Navigating the complexities of personal taxation can feel daunting, but understanding strategies for optimization can significantly impact your financial well-being. This guide explores various methods to legally minimize your tax liability, from understanding deductions and credits to employing effective investment strategies and planning for life’s major events. We’ll delve into tax-advantaged accounts, charitable giving, and the importance of seeking professional advice when needed.

By learning how to strategically manage your income and investments, you can retain a greater portion of your hard-earned money. This involves not only understanding current tax laws but also proactively planning for future financial goals. This guide aims to equip you with the knowledge and tools to make informed decisions about your financial future.

Understanding Taxable Income

Taxable income forms the foundation of your personal tax liability. It represents the amount of your income that is subject to federal income tax after accounting for deductions and credits. Accurately determining your taxable income is crucial for minimizing your tax burden and ensuring compliance with tax laws. Understanding the various components that contribute to, and reduce, your taxable income is essential for effective tax planning.

Types of Income Subject to Personal Taxation

Numerous forms of income are considered taxable. These include wages and salaries from employment, self-employment income (including profits from a business or freelance work), interest income from savings accounts and bonds, dividends from stocks, capital gains from the sale of assets (like stocks or real estate), rental income from properties, and alimony received (in certain cases). Each type of income may be taxed differently, with varying rates and reporting requirements. For example, capital gains are taxed at different rates depending on the length of time the asset was held. Understanding these distinctions is vital for accurate tax preparation.

Standard Deduction and its Impact on Taxable Income

The standard deduction is a flat amount that reduces your gross income, lowering your taxable income. It’s designed to account for common expenses that aren’t itemized. The amount varies based on your filing status (single, married filing jointly, etc.) and age. Claiming the standard deduction simplifies tax preparation, particularly for individuals with relatively few itemized deductions. For example, a single taxpayer might have a standard deduction of $13,850 (2023), meaning this amount is subtracted from their gross income before calculating their taxable income. If their gross income is $50,000, their taxable income would be $36,150 ($50,000 – $13,850).

Common Deductions and Credits That Reduce Taxable Income

Several deductions and credits can further reduce your taxable income. Deductions directly subtract from your gross income, while credits directly reduce the amount of tax you owe. Common deductions include those for charitable contributions, home mortgage interest (subject to limitations), and state and local taxes (subject to limitations). Common credits include the Earned Income Tax Credit (EITC) for low-to-moderate-income working individuals and families, the Child Tax Credit for qualifying children, and the American Opportunity Tax Credit for qualified education expenses. These deductions and credits can significantly lower your tax liability. For instance, a significant charitable donation could reduce your taxable income substantially. Similarly, the EITC can provide a substantial reduction in your tax owed, even resulting in a refund.

Tax Brackets and Filing Statuses

The following table illustrates the 2023 federal income tax brackets for single and married filing jointly statuses. Note that these are simplified examples and do not include all possible scenarios or tax adjustments. Consult the IRS website or a tax professional for the most up-to-date and comprehensive information.

| Filing Status | Taxable Income | Tax Rate | Example Tax Calculation |

|---|---|---|---|

| Single | $0 to $11,000 | 10% | $1,100 tax on $11,000 |

| Single | $11,001 to $44,725 | 12% | $3,987 tax on $44,725 – $11,000 = $33,725 |

| Married Filing Jointly | $0 to $22,000 | 10% | $2,200 tax on $22,000 |

| Married Filing Jointly | $22,001 to $89,450 | 12% | $8,334 tax on $89,450 – $22,000 = $67,450 |

Tax Planning Strategies for Individuals

Effective tax planning is crucial for maximizing your financial well-being. By strategically managing your income and expenses throughout the year, you can significantly reduce your tax liability and increase your after-tax income. This involves understanding various tax deductions, credits, and investment vehicles available to you. Proactive planning allows you to take control of your financial future and optimize your tax position.

Tax-Advantaged Retirement Accounts

Tax-advantaged retirement accounts, such as 401(k)s and IRAs, offer significant benefits for long-term financial planning and tax minimization. Contributions to these accounts are often tax-deductible, reducing your current taxable income. Furthermore, the investment earnings within these accounts grow tax-deferred, meaning you don’t pay taxes on the gains until retirement. This allows your investments to compound more rapidly, leading to greater wealth accumulation. The specific tax advantages vary depending on the type of account and your income level. For example, traditional 401(k)s and IRAs offer upfront tax deductions, while Roth 401(k)s and Roth IRAs provide tax-free withdrawals in retirement.

Charitable Contributions and Tax Deductions

Charitable contributions can provide a valuable tax benefit for individuals. Donations to qualified charities are often deductible from your taxable income. The amount you can deduct depends on whether you itemize your deductions or take the standard deduction. For example, if you donate $5,000 to a qualified charity and itemize, you could reduce your taxable income by $5,000, resulting in a lower tax bill. Careful record-keeping of donations, including receipts and bank statements, is essential for claiming this deduction. Different types of charitable contributions, such as cash, property, and volunteer time, may have different deduction rules.

Hypothetical Tax Plan for a Single Individual Earning $75,000 Annually

Let’s consider a hypothetical tax plan for a single individual earning $75,000 annually. We’ll assume this individual itemizes deductions to maximize their tax savings.

| Item | Amount |

|---|---|

| Gross Income | $75,000 |

| Standard Deduction (2023) | $13,850 |

| 401(k) Contribution (Assumed 15%) | $11,250 |

| Charitable Contributions | $2,000 |

| Other Itemized Deductions (e.g., State Taxes, Medical Expenses exceeding 7.5% of AGI) | $3,000 |

| Adjusted Gross Income (AGI) | $43,900 |

| Taxable Income (after deductions and credits) | (This will depend on the applicable tax brackets and any other applicable credits) |

This hypothetical plan illustrates how utilizing various deductions and contributions can significantly reduce taxable income. The actual tax liability will depend on the specific tax brackets and any applicable tax credits for the given tax year. It’s important to consult with a tax professional for personalized advice. This example does not account for potential tax credits which could further reduce the tax liability.

Investment Strategies for Tax Optimization

Investing wisely can significantly reduce your tax burden and enhance your long-term financial health. Understanding the tax implications of different investment vehicles is crucial for building a tax-efficient portfolio aligned with your risk tolerance and financial goals. This section will explore various investment strategies designed to minimize your tax liability while maximizing your returns.

Comparison of Investment Vehicles and Their Tax Implications

Stocks, bonds, and mutual funds represent three major investment categories, each with distinct tax implications. Stocks, when sold at a profit, generate capital gains taxes, the rate of which depends on the holding period (short-term or long-term). Dividends received from stocks are also taxable, often at preferential rates compared to ordinary income. Bonds, on the other hand, primarily generate interest income, which is taxed as ordinary income. Mutual funds, being diversified portfolios of stocks and/or bonds, inherit the tax characteristics of their underlying holdings. They also generate capital gains distributions and dividend distributions that are passed on to investors and taxed accordingly. The tax efficiency of a mutual fund depends on its investment strategy and trading frequency; funds with lower turnover generally generate fewer taxable distributions.

Tax-Efficient Investment Strategies for Long-Term Growth

Long-term growth requires a strategic approach that minimizes tax drag. One key strategy is to maximize contributions to tax-advantaged accounts such as 401(k)s and IRAs. These accounts offer tax deferral or tax-free growth, significantly reducing your current tax liability and allowing your investments to compound more effectively over time. Another strategy involves focusing on investments that generate long-term capital gains rather than short-term gains or ordinary income. Holding investments for longer periods allows you to benefit from lower capital gains tax rates. Furthermore, strategically utilizing tax-loss harvesting, as detailed below, can further enhance long-term tax efficiency.

Tax-Loss Harvesting and Its Benefits

Tax-loss harvesting is a powerful strategy that involves selling investments that have lost value to offset capital gains from other investments. For example, if you have a $5,000 loss on one stock and a $3,000 gain on another, you can use the $3,000 loss to offset the gain, reducing your taxable income. This strategy is particularly beneficial in years with significant capital gains. The maximum amount of capital losses that can be used to offset ordinary income is $3,000 per year for single filers and $1,500 for married filing separately. Any excess loss can be carried forward to future years. It’s important to note that tax-loss harvesting should be a part of a comprehensive investment strategy and should not drive investment decisions solely based on tax implications.

Investment Strategies Categorized by Risk Tolerance and Tax Efficiency

Choosing the right investment strategy depends heavily on your risk tolerance and your desire for tax efficiency. Below are some examples, keeping in mind that individual circumstances may vary significantly.

- Low Risk, High Tax Efficiency: High-yield savings accounts, certificates of deposit (CDs), and municipal bonds (tax-exempt in many cases). These offer stability but may not provide significant growth.

- Moderate Risk, Moderate Tax Efficiency: Index funds (low turnover, lower expense ratios), dividend-paying stocks (qualifying dividends are taxed at preferential rates), and balanced mutual funds. These offer a blend of growth and stability with moderate tax implications.

- High Risk, Variable Tax Efficiency: Growth stocks, individual bonds (subject to interest income tax), and actively managed mutual funds (higher turnover may lead to higher tax distributions). These offer higher potential returns but also carry greater risk and potentially higher tax liabilities.

Tax Implications of Major Life Events

Life’s significant milestones often bring about considerable tax implications. Understanding these changes can help you proactively manage your tax liability and optimize your financial planning. This section will explore the tax consequences associated with marriage, divorce, childbirth, homeownership, and inheritance.

Marriage

Marriage can significantly alter your tax situation. Filing jointly often results in a lower overall tax liability due to the combined income and access to higher standard deductions and tax brackets. However, it’s crucial to consider the implications of combining incomes and assets, as this can affect your overall tax bracket and eligibility for certain tax credits. For example, a couple with significantly different incomes might find that while filing jointly reduces their overall tax, it also eliminates their eligibility for certain low-income tax credits one spouse might have qualified for individually.

Divorce

Divorce introduces a complex set of tax considerations. The division of assets, including property, retirement accounts, and investments, has tax consequences. Alimony payments, while deductible for the payer and taxable for the recipient, have changed significantly under current tax laws. Understanding these changes is critical for accurate tax reporting. For example, alimony paid after 2018 is no longer deductible by the payer or included in the recipient’s income. This has major implications for financial planning during and after divorce.

Having Children

Welcoming a child into your family brings various tax benefits. The Child Tax Credit, for example, provides a substantial reduction in tax liability. Other credits and deductions, such as the Child and Dependent Care Credit, may also be available depending on your circumstances. Careful planning around childcare expenses can also help maximize tax savings. For instance, families can utilize 529 plans to save for college expenses tax-advantaged.

Homeownership (Mortgage Interest Deduction)

Homeownership offers significant tax advantages, primarily through the mortgage interest deduction. This allows homeowners to deduct the interest paid on their mortgage, reducing their taxable income. The amount deductible depends on the loan amount, interest rate, and type of mortgage. It’s important to note that there are limits on the amount of mortgage debt eligible for the deduction. For example, the deduction is limited to mortgages up to $750,000 for loans acquired after 2017.

Inheritance

Inheriting assets can have both tax advantages and disadvantages. The inheritance itself is generally not subject to income tax. However, any subsequent sale of inherited assets will be subject to capital gains tax, based on the difference between the asset’s fair market value at the time of inheritance (the stepped-up basis) and the selling price. Understanding the stepped-up basis is crucial for proper tax planning. For example, if an asset was purchased for $10,000 and inherited at a value of $20,000, the basis for capital gains calculation would be $20,000, not $10,000. This can significantly reduce the tax liability compared to inheriting the original cost basis.

| Life Event | Tax Implications | Potential Tax Benefits | Potential Tax Disadvantages |

|---|---|---|---|

| Marriage | Changes in filing status, combined income | Lower tax liability through joint filing, access to higher standard deduction | Loss of certain individual tax credits |

| Divorce | Division of assets, alimony payments (pre-2019) | Deduction of alimony payments (pre-2019) | Tax implications on asset division, potential increased tax liability |

| Having Children | Eligibility for child tax credit and other dependent care credits | Child Tax Credit, Child and Dependent Care Credit | Increased expenses, potential adjustments to deductions |

| Homeownership | Mortgage interest deduction | Reduction in taxable income through mortgage interest deduction | Limits on deductible mortgage debt |

| Inheritance | Stepped-up basis for inherited assets | Potential reduction in capital gains tax | Capital gains tax on subsequent sale of inherited assets |

Seeking Professional Tax Advice

Navigating the complexities of personal tax optimization can be challenging, even with a thorough understanding of the tax code. A qualified tax professional can provide invaluable assistance, ensuring you maximize deductions, minimize liabilities, and stay compliant with all applicable regulations. Their expertise can save you time, money, and potential legal headaches.

Professional tax advice is particularly beneficial in situations where your financial circumstances are complex or undergoing significant change. This includes instances of high income, significant investments, multiple income streams, business ownership, inheritance, or major life events like marriage, divorce, or the birth of a child. A tax advisor can help you navigate these complexities and develop a personalized strategy to optimize your tax situation.

Circumstances Warranting Professional Tax Advice

Several situations strongly suggest the need for professional tax guidance. Individuals with substantial investment portfolios, including real estate, stocks, and bonds, often benefit from expert advice to optimize investment strategies for tax efficiency. Similarly, self-employed individuals or business owners face unique tax challenges requiring specialized knowledge in areas like deductions, depreciation, and business entity selection. High-net-worth individuals often have complex financial structures that necessitate expert planning to minimize tax liabilities effectively. Lastly, anyone facing an IRS audit will undoubtedly require the services of a qualified tax professional.

Questions to Ask a Tax Advisor

Before engaging a tax advisor, it’s crucial to ask clarifying questions to ensure they’re the right fit for your needs. The advisor’s experience in handling cases similar to yours is crucial. Understanding their fee structure and payment terms is equally important. It’s also essential to inquire about their communication style and response time, ensuring you’ll receive timely and understandable advice. Finally, asking about their professional certifications and memberships in relevant organizations can provide insight into their credibility and expertise.

Types of Tax Professionals

Several types of professionals provide tax advice. Certified Public Accountants (CPAs) are licensed professionals who have passed a rigorous exam and meet stringent continuing education requirements. Enrolled Agents (EAs) are federally authorized tax practitioners who specialize in representing taxpayers before the IRS. Both CPAs and EAs possess extensive knowledge of tax laws and regulations, enabling them to provide comprehensive tax planning and preparation services. While both can offer valuable assistance, their specific areas of expertise may differ, with CPAs often involved in broader financial advisory roles. The choice depends on individual needs and the complexity of the tax situation. For example, a CPA might be better suited for complex business tax issues, while an EA might be more focused on individual tax returns and IRS representation.

Staying Compliant with Tax Laws

Navigating the tax system can be complex, but understanding and adhering to tax laws is crucial for avoiding penalties and maintaining financial well-being. Compliance involves accurate record-keeping, timely filing, and a thorough understanding of applicable regulations. Failure to comply can lead to significant financial repercussions.

Accurate record-keeping is the cornerstone of tax compliance. Maintaining detailed and organized financial records allows for the accurate calculation of taxable income and ensures a smooth and efficient tax filing process. This also simplifies any potential audits and provides a clear history of your financial transactions.

Penalties for Tax Evasion and Non-Compliance

The penalties for tax evasion and non-compliance can be substantial and vary depending on the severity and nature of the violation. These penalties can include financial fines, interest charges on unpaid taxes, and even criminal prosecution in severe cases of intentional tax fraud. For example, failing to file a tax return can result in penalties equal to a percentage of the unpaid tax, plus interest. Similarly, intentionally underreporting income can lead to significantly higher penalties and potential legal action. The IRS has various methods for detecting non-compliance, including data matching with third-party payers and thorough audits of selected returns.

Best Practices for Avoiding Common Tax Filing Mistakes

Several common mistakes can lead to delays, penalties, or amended returns. These mistakes often stem from simple oversights or a lack of understanding of specific tax regulations. Proactive measures can mitigate these risks.

- Double-checking all information for accuracy before submitting your return.

- Keeping meticulous records of all income and expenses throughout the year.

- Understanding the different tax forms and schedules required for your specific situation.

- Utilizing tax software or seeking professional help to ensure accurate completion of your tax return.

- Filing your return before the deadline to avoid late-filing penalties.

Filing a Tax Return: A Step-by-Step Guide

Filing your tax return can seem daunting, but breaking it down into manageable steps simplifies the process. Accurate and timely filing is essential for maintaining compliance.

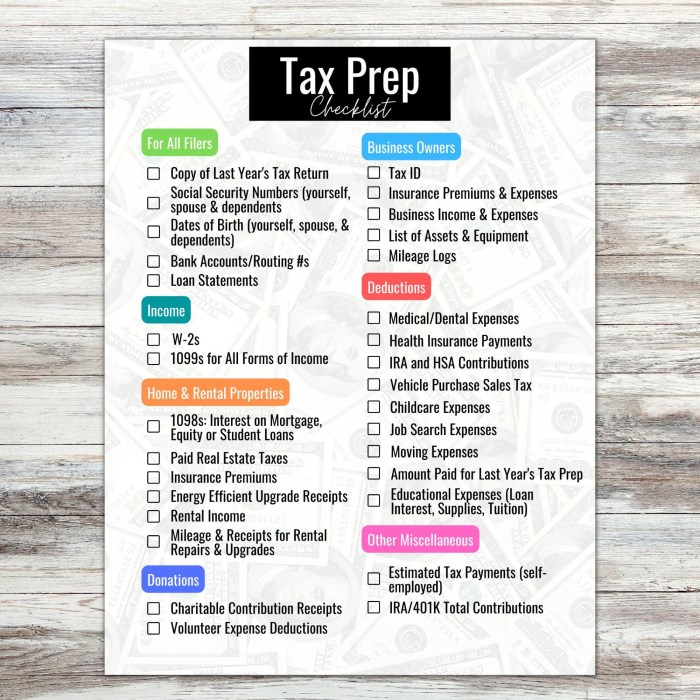

- Gather necessary documents: Collect all relevant tax documents, including W-2s, 1099s, receipts for deductions, and any other supporting documentation.

- Choose a filing method: Decide whether to file electronically or by mail. Electronic filing is generally faster and more efficient.

- Select the appropriate tax form: Determine which tax form(s) apply to your situation (e.g., Form 1040 for individual income tax returns).

- Complete the tax form accurately: Carefully fill out all required fields on the tax form, ensuring accuracy and completeness.

- Review and verify: Thoroughly review the completed tax return before submitting it to ensure accuracy and identify any potential errors.

- File your return: Submit your tax return by the designated deadline, either electronically or by mail.

Final Wrap-Up

Effective personal tax optimization is a proactive, ongoing process, not a one-time event. By consistently applying the strategies discussed – from understanding your taxable income and utilizing available deductions to making tax-efficient investment choices and seeking professional guidance when necessary – you can significantly improve your financial position. Remember, informed decisions today can lead to substantial long-term benefits.

Common Queries

What is the difference between a CPA and an enrolled agent?

Certified Public Accountants (CPAs) are licensed professionals who can provide a wide range of accounting and tax services. Enrolled agents are federally licensed tax professionals who specialize in representing taxpayers before the IRS.

When should I seek professional tax advice?

Professional advice is beneficial when dealing with complex financial situations, significant life changes (marriage, divorce, inheritance), or if you are unsure about the best strategies for your specific circumstances.

What are some common tax filing mistakes to avoid?

Common mistakes include inaccurate reporting of income, neglecting deductions and credits, and failing to maintain proper records. Using tax software or seeking professional help can significantly reduce errors.

How often should I review my tax strategy?

Ideally, your tax strategy should be reviewed annually, or whenever there’s a significant change in your income, family status, or investment portfolio.