Real Estate Investment Trusts (REITs) offer a compelling avenue for investors seeking exposure to the real estate market without the complexities of direct property ownership. These publicly traded companies pool capital from numerous investors to acquire, manage, and operate income-producing real estate, offering diversification and liquidity advantages not always found in traditional real estate investments. This guide delves into the intricacies of REITs, exploring their various types, investment strategies, tax implications, and market dynamics, equipping readers with the knowledge to navigate this dynamic sector effectively.

From understanding the fundamental differences between Equity, Mortgage, and Hybrid REITs to analyzing key financial metrics and conducting thorough due diligence, we’ll cover the essential aspects of REIT investing. We’ll also examine the influence of macroeconomic factors on REIT performance and provide practical strategies for building and managing a diversified REIT portfolio, empowering you to make informed investment decisions.

Definition and Types of REITs

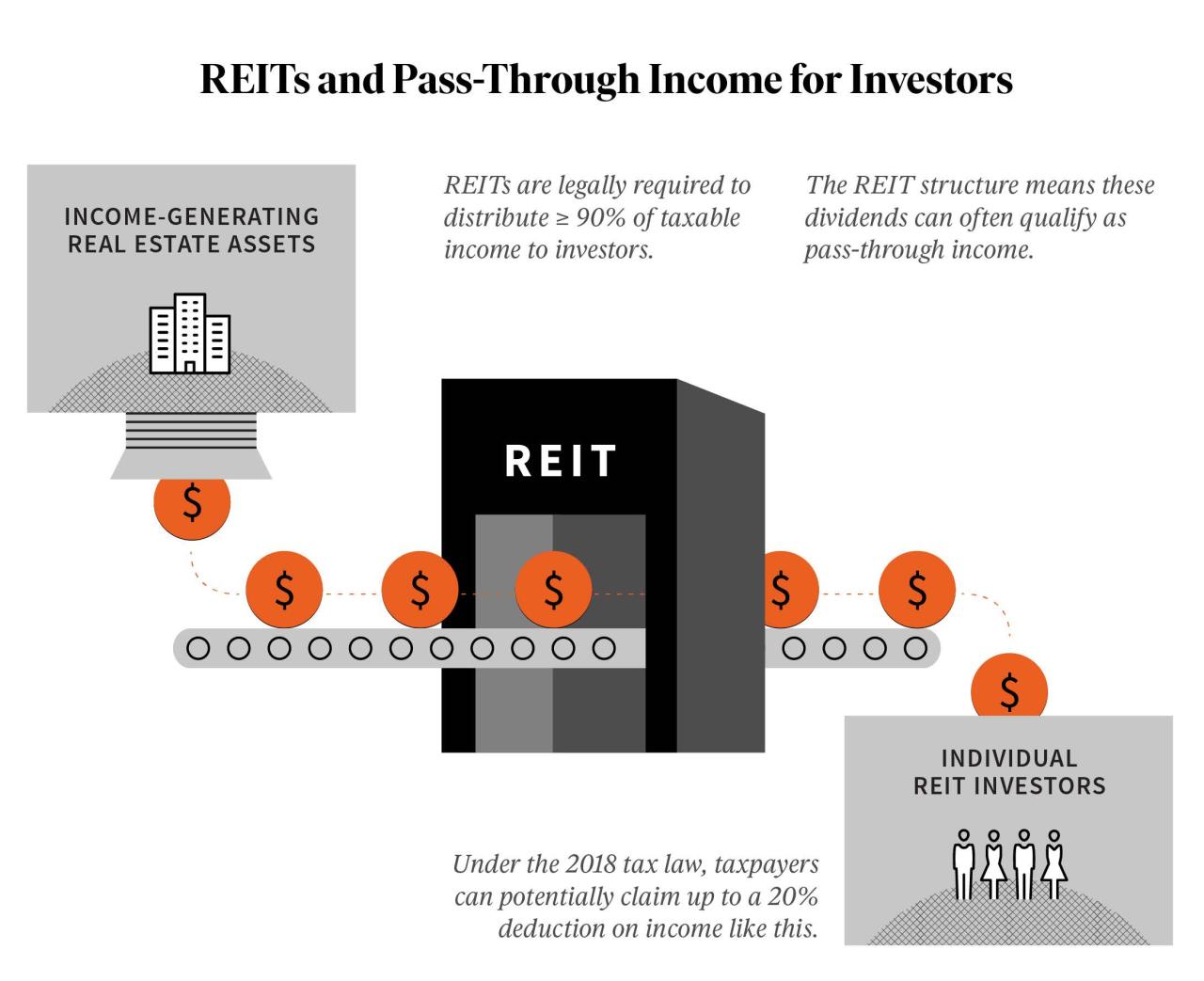

Real Estate Investment Trusts (REITs) are companies that own or finance income-producing real estate across a range of property sectors. They are structured to allow investors to participate in the real estate market without directly owning or managing properties. This structure offers diversification and liquidity benefits not typically found in direct real estate investment. A key characteristic is that REITs are required to distribute a significant portion of their taxable income to shareholders as dividends, which makes them attractive to income-seeking investors.

REITs are categorized primarily based on the type of real estate they invest in and their investment strategies. Understanding these distinctions is crucial for investors seeking to align their portfolios with specific risk and return profiles.

Equity REITs

Equity REITs directly own and operate income-producing real estate. Their revenue streams primarily come from rental income generated from properties such as office buildings, apartments, retail spaces, or industrial facilities. These REITs invest in the physical assets themselves, and their success hinges on occupancy rates, rental income growth, and property appreciation. Examples include publicly traded companies like Prologis (industrial), AvalonBay Communities (apartments), and Welltower (healthcare facilities). Their investment strategy typically involves acquiring, managing, and potentially developing properties to maximize returns through rent collection and asset value growth.

Mortgage REITs

Mortgage REITs, unlike Equity REITs, do not directly own properties. Instead, they invest in and manage mortgages and mortgage-backed securities. Their primary income source is derived from the interest earned on these mortgages. Mortgage REITs are highly sensitive to interest rate fluctuations. A rise in interest rates can impact their profitability, while a decrease might be beneficial. Examples include Annaly Capital Management and Starwood Property Trust. Their investment strategies revolve around managing interest rate risk and identifying attractive mortgage investments.

Hybrid REITs

Hybrid REITs combine characteristics of both Equity and Mortgage REITs. They invest in both real estate properties and mortgage-backed securities, allowing for a more diversified investment strategy. This diversification can potentially mitigate risk associated with solely focusing on either Equity or Mortgage investments. Examples of Hybrid REITs can be less easily categorized as they often blend strategies. A REIT might own properties while also holding a significant mortgage portfolio. Their investment strategies are tailored to balance the returns and risks associated with both property ownership and mortgage lending.

| Feature | Equity REITs | Mortgage REITs | Hybrid REITs |

|---|---|---|---|

| Primary Investment | Income-producing real estate | Mortgages & Mortgage-backed securities | Both real estate & mortgages |

| Income Source | Rental income, property appreciation | Interest income | Rental income, interest income, property appreciation |

| Interest Rate Sensitivity | Low | High | Moderate |

| Risk Profile | Moderate to High | Moderate to High | Moderate |

REIT Investment Strategies

Investing in REITs offers a diverse range of approaches, allowing investors to tailor their portfolios to specific risk tolerances and financial goals. Understanding these strategies, along with the inherent risks, is crucial for successful REIT investment.

Diversification Strategies for REIT Investment

Diversification is a cornerstone of effective REIT investing. By spreading investments across different REIT sectors, geographic locations, and capitalization sizes, investors can mitigate risk and potentially enhance returns. A diversified portfolio might include equity REITs focused on residential, retail, or industrial properties, alongside mortgage REITs. Geographic diversification could involve holding REITs operating in various regions or countries, reducing exposure to localized economic downturns. Similarly, diversifying across REITs of different market capitalizations can offer exposure to companies with varying growth potential and risk profiles. For example, an investor might allocate a portion of their portfolio to large-cap REITs known for stability and dividend payouts, while allocating another portion to smaller-cap REITs with potentially higher growth prospects.

Sector-Specific REIT Investment Strategies

Focusing on specific REIT sectors allows investors to capitalize on trends within those markets. For instance, an investor bullish on the growth of e-commerce might concentrate on industrial REITs owning distribution centers and logistics facilities. Conversely, an investor anticipating a housing boom could invest heavily in residential REITs. This approach, while potentially offering higher returns, also carries higher risk, as it is more susceptible to sector-specific downturns. A downturn in the retail sector, for example, would disproportionately affect retail REITs.

Risks Associated with REIT Investment

REIT investment, like any investment, carries inherent risks. Interest rate risk is a significant factor, as rising interest rates can increase borrowing costs for REITs, impacting profitability and potentially lowering valuations. Economic downturns can also negatively impact REIT performance, as occupancy rates may fall and rental income decline. Furthermore, the value of underlying real estate assets can fluctuate significantly, influencing REIT share prices. Finally, management quality plays a crucial role; poor management can lead to underperformance and decreased shareholder value.

REITs vs. Direct Real Estate Investment: Advantages and Disadvantages

Investing in REITs offers several advantages over direct real estate investment. REITs provide liquidity, allowing investors to readily buy and sell shares on public exchanges. They also offer diversification opportunities not readily available with direct real estate ownership. Furthermore, REITs typically provide professional management, reducing the burden on individual investors. However, direct real estate ownership offers greater control over property management and potential for higher returns (though also higher risk and capital requirements). Direct ownership also provides potential tax advantages, such as depreciation deductions, which are not directly available with REITs.

Comparative Performance of Different REIT Types (Last 5 Years)

The performance of different REIT types can vary considerably over time. The following table provides a hypothetical illustration (replace with actual data from a reliable source like a financial news site or database):

| REIT Type | 2019 | 2020 | 2021 | 2022 | 2023 (YTD) |

|---|---|---|---|---|---|

| Residential | 10% | 5% | 15% | -2% | 8% |

| Retail | -5% | -10% | 2% | 3% | 5% |

| Industrial | 12% | 8% | 18% | 10% | 6% |

| Healthcare | 7% | 4% | 10% | 6% | 9% |

*Note: This is hypothetical data for illustrative purposes only and does not reflect actual market performance.* Always consult reliable financial sources for accurate and up-to-date information.

REIT Taxation and Regulations

Investing in Real Estate Investment Trusts (REITs) offers a unique blend of potential returns and tax advantages, but understanding the tax implications and regulatory framework is crucial for any investor. This section will clarify the tax treatment of REITs, primarily focusing on the United States regulatory environment, and Artikel the key requirements for REIT qualification.

Tax Implications of Investing in REITs

REITs are structured to pass the majority of their income directly to shareholders, avoiding corporate-level taxation. This is achieved through a system of stringent requirements and regulations. The tax benefits for investors primarily stem from the dividend distributions made by REITs. These distributions are generally taxed as ordinary income, not capital gains, meaning they are taxed at your individual income tax rate. However, this is a key advantage as it can lead to a higher after-tax return compared to directly owning real estate which is often subject to depreciation recapture taxes and other complexities. It’s important to note that the specific tax treatment can vary depending on your individual circumstances and the type of REIT. Professional tax advice should always be sought for personalized guidance.

Regulatory Framework Governing REITs in the United States

The regulatory framework for REITs in the United States is primarily governed by the Internal Revenue Code (IRC), specifically Section 856. The Securities and Exchange Commission (SEC) also plays a significant role in overseeing the public offerings and ongoing reporting requirements of publicly traded REITs. This dual oversight ensures both tax compliance and investor protection. The IRC establishes strict rules and tests that REITs must meet to maintain their tax-advantaged status. Failure to comply can result in the loss of these benefits and significant tax liabilities. This rigorous regulatory environment is designed to maintain the integrity of the REIT structure and to protect investors.

Key Requirements for REIT Qualification

A company must meet several stringent requirements to qualify as a REIT under the IRC. These requirements ensure that REITs primarily invest in real estate and distribute a significant portion of their income to shareholders. Key requirements include:

- Income Test: A significant portion of the REIT’s income must come from real estate-related sources.

- Asset Test: A specified percentage of the REIT’s assets must be invested in real estate.

- Distribution Test: The REIT must distribute at least 90% of its taxable income to shareholders annually.

- Shareholder Test: The REIT must have a minimum number of shareholders and cannot have a small number of shareholders owning a disproportionately large percentage of the shares.

- Diversification Requirements: The REIT cannot hold an excessive amount of its assets in any single property or related properties.

REIT Taxation: A Bulleted Summary

Understanding the tax implications of REIT investments is critical. Here’s a summary of key points:

- REITs are designed to avoid corporate-level taxation.

- Distributions to shareholders are generally taxed as ordinary income.

- Capital gains from selling REIT shares are taxed at capital gains rates.

- Tax treatment can vary based on individual circumstances and REIT type.

- Non-compliance with REIT requirements can lead to significant tax penalties.

- Professional tax advice is recommended for personalized guidance.

REIT Market Analysis

The REIT market is a dynamic sector influenced by a complex interplay of macroeconomic factors and individual company performance. Understanding current market conditions, including capitalization, trading volume, and the impact of external forces, is crucial for successful REIT investment. This analysis will explore these aspects and illustrate how to construct a hypothetical portfolio based on specific investor goals.

Current REIT Market Conditions

The REIT market experiences cyclical fluctuations mirroring broader economic trends. Currently, the market shows [insert current market condition, e.g., moderate growth, correction, etc. Cite source: e.g., National Association of Real Estate Investment Trusts (NAREIT) data]. Factors contributing to this condition include [insert factors, e.g., rising interest rates, inflation, supply chain issues, etc. Cite source]. Specific sectors within the REIT market, such as residential, retail, or industrial, may exhibit different performance levels based on their sensitivity to these macroeconomic factors. For example, during periods of high inflation, REITs focused on essential properties like apartments or self-storage facilities may outperform those in more discretionary sectors like retail.

REIT Market Capitalization and Trading Volume

Total market capitalization for REITs in [insert region, e.g., the United States] is currently approximately [insert current market capitalization figure, e.g., $X trillion]. This figure fluctuates daily based on trading activity and changes in individual REIT valuations. Daily trading volume typically ranges from [insert range of daily trading volume, e.g., $Y billion to $Z billion], though this can increase significantly during periods of heightened market volatility. [Cite source: e.g., Financial news sources such as Bloomberg or Yahoo Finance]. Variations in trading volume can reflect investor sentiment and the overall market’s risk appetite. High volume might indicate increased investor interest, while lower volume could signal a period of consolidation or uncertainty.

Hypothetical REIT Portfolio Construction

Let’s consider an investor with a moderate risk tolerance and a long-term investment goal of capital appreciation and stable dividend income. A diversified portfolio might include:

- 30% in Equity REITs focused on residential properties (e.g., apartments): This provides exposure to a sector typically less sensitive to economic downturns due to consistent demand for housing.

- 25% in Healthcare REITs: This sector offers relatively stable cash flows and strong long-term growth prospects, given the aging population.

- 20% in Industrial REITs: This sector benefits from e-commerce growth and increasing demand for logistics facilities.

- 15% in Office REITs: While this sector faces challenges in the post-pandemic environment, selectively choosing REITs in high-demand locations can still yield positive returns.

- 10% in Self-Storage REITs: This sector offers resilience to economic fluctuations due to consistent demand for storage units.

This allocation balances risk and return, aiming for steady income through dividends while also participating in potential capital appreciation. The specific REITs chosen within each sector would require further due diligence based on individual company performance and financial health. This is a hypothetical example and not financial advice.

Impact of Macroeconomic Factors on REIT Performance

Interest rate changes significantly impact REIT valuations. Rising interest rates typically increase borrowing costs for REITs, potentially reducing profitability and decreasing valuations. Conversely, falling interest rates can boost REIT valuations and increase borrowing capacity, encouraging expansion and development. Inflation also plays a crucial role. High inflation can increase operating costs for REITs, potentially squeezing margins. However, inflation can also lead to higher rental rates, potentially offsetting increased costs, particularly in sectors like residential or industrial REITs. For instance, during periods of high inflation, REITs can adjust rental rates to match the increase in operating costs, maintaining profitability. Conversely, during deflationary periods, REITs may struggle to maintain profitability due to the downward pressure on rental rates. The relationship between macroeconomic factors and REIT performance is complex and requires ongoing monitoring and analysis.

REIT Financial Statements and Analysis

Understanding a REIT’s financial health is crucial for investors. Analyzing its financial statements provides insights into its profitability, liquidity, and overall financial strength. Key metrics and ratios offer a comprehensive evaluation, allowing investors to make informed decisions.

Key Financial Metrics for REIT Performance Evaluation

Funds From Operations (FFO) and Net Asset Value (NAV) are two of the most important metrics used to assess REIT performance. FFO adjusts net income to reflect the non-cash nature of depreciation and amortization, providing a more accurate picture of a REIT’s cash flow. It’s a crucial indicator of a REIT’s ability to pay dividends and reinvest in its properties. NAV, on the other hand, represents the net asset value of the REIT’s underlying properties, after deducting liabilities. It provides a measure of the intrinsic value of the REIT’s assets. Other important metrics include Adjusted Funds From Operations (AFFO), which further adjusts FFO for capital expenditures, offering a clearer view of sustainable dividend payouts.

Components of a REIT’s Balance Sheet and Income Statement

A REIT’s balance sheet shows its assets (primarily properties and cash), liabilities (debt and other obligations), and equity (shareholder investments). The income statement, conversely, details the REIT’s revenues (rental income, other operating income), expenses (operating expenses, interest expense), and ultimately, its net income. Analyzing both statements in conjunction provides a holistic view of the REIT’s financial position. For instance, a high debt-to-equity ratio on the balance sheet could indicate higher financial risk, while consistently high occupancy rates and strong net operating income (NOI) on the income statement suggest strong operational performance.

Sample REIT Financial Statement Analysis

Let’s consider a hypothetical REIT, “PropertyPros REIT,” for illustrative purposes.

| Ratio | PropertyPros REIT | Industry Average | Interpretation |

|---|---|---|---|

| FFO per Share | $2.50 | $2.00 | Above average FFO, indicating strong cash flow generation. |

| AFFO per Share | $2.00 | $1.70 | Above average AFFO, suggesting sustainable dividend payouts. |

| Net Asset Value (NAV) per Share | $20.00 | $18.00 | Above average NAV, suggesting the underlying assets are undervalued. |

| Debt-to-Equity Ratio | 0.6 | 0.7 | Lower than the industry average, indicating lower financial risk. |

This simplified analysis shows PropertyPros REIT performing better than the industry average across key metrics, suggesting a relatively strong financial position. However, a comprehensive analysis would involve a deeper dive into individual line items and trends over time.

Evaluating the Creditworthiness of a REIT

Assessing a REIT’s creditworthiness involves evaluating its ability to meet its debt obligations. This involves examining several factors, including its debt-to-equity ratio (as shown above), interest coverage ratio (the ratio of earnings to interest expense), and credit ratings from agencies like Moody’s and Standard & Poor’s. A high interest coverage ratio indicates the REIT’s ability to comfortably cover its interest payments, while a strong credit rating reflects a lower perceived risk of default. Analyzing the REIT’s cash flow generation capacity and its overall financial leverage are also crucial aspects of this evaluation. For example, a REIT with a high proportion of fixed-rate debt might be less vulnerable to interest rate hikes compared to one with a significant portion of variable-rate debt.

REIT Due Diligence and Selection

Investing in REITs requires careful consideration and a thorough due diligence process to mitigate risks and maximize returns. Understanding a REIT’s financial health, management team, and market position is crucial before committing capital. This section Artikels key factors to consider and provides a step-by-step guide to conducting effective REIT due diligence.

Key Factors in REIT Evaluation

Several critical factors influence a REIT’s investment potential. These factors should be carefully analyzed to determine the suitability of a REIT for a specific investment portfolio. A comprehensive assessment goes beyond simply looking at the dividend yield.

- Financial Strength: Examine key financial ratios such as debt-to-equity ratio, interest coverage ratio, and funds from operations (FFO) to assess the REIT’s financial stability and ability to meet its obligations. A high debt load can be a significant risk factor, while strong FFO indicates a healthy cash flow.

- Management Quality: Evaluate the experience and track record of the REIT’s management team. Look for a team with a proven history of successful property management and investment decisions. Consider their compensation structure and any potential conflicts of interest.

- Portfolio Quality: Analyze the REIT’s portfolio of properties. Consider factors such as location, occupancy rates, lease terms, and the overall quality of the assets. Diversification across property types and geographic locations can mitigate risk.

- Market Conditions: Assess the current market conditions for the specific property types held by the REIT. Understanding supply and demand dynamics, rental rates, and potential economic factors affecting the market is vital.

- Dividend History and Sustainability: Review the REIT’s dividend payout history and its sustainability. A consistent dividend payout is attractive to investors, but it’s crucial to ensure the payout is sustainable and not jeopardizing the REIT’s financial health.

The REIT Due Diligence Process

Conducting thorough due diligence is a systematic process involving several steps to ensure a comprehensive understanding of the REIT before investing.

- Identify Potential REITs: Begin by identifying REITs that align with your investment goals and risk tolerance. Consider factors such as property type, geographic focus, and investment strategy.

- Gather Information: Collect relevant information about the selected REITs, including their annual reports, quarterly filings, investor presentations, and press releases. Utilize reputable financial databases and news sources.

- Analyze Financial Statements: Scrutinize the REIT’s financial statements, paying close attention to key metrics like FFO, net asset value (NAV), and debt levels. Compare these metrics to industry benchmarks and historical trends.

- Assess Management and Governance: Review the REIT’s management team’s experience, compensation, and track record. Analyze their corporate governance structure and any potential conflicts of interest.

- Evaluate Portfolio Quality: Thoroughly examine the REIT’s property portfolio, including location, occupancy rates, lease terms, and the overall quality of the assets. Consider diversification and potential risks.

- Market Research: Conduct thorough market research to understand the current and projected market conditions for the property types held by the REIT. Consider economic factors, supply and demand dynamics, and competition.

- Independent Valuation: If possible, consider obtaining an independent valuation of the REIT’s assets to ensure the NAV is accurately reflected.

- Legal Review: Engage legal counsel to review relevant legal documents and ensure compliance with regulations.

REIT Due Diligence Checklist

Before investing in a REIT, it is essential to review a comprehensive checklist of items. This checklist helps ensure all crucial aspects of the REIT are thoroughly examined.

- Review of the REIT’s most recent annual report and quarterly filings.

- Analysis of key financial ratios (debt-to-equity, interest coverage, FFO).

- Assessment of the management team’s experience and track record.

- Evaluation of the REIT’s property portfolio, including location, occupancy, and lease terms.

- Market research to understand supply and demand dynamics.

- Review of the REIT’s dividend history and payout ratio.

- Assessment of the REIT’s competitive landscape.

- Consideration of potential risks and opportunities.

- Legal review of relevant documents.

REIT Portfolio Management

Effective REIT portfolio management is crucial for maximizing returns and mitigating risks. A well-structured portfolio considers diversification across various property types, geographic locations, and REIT sizes, balancing risk and reward to achieve long-term investment goals. This involves strategic asset allocation, ongoing monitoring, and proactive adjustments to adapt to changing market conditions.

Diversification Strategies for a REIT Portfolio

Diversifying a REIT portfolio is essential to reduce the impact of negative events affecting a single REIT or property type. A well-diversified portfolio spreads risk across multiple investments, potentially leading to more stable returns over time. This involves considering various factors, including property type, geographic location, and the size and capitalization of the REITs. Over-concentration in a single sector or region can significantly increase portfolio vulnerability.

Risk Management in REIT Investing

Risk management in REIT investing involves identifying, assessing, and mitigating potential threats to portfolio performance. This includes market risk (fluctuations in REIT prices), interest rate risk (impact of changing interest rates on borrowing costs and valuations), and specific risks related to individual REITs or properties (e.g., tenant defaults, property damage). Effective risk management strategies include diversification, hedging techniques (such as using derivatives), and setting appropriate stop-loss orders. Regular monitoring of market trends and economic indicators is also crucial.

Methods for Rebalancing a REIT Portfolio

Rebalancing a REIT portfolio involves adjusting the allocation of assets to maintain the desired asset allocation strategy. This is done periodically to bring the portfolio back to its target weights after market fluctuations have caused deviations. Rebalancing can involve selling overweighted assets and buying underweighted assets. The frequency of rebalancing depends on the investor’s risk tolerance and investment horizon. For example, a more aggressive investor might rebalance more frequently than a conservative investor.

Hypothetical REIT Portfolio Diversification Strategy

A diversified REIT portfolio should aim for exposure across various property types and geographic locations to mitigate risk. Consider this hypothetical example:

- Residential (25%): Investment in a mix of apartment REITs located in diverse regions (e.g., Sunbelt states and major metropolitan areas on the East and West Coasts) to capture different market dynamics.

- Commercial (25%): Allocation to REITs focused on office buildings in major cities, and retail REITs with a focus on e-commerce resistant properties such as grocery-anchored shopping centers, creating a balance between traditional and evolving commercial real estate.

- Industrial (20%): Investment in logistics and warehouse REITs, benefiting from the growth of e-commerce and supply chain management. Geographic diversification is important, including locations near major transportation hubs.

- Healthcare (15%): Allocation to REITs owning medical office buildings and senior housing facilities, considering the growing demand for healthcare services driven by an aging population. This sector often demonstrates more stability during economic downturns.

- Data Centers (10%): Investment in REITs owning data centers, reflecting the growing demand for data storage and processing capacity in the digital economy. This sector is characterized by high barriers to entry and long-term contracts.

- Self-Storage (5%): Investment in self-storage REITs, benefiting from consistent demand across economic cycles. This sector offers relatively low capital expenditures and operational flexibility.

This hypothetical portfolio aims for diversification across property sectors and reduces reliance on any single market segment. The specific allocation percentages can be adjusted based on individual risk tolerance and market outlook. It’s crucial to remember that this is a sample portfolio and individual investors should conduct thorough research and consult with financial professionals before making investment decisions.

Illustrative Example of a REIT Investment

This section provides a detailed analysis of a hypothetical REIT, focusing on its investment strategy, financial performance, risk profile, and investment potential evaluation. The data presented is for illustrative purposes and should not be considered investment advice. Remember to conduct thorough due diligence before investing in any REIT.

Investment Strategy and Portfolio Composition

Our example REIT, “AmeriRetail Properties,” focuses on acquiring and managing Class A retail properties located in high-growth suburban areas across the Midwestern United States. The REIT’s investment strategy prioritizes long-term lease agreements with established national retailers, aiming for stable and predictable cash flows. Their portfolio consists primarily of large-format anchor stores and accompanying smaller shops within well-maintained shopping centers. These locations are strategically chosen based on factors such as population density, demographics, traffic patterns, and proximity to residential areas and other amenities. AmeriRetail Properties currently owns approximately 50 properties, totaling over 5 million square feet of leasable space, distributed across five states: Illinois, Indiana, Ohio, Michigan, and Wisconsin. The majority of their tenants are well-known national chains, providing a degree of diversification and mitigating the risk associated with individual tenant defaults.

Financial Performance and Key Metrics

Over the past five years, AmeriRetail Properties has demonstrated consistent growth in Funds From Operations (FFO), a key metric for REIT performance. Their FFO has increased at a compound annual growth rate (CAGR) of approximately 6%. This growth is attributable to a combination of increased occupancy rates, rent growth, and strategic acquisitions. The REIT maintains a healthy occupancy rate, consistently above 95%, reflecting the strong demand for their high-quality properties in desirable locations. Their debt-to-equity ratio remains below 0.5, indicating a conservative financial strategy and a low level of financial risk. AmeriRetail Properties has also consistently paid out a substantial portion of its FFO as dividends, providing attractive returns for investors. For example, in the most recent fiscal year, their dividend payout ratio was approximately 80%, reflecting their commitment to shareholder value.

Risk Profile and Potential Challenges

While AmeriRetail Properties presents a relatively low-risk investment opportunity due to its focus on established tenants and high-quality properties, several potential challenges exist. The increasing popularity of e-commerce poses a threat to traditional brick-and-mortar retail, potentially impacting occupancy rates and rental income. Economic downturns could also affect consumer spending and tenant solvency. Furthermore, interest rate increases can influence borrowing costs, potentially impacting the REIT’s ability to finance acquisitions and maintain its dividend payout. However, AmeriRetail’s strategy of focusing on Class A properties in high-growth areas, combined with its conservative financial management, mitigates some of these risks. The diversification of their tenant base and geographical spread also helps reduce the impact of individual tenant defaults or regional economic fluctuations.

Investment Potential Evaluation

Evaluating the investment potential of AmeriRetail Properties involves a comprehensive assessment of its financial performance, risk profile, and valuation. This would typically involve analyzing key financial ratios, such as the price-to-FFO ratio (P/FFO), to compare its valuation to similar REITs. A thorough assessment of the REIT’s management team and its track record is also crucial. The stability of their tenant base and the strength of their lease agreements are key factors to consider. Furthermore, analyzing market trends in the retail sector and the specific geographic locations of their properties is essential for understanding the long-term prospects of the investment. A discounted cash flow (DCF) analysis could provide a more detailed valuation, considering future cash flows and the appropriate discount rate. This analysis would factor in expected growth rates, occupancy rates, and potential risks, providing an estimate of the intrinsic value of the REIT. By comparing this intrinsic value to the current market price, an investor can determine if the REIT is undervalued or overvalued.

Concluding Remarks

Investing in REITs presents a unique opportunity to participate in the real estate market with enhanced liquidity and diversification. By understanding the various types of REITs, their associated risks and rewards, and employing sound investment strategies, investors can effectively leverage this asset class to achieve their financial goals. However, thorough due diligence, a clear understanding of market dynamics, and careful portfolio management remain crucial for success in this sector. This guide serves as a foundational resource, providing a framework for informed decision-making in the dynamic world of REIT investment.

Popular Questions

What is the minimum investment required for REITs?

The minimum investment in REITs varies depending on the brokerage and the specific REIT. Many brokers allow fractional share purchases, making REIT investing accessible to a wide range of investors.

How are REIT dividends taxed?

REIT dividends are typically taxed as ordinary income, unlike qualified dividends which receive preferential tax rates. However, specific tax implications depend on individual circumstances and applicable tax laws.

Are REITs suitable for all investors?

REITs can be a part of a diversified portfolio, but their suitability depends on individual risk tolerance, investment goals, and overall financial situation. It’s advisable to consult a financial advisor before making any investment decisions.

What are the risks associated with investing in REITs?

REITs are subject to market risks, interest rate fluctuations, and changes in real estate market conditions. Specific risks vary depending on the type of REIT and its underlying assets.