Real Estate Investment Trusts (REITs) offer a compelling avenue for investors seeking exposure to the real estate market without the complexities of direct property ownership. These publicly traded companies pool capital from numerous investors to acquire, manage, and operate income-producing real estate, providing a diversified portfolio approach to a traditionally illiquid asset class. This exploration delves into the diverse facets of REITs, examining their various types, investment strategies, and associated risks and rewards.

From understanding the fundamental characteristics of REITs and their diverse structures—equity, mortgage, and hybrid—to navigating the intricacies of financial performance analysis and market trends, this overview equips readers with the knowledge necessary to make informed investment decisions. We will also explore how REITs can contribute to a well-rounded investment portfolio, emphasizing the importance of risk mitigation and legal considerations.

Introduction to Real Estate Investment Trusts (REITs)

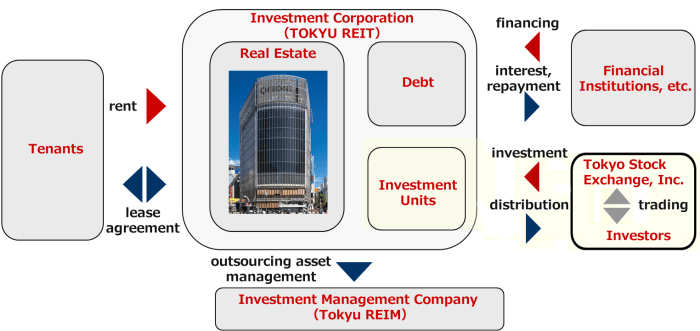

Real Estate Investment Trusts, or REITs, are companies that own or finance income-producing real estate across a range of property sectors. They are a popular investment vehicle offering investors a way to participate in the real estate market without directly owning properties. REITs are structured to pass the majority of their income to shareholders in the form of dividends, making them attractive for income-seeking investors. This structure is facilitated by specific tax regulations that incentivize the distribution of profits.

REITs operate under a specific set of rules and regulations, most notably the requirement to distribute at least 90% of their taxable income as dividends to shareholders. This characteristic significantly impacts their financial structure and investment strategy. Because they are required to distribute a substantial portion of their earnings, REITs generally reinvest less in their own growth compared to other companies. This focus on dividend payouts often results in a higher dividend yield compared to other investment options.

Types of REITs

REITs are categorized into several types based on their underlying investment strategy and the type of real estate they own or finance. Understanding these categories is crucial for investors to select REITs aligned with their risk tolerance and investment objectives. The most common classifications include Equity REITs, Mortgage REITs, and Hybrid REITs.

Equity REITs

Equity REITs directly own and operate income-producing real estate. These properties generate rental income, which is then distributed to shareholders as dividends. Examples include shopping centers, office buildings, apartments, and hotels. A well-known example is Prologis, Inc. (PLD), a global leader in industrial real estate, focusing on logistics and distribution centers. Their investment strategy centers on owning and leasing strategically located warehouses and distribution facilities to a diverse range of tenants. Another example is Public Storage (PSA), a major player in the self-storage industry, owning and operating numerous self-storage facilities across the United States. Their strategy emphasizes the high demand for self-storage units in various geographic markets.

Mortgage REITs

Mortgage REITs, unlike Equity REITs, primarily invest in mortgages and mortgage-backed securities rather than directly owning properties. They generate income from interest payments on these mortgages. These REITs are often more sensitive to interest rate fluctuations than Equity REITs. An example of a Mortgage REIT is Annaly Capital Management, Inc. (NLY), which invests in agency mortgage-backed securities and other mortgage-related assets. Their investment strategy involves actively managing their portfolio to capitalize on shifts in the interest rate environment.

Hybrid REITs

Hybrid REITs combine elements of both Equity and Mortgage REITs, investing in both properties and mortgages. This diversification can offer a balance between income stability and potential capital appreciation. Examples of Hybrid REITs can be more complex to identify as they often blend different investment approaches. Many REITs may incorporate elements of both Equity and Mortgage strategies, making precise categorization sometimes challenging. Analyzing the specific investment portfolio of a given REIT is crucial to accurately classify it as a Hybrid.

REIT Investment Strategies

Investing in Real Estate Investment Trusts (REITs) offers a diverse range of approaches, each carrying its own set of advantages and disadvantages. Understanding these strategies is crucial for tailoring an investment portfolio that aligns with individual risk tolerance and financial goals. The primary methods for accessing the REIT market include direct investment in individual REITs, investment through REIT exchange-traded funds (ETFs), and investment via REIT mutual funds.

Direct investment in individual REITs involves purchasing shares of specific REITs listed on stock exchanges. This approach allows for detailed analysis and selection of companies based on factors such as their specialization (e.g., residential, retail, healthcare), financial performance, and management quality. However, it requires a higher level of understanding of the REIT market and individual company analysis, and carries the risk of significant losses if a chosen REIT underperforms.

REIT Investment Strategies: Direct Investment, ETFs, and Mutual Funds

Direct investment offers the potential for higher returns but also entails higher risk due to the concentration of investment in a limited number of REITs. Conversely, investing in REIT ETFs or mutual funds provides diversification across a broader range of REITs, mitigating the risk associated with individual company underperformance. ETFs generally offer lower expense ratios than mutual funds, making them an attractive option for long-term investors. Mutual funds, on the other hand, may offer more active management and potentially higher returns, but with potentially higher expense ratios.

Risk and Reward Comparison of REIT Investment Approaches

The risk-reward profile varies significantly across these investment strategies. Direct investment in individual REITs carries higher risk due to the lack of diversification, but also presents the opportunity for higher returns if the chosen REITs perform well. Investing in REIT ETFs or mutual funds reduces risk through diversification, but may also result in lower potential returns compared to a successful direct investment strategy. For example, a well-researched direct investment in a rapidly growing data center REIT could yield significantly higher returns than a diversified REIT ETF, but the risk of that single REIT failing is also considerably higher. Conversely, the ETF provides stability and reduces risk but may not capture the exceptional growth potential of a single, high-performing REIT.

Factors to Consider When Selecting REITs

Several key factors should be considered when selecting REITs for a portfolio. These include the REIT’s specialization (e.g., residential, commercial, industrial), its financial health (e.g., debt-to-equity ratio, occupancy rates), its dividend yield and payout ratio, and the quality of its management team. Furthermore, the overall market conditions and the economic outlook should be considered, as these factors can significantly impact the performance of REITs. For instance, during periods of economic uncertainty, REITs focused on essential real estate sectors (e.g., healthcare, infrastructure) may outperform those in more cyclical sectors (e.g., retail, hospitality). A thorough due diligence process, including an assessment of the REIT’s financial statements and competitive landscape, is essential for making informed investment decisions.

REIT Financial Performance Analysis

Analyzing the financial performance of a Real Estate Investment Trust (REIT) requires a nuanced understanding of specific metrics that go beyond traditional accounting measures. This is crucial for investors to assess a REIT’s profitability, stability, and overall investment potential. Understanding these key indicators allows for a more informed investment decision, mitigating potential risks and maximizing returns.

Several key financial metrics provide a comprehensive view of a REIT’s financial health. These metrics offer insights into profitability, efficiency, and risk, going beyond simple net income figures.

Key Financial Metrics for REIT Evaluation

Investors rely on several key metrics to gauge REIT performance. These metrics provide a more accurate picture than traditional accounting methods because they account for the unique characteristics of REITs, such as high depreciation and interest expense.

- Funds From Operations (FFO): FFO is a crucial metric that adds back depreciation and amortization to net income. This adjustment reflects the cash flow generated by the REIT’s operations, which is more relevant for real estate than net income due to the significant non-cash depreciation expense inherent in property ownership. The formula is typically: Net Income + Depreciation + Amortization

- Adjusted Funds From Operations (AFFO): AFFO is a more refined metric than FFO. It further adjusts FFO by subtracting capital expenditures (CapEx) related to maintaining the property portfolio. This provides a clearer picture of the cash flow available for distribution to shareholders. A higher AFFO suggests stronger cash flow and better sustainability of dividend payments. The formula is typically: FFO – Capital Expenditures (excluding tenant improvements)

- Occupancy Rates: Occupancy rates indicate the percentage of a REIT’s properties that are leased. High occupancy rates demonstrate strong demand for the REIT’s properties and contribute to higher rental income and overall financial stability. A consistently high occupancy rate is a positive sign.

- Net Asset Value (NAV): NAV represents the net value of a REIT’s assets minus its liabilities, per share. It is a measure of the underlying value of the REIT’s properties. While not a direct measure of performance, changes in NAV can signal shifts in market perception of the REIT’s portfolio value.

Comparative Financial Performance of Three REITs

The following table compares the financial performance of three hypothetical REITs (REIT A, REIT B, and REIT C) over the past five years. Note that these are illustrative examples and not representative of any specific REITs. Real-world data should be sourced from reliable financial databases for accurate analysis.

| Metric | REIT A | REIT B | REIT C |

|---|---|---|---|

| FFO (USD millions) | 100, 105, 110, 115, 120 | 90, 95, 100, 105, 110 | 80, 85, 90, 95, 100 |

| AFFO (USD millions) | 80, 85, 90, 95, 100 | 70, 75, 80, 85, 90 | 60, 65, 70, 75, 80 |

| Occupancy Rate (%) | 95, 96, 97, 98, 99 | 92, 93, 94, 95, 96 | 88, 89, 90, 91, 92 |

| NAV per Share (USD) | 20, 21, 22, 23, 24 | 18, 19, 20, 21, 22 | 16, 17, 18, 19, 20 |

Interpreting REIT Financial Statements and Identifying Potential Risks

Analyzing REIT financial statements requires careful consideration of several factors. A holistic approach, considering multiple metrics and external factors, is essential for a thorough assessment.

- Debt Levels: High levels of debt can increase financial risk, especially during economic downturns. Examine the REIT’s debt-to-equity ratio and interest coverage ratio to assess its financial leverage.

- Lease Expiration Dates: A large concentration of lease expirations in the near future can pose a risk to occupancy rates and rental income. Review the lease portfolio to understand the timing and terms of lease agreements.

- Property Values: Changes in property values can significantly impact a REIT’s NAV and overall financial health. Monitor market conditions and economic indicators that could affect property valuations.

- Management Quality: Effective management is crucial for REIT success. Assess the experience and track record of the REIT’s management team.

- Geographic Diversification: Over-reliance on a single geographic market can increase exposure to regional economic downturns. Examine the geographic diversification of the REIT’s property portfolio.

REIT Market Trends and Regulations

The REIT market is a dynamic landscape influenced by a complex interplay of macroeconomic factors, technological advancements, and regulatory frameworks. Understanding these trends and regulations is crucial for investors seeking to navigate this asset class effectively. This section will explore current market shaping forces and the regulatory environment governing REITs, highlighting their impact on investment strategies.

Interest Rate Sensitivity and Inflationary Pressures

Interest rates significantly impact REIT valuations. Higher interest rates increase borrowing costs for REITs, potentially reducing profitability and impacting dividend payouts. Conversely, lower interest rates can stimulate borrowing and investment, boosting REIT performance. Inflation also plays a critical role, affecting both operating costs and rental income. High inflation can erode profit margins if rental increases fail to keep pace with rising expenses. For example, the significant interest rate hikes implemented by the Federal Reserve in 2022 and 2023 led to a period of decreased REIT valuations as borrowing costs rose sharply for many companies. Conversely, periods of low inflation can benefit REITs, particularly those with long-term leases, allowing them to maintain higher profit margins.

Technological Advancements and Disruption

Technological advancements are reshaping the REIT landscape, impacting everything from property management to tenant acquisition. Proptech companies are developing innovative solutions for property management, streamlining processes and improving efficiency. E-commerce and remote work trends are also influencing demand for different types of real estate, creating both opportunities and challenges for REITs. For instance, the rise of e-commerce has increased demand for warehouse and logistics properties, benefiting REITs focused on these sectors. Simultaneously, the shift towards remote work has altered the demand for office space, leading some REITs to adapt their portfolios to accommodate this change.

Regulatory Environment and its Impact

REITs operate under a specific regulatory framework designed to encourage investment and maintain investor confidence. Compliance with these regulations is crucial for maintaining REIT status and accessing tax benefits. Changes in tax laws or regulations can significantly impact REIT investment decisions. For example, changes in depreciation rules or tax incentives for specific property types can influence the attractiveness of certain REIT investments. Stricter environmental regulations, for instance, could impact the value of properties that do not meet certain sustainability standards, requiring REITs to invest in renovations or face potential devaluation.

Timeline of Significant Events (Last Decade)

The following timeline highlights key events shaping the REIT market over the past decade:

| Year | Event | Impact on REIT Market |

|---|---|---|

| 2014 | Increased interest rates by the Federal Reserve | Caused a slight dip in REIT valuations, particularly in sectors sensitive to interest rate changes. |

| 2016 | Brexit vote | Increased market volatility, impacting global REIT investments. |

| 2017-2019 | Sustained period of low interest rates | Fueled significant investment in REITs, driving up valuations. |

| 2020 | COVID-19 pandemic | Caused significant disruption, with varying impacts across different REIT sectors (e.g., negative impact on retail, positive impact on industrial). |

| 2022-2023 | Aggressive interest rate hikes by the Federal Reserve | Led to a decline in REIT valuations due to increased borrowing costs and decreased investor confidence. |

REITs and Portfolio Diversification

REITs offer a compelling avenue for enhancing portfolio diversification due to their unique characteristics as income-generating real estate investments. Unlike traditional stocks or bonds, REITs provide exposure to a tangible asset class with a relatively low correlation to other major asset categories, potentially mitigating overall portfolio risk. This section explores how REITs contribute to a more robust and resilient investment strategy.

REIT returns typically exhibit a lower correlation with traditional stock and bond markets. This reduced correlation stems from the fact that REIT performance is driven by factors distinct from those influencing equities and fixed-income securities. For instance, REIT values are influenced by factors such as property rental rates, occupancy levels, interest rates, and inflation, which don’t always move in lockstep with broader market trends. This lack of perfect correlation makes REITs a valuable tool for reducing overall portfolio volatility.

Correlation Between REIT Returns and Other Asset Classes

Studies consistently show a relatively low correlation between REIT returns and those of stocks and bonds. While the precise correlation coefficient can vary depending on the specific time period and market conditions, REITs generally demonstrate a weaker relationship with equities than with bonds. For example, during periods of high market volatility, REITs may exhibit less dramatic price swings than stocks, offering a relative haven for investors. Conversely, during periods of rising interest rates, REITs might underperform bonds due to increased borrowing costs. However, the overall lack of strong positive correlation with either asset class contributes to a diversified portfolio. The historical data, while not perfectly predictive, provides a strong indication of this diversification benefit.

Incorporating REITs into a Well-Diversified Portfolio

The optimal allocation of REITs within a diversified portfolio depends on individual risk tolerance, investment goals, and overall asset allocation strategy. However, a common approach is to allocate a percentage of the portfolio to REITs, ranging from 5% to 20%, depending on individual circumstances. For example, a conservative investor might allocate 5-10% to REITs, while a more aggressive investor might allocate 15-20%. This allocation should be determined in conjunction with a broader asset allocation strategy that includes stocks, bonds, and other asset classes. It’s crucial to consider the specific types of REITs included (e.g., residential, commercial, healthcare) to further enhance diversification within the REIT allocation itself. Diversification across REIT sectors helps mitigate the risk associated with any single property type or market segment. A balanced approach that accounts for both overall portfolio allocation and REIT sector diversification is key to maximizing the benefits of incorporating REITs into an investment strategy.

Risks Associated with REIT Investments

Investing in Real Estate Investment Trusts (REITs) offers the potential for attractive returns, but like any investment, it carries inherent risks. Understanding these risks and implementing appropriate mitigation strategies is crucial for successful REIT investing. Ignoring these risks can lead to significant financial losses. This section details the key risks associated with REIT investments and provides strategies for managing them.

Interest Rate Risk

Interest rate fluctuations significantly impact REIT performance. Rising interest rates increase borrowing costs for REITs, potentially reducing profitability and impacting dividend payouts. Conversely, falling interest rates can boost profitability but may also signal a weakening economy. The sensitivity of REITs to interest rate changes varies depending on the type of REIT and its leverage. For example, mortgage REITs (mREITs) are particularly vulnerable to interest rate swings due to their reliance on borrowing to finance investments. High interest rates make it more expensive for mREITs to acquire mortgages, and simultaneously reduce the value of their existing mortgage holdings. Equity REITs are generally less sensitive but are still affected.

Credit Risk

Credit risk arises from the possibility of tenants defaulting on lease payments or borrowers failing to repay loans. This is particularly relevant for REITs holding properties with high vacancy rates or leasing to tenants with questionable creditworthiness. A significant tenant default can significantly impact a REIT’s cash flow and profitability. Diversification across multiple tenants and properties helps to mitigate this risk, but it doesn’t eliminate it entirely. The 2008 financial crisis provided a stark illustration of credit risk, with many commercial properties experiencing high vacancy rates due to business failures.

Market Risk

Market risk encompasses the broader economic and market conditions that can affect REIT valuations. Factors such as economic recessions, changes in investor sentiment, and geopolitical events can all impact REIT prices. For instance, during periods of economic uncertainty, investors may move away from REITs, leading to price declines. The dot-com bubble burst in 2000 and the subsequent 2008 financial crisis both demonstrated the impact of market risk on REIT valuations, with significant price drops experienced across the sector.

Liquidity Risk

Liquidity risk refers to the ease with which REIT shares can be bought or sold. While publicly traded REITs generally offer good liquidity, this can diminish during times of market stress. During periods of market turmoil, trading volume may decrease, making it difficult to sell shares at a desired price. This risk is particularly relevant for smaller or less-liquid REITs.

Management Risk

The quality of REIT management significantly impacts performance. Poor management decisions, such as overleveraging, inadequate property management, or poor investment choices, can negatively affect returns. Investors should carefully assess the management team’s experience, track record, and overall strategy before investing.

Strategies to Mitigate Risks

Investing in REITs requires careful consideration of risk. Here are several strategies to mitigate these risks:

- Diversification: Invest in a diversified portfolio of REITs across different property sectors (e.g., residential, retail, office) and geographic locations. This helps to reduce the impact of risks specific to a single property type or region.

- Due Diligence: Conduct thorough research on individual REITs, including their financial statements, management team, and investment strategy. Understand the specific risks associated with each REIT before investing.

- Hedging Strategies: Employ hedging techniques, such as interest rate swaps or options, to protect against interest rate fluctuations or market declines. These strategies can be complex and expensive, but they can offer significant protection in certain market conditions.

- Long-Term Investment Horizon: REIT investments are generally best suited for long-term investors who can ride out short-term market fluctuations. A longer-term perspective helps to reduce the impact of market volatility.

- Regular Monitoring: Regularly monitor your REIT investments and adjust your portfolio as needed based on changes in market conditions and the performance of individual REITs.

REIT Taxation and Legal Considerations

Real Estate Investment Trusts (REITs) operate within a specific legal and tax framework designed to encourage investment in real estate and provide benefits to both investors and the broader economy. Understanding this framework is crucial for anyone considering REIT investments, as it significantly impacts returns and risk profiles. This section will explore the tax advantages inherent in REIT structures, the legal regulations governing their operations, and the cross-border implications of investing in REITs across different tax jurisdictions.

Tax Advantages of REIT Investments

REITs enjoy significant tax advantages due to their adherence to specific regulatory requirements. The most notable benefit is the avoidance of corporate-level taxation. This means that REITs distribute most of their taxable income to shareholders as dividends, avoiding double taxation (once at the corporate level and again at the individual level). This pass-through taxation structure is a key attraction for investors, allowing them to receive income without the intermediary tax burden. To maintain this tax-advantaged status, REITs must meet stringent requirements, including distributing at least 90% of their taxable income as dividends. Failure to comply can result in significant tax penalties. The tax implications for individual investors will vary based on their specific tax bracket and overall investment portfolio. These dividends are typically taxed as ordinary income, but the actual tax liability will depend on individual circumstances.

Legal Framework Governing REIT Operations and Investor Rights

The legal framework governing REITs varies slightly from country to country, but common themes include regulations concerning ownership structure, distribution requirements, investment restrictions, and investor protections. In the United States, for example, the Internal Revenue Code (IRC) Artikels specific requirements that REITs must meet to maintain their tax-advantaged status. These requirements encompass aspects such as the proportion of income distributed as dividends, the composition of their assets, and the limitations on the proportion of income derived from a single source. Furthermore, investor rights are generally protected through regulations ensuring transparency in financial reporting and corporate governance. Shareholders have the right to receive annual reports, participate in shareholder meetings, and vote on major corporate decisions. The specific rights and protections afforded to investors may vary based on the jurisdiction in which the REIT is incorporated and listed.

Implications of Different Tax Jurisdictions on REIT Investments

International REIT investments introduce complexities related to cross-border taxation. Tax treaties between countries can significantly impact the tax liability of foreign investors. Withholding taxes on dividend payments are common, and the rates can vary considerably depending on the relevant tax treaty. Furthermore, capital gains taxes on the sale of REIT shares are also subject to the tax laws of the investor’s residence country. For example, a US investor investing in a UK REIT might face US capital gains tax on any profits from the sale of shares, in addition to any UK withholding taxes on dividends. Understanding these cross-border implications is critical for international investors, requiring careful consideration of the tax implications in both the REIT’s country of origin and the investor’s country of residence. Professional tax advice is often recommended for navigating the complexities of international REIT investments.

Future Outlook for REITs

The future performance of Real Estate Investment Trusts (REITs) is intricately linked to broader macroeconomic trends, technological advancements, and evolving investor preferences. While predicting the future with certainty is impossible, analyzing current market dynamics and emerging patterns allows for a reasoned assessment of potential growth trajectories and challenges. Several key factors will shape the REIT landscape in the coming years.

Predicting future REIT performance requires considering various interconnected elements. Interest rate fluctuations significantly impact REIT valuations, as higher rates increase borrowing costs and reduce the attractiveness of dividend yields. Similarly, economic growth, inflation, and demographic shifts influence real estate demand and rental rates, directly affecting REIT profitability. Technological disruptions, such as the rise of e-commerce and changing workplace dynamics, are reshaping real estate usage and necessitating adaptations within the REIT sector.

Projected REIT Market Growth

A visual representation of projected REIT market growth could be a line graph. The x-axis would represent time (e.g., years from 2024 to 2030), and the y-axis would represent market capitalization or total asset value. The line itself would show an upward trend, reflecting overall market growth, but with some fluctuations reflecting economic cycles and sector-specific events. For example, a slight dip could be shown around 2025 to represent a potential correction due to rising interest rates, followed by a steeper incline from 2026 onwards reflecting a recovery and increased investor confidence, mirroring the growth experienced by the S&P 500 index after previous market corrections. The graph would demonstrate a generally positive outlook, though not a uniformly linear one, emphasizing the inherent volatility of the market. This projected growth is predicated on continued demand for commercial real estate, coupled with strategic adaptations by REITs to emerging market trends. Specific growth rates would need to be supported by detailed market research and analysis from reputable financial institutions.

Influence of Macroeconomic Factors

Macroeconomic factors will profoundly influence REIT performance. For instance, a period of sustained economic expansion, characterized by low unemployment and rising consumer confidence, would likely boost demand for commercial and residential real estate, leading to higher rental income and increased REIT valuations. Conversely, a recessionary environment could depress demand, impacting occupancy rates and rental income. Inflation also plays a crucial role; while inflation can boost rental income, it also increases operating costs and borrowing costs, potentially offsetting the benefits. The Federal Reserve’s monetary policy decisions, particularly interest rate adjustments, significantly impact REIT financing costs and investor sentiment, creating both opportunities and challenges for the sector. For example, the rapid interest rate hikes in 2022 led to a period of decreased REIT valuations, illustrating the direct link between monetary policy and REIT performance.

Technological Disruption and Adaptation

Technological advancements are reshaping the real estate landscape, presenting both opportunities and challenges for REITs. The growth of e-commerce has altered demand for retail spaces, while the rise of remote work has impacted office occupancy rates. REITs are responding by diversifying their portfolios, investing in data centers and logistics properties to capitalize on emerging trends, and by implementing technological solutions to improve operational efficiency and enhance tenant experiences. For example, the adoption of smart building technologies can optimize energy consumption, reducing operating costs and enhancing sustainability efforts. This adaptation and innovation will be key to the long-term success of REITs in a rapidly changing technological environment.

Final Conclusion

Investing in REITs presents a unique opportunity to participate in the real estate market with relative ease and diversification. While understanding the inherent risks associated with any investment is crucial, the potential for consistent income generation and long-term capital appreciation makes REITs a worthy addition to a diversified portfolio. By carefully analyzing financial performance metrics, staying informed about market trends, and implementing effective risk management strategies, investors can harness the potential of REITs to achieve their financial goals. This exploration serves as a foundation for further research and confident decision-making in the dynamic world of real estate investment.

Questions Often Asked

What is the minimum investment required for REITs?

The minimum investment varies depending on the REIT and the investment vehicle (e.g., individual shares, ETFs). Some REITs may have relatively low minimums for purchasing shares, while others may require larger investments through mutual funds or ETFs.

How are REIT dividends taxed?

REIT dividends are typically taxed as ordinary income, not as capital gains. However, specific tax implications can vary based on individual circumstances and applicable tax laws.

Are REITs suitable for all investors?

REITs are not suitable for all investors. The inherent risks associated with real estate investments, including interest rate sensitivity and market volatility, should be carefully considered before investing. It’s advisable to consult a financial advisor to determine if REITs align with your individual risk tolerance and investment objectives.

What are the downsides of investing in REITs?

Potential downsides include vulnerability to interest rate changes, susceptibility to economic downturns affecting real estate markets, and the potential for management issues impacting the REIT’s performance.