Retirement Planning Advisors Guide: Embark on a hilarious yet informative journey into the surprisingly exciting world of retirement planning! Forget dusty spreadsheets and boring lectures; we’re diving headfirst into the crucial (and often comical) decisions that shape your golden years. From navigating the bewildering maze of IRAs and 401(k)s to outsmarting inflation (that sneaky villain!), we’ll arm you with the knowledge to make your retirement dreams a reality – or at least a really good attempt at a reality. Prepare for laughter, enlightenment, and maybe even a newfound appreciation for compound interest.

This guide unravels the complexities of retirement planning, offering a step-by-step approach to securing your financial future. We’ll explore various investment strategies, risk management techniques, and estate planning essentials, all while keeping things engaging and (dare we say it?) fun. Whether you’re a seasoned investor or just starting to think about retirement, this guide is your passport to a worry-free – or at least less worry-filled – future.

Understanding Retirement Planning Needs

Retirement planning: it’s not just about counting down the days until you can finally wear those ridiculously oversized sunglasses you’ve been eyeing. It’s a strategic, multi-stage process that requires careful consideration of your current financial situation, future aspirations (think: private island or slightly less ambitious – a comfortable cottage?), and the ever-present uncertainties of life. Think of it as a well-orchestrated symphony of savings, investments, and smart decisions – not a chaotic polka.

Stages of Retirement Planning

Retirement planning isn’t a sprint; it’s a marathon, albeit one with potentially more enjoyable pit stops. The process typically unfolds across several key stages. Early planning focuses on establishing a strong financial foundation through consistent saving and investing. The middle stage involves refining your investment strategy, considering risk tolerance, and potentially adjusting your savings goals based on life changes. The final stage involves actively managing your retirement assets, ensuring you have enough to support your lifestyle, and adapting your plan as needed. Failing to plan is planning to fail, as the old adage wisely states – unless you’re planning on winning the lottery, in which case, skip to the “champagne wishes and caviar dreams” section of your retirement plan.

Factors Influencing Retirement Planning Decisions

Numerous factors play a significant role in shaping your retirement strategy. Age, for instance, dictates the time horizon you have for saving and investing. Younger individuals generally have more time to recover from market downturns, while those closer to retirement need a more conservative approach. Health is another crucial factor; anticipated healthcare costs can significantly impact retirement expenses. Income, both current and projected, influences the amount you can save and the lifestyle you can afford in retirement. Lifestyle preferences, finally, determine your desired spending level and the type of retirement you envision. Do you dream of world travel or quiet evenings at home with a good book? Your retirement plan should reflect these aspirations.

Assessing Retirement Readiness

A step-by-step guide to determine if your golden years will be gilded or just…gold-ish. First, calculate your current net worth, subtracting debts from assets. Next, estimate your future retirement expenses, considering inflation and potential healthcare costs. Then, project your retirement income from Social Security, pensions, and other sources. Compare your projected retirement income to your estimated expenses. If your income exceeds your expenses, congratulations! You’re likely on the right track. If not, it’s time to re-evaluate your savings strategy, consider working longer, or adjusting your lifestyle expectations. Remember, a little planning now can prevent a whole lot of “oops” later.

Comparison of Retirement Savings Vehicles

The following table compares several common retirement savings vehicles. Remember, the “best” option depends on your individual circumstances and financial goals. Consult a financial advisor for personalized guidance.

| Savings Vehicle | Tax Advantages | Contribution Limits | Withdrawal Rules |

|---|---|---|---|

| 401(k) | Tax-deferred growth; contributions may be pre-tax | Varies by employer | Taxed in retirement; early withdrawals may incur penalties |

| Traditional IRA | Tax-deductible contributions; tax-deferred growth | Annual limits apply | Taxed in retirement; early withdrawals may incur penalties |

| Roth IRA | Tax-free withdrawals in retirement | Annual limits apply | Contributions are not tax-deductible; early withdrawals of earnings may incur penalties |

Defining Financial Goals and Objectives

Retirement planning isn’t just about squirreling away cash; it’s about crafting a vision of your golden years – a vision so compelling, it’ll make you want to skip the daily commute (and maybe even the sensible cardigan). Setting realistic goals is the bedrock of a successful retirement plan, preventing the disappointment of falling short of expectations or, worse, discovering you’ve over-saved for a lifestyle that leaves you utterly bored.

Setting realistic retirement goals involves a delicate balance between ambition and practicality. It’s about acknowledging your current financial situation, considering your potential future income (that part-time gig teaching interpretive dance might pay off!), and anticipating unforeseen expenses (like that unexpected trip to the Galapagos to study giant tortoises). The key is to create a plan that is both aspirational and achievable.

Determining Required Retirement Income

Calculating your required retirement income requires a bit more than pulling numbers out of a hat (though we wouldn’t judge if you tried). It involves carefully considering your desired lifestyle, factoring in inflation, and projecting your expenses over your retirement years. This isn’t an exact science, but a well-informed estimate. A common approach involves using a retirement income calculator, readily available online from reputable financial institutions. These tools consider factors like current savings, anticipated investment returns, and your planned spending.

Retirement Savings Needs Calculator Worksheet

This worksheet helps you estimate your retirement savings needs. Remember, these are estimates; consult a financial advisor for personalized guidance.

| Item | Amount |

|---|---|

| Current Annual Expenses | $____________ |

| Projected Annual Expenses in Retirement (adjusted for inflation) | $____________ |

| Desired Retirement Income (Annual) | $____________ |

| Number of Retirement Years | ____________ |

| Estimated Annual Investment Return (consult a financial professional for a realistic rate) | ____________% |

| Total Retirement Savings Needed (Desired Income x Number of Years) | $____________ |

| Current Retirement Savings | $____________ |

| Savings Gap (Total Needed – Current Savings) | $____________ |

Retirement Lifestyle Examples and Associated Costs

Understanding the cost of different retirement lifestyles is crucial for setting realistic goals. Consider these examples, remembering that costs vary greatly depending on location and individual preferences.

- The “Comfortable Retirement”: This lifestyle involves maintaining a similar standard of living to your pre-retirement years, perhaps with slightly less work-related spending. Expenses might include a modest mortgage or rent, travel a couple of times a year, and regular outings with friends. Estimated annual cost: $50,000 – $100,000 (highly variable based on location and preferences).

- The “Luxury Retirement”: This involves a significant upgrade in lifestyle, potentially including international travel, a larger home, and expensive hobbies (like collecting rare stamps or vintage cars). Estimated annual cost: $150,000+

- The “Frugal Retirement”: This lifestyle prioritizes minimizing expenses to maximize financial security. It may involve downsizing to a smaller home, limiting travel, and focusing on low-cost hobbies. Estimated annual cost: $30,000 – $50,000 (highly variable based on location and preferences).

Remember, these are just examples. Your ideal retirement lifestyle and its associated costs will depend on your personal preferences and financial circumstances. The key is to create a plan that aligns with your aspirations without jeopardizing your financial well-being. Don’t forget the giant tortoises!

Investment Strategies for Retirement

Planning for retirement is like planning a ridiculously long and luxurious vacation – you need a solid itinerary, and that itinerary involves smart investing. Ignoring this crucial step is akin to showing up at the airport without a ticket; you might get there eventually, but it won’t be pretty, or comfortable. This section will guide you through navigating the sometimes-bewildering world of retirement investment strategies.

Various Investment Options for Retirement Planning

A diverse range of investment vehicles are available to help you build your retirement nest egg. These options vary significantly in terms of risk and potential returns. Choosing the right mix is key to achieving your financial goals without experiencing a heart attack every time you check your portfolio. Consider these options: stocks (equities), bonds (fixed-income securities), real estate, mutual funds, exchange-traded funds (ETFs), and annuities. Each has its own risk profile and potential rewards. For example, stocks generally offer higher potential returns but also carry greater risk compared to bonds. Real estate can provide both income and appreciation, but requires significant capital investment and management.

Comparison of Conservative, Moderate, and Aggressive Investment Approaches

Retirement investment strategies can be broadly categorized into conservative, moderate, and aggressive approaches. A conservative approach prioritizes capital preservation and minimizes risk, typically focusing on low-risk investments like bonds and money market accounts. This strategy offers stability but may yield lower returns over the long term. Think of it as a steady, reliable tortoise in the investment race. A moderate approach balances risk and return, incorporating a mix of stocks and bonds. It aims to achieve reasonable returns while managing risk effectively. This is the Goldilocks approach—not too hot, not too cold. Finally, an aggressive approach prioritizes high growth potential, often investing heavily in stocks and other higher-risk assets. This strategy offers the potential for substantial returns but also carries a greater risk of significant losses. This is the hare in the race, potentially fast but also prone to stumbling. The optimal approach depends on your individual risk tolerance, time horizon, and financial goals.

Factors to Consider When Selecting Investments for Retirement

Before diving headfirst into the world of investments, it’s crucial to carefully consider several factors. These factors will significantly influence your investment strategy and ultimately your retirement success.

- Time Horizon: How many years do you have until retirement? A longer time horizon allows for greater risk-taking, while a shorter time horizon necessitates a more conservative approach.

- Risk Tolerance: How comfortable are you with the possibility of losing some of your investment? Your risk tolerance should align with your investment strategy and time horizon.

- Financial Goals: What is your desired retirement lifestyle? Clearly defining your financial goals will help you determine the amount of money you need to save and the level of risk you’re willing to take.

- Investment Knowledge and Experience: Are you comfortable managing your investments independently, or would you prefer to work with a financial advisor?

- Fees and Expenses: Be mindful of the fees associated with different investment options. High fees can significantly eat into your returns over time.

Creating a Diversified Investment Portfolio for Retirement

Diversification is crucial for mitigating risk. Don’t put all your eggs in one basket! A diversified portfolio spreads your investments across various asset classes to reduce the impact of any single investment performing poorly.

- Allocate Assets Strategically: A common approach is to allocate assets based on your risk tolerance and time horizon. For example, a younger investor with a longer time horizon might allocate a larger portion of their portfolio to stocks, while an older investor closer to retirement might favor a more conservative allocation with a higher percentage in bonds.

- Consider Different Asset Classes: Include a mix of stocks, bonds, real estate, and potentially other asset classes like commodities or alternative investments. This broad diversification helps reduce overall portfolio volatility.

- Regularly Rebalance Your Portfolio: Over time, your asset allocation may drift from your target due to market fluctuations. Regularly rebalancing ensures your portfolio remains aligned with your risk tolerance and financial goals. This might involve selling some assets that have performed well and buying assets that have underperformed to restore your desired allocation.

- Seek Professional Advice: Consider consulting with a financial advisor to help create a personalized investment strategy tailored to your specific circumstances. They can provide valuable insights and guidance based on your individual needs and goals.

Risk Management and Insurance Planning

Retirement planning isn’t just about accumulating wealth; it’s about safeguarding it against life’s inevitable curveballs. Think of it like building a magnificent sandcastle – you can spend years crafting the perfect turrets and moats, but a rogue wave (or, you know, inflation) can wipe it all out in seconds. Proper risk management is your seawall, protecting your retirement dreams from the unpredictable tides of the financial world.

Identifying Potential Retirement Plan Risks

Several significant risks can threaten your carefully constructed retirement nest egg. Inflation, the insidious creep of rising prices, can erode the purchasing power of your savings over time. Imagine planning for a comfortable retirement based on today’s prices, only to find your money buys significantly less in 20 years. Market volatility, the rollercoaster ride of stock prices, can cause substantial fluctuations in your investment portfolio, potentially leaving you with less than anticipated. And then there’s longevity risk – the very real possibility of outliving your savings. Living longer than expected is wonderful, but running out of money before you run out of life is less so.

The Role of Insurance in Retirement Planning

Insurance acts as a safety net, mitigating the impact of unforeseen events. Health insurance is paramount, protecting you from potentially crippling medical expenses. The costs associated with serious illnesses or long-term care can quickly deplete your retirement funds. Long-term care insurance, specifically, is designed to cover the costs of assisted living facilities, nursing homes, or in-home care should you require it in your later years. Think of it as an insurance policy against becoming a burden to your loved ones – and your wallet. Other insurance types can also play a role, depending on individual circumstances.

Strategies for Mitigating Retirement Risks

Diversification is key to navigating market volatility. Don’t put all your eggs in one basket! Spread your investments across different asset classes (stocks, bonds, real estate) to reduce the impact of any single market downturn. Regularly rebalancing your portfolio ensures you maintain your desired asset allocation over time. Consider inflation-protected securities to safeguard against the erosion of purchasing power. For longevity risk, explore options like annuities that provide a guaranteed stream of income for life, offering peace of mind even if you live longer than expected. Finally, meticulously budgeting and planning for unexpected expenses can help you weather unforeseen financial storms.

Types of Insurance and Their Relevance to Retirement

| Insurance Type | Description | Relevance to Retirement | Example |

|---|---|---|---|

| Health Insurance | Covers medical expenses, including doctor visits, hospital stays, and prescription drugs. | Essential for managing potential healthcare costs in retirement, which can be substantial. | Medicare, supplemented by a Medigap policy to cover co-pays and deductibles. |

| Long-Term Care Insurance | Covers the costs of long-term care services, such as assisted living, nursing homes, or in-home care. | Protects retirement savings from the potentially devastating costs of long-term care. | A policy that covers a portion of the costs associated with nursing home care for a specified period. |

| Life Insurance | Provides a death benefit to beneficiaries upon the death of the insured. | Can provide financial security for surviving spouses or dependents, replacing lost income. | A term life insurance policy to cover a mortgage or provide for children’s education. |

| Disability Insurance | Replaces a portion of your income if you become disabled and unable to work. | Crucial for protecting your retirement savings if you become unable to earn income before retirement. | An individual disability income policy that pays a monthly benefit if you become disabled. |

Estate Planning and Legacy Considerations: Retirement Planning Advisors Guide

Retirement: the golden years, a time for relaxation, travel, and… meticulously crafting your exit strategy? Yes, unfortunately, even paradise requires a bit of paperwork. Estate planning might sound morbid, but it’s really about ensuring your hard-earned wealth goes where you intend it to, minimizing potential headaches for your loved ones (and your tax bill!). Think of it as the ultimate retirement gift – to yourself and your heirs.

Estate planning, in the context of retirement, becomes even more crucial. You’ve likely accumulated significant assets over your working life, and a well-structured plan safeguards these assets from potential disputes and ensures their efficient distribution according to your wishes. Ignoring this aspect could lead to unintended consequences, leaving your family navigating a legal and financial minefield when they should be celebrating your legacy.

Wills and Trusts: The Power Duo of Estate Planning, Retirement Planning Advisors Guide

A will is your basic instruction manual for distributing your assets after your demise. It dictates who gets what, who manages the assets for minors, and appoints an executor to oversee the process. However, a will goes through probate, a court process that can be time-consuming and costly. This is where trusts shine. Trusts act as a separate legal entity holding assets and managing their distribution, often avoiding probate and offering greater control over asset management. There are various types of trusts, each with its own benefits and complexities – from simple revocable trusts to more sophisticated irrevocable trusts. The choice depends on your specific needs and circumstances. For instance, a trust could provide for a spouse’s care while ensuring assets eventually go to children.

Transferring Assets to Heirs: A Smooth Transition

Transferring assets isn’t just about writing a will or establishing a trust; it involves careful planning and potentially complex tax considerations. This might include gifting assets during your lifetime (subject to gift tax limits, of course!), strategically using life insurance policies, or setting up joint accounts with beneficiaries. The goal is to minimize taxes and ensure your heirs receive the maximum benefit from your assets. For example, gifting assets with a high growth potential early can reduce the eventual tax burden on your heirs. However, remember that this requires careful consideration of gift tax implications.

Creating a Comprehensive Estate Plan: A Step-by-Step Guide

Preparing a comprehensive estate plan is not a one-size-fits-all endeavor. It’s tailored to individual circumstances, requiring a professional consultation. However, a well-structured plan generally includes the following:

- Inventory of Assets: A complete list of all your assets, including bank accounts, investments, real estate, and personal property.

- Designation of Beneficiaries: Clearly identifying who will inherit your assets and specifying the distribution of each asset.

- Selection of Executor and Trustee: Choosing responsible individuals to manage your estate and ensure smooth asset distribution.

- Healthcare Directives: Documenting your wishes regarding healthcare decisions if you become incapacitated.

- Power of Attorney: Appointing someone to manage your financial affairs if you become unable to do so.

Remember, this is just a basic framework. Complex situations may require additional planning, such as setting up special needs trusts or considering business succession plans. The key is to seek professional guidance from an estate planning attorney and financial advisor to ensure your plan is both comprehensive and appropriate for your unique circumstances. Failing to plan is planning to fail – and nobody wants to leave their heirs a legacy of legal battles and financial uncertainty.

Tax Implications of Retirement Planning

Retirement planning isn’t just about accumulating wealth; it’s also a delicate dance with Uncle Sam. Understanding the tax implications of your hard-earned savings is crucial to maximizing your golden years, ensuring you don’t end up paying more to the IRS than necessary. Let’s delve into the fascinating (and sometimes frustrating) world of taxes and retirement.

Tax Implications of Different Retirement Savings Vehicles

The tax advantages of various retirement accounts vary significantly. Traditional IRAs, for example, offer upfront tax deductions, meaning your contributions reduce your taxable income immediately. However, withdrawals in retirement are taxed as ordinary income. Conversely, Roth IRAs don’t provide an immediate tax break, but withdrawals in retirement are tax-free, a significant advantage for those anticipating higher tax brackets in their later years. 401(k) plans often mirror the tax structure of traditional IRAs, with pre-tax contributions and taxable withdrawals, while Roth 401(k)s follow the Roth IRA model. The choice depends heavily on your current and projected tax bracket, risk tolerance, and long-term financial goals. Careful consideration of these factors is essential for optimal tax efficiency.

Tax-Efficient Strategies for Retirement Withdrawals

Strategic withdrawal planning can significantly impact your overall tax burden. One effective strategy is to prioritize withdrawals from accounts with the lowest tax implications, such as Roth IRAs. Another is to carefully manage your taxable income to stay within a lower tax bracket. For instance, a retiree might strategically time larger withdrawals in years with lower anticipated income, minimizing their overall tax liability. This requires careful planning and often the assistance of a financial professional to model different scenarios and optimize withdrawal strategies. Remember, a little planning can go a long way in avoiding a hefty tax bill.

Tax Planning for Inherited Retirement Accounts

Inheriting a retirement account, while a welcome event, comes with its own set of tax complexities. The rules surrounding inherited IRAs and 401(k)s differ depending on the beneficiary’s relationship to the deceased and the type of account. For example, non-spouse beneficiaries typically must withdraw the entire account balance within a specific timeframe, potentially pushing them into higher tax brackets. Understanding these rules is paramount to minimizing tax liabilities and effectively managing the inherited assets. Seeking professional guidance is highly recommended to navigate these intricacies and ensure a smooth transition of inherited wealth.

Understanding Tax Brackets and Their Impact on Retirement Income

Tax brackets represent the different income ranges subject to varying tax rates. As your retirement income changes, so too does your tax bracket. For instance, a retiree might find themselves in a lower tax bracket during the initial years of retirement due to lower income from social security and pensions, but their bracket could increase as they start drawing down from their retirement savings. This fluctuation can significantly affect your post-tax income. Understanding the implications of different tax brackets allows for better planning and helps retirees make informed decisions about their withdrawals and investment strategies, ensuring they maximize their after-tax income during retirement. Imagine it as a game of tax Tetris – fitting your withdrawals into the most advantageous tax bracket slots.

Seeking Professional Advice

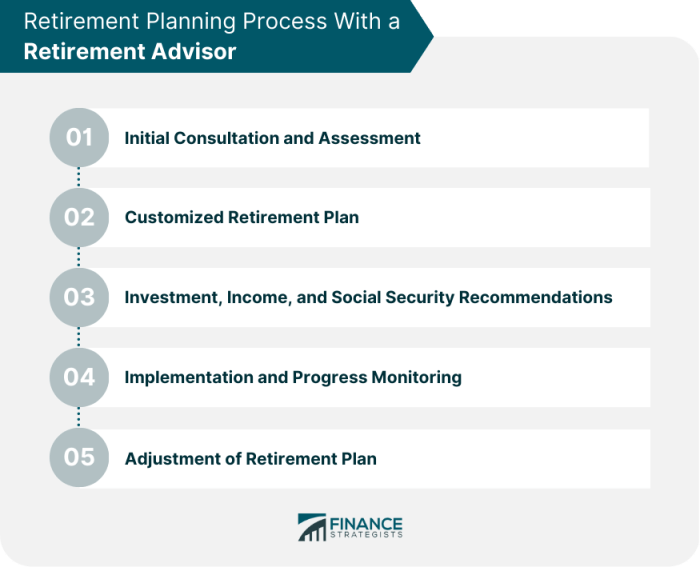

Embarking on the retirement planning journey solo is like navigating a pirate ship without a map – thrilling, perhaps, but also likely to end in tears (and possibly scurvy). A skilled retirement planning advisor acts as your trusty first mate, guiding you through the choppy waters of investments, taxes, and estate planning, ensuring you reach your golden years in comfort, not capsized in debt. Let’s explore the benefits of having a seasoned professional on your side.

Benefits of Working with a Retirement Planning Advisor

Engaging a financial advisor offers numerous advantages. They provide personalized strategies tailored to your unique circumstances, considering your risk tolerance, financial goals, and time horizon. This personalized approach minimizes the chance of costly mistakes and maximizes your chances of achieving your retirement dreams. Advisors also offer ongoing support and adjustments to your plan as life throws its inevitable curveballs (unexpected medical bills, changes in market conditions, or even winning the lottery!). They act as a consistent source of information, keeping you abreast of the ever-shifting financial landscape and ensuring your plan remains on track.

Qualities to Look for When Selecting a Financial Advisor

Choosing the right advisor is crucial. Look for someone with a proven track record, demonstrable experience in retirement planning, and a fiduciary duty—meaning they are legally obligated to act in your best interest. Transparency is key; a good advisor will clearly explain their fees and investment strategies, avoiding financial jargon that would make a seasoned accountant blush. Furthermore, consider their communication style; you want someone you feel comfortable with and who can explain complex financial concepts in a way you understand. A strong relationship built on trust is paramount for a successful partnership.

Different Types of Fees Charged by Financial Advisors

Financial advisors utilize various fee structures. Some charge a percentage of assets under management (AUM), meaning their fees are directly tied to the size of your portfolio. Others operate on a fee-only basis, charging a predetermined hourly rate or a flat fee for specific services. Some may utilize a commission-based model, earning a commission on the financial products they sell. Understanding these different fee structures is crucial for comparing advisors and making an informed decision. It’s important to thoroughly review the fee schedule to avoid any unpleasant surprises down the line. Remember, transparency is your friend.

Questions to Ask a Potential Retirement Planning Advisor

Before committing to an advisor, it’s essential to ask pertinent questions to gauge their expertise and suitability for your needs. Inquire about their experience, certifications, and investment philosophy. Ask about their process for developing a retirement plan, how they manage conflicts of interest, and how often they will review and adjust your plan. Don’t hesitate to ask about their past performance (keeping in mind past performance is not necessarily indicative of future results!), their client retention rate, and their approach to risk management. Thorough questioning will ensure a comfortable and productive working relationship.

Illustrating Retirement Scenarios

Retirement planning, much like a well-aged Merlot, requires careful consideration and a dash of foresight to truly blossom. Let’s explore a couple of scenarios – one a testament to diligent planning, the other a cautionary tale (with a happy ending, we promise!).

Successful Retirement: The “Golden Years” Edition

Imagine Bartholomew “Barty” Butterfield, a retired accountant. Barty, a man whose meticulous nature extended beyond spreadsheets to encompass his entire financial life, meticulously crafted a retirement plan decades in advance. His asset allocation was a symphony of diversification: 40% in low-risk bonds providing a steady stream of income, 30% in moderate-risk mutual funds for growth potential, and 30% in real estate (a charming seaside cottage, naturally). His income streams included a comfortable pension, Social Security benefits, and the regular dividends from his investments. He even factored in inflation, demonstrating a level of foresight that would make a financial oracle blush. Barty’s lifestyle is a testament to thoughtful planning. He enjoys leisurely walks on the beach, regular bridge games with his friends (always winning, of course), and volunteering at the local library, sharing his accounting expertise with aspiring finance whizzes. He occasionally indulges in expensive single malt scotch, justifying it as a “necessary expense for maintaining mental acuity.” This isn’t just retirement; it’s a masterclass in living well.

Challenging Retirement: The “Unexpected Twist” Edition

Then there’s Penelope “Penny” Plumtree, a vibrant artist whose retirement plan, while well-intentioned, encountered a few unexpected potholes. Penny, unlike Barty, favored a more “go-with-the-flow” approach. Her investments were heavily concentrated in the volatile tech sector, a gamble that initially paid off handsomely. However, a sudden market downturn, coupled with unexpected and significant medical expenses, left her retirement savings considerably depleted. The initial panic gave way to resourcefulness. Penny, ever the adaptable artist, turned her passion into a profitable online art class business, supplementing her dwindling savings. She also downsized her home, moving into a smaller, more manageable apartment. While her retirement certainly didn’t unfold as planned, Penny’s resilience and creativity demonstrate the importance of adaptability and having a backup plan. Her story underscores that even the best-laid plans can be disrupted, highlighting the value of having contingency plans in place.

Ending Remarks

So, there you have it: a whirlwind tour through the often-overlooked, yet undeniably crucial, world of retirement planning. Remember, securing a comfortable retirement isn’t just about numbers on a spreadsheet; it’s about envisioning your ideal future and building a plan to get you there. While the process might seem daunting at times, armed with the right knowledge and a dash of humor, you can navigate the complexities and emerge victorious – or at least, financially secure enough to enjoy a well-deserved margarita on a sunny beach.

FAQ

What if I don’t have much money to start saving for retirement?

Even small, consistent contributions can make a significant difference over time thanks to the magic of compound interest. Start small, and increase your contributions as your income allows.

How often should I review my retirement plan?

At least annually, or more frequently if there are significant life changes (marriage, job loss, etc.).

Can I change my retirement savings plan once I’ve started?

Yes, but there may be penalties depending on the type of plan and the changes made. Consult a financial advisor for guidance.

What’s the difference between a traditional IRA and a Roth IRA?

Traditional IRAs offer tax deductions on contributions, but withdrawals are taxed in retirement. Roth IRAs have no upfront tax deduction, but withdrawals are tax-free in retirement. The best choice depends on your individual tax situation and predictions for future tax rates.