Real Estate Investment Analysis: Let’s face it, bricks and mortar aren’t exactly known for their thrilling narratives. But beneath the surface of property valuations and mortgage rates lies a world of strategic maneuvering, financial wizardry (or at least, competent accounting), and the potential for serious wealth creation – or equally serious losses, if you’re not careful. This exploration delves into the art and science of analyzing real estate investments, equipping you with the knowledge to navigate this potentially lucrative, yet occasionally treacherous, landscape. We’ll uncover the secrets to successful property investment, from market research to exit strategies, all while keeping things engaging enough to avoid the dreaded “snooze button” effect.

This guide provides a comprehensive overview of the key principles and techniques involved in real estate investment analysis. We’ll cover everything from identifying promising investment opportunities and conducting thorough due diligence to understanding financial metrics, managing risks, and navigating the legal and tax implications. Whether you’re a seasoned investor looking to refine your strategies or a newcomer eager to learn the ropes, this analysis will equip you with the tools you need to make informed investment decisions and, hopefully, avoid becoming another cautionary tale in the annals of real estate.

Introduction to Real Estate Investment

Real estate investment, in its simplest form, is the art of acquiring, managing, and eventually selling (or renting) properties for profit. Think of it as a high-stakes game of Monopoly, but with actual bricks and mortar – and significantly more paperwork. It’s a world where appreciation, depreciation, and tax deductions dance a tango of financial possibility (and occasional peril).

Real estate investing offers a compelling alternative to traditional investments, presenting a tangible asset with the potential for significant returns. However, like any venture involving substantial financial commitment, it’s not without its inherent risks. Navigating this landscape successfully requires a blend of shrewd analysis, a healthy dose of patience, and perhaps a lucky horseshoe (or two).

Types of Real Estate Investments

The world of real estate investment is surprisingly diverse. It’s not just about buying a house and hoping it appreciates; the options are numerous, each with its own set of advantages and disadvantages. Choosing the right path depends heavily on your financial situation, risk tolerance, and time commitment.

Consider these common investment strategies:

- Buy-and-Hold: This is the classic approach. You purchase a property, often a rental property, and hold onto it for the long term, collecting rental income and benefiting from appreciation. Think slow and steady wins the race – a marathon, not a sprint.

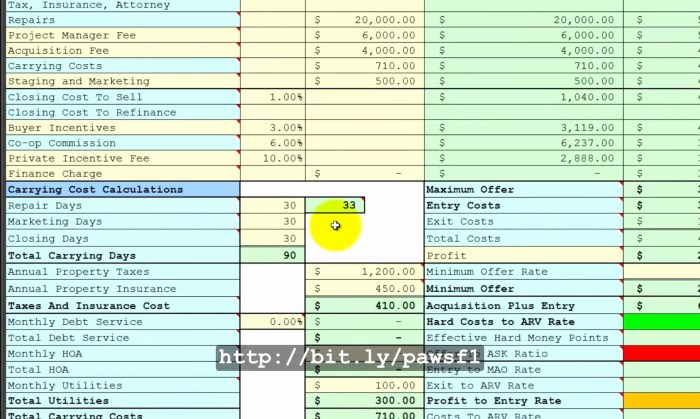

- Flipping: A high-octane strategy where you buy undervalued properties, renovate them, and quickly resell them for a profit. This requires significant upfront capital, a knack for renovation, and a strong understanding of market timing. Think Formula 1 racing – speed and precision are crucial.

- Wholesaling: This involves finding undervalued properties, putting them under contract, and then assigning the contract to another investor for a fee. It’s a less capital-intensive approach, focusing on deal-finding skills and negotiation prowess. Think of it as being a real estate matchmaker – connecting buyers and sellers.

- REITs (Real Estate Investment Trusts): These are companies that own or finance income-producing real estate. They trade on major stock exchanges, offering a relatively liquid way to invest in real estate without directly owning properties. Think of it as a diversified portfolio of real estate, conveniently packaged.

Potential Benefits and Risks of Real Estate Investment

The allure of real estate lies in its potential for substantial returns, but it’s crucial to acknowledge the inherent risks.

Benefits: Potential for high returns through appreciation, rental income, and tax advantages; tangible asset; inflation hedge; leverage potential (using borrowed money to amplify returns).

Risks: Market volatility; vacancy risk (for rental properties); property maintenance and repair costs; interest rate fluctuations; liquidity risk (difficulty selling quickly); potential for negative cash flow.

Comparison of Investment Strategies

| Strategy | Capital Required | Time Commitment | Risk Level |

|---|---|---|---|

| Buy-and-Hold | High to Moderate | Long-term | Moderate |

| Flipping | High | Short-term | High |

| Wholesaling | Low | Short-term | Moderate |

| REITs | Low to Moderate | Low | Moderate |

Financial Analysis Techniques

Let’s dive into the thrilling world of real estate financial analysis – where spreadsheets sing, numbers dance, and profits… well, hopefully, profits materialize! This isn’t your grandma’s knitting circle; this is where the rubber meets the road (or the foundation, in this case). We’ll unravel the mysteries of various techniques to ensure your investment decisions are as sharp as a freshly-honed crowbar.

Return on Investment (ROI) Calculation Methods

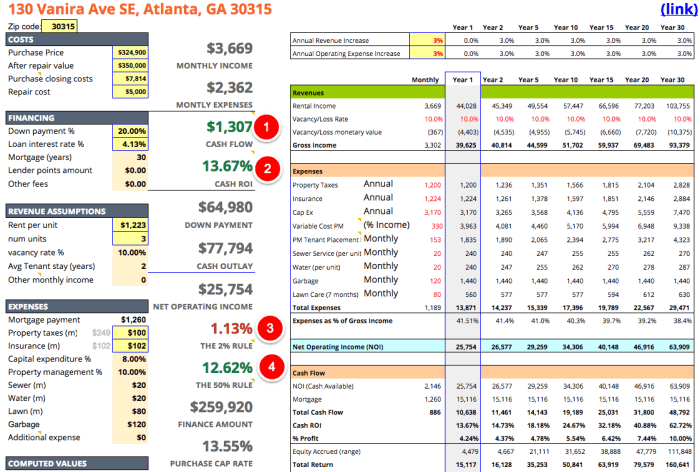

Several methods exist for calculating ROI, each offering a slightly different perspective on your investment’s profitability. Understanding these nuances is crucial for a comprehensive assessment. The most common methods provide a snapshot of your investment’s performance and its overall financial health.

The simplest ROI calculation is:

ROI = (Net Profit / Cost of Investment) x 100%

This straightforward method provides a quick overview, but it may not capture the nuances of time value of money or the complexities of multi-year investment horizons. More sophisticated methods, such as internal rate of return (IRR) and discounted cash flow (DCF) analysis, offer a more nuanced understanding, especially for longer-term projects. For example, a property purchased for $100,000 that generates $10,000 in annual net profit after all expenses will have a simple ROI of 10%. However, the time it takes to recoup the initial investment and the potential for future appreciation must also be considered. A higher IRR, for example, might indicate a better investment despite a lower initial ROI.

Capitalization Rates (Cap Rates) in Property Valuation

Cap rates are a cornerstone of commercial real estate valuation. Think of it as a quick-and-dirty way to gauge a property’s potential profitability. Essentially, it shows the potential rate of return based on the property’s net operating income (NOI). It’s calculated as follows:

Cap Rate = Net Operating Income (NOI) / Property Value

A higher cap rate generally indicates a higher potential return, but it’s crucial to remember that cap rates are influenced by market conditions and the risk associated with the property. For instance, a property with a higher cap rate might reflect a higher level of risk, while a lower cap rate might signal a more stable, but potentially less lucrative, investment. A property with an NOI of $50,000 and a market value of $500,000 would have a cap rate of 10%.

Discounted Cash Flow (DCF) Analysis

DCF analysis is the gold standard for evaluating long-term investments, considering the time value of money. It projects future cash flows and discounts them back to their present value, giving you a more accurate picture of the investment’s worth. This sophisticated technique accounts for inflation, risk, and the opportunity cost of capital.

A DCF analysis involves:

- Projecting future cash flows (rental income, operating expenses, etc.)

- Determining an appropriate discount rate (reflecting the risk and opportunity cost)

- Discounting each future cash flow back to its present value

- Summing the present values of all future cash flows to arrive at the Net Present Value (NPV)

A positive NPV suggests the investment is worthwhile; a negative NPV indicates otherwise. For example, a property projected to generate $10,000 in annual cash flow for 10 years, with a 10% discount rate, would require calculating the present value of each year’s cash flow and summing those values to obtain the NPV. A higher discount rate would reduce the NPV, indicating a higher perceived risk.

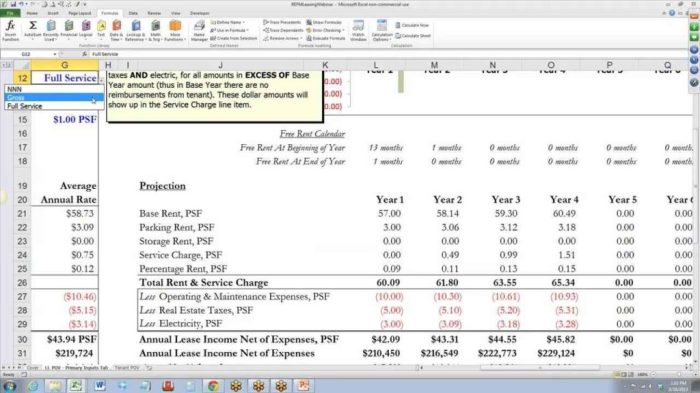

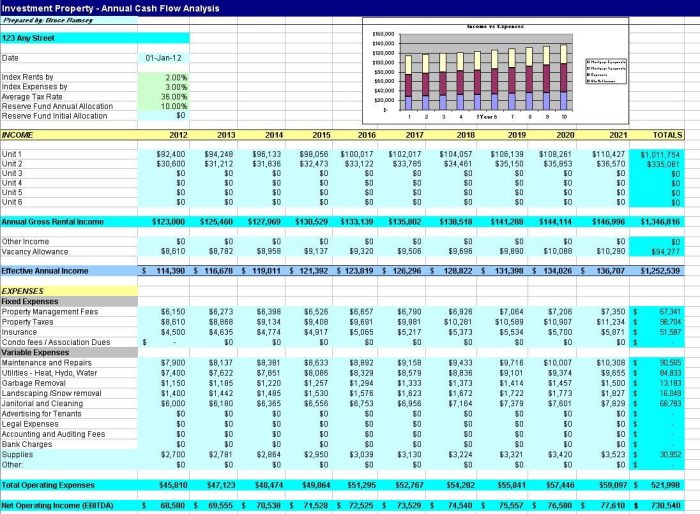

Pro Forma Financial Statement Creation

A pro forma statement is essentially a projected financial statement. It’s your crystal ball for forecasting future financial performance. Creating one requires careful estimation of income and expenses, based on market research and realistic assumptions. This involves anticipating rental income, vacancy rates, operating expenses, property taxes, and potential capital expenditures.

The process typically includes:

- Estimating rental income based on market rents and occupancy rates.

- Projecting operating expenses, including property taxes, insurance, maintenance, and management fees.

- Calculating net operating income (NOI) by subtracting operating expenses from rental income.

- Estimating potential capital expenditures (e.g., roof replacement, major renovations).

- Projecting cash flows over a specified period (e.g., 5-10 years).

A well-constructed pro forma statement provides a roadmap for your investment, highlighting potential pitfalls and opportunities. It’s vital to be realistic in your projections and consider various scenarios (best-case, worst-case, and most likely).

Key Financial Metrics for Investment Decisions

Several key metrics are essential for making informed investment decisions. These provide a comprehensive overview of the investment’s financial health and its potential for profitability. These metrics should be considered holistically, not in isolation.

Some of the most important metrics include:

- Return on Investment (ROI)

- Internal Rate of Return (IRR)

- Net Present Value (NPV)

- Capitalization Rate (Cap Rate)

- Cash-on-Cash Return

- Debt Service Coverage Ratio (DSCR)

By carefully analyzing these metrics, investors can gain a clear understanding of the financial implications of their investment decisions, facilitating better risk management and optimizing returns.

Property Valuation and Appraisal

Property valuation, the art of putting a price tag on a piece of real estate, is far more nuanced than simply guessing. It’s a crucial step in any real estate investment, and getting it wrong can be…well, let’s just say it’s not fun. Think of it as the detective work before the big heist (your profitable investment). This section will unravel the mysteries of property valuation, ensuring you don’t get caught with your pants down (or your investment portfolio in the red).

Approaches to Property Valuation

Three primary approaches dominate the world of property valuation: the sales comparison approach, the income approach, and the cost approach. Each offers a unique perspective, like three wise monkeys – see no evil (overvaluation), hear no evil (undervaluation), and speak no evil (misleading appraisals). Understanding their strengths and weaknesses is key to a successful valuation.

Sales Comparison Approach

This approach, as the name suggests, compares the subject property to recently sold comparable properties in the same area. It’s like comparing apples to apples (or, more accurately, houses to houses). The more similar the comparables, the more reliable the valuation. Factors considered include size, location, age, condition, and features. For example, a charming Victorian with a leaky roof will likely fetch less than a similar property in pristine condition. This approach relies heavily on the availability of reliable comparable sales data.

Income Approach

This method focuses on the income-generating potential of the property. It’s all about the money, honey! The present value of future net operating income (NOI) is estimated and discounted to determine the property’s value. This is particularly useful for income-producing properties like apartment buildings or commercial spaces. For instance, a building with high occupancy rates and strong rental income will command a higher valuation than a similar building with low occupancy. The formula often used is the capitalization rate (Cap Rate) method: Value = NOI / Cap Rate.

Cost Approach

This approach estimates the value of the property by considering the cost of replacing or reproducing it. It’s like building a LEGO castle and figuring out the cost of all the bricks. This method is most useful for newer properties or unique properties where comparable sales data is scarce. The cost of construction, land value, and depreciation are all factored into the equation. A newly built mansion will naturally have a higher value than a similarly sized, older property due to the cost of modern construction.

The Role of an Appraiser

Appraisers are the Sherlock Holmes of the real estate world, meticulously investigating and analyzing properties to determine their fair market value. They are independent professionals who provide unbiased opinions, helping to prevent overpaying or accepting a low-ball offer. Their expertise ensures transparency and protects both buyers and sellers from potentially disastrous financial decisions. A good appraiser is like a financial guardian angel, guiding you away from property pitfalls.

Factors Influencing Property Value

Numerous factors can impact property value, creating a complex equation of desirability. Location, location, location, as the saying goes, is paramount. But beyond that, factors like market conditions (boom or bust!), interest rates, property condition, and local amenities (think proximity to schools, parks, and shopping centers) all play a crucial role. Even things like crime rates and school district rankings can significantly influence a property’s value.

Comparative Market Analysis (CMA)

A CMA is a crucial tool for real estate agents and investors alike. It’s a less formal version of an appraisal, providing a preliminary estimate of a property’s value. It involves analyzing recent sales of comparable properties, but it’s typically quicker and less expensive than a full appraisal. Think of it as a quick sketch before the finished masterpiece (the formal appraisal). CMAs are frequently used to help determine a listing price for a property or to evaluate the potential return on investment for a potential purchase.

Strengths and Weaknesses of Valuation Approaches

| Approach | Strengths | Weaknesses | Best Suited For |

|---|---|---|---|

| Sales Comparison | Relatively simple, relies on market data | Requires comparable properties, subjective adjustments | Residential properties, land |

| Income Approach | Directly relates value to income, useful for income-producing properties | Requires accurate income and expense projections, sensitive to discount rate | Apartment buildings, commercial properties |

| Cost Approach | Useful for new or unique properties, less reliant on market data | Difficult to estimate depreciation, land valuation can be subjective | New construction, specialized properties |

Risk Management and Mitigation

Investing in real estate can be a rollercoaster – thrilling highs and stomach-churning lows. While the potential for significant returns is undeniably alluring, ignoring the inherent risks is a recipe for disaster. This section delves into the crucial art of identifying, mitigating, and ultimately, mastering the challenges that can derail even the most meticulously planned real estate ventures. Think of it as your survival guide to the wild west of property investment.

Potential risks associated with real estate investments are numerous and varied, ranging from the mundane to the downright catastrophic. Understanding these risks is the first step towards building a robust risk management strategy. Ignoring them is akin to sailing a ship without a map – exciting, perhaps, but ultimately unwise.

Identifying Potential Risks

Real estate investments face a diverse range of risks. These can be broadly categorized into market risks (fluctuations in property values, interest rates, and economic downturns), property-specific risks (structural issues, tenant problems, and unexpected maintenance costs), and financial risks (inadequate financing, high leverage, and cash flow challenges). For example, a sudden economic recession could drastically reduce property values, impacting the investor’s return. Similarly, unforeseen structural damage could lead to substantial repair expenses. A thorough due diligence process is critical in mitigating these risks.

Strategies for Mitigating Risks

Mitigating risk involves proactive steps to reduce the likelihood or impact of negative events. Diversification is a cornerstone of any effective risk management strategy. Don’t put all your eggs in one basket! Spreading investments across different property types, geographical locations, and even asset classes can significantly reduce overall portfolio volatility. Furthermore, thorough due diligence – including property inspections, market research, and legal reviews – is essential before committing to any investment. Careful financial planning, including securing adequate financing and maintaining sufficient reserves for unexpected expenses, is also paramount.

The Importance of Insurance

Insurance acts as a financial safety net, protecting investments from unforeseen events. Property insurance covers damage from fire, storms, or other natural disasters. Liability insurance protects against lawsuits stemming from accidents on the property. Rent guarantee insurance can safeguard against rental income loss due to tenant default. Consider these as essential components of a well-rounded risk management plan; neglecting them is financially reckless. Think of it as your insurance policy against Murphy’s Law – whatever can go wrong, probably will.

Examples of Risk Management Plans

A robust risk management plan should be tailored to the specific circumstances of each investment. However, common elements include:

- Comprehensive Due Diligence: Thorough inspections, appraisals, and title searches.

- Diversification: Spreading investments across multiple properties and locations.

- Financial Planning: Creating realistic budgets, securing appropriate financing, and maintaining emergency funds.

- Insurance Coverage: Securing adequate property, liability, and other relevant insurance.

- Contingency Planning: Developing strategies for dealing with potential setbacks, such as tenant defaults or unexpected repairs.

A simple example of a contingency plan might involve setting aside a reserve fund equal to 10% of the property’s value to cover unexpected repairs or vacancies.

Risk Assessment Matrix for Real Estate Investments

A risk assessment matrix provides a structured approach to evaluating and prioritizing risks. It typically involves identifying potential risks, assessing their likelihood and impact, and assigning a risk score. A simple matrix might use a scale of 1-5 for both likelihood and impact, with a higher score indicating greater risk. The matrix can then be used to guide the development of mitigation strategies, focusing on the highest-risk items first. For instance, a property in a high-crime area with a high likelihood of vandalism might receive a high risk score, prompting the implementation of security measures.

| Risk | Likelihood (1-5) | Impact (1-5) | Risk Score | Mitigation Strategy |

|---|---|---|---|---|

| Market downturn | 4 | 5 | 20 | Diversification, debt reduction |

| Tenant default | 3 | 3 | 9 | Thorough tenant screening, rent guarantee insurance |

| Unexpected repairs | 2 | 4 | 8 | Regular maintenance, reserve fund |

Financing and Capital Acquisition

Securing the funds to fuel your real estate empire is arguably more thrilling than actually buying the property itself – think of it as the high-stakes poker game before the main event. This section will delve into the fascinating world of real estate financing, revealing the strategies and techniques that can turn your dreams of brick-and-mortar wealth into a reality. We’ll explore various financing options, compare loan types, and even unveil some creative financing secrets that might just leave you speechless (or at least, slightly more financially secure).

The acquisition of capital for real estate investments involves navigating a complex landscape of financing options. The choice of financing method significantly impacts the overall profitability and risk profile of the investment. A careful consideration of various factors, including loan terms, interest rates, and repayment schedules, is crucial for success.

Mortgage Financing

Mortgages, the classic workhorse of real estate financing, are loans secured by the property itself. This means the lender holds a lien on the property until the loan is repaid. Different mortgage types exist, each with its own set of terms and conditions. For example, a fixed-rate mortgage offers predictable monthly payments, while an adjustable-rate mortgage (ARM) presents fluctuating interest rates, potentially leading to unpredictable payments. The choice between these options depends on factors such as the investor’s risk tolerance and the predicted future interest rate environment. A 30-year fixed-rate mortgage, for instance, allows for lower monthly payments but results in a higher total interest paid over the life of the loan, compared to a 15-year fixed-rate mortgage. Conversely, a 15-year mortgage has higher monthly payments but significantly lower overall interest costs. Imagine the sheer satisfaction of paying off your mortgage much sooner, although your monthly budget might initially groan under the weight.

Private Lending

Private lending, often characterized by its speed and flexibility, provides an alternative to traditional bank financing. Private lenders, ranging from high-net-worth individuals to specialized lending firms, often offer shorter-term loans with higher interest rates than banks. However, this increased cost can be offset by the faster approval process and the ability to secure funding for projects that may not meet the stringent requirements of traditional lenders. This is particularly useful for investors pursuing opportunities that require quick action, like acquiring distressed properties. For example, an investor might leverage private lending to purchase a property at a deeply discounted price, knowing they have a limited timeframe to secure a more conventional loan.

Obtaining Financing

The process of obtaining financing generally involves several key steps: pre-qualification, loan application, appraisal, underwriting, and closing. Pre-qualification provides an initial assessment of borrowing capacity, allowing investors to determine how much they can borrow. The loan application requires detailed financial information, including credit history, income, and assets. An appraisal determines the property’s market value, which influences the loan amount. Underwriting involves a thorough review of the application and appraisal to assess the risk to the lender. Finally, closing involves the signing of loan documents and the disbursement of funds. Each step requires careful preparation and attention to detail to ensure a smooth and efficient process.

Securing Favorable Loan Terms

Securing favorable loan terms is paramount to maximizing investment returns. Factors such as interest rate, loan-to-value ratio (LTV), and loan fees significantly impact the overall cost of financing. Negotiating with lenders to secure a lower interest rate, a higher LTV, or reduced fees can substantially improve the investment’s profitability. A strong credit score, a substantial down payment, and a well-prepared loan application can significantly enhance the investor’s negotiating power. For instance, a lower LTV might translate to a lower interest rate, reflecting the reduced risk for the lender.

Creative Financing Strategies

Creative financing involves employing unconventional methods to acquire properties, often leveraging the seller’s financing or employing strategies such as lease-options or subject-to mortgages. A lease-option allows the buyer to lease the property with an option to purchase it later, providing time to secure financing. A subject-to mortgage allows the buyer to assume the seller’s existing mortgage, potentially avoiding the need for a new loan. These strategies can be particularly useful in situations where traditional financing is difficult to obtain. Imagine acquiring a property with little or no upfront cash investment using a creative financing approach—a true testament to financial ingenuity!

Tax Implications of Real Estate Investment: Real Estate Investment Analysis

Ah, taxes—the spice of life, or at least the spice that makes your accountant very, very rich. Investing in real estate can be incredibly lucrative, but navigating the tax landscape is crucial to maximizing your profits and avoiding a hefty bill from Uncle Sam. Let’s delve into the fascinating (yes, really!) world of real estate tax implications.

Owning and operating investment properties introduces a whole new level of tax complexity compared to your average lemonade stand. You’ll be dealing with deductions, depreciation, capital gains, and a host of other terms that might sound like a foreign language. But fear not, dear investor! With the right knowledge, you can turn these tax complexities into opportunities to significantly reduce your tax liability.

Strategies for Minimizing Tax Liability, Real Estate Investment Analysis

Minimizing your tax liability isn’t about dodging taxes; it’s about strategically utilizing the tax code to your advantage. This involves understanding which expenses are deductible and maximizing allowable deductions. Proper accounting and record-keeping are paramount. Think of it as a high-stakes game of financial Tetris, fitting all those deductible expenses into the perfect tax-reducing configuration. One key strategy is to understand and utilize depreciation, which allows you to deduct a portion of your property’s value each year, effectively lowering your taxable income.

Relevant Tax Deductions and Credits

A plethora of deductions and credits exist specifically for real estate investors. These can significantly reduce your tax burden. For example, you can deduct mortgage interest, property taxes, insurance premiums, and operating expenses such as repairs and maintenance. Depending on your circumstances, you may also qualify for certain tax credits, further reducing your tax bill. Imagine it as a treasure hunt, where the treasure is a smaller tax bill!

Preparing Tax Returns for Investment Properties

Preparing tax returns for investment properties is more involved than filing a simple W-2. You’ll need to meticulously track all income and expenses related to your property. This includes rental income, repairs, insurance, property taxes, mortgage interest, and depreciation. It’s advisable to use accounting software designed for real estate investors or consult with a tax professional experienced in real estate taxation. This ensures accuracy and helps avoid costly mistakes. Consider it a crucial investment in itself – a small cost for significant tax savings.

Common Tax Considerations for Real Estate Investors

Understanding these common considerations will help you navigate the complexities of real estate taxation with greater confidence.

- Depreciation: This allows you to deduct a portion of your property’s value each year, reducing your taxable income. It’s a powerful tool, but understanding the rules and methods is crucial.

- Capital Gains Taxes: When you sell a property, you’ll likely owe capital gains taxes on the profit. However, various strategies can help mitigate this, such as utilizing the 1031 exchange.

- Passive Activity Losses: Losses from rental real estate are often considered passive activity losses, and there are limitations on how much you can deduct against your other income.

- Record Keeping: Meticulous record-keeping is essential. Keep detailed records of all income and expenses, including receipts and bank statements.

- Tax Professionals: Consulting a tax professional experienced in real estate is highly recommended. They can provide personalized advice and help you navigate the complexities of the tax code.

Exit Strategies and Portfolio Management

So, you’ve successfully navigated the treacherous waters of real estate investment – congratulations! But the journey doesn’t end with acquisition; a well-executed exit strategy is the key to unlocking the true potential of your investment, transforming it from a potentially stressful asset into a source of substantial profit (or at least a less stressful one). Think of it like this: you wouldn’t embark on a cross-country road trip without knowing your destination, would you?

Various Exit Strategies for Real Estate Investments

Real estate offers a delightful variety of exit routes, each with its own unique charm (and potential pitfalls). Choosing the right one depends on your individual circumstances, risk tolerance, and, of course, the current market conditions. It’s less about picking the “best” strategy and more about selecting the strategy that best aligns with your overall goals.

The Importance of a Well-Defined Exit Strategy

A well-defined exit strategy isn’t just a good idea; it’s a necessity. It provides a roadmap for navigating the complexities of selling, refinancing, or otherwise divesting your property. Without a clear plan, you risk being caught off guard by market fluctuations, unexpected expenses, or simply the sheer emotional toll of a drawn-out sale process. A solid exit strategy allows you to make informed decisions, maximize your return on investment, and minimize potential losses. It’s like having a detailed map for a treasure hunt – you know exactly where to go, even if you encounter unexpected obstacles.

Principles of Portfolio Diversification in Real Estate

Don’t put all your eggs in one basket! Diversification is the cornerstone of sound real estate investment. Spreading your investments across different property types (residential, commercial, industrial), geographic locations, and risk profiles can significantly mitigate potential losses. Imagine your portfolio as a carefully constructed Jenga tower: a diverse portfolio is more resilient to unexpected market shocks than one heavily concentrated in a single area or property type.

Examples of Successful Exit Strategies

Let’s look at some real-world examples. Consider a savvy investor who purchased a multi-family property in a rapidly growing urban area. After several years of positive cash flow, they successfully refinanced the property, pulling out significant equity to reinvest in other ventures. Or take the case of an investor who strategically timed the sale of a commercial property during a market peak, realizing substantial capital gains. These are just two examples of how a well-planned exit strategy can lead to significant financial success.

Comparison of Different Exit Strategies

The following table compares several common exit strategies, considering their timelines and potential returns. Remember, these are general estimates, and actual results may vary depending on market conditions and individual circumstances.

| Exit Strategy | Timeline | Potential Return | Risk Level |

|---|---|---|---|

| Selling | Variable (months to years) | High (depending on market conditions) | Moderate (market dependent) |

| Refinancing | Weeks to months | Moderate (access to equity) | Low (if property value is stable) |

| 1031 Exchange | Months | Tax-deferred gains | Moderate (complex regulations) |

| Holding for Long-Term Appreciation | Years | Potentially High (capital appreciation) | High (market fluctuations, maintenance costs) |

Wrap-Up

So, there you have it – a whirlwind tour through the sometimes-chaotic, always-fascinating world of real estate investment analysis. Remember, while the potential rewards are undeniably enticing (think beachfront properties and early retirement), success hinges on meticulous planning, a healthy dose of skepticism, and a willingness to learn from both your triumphs and your – let’s face it – inevitable stumbles. By mastering the principles Artikeld here, you’ll be well-equipped to navigate the market, identify profitable opportunities, and ultimately, build a robust and rewarding real estate portfolio. Now go forth and conquer (the housing market, that is!).

Helpful Answers

What is the difference between a Cap Rate and ROI?

Cap Rate (Capitalization Rate) focuses on the potential income a property generates relative to its purchase price, offering a snapshot of potential return. ROI (Return on Investment) is a broader measure considering all costs and profits over the investment period, providing a more complete picture of profitability.

How important is location when choosing an investment property?

Location is paramount. A poorly located property, regardless of its other attributes, will struggle to attract tenants or appreciate in value. Consider factors like proximity to amenities, transportation, schools, and employment opportunities.

What are some common red flags to watch out for when buying investment property?

Red flags include unusually low prices (suggesting hidden problems), significant deferred maintenance, rapidly changing neighborhood demographics, and overly aggressive sellers.

What is a 1031 exchange?

A 1031 exchange is a tax-deferred exchange that allows investors to sell a property, reinvest the proceeds into a like-kind property, and defer paying capital gains taxes. It’s a powerful tool for long-term real estate investors.