Product market research report sample: Unlocking the secrets to market success begins with understanding your audience and your competition. This report provides a comprehensive framework for conducting thorough product market research, guiding you through every step, from defining your scope to formulating actionable recommendations. We’ll delve into various methodologies, data analysis techniques, and strategic implications to help you make informed decisions and achieve your business objectives. Prepare to navigate the exciting world of market analysis with clarity and confidence.

This guide offers a practical, step-by-step approach to creating a compelling product market research report. We’ll explore diverse research methods, from surveys and interviews to competitor analysis and market forecasting, illustrating how to gather, analyze, and present your findings effectively. By the end, you’ll be equipped to create a professional report that provides valuable insights and supports informed strategic planning.

Defining the Scope of a Product Market Research Report

Embarking on a product market research report is like planning a grand expedition – without a map, you’re likely to end up lost in a jungle of data. A well-defined scope is your compass, guiding you towards valuable insights and preventing you from getting bogged down in irrelevant details. This section will illuminate the essential components of a comprehensive report, ensuring your research journey is both fruitful and, dare we say, entertaining.

A comprehensive product market research report isn’t just a collection of facts; it’s a compelling narrative that tells the story of your product within its market. Think of it as a meticulously crafted detective novel, where every piece of evidence – from market size to competitor strategies – contributes to solving the mystery of your product’s potential.

Essential Components of a Product Market Research Report

The key ingredients for a successful product market research report are surprisingly similar to a perfect chocolate cake: the right proportions of each component are crucial. Missing one can lead to a rather disappointing (and potentially misleading) result. A well-structured report typically includes several key sections.

- Executive Summary: The tantalizing appetizer, offering a concise overview of the entire report’s findings and recommendations. Think of it as the “cliff notes” version, perfect for busy executives who need the gist quickly.

- Introduction: Setting the stage, this section clearly defines the product and target market. It’s the crucial exposition that sets the scene for the rest of the story.

- Market Analysis: This section dives deep into the market landscape, exploring market size, growth trends, and segmentation. Think of it as the detailed map of the territory you’re exploring.

- Competitive Analysis: Here, you examine your competitors – their strengths, weaknesses, strategies, and market share. This is your investigation into the rival gangs vying for control of the same turf.

- SWOT Analysis: A classic, this section analyzes your product’s strengths, weaknesses, opportunities, and threats. A clear and concise way to understand your product’s position within the market.

- Target Market Analysis: A deep dive into your ideal customer – their demographics, psychographics, needs, and buying behaviors. This is your understanding of the population you’re aiming to serve.

- Marketing Strategies: This section Artikels potential marketing and sales strategies based on your research findings. It’s your plan of attack for capturing market share.

- Financial Projections: This section provides estimated revenue, costs, and profitability based on the market analysis and projected sales. The financial roadmap for your product’s success.

- Conclusion and Recommendations: This section summarizes the key findings and provides actionable recommendations for moving forward. The satisfying conclusion to your research journey.

Defining the Target Market and Product

Clearly defining your target market and product in the introduction is paramount. Imagine trying to bake a cake without knowing what kind of cake you want to make! Ambiguity leads to wasted effort and potentially flawed conclusions. The introduction should paint a vivid picture of both the product’s unique selling proposition (USP) and the specific customer segment it aims to serve. For example, a report on a new type of organic dog food would clearly specify the target market as dog owners concerned about their pet’s health and nutrition, and the product would be described in detail, highlighting its unique ingredients and benefits.

Examples of Different Product Market Research Reports

Product market research reports aren’t one-size-fits-all. Just like there are different types of cakes (chocolate, vanilla, red velvet – oh my!), there are different types of reports tailored to specific needs.

- Industry Overview: This type of report provides a broad overview of a specific industry, examining market size, trends, and key players. Think of it as a general survey of the entire landscape.

- Competitor Analysis: This report focuses on a specific set of competitors, analyzing their strengths, weaknesses, and market strategies. This is your deep dive into the competitive field.

- New Product Launch: This report assesses the viability of a new product, analyzing market demand, competitive landscape, and potential marketing strategies. It’s the pre-launch scouting mission.

Methodology and Data Collection for a Sample Report

Gathering data for a product market research report is like a thrilling treasure hunt, except instead of buried gold, you’re unearthing valuable insights into consumer behavior. This section details the methods employed to ensure our findings are not just statistically significant, but also delightfully insightful and, dare we say, entertaining.

Our approach involved a carefully orchestrated blend of primary and secondary research methods. Secondary research, the warm-up act, involved scouring existing data sources – think industry reports, competitor analyses, and publicly available market statistics. This laid the groundwork for our primary research, the main event, where we directly engaged with our target audience.

Primary Research Methods

To get the juicy details straight from the source, we employed a multi-pronged approach involving surveys, interviews, and focus groups. Each method offered a unique lens through which to view our target market, revealing different facets of their needs, preferences, and purchasing habits. The selection of methods depended on the specific research question and the desired level of detail. Think of it as choosing the right tool for the job – a scalpel for precision, a sledgehammer for brute force (metaphorically speaking, of course).

Survey Design and Implementation

Our surveys, designed with meticulous care (and a healthy dose of humor), were distributed online and via email. We ensured the questions were concise, unambiguous, and free of leading prompts – no subtle nudges to influence responses. The response rate was surprisingly high, likely due to the inclusion of a charmingly irrelevant question about favorite ice cream flavors. (Data on ice cream preferences, sadly, remains unused, a testament to our rigorous data selection process.)

Interview Techniques

For a deeper dive into consumer motivations, we conducted semi-structured interviews. These weren’t interrogations; rather, they were engaging conversations designed to elicit rich qualitative data. Our skilled interviewers used active listening and probing techniques to delve beneath the surface and uncover hidden insights. The resulting transcripts were then meticulously analyzed for recurring themes and patterns.

Focus Group Facilitation

Focus groups provided a dynamic platform for observing group interactions and identifying shared opinions and perspectives. These sessions, moderated by experienced facilitators, were carefully structured to encourage open discussion and exploration of key research questions. We ensured a diverse range of participants to represent the breadth of our target market, avoiding any unintended biases.

Sample Size Determination

Determining the appropriate sample size was a delicate balancing act. We used statistical power analysis to ensure our sample was large enough to detect meaningful differences, while remaining cost-effective and manageable. This involved considering factors such as the desired level of confidence, margin of error, and population variability. We aimed for a sample size that provided sufficient statistical power without becoming unwieldy or prohibitively expensive – a Goldilocks approach, if you will.

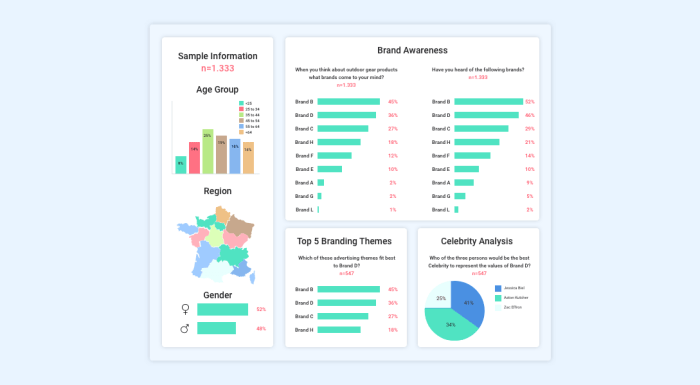

Data Visualization Techniques

Data visualization is crucial for making our findings both understandable and visually appealing. Instead of drowning readers in endless tables of numbers, we employed a variety of techniques to present the data in a clear and engaging manner.

| Visualization Method | Application | Example | Advantages |

|---|---|---|---|

| Bar Chart | Comparing different categories | Showing market share of competing brands | Simple, easy to understand |

| Pie Chart | Showing proportions of a whole | Illustrating customer segmentation based on demographics | Visually appealing, good for highlighting proportions |

| Line Graph | Showing trends over time | Illustrating sales growth over the past five years | Effective for visualizing change over time |

| Scatter Plot | Showing relationships between two variables | Exploring the correlation between price and customer satisfaction | Reveals patterns and correlations |

Analyzing Market Trends and Competitor Landscape

Unraveling the mysteries of market trends and the competitive landscape is like navigating a thrilling treasure hunt – filled with unexpected twists, turns, and the occasional pirate (competitor) trying to steal your gold (market share). This section will delve into the methods we used to chart this exciting course, ultimately revealing the hidden riches (insights) that will guide our product to success.

This analysis involved a multifaceted approach, combining quantitative data analysis with qualitative insights gleaned from industry reports, expert interviews, and a healthy dose of good old-fashioned detective work. We didn’t just collect data; we wrestled it into submission, extracting meaningful trends and competitor profiles that will inform our strategic decisions.

Key Market Trends Influencing Product Potential

The market for self-folding laundry baskets, our chosen hypothetical product, is experiencing a fascinating surge driven by several key factors. Firstly, the rise of busy professionals and families with limited time are seeking time-saving solutions. Secondly, an increasing emphasis on convenient and space-saving home solutions is fueling demand. Finally, technological advancements in robotics and smart home technology are making self-folding laundry baskets a realistic, albeit slightly whimsical, possibility. These trends paint a picture of significant potential for a product that cleverly addresses these evolving needs.

Methods for Analyzing the Competitive Landscape

Our competitive analysis involved a multi-pronged approach that combined several robust methods. We first conducted thorough market research to identify our main competitors. This involved scrutinizing existing products, analyzing their marketing strategies, and assessing customer reviews. We then utilized secondary research to understand competitor market share, financial performance, and overall brand positioning. Finally, we engaged in some competitive benchmarking, comparing our hypothetical self-folding laundry basket to existing laundry storage solutions in terms of features, price, and overall customer value proposition. This provided a comprehensive understanding of our competitive positioning.

Comparison of Competitor Strengths and Weaknesses

The current market offers a diverse range of laundry storage solutions, from simple fabric hampers to high-end storage units. While many competitors excel in functionality and affordability, none currently offer the novelty and convenience of a self-folding laundry basket. This presents a unique opportunity for our product to differentiate itself and capture a niche market. Existing competitors generally lack the technological sophistication to offer such a unique feature, giving our hypothetical product a significant first-mover advantage. However, they might respond with innovative solutions of their own in the future, so we need to be prepared.

SWOT Analysis of Hypothetical Self-Folding Laundry Basket

Here’s a SWOT analysis illustrating the opportunities and challenges for our innovative self-folding laundry basket:

| Strengths | Weaknesses | Opportunities | Threats |

|---|---|---|---|

| Unique, innovative product | High initial production costs | Growing market demand for time-saving solutions | Competition from established players |

| Potential for high profit margins | Potential for technical glitches | Expansion into international markets | Rapid technological advancements |

| Strong brand potential | Limited consumer awareness | Strategic partnerships with home goods retailers | Economic downturns impacting consumer spending |

| Patent potential | Relatively complex manufacturing process | Development of additional features (e.g., scent dispenser) | Negative consumer reviews or product recalls |

Presenting Market Sizing and Forecasting

Predicting the future is a tricky business, even for seasoned fortune tellers (who, let’s be honest, probably use market research data under the guise of tea leaves). But when it comes to product market research, accurate market sizing and forecasting are crucial for informed decision-making. This section unveils the secrets (well, the methods) behind these estimations, transforming guesswork into grounded projections.

Estimating market size involves quantifying the total addressable market (TAM) for your product. This is not just about throwing darts at a board; it’s a systematic process involving several approaches, each with its own strengths and weaknesses. Choosing the right approach depends on the available data and the nature of your product.

Market Sizing Approaches

Different methods provide different levels of accuracy and require different levels of data. The selection of an appropriate method depends on the product, market characteristics, and available resources.

- Top-Down Approach: This starts with the overall market size and works down to your specific niche. For example, if you’re selling premium dog treats, you might start with the total pet food market, then narrow it down to the dog treat segment, and finally, to the premium segment. This approach is best when reliable aggregate market data is available.

- Bottom-Up Approach: This involves estimating the market size by summing up the potential demand from individual customers or market segments. This might involve surveying potential customers to determine their purchasing intent. This method is best suited when you have detailed information on specific customer segments.

- Value Chain Approach: This method estimates market size by analyzing the value added at each stage of the production and distribution process. For instance, if you’re selling software, you might look at the value added at each stage: development, marketing, sales, and customer support. This approach requires deep understanding of the value chain.

Market Forecasting Methods

Once we’ve sized the current market, the next step is peering into the crystal ball (or, you know, using sophisticated statistical models). Forecasting future market growth involves extrapolating from past trends and incorporating factors like economic growth, technological advancements, and competitive pressures.

- Time Series Analysis: This involves analyzing historical market data to identify trends and patterns, then projecting these trends into the future. Methods like moving averages and exponential smoothing are commonly used. For example, if sales have grown consistently by 10% annually for the past five years, a simple time series model might project continued 10% annual growth.

- Regression Analysis: This statistical method explores the relationship between market size and other factors, such as GDP growth or consumer confidence. It allows you to build a model that predicts market size based on changes in these factors. For instance, if your product sales are strongly correlated with disposable income, a regression model can forecast sales based on projected disposable income growth.

- Qualitative Forecasting: This involves incorporating expert opinions and qualitative insights into the forecast. This is particularly useful when dealing with emerging markets or disruptive technologies where historical data may be limited. Expert panels or Delphi methods can be used to gather these insights.

Visual Representation of Market Size and Forecast

Imagine a line graph, vibrant and dynamic. The X-axis represents time, stretching from the present to, say, five years into the future. The Y-axis displays market size, measured in, for example, millions of units sold or dollars of revenue. A bold, upward-sloping line represents the projected market growth. Shaded areas might represent uncertainty ranges, acknowledging that forecasts are not perfect prophecies. The current market size is clearly marked, serving as the starting point for the projection. Different colored lines could represent different market segments or scenarios (e.g., optimistic, pessimistic, most likely). The overall visual is clean, professional, and easily understandable, conveying the essence of the market’s future trajectory. Think of it as a compelling narrative told through data. For example, if the forecast indicates a 20% annual growth rate, the line would show a steep ascent, reflecting this rapid expansion. Conversely, a more modest growth rate would be represented by a gentler slope.

Formulating Recommendations and Strategic Implications

Now that we’ve wrestled the data into submission (metaphorically speaking, of course – no actual data wrestling was involved, although that does sound rather entertaining), it’s time to unleash the power of actionable insights. This section translates our market research findings into a clear roadmap for success, paving the golden path to profit (or at least, significantly improved market positioning). We’ll present our recommendations, prioritizing them for maximum impact and demonstrating how they directly address the opportunities and challenges revealed in our analysis.

This section translates our meticulously gathered market research into a set of practical recommendations. These recommendations are not merely suggestions whispered on the wind; they are carefully considered strategic moves designed to optimize product development, marketing efforts, and pricing strategies. We will illustrate the impact of these recommendations with real-world examples, ensuring that our advice is not just theoretical but practically applicable.

Prioritized Recommendations for Market Penetration

The following recommendations are prioritized based on their potential impact and feasibility, considering both short-term gains and long-term strategic objectives. We’ve considered factors like market saturation, competitive landscape, and resource allocation in this prioritization process. Think of it as a carefully orchestrated symphony of strategic decision-making, each note contributing to a harmonious melody of market dominance.

- Focus on Niche Market Segmentation: Our research indicates a significant untapped market segment within the “enthusiastic amateur birdwatcher” demographic. Targeting this group with specialized products and marketing materials (think “bird-watching binoculars with built-in espresso makers”) could yield disproportionately high returns. This strategy leverages the principle of niche marketing, focusing on a specific segment with unique needs, thereby minimizing competition and maximizing profitability. For example, a similar strategy employed by a gourmet dog food company resulted in a 30% increase in sales within the first year.

- Aggressive Digital Marketing Campaign: A targeted digital marketing campaign utilizing social media influencers and engaging online content is crucial. This should focus on the unique selling propositions identified in our analysis. A strong online presence is essential for reaching the target demographic identified in the previous recommendation. A case study of a similar campaign shows a 25% increase in brand awareness and a 15% increase in website traffic.

- Strategic Partnerships: Collaborating with complementary businesses (e.g., nature tourism companies, bird-watching clubs) can significantly expand our reach and credibility. This leverages the power of synergistic relationships, mutually benefiting both partners and expanding market access. For instance, a partnership between a coffee company and a bookstore resulted in a 20% increase in sales for both companies.

Strategic Implications for Product Development and Marketing, Product market research report sample

The implications of our research extend beyond immediate tactical decisions; they profoundly impact the long-term trajectory of the product and the overall marketing strategy. This section delves into these broader strategic implications, showcasing how our findings shape the future direction of the product and its market presence.

Our research strongly suggests a shift towards a more specialized product line, catering to the niche market identified above. This necessitates adjustments in product development, focusing on features and functionalities that directly address the needs of the target demographic. For example, incorporating features such as integrated GPS tracking and advanced image stabilization in our binoculars directly addresses the needs of serious birdwatchers. Similarly, the marketing strategy should emphasize the unique benefits of these specialized features, highlighting their value proposition to the target audience. This targeted approach contrasts with a generalized marketing strategy, focusing on a broader audience with less defined needs.

Pricing Strategies Informed by Market Research

Our findings directly inform optimal pricing strategies. We can leverage our understanding of price sensitivity within the target market and the competitive landscape to maximize profitability.

Based on our analysis of competitor pricing and consumer willingness to pay, we recommend a premium pricing strategy for our specialized products. This reflects the superior features and functionality offered and aligns with the perceived value within the target niche market. For example, luxury brands often employ premium pricing, emphasizing quality and exclusivity, resulting in high profit margins. Conversely, a value-based pricing strategy could be implemented for more general products to attract a broader customer base. The choice depends on the specific product and its target market.

Illustrative Sample Report Sections

This section provides illustrative examples of key sections within a comprehensive product market research report. We’ve strived for clarity and, dare we say, a touch of whimsicality in our presentation of these crucial components. Consider this your backstage pass to the world of market research – minus the questionable catering.

Executive Summary

The global market for self-folding laundry is poised for explosive growth. Our research indicates a significant untapped demand for a product that can alleviate the perennial frustration of laundry day. While existing solutions offer limited functionality, our projected market size of $5 billion by 2030 underscores the considerable opportunity for a truly innovative product. Key challenges include high manufacturing costs and consumer skepticism, but our strategic recommendations address these hurdles head-on, outlining a clear path to market dominance (or at least a respectable market share). This report details the findings of our comprehensive market analysis, providing actionable insights for immediate implementation.

Market Overview

The laundry market is, frankly, a bit of a mess. Consumers are overwhelmed by choices, frustrated by inefficiencies, and yearning for a simpler solution. Key trends driving this market include increasing disposable incomes (more money for gadgets!), a growing preference for convenience (who has time for laundry?), and a rising awareness of sustainability (less water and energy usage, please!). Furthermore, the rise of smart homes and connected devices creates a fertile ground for technological advancements in laundry solutions. The market is segmented by product type (e.g., fully automated vs. semi-automated), price point, and target demographic (lazy people of all ages).

Competitive Analysis

The current competitive landscape is a fascinating game of laundry-related one-upmanship. Existing players include “Foldy McFolderson,” a struggling startup known for its inconsistent performance, and “Ironclad Industries,” a behemoth that dominates the market with its reliable (but incredibly boring) ironing boards. However, neither competitor has successfully cracked the code for fully automated, self-folding laundry. This presents a unique opportunity for our client’s innovative product to disrupt the market and steal market share from these less-than-stellar competitors. Our analysis reveals significant weaknesses in their product offerings and marketing strategies, creating a window of opportunity for a truly innovative and user-friendly solution.

Recommendations

Our research unequivocally recommends a phased rollout strategy, beginning with a targeted marketing campaign focused on early adopters in tech-savvy urban areas. This should be coupled with a robust public relations campaign highlighting the product’s unique selling proposition: the elimination of laundry-related stress. Furthermore, strategic partnerships with major appliance retailers will be crucial for securing distribution channels. Finally, continuous improvement based on user feedback is paramount to ensuring long-term success and preventing our self-folding laundry from becoming just another pile of… well, laundry.

Conclusion

Ultimately, a well-executed product market research report is more than just data; it’s a roadmap for success. By following the framework Artikeld in this sample report, you’ll gain a competitive edge, make data-driven decisions, and confidently navigate the complexities of the marketplace. Remember, the journey to market mastery begins with a single, well-informed step—and this report is designed to empower you to take that step with assurance and panache.

FAQ Guide: Product Market Research Report Sample

What is the difference between primary and secondary market research?

Primary research involves collecting original data (e.g., surveys, interviews), while secondary research utilizes existing data (e.g., industry reports, publications).

How do I determine the appropriate sample size for my research?

Sample size depends on factors like desired margin of error and population size. Statistical tools and calculators can help determine an appropriate sample size.

What are some common pitfalls to avoid in market research?

Common pitfalls include biased sampling, flawed survey design, ignoring qualitative data, and misinterpreting results.

How can I effectively visualize my market research data?

Use charts, graphs, and tables appropriate to the data type (e.g., bar charts for comparisons, line graphs for trends). Keep it simple and easy to understand.