insurance, and potential maintenance costs.

- Life Insurance: Secure adequate life insurance to protect your family’s financial well-being in case of unexpected events. The policy amount should cover outstanding debts, future educational expenses, and provide for the family’s ongoing needs.

Financial Planning for Retirement

Retirement planning involves saving aggressively throughout your working years to ensure financial security during retirement. This requires careful consideration of various factors including Social Security benefits, pension plans, and personal savings.

Strategies for successful retirement planning include:

- Maximize Retirement Savings: Contribute the maximum amount allowed to retirement accounts such as 401(k)s and IRAs. Consider tax-advantaged accounts to reduce your tax burden.

- Social Security Benefits: Understand how Social Security benefits work and plan your retirement around the expected benefits. Delaying benefits can result in higher monthly payments.

- Pension Plans: If you have a pension plan, understand its terms and how it will contribute to your retirement income. Consider the impact of inflation on your pension’s purchasing power.

- Healthcare Costs: Factor in the significant costs associated with healthcare during retirement. Explore options like Medicare and supplemental health insurance.

- Investment Diversification: Diversify your retirement investments to mitigate risk and potentially maximize returns. Consider a mix of stocks, bonds, and other asset classes based on your risk tolerance and time horizon.

Comparison of Financial Challenges and Opportunities Across Age Groups

Different age groups face unique financial challenges and opportunities. Young adults often struggle with building credit and saving for the future, while families with young children face significant expenses related to childcare and education. Retirement planning becomes increasingly crucial as individuals approach their later years, requiring careful consideration of income sources and healthcare costs. Each stage presents distinct opportunities for financial growth and security, provided appropriate planning and management strategies are employed. For example, young adults have more time to benefit from the power of compounding interest, while older individuals may have accumulated assets that can be strategically managed for retirement income.

Protecting Your Financial Well-being

Securing your financial future involves more than just budgeting and investing; it also requires actively protecting yourself from threats and planning for unforeseen circumstances. This section will cover essential strategies to safeguard your financial well-being, ensuring your hard-earned money remains secure and available for your future goals.

Common Financial Scams and Fraudulent Activities

Financial scams are prevalent, targeting individuals through various deceptive tactics. Understanding these schemes is the first step in avoiding them. Common examples include phishing emails disguised as legitimate communications from banks or government agencies, requesting personal information or login credentials. Another prevalent scam involves unsolicited calls or texts promising unrealistic investment returns or lottery winnings, often requiring upfront payments. Advance-fee fraud, where victims pay upfront fees for services that are never delivered, is also common. To avoid these scams, be wary of unsolicited communications requesting personal information, verify the legitimacy of any request through official channels, and never send money to someone you don’t know or trust. Remember, legitimate organizations will never ask for your banking details via email or text message.

Insurance and Choosing Appropriate Coverage

Insurance provides a crucial safety net against unexpected events. Health insurance protects against high medical costs, while auto insurance covers damages and injuries resulting from accidents. Homeowners or renters insurance protects your property from damage or theft, and life insurance provides financial security for your dependents in the event of your death. Choosing appropriate coverage involves assessing your individual needs and risk tolerance. Factors to consider include your age, health, lifestyle, and the value of your assets. Comparing policies from different providers and understanding the terms and conditions of each policy is vital before making a decision. Consult with an insurance broker to determine the most suitable coverage for your circumstances.

The Benefits of a Will and Power of Attorney

A will Artikels how your assets will be distributed after your death, ensuring your wishes are followed. Without a will, the distribution of your assets is governed by state laws, which may not align with your preferences. A power of attorney designates someone to manage your financial affairs if you become incapacitated. This is crucial in ensuring your financial matters are handled responsibly should you be unable to manage them yourself. Creating a will and power of attorney provides peace of mind, knowing your affairs are in order and your loved ones are protected. It is advisable to consult with an attorney to draft these legal documents, ensuring they are legally sound and reflect your specific wishes.

Protecting Your Financial Information from Identity Theft

Identity theft occurs when someone uses your personal information without your consent to commit fraud. Protecting your information requires vigilance and proactive measures. This includes regularly monitoring your bank and credit card statements for unauthorized activity, using strong and unique passwords for online accounts, and shredding documents containing sensitive information. Be cautious about sharing personal information online or over the phone, and consider using a credit monitoring service to detect any suspicious activity early. In the event of identity theft, report it immediately to the relevant authorities and credit bureaus, and take steps to correct any inaccuracies on your credit report. A proactive approach to protecting your personal data is essential to mitigating the risk of identity theft.

Ultimate Conclusion

Taking control of your personal finances is a journey, not a destination. By implementing the strategies and techniques Artikeld in this guide, you can build a solid financial foundation, navigate life’s challenges with confidence, and work towards achieving your long-term financial aspirations. Remember, consistent effort and informed decision-making are key to securing a prosperous future. Start planning today and reap the rewards of financial well-being.

Popular Questions

What is the difference between the debt snowball and debt avalanche methods?

The debt snowball method prioritizes paying off the smallest debts first for motivation, while the debt avalanche method focuses on paying off the highest-interest debts first to save money on interest.

How much should I contribute to my retirement savings?

The recommended contribution depends on your income, age, and retirement goals. A good starting point is to aim for at least 15% of your pre-tax income.

What is an emergency fund, and how much should I have?

An emergency fund is a savings account holding 3-6 months’ worth of living expenses to cover unexpected events like job loss or medical emergencies.

How can I improve my credit score?

Pay bills on time, keep credit utilization low, and maintain a diverse credit history. Avoid opening too many new accounts simultaneously.