Personal Finance Management Review: Think of it as your financial Sherpa, guiding you through the treacherous mountains of debt and into the sunny valleys of financial freedom. This isn’t your grandpa’s dusty accounting textbook; we’re talking witty strategies, surprisingly engaging budgeting methods, and investment advice that won’t bore you to tears (we promise!). Prepare to conquer your finances with humor and a healthy dose of common sense.

This review delves into the essential aspects of personal finance management, from crafting a budget that doesn’t feel like a prison sentence to navigating the sometimes-scary world of investing. We’ll explore practical strategies for managing debt, saving for the future, and protecting your hard-earned cash. Get ready for a financial adventure that’s both informative and, dare we say, fun!

Introduction to Personal Finance Management

Ah, personal finance. The phrase itself can induce a mild panic attack in even the most financially savvy among us. But fear not, dear reader! Mastering your money doesn’t require a degree in astrophysics (though it *might* help with predicting market fluctuations). Effective personal finance management is simply about taking control of your financial future, and it’s surprisingly less daunting than wrestling a grumpy badger.

Effective personal finance management is crucial for achieving financial stability and security. Without a plan, your money can vanish faster than a plate of cookies at a children’s party. It’s the key to unlocking your dreams, whether that’s buying a cozy cottage by the sea, retiring comfortably, or simply avoiding the gnawing anxiety of impending debt. Essentially, it’s about ensuring your money works *for* you, not the other way around.

Key Components of a Robust Personal Finance Plan

A solid personal finance plan is like a well-built house: it requires a strong foundation and carefully constructed components. Without these elements, the whole thing could crumble.

A robust personal finance plan typically incorporates several key areas: budgeting, saving, investing, debt management, and insurance. Let’s explore each of these crucial elements in more detail. Budgeting involves tracking your income and expenses to understand where your money is going. Saving allows you to build a financial cushion for unexpected events or future goals. Investing helps your money grow over time, potentially outpacing inflation. Debt management involves strategies to reduce and eliminate debt, while insurance protects you from unforeseen financial risks. Each element plays a vital role in creating a comprehensive and effective financial strategy.

Benefits of Improved Financial Management

The rewards of improved financial management are numerous and far-reaching, extending beyond simply having more money in your bank account. Imagine the relief of knowing you have enough saved for emergencies, the excitement of achieving a long-term goal, or the freedom from the crushing weight of debt.

Improved financial management can lead to reduced stress and increased peace of mind. Knowing you’re on track financially can significantly reduce anxiety about money matters. It also opens doors to new opportunities, allowing you to pursue your passions or make significant life changes without the constant worry of financial instability. For example, improved financial management could enable someone to start their own business, pursue further education, or simply enjoy more leisure time without the constant pressure of financial constraints. The benefits extend to long-term financial security, allowing for comfortable retirement and the ability to leave a legacy for future generations.

Budgeting and Expense Tracking

Ah, budgeting. The very word conjures images of spreadsheets, meticulous calculations, and the soul-crushing realization that your avocado toast habit is bankrupting you (metaphorically, of course…unless?). But fear not, dear reader! Mastering budgeting and expense tracking isn’t about becoming a financial monk; it’s about gaining control of your money so you can actually *enjoy* it.

Budgeting and expense tracking are the cornerstones of successful personal finance. By understanding where your money goes, you can identify areas for improvement and make informed decisions about your spending habits. This empowers you to achieve your financial goals, whether that’s buying a dream house, retiring early, or simply having enough money for that aforementioned avocado toast (in moderation, of course).

Different Budgeting Methods

Choosing the right budgeting method is like choosing the right weapon in a financial battle – some are better suited to certain personalities and lifestyles than others. Let’s explore a few popular contenders:

| Method | Description | Pros | Cons |

|---|---|---|---|

| 50/30/20 Rule | Allocate 50% of your after-tax income to needs, 30% to wants, and 20% to savings and debt repayment. | Simple and easy to understand; provides a clear framework. | Can be too rigid; doesn’t account for individual circumstances or fluctuating income. |

| Zero-Based Budgeting | Assign every dollar of your income to a specific category, ensuring that income minus expenses equals zero. | Highly effective for controlling spending and maximizing savings; promotes mindful spending. | Requires more time and effort; can be complex for beginners. |

| Envelope System | Allocate cash to different envelopes representing spending categories (e.g., groceries, entertainment). | Visual and tangible; helps avoid overspending in specific categories. | Less convenient for tracking expenses; not ideal for digital transactions. |

| 50/30/20 Rule with Tweaks | A modified 50/30/20 rule, where the percentages are adjusted based on personal priorities and financial goals. For example, someone prioritizing retirement might allocate 30% to savings. | Flexible and adaptable; allows for personalized financial planning. | Requires more planning and self-discipline than the standard 50/30/20 rule. |

Effective Expense Tracking

Tracking your expenses might sound tedious, but it’s the key to understanding your spending habits. Think of it as a financial detective story – you’re uncovering the mysteries of where your money vanishes! Fortunately, several tools can make this process easier and even…fun? (Okay, maybe not *fun*, but definitely less painful).

Many people find success using spreadsheets (like Google Sheets or Microsoft Excel) to manually record their transactions. Others prefer budgeting apps, which often offer features like automated transaction imports, category tracking, and visual representations of spending patterns. Some popular examples include Mint, YNAB (You Need A Budget), and Personal Capital. The best tool depends on your personal preferences and tech savviness.

Identifying and Reducing Unnecessary Spending

This is where the real magic happens. Once you’ve tracked your expenses for a while, you’ll start to see patterns emerge. You might discover that your daily coffee habit is costing you more than you thought, or that those impulse online purchases are adding up.

Strategies for reducing unnecessary spending include:

* Identifying recurring subscriptions: Many people unknowingly pay for services they no longer use. Regularly review your subscriptions and cancel any that are unnecessary.

* Tracking impulse purchases: Pay attention to your spending triggers and develop strategies to avoid impulsive buys.

* Setting a spending limit: Establish a daily or weekly spending limit for non-essential items and stick to it.

* Using the “waiting period” technique: Before making a significant purchase, wait a certain amount of time (e.g., 24 hours) to see if you still want it.

Debt Management Strategies

Ah, debt. That delightful little financial gremlin that whispers sweet nothings about instant gratification while simultaneously plotting your financial demise. But fear not, intrepid budgeter! We’re here to arm you with the strategies to slay this beast and reclaim your financial freedom. We’ll explore effective methods to tackle your debts, transforming them from a mountain of worry into a molehill of manageable payments.

Debt repayment methods aren’t a one-size-fits-all affair; they’re more like a tailor-made suit for your unique financial physique. Understanding the different approaches allows you to choose the one that best aligns with your personality, financial situation, and tolerance for stress (because let’s be honest, dealing with debt can be stressful!).

Debt Snowball vs. Debt Avalanche, Personal Finance Management Review

The debt snowball method focuses on paying off the smallest debts first, regardless of interest rates. This approach provides a quick psychological win, boosting your motivation as you see debts disappear. Imagine it like knocking down small dominoes before tackling the larger ones – satisfying and momentum-building. The debt avalanche method, conversely, prioritizes paying off debts with the highest interest rates first, minimizing the total interest paid over time. This is the mathematically superior approach, but can be less motivating in the early stages as you might not see quick wins. Think of it as strategically targeting the biggest, most menacing dominoes first to minimize the overall damage. The choice depends on your preferred approach: quick psychological wins versus long-term financial optimization.

Creating a Debt Repayment Plan

A well-structured debt repayment plan is your roadmap to financial freedom. It requires discipline, but the rewards are well worth the effort.

- List all debts: Compile a comprehensive list of all your debts, including credit cards, loans, and any other outstanding balances. Note the balance, interest rate, and minimum payment for each.

- Choose a repayment method: Select either the debt snowball or debt avalanche method, based on your personality and financial goals. Remember, there’s no right or wrong answer – the best method is the one you can stick to.

- Create a budget: Develop a realistic budget that accounts for all your income and expenses. Identify areas where you can cut back to free up extra funds for debt repayment.

- Allocate extra funds: Direct any extra income towards your debt repayment. Even small amounts can make a significant difference over time. Consider side hustles or selling unwanted items to boost your repayment capacity.

- Track your progress: Regularly monitor your progress and make adjustments to your plan as needed. Celebrate your milestones to stay motivated!

- Seek professional help: If you’re struggling to manage your debt, consider seeking professional financial advice. A credit counselor can help you create a plan and negotiate with creditors.

Consequences of High-Interest Debt and Solutions

High-interest debt is a financial vortex that can quickly suck you into a cycle of never-ending payments. The interest alone can significantly outweigh the principal amount, leaving you perpetually behind. This can lead to stress, financial instability, and even damage to your credit score. For example, imagine a $10,000 credit card debt with a 20% interest rate. Ignoring it could lead to a snowball effect, making the debt even larger over time.

To combat this, focus on aggressively reducing high-interest debt through methods Artikeld above. Consider debt consolidation to lower your interest rate and simplify payments. This involves obtaining a lower-interest loan to pay off multiple high-interest debts. Remember, seeking professional help is not a sign of weakness but a strategic move towards regaining control of your finances.

Savings and Investing

So, you’ve conquered budgeting and are swimming in a sea of fiscal responsibility (or at least treading water). Congratulations! Now it’s time to talk about the fun stuff: growing your money. We’re not talking about magic beans here, though that would be amazing. We’re talking about smart strategies to build wealth and secure your financial future. Think of it as financial fitness – the more you work at it, the better you’ll feel (and the bigger your bank account will get).

Saving and investing are two sides of the same coin – or, more accurately, two parts of a well-oiled financial machine. Saving provides the fuel, while investing provides the engine to propel you toward financial freedom. Let’s dive in.

Emergency Fund Establishment

Establishing an emergency fund is crucial. Think of it as your financial parachute – you hope you never need it, but when you do, you’ll be incredibly grateful you had it. A well-stocked emergency fund acts as a buffer against unexpected expenses like job loss, medical emergencies, or car repairs. Aim for 3-6 months’ worth of living expenses. This might seem daunting, but even small, consistent contributions add up over time. Imagine this: You’re suddenly faced with a $2,000 car repair. Without an emergency fund, you might be forced into debt. With one, you simply reach into your savings and handle it without disrupting your budget.

Investment Options

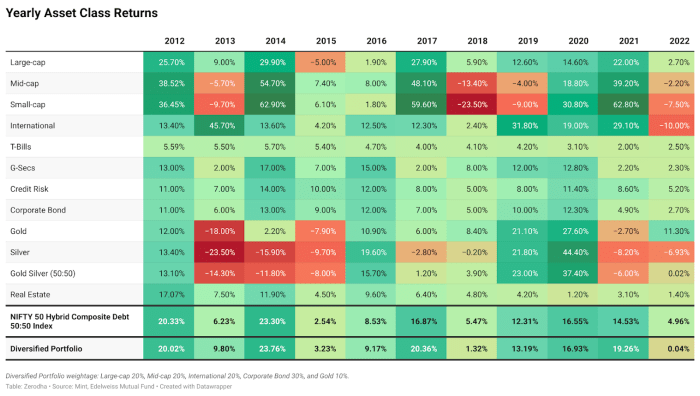

Investing your savings can help your money grow faster than it would in a low-interest savings account. Several investment options cater to different risk tolerances and financial goals. Remember, higher potential returns often come with higher risks.

- Stocks: Represent ownership in a company. Their value fluctuates based on the company’s performance and market conditions. Investing in individual stocks can be risky, but diversification through a portfolio can mitigate some of that risk. Think of it like this: You’re betting on the success of a particular company. If the company thrives, your investment grows. If it struggles, your investment might decrease.

- Bonds: Essentially loans you make to a company or government. They typically offer lower returns than stocks but are generally considered less risky. Imagine lending money to a very reliable borrower – you get your money back plus interest, but the growth is more predictable and slower.

- Mutual Funds: Professionally managed portfolios that invest in a diversified mix of stocks, bonds, or other assets. They offer diversification and professional management, making them a popular choice for investors of all levels. Think of it as hiring an expert to manage your money for you – they spread the risk across many different investments.

Savings Goal Setting and Financial Independence

Setting realistic savings goals is key to achieving financial independence. Start by defining your goals – are you saving for a down payment on a house, retirement, or something else? Break down large goals into smaller, more manageable milestones. For example, instead of aiming for $100,000 in savings, focus on saving $10,000 per year. Regularly review your progress and adjust your strategy as needed. Remember, the journey to financial independence is a marathon, not a sprint. Consistency is crucial. Imagine running a marathon: You wouldn’t expect to run 26 miles on your first attempt. Similarly, building wealth takes time and dedication.

Retirement Planning

Planning for retirement might sound like a distant, dusty topic, but trust us, it’s more exciting than a tax audit (and significantly less painful). Think of it as securing your golden years – a time when you can finally afford that ridiculously oversized hat you’ve always dreamed of. Proper retirement planning involves understanding your options, estimating your needs, and creating a realistic roadmap to financial freedom.

Retirement savings vehicles are the trusty steeds that carry you towards your financial sunset. Understanding their nuances is key to maximizing your returns and minimizing your taxes.

Retirement Savings Vehicles

Choosing the right retirement savings vehicle depends on your individual circumstances, risk tolerance, and tax situation. Two popular options are 401(k)s and IRAs. 401(k) plans are employer-sponsored, often offering matching contributions – free money! IRAs, on the other hand, are individual retirement accounts, offering various options depending on your income and contribution limits. Traditional plans offer tax deductions now, while Roth plans offer tax-free withdrawals in retirement. The choice depends on your current and projected tax bracket. Imagine it like choosing between a delicious dessert now or a delicious dessert later – both are sweet, but the timing impacts the overall experience.

Factors Affecting Retirement Savings Needs

Determining how much you need to save for retirement involves a bit of financial crystal-ball gazing, but with a healthy dose of realism. Several key factors influence your retirement savings needs. These include your desired lifestyle, expected lifespan, current savings, and anticipated healthcare costs. For instance, if you envision a lavish retirement filled with private jet travel and caviar, you’ll need to save considerably more than someone aiming for a more modest lifestyle. Similarly, longer life expectancies require larger nest eggs. Planning for unexpected medical expenses is also crucial, as healthcare costs can significantly impact your retirement budget.

Sample Retirement Plan Timeline

A well-structured retirement plan unfolds over time, much like a perfectly aged wine. Consider this sample timeline, which is highly adaptable to individual needs and circumstances:

| Age | Milestone |

|---|---|

| 25-35 | Start contributing to a 401(k) or IRA; begin building an emergency fund; establish good financial habits. This is the ideal time to take advantage of the power of compounding. Even small contributions early on can make a huge difference over time. |

| 35-45 | Increase retirement contributions; review and adjust investment strategy; consider purchasing a home or paying off existing debts. This is when you should really be thinking about maximizing your contributions to take advantage of employer matching and tax advantages. |

| 45-55 | Re-evaluate retirement goals and savings; explore additional investment opportunities; begin planning for potential healthcare expenses. As you get closer to retirement, it’s crucial to make sure your savings are on track. Consider adjusting your investment strategy to become more conservative as you approach retirement. |

| 55-65 | Maximize retirement contributions; carefully manage investments; begin researching and selecting health insurance options for retirement. This is the final push! Make sure you’re on track to meet your retirement goals. Pay close attention to your investment portfolio and adjust as needed. |

Remember: This is just a sample timeline. Consult with a financial advisor to create a personalized retirement plan that aligns with your specific circumstances.

Protecting Your Finances

Let’s face it, money makes the world go ’round, but unfortunately, so do financial woes. Protecting your hard-earned cash isn’t just about stuffing it under your mattress (though that *could* be a surprisingly effective anti-theft measure, albeit inconvenient). It’s about employing smart strategies to safeguard your financial future from the inevitable bumps in the road – and the occasional rogue asteroid.

Protecting your finances involves a multi-pronged approach, combining the wisdom of a seasoned detective with the foresight of a financial Nostradamus. This involves strategically utilizing insurance, thwarting identity thieves, and securing your vital financial documents. Think of it as building a financial fortress, impenetrable to the forces of misfortune.

Insurance: Your Financial Safety Net

Insurance isn’t just for boring adults; it’s your financial parachute. Think of it as a preemptive strike against the unexpected. Health insurance protects you from crippling medical bills, life insurance provides a financial cushion for your loved ones should the worst happen, and disability insurance ensures a steady income stream if you’re unable to work. These aren’t optional extras; they’re essential components of a robust financial plan. Consider the scenario: a sudden illness could leave you with hundreds of thousands of dollars in medical debt. Health insurance acts as a buffer, reducing the financial burden and allowing you to focus on recovery. Similarly, life insurance replaces lost income and provides financial security for dependents. Without insurance, a single unforeseen event could unravel years of careful financial planning.

Protecting Against Identity Theft and Fraud

Identity theft is a modern-day plague, and unfortunately, you’re not immune. It’s the digital equivalent of having your wallet stolen, except the thief can access your bank accounts, credit cards, and even your medical records. Protecting yourself requires vigilance and proactive measures. Regularly monitor your credit reports for any suspicious activity. Consider using strong, unique passwords for all your online accounts and enabling two-factor authentication wherever possible. Be wary of phishing scams – those emails promising you millions of dollars or threatening legal action if you don’t click a link. They’re usually just trying to steal your information. Think of it like this: your digital identity is a valuable commodity, and protecting it requires the same level of care as protecting your physical valuables.

Securing Financial Documents and Information

Your financial documents are the blueprints of your financial life. Losing them is like losing the instructions to your financial fortress – leaving it vulnerable to attack. Store important documents in a safe, fireproof location. Consider using a secure digital storage system with strong password protection and encryption. Shred any documents containing sensitive information before discarding them. Regularly review your bank and credit card statements for any unauthorized transactions. Remember, prevention is better than cure. Protecting your financial documents isn’t about paranoia; it’s about responsible financial stewardship. Imagine the chaos of losing your mortgage papers, tax returns, or investment statements; securing them safeguards your financial well-being and reduces potential future headaches.

Financial Goal Setting and Review

So, you’ve mastered budgeting, conquered debt, and are merrily saving and investing. Fantastic! But without a roadmap, even the most meticulously planned financial journey can end up in a ditch (a very expensive ditch, filled with regret). This section is all about setting clear, achievable financial goals and regularly checking your progress—because even the most well-intentioned squirrel needs to occasionally check if its nut stash is still intact.

Financial goal setting isn’t about wishing upon a star; it’s about creating a structured plan to achieve your financial dreams. This involves defining specific, measurable, achievable, relevant, and time-bound (SMART) goals. Regular review allows for course correction, ensuring you stay on track and adapt to life’s inevitable curveballs.

SMART Financial Goal Setting

The SMART acronym provides a framework for creating effective financial goals. Let’s break it down: Specific – clearly define your goal; Measurable – quantify it with numbers; Achievable – make sure it’s realistic; Relevant – ensure it aligns with your overall financial plan; Time-bound – set a deadline. For example, instead of “save more money,” a SMART goal would be “save $10,000 for a down payment on a house within two years.” This provides clarity and direction.

Methods for Regularly Reviewing Financial Plans

Regularly reviewing your financial plan is crucial for success. This isn’t about endlessly scrutinizing every penny (though that can be fun for some!), but rather a periodic check-in to ensure you’re on the right path. Consider a quarterly or annual review, using your budget and investment performance as benchmarks. This allows you to identify areas needing adjustment and celebrate your wins! For example, you might review your budget after every three months and make adjustments as needed, such as cutting expenses or increasing savings contributions.

Examples of Common Financial Goals and How to Achieve Them

Many common financial goals can be achieved with diligent planning and consistent effort. Let’s look at a few:

| Goal | Steps to Achieve | Example |

|---|---|---|

| Emergency Fund | Automate savings, reduce unnecessary expenses. | Aim to save 3-6 months’ worth of living expenses in a high-yield savings account. If your monthly expenses are $3000, your goal would be $9000-$18000. |

| Debt Reduction | Create a debt repayment plan (snowball or avalanche method), increase payments when possible. | Prioritize high-interest debts first (avalanche method) or tackle the smallest debts first for motivational wins (snowball method). |

| Home Ownership | Save for a down payment, improve credit score, shop for a mortgage. | Saving $20,000 for a down payment within 3 years, while simultaneously working on improving your credit score to qualify for a favorable interest rate. |

| Retirement Savings | Maximize employer-sponsored retirement plans, contribute to individual retirement accounts (IRAs). | Contributing the maximum amount allowed to your 401(k) and a Roth IRA annually. |

Remember, consistent effort is key. Even small, incremental changes over time can lead to significant results. Don’t be afraid to adjust your plan as needed—life throws curveballs, and your financial plan should be flexible enough to adapt.

Utilizing Financial Tools and Resources

Navigating the world of personal finance can feel like trying to assemble IKEA furniture without the instructions – confusing, potentially frustrating, and occasionally leading to unexpected results (like a wobbly bookshelf representing your retirement fund). Thankfully, there are tools and resources to help you avoid a financial meltdown. This section explores various software, apps, and educational avenues to empower you on your journey to financial freedom.

Personal Finance Software and Apps

Choosing the right financial software or app is like choosing the right pair of shoes – the wrong choice can lead to blisters (or bankruptcies!). The market offers a variety of options, each with its strengths and weaknesses. To help you navigate this, here’s a comparison of some popular choices:

| Feature | Mint | Personal Capital | YNAB (You Need A Budget) | EveryDollar |

|---|---|---|---|---|

| Budgeting | Automatic categorization, visual dashboards | Comprehensive budgeting tools, net worth tracking | Zero-based budgeting methodology | Envelope budgeting system, simple interface |

| Expense Tracking | Automatic import from bank accounts | Detailed transaction analysis | Manual entry, strong focus on intentional spending | Manual entry, designed for simplicity |

| Investment Tracking | Basic investment tracking | Advanced portfolio analysis, retirement planning tools | Not a primary focus | Not a primary focus |

| Debt Management | Debt tracking, payoff tools | Debt payoff strategies, analysis | Debt snowball/avalanche method support | Debt snowball/avalanche method support |

| Cost | Free (with ads), premium subscription available | Free (basic), premium subscription available | Subscription based | Subscription based (lower cost than YNAB) |

Note: Features and pricing are subject to change. Always check the provider’s website for the most up-to-date information.

Accessing Financial Education and Advice

The internet is a treasure trove (or a potential swamp) of financial information. Sifting through the wheat from the chaff requires discernment. Reliable sources include government websites (like the Consumer Financial Protection Bureau in the US), reputable non-profit organizations, and well-established financial institutions offering educational resources. Many offer free webinars, workshops, and downloadable guides.

Benefits of Seeking Professional Financial Advice

While DIY finance can be rewarding, sometimes it’s wise to call in the professionals. A qualified financial advisor can provide personalized guidance tailored to your specific financial situation, goals, and risk tolerance. They can help navigate complex financial matters like estate planning, tax optimization, and investment strategies, saving you time, money, and potential headaches. Think of it as having a personal financial Sherpa to guide you through the sometimes treacherous terrain of your financial journey.

Illustrative Example: The Miller Family Budget

Let’s meet the Millers, a charmingly chaotic family of four navigating the thrilling waters of personal finance. They’ve embraced budgeting not as a chore, but as a strategic game plan to achieve their financial dreams (which, let’s be honest, mostly involve a slightly larger vacation fund). Their journey, though fictional, illustrates the power of a well-structured budget.

The Millers, like many families, have found that effective personal finance management requires a blend of careful planning, realistic expectations, and a dash of humor to keep things from getting too stressful. Their budget is a testament to this approach, reflecting their priorities and financial realities.

The Miller Family’s Financial Snapshot

The Millers, consisting of two working adults (John and Mary) and two children (aged 8 and 10), have a combined annual gross income of $120,000. After taxes and other deductions, their net monthly income is $7,500. They have a mortgage on their home, a modest auto loan, and some credit card debt they’re diligently chipping away at. Their financial goals include paying off their debt, saving for their children’s college education, and building a substantial emergency fund.

The Miller Family Budget: A Detailed Breakdown

The following table Artikels the Miller family’s monthly budget:

| Category | Amount ($) | Percentage of Income (%) |

|---|---|---|

| Housing (Mortgage, Property Tax, Insurance) | 2,000 | 26.7 |

| Transportation (Car Payment, Gas, Insurance) | 500 | 6.7 |

| Food (Groceries, Eating Out) | 800 | 10.7 |

| Utilities (Electricity, Water, Gas, Internet) | 300 | 4.0 |

| Healthcare (Insurance Premiums, Co-pays) | 400 | 5.3 |

| Debt Repayment (Mortgage, Auto Loan, Credit Cards) | 1,000 | 13.3 |

| Savings (Emergency Fund, College Fund, Investments) | 1,000 | 13.3 |

| Children’s Activities (School, Sports, Entertainment) | 300 | 4.0 |

| Personal Spending (Clothing, Entertainment, etc.) | 500 | 6.7 |

| Miscellaneous | 100 | 1.3 |

| Total Expenses | 7,500 | 100 |

Rationale Behind Budget Allocation

The Millers prioritize housing and debt repayment, reflecting their commitment to long-term financial stability and reducing their financial burden. A significant portion of their income is allocated to savings, demonstrating their proactive approach to securing their future. While they enjoy occasional outings, they maintain a relatively modest budget for food and personal spending, reflecting their disciplined approach to financial management. The allocation to children’s activities underscores their commitment to their children’s well-being and development. The small “miscellaneous” category acts as a buffer for unexpected expenses.

Last Recap

So, there you have it – a whirlwind tour of personal finance management! While achieving financial serenity might not happen overnight (unless you win the lottery, in which case, please share!), consistent effort and a well-crafted plan are your secret weapons. Remember, it’s not about deprivation; it’s about making informed choices that align with your goals. Embrace the journey, celebrate small victories, and watch your financial well-being blossom. Now go forth and conquer your finances! (responsibly, of course).

Questions Often Asked: Personal Finance Management Review

What if I hate spreadsheets?

Fear not! Numerous budgeting apps offer user-friendly interfaces and automated tracking. Find one that suits your style.

How much should I save for retirement?

The magic number varies, depending on your lifestyle and retirement goals. A financial advisor can help determine a personalized amount.

What’s the best way to deal with unexpected expenses?

An emergency fund is your best friend! Aim for 3-6 months’ worth of living expenses in a readily accessible account.

Is it too late to start managing my finances?

Absolutely not! It’s never too late to take control of your financial future. Start small, set realistic goals, and celebrate progress along the way.