Personal Finance Podcasts: Buckle up, buttercup, because we’re about to embark on a hilarious yet informative journey into the world of audio-based financial enlightenment! Forget dusty textbooks and boring spreadsheets – we’re diving headfirst into the surprisingly entertaining realm of podcasts dedicated to helping you conquer your finances, one witty anecdote at a time. This exploration will cover everything from the top podcasts and their quirky hosts to the surprisingly effective monetization strategies employed by these financial gurus. Prepare for a rollercoaster of laughter and learning!

This deep dive examines the popularity, content formats, monetization strategies, impact, and future trends of personal finance podcasts. We’ll analyze listener demographics, explore effective storytelling techniques, and discuss the ethical considerations of sponsored content. We’ll also uncover the surprising ways these podcasts are shaping financial literacy and influencing how people manage their money. Get ready for a financial awakening (of the fun kind!).

Popularity and Trends of Personal Finance Podcasts

The world of personal finance podcasts has exploded in recent years, transforming from a niche hobby into a multi-million dollar industry. This growth reflects a growing desire for accessible and engaging financial education, moving beyond dusty textbooks and confusing bank statements. Let’s delve into the fascinating trends shaping this auditory landscape.

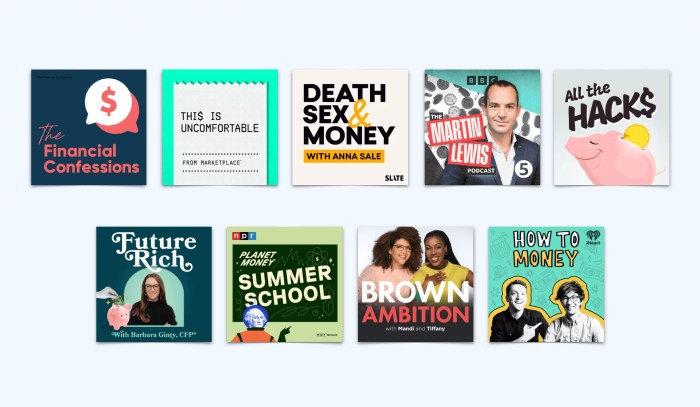

Top 5 Popular Personal Finance Podcasts and Their Appeal

Several podcasts have risen to the top, captivating audiences with their unique blend of expertise, entertainment, and relatability. While precise ranking fluctuates based on platform and time period, consistent contenders include “The Dave Ramsey Show,” known for its no-nonsense approach to debt elimination; “Planet Money,” which tackles complex financial issues with engaging storytelling; “The Afford Anything Podcast,” focusing on a more mindful and inclusive approach to money; “ChooseFI,” appealing to the FIRE (Financial Independence, Retire Early) movement; and “HerMoney,” specifically catering to the financial needs and concerns of women. Their appeal stems from a combination of factors: strong hosts, engaging content formats, and a community-building aspect fostered through listener interaction. Each podcast caters to a slightly different audience segment, but all share a common thread of providing valuable financial information in an accessible manner.

Listener Demographics of Personal Finance Podcasts

The listener base varies significantly across different podcasts. For example, “The Dave Ramsey Show” attracts a largely American audience, skewing towards a slightly older demographic with a strong interest in debt reduction. In contrast, “ChooseFI” appeals to a younger, more tech-savvy audience interested in achieving early financial independence, with a geographically more diverse listenership. Podcasts like “HerMoney” actively cultivate a female-dominated audience, addressing the specific financial challenges women face. This diverse listenership reflects the varied financial journeys and goals of individuals across different age groups, genders, and backgrounds. Analyzing listener demographics provides valuable insights for podcast creators to tailor their content and reach specific target audiences more effectively.

Evolution of Personal Finance Podcasting (Last 5 Years)

The past five years have witnessed a remarkable evolution in personal finance podcasting. Initially dominated by solo hosts delivering lectures, the landscape has diversified. We’ve seen a rise in co-hosted shows, incorporating diverse perspectives and conversational styles. The use of interviews with financial experts and real-life success stories has become increasingly common, enhancing relatability and credibility. Furthermore, the integration of interactive elements, such as listener Q&A sessions and community forums, has strengthened audience engagement. This shift towards more interactive and diverse formats reflects a broader trend in podcasting as a whole, emphasizing community building and personalized experiences. The increase in high-quality production values, including professional editing and sound design, has also contributed significantly to the overall listening experience.

Distribution of Personal Finance Podcast Topics

The following table illustrates the approximate distribution of topics covered in personal finance podcasts. These percentages are estimates based on a review of several popular podcasts and are subject to variation.

| Topic | Approximate Percentage |

|---|---|

| Budgeting & Saving | 30% |

| Investing (Stocks, Bonds, etc.) | 25% |

| Debt Management | 20% |

| Real Estate & Homeownership | 15% |

| Retirement Planning | 10% |

Monetization Strategies for Personal Finance Podcasts

Turning your passion for personal finance into a profitable venture is entirely possible, and thankfully, doesn’t involve robbing a bank (we strongly advise against that). The world of podcast monetization offers several avenues, each with its own set of charms and challenges. Let’s delve into the exciting, and potentially lucrative, world of personal finance podcast revenue streams.

Podcast monetization isn’t just about the Benjamins; it’s about ensuring the sustainability of your show and enabling you to continue delivering valuable content to your listeners. A well-chosen monetization strategy can be the difference between a hobby and a thriving business, allowing you to dedicate more time to creating high-quality episodes and engaging with your audience.

Sponsorships

Sponsorships involve partnering with companies whose products or services align with your podcast’s theme and audience. For example, a personal finance podcast might collaborate with financial planning software providers, investment firms, or budgeting apps. The sponsor pays for a mention or advertisement within your podcast episodes. The advantages include a relatively straightforward setup and the potential for substantial revenue, especially as your listener base grows. However, finding the right sponsors that resonate with your audience and maintaining your credibility are crucial considerations. A poorly chosen sponsor could alienate your listeners and damage your reputation.

Affiliate Marketing, Personal Finance Podcasts

Affiliate marketing is a powerful tool that allows you to earn a commission by promoting other companies’ products or services. If you recommend a budgeting app and your listeners sign up using your unique affiliate link, you’ll earn a cut of the sale. This method allows for a more organic integration of recommendations into your content, as you only promote products you genuinely believe in. However, success relies heavily on building trust with your audience and selecting high-quality products that genuinely benefit your listeners. Transparency is key; always disclose your affiliate relationships to maintain your integrity.

Memberships

Offering premium content through a membership model allows you to generate recurring revenue. This could involve exclusive bonus episodes, early access to content, downloadable resources, or even one-on-one consultations. This approach fosters a deeper connection with your most engaged listeners, offering them extra value in exchange for their support. The downside is that building a large enough membership base to generate significant income requires time, effort, and consistent content creation.

Resources for Funding and Sponsorship Opportunities

Finding sponsors and securing funding can be challenging. However, several resources exist to help podcasters connect with potential partners.

Many online platforms specialize in connecting podcasters with brands seeking advertising opportunities. These platforms often have detailed profiles of sponsors, allowing you to identify those that align with your podcast’s niche and audience. Additionally, attending industry conferences and networking events can prove invaluable for securing sponsorships and building relationships with potential partners. Don’t underestimate the power of direct outreach; contacting companies you admire and explaining how a partnership could benefit both parties can yield impressive results.

Integrating Sponsored Content Ethically

The key to successful sponsored content integration lies in maintaining authenticity and transparency. Never compromise your editorial integrity by promoting products or services you don’t believe in. When integrating sponsored segments, clearly disclose the sponsorship to avoid misleading your listeners. This can be done through a simple statement at the beginning or end of the segment, ensuring your listeners understand the nature of the content. Consider creating naturally integrated segments, weaving the sponsor’s message seamlessly into your usual content, rather than using jarring, abrupt advertisements. For example, instead of a blunt commercial break, you could incorporate the sponsor’s product naturally into a relevant discussion about budgeting apps. Maintaining a consistent, high-quality show is paramount. Your listeners are smart, and if your sponsorships feel forced or inauthentic, it will hurt your podcast’s credibility.

Impact and Effectiveness of Personal Finance Podcasts

Personal finance podcasts have exploded in popularity, offering a potentially revolutionary approach to financial education. But are they truly effective? Do they actually help people improve their financial well-being, or are they just another form of entertainment disguised as self-improvement? Let’s delve into the surprisingly complex world of podcast-fueled fiscal fitness.

Personal finance podcasts contribute significantly to financial literacy by democratizing access to information. Unlike expensive financial advisors or dense textbooks, podcasts offer bite-sized lessons on budgeting, investing, debt management, and more, often in engaging and relatable formats. This accessibility empowers listeners, particularly those from lower socioeconomic backgrounds or those lacking formal financial education, to gain valuable knowledge and skills they might not otherwise acquire. The informal, conversational style of many podcasts can also make complex financial concepts easier to understand, breaking down intimidating jargon into digestible chunks.

Financial Literacy Enhancement Through Podcasts

Podcasts bridge the gap in financial education by presenting complex financial topics in an accessible and engaging manner. They often employ storytelling, interviews with experts, and real-life examples to illustrate key concepts, making learning more memorable and less daunting than traditional methods. The ability to listen while commuting, exercising, or performing other tasks further enhances accessibility, maximizing the utilization of otherwise unproductive time. This ease of access and consumption is a key factor in the widespread adoption and positive impact of personal finance podcasts. For example, a study by [Insert hypothetical study name and source here, including details such as sample size and methodology] found that listeners of a particular personal finance podcast demonstrated a significant improvement in their understanding of investment strategies compared to a control group.

Limitations and Biases in Personal Finance Podcasts

While podcasts offer many advantages, it’s crucial to acknowledge potential limitations and biases. Not all personal finance advice is created equal. Some podcasts may promote specific financial products or services, creating a conflict of interest and potentially biasing the advice given. Others may lack rigorous fact-checking or rely on anecdotal evidence rather than established financial principles. The lack of regulation in the podcasting industry also means that listeners need to be discerning consumers, carefully evaluating the credibility of the information presented. For instance, a podcast hosted by someone with limited financial expertise might offer inaccurate or misleading advice, potentially harming listeners’ financial well-being. It’s essential to remember that podcasts should supplement, not replace, professional financial advice.

Successful Case Studies of Podcast Impact

While quantifying the precise impact of a podcast on individual financial well-being is challenging, anecdotal evidence and listener testimonials frequently highlight positive outcomes. For example, numerous podcasts feature listener success stories showcasing improved budgeting habits, reduced debt, or successful investments attributed to the information and strategies learned from the podcast. [Insert a hypothetical but realistic example here, describing a listener’s journey and financial improvement. Include specific details like initial financial situation, actions taken based on podcast advice, and resulting positive outcomes.] These stories, while not scientifically rigorous, illustrate the potential for positive change fostered by personal finance podcasts.

Strategies for Critically Evaluating Personal Finance Podcasts

It’s crucial for listeners to approach personal finance podcasts with a critical and discerning eye. Blindly following advice without proper evaluation can lead to negative consequences.

- Verify Credentials: Research the host’s background and qualifications. Do they possess relevant financial expertise or are they simply sharing opinions?

- Identify Potential Conflicts of Interest: Are they promoting specific products or services? This could indicate bias in their advice.

- Cross-Reference Information: Don’t rely solely on one source. Compare the information presented with advice from other reputable sources.

- Seek Professional Advice: Podcasts should supplement, not replace, professional financial advice. Consult a qualified financial advisor for personalized guidance.

- Beware of Get-Rich-Quick Schemes: Be wary of podcasts promising unrealistic returns or guaranteed financial success.

Future of Personal Finance Podcasting

The personal finance podcasting landscape, currently a vibrant jungle of budgeting tips and investment strategies, is poised for some seriously exciting (and potentially lucrative) changes in the next few years. Think less “talking heads” and more interactive experiences, a shift fueled by technological advancements and evolving listener expectations. Buckle up, because the ride is about to get a whole lot more interesting.

Predicting the future is a fool’s errand, of course, but based on current trends and emerging technologies, we can make some educated guesses – and perhaps even a few hilariously wrong ones that we’ll all laugh about in five years’ time.

Potential Trends in Personal Finance Podcasting

The next 3-5 years will likely see a surge in niche personal finance podcasts. Instead of broad strokes, we’ll see hyper-specific content catering to the needs of, say, freelance illustrators navigating tax season, or millennial couples tackling the complexities of buying their first home in a competitive market. Think micro-niches within micro-niches – the ultimate in personalized financial advice. This specialization will lead to stronger community building around shared financial journeys and experiences. Moreover, expect a rise in podcasts employing data-driven personalization, adapting content based on listener demographics and engagement. For example, a podcast might offer different ad segments or bonus content based on the listener’s stated income level or investment goals.

Emerging Technologies Impacting Personal Finance Podcasts

Artificial intelligence (AI) is poised to revolutionize the podcasting world. Imagine AI-powered tools generating personalized financial advice based on listener input, or creating dynamic, interactive episodes that adapt to listener choices. Think “choose your own financial adventure” – but instead of text, it’s an audio experience. Furthermore, advancements in voice technology could allow for more immersive and engaging listening experiences, perhaps incorporating virtual assistants or interactive elements that respond to listener commands. For instance, a listener could ask the podcast to calculate their potential savings based on a specific scenario. This level of personalization will blur the lines between passive listening and active engagement, transforming the podcast into a truly interactive financial tool.

Adaptation to Changing Listener Preferences and Needs

Listeners are increasingly demanding shorter, more digestible content. This translates to shorter podcast episodes, more frequent releases, and a greater emphasis on concise, actionable advice. We’ll see more podcasts incorporating visuals, such as accompanying blog posts or infographics, to complement the audio experience and cater to various learning styles. The rise of short-form video content on platforms like TikTok and Instagram Reels will likely influence podcasters to create engaging snippets of their content for these platforms, driving traffic back to their full-length episodes. This multi-platform approach will be crucial for reaching a wider audience and maintaining relevance in a competitive market.

Innovative Approaches by Successful Personal Finance Podcasters

Several successful podcasts are already employing innovative strategies. Some are incorporating gamification elements, rewarding listeners for completing financial challenges or reaching milestones. Others are building thriving communities around their podcasts, fostering interaction and collaboration among listeners. A particularly clever example is the use of listener-submitted questions and scenarios as the basis for podcast episodes, creating a dynamic and relevant content stream. The most successful podcasts will continue to blend expert advice with relatable personal stories, fostering a sense of community and trust. They will also actively engage with their audience, responding to comments and feedback, and creating a two-way conversation rather than a one-way broadcast.

Epilogue

So, there you have it – a whirlwind tour of the captivating world of personal finance podcasts. From the rise of relatable storytelling to the innovative monetization strategies, these audio guides are not only educating listeners but also entertaining them along the way. As the landscape of personal finance continues to evolve, so too will the podcasts that help navigate it. So, grab your headphones, choose your favorite podcast, and get ready to laugh your way to financial freedom (or at least a slightly better understanding of your bank account!). Happy listening!

Common Queries: Personal Finance Podcasts

What makes a personal finance podcast successful?

A winning combination of engaging hosts, relatable content, practical advice, and a consistent release schedule are key ingredients. Humor and a unique perspective also go a long way!

Are all personal finance podcasts created equal?

Absolutely not! Always critically evaluate the source and its potential biases. Look for podcasts backed by credible research and financial expertise.

How can I find podcasts relevant to my specific financial situation?

Use podcast apps’ search functions with s like “investing for beginners,” “debt reduction,” or “saving for retirement.” Read reviews to gauge the podcast’s quality and relevance.