Quantitative Market Research Reports: Prepare yourself for a statistically significant journey into the fascinating world of data-driven insights! We’ll explore the nuts and bolts of crafting compelling reports, from designing surveys that don’t induce existential dread in respondents to interpreting results that don’t make your head spin faster than a centrifuge. Get ready to unleash your inner data detective—no magnifying glass required (though a good spreadsheet program is highly recommended).

This exploration delves into the methodologies behind creating robust quantitative market research reports. We’ll cover everything from choosing the right data collection methods (think surveys versus experiments—a battle for the ages!) to mastering the art of data visualization (because a picture is worth a thousand data points, or so we’re told). We’ll also tackle the ethical considerations and potential pitfalls—because even numbers can be mischievous sometimes.

Defining Quantitative Market Research Reports

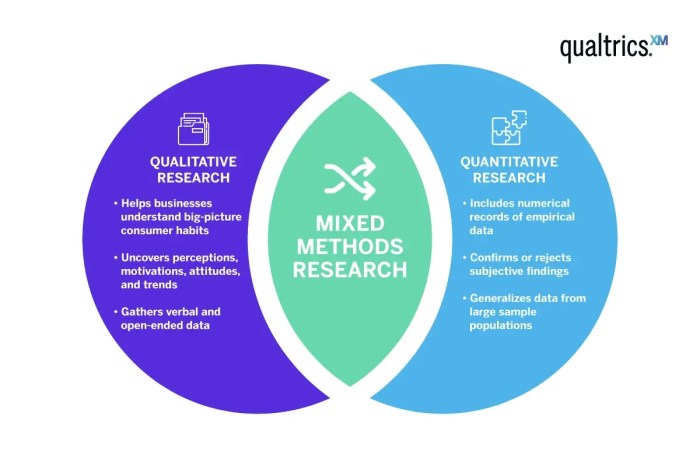

Quantitative market research reports are, shall we say, the Sherlock Holmes of the business world – they meticulously gather clues (data) to solve the mysteries of consumer behavior and market trends. Unlike their qualitative counterparts, which delve into the “why” behind consumer choices, quantitative reports focus on the “what” and “how many,” providing hard numbers and statistical analysis to paint a clear picture of the market landscape. Think of them as the meticulous accountant to the qualitative researcher’s insightful novelist.

Quantitative market research reports are characterized by their reliance on numerical data, statistical analysis, and large sample sizes. This allows for the generalization of findings to a larger population, offering a powerful tool for decision-making based on objective evidence. They employ standardized questionnaires and surveys, ensuring consistency and minimizing bias, unlike, say, a wild goose chase for subjective opinions. The beauty lies in the ability to quantify preferences, predict future trends, and measure the impact of marketing campaigns with statistical precision – something even the most astute detective would appreciate.

Typical Sections of a Quantitative Market Research Report

A typical quantitative market research report follows a logical structure, guiding the reader through the research process and findings. This structure ensures clarity and facilitates easy comprehension, much like a well-organized crime scene. Sections typically include an executive summary (the concise overview, like a detective’s quick summary of the case), research methodology (explaining the approach, like the detective outlining their investigation method), data analysis (the presentation of findings, akin to presenting evidence), conclusions (the answers, like solving the case), and recommendations (the next steps, like suggesting further investigations). The entire report should be as clear as a fingerprint at a crime scene.

Examples of Quantitative Market Research Reports

Several types of quantitative market research reports exist, each serving a specific purpose. Market sizing reports, for instance, meticulously estimate the size and potential of a particular market segment. Imagine these reports as a treasure map, guiding businesses to the most lucrative territories. Customer satisfaction surveys, on the other hand, quantify customer happiness with products or services, providing valuable feedback for improvement. These are like a customer feedback satisfaction thermometer, measuring the temperature of customer satisfaction. Brand awareness studies measure the visibility and recognition of a brand – think of these as a brand’s popularity contest, quantified for strategic decision-making. Predictive modeling reports forecast future trends based on statistical analysis of past data, offering a glimpse into the future, like a crystal ball with numbers.

Comparison of Quantitative and Qualitative Market Research Reports

The following table neatly summarizes the key differences between quantitative and qualitative market research reports.

| Feature | Quantitative Research | Qualitative Research |

|---|---|---|

| Data Type | Numerical data (e.g., percentages, averages) | Textual data (e.g., interviews, focus groups) |

| Sample Size | Large | Small |

| Data Analysis | Statistical analysis | Thematic analysis |

| Generalizability | High | Low |

| Objective/Subjective | Objective | Subjective |

Data Collection Methods in Quantitative Reports

Gathering data for quantitative market research is like a meticulously planned treasure hunt – exciting, potentially rewarding, and requiring a very specific set of tools. The methods you choose directly impact the accuracy and usefulness of your findings, so selecting the right approach is paramount. A poorly chosen method can lead to results as reliable as a chocolate teapot (delicious, but not very functional for holding liquids).

Several common methods exist, each with its own strengths and weaknesses. Understanding these nuances is crucial for designing a robust and effective research strategy. Let’s delve into the fascinating world of quantitative data collection.

Surveys

Surveys, the workhorses of quantitative research, are questionnaires designed to collect data from a large sample of respondents. They can be administered through various channels, including online platforms, email, phone calls, or even in person. The beauty of surveys lies in their ability to gather large amounts of data relatively quickly and cost-effectively. However, response rates can be a challenge, and the phrasing of questions can inadvertently bias the results, leading to responses more akin to a carefully crafted haiku than a truthful reflection of reality. For example, a poorly worded question about preferred ice cream flavors might unintentionally favor one flavor over others, simply due to the order in which the options are presented.

Experiments

Experiments, often referred to as A/B testing in the digital realm, involve manipulating one or more variables to observe their effect on a dependent variable. Imagine testing two different versions of a website to see which one generates more conversions. This method allows for the establishment of cause-and-effect relationships, providing strong evidence for the impact of specific factors. However, experiments can be expensive and time-consuming to set up and run, and the artificial nature of the experimental setting might not perfectly reflect real-world conditions. For instance, a lab experiment testing the effectiveness of a new toothpaste might not accurately predict its success in the chaotic environment of a typical bathroom.

Observations

Observations involve systematically watching and recording behaviors or events. This method is particularly useful when studying consumer behavior in natural settings, such as observing shoppers in a supermarket. The advantage of this approach is its ability to capture unbiased data. However, observer bias can creep in, and the process can be time-consuming and labor-intensive. Furthermore, the act of observation itself might influence the behavior being studied – the proverbial “watched pot never boils” effect.

Existing Data Analysis (Secondary Data)

Sometimes, the best data is already out there, waiting to be analyzed. Existing data analysis, utilizing data from sources like government statistics, market reports, or company databases, offers a cost-effective and efficient way to gain insights. This approach is particularly useful for identifying trends and patterns over time. However, the data may not always be perfectly tailored to the specific research question, and the quality and reliability of the data must be carefully assessed before drawing any conclusions. One might find discrepancies between different data sources, leading to the frustrating experience of chasing down the elusive “truth” like a particularly mischievous squirrel.

Hypothetical Survey Questionnaire: “Gourmet Dog Biscuits”

Let’s say we’re researching a new line of gourmet dog biscuits, “Pawtisserie Delights.” A survey questionnaire might include questions such as:

1. What breed is your dog?

2. How often do you buy dog treats?

3. What is your approximate annual spending on dog treats?

4. On a scale of 1 to 5 (1 being strongly disagree, 5 being strongly agree), how important are the following factors when choosing dog treats: a) Natural ingredients; b) Taste; c) Price; d) Packaging.

5. Would you be willing to pay [Price] for a bag of Pawtisserie Delights?

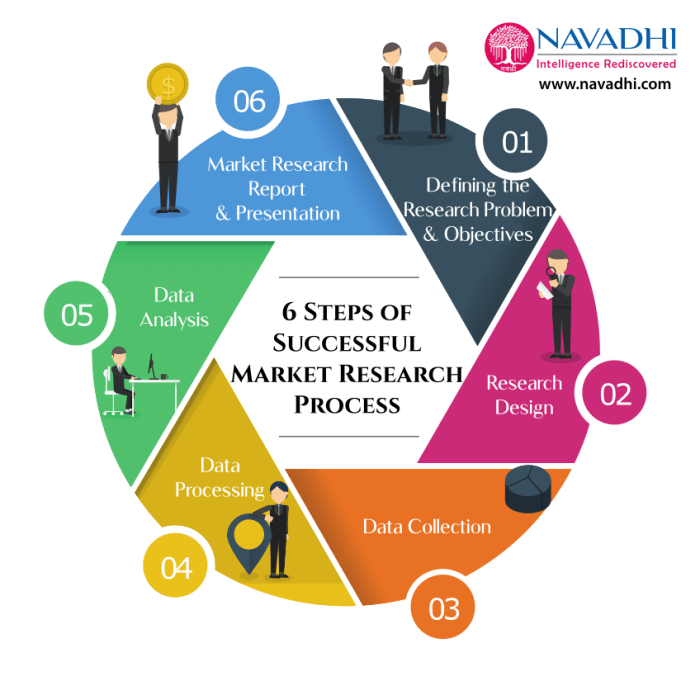

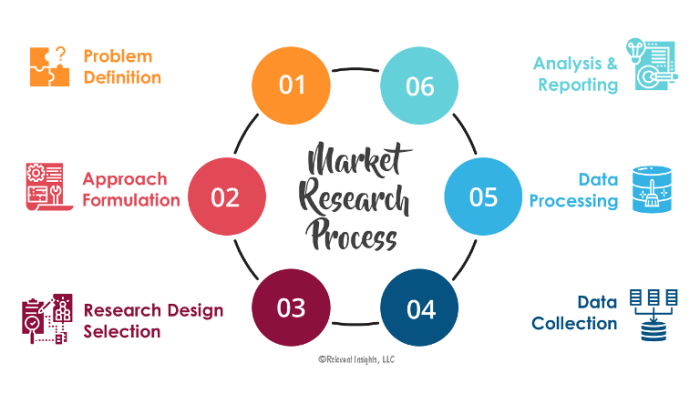

Steps in Conducting a Quantitative Market Research Study

The process of conducting a quantitative market research study resembles a well-choreographed ballet – each step is essential for a successful performance. Failing to execute a step correctly can lead to a performance that’s less than stellar, potentially leaving your audience (and your stakeholders) unimpressed.

The steps typically involve:

- Defining the research objectives and hypotheses.

- Determining the target population and sampling method.

- Selecting an appropriate data collection method.

- Developing and pretesting the data collection instrument (e.g., survey).

- Collecting and cleaning the data.

- Analyzing the data using appropriate statistical techniques.

- Interpreting the results and drawing conclusions.

- Preparing a comprehensive report summarizing the findings.

Data Analysis Techniques

Unleashing the power of numbers in market research requires more than just collecting data; it demands a deft touch in analysis. Think of it as being a detective, but instead of fingerprints, you’re dealing with percentages, means, and standard deviations – all whispering secrets about consumer behavior. This section will delve into the statistical sleuthing required to extract meaningful insights from your quantitative data.

Quantitative data analysis employs a variety of statistical techniques, each with its own strengths and quirks. The choice of technique depends heavily on the research question and the nature of the data itself. It’s a bit like choosing the right tool for the job – you wouldn’t use a sledgehammer to crack a nut (unless you’re particularly enthusiastic about making a mess, of course).

Statistical Techniques

A panoply of statistical techniques awaits the intrepid market researcher. From the humble mean to the mighty regression analysis, each method serves a unique purpose in unveiling the hidden patterns within your data. Let’s explore some of the most common and useful ones.

Descriptive statistics provide a summary of your data’s main features. This includes measures of central tendency (like the mean, median, and mode), which tell us where the “center” of the data lies, and measures of dispersion (like the range, variance, and standard deviation), which indicate how spread out the data is. Inferential statistics, on the other hand, allow us to draw conclusions about a population based on a sample of data. This involves techniques like hypothesis testing and regression analysis. Think of it as using a small piece of the puzzle to understand the entire picture.

Interpretation of Key Statistical Measures

Understanding the nuances of statistical measures is crucial for accurate interpretation. The mean, often called the average, is calculated by summing all values and dividing by the number of values. The median represents the middle value when data is ordered. The mode indicates the most frequent value. These measures offer different perspectives on the central tendency of the data. For example, if your data is skewed by outliers (extreme values), the median might be a more robust measure of central tendency than the mean. The standard deviation quantifies the amount of variation or dispersion in a dataset. A larger standard deviation indicates greater variability. For instance, a high standard deviation in customer satisfaction scores suggests a wide range of opinions, while a low standard deviation points to more consistent experiences.

Visual Data Presentation

Data visualization is the art of transforming raw numbers into compelling visuals. Charts and graphs are the artist’s tools, making complex data accessible and engaging. A well-crafted visual can communicate insights far more effectively than pages of tables.

| Chart Type | Description | Best Use Cases | Example |

|---|---|---|---|

| Bar Chart | Compares values across different categories. | Showing sales figures for different product lines, comparing customer satisfaction scores across regions. | Imagine a bar chart showing the sales of apples, bananas, and oranges, with the height of each bar representing the quantity sold. |

| Pie Chart | Shows the proportion of each category to the whole. | Illustrating market share of competing brands, showing the breakdown of customer demographics. | A pie chart could represent the market share of different brands of soda, with each slice representing a brand’s percentage of the total market. |

| Line Chart | Displays trends over time. | Tracking website traffic over months, showing sales growth over years. | A line chart could track the daily number of website visits over a month, illustrating any peaks or valleys in traffic. |

| Scatter Plot | Shows the relationship between two variables. | Examining the correlation between advertising spend and sales, exploring the relationship between price and demand. | A scatter plot could illustrate the relationship between the price of a product and the quantity demanded, with each point representing a specific price-quantity combination. |

Potential Pitfalls in Data Analysis and Solutions

Data analysis, while exciting, can be fraught with peril. Ignoring potential pitfalls can lead to misleading conclusions and poor decision-making. One common issue is confirmation bias, where analysts may unconsciously favor data that supports their pre-existing beliefs. To mitigate this, it’s crucial to maintain objectivity and critically evaluate all findings. Another potential pitfall is failing to account for confounding variables. These are factors that influence both the independent and dependent variables, potentially leading to spurious correlations. Careful study design and statistical controls can help to address this. Finally, misinterpreting statistical significance can lead to erroneous conclusions. A statistically significant result doesn’t necessarily imply practical significance. Always consider the context and the magnitude of the effect.

Report Structure and Presentation

Crafting a quantitative market research report is like baking a magnificent cake: you need the right ingredients (data), the correct recipe (methodology), and, crucially, a stunning presentation to showcase your culinary masterpiece (findings). A poorly presented report, no matter how insightful the data, risks ending up in the metaphorical trash can, uneaten and unappreciated. Let’s ensure your report avoids such a fate.

A well-structured quantitative market research report follows a logical flow, guiding the reader seamlessly from the problem statement to actionable recommendations. Think of it as a carefully choreographed dance, where each section plays its part in a harmonious whole. This structure ensures clarity, impact, and, dare we say, a touch of elegance.

Key Elements of a Well-Structured Quantitative Market Research Report

The essential components of a compelling quantitative market research report include an executive summary (the tantalizing appetizer), an introduction (setting the stage), methodology (explaining the recipe), results (the main course), discussion (the insightful commentary), conclusions (the satisfying resolution), and recommendations (the call to action). Each section plays a vital role, contributing to the overall narrative. A clear and concise structure is paramount; remember, even the most complex data can be communicated effectively with careful planning.

Effective Data Visualization Techniques

Data visualization is the art of transforming raw numbers into easily digestible visual representations. Think of it as translating complex scientific jargon into everyday language, making your report accessible to a broader audience. Different visualization methods are suited to different types of data. For example, bar charts excel at comparing categories, while line charts illustrate trends over time. Pie charts effectively show proportions of a whole, and scatter plots reveal correlations between variables. Imagine a scatter plot demonstrating the strong positive correlation between ice cream sales and crime rates – a fun and memorable way to present your data! (Note: This is a playful example; the correlation might not be causal).

Sample Executive Summary

Let’s imagine a hypothetical report on the effectiveness of a new social media marketing campaign for “Fluffy Paws,” a premium cat food company. The executive summary might look something like this:

This report analyzes the effectiveness of Fluffy Paws’ recent social media marketing campaign. Quantitative data collected from online surveys and website analytics reveals a significant increase in brand awareness (+25%) and website traffic (+30%) following the campaign launch. The data suggests a strong positive correlation between social media engagement and sales leads. We recommend continuing the campaign with minor adjustments to optimize engagement further.

Findings and Recommendations

For our Fluffy Paws example, the findings section would detail the specific results of the campaign, including metrics such as website visits, social media interactions, and sales conversions. The recommendations section would then suggest concrete actions, such as increasing the frequency of posts, experimenting with different ad formats, or targeting specific demographics. A well-structured findings and recommendations section is critical for making your report actionable. It should be clear, concise, and directly linked to the initial research objectives, avoiding ambiguity and ensuring that the reader can easily understand the implications of the data.

Applications and Uses of Quantitative Market Research Reports

Quantitative market research reports, those numerical behemoths of business intelligence, aren’t just dusty tomes gathering cobwebs in a forgotten corner. They’re the secret weapon of savvy businesses, providing the hard data needed to navigate the treacherous waters of the marketplace and make decisions that aren’t just educated guesses, but informed, data-driven triumphs. Think of them as your business’s crystal ball, powered by spreadsheets and statistical significance.

Businesses leverage quantitative market research reports for strategic decision-making in a myriad of ways, from identifying lucrative market segments to optimizing pricing strategies. The insights gleaned from these reports are not mere suggestions; they are the compass guiding businesses towards profitability and sustainable growth. These reports allow companies to move beyond gut feelings and embrace the cold, hard facts that dictate success in the modern business landscape.

Strategic Decision-Making Using Quantitative Market Research

The use of quantitative market research significantly impacts strategic decision-making. For instance, a company considering launching a new product can use data on market size, customer preferences, and competitor analysis to assess the potential success of the venture. This allows for a more informed decision about resource allocation, minimizing risk and maximizing return on investment. Instead of throwing darts in the dark, businesses can use quantitative data to pinpoint their target and aim with precision. Imagine trying to hit a bullseye blindfolded – without quantitative research, that’s essentially what businesses are doing.

Quantitative Market Research and Marketing Campaigns, Quantitative market research reports

Quantitative market research plays a crucial role in informing the design and execution of marketing campaigns. By analyzing data on consumer demographics, buying habits, and media consumption patterns, businesses can tailor their marketing messages and channel strategies to reach their target audience effectively. A perfectly crafted marketing message, delivered to the wrong audience, is like sending a love letter to a brick wall – completely ineffective. Quantitative research ensures that the message reaches the right people, at the right time, and through the right channels. This precision targeting can dramatically increase campaign ROI. For example, a social media campaign might be tailored based on age and location data revealing that a particular demographic is most receptive to a certain type of ad.

Quantitative Market Research Across Industries

The applications of quantitative market research are remarkably diverse, spanning a wide range of industries.

In the technology sector, quantitative research helps companies understand consumer preferences for new gadgets, assess market demand for software applications, and track the adoption rates of new technologies. This data informs product development, marketing strategies, and investment decisions. For example, understanding user feedback on a new software feature through surveys can reveal areas for improvement before widespread release.

Within the healthcare industry, quantitative research is invaluable for evaluating the effectiveness of new treatments, assessing patient satisfaction, and understanding disease prevalence. This information guides resource allocation, improves healthcare delivery, and contributes to public health initiatives. For example, a pharmaceutical company might conduct clinical trials to gather quantitative data on the efficacy and safety of a new drug before seeking regulatory approval.

In the consumer goods sector, quantitative research helps companies understand consumer preferences for different product attributes, track brand awareness, and measure the effectiveness of advertising campaigns. This data informs product development, marketing strategies, and pricing decisions. A consumer goods company might use sales data to identify regional variations in consumer preferences and tailor their product offerings accordingly.

Case Studies Illustrating the Impact of Quantitative Market Research

Let’s say a fictional company, “FizzPop Beverages,” used quantitative market research to discover that their new energy drink was underperforming in a specific demographic. Their research showed a preference for a different flavor profile in that segment. By adjusting their product based on this data, FizzPop experienced a significant increase in sales within that demographic, proving the value of acting on concrete, quantifiable data. This is far more effective than simply guessing what the consumers want.

Another example could be a tech company, “InnovateTech,” which used quantitative customer satisfaction surveys to identify a major usability issue in their flagship software. Addressing this issue based on the quantitative data resulted in improved customer retention and positive reviews, boosting their brand reputation and market share. This shows that listening to the numbers can have a profound effect on customer loyalty and the company’s bottom line.

Limitations and Considerations: Quantitative Market Research Reports

Quantitative market research, while powerful, isn’t a magic 8-ball that spits out perfectly accurate predictions. Like a particularly stubborn mule, it has its limitations, and understanding these is crucial to interpreting results responsibly. Ignoring these limitations is akin to building a castle on quicksand – impressive in theory, but destined for a spectacular collapse.

The inherent limitations and ethical considerations of quantitative research can significantly influence the validity and reliability of the findings. Failing to acknowledge these factors can lead to misinterpretations, flawed conclusions, and ultimately, poor business decisions. Therefore, a comprehensive understanding of these aspects is paramount for conducting and interpreting quantitative market research effectively. Let’s delve into the nitty-gritty, shall we?

Potential Limitations of Quantitative Market Research Reports

Quantitative research, while precise in its numerical approach, isn’t without its quirks. One significant limitation lies in its inability to delve into the rich tapestry of ‘why’ behind the numbers. For instance, a survey might reveal that 70% of consumers prefer brand A over brand B, but it won’t necessarily explain *why*. This lack of qualitative depth can leave crucial insights unexplored. Furthermore, the reliance on pre-defined questions can inadvertently limit the scope of responses, potentially overlooking unforeseen factors that might influence consumer behavior. Imagine trying to understand the complexities of the human heart using only a ruler – you’d get some measurements, but a very incomplete picture.

Ethical Considerations in Quantitative Market Research

Ethical conduct is the bedrock of any credible research. In quantitative market research, this translates to several key areas. Transparency with participants is paramount – informing them about the study’s purpose, data usage, and their rights to withdraw is non-negotiable. Confidentiality must be meticulously maintained; participants’ data should be anonymized and securely stored to protect their privacy. Furthermore, researchers must avoid manipulative or misleading questions that could sway responses and ensure the research doesn’t cause any undue harm or distress to participants. Think of it like this: ethical research is about treating participants with the respect they deserve, not treating them like lab rats.

Data Validation and Reliability in Quantitative Studies

The accuracy of quantitative research hinges on the reliability and validity of the data. Reliability refers to the consistency of the results; if the study were repeated, would it yield similar findings? Validity, on the other hand, refers to the accuracy of the measurements; does the study actually measure what it intends to measure? Consider a scale that consistently shows you weigh 10 pounds less than you actually do. It’s reliable (consistent), but completely invalid (inaccurate). Data validation techniques, such as cross-checking data sources and using statistical tests, are crucial to ensure both reliability and validity. These techniques help weed out errors and ensure the data is fit for purpose, preventing the drawing of erroneous conclusions based on flawed information.

Potential Biases in Quantitative Research and Mitigation Strategies

Bias, like a persistent uninvited guest, can creep into quantitative research in various forms. Sampling bias occurs when the sample doesn’t accurately represent the population; for example, surveying only university students to understand the preferences of the entire adult population. Measurement bias can arise from poorly designed questionnaires or flawed data collection methods. Confirmation bias, a researcher’s subconscious tendency to favor results that confirm pre-existing beliefs, is another significant concern. To mitigate these biases, researchers should employ rigorous sampling techniques, carefully design questionnaires, use blind or double-blind studies where appropriate, and be critically self-aware of their own potential biases. Think of it as a detective carefully examining every clue, aware that their own preconceptions might cloud their judgment.

Final Summary

So, there you have it: a whirlwind tour of the quantitative market research report. Armed with this knowledge, you can now confidently navigate the labyrinthine world of data, transforming raw numbers into actionable insights that will make your business decisions as sharp as a tack (or at least, sharper than a slightly dull butter knife). Remember, the power of data is in your hands—use it wisely (and maybe with a little humor). After all, even spreadsheets deserve a good chuckle now and then.

FAQs

What’s the difference between a population and a sample in quantitative market research?

The population is the entire group you’re interested in studying (e.g., all coffee drinkers in the US). A sample is a smaller, representative subset of that population (e.g., 1,000 coffee drinkers surveyed across the US) used to make inferences about the larger group. Getting a truly representative sample is crucial for accurate results—otherwise, you risk drawing conclusions about the entire population based on a biased subset.

How do I choose the right sample size for my research?

Sample size depends on factors like the desired margin of error, confidence level, and population size. Larger samples generally lead to more precise results but can be more costly and time-consuming. There are statistical formulas and online calculators to help determine the optimal sample size for your specific needs.

What are some common mistakes to avoid when creating a quantitative market research report?

Common pitfalls include using biased sampling methods, misinterpreting statistical results, failing to adequately address limitations, and presenting data in a confusing or misleading manner. Careful planning, rigorous analysis, and transparent reporting are essential to avoid these errors.