Personal Finance Management Review: Let’s face it, money talks – and sometimes it screams. This isn’t your grandma’s dusty financial advice; we’re diving headfirst into the thrilling world of budgeting, saving, and investing, armed with wit, wisdom, and maybe a spreadsheet or two. Prepare for a financial adventure that’s less “Wall Street” and more “Wallet Street.” We’ll tackle everything from conquering debt (yes, even those pesky student loans) to planning for a retirement filled with margaritas on a beach (the responsible kind, of course). Buckle up, buttercup, because this is going to be fun.

This review will cover the essential components of effective personal finance management, from creating a realistic budget and tracking expenses to developing smart savings and investment strategies. We’ll explore various debt management techniques, delve into retirement planning, and even discuss the importance of protecting your financial information from those digital bandits lurking in the shadows. We’ll also examine the benefits of seeking professional financial advice, because sometimes, even the most financially savvy among us need a little help navigating the choppy waters of personal finance.

Introduction to Personal Finance Management

Personal finance management, in its simplest form, is the art (and sometimes the agonizing science) of taking control of your money. It’s about making informed decisions about how you earn, spend, save, and invest your hard-earned cash, ensuring your financial future isn’t a terrifying rollercoaster ride but a smoothly paved highway to financial freedom (or at least, a less bumpy road). Think of it as being the CEO of your own personal economy.

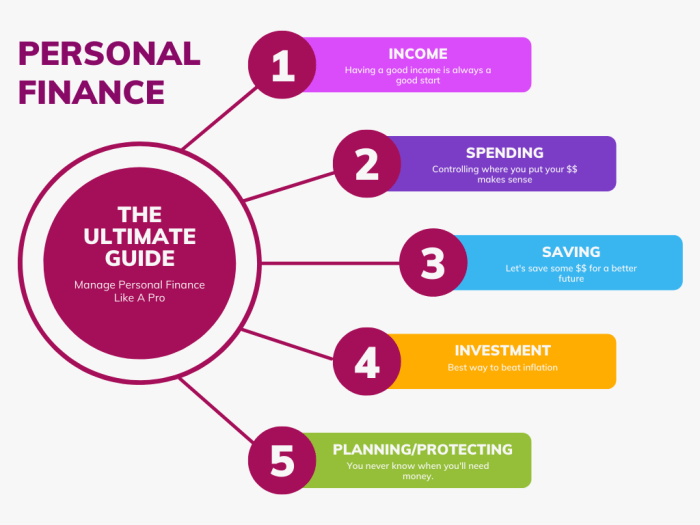

Effective personal finance management involves several crucial components, all working in harmonious (hopefully!) concert. Without a well-orchestrated approach, your finances can quickly become a chaotic symphony of debt and missed opportunities.

Key Components of Effective Personal Finance Management

The foundation of a robust personal finance system rests on a few key pillars. These aren’t just suggestions; they’re the cornerstones of a financially secure future. Ignoring them is like trying to build a house on quicksand – eventually, things will come crashing down.

- Budgeting: Creating a realistic budget involves tracking your income and expenses. This isn’t about deprivation; it’s about understanding where your money goes so you can make informed choices. A simple budgeting method could involve using a spreadsheet to categorize your spending, identifying areas where you can cut back, and setting savings goals.

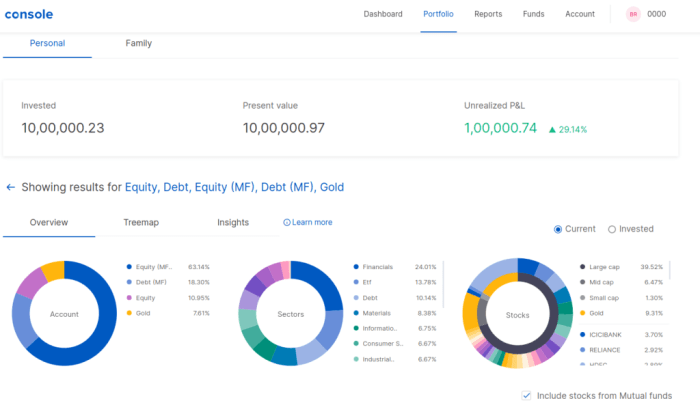

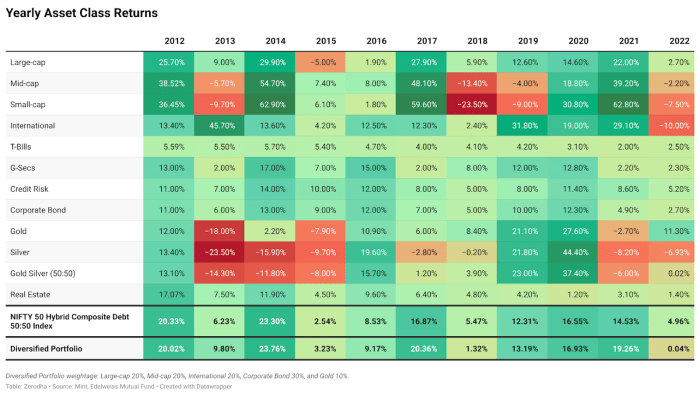

- Saving and Investing: Saving is about setting aside money for short-term goals (like a new phone or a holiday), while investing is about growing your wealth over the long term (like retirement). Diversifying investments across different asset classes (stocks, bonds, real estate) can help mitigate risk. For example, a young professional might allocate a portion of their savings to a retirement account and another portion to a high-yield savings account for emergencies.

- Debt Management: High-interest debt, like credit card debt, can quickly spiral out of control. Strategies for managing debt include creating a debt repayment plan (like the snowball or avalanche method), negotiating lower interest rates, and avoiding further debt accumulation. For instance, someone with multiple credit cards might prioritize paying off the card with the highest interest rate first, using the avalanche method.

- Financial Goal Setting: Defining clear, measurable, achievable, relevant, and time-bound (SMART) financial goals provides direction and motivation. Examples include saving for a down payment on a house, paying off student loans, or funding a child’s education. A specific goal, such as saving $20,000 for a down payment within three years, is far more effective than a vague aspiration to “save more money.”

Benefits of Implementing a Robust Personal Finance Management System

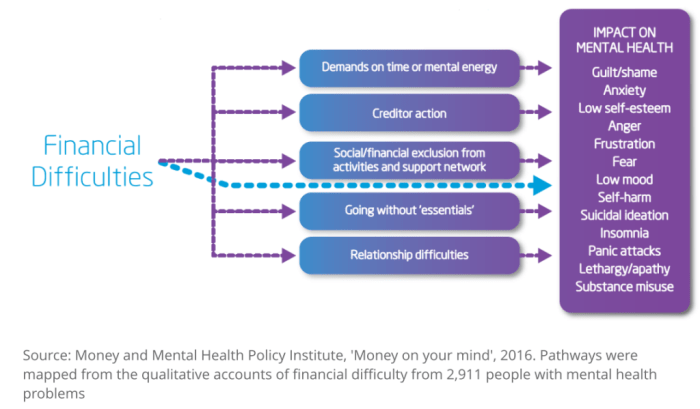

The advantages of taking charge of your finances extend far beyond simply having more money in the bank. It’s about achieving a sense of control, reducing stress, and creating a brighter future.

A well-structured personal finance system offers numerous benefits:

- Reduced Financial Stress: Knowing where your money is going and having a plan for the future significantly reduces anxiety and stress related to finances.

- Achieving Financial Goals: A clear plan and consistent execution increase the likelihood of achieving your short-term and long-term financial goals, whether it’s buying a home, retiring comfortably, or simply having more financial freedom.

- Improved Financial Security: A robust system provides a safety net against unexpected expenses and life events, allowing you to weather financial storms more effectively.

- Increased Wealth: Through strategic saving and investing, you can grow your wealth over time and secure a more prosperous future.

Budgeting and Expense Tracking

Ah, budgeting. The word itself conjures images of spreadsheets, grim calculations, and the soul-crushing realization that your avocado toast habit is bankrupting you. But fear not, dear reader! Mastering budgeting and expense tracking is less about financial asceticism and more about informed decision-making, paving the way for a financially fulfilling life (or at least, one where you can still afford the occasional avocado toast). This section will equip you with the tools and strategies to navigate the sometimes-treacherous waters of personal finance.

Sample Monthly Budget Template

A well-structured budget is your financial compass, guiding you towards your savings goals and preventing those nasty surprise overdrafts. Below is a sample template. Remember, the key is to personalize it to reflect your unique income and spending patterns. Don’t be afraid to adjust categories and amounts as needed. Think of it as a living document, constantly evolving with your financial life.

| Category | Budget | Actual | Difference |

|---|---|---|---|

| Housing (Rent/Mortgage) | $1500 | $1450 | $50 |

| Transportation | $300 | $350 | -$50 |

| Food (Groceries & Dining) | $500 | $480 | $20 |

| Utilities (Electricity, Water, etc.) | $200 | $180 | $20 |

| Debt Payments (Loans, Credit Cards) | $250 | $250 | $0 |

| Entertainment | $100 | $120 | -$20 |

| Savings | $300 | $300 | $0 |

| Other Expenses | $100 | $90 | $10 |

| Total | $3300 | $3220 | $80 |

Different Budgeting Methods

Several budgeting philosophies exist, each with its own unique approach. Choosing the right one depends on your personality and financial goals.

The 50/30/20 rule is a popular and straightforward method. It suggests allocating 50% of your after-tax income to needs (housing, food, transportation), 30% to wants (entertainment, dining out), and 20% to savings and debt repayment. This provides a simple framework for balancing essential expenses with discretionary spending and financial security.

Zero-based budgeting, on the other hand, requires a more meticulous approach. Every dollar is assigned a specific purpose, ensuring that your spending matches your income. This method can be more time-consuming but offers a high degree of control over your finances. It’s like a financial Tetris game – fitting every expense piece into its allocated space.

Tips for Effectively Tracking Expenses

Effective expense tracking is crucial for staying on budget. Fortunately, many tools are available to simplify this process. Spreadsheets, while requiring manual input, provide a high degree of customization. You can categorize expenses, track trends, and create visual representations of your spending habits. Budgeting apps, on the other hand, automate much of the process, often linking directly to your bank accounts and credit cards for seamless tracking. Some even provide insightful analysis and personalized financial advice. The best method depends on your tech-savviness and personal preferences. The key is to choose a method you’ll actually stick with – consistency is key!

Debt Management Strategies

Ah, debt. That delightful little companion that whispers sweet nothings of instant gratification while simultaneously plotting your financial downfall. But fear not, intrepid financial adventurer! We’re here to equip you with the strategies to conquer this foe and reclaim your financial freedom. This section will explore various debt repayment methods and arm you with the knowledge to slay those high-interest dragons.

Debt repayment strategies aren’t a one-size-fits-all affair; they’re more like a well-stocked arsenal, and the right weapon depends on your specific battlefield (i.e., your debt situation). Understanding your options is key to devising a plan that will leave your debt gasping for air.

Debt Snowball vs. Debt Avalanche

The debt snowball and debt avalanche methods are two popular approaches to tackling multiple debts. The debt snowball method focuses on paying off the smallest debt first, regardless of its interest rate, to build momentum and motivation. The debt avalanche method, on the other hand, prioritizes paying off the debt with the highest interest rate first, minimizing the total interest paid over time.

Imagine a snowball rolling down a hill: It starts small, but gathers momentum as it rolls, becoming larger and more powerful. That’s the debt snowball method in a nutshell. The debt avalanche, conversely, is like targeting the biggest, most dangerous avalanche first before tackling smaller ones; it’s more mathematically efficient but can be less motivating in the short term. The best approach depends on your personality and financial goals; some prefer the psychological boost of the snowball, while others prioritize the long-term cost savings of the avalanche.

Understanding Interest Rates and APRs

Interest rates and APRs (Annual Percentage Rates) are the silent assassins of your finances. Understanding them is crucial for effective debt management. The interest rate is the cost of borrowing money, expressed as a percentage of the principal amount. The APR, however, is a more comprehensive measure that includes not only the interest rate but also other fees and charges associated with the loan. Always scrutinize the APR; it gives you the true cost of borrowing.

A high APR means you’re paying significantly more in interest over the life of the loan. A lower APR is your financial friend.

For example, let’s say you have two credit card debts: one with a 15% APR and another with a 25% APR. The 25% APR debt will cost you significantly more in interest over time, even if the principal balance is lower. This highlights the importance of understanding and comparing APRs when making financial decisions.

Creating a High-Interest Debt Elimination Plan

Creating a plan to eliminate high-interest debt requires a systematic approach. First, list all your debts, including the principal balance, interest rate, and minimum payment for each. Then, choose a debt repayment strategy (snowball or avalanche). Allocate as much extra money as possible towards the priority debt while making minimum payments on others. As you pay off debts, redirect those payments towards the next highest-interest debt, maintaining momentum until you are debt-free.

Consider budgeting strategies to increase your available funds for debt repayment. This might involve cutting expenses, increasing income, or a combination of both. Regularly review and adjust your plan as your financial situation changes. Remember, consistency and discipline are your greatest allies in this battle.

Savings and Investment Planning: Personal Finance Management Review

So, you’ve conquered budgeting and are debt-free (or at least on the path to freedom!). Congratulations, you magnificent money manager! Now it’s time to talk about the fun part: growing your wealth. Think of it as leveling up in the game of life, except the rewards are financial security and maybe even early retirement. Let’s dive into the exciting world of savings and investment planning.

Saving and investing are two sides of the same coin – one protects your present, the other builds your future. Smart saving provides a safety net and funds for short-term goals, while investing helps your money work for you, generating wealth for long-term aspirations like a down payment on a house or a comfortable retirement. The key is finding the right balance between the two, tailored to your personal circumstances and risk tolerance.

Setting Short-Term and Long-Term Savings Goals

A well-defined savings plan requires clear goals. Short-term goals, typically achievable within a year, might include a down payment for a car, a dream vacation, or emergency funds. Long-term goals, spanning several years, often involve significant purchases like a house, education, or retirement. Breaking down large goals into smaller, manageable steps makes them less daunting and keeps you motivated.

To set effective goals, use the SMART method: Specific (define the exact amount), Measurable (track your progress), Achievable (set realistic targets), Relevant (align with your life goals), and Time-bound (set a deadline). For example, instead of “save for a down payment,” aim for “save $20,000 for a down payment by December 2025.”

Benefits of Diversification in Investment Portfolios

Diversification is your investment BFF. Think of it as not putting all your eggs in one basket. By spreading your investments across different asset classes (like stocks, bonds, and real estate), you reduce the overall risk of your portfolio. If one investment performs poorly, others might offset those losses. This doesn’t guarantee profits, but it significantly reduces the volatility of your returns. It’s like having a well-balanced diet for your investments – variety is key!

Comparison of Different Investment Options

Choosing the right investment options depends on your risk tolerance, time horizon, and financial goals. High-risk investments offer the potential for higher returns but also carry a greater chance of loss. Low-risk investments offer stability but typically yield lower returns. Here’s a simplified comparison:

| Investment Type | Risk Level | Potential Return | Suitability |

|---|---|---|---|

| Stocks | High | High | Long-term investors with higher risk tolerance |

| Bonds | Low to Moderate | Moderate | Investors seeking stability and moderate returns |

| Mutual Funds | Low to High (depending on the fund) | Low to High (depending on the fund) | Investors seeking diversification and professional management |

| Real Estate | Moderate to High | Moderate to High | Long-term investors with significant capital and interest in property management (or willingness to hire a property manager) |

Retirement Planning

Retirement: the golden years, the time for leisurely pursuits, the era of finally figuring out how to use that fancy espresso machine you always wanted. But achieving this blissful state requires careful planning, lest you find yourself trading in your dream retirement for a slightly less glamorous reality. Think of retirement planning not as a sprint, but a marathon – a very, very long marathon with a surprisingly delicious finish line.

The Importance of Early Retirement Savings

Starting your retirement savings early is akin to planting a money tree – the earlier you plant it, the more time it has to grow into a magnificent, fruit-bearing behemoth. Compounding interest, that magical financial alchemy, works wonders over time. A small contribution made early will grow exponentially more than a larger contribution made later. Imagine two individuals: one starts saving $100 a month at age 25, the other waits until 45 and saves $200 a month. Assuming a 7% annual return, by age 65, the early bird will have significantly more in their nest egg. This isn’t just about numbers; it’s about flexibility and peace of mind. Starting early allows you to adjust your savings strategy if needed, reducing stress and increasing your options in the long run.

Types of Retirement Accounts

Various retirement accounts offer different benefits and tax advantages. Understanding these differences is crucial for tailoring a plan to your specific needs.

- 401(k) Plans: These employer-sponsored plans often include matching contributions, essentially free money! The contributions are typically pre-tax, reducing your current taxable income. However, withdrawals in retirement are taxed.

- Traditional IRAs: Individual Retirement Accounts allow for tax-deductible contributions, lowering your current tax bill. Similar to 401(k)s, withdrawals are taxed in retirement.

- Roth IRAs: Unlike traditional IRAs, contributions to Roth IRAs are made after tax, but withdrawals in retirement are tax-free! This can be particularly advantageous if you anticipate being in a higher tax bracket in retirement.

Sample Retirement Plan

Let’s craft a hypothetical retirement plan for Sarah, a 30-year-old with an annual income of $60,000 and a goal of maintaining her current lifestyle in retirement. Sarah aims to retire at 65.

First, Sarah needs to determine her desired retirement income. Assuming she wants to maintain her current lifestyle, she’ll need to estimate her expenses in retirement. Let’s assume her annual expenses will be $40,000, adjusted for inflation. To achieve this, she needs to accumulate a substantial nest egg. Financial planning tools and advisors can help determine the necessary savings amount. Sarah might consider contributing a percentage of her income to both a 401(k) (if offered by her employer) and a Roth IRA. Regular contributions, even small ones, will compound over time. She should also regularly review and adjust her plan as her income and circumstances change. Regularly reviewing her investment portfolio and adjusting it to match her risk tolerance and time horizon is crucial. This isn’t a “set it and forget it” scenario; regular adjustments are key to long-term success. Finally, consulting a financial advisor can offer personalized guidance and ensure her plan aligns with her goals and risk tolerance.

Financial Goal Setting and Monitoring

Achieving financial freedom isn’t a whimsical daydream; it’s a meticulously crafted plan, executed with the precision of a Swiss watchmaker (though hopefully less prone to tiny, expensive repairs). This involves setting clear financial goals and then, crucially, tracking your progress. Think of it as a treasure hunt, but instead of X marking the spot, X marks your financial aspirations – and you need a map (your plan) and a compass (your monitoring system) to find it.

Setting SMART financial goals is the cornerstone of this process. It’s not just about wanting a bigger house or a fancy car; it’s about defining those desires with the precision of a laser beam. Regular monitoring ensures you stay on track, allowing for course corrections along the way – because let’s face it, life rarely follows a perfectly straight line.

SMART Goal Setting Strategies, Personal Finance Management Review

Setting SMART goals ensures your financial aspirations are clear, measurable, and achievable within a reasonable timeframe. Failing to plan is planning to fail, as the old adage goes, and vague desires rarely translate into tangible results. Let’s illustrate with an example. Instead of aiming vaguely for “better financial security,” a SMART goal might be: “Save $10,000 (Specific, Measurable) for a down payment on a house within two years (Time-bound) by increasing my savings rate by 10% of my monthly income (Achievable) to fund my homeownership dreams (Relevant).”

Regular Progress Monitoring Methods

Monitoring your progress isn’t about obsessive checking; it’s about maintaining a healthy awareness of your financial trajectory. Regular reviews, perhaps monthly or quarterly, are essential. You can use budgeting apps, spreadsheets, or even a simple notebook to track your income, expenses, and savings progress against your goals. Visualizing progress, such as using charts or graphs to illustrate your savings growth, can be incredibly motivating. For example, tracking your savings towards your $10,000 down payment goal using a simple bar graph would visually represent your progress and show you how much closer you are to your target.

Adjusting Financial Plans for Life Changes

Life throws curveballs. Unexpected job losses, medical emergencies, or even a sudden windfall can disrupt even the best-laid financial plans. The key is adaptability. Regular reviews of your financial plan allow you to anticipate and adjust to these changes. Perhaps a job loss requires a temporary reduction in savings contributions, or a windfall allows for accelerated debt repayment. The important thing is to acknowledge the change, re-evaluate your plan, and make necessary adjustments. For example, if you experience an unexpected job loss, you might need to temporarily reduce your savings contributions and focus on building an emergency fund. Once you have secured a new job, you can re-evaluate your savings plan and adjust accordingly. This demonstrates the importance of flexibility and adaptability in financial planning.

Protecting Your Finances

Protecting your hard-earned cash isn’t just about making smart investments; it’s about safeguarding it from the sneaky villains of the financial world. Think of it as building a fortress around your money, complete with moats (insurance) and drawbridges (strong passwords). Ignoring this crucial aspect is like leaving your wallet on a park bench – tempting fate, and potentially losing everything.

We’ll explore common financial threats and how to fortify your defenses, ensuring your financial future remains bright and secure, not shadowed by unexpected losses.

Common Financial Risks and Threats

Financial risks are everywhere, lurking like mischievous gremlins. Identity theft, a particularly nasty one, involves someone using your personal information – your name, Social Security number, bank details – to open accounts, make purchases, or even commit crimes in your name. Fraud, another unwelcome guest, can take many forms, from phishing scams (those deceptively charming emails promising riches) to credit card skimming (those tiny devices that steal your card information). Failing to adequately protect yourself can lead to significant financial losses, emotional distress, and a whole lot of paperwork.

Protecting Personal Financial Information

Safeguarding your financial information requires a multi-layered approach, much like a well-defended castle. Start with strong, unique passwords for all your online accounts – think of them as your castle’s sturdy gates. Avoid using easily guessable information like birthdays or pet names. Regularly monitor your bank and credit card statements, looking for any unauthorized transactions – these are your castle’s watchtowers. Shred sensitive documents before discarding them, preventing unwanted eyes from accessing your private information. Consider using credit monitoring services, which act as your castle’s alarm system, alerting you to suspicious activity. Be wary of phishing scams and never click on suspicious links or provide personal information unless you are absolutely certain of the sender’s legitimacy.

The Importance of Insurance

Insurance is your financial safety net, a crucial element in protecting yourself against unexpected events. Health insurance protects you from crippling medical bills, providing peace of mind in case of illness or injury. Auto insurance safeguards you from the financial fallout of car accidents, covering damages and medical expenses. Homeowners or renters insurance protects your property and belongings from damage or theft. Life insurance provides financial security for your loved ones in the event of your passing. While insurance premiums may seem like an expense, the potential cost of not having it far outweighs the premiums – think of it as a small price to pay for significant peace of mind. Consider the potential financial devastation of a major medical emergency without health insurance, or a house fire without homeowners insurance – these are situations that can financially ruin even the most careful savers.

Seeking Professional Financial Advice

Navigating the sometimes-treacherous waters of personal finance can feel like trying to assemble IKEA furniture blindfolded – frustrating, potentially damaging, and occasionally leading to tears. While DIY financial management is admirable, seeking professional guidance can be the difference between a well-structured financial future and a chaotic pile of unpaid bills. Let’s explore when professional help is invaluable, and how to find a financial advisor who won’t leave you with more questions than answers.

Professional financial advice becomes particularly beneficial during periods of significant life change or financial complexity. For example, inheriting a substantial sum of money suddenly requires careful planning to avoid impulsive decisions that could jeopardize your long-term financial well-being. Similarly, navigating a divorce often involves intricate financial disentanglement that a qualified advisor can simplify. Even seemingly straightforward events, like buying a home or planning for retirement, benefit greatly from expert guidance to ensure you make informed decisions and optimize your financial outcomes.

Finding a Qualified and Reputable Financial Advisor

Choosing a financial advisor is akin to choosing a doctor – you need someone trustworthy, knowledgeable, and capable of understanding your specific needs. A haphazard approach could lead to costly mistakes. Therefore, thorough research is essential. Start by checking the advisor’s credentials and certifications. Look for designations like Certified Financial Planner (CFP®) or Chartered Financial Analyst (CFA), indicating a commitment to professional standards and ethical conduct. Online resources, such as the websites of professional organizations, can help verify credentials and identify any disciplinary actions. Additionally, seek recommendations from trusted sources – friends, family, or even your accountant – to gain firsthand insights into the advisor’s capabilities and working style. Don’t forget to check online reviews and testimonials, though remember to take these with a grain of salt, as they can be subjective.

Questions to Ask a Potential Financial Advisor

Before entrusting your financial future to an advisor, it’s crucial to ask pertinent questions to gauge their suitability. Understanding their fee structure is paramount. Ask for a clear explanation of all fees, including any commissions or hidden charges. Inquire about their investment philosophy and how it aligns with your risk tolerance and financial goals. Clarify their experience with clients in similar situations to yours. Understanding their approach to financial planning is crucial; are they proactive in adjusting strategies to changing market conditions, or do they favor a more passive, set-it-and-forget-it approach? Finally, ask for references and contact previous clients to get a more comprehensive perspective on their performance and client satisfaction. This process ensures you are selecting an advisor who is not only qualified but also a good fit for your individual needs and personality.

Illustrative Example: Financial Literacy for Young Adults

Navigating the treacherous waters of personal finance can feel like a solo voyage on a leaky raft in a hurricane, especially for young adults. But fear not, intrepid financial explorers! This example charts the course of a fictional young adult, showcasing both the rocky shoals and the calm seas of financial management. Our protagonist, let’s call her Anya, begins her journey armed with little more than a part-time job and a burning desire (and perhaps a slight fear) to build a secure financial future.

Anya’s Financial Journey: A Five-Year Odyssey

Anya’s Starting Point and Early Challenges

Anya, fresh out of college with a mountain of student loan debt and a less-than-impressive starting salary, initially struggled with budgeting and expense tracking. Her initial attempts at financial planning were, let’s say, less than stellar. She frequently overspent, relying heavily on credit cards to bridge the gap between income and expenses. This led to accumulating more debt, a vicious cycle that many young adults fall into.

Key Decisions and Their Outcomes

The following bullet points illustrate Anya’s pivotal financial decisions over the five-year period:

- Year 1: Anya created a simple budget using a spreadsheet, tracking her income and expenses meticulously. This, combined with cutting back on non-essential spending, allowed her to start making small but consistent payments towards her student loans.

- Year 2: Recognizing the high interest rates on her credit cards, Anya prioritized paying them down aggressively, employing the debt avalanche method (focusing on the highest interest debt first). This strategy reduced her overall debt burden significantly.

- Year 3: With her credit card debt under control, Anya started contributing to a retirement savings plan (401k) through her employer’s matching program. This took advantage of free money, a crucial step in long-term wealth building. She also opened a high-yield savings account to build an emergency fund.

- Year 4: Anya researched and started investing a small portion of her savings in low-cost index funds, diversifying her portfolio to minimize risk. She also began exploring options for additional income streams, such as freelance work.

- Year 5: Anya successfully paid off her student loans. She continued contributing to her retirement account and investing, steadily increasing her asset base. Her emergency fund grew to cover 6 months of living expenses, providing a safety net for unexpected events.

Visual Representation of Anya’s Financial Progress

Imagine a graph charting Anya’s net worth over five years. The initial years show a slow, almost imperceptible upward trend, as her income barely outpaces her expenses. The line representing her debt is initially steep, then gradually flattens as she diligently pays down her credit card debt and student loans. As the years progress, the upward trend of her net worth accelerates, fueled by consistent savings, smart investments, and the compounding effect of her investments. By year five, the line representing her assets significantly surpasses the line representing her debt, showcasing her remarkable financial progress. The graph paints a picture of steady growth, a testament to the power of consistent effort and informed financial decision-making. The contrast between the initially steep debt line and the later strong asset growth line visually highlights the transformative impact of responsible financial management.

Final Summary

So, there you have it – a whirlwind tour of personal finance management! While we’ve covered a lot of ground (and hopefully, made you chuckle along the way), remember that effective financial management is a journey, not a destination. It’s about finding a system that works for you, adapting as your life changes, and celebrating those small victories along the way. Embrace the process, stay informed, and don’t be afraid to seek professional help when needed. After all, a little financial savvy can go a long way towards achieving your dreams – whether that’s early retirement, a down payment on a dream home, or simply more money for those aforementioned margaritas.

Query Resolution

What’s the best budgeting app?

The “best” app depends on your needs and preferences. Mint and YNAB (You Need A Budget) are popular choices, but many free and paid options exist. Experiment to find what suits you.

How much should I save for retirement?

A general rule of thumb is to aim for saving at least 15% of your pre-tax income, but the ideal amount depends on your age, income, expenses, and desired retirement lifestyle. Consult a financial advisor for personalized guidance.

What if I’m already in significant debt?

Don’t panic! Create a debt repayment plan, prioritizing high-interest debts. Consider debt consolidation or seeking credit counseling. Small, consistent steps make a difference.

When should I start investing?

The sooner, the better! Even small, regular investments can grow significantly over time due to compound interest. Start as early as possible, even if it’s a small amount.