Personal Tax Planning Guide: Embark on a journey into the surprisingly delightful world of taxes! While the mere mention of tax season might send shivers down your spine, understanding the intricacies of personal tax planning can actually be empowering – and maybe even a little bit fun. This guide unravels the mysteries of deductions, credits, and strategies to help you keep more of your hard-earned money. Prepare to be amazed (and possibly slightly amused) by how much you can learn.

This guide navigates the often-bewildering landscape of personal taxation, offering clear explanations and practical strategies for individuals at all income levels. From understanding taxable income and deductions to exploring advanced tax planning techniques for high-income earners, we’ll cover it all. We’ll also delve into retirement planning, investment strategies, and estate planning, ensuring you’re equipped to make informed financial decisions. Get ready to conquer your taxes!

Introduction to Personal Tax Planning

Let’s face it: taxes aren’t exactly a barrel of laughs. But understanding personal tax planning can transform your relationship with the taxman from adversarial to… well, maybe not exactly friendly, but certainly less stressful. Think of it as a strategic game where you, the brilliant player, outsmart the system (legally, of course!).

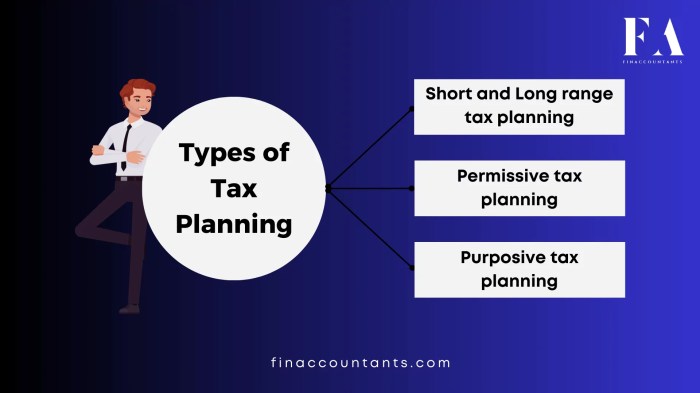

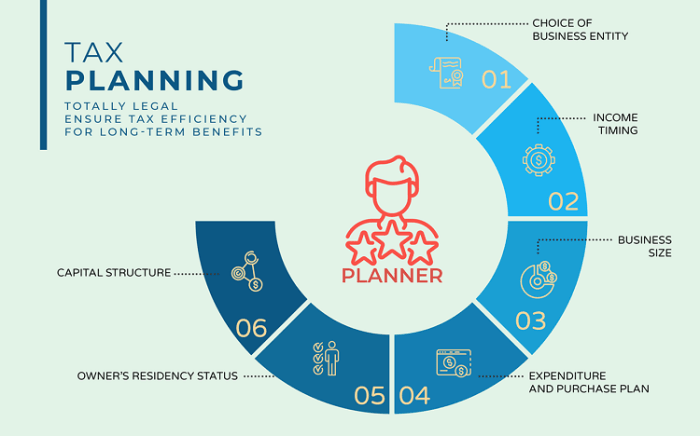

Personal tax planning is the art and science of legally minimizing your tax liability. It’s about proactively strategizing your financial decisions to reduce your tax burden throughout the year, rather than just scrambling at tax time. It’s not about cheating; it’s about making informed choices that keep more money in your pocket. Think of it as financial aikido – using the system’s own momentum to your advantage.

The Importance of Proactive Tax Planning

Reacting to tax deadlines is like trying to put out a fire with a teaspoon. Proactive planning, on the other hand, is like having a fire extinguisher – ready and waiting to prevent a blaze before it even starts. By planning ahead, you can take advantage of various tax deductions, credits, and strategies to significantly reduce your overall tax liability. This allows for better financial control and more opportunities to achieve your financial goals. Ignoring tax planning is akin to sailing a ship without a map – you might eventually reach your destination, but the journey will be far more turbulent and possibly lead to unexpected storms.

Key Benefits of Effective Personal Tax Planning

Effective personal tax planning offers several significant advantages. These advantages aren’t just about saving money; they’re about gaining control and security.

- Increased Disposable Income: By strategically minimizing your tax burden, you’ll have more money available for investments, savings, or simply enjoying life’s finer things. Imagine that extra cash funding a dream vacation or a down payment on a house – the possibilities are endless (and tax-free!).

- Improved Financial Security: Knowing you’ve optimized your tax situation provides peace of mind. This security allows you to focus on other aspects of your financial life without the constant worry of unexpected tax bills. It’s like having a financial safety net, knowing you’ve done everything you can to protect yourself.

- Long-Term Wealth Building: Strategic tax planning isn’t just about short-term savings; it’s a long-term investment in your financial future. By maximizing tax-advantaged accounts and minimizing tax liabilities, you can accelerate your wealth accumulation. Think of it as compound interest for your savings, but even better because you’re also saving on taxes.

Potential Consequences of Neglecting Tax Planning

Neglecting tax planning can lead to a number of unpleasant surprises. It’s like playing poker without knowing the rules – you might get lucky, but the odds are stacked against you.

- Higher Tax Liability: The most obvious consequence is paying more taxes than necessary. This can significantly impact your financial well-being, potentially hindering your ability to save, invest, or achieve your financial goals. This is like leaving money on the table – money that could be used for far more enjoyable purposes.

- Penalties and Interest: Failing to file taxes on time or accurately can result in hefty penalties and interest charges. These additional costs can quickly add up, turning a minor oversight into a significant financial burden. Imagine this as a financial penalty for not playing by the rules.

- Audits: The IRS may conduct an audit if your tax return raises red flags. Audits are time-consuming, stressful, and can lead to further penalties if errors are discovered. This is like getting a surprise visit from the tax police – definitely not a pleasant experience.

Understanding Taxable Income and Deductions

Navigating the world of personal taxes can feel like traversing a particularly thorny jungle, but fear not, intrepid tax adventurer! This section will illuminate the often-mysterious concepts of taxable income and deductions, transforming you from a tax novice into a tax-savvy explorer. We’ll equip you with the knowledge to confidently chart your course through the tax landscape and, hopefully, emerge with a slightly larger treasure chest (or at least a smaller tax bill).

Types of Taxable Income

Taxable income is, simply put, the money the government considers fair game for taxation. It’s not just your salary, oh no, it’s a much broader, and sometimes surprisingly inclusive, category. Various sources contribute to your overall taxable income, each with its own set of rules and regulations. Failing to report all sources of taxable income can lead to penalties, so it’s crucial to understand what counts.

Common Tax Deductions Available to Individuals

Ah, deductions – the delightful deductions! These are the reductions you can apply to your gross income to lower your taxable income. Think of them as your tax-reducing superheroes, bravely fighting to minimize your tax liability. A wide range of deductions are available, depending on your individual circumstances. Knowing which deductions apply to you is key to optimizing your tax return.

Examples of Eligible Expenses for Tax Deductions

Let’s get down to the nitty-gritty. What kinds of expenses can actually reduce your tax bill? The possibilities are more varied than you might think. From charitable donations to home office expenses, many everyday expenditures can contribute to a more favorable tax outcome. Careful record-keeping is essential, as you’ll need to prove these expenses to the tax authorities.

Documentation Required to Support Tax Deductions

“Show me the money!” (or rather, “show me the receipts!”) The tax authorities require proof to support your claimed deductions. This usually involves gathering receipts, invoices, bank statements, and other relevant documentation. The more organized you are, the smoother the process will be. Think of this as creating your own personal tax treasure map – the more detailed the map, the easier it is to find the tax-reducing gold.

Comparison of Various Tax Deductions and Their Limitations

The following table summarizes some common tax deductions and their limitations. Remember, tax laws are subject to change, so always consult the latest official guidelines.

| Deduction Type | Description | Limitation | Required Documentation |

|---|---|---|---|

| Charitable Donations | Donations to registered charities. | Usually limited to a percentage of your income. | Donation receipts. |

| Medical Expenses | Eligible medical expenses exceeding a certain percentage of your income. | Specific expenses qualify; consult tax regulations. | Medical bills, receipts. |

| Home Office Expenses | Expenses related to a dedicated home office space used for business. | Proportionate to the area used for business. | Lease/mortgage statements, utility bills, etc. |

| RRSP Contributions | Contributions to a Registered Retirement Savings Plan. | Annual contribution limits apply. | Contribution receipts. |

Tax Planning Strategies for Different Income Levels

Ah, the beautiful dance between income and taxes! It’s a waltz that can be exhilarating or exhausting, depending on your moves. Understanding how to navigate this financial foxtrot is key to keeping more of your hard-earned cash. This section explores effective tax planning strategies tailored to different income brackets, ensuring you’re always one step ahead of the taxman (who, let’s face it, is a pretty good dancer himself).

Tax Planning Strategies for Low-Income Individuals

For those with lower incomes, the focus often shifts from minimizing tax liability to maximizing available benefits and credits. While the tax burden may seem less daunting, strategic planning can still yield significant savings, freeing up funds for essential needs or future investments.

- Earned Income Tax Credit (EITC): This is a substantial credit for low-to-moderate-income working individuals and families. Properly claiming this credit can significantly reduce your tax liability or even result in a refund. Think of it as a tax-payer reward for hard work.

- Child Tax Credit (CTC): If you have qualifying children, the CTC can provide a substantial reduction in your tax bill. Knowing the eligibility requirements and claiming the credit correctly is crucial. It’s like a little extra help for raising the next generation of tax experts (or at least, taxpayers).

- Standard Deduction vs. Itemized Deductions: Carefully compare the standard deduction against itemized deductions to determine which option offers the greatest tax advantage. This might seem like a small thing, but the difference can be surprisingly substantial.

Tax Planning Strategies for Middle-Income Earners

Middle-income earners often find themselves juggling various financial responsibilities, making strategic tax planning even more vital. A well-crafted plan can help optimize savings and ensure financial stability. This is where the middle-income dance really shines.

- Retirement Savings Contributions: Maximizing contributions to tax-advantaged retirement accounts like 401(k)s and IRAs can significantly reduce your taxable income. This is like putting money aside for a rainy day, and that day happens to be called “retirement”.

- Health Savings Accounts (HSAs): If you have a high-deductible health plan, an HSA offers a triple tax advantage: contributions are tax-deductible, earnings grow tax-free, and withdrawals for qualified medical expenses are tax-free. It’s a healthcare financial three-step.

- Tax-Loss Harvesting: This involves selling losing investments to offset capital gains, reducing your overall tax liability. Think of it as a financial game of whack-a-mole – whack those losses before they whack your wallet.

Tax Planning Strategies for High-Income Individuals

High-income individuals face a more complex tax landscape, necessitating a more sophisticated approach. Advanced tax planning strategies are essential to minimize tax liability and optimize long-term financial goals. This is the advanced tax tango – it requires skill, precision, and a healthy dose of strategy.

- Tax-Efficient Investing: This involves carefully selecting investments that minimize tax exposure, such as municipal bonds or tax-advantaged mutual funds. This strategy is about being clever, not just rich.

- Estate Planning: Implementing strategies like trusts and gifting can significantly reduce estate taxes and ensure a smoother transfer of wealth to heirs. This is less of a dance and more of a well-orchestrated symphony of financial planning.

- Qualified Charitable Distributions (QCDs): For those age 70½ and older, QCDs allow direct contributions from IRA accounts to charity, reducing taxable income without affecting the contribution limits. This is a win-win – you give to charity and lower your taxes.

Retirement Planning and Tax Implications

Retirement: the golden years, a time for leisurely pursuits, and… a surprisingly complex tax landscape. Navigating the tax implications of retirement planning can feel like trying to solve a Rubik’s Cube blindfolded, but fear not! This section will illuminate the path to a tax-efficient retirement. We’ll unravel the mysteries of various retirement savings plans, compare the tax benefits of different options, and shed light on the tax consequences of withdrawals. Prepare to be amazed (and possibly slightly less stressed).

Tax Advantages of Retirement Savings Plans

Retirement savings plans offer a variety of tax advantages designed to incentivize saving for your golden years. These advantages primarily manifest as tax deductions, tax-deferred growth, or tax-free withdrawals, depending on the specific plan. The key is choosing the plan that best aligns with your individual financial situation and risk tolerance. Understanding these tax benefits is crucial for maximizing your retirement savings and minimizing your tax burden.

Traditional vs. Roth IRAs: A Tax Showdown

The age-old battle: Traditional IRA versus Roth IRA. Both offer significant tax advantages, but they operate in fundamentally different ways. Traditional IRAs allow for pre-tax contributions, reducing your current taxable income. However, withdrawals in retirement are taxed as ordinary income. Roth IRAs, on the other hand, involve after-tax contributions, meaning no upfront tax break. The reward? Tax-free withdrawals in retirement! The best choice depends on your current and projected tax brackets. If you expect to be in a higher tax bracket in retirement, a Roth IRA might be more advantageous. Conversely, a lower projected tax bracket might make a Traditional IRA more appealing. It’s a strategic game, and choosing wisely can significantly impact your retirement finances.

Tax Implications of Retirement Account Withdrawals

Withdrawing funds from your retirement accounts isn’t as simple as hitting the “withdraw” button. The tax implications vary significantly depending on the type of account, your age, and the distribution method. Early withdrawals from many plans often incur penalties, in addition to being taxed as ordinary income. However, once you reach the age of 59 1/2, the penalty usually disappears, though the income tax remains. Understanding these rules is crucial to avoiding unexpected tax bills and preserving your retirement nest egg. Careful planning, including consulting a financial advisor, can help you navigate this potentially complex area.

Summary of Tax Benefits of Different Retirement Plans

| Retirement Plan | Contribution Tax Treatment | Growth Tax Treatment | Withdrawal Tax Treatment |

|---|---|---|---|

| Traditional IRA | Pre-tax (deductible) | Tax-deferred | Taxed as ordinary income |

| Roth IRA | After-tax | Tax-free | Tax-free |

| 401(k) | Pre-tax | Tax-deferred | Taxed as ordinary income |

| 403(b) | Pre-tax | Tax-deferred | Taxed as ordinary income |

Tax Implications of Investments

Investing your hard-earned cash can be a thrilling rollercoaster ride, full of ups, downs, and unexpected twists. But before you dive headfirst into the world of stocks, bonds, and real estate, let’s strap on our metaphorical seatbelts and explore the often-overlooked, yet critically important, tax implications. Understanding these implications can mean the difference between a comfortable retirement and, well, let’s just say a less comfortable one.

Investing wisely is about more than just picking the right assets; it’s also about strategically managing the tax burden associated with those assets. This section will delve into the tax treatment of various investment types, explore the complexities of capital gains and losses, and offer strategies to help you keep more of your investment profits. Think of it as your personal tax-optimization cheat sheet (but please, use it responsibly!).

Capital Gains and Losses

Capital gains occur when you sell an asset for more than you paid for it, while capital losses happen when you sell for less. The tax implications depend on several factors, including the type of asset, how long you held it (short-term versus long-term), and your overall income. Long-term capital gains (assets held for more than one year) are generally taxed at lower rates than short-term gains. Conversely, capital losses can be used to offset capital gains, potentially reducing your tax liability. For example, if you have a $10,000 capital gain and a $5,000 capital loss, your taxable capital gain is reduced to $5,000. However, there are limitations on the amount of capital losses you can deduct in a single year.

Tax Treatment of Different Investment Types

The tax treatment of investments varies considerably depending on the asset class.

| Investment Type | Tax Implications | Example |

|---|---|---|

| Stocks | Capital gains taxes apply upon sale. Dividends may also be taxable. | Selling shares of ABC Corp for a profit results in a capital gains tax liability. Dividends received from ABC Corp are also taxable income. |

| Bonds | Interest income is generally taxable at your ordinary income tax rate. | Interest earned from a corporate bond is taxed as ordinary income, potentially at a higher rate than long-term capital gains. |

| Real Estate | Capital gains taxes apply upon sale. Depreciation deductions may be available while you own the property, reducing your taxable income. | Selling a rental property for a profit generates a capital gains tax liability. However, depreciation deductions taken over the years reduced taxable income during the ownership period. |

Strategies for Minimizing Capital Gains Taxes

Minimizing your capital gains tax bill involves careful planning and execution. One key strategy is to take advantage of tax-loss harvesting, where you sell losing investments to offset gains. Another is to strategically time your sales to take advantage of lower tax brackets or to spread out your gains over multiple years. Consider consulting with a financial advisor to develop a personalized tax-efficient investment strategy. This can involve techniques like tax-loss harvesting and careful asset allocation.

Tax-Advantaged Investment Accounts

Several investment accounts offer tax advantages, allowing your investments to grow tax-deferred or tax-free. These include:

- 401(k)s and 403(b)s: Retirement accounts offered through employers. Contributions are often tax-deductible, and investment earnings grow tax-deferred.

- IRAs (Traditional and Roth): Individual Retirement Accounts. Traditional IRAs offer tax-deductible contributions and tax-deferred growth, while Roth IRAs offer tax-free growth and withdrawals in retirement (subject to certain conditions).

- 529 Plans: Education savings plans offering tax-advantaged growth for qualified education expenses.

Choosing the right account depends on your individual circumstances and financial goals. For instance, a younger investor might favor a Roth IRA for its tax-free withdrawals in retirement, while an older investor might prefer a Traditional IRA for its immediate tax deduction. Careful consideration of your personal tax situation is crucial when choosing between these options.

Estate Planning and Tax Considerations

Let’s face it, nobody wants to think about their own mortality, but neglecting estate planning is like leaving a delicious cake out in the rain – a recipe for disaster. Proper estate planning isn’t just about ensuring your loved ones are taken care of; it’s also a crucial strategy to minimize your tax burden after you’ve shuffled off this mortal coil. Think of it as a final tax-saving power move.

Estate planning, from a tax perspective, involves strategically managing your assets to minimize the tax liabilities associated with transferring your wealth after your death. This is especially important because the tax implications of inheritance can be surprisingly hefty, depending on the size of your estate and the applicable tax laws. Failing to plan can leave your heirs with a significantly reduced inheritance, and frankly, that’s just bad form.

Tax Implications of Inheritance and Estate Taxes

Inheritance taxes, often levied on the recipient of an inheritance, and estate taxes, imposed on the value of the deceased’s estate, vary significantly across jurisdictions. These taxes can consume a substantial portion of your hard-earned wealth, leaving less for your beneficiaries. For example, imagine leaving a $5 million estate; depending on the applicable tax rates and deductions, a significant chunk of that could go straight to the government, leaving your family with considerably less. Proper planning can significantly mitigate this.

Strategies for Minimizing Estate Taxes

Minimizing estate taxes requires a proactive and multi-faceted approach. This isn’t about hiding your money under a mattress (though that might make for a fun story); it’s about utilizing legal and financial strategies to reduce your taxable estate. Effective strategies often involve a combination of approaches.

Estate Planning Tools that Minimize Tax Burdens

Several tools can help minimize your estate tax burden. These tools offer various approaches to managing and distributing assets, each with its own tax implications.

- Will: A will dictates how your assets will be distributed after your death. While not directly a tax-minimization tool, it ensures your wishes are followed, which is essential for efficient tax planning.

- Trusts: Trusts can be powerful tools for estate tax reduction. Different types of trusts, such as irrevocable life insurance trusts (ILITs) or qualified personal residence trusts (QPRTs), offer various tax advantages by removing assets from your taxable estate.

- Charitable Giving: Donating assets to qualified charities can reduce your taxable estate. This not only helps a worthy cause but also provides a significant tax benefit.

- Gifting: Gifting assets during your lifetime allows you to utilize the annual gift tax exclusion, which currently allows for a certain amount of gifting each year without incurring gift tax. This effectively reduces the size of your taxable estate.

“Proper estate planning isn’t about avoiding taxes entirely; it’s about legally and strategically minimizing your tax burden to maximize the inheritance for your loved ones.”

Tax Credits and Benefits

Ah, tax credits – the delightful little loopholes that can make your tax burden feel less like a mountain of debt and more like a manageable molehill. Or, at the very least, a slightly smaller mountain. Let’s explore the world of tax credits and benefits, where the government essentially gives you money back for doing… well, various things.

Tax credits directly reduce the amount of tax you owe, unlike deductions, which only reduce your taxable income. Think of it this way: deductions are like getting a discount, while credits are like getting a gift card. And who doesn’t love a good gift card?

Child Tax Credit

The Child Tax Credit (CTC) is a significant tax break for families with qualifying children. Eligibility depends on the child’s age, residency status, and relationship to the taxpayer. The credit amount varies depending on the child’s age and the taxpayer’s income. For example, a family with two qualifying children under age 17 might be eligible for a substantial reduction in their tax liability. The specific amounts and eligibility requirements are subject to change based on yearly legislation, so it is always best to check with the most current IRS guidelines.

Earned Income Tax Credit

The Earned Income Tax Credit (EITC) is a refundable tax credit for low-to-moderate-income working individuals and families. This means you can potentially receive a refund even if you owe no taxes. Eligibility is based on income, filing status, and the number of qualifying children. A single parent working a minimum wage job might find the EITC significantly reduces their tax burden, or even results in a substantial refund. Again, the specific amounts are subject to change, so always refer to the latest IRS information.

American Opportunity Tax Credit

The American Opportunity Tax Credit (AOTC) helps offset the cost of higher education. This credit is for students pursuing a degree at an eligible educational institution. The credit is partially refundable, meaning a portion can be received back even if it exceeds the tax liability. For example, a student pursuing a bachelor’s degree could receive a substantial credit to help pay for tuition, fees, and books.

Retirement Savings Contributions Credit

This credit incentivizes saving for retirement. Eligibility is based on income and the amount contributed to a retirement account such as a traditional IRA or a 401(k). It’s designed to help those with modest incomes save for their future, making retirement planning more attainable. A low-income worker contributing to a retirement account might find this credit particularly beneficial.

Table of Tax Credits and Benefits

| Tax Credit | Description | Eligibility Requirements | Example |

|---|---|---|---|

| Child Tax Credit | Reduces tax liability for families with qualifying children. | Child’s age, residency, relationship to taxpayer, income limits. | Family with two children under 17 may receive a significant credit. |

| Earned Income Tax Credit | Refundable credit for low-to-moderate income workers. | Income, filing status, number of qualifying children. | Single parent with low income may receive a refund. |

| American Opportunity Tax Credit | Helps pay for higher education expenses. | Student status, enrollment at eligible institution, income limits. | College student may receive credit for tuition and fees. |

| Retirement Savings Contributions Credit | Incentivizes retirement savings for low-to-moderate income individuals. | Income, contributions to retirement accounts. | Low-income worker may receive credit for contributions to a 401(k). |

Staying Compliant with Tax Laws

Navigating the world of personal taxes can feel like a thrilling adventure through a bureaucratic jungle, but fear not, intrepid tax traveler! Staying compliant isn’t as daunting as it seems, provided you arm yourself with the right tools and a healthy dose of organizational prowess. This section will guide you through the essential steps to ensure a smooth and (relatively) stress-free tax season.

Accurate record-keeping is the cornerstone of tax compliance. Think of it as building a sturdy financial fortress, brick by painstaking brick. A chaotic jumble of receipts and bank statements is not a foundation for success. Instead, meticulous record-keeping safeguards you from potential audits and ensures you claim every deduction you deserve.

Methods for Accurately Tracking Income and Expenses

Maintaining detailed records of both your income and expenses is crucial. This involves more than just shoving receipts into a shoebox (though we’ve all been there!). Consider using accounting software, spreadsheets, or even a dedicated notebook to categorize transactions. For income, keep records of pay stubs, 1099 forms, and any other documentation proving earnings. For expenses, meticulously record receipts, invoices, and bank statements related to deductible items. Remember, the IRS appreciates detail – the more organized you are, the less they’ll have to question. A well-organized system will save you time and potential headaches down the line. Imagine the satisfaction of effortlessly providing documentation should the need arise – a true testament to your fiscal responsibility.

The Importance of Filing Taxes on Time

Filing your taxes on time is not merely a suggestion; it’s a legal requirement. Delaying filing can lead to penalties and interest charges that can quickly escalate, turning a simple oversight into a significant financial burden. Think of it as paying a hefty late fee for a library book, but instead of a overdue novel, it’s your financial well-being. The IRS doesn’t take kindly to tardiness, so mark your calendar and set reminders to ensure you meet the deadline. Procrastination is the thief of time, and in this case, also the thief of your hard-earned money.

Consequences of Non-Compliance with Tax Laws

Failing to comply with tax laws can result in a range of unpleasant consequences, from hefty fines and penalties to potential legal action. The IRS has sophisticated methods for detecting discrepancies, so attempting to underreport income or claim false deductions is a risky gamble. In addition to financial penalties, non-compliance can damage your credit score and even lead to criminal charges in severe cases. Remember, honesty is not just the best policy; it’s the only policy that keeps you out of hot water with the IRS.

A Step-by-Step Guide for Preparing and Filing Tax Returns, Personal Tax Planning Guide

Preparing and filing your tax return may seem intimidating, but breaking it down into manageable steps can simplify the process.

- Gather Your Documents: Collect all necessary tax documents, including W-2s, 1099s, receipts for deductible expenses, and any other relevant financial records.

- Choose a Filing Method: Decide whether to file electronically or by mail. Electronic filing is generally faster and more efficient.

- Select Tax Software or a Tax Professional: Use tax software or hire a tax professional to assist with the preparation of your return.

- Review Your Return Carefully: Before submitting your return, thoroughly review it for accuracy and completeness.

- File Your Return: Submit your tax return by the deadline to avoid penalties.

Following these steps will help ensure a smooth and accurate tax filing experience. Remember, accuracy is key, and seeking professional help if needed is a smart move.

Seeking Professional Tax Advice

Navigating the complex world of personal taxes can feel like trying to assemble flat-pack furniture with only half the instructions – frustrating, time-consuming, and potentially leading to a wobbly result (a hefty tax bill, perhaps?). Therefore, seeking professional tax advice isn’t just a luxury; it’s a smart investment in your financial well-being. Think of it as having a seasoned guide navigate you through the tax jungle, ensuring you reach your destination without getting tangled in thorns (penalties and audits).

The benefits of enlisting a tax professional are numerous and often outweigh the cost. A skilled advisor can not only help you minimize your tax liability legally but also proactively plan for your financial future, ensuring you’re making the most of available deductions and credits. They act as your personal tax Sherpa, leading you to the summit of financial success.

Situations Requiring Professional Tax Advice

Professional tax advice becomes especially crucial in certain circumstances. These situations often involve complexities that go beyond the scope of readily available online resources or simple tax software. Failing to seek expert help in these scenarios can lead to costly mistakes.

- Complex Income Streams: If you have multiple sources of income, such as salary, freelance work, investments, and rental properties, the intricacies of reporting and deductions can quickly become overwhelming. A tax professional can simplify this process and ensure you are compliant.

- Significant Business Income or Expenses: Running a business introduces a whole new layer of tax considerations, from deductions for home office expenses to understanding self-employment taxes. Professional guidance is essential to navigate these complexities effectively.

- Significant Capital Gains or Losses: Investments, property sales, and other capital transactions can result in substantial gains or losses that have complex tax implications. A tax professional can help optimize your strategies to minimize your tax burden.

- International Tax Implications: If you have income from foreign sources or assets held abroad, navigating international tax laws is paramount. Professional help is crucial in this area to avoid costly mistakes and penalties.

- Estate Planning: As your wealth grows, so does the complexity of estate planning. A tax professional can assist in developing a strategy to minimize estate taxes and ensure a smooth transition of assets to your beneficiaries.

Choosing a Tax Advisor

Selecting the right tax advisor is a decision that should not be taken lightly. It’s like choosing a doctor – you need someone you trust and who has the expertise to handle your specific needs.

Several key factors should be considered:

- Credentials and Experience: Look for a Certified Public Accountant (CPA) or an Enrolled Agent (EA) who has experience handling cases similar to yours. Experience matters, particularly when dealing with intricate tax situations.

- Fees and Services: Understand the advisor’s fee structure and the services included. While cost is a factor, remember that a skilled professional can often save you far more in taxes than their fees.

- Communication and Trust: Effective communication is essential. Choose an advisor who explains complex concepts clearly and is responsive to your questions. Trust is paramount in a professional relationship of this nature.

- References and Reviews: Check online reviews and ask for references from previous clients to gauge their experience and satisfaction.

The Value of Personalized Tax Planning

Generic tax advice is like wearing a pair of shoes that don’t quite fit – it might work for a while, but it won’t be comfortable or optimal in the long run. Personalized tax planning, on the other hand, is like having a custom-made suit – it’s tailored to your specific circumstances, maximizing your tax benefits and minimizing your liabilities. This approach considers your unique income, expenses, investments, and future goals to create a comprehensive strategy designed to help you achieve your financial objectives. It’s not just about minimizing taxes this year; it’s about building a sustainable financial plan for the future. Think of it as a long-term investment in your financial health and peace of mind.

Illustrative Examples of Tax Scenarios

Let’s delve into the wonderfully bewildering world of tax scenarios with some real-world examples. Buckle up, because it’s going to be a bumpy – but hopefully enlightening – ride! We’ll explore how deductions and credits can significantly impact your tax liability, proving that understanding tax laws can be both financially rewarding and surprisingly entertaining.

Tax Deduction Scenario: The Case of the Charitable Baker

Imagine Beatrice, a delightful baker with a heart of gold (and a penchant for perfectly risen sourdough). Beatrice, a single filer, donates $2,000 worth of her delicious pastries to a local homeless shelter. Since she itemizes her deductions, she can deduct this amount from her gross income. Let’s assume her gross income is $60,000, and her total itemized deductions (excluding the charitable contribution) amount to $10,000.

Her adjusted gross income (AGI) before the charitable contribution deduction would be $60,000 – $10,000 = $50,000. After deducting the $2,000 charitable contribution, her AGI becomes $48,000. This reduction in AGI leads to a lower taxable income, resulting in a smaller tax bill. The exact tax savings will depend on Beatrice’s tax bracket, but it’s safe to say she’s made a delicious difference – both for the homeless shelter and her wallet!

Tax Credit Scenario: The Eco-Friendly Family

Meet the Millers, a family of four committed to environmental sustainability. They purchased a new energy-efficient heat pump for their home, costing $10,000. The government offers a tax credit for energy-efficient home improvements. Let’s assume the credit is 30% of the cost, up to a maximum of $2,000.

The Millers’ tax credit calculation is straightforward: $10,000 (cost) x 0.30 (credit rate) = $3,000. However, because the maximum credit is capped at $2,000, they receive a $2,000 tax credit. This credit directly reduces their tax liability by $2,000, providing a more substantial benefit than a deduction of the same amount would have. This means that instead of reducing their taxable income, the credit directly lowers the amount of tax they owe, offering a more significant financial boost for their green initiative. They’re saving money and the planet – a truly winning combination!

Last Recap: Personal Tax Planning Guide

Mastering personal tax planning isn’t about becoming a tax lawyer overnight; it’s about gaining control over your financial future. By understanding the fundamentals and employing the strategies Artikeld in this guide, you can significantly reduce your tax burden and achieve greater financial peace of mind. So, go forth and file – with confidence and a newfound appreciation for the art of tax optimization! Remember, a little planning goes a long way, and while taxes might not be a party, they certainly don’t have to be a nightmare.

Questions Often Asked

What happens if I don’t file my taxes on time?

Late filing penalties can be substantial, including interest charges on unpaid taxes. It’s best to file on time, or request an extension if needed.

Can I deduct my charitable donations?

Yes, you can generally deduct cash contributions to qualified charities, subject to limitations. Keep accurate records of your donations.

What is a tax audit, and how can I prepare for one?

A tax audit is a review of your tax return by the IRS. Maintain meticulous records of income, expenses, and deductions to ensure you can readily provide documentation if audited.

What are the differences between a Traditional IRA and a Roth IRA?

Traditional IRAs offer tax deductions for contributions but tax your withdrawals in retirement, while Roth IRAs don’t offer upfront deductions but provide tax-free withdrawals in retirement. The best choice depends on your individual circumstances and projected tax rates.