Navigating the complexities of personal taxes can feel daunting, but proactive planning can significantly impact your financial well-being. This guide provides a comprehensive overview of effective tax strategies, empowering you to make informed decisions and optimize your tax liability. We’ll explore various income types, deductions, and strategies tailored to different income levels, helping you understand how to minimize your tax burden and maximize your financial resources.

From understanding taxable income and utilizing available deductions to strategically planning for retirement and investments, we’ll cover essential aspects of personal tax management. We will also delve into estate planning and the importance of seeking professional advice when necessary. This guide aims to equip you with the knowledge and tools to confidently navigate the tax landscape.

Introduction to Personal Tax Planning

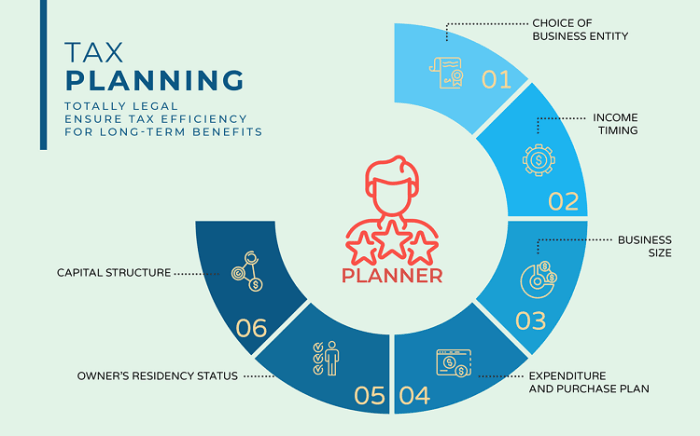

Proactive personal tax planning is crucial for maximizing your financial well-being. It’s not just about minimizing your tax bill; it’s about strategically managing your finances to achieve your long-term financial goals, whether that’s saving for retirement, buying a home, or funding your children’s education. Failing to plan effectively can lead to significant financial losses over time.

Effective tax planning strategies offer several key benefits. These include reducing your overall tax liability, increasing your disposable income, improving your cash flow, and optimizing your investment returns. By understanding the tax implications of your financial decisions, you can make informed choices that lead to greater financial security and prosperity. Proper planning can also help avoid costly penalties and interest charges resulting from unintentional non-compliance.

Tax Brackets and Their Implications

Understanding your tax bracket is fundamental to effective tax planning. Tax brackets represent different income ranges, each subject to a specific tax rate. As your income increases, you move into higher tax brackets, resulting in a progressively higher tax rate on a portion of your income, not your entire income. For example, in many jurisdictions, there are several tax brackets, ranging from a lower rate for lower incomes to a higher rate for higher incomes. This system is often referred to as a progressive tax system. It’s important to note that the specific tax brackets and rates vary depending on your location and filing status (single, married filing jointly, etc.). Accurate knowledge of your tax bracket allows you to make informed decisions about income, deductions, and investments to minimize your tax burden within the legal framework. For instance, you might adjust your investment strategy to take advantage of tax-advantaged accounts or defer income to a lower-tax year.

Understanding Taxable Income

Taxable income forms the foundation of your personal tax liability. It represents the amount of your income that is subject to tax after accounting for allowable deductions and allowances. Understanding how taxable income is calculated is crucial for effective tax planning. This section will explore various income types and the mechanisms available to reduce your tax burden.

Understanding the different types of income that are subject to tax is fundamental to accurate tax filing. Various sources contribute to your overall income, and each may be treated differently for tax purposes.

Types of Taxable Income

Taxable income encompasses a broad range of earnings. This includes, but is not limited to, salary and wages from employment, investment income (such as dividends and interest), business profits (for self-employed individuals), rental income from property, capital gains from the sale of assets, and even certain types of government benefits. The specific tax treatment of each income type may vary depending on local tax laws and regulations. For example, capital gains often receive preferential tax treatment compared to ordinary income. It’s important to consult relevant tax guidelines for a complete understanding of the tax implications of each income source.

Deductions and Allowances

Several deductions and allowances can significantly reduce your taxable income, ultimately lowering your tax liability. These provisions are designed to provide relief for specific circumstances or expenses. Understanding and utilizing these deductions is a key element of effective tax planning.

Common Deductions and Their Impact

The following table illustrates some common deductions and their potential impact on taxable income. Remember that eligibility criteria and specific amounts can vary depending on individual circumstances and applicable tax laws. Always consult with a tax professional or refer to the official tax guidelines for the most accurate and up-to-date information.

| Deduction Type | Description | Eligibility Criteria | Tax Savings Example |

|---|---|---|---|

| Charitable Donations | Donations to registered charities. | Donations must be to a registered charity and typically require proof of donation. | A $1000 donation with a 20% tax rate could result in a $200 tax reduction. |

| Registered Retirement Savings Plan (RRSP) Contributions | Contributions made to a registered retirement savings plan. | Contributions are subject to annual contribution limits. | A $5000 contribution may reduce taxable income by $5000, resulting in a tax saving dependent on the individual’s tax bracket. |

| Medical Expenses | Eligible medical expenses exceeding a certain percentage of your net income. | Specific medical expenses qualify; receipts are required. The threshold for deductibility is usually a percentage of your net income. | If eligible medical expenses exceed the threshold, a portion may be deductible, resulting in tax savings. The exact amount depends on the excess and the individual’s tax bracket. |

| Child Care Expenses | Expenses incurred for childcare to allow for work or education. | Expenses must be for eligible childcare, and receipts are usually required. There are often income limits for eligibility. | Depending on the amount of expenses and the applicable tax credit rates, significant tax savings can be achieved. |

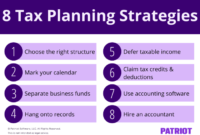

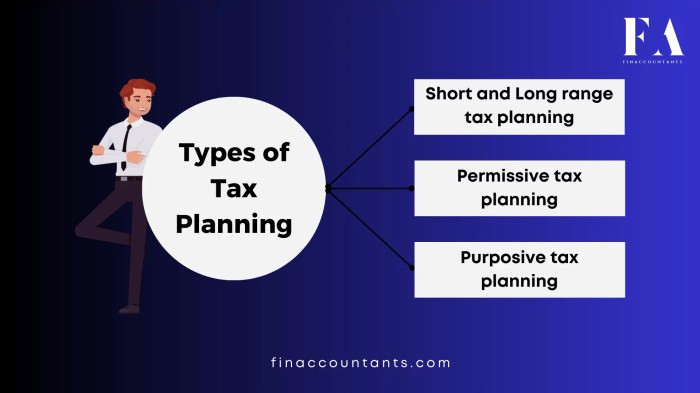

Tax Planning Strategies for Different Income Levels

Effective tax planning isn’t a one-size-fits-all approach. Strategies that work well for high-income earners might be entirely unsuitable, or even unavailable, to those with lower incomes. Understanding your income bracket is crucial for maximizing tax efficiency and minimizing your tax burden. This section Artikels suitable tax planning strategies categorized by income level: low, medium, and high.

Tax Planning Strategies for Low-Income Earners

Low-income earners often face different challenges regarding tax planning. Their focus is typically on maximizing deductions and credits to reduce their overall tax liability, rather than sophisticated investment strategies. The goal is to ensure they are taking full advantage of all available benefits designed to support lower-income individuals and families.

- Earned Income Tax Credit (EITC): This is a refundable tax credit for low-to-moderate-income working individuals and couples, potentially significantly reducing or eliminating their tax liability. Eligibility requirements vary based on income, filing status, and number of dependents.

- Child Tax Credit (CTC): If applicable, claiming the CTC can significantly reduce taxes owed for families with qualifying children. This credit is partially refundable, meaning a portion can be received back even if the credit exceeds the tax liability.

- Standard Deduction Maximization: Low-income earners should ensure they are utilizing the full standard deduction amount allowed by the IRS. This reduces taxable income without requiring itemized deductions.

Tax Planning Strategies for Medium-Income Earners

Medium-income earners have a broader range of tax planning options available to them compared to low-income earners. They can leverage a combination of deductions, credits, and tax-advantaged savings plans to optimize their tax situation. The focus shifts towards strategic savings and investment planning alongside utilizing available deductions.

- Tax-Advantaged Retirement Accounts: Contributing to a 401(k) or traditional IRA allows for pre-tax contributions, reducing current taxable income. The tax benefit is realized upon retirement when withdrawals are taxed.

- Health Savings Account (HSA): For those with a high-deductible health plan, an HSA offers tax advantages for saving for healthcare expenses. Contributions are tax-deductible, grow tax-free, and withdrawals for qualified medical expenses are tax-free.

- Itemized Deductions: Medium-income earners should analyze whether itemizing deductions (such as mortgage interest, charitable contributions, and state and local taxes) results in a lower tax liability than the standard deduction.

Tax Planning Strategies for High-Income Earners

High-income earners face more complex tax situations and have access to a wider array of sophisticated tax planning strategies. The focus here is often on minimizing the overall tax burden through strategic investments and tax-efficient wealth management techniques.

- Tax-Loss Harvesting: Offsetting capital gains with capital losses can reduce overall capital gains taxes. This involves selling losing investments to offset gains from other investments.

- Qualified Dividends and Capital Gains Rates: Understanding the different tax rates for qualified dividends and capital gains is crucial for optimizing investment strategies. High-income earners may benefit from holding investments longer to qualify for lower rates.

- Tax-Efficient Investments: Investing in tax-advantaged accounts like Roth IRAs (for those who expect to be in a higher tax bracket in retirement) can provide long-term tax benefits.

- Estate Planning: High-income earners should consider advanced estate planning strategies to minimize estate taxes and ensure a smooth transfer of wealth to heirs. This may involve trusts and other complex financial instruments.

Retirement Planning and Tax Implications

Planning for retirement involves careful consideration of various tax implications to maximize savings and minimize your tax burden during retirement. Understanding the tax advantages offered by different retirement plans is crucial for building a secure financial future. This section will explore the tax implications of several popular retirement savings vehicles.

Tax-Advantaged Retirement Accounts

Several retirement accounts offer tax advantages, allowing you to reduce your current taxable income and potentially defer taxes until retirement. These plans differ in their contribution limits, tax treatment of contributions and earnings, and withdrawal rules. Choosing the right plan depends on individual circumstances and financial goals.

Examples of Tax-Advantaged Retirement Accounts and Their Benefits

The most common tax-advantaged retirement accounts include 401(k)s, Traditional IRAs, Roth IRAs, and SEP IRAs. Each offers unique benefits. For instance, 401(k) plans, often sponsored by employers, allow pre-tax contributions, reducing your current taxable income. Traditional IRAs also allow for pre-tax contributions, offering similar tax benefits. However, Roth IRAs, while contributing after-tax dollars, offer tax-free withdrawals in retirement. SEP IRAs are designed for self-employed individuals and small business owners, offering significant contribution flexibility.

Comparison of Retirement Plans

The following table compares key features of different retirement plans:

| Retirement Plan | Contribution Limits (2024 – Example) | Tax Benefits | Withdrawal Rules |

|---|---|---|---|

| 401(k) | $23,000 (employee) + $7,500 (50+ catch-up) | Pre-tax contributions reduce current taxable income; earnings grow tax-deferred. | Withdrawals are taxed in retirement; early withdrawals may incur penalties. |

| Traditional IRA | $7,000 (individual) + $1,000 (50+ catch-up) | Pre-tax contributions reduce current taxable income; earnings grow tax-deferred. | Withdrawals are taxed in retirement; early withdrawals may incur penalties. |

| Roth IRA | $7,000 (individual) + $1,000 (50+ catch-up) | Contributions are made after tax, but withdrawals in retirement are tax-free. | Withdrawals of contributions are tax-free; early withdrawals of earnings may incur penalties. |

| SEP IRA | Up to 25% of net self-employment income | Contributions are tax-deductible for business owners; earnings grow tax-deferred. | Withdrawals are taxed in retirement; early withdrawals may incur penalties. |

Tax Implications of Investments

Understanding the tax implications of your investments is crucial for effective personal tax planning. Different investment types are treated differently by the tax system, and a well-informed approach can significantly reduce your overall tax liability. This section will explore the tax treatment of common investments and the impact of capital gains and losses.

Tax Treatment of Different Investment Types

The tax implications of investments vary greatly depending on the asset class. Stocks, bonds, and real estate each have unique tax characteristics.

Stocks: Profits from selling stocks are considered capital gains, taxed at rates dependent on the holding period. Short-term capital gains (assets held for one year or less) are taxed at your ordinary income tax rate. Long-term capital gains (assets held for more than one year) are taxed at preferential rates, generally lower than ordinary income rates. Dividends received from stocks are also taxable, although qualified dividends may receive a reduced tax rate. For example, if you sell a stock for $10,000 that you purchased for $5,000 after holding it for two years, you’ll have a $5,000 long-term capital gain, taxed at the applicable long-term capital gains rate.

Bonds: Interest income from bonds is generally taxed as ordinary income. This means it’s taxed at your regular income tax bracket. Municipal bonds, however, often offer tax-exempt interest, making them attractive to investors in higher tax brackets. For example, if you receive $1,000 in interest from a corporate bond, this entire amount is added to your taxable income and taxed at your ordinary income tax rate.

Real Estate: Real estate investments can generate income through rental payments and capital gains from the sale of the property. Rental income is taxed as ordinary income, while capital gains are taxed similarly to stock capital gains, with rates depending on the holding period. Depreciation deductions can offset rental income, reducing taxable income. However, when the property is sold, depreciation recapture may result in a higher tax liability. For example, if you sell a rental property for $500,000 after deducting $100,000 in depreciation, you may face capital gains tax on the $500,000 profit but also additional tax on the recaptured depreciation.

Capital Gains and Losses

Capital gains represent profits from the sale of assets held for investment purposes, while capital losses represent losses from such sales. The tax implications of capital gains and losses depend on the type of asset, holding period, and the net capital gain or loss for the year. Capital losses can be used to offset capital gains, reducing your overall tax liability. If capital losses exceed capital gains, you can deduct up to $3,000 ($1,500 if married filing separately) against ordinary income. Any excess loss can be carried forward to future years. For instance, if you have $10,000 in capital gains and $15,000 in capital losses, you can deduct $3,000 against your ordinary income, and carry forward the remaining $2,000 loss to offset future gains.

Investment Choices and Overall Tax Liability

The types of investments you choose directly impact your overall tax liability. A portfolio heavily weighted towards tax-advantaged investments, such as municipal bonds or investments within tax-advantaged accounts like a 401(k) or IRA, will generally result in a lower tax burden compared to a portfolio primarily comprised of taxable investments like stocks generating significant dividends or short-term gains. For example, an investor with a high income might benefit from allocating a larger portion of their portfolio to municipal bonds to reduce their overall tax burden, while an investor in a lower tax bracket might find that the benefits of municipal bonds are less significant. Careful planning and diversification across various asset classes, considering their respective tax implications, are essential for minimizing your tax liability.

Estate Planning and Tax Considerations

Effective estate planning is crucial not only for ensuring your wishes are carried out after your death but also for minimizing potential tax liabilities for your heirs. Failing to plan can lead to significant tax burdens and unnecessary complications for your loved ones. This section will Artikel key aspects of estate planning and strategies to mitigate tax implications.

Estate tax planning involves strategies to reduce the amount of estate tax owed upon your death. These strategies often involve minimizing the taxable value of your estate and utilizing legal structures to transfer assets efficiently. Understanding the complexities of estate tax laws is essential, and seeking professional advice is highly recommended.

Estate Tax Minimization Strategies

Minimizing estate tax involves proactive strategies implemented during your lifetime. These strategies aim to reduce the overall value of your estate subject to tax. Common strategies include gifting assets to beneficiaries, making use of available tax exemptions, and employing various trust structures. Careful consideration of your individual circumstances and financial situation is crucial in determining the most appropriate strategies. For instance, gifting assets to family members while you are alive allows you to utilize your lifetime gift tax exemption, reducing the size of your estate at the time of your death. Similarly, establishing trusts can provide a way to manage and distribute assets in a tax-efficient manner.

The Importance of Wills and Trusts

A will is a legal document outlining how your assets will be distributed after your death. Without a will, your assets will be distributed according to your state’s intestacy laws, which may not align with your wishes. Trusts, on the other hand, are legal entities that hold and manage assets for the benefit of designated beneficiaries. Different types of trusts offer various tax advantages and control mechanisms. For example, a revocable living trust allows you to retain control of your assets during your lifetime and can help avoid probate, the lengthy and often costly court process of administering an estate. An irrevocable trust, however, provides more significant tax benefits but sacrifices control over the assets.

Creating a Basic Estate Plan

Developing a comprehensive estate plan requires careful consideration and often professional guidance. A basic estate plan typically includes the following steps:

First, you need to assess your assets and liabilities. This involves making a detailed inventory of all your property, including real estate, investments, bank accounts, and personal belongings. You should also list any debts or liabilities you have.

- Inventory your assets and liabilities: Create a comprehensive list of all your possessions and debts.

- Determine your beneficiaries: Identify the individuals or organizations you wish to inherit your assets.

- Choose an executor: Select a trustworthy individual to manage the distribution of your assets after your death.

- Draft a will: Formalize your wishes for the distribution of your assets. Consider consulting with an estate planning attorney to ensure your will is legally sound and meets your specific needs.

- Consider establishing a trust: Explore the benefits of trusts for asset protection, tax minimization, and estate administration. This may involve seeking professional advice from a financial advisor or estate planning attorney.

- Review and update your plan: Your estate plan should be reviewed and updated periodically to reflect changes in your circumstances, such as marriage, divorce, birth of a child, or significant changes in your assets.

Tax Credits and Benefits

Navigating the tax system can be complex, but understanding available tax credits and benefits can significantly reduce your tax burden. These provisions offer financial relief to taxpayers who meet specific criteria, making tax planning more effective. This section Artikels several common tax credits and benefits, explaining their eligibility requirements and how to claim them.

Tax credits directly reduce the amount of tax owed, dollar for dollar. Benefits, on the other hand, may reduce taxable income or provide direct payments, impacting your overall tax liability. It’s crucial to understand the differences to maximize your savings.

Types of Tax Credits and Benefits

Several tax credits and benefits are available, depending on your individual circumstances. These can include credits for children, education, disability, and retirement savings, among others. Understanding which credits apply to your situation is key to minimizing your tax bill. Eligibility criteria vary depending on income, family status, and other factors.

Claiming Tax Credits and Benefits

Accurately claiming tax credits and benefits requires careful attention to detail. Most credits and benefits are claimed using specific forms that accompany your tax return. It’s advisable to maintain thorough records of all supporting documentation, such as medical expenses, education costs, or childcare receipts. The accuracy of your claim directly impacts the amount of relief you receive. Incorrectly claimed credits may lead to delays or adjustments to your refund.

Summary of Tax Credits and Benefits

| Tax Credit/Benefit | Eligibility Requirements | Maximum Credit Amount (2024 – Example, verify with current tax year) | Claiming Instructions |

|---|---|---|---|

| Child Tax Credit | Qualifying child under age 17, meet residency and relationship tests, income limits may apply. | $2,000 per qualifying child (This is an example, actual amounts vary and are subject to change) | Form 1040, Schedule 8812 |

| Earned Income Tax Credit (EITC) | Low-to-moderate-income working individuals and families; meet income and other requirements. | Varies depending on income, filing status, and number of children (This is an example, actual amounts vary and are subject to change) | Form 1040, Schedule EITC |

| American Opportunity Tax Credit (AOTC) | For qualified education expenses for the first four years of higher education; income limits apply. | Up to $2,500 per student per year (This is an example, actual amounts vary and are subject to change) | Form 8863 |

| Lifetime Learning Credit (LLC) | For qualified education expenses; no limit on the number of years the credit can be claimed. | Up to $2,000 per tax return (This is an example, actual amounts vary and are subject to change) | Form 8863 |

Seeking Professional Tax Advice

Navigating the complexities of personal tax planning can be challenging, even with a thorough understanding of the basic principles. Seeking professional guidance can significantly reduce stress and potentially lead to significant tax savings. Understanding when and how to access this expertise is crucial for effective tax management.

The decision to engage a tax professional often depends on the complexity of your individual financial situation. While straightforward tax returns can often be managed independently, more intricate circumstances necessitate expert assistance. This might include owning a business, significant investment portfolios, international income, or complex estate planning needs. Even if your situation seems straightforward, a professional consultation can provide valuable insights and peace of mind.

Types of Tax Professionals

Several types of qualified professionals offer tax advice and preparation services. Each possesses unique qualifications and expertise. Choosing the right professional depends on your specific needs and budget.

- Certified Public Accountants (CPAs): CPAs are licensed professionals who have passed a rigorous exam and meet specific experience requirements. They possess extensive knowledge of accounting, auditing, and taxation, and can offer a wide range of services, from tax preparation and planning to financial advisory services.

- Enrolled Agents (EAs): EAs are federally licensed tax practitioners who specialize in taxation. They are authorized to represent taxpayers before the IRS and have a high level of expertise in tax law and regulations. They often focus specifically on tax preparation and problem resolution with the IRS.

- Tax Attorneys: Tax attorneys are lawyers who specialize in tax law. They can provide legal advice on tax-related matters, represent taxpayers in tax audits or disputes, and assist with complex tax planning strategies. They are particularly helpful in navigating legal aspects of tax law.

Finding a Qualified Tax Professional

Selecting a competent and trustworthy tax professional requires careful consideration. A thorough vetting process can safeguard your financial interests and ensure you receive accurate and effective tax services.

- Seek Recommendations: Ask trusted friends, family members, or financial advisors for referrals. Word-of-mouth recommendations often provide valuable insights into a professional’s competence and client service.

- Verify Credentials: Check the professional’s credentials and licensing information. For CPAs, verify their license with your state’s board of accountancy. For EAs, check their enrollment status with the IRS. For tax attorneys, confirm their bar admission and specialization.

- Review Online Reviews and Testimonials: Examine online reviews and testimonials from previous clients to gauge their experiences with the professional’s services, responsiveness, and expertise. Reputable professionals often have a consistent record of positive feedback.

- Schedule a Consultation: Before committing to a professional, schedule a consultation to discuss your tax needs and assess their expertise and communication style. A good professional will take the time to understand your situation and answer your questions clearly and thoroughly.

- Clarify Fees and Services: Obtain a clear understanding of the professional’s fees and the services included. Avoid professionals who offer unrealistically low fees or unclear pricing structures.

Illustrative Example: A Family’s Tax Situation

This example illustrates how a family can utilize various tax planning strategies to minimize their tax liability. We’ll follow the Smith family, a two-income household with two children, throughout the tax year, demonstrating the impact of proactive tax planning.

The Smith family, consisting of John and Mary, both employed professionals, and their two children, aged 8 and 10, have a combined annual gross income of $200,000. John earns $120,000, and Mary earns $80,000. They have various deductions and credits available to them, which we will explore.

The Smith Family’s Tax Situation Before Tax Planning

Before implementing any tax planning strategies, the Smith family’s taxable income is calculated using their gross income, less standard deductions and exemptions. Assuming a standard deduction of $25,900 for a married couple filing jointly in a given tax year and no other deductions, their taxable income would be $174,100 ($200,000 – $25,900). Based on the applicable tax brackets, their estimated tax liability would be approximately $30,000. This calculation is simplified and does not account for all potential deductions and credits.

Implementing Tax Planning Strategies

The Smith family could significantly reduce their tax burden by implementing several strategies. These strategies include maximizing contributions to tax-advantaged retirement accounts, utilizing tax deductions for charitable contributions, and exploring available tax credits for their children.

Tax Savings Through Retirement Contributions

By contributing the maximum allowed to their 401(k) plans, John and Mary could reduce their taxable income. Assuming a maximum contribution of $22,500 each (for a given tax year), their combined contribution would be $45,000. This would reduce their taxable income to $129,100 ($174,100 – $45,000).

Utilizing Tax Deductions for Charitable Contributions

The Smith family also made charitable contributions totaling $5,000 during the tax year. This amount is itemized, further reducing their taxable income to $124,100 ($129,100 – $5,000).

Child Tax Credit

The Smith family is eligible for the Child Tax Credit, which, in a given tax year, could reduce their tax liability by $2,000 per child, for a total credit of $4,000.

The Smith Family’s Tax Situation After Tax Planning

After implementing these strategies, the Smith family’s taxable income is significantly reduced. Their estimated tax liability, based on their reduced taxable income of $124,100 and the $4,000 child tax credit, would be substantially lower than the initial estimate of $30,000. The precise amount would depend on the applicable tax brackets for that year. This illustrates the significant impact that proactive tax planning can have on a family’s overall tax burden. This example uses simplified calculations and does not encompass all possible tax deductions and credits. Consulting a tax professional is always recommended for personalized advice.

Last Point

Effective personal tax planning is not merely about minimizing your tax bill; it’s about strategically managing your financial future. By understanding your tax obligations, utilizing available deductions and credits, and planning for long-term financial goals, you can secure a more prosperous future. Remember, seeking professional advice can be invaluable in navigating complex tax situations, ensuring you’re making the best choices for your unique circumstances. Take control of your financial future—start planning today.

User Queries

What is a tax deduction?

A tax deduction reduces your taxable income, lowering the amount of tax you owe. Examples include charitable donations and certain business expenses.

What is a tax credit?

A tax credit directly reduces the amount of tax you owe, offering a more significant benefit than a deduction.

When should I consult a tax professional?

Consult a tax professional when dealing with complex tax situations, significant investments, or substantial changes in your financial circumstances.

What are the penalties for filing taxes late?

Penalties for late filing vary but generally include interest charges on unpaid taxes. Consult the IRS website for specific details.

How often should I review my tax plan?

It’s recommended to review your tax plan annually or whenever there are significant life changes (marriage, new child, job change, etc.).