Securing a comfortable and fulfilling retirement requires careful planning and proactive decision-making. This Retirement Planning Guide serves as your comprehensive roadmap, navigating the complexities of financial preparation for your golden years. We’ll explore strategies for setting realistic goals, assessing your current financial health, and developing a robust savings and investment plan tailored to your unique circumstances. Understanding the intricacies of retirement accounts, managing debt, and planning for healthcare costs are crucial elements we will address, ensuring a smooth transition into retirement.

From defining your ideal retirement lifestyle and calculating your target income to selecting appropriate investment vehicles and managing potential risks, this guide offers practical advice and actionable steps. We’ll delve into various retirement savings options, including 401(k)s, IRAs, and Roth IRAs, comparing their benefits and drawbacks to help you make informed choices. Moreover, we will address essential aspects like estate planning and minimizing your tax burden, leaving you well-prepared for a financially secure and enjoyable retirement.

Defining Retirement Goals

Retirement planning is a multifaceted process that extends far beyond simply saving money. It involves a thoughtful consideration of your aspirations, lifestyle preferences, and financial resources to create a secure and fulfilling future. Successfully navigating this process requires a clear understanding of your retirement goals and a well-defined plan to achieve them.

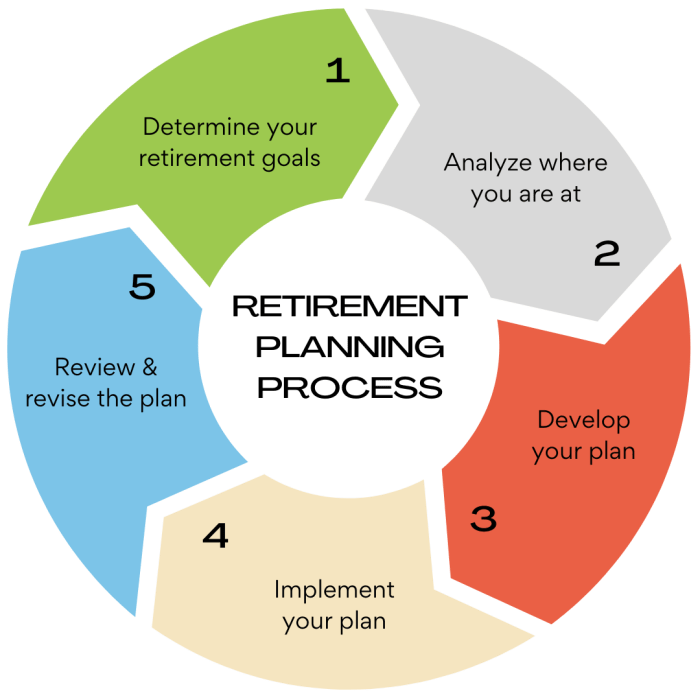

Retirement planning unfolds in several key stages. The initial phase involves assessing your current financial situation, including assets, debts, and income. This is followed by defining your retirement goals, projecting your future expenses, and developing a savings and investment strategy. Regular review and adjustments are crucial throughout the process to adapt to changing circumstances and ensure your plan remains on track.

Setting realistic financial goals is paramount to successful retirement planning. Overly optimistic projections can lead to disappointment and financial insecurity, while overly conservative goals may limit your enjoyment of retirement. A realistic approach involves carefully considering your desired lifestyle and the associated costs, aligning them with your projected income streams.

Retirement Lifestyles and Associated Costs

Different retirement lifestyles entail vastly different cost structures. For instance, a retiree who plans to travel extensively and dine out frequently will incur significantly higher expenses than someone who prefers a simpler, home-based lifestyle. A luxurious retirement in a coastal city might cost several times more than a comfortable retirement in a smaller town. Consider these examples: A retiree choosing to live in a vibrant city like New York City might face significantly higher housing costs, entertainment expenses, and transportation fees compared to someone residing in a rural area with lower taxes and cost of living. Conversely, someone choosing a simpler lifestyle, focused on gardening, home projects, and local activities, could significantly reduce their expenses. These varying lifestyles should be considered when setting financial goals.

Calculating a Retirement Income Target

Calculating your retirement income target requires a thorough assessment of your anticipated expenses and income sources. Begin by estimating your annual expenses in retirement, considering factors such as housing, healthcare, food, transportation, and entertainment. Factor in inflation; expenses are likely to increase over time. Next, estimate your income sources, including Social Security benefits, pensions, and any other potential income streams. The difference between your projected expenses and income represents your retirement income gap – the amount you need to accumulate through savings and investments. A common approach is to use a retirement calculator or seek professional financial advice to determine the necessary savings and investment strategies to bridge this gap. For example, if your estimated annual expenses are $50,000 and your projected income from Social Security and pensions is $25,000, your retirement income gap is $25,000 annually. You would then need to plan your savings and investments accordingly to generate this additional income.

Assessing Current Financial Situation

Understanding your current financial health is the cornerstone of effective retirement planning. Before you can project future needs and create a retirement strategy, you need a clear picture of where you stand today. This involves creating a personal balance sheet, tracking your income and expenses, and analyzing your net worth.

Creating a Personal Balance Sheet

A personal balance sheet is a snapshot of your financial assets and liabilities at a specific point in time. It helps you determine your net worth, a key indicator of your overall financial health. To create one, you’ll need to list all your assets (what you own) and liabilities (what you owe).

Calculating Net Worth and Assessing Financial Health

Your net worth is simply the difference between your total assets and your total liabilities. The formula is:

Net Worth = Total Assets – Total Liabilities

. A positive net worth indicates that your assets exceed your debts, signifying a healthy financial position. A negative net worth, conversely, means you owe more than you own, requiring immediate attention to financial management. Regularly calculating your net worth allows you to monitor your progress towards your financial goals. For example, if someone has assets totaling $500,000 and liabilities of $100,000, their net worth is $400,000.

Tracking Income and Expenses

Accurately tracking your income and expenses is crucial for identifying areas where you can save and improve your financial situation. This can be done manually using a spreadsheet or notebook, or with budgeting apps and software that automatically categorize transactions. Analyzing your spending habits can reveal areas of overspending and potential for savings. For instance, detailed expense tracking might reveal that dining out accounts for a significant portion of your monthly budget, prompting a reduction in restaurant visits.

Sample Budget Template

A well-organized budget is essential for effective financial planning. The following table provides a sample budget template, illustrating different expense categories. You can adapt this template to fit your specific needs and circumstances.

| Income | Expenses | Category | Notes |

|---|---|---|---|

| Salary | $1,000 | Housing | Rent or mortgage payment |

| Investments | $200 | Transportation | Car payment, gas, public transport |

| Other Income | $150 | Food | Groceries, dining out |

| $300 | Utilities | Electricity, water, gas | |

| $100 | Healthcare | Insurance, medical expenses | |

| $50 | Entertainment | Movies, concerts, subscriptions | |

| $100 | Debt Payments | Loan repayments, credit card payments | |

| $50 | Savings | Retirement contributions, emergency fund | |

| Total Income: $1350 | Total Expenses: $1300 |

Retirement Savings Strategies

Planning for a comfortable retirement requires a robust savings strategy. This involves understanding the various retirement savings vehicles available and selecting the ones best suited to your individual financial circumstances and goals. Careful consideration of asset allocation and consistent contributions are crucial for long-term success.

Retirement Savings Vehicles: 401(k), IRA, and Roth IRA

Choosing the right retirement savings vehicle depends on your income, tax bracket, risk tolerance, and retirement timeline. Each option offers unique advantages and disadvantages.

- 401(k): A 401(k) is a retirement savings plan sponsored by your employer. Contributions are often tax-deferred, meaning you don’t pay taxes on the money until you withdraw it in retirement. Many employers offer matching contributions, essentially giving you free money towards your retirement. However, 401(k)s may have limited investment options compared to other plans, and early withdrawals often incur penalties.

- Traditional IRA: A Traditional IRA allows you to contribute pre-tax dollars, reducing your current taxable income. Your contributions grow tax-deferred, and you pay taxes only upon withdrawal in retirement. However, contributions may be limited based on income, and withdrawals are taxed in retirement.

- Roth IRA: A Roth IRA allows you to contribute after-tax dollars. Your contributions and earnings grow tax-free, and withdrawals in retirement are tax-free. This is advantageous for those who anticipate being in a higher tax bracket in retirement than they are currently. Contribution limits are similar to Traditional IRAs and may also be income-limited.

Sample Asset Allocation Strategy

A diversified portfolio is key to mitigating risk and maximizing returns. A sample asset allocation strategy might look like this, but remember to tailor it to your risk tolerance and time horizon:

| Asset Class | Percentage |

|---|---|

| Stocks (Domestic and International) | 60% |

| Bonds (Government and Corporate) | 30% |

| Real Estate (Direct or through REITs) | 10% |

This example allocates a larger percentage to stocks, reflecting a higher risk tolerance suitable for someone with a longer time horizon before retirement. A more conservative approach might involve a higher percentage in bonds.

Opening and Contributing to a Retirement Account: A Step-by-Step Guide

Opening and contributing to a retirement account is relatively straightforward.

- Choose a Plan: Decide which type of retirement account best suits your needs (401(k), Traditional IRA, Roth IRA).

- Find a Provider: If you’re opening a 401(k), your employer will provide the details. For IRAs, you can choose from various brokerage firms or banks.

- Complete the Application: Fill out the necessary paperwork, providing personal information and banking details.

- Choose Investments: Select investments based on your risk tolerance and retirement timeline. Consider diversification across asset classes.

- Make Contributions: Set up automatic contributions from your checking or savings account to ensure regular investments.

- Review Regularly: Monitor your account balance and investment performance, making adjustments as needed.

Remember to consult with a financial advisor to create a personalized retirement plan that aligns with your specific goals and circumstances.

Investment Options for Retirement

Planning for retirement involves carefully considering various investment options to ensure your savings grow and provide a comfortable income stream in your later years. The choice of investments should align with your risk tolerance, time horizon, and financial goals. Diversification across different asset classes is crucial to mitigate risk and potentially maximize returns.

Investment Options and Risk Tolerance

Different investment options carry varying levels of risk and potential returns. Understanding this relationship is key to building a suitable retirement portfolio. Higher potential returns often come with higher risk, and vice-versa. It’s important to find a balance that aligns with your comfort level and financial objectives. For instance, a younger investor with a longer time horizon might tolerate more risk, while someone closer to retirement might prioritize preserving capital.

Risk and Return Comparison of Investment Classes

The following table compares the risk and return potential of various investment classes commonly used in retirement planning. It is important to note that past performance is not indicative of future results, and market conditions can significantly impact returns.

| Investment Type | Risk Level | Potential Return | Description |

|---|---|---|---|

| Stocks (Equities) | High | High | Represent ownership in a company. Offer potential for significant growth but also carry the risk of substantial losses. |

| Bonds (Fixed Income) | Medium to Low | Medium to Low | Debt instruments issued by governments or corporations. Generally considered less risky than stocks but offer lower potential returns. |

| Mutual Funds | Medium to High (depending on fund type) | Medium to High (depending on fund type) | Professionally managed portfolios that invest in a diversified mix of stocks, bonds, or other assets. Risk and return vary depending on the fund’s investment strategy. |

| Real Estate | Medium to High | Medium to High | Investing in properties can offer potential for capital appreciation and rental income, but it involves significant upfront costs and can be illiquid. |

| Annuities | Low to Medium (depending on type) | Low to Medium (depending on type) | Contracts with insurance companies that provide guaranteed income streams in retirement. Different types offer varying levels of risk and return. |

Calculating Potential Returns and Portfolio Diversification

Calculating potential returns involves estimating the growth of each asset class in your portfolio over time. This is inherently uncertain, but you can use historical data and projections to make informed estimates. For example, if you invest $10,000 in a stock with an expected annual return of 7%, you might project it to be worth approximately $17,000 after 10 years (assuming compounding). The formula for compound interest is: Future Value = Present Value * (1 + interest rate)^number of years.

Future Value = $10,000 * (1 + 0.07)^10 ≈ $19,671.51

Portfolio diversification involves spreading your investments across different asset classes to reduce overall risk. For example, you might allocate 60% of your portfolio to stocks, 30% to bonds, and 10% to real estate. This approach reduces the impact of poor performance in any single asset class on your overall portfolio value. The specific allocation should be tailored to your individual risk tolerance and financial goals. A financial advisor can help you create a diversified portfolio that meets your needs.

Managing Debt and Expenses

Entering retirement is a significant life transition, and careful management of debt and expenses is crucial for ensuring financial security and peace of mind. A well-structured plan addressing these aspects can significantly impact your retirement lifestyle and prevent unforeseen financial hardship. This section Artikels strategies for effectively managing your financial resources during retirement.

Strategies for Reducing High-Interest Debt Before Retirement

High-interest debt, such as credit card debt, can significantly hinder your retirement savings and enjoyment. Prioritizing its reduction before retirement is vital. Effective strategies include the debt snowball or avalanche methods. The snowball method involves paying off the smallest debt first for motivation, while the avalanche method focuses on the debt with the highest interest rate for maximum savings. Consider debt consolidation options, such as balance transfer credit cards or personal loans, to potentially lower interest rates and simplify payments. Negotiating with creditors for lower interest rates or payment plans can also be beneficial.

Creating a Debt Reduction Plan

A comprehensive debt reduction plan requires a realistic assessment of your current financial situation and the development of a clear strategy. Begin by listing all your debts, including the balance, interest rate, and minimum payment. Then, choose a debt reduction method (snowball or avalanche) and allocate funds accordingly. Track your progress regularly and adjust your plan as needed. Remember to incorporate this plan into your overall retirement budget to ensure sufficient funds for both debt repayment and retirement expenses. For example, a retiree with $20,000 in credit card debt at 18% interest might allocate $500 monthly to repayment, prioritizing it over other expenses until the debt is eliminated.

Controlling Expenses and Budgeting Effectively in Retirement

Retirement often brings changes in income and expenses. Effective budgeting is essential to maintain financial stability. Start by creating a detailed budget that includes all anticipated income sources (pensions, Social Security, investments) and expenses (housing, healthcare, food, transportation). Track your spending meticulously to identify areas where you can cut back. Consider using budgeting apps or spreadsheets to simplify the process. Regularly review and adjust your budget to reflect any changes in your income or expenses. For instance, a retiree might meticulously track grocery spending, discovering they can save by switching to cheaper brands or cooking at home more frequently.

Cost-Saving Measures for Retirees

Numerous cost-saving measures can significantly improve your financial well-being in retirement. Downsizing your home can reduce housing costs and property taxes. Exploring lower-cost healthcare options, such as Medicare Advantage plans, can mitigate healthcare expenses. Reducing energy consumption through energy-efficient appliances and mindful usage can lower utility bills. Taking advantage of senior discounts on various goods and services can also contribute to substantial savings over time. For example, a retiree might switch to a smaller, more energy-efficient vehicle to reduce fuel and maintenance costs, while also utilizing senior discounts at local restaurants and entertainment venues.

Healthcare Planning in Retirement

Planning for healthcare costs is a crucial aspect of retirement preparation. Unexpected medical expenses can significantly deplete your savings and impact your quality of life in your later years. Failing to adequately plan can lead to financial hardship and compromise your retirement goals. A proactive approach, involving understanding your options and developing strategies to manage costs, is essential for a secure and comfortable retirement.

Medicare and Supplemental Insurance Options

Medicare is the primary government health insurance program for individuals aged 65 and older and certain younger people with disabilities. It’s divided into several parts: Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug insurance). Understanding the intricacies of each part is vital. Many retirees opt for supplemental insurance, often called Medigap, to help cover the gaps in Medicare coverage, such as deductibles and co-pays. These supplemental plans are offered by private insurance companies. The type of supplemental insurance chosen will depend on individual needs and budget. Careful comparison shopping is recommended.

Strategies for Managing Healthcare Expenses

Effective strategies for managing healthcare expenses include understanding your Medicare coverage, exploring supplemental insurance options, and actively managing your health. This includes preventative care, such as regular check-ups and screenings, to help prevent costly health issues down the line. Additionally, comparing prescription drug costs at different pharmacies and exploring generic alternatives can save significant amounts over time. Staying informed about available programs and resources, such as state-sponsored assistance programs for prescription drugs, can also help.

Potential Healthcare Costs in Retirement

Planning for retirement healthcare necessitates considering a wide range of potential expenses. A thorough assessment of these costs will allow for better financial preparedness.

- Medicare Premiums: Monthly premiums for Part B and Part D vary based on income.

- Medicare Deductibles and Co-pays: These out-of-pocket expenses can add up quickly.

- Medigap Premiums: The cost of supplemental insurance varies depending on the plan chosen.

- Prescription Drug Costs: Even with Part D coverage, prescription drugs can be expensive.

- Long-Term Care Costs: Nursing homes and assisted living facilities can be exceptionally costly.

- Dental and Vision Care: These are often not covered by Medicare and require separate insurance or out-of-pocket payments.

- Over-the-Counter Medications and Supplies: These everyday expenses can accumulate over time.

- Home Healthcare Services: If needed, these services can be expensive.

Estate Planning and Legacy

Securing your financial future in retirement also involves thoughtfully considering what happens to your assets after you’re gone. Estate planning is crucial not only for distributing your wealth according to your wishes but also for protecting your loved ones from potential legal and financial complications. A well-structured estate plan can provide peace of mind, knowing your affairs are in order and your legacy is protected.

Effective estate planning ensures a smooth transition of your assets, minimizing potential family disputes and tax burdens. It also allows you to make provisions for individuals who may require ongoing support, such as disabled family members or those with special needs. Failing to plan can result in lengthy legal battles, significant financial losses, and emotional distress for your heirs.

Estate Planning Tools

Several tools facilitate effective estate planning, each serving a distinct purpose. Understanding their differences is vital in choosing the right instruments to meet your specific needs and circumstances.

- Wills: A will is a legal document outlining how you wish to distribute your assets after your death. It designates beneficiaries for your property, including real estate, bank accounts, and personal belongings. Without a will, state laws dictate the distribution, which may not align with your wishes.

- Trusts: Trusts are legal entities that hold and manage assets on behalf of beneficiaries. They offer greater control and flexibility compared to wills, allowing for more complex distribution arrangements and asset protection. Different types of trusts exist, each with specific purposes and benefits, such as revocable living trusts that can be modified during your lifetime and irrevocable trusts that offer greater asset protection from creditors and taxes.

- Power of Attorney: A power of attorney designates someone to manage your financial and legal affairs if you become incapacitated. This ensures that someone you trust can handle your bills, investments, and other essential matters while you are unable to do so yourself. This can include durable power of attorney for financial matters and healthcare power of attorney for medical decisions.

Creating a Will and Choosing Beneficiaries

The process of creating a will typically involves consulting with an estate planning attorney. The attorney will guide you through the process, ensuring the will is legally sound and reflects your wishes. This includes identifying all your assets, determining how you want them distributed, and naming beneficiaries for each asset. Carefully considering your beneficiaries is critical; ensure you choose individuals you trust and who will manage your assets responsibly. You should also consider naming alternate beneficiaries in case your primary choices are unable or unwilling to accept the responsibility. Regularly reviewing and updating your will is advisable, especially after significant life events such as marriage, divorce, or the birth of a child.

Essential Estate Planning Documents Checklist

A comprehensive estate plan goes beyond just a will. Gathering and organizing these documents ensures a smooth transition for your loved ones.

- Will: A legally binding document detailing the distribution of your assets.

- Trust Documents (if applicable): The legal documents establishing and governing any trusts you’ve created.

- Power of Attorney (Financial and Healthcare): Documents authorizing individuals to manage your affairs if you become incapacitated.

- Healthcare Directives: Documents outlining your wishes regarding medical treatment, such as a living will or advance directive.

- Inventory of Assets: A detailed list of all your assets, including their location and value.

- Beneficiary Designations: Documentation specifying beneficiaries for retirement accounts, life insurance policies, and other assets.

- Safe Deposit Box Information: Details on the location and access information for any safe deposit boxes.

Tax Implications of Retirement Planning

Retirement planning isn’t just about saving enough money; it’s also about strategically managing the tax implications throughout the process and during your retirement years. Understanding how taxes affect your savings and withdrawals is crucial for maximizing your retirement income and minimizing your tax liability. This section will explore the tax implications of various retirement savings and withdrawal strategies, highlighting the benefits of different accounts and providing strategies for tax-efficient planning.

Tax Benefits of Different Retirement Accounts

Different retirement accounts offer varying levels of tax advantages. Traditional IRAs, for example, allow for pre-tax contributions, reducing your taxable income in the year of contribution. However, withdrawals in retirement are taxed as ordinary income. Roth IRAs, conversely, involve after-tax contributions but offer tax-free withdrawals in retirement, provided certain conditions are met. Employer-sponsored plans like 401(k)s often mirror the tax treatment of traditional or Roth IRAs, depending on the specific plan design. Understanding these differences is key to choosing the account that best aligns with your individual financial situation and tax bracket.

Tax Implications of Withdrawal Strategies

The timing and type of withdrawals from your retirement accounts significantly impact your tax liability. Withdrawing from a traditional IRA or 401(k) results in taxable income, potentially pushing you into a higher tax bracket. Strategic withdrawals, such as taking only the minimum required distributions (RMDs) or carefully managing withdrawals to stay within a lower tax bracket, can help minimize your tax burden. Roth IRA withdrawals, as mentioned, are generally tax-free, offering a significant advantage in retirement. The complexity increases when considering inherited IRAs and the various rules governing their distribution.

Minimizing Tax Liability in Retirement

Minimizing your tax liability in retirement requires proactive planning. This includes diversifying your retirement income sources, potentially incorporating tax-advantaged investments, and considering tax-loss harvesting strategies. For example, utilizing tax-loss harvesting can offset capital gains from other investments, thereby reducing your overall tax burden. Careful consideration of your state’s tax laws is also essential, as state income taxes can significantly impact your net retirement income. Consulting with a qualified financial advisor can help you develop a personalized tax-efficient retirement plan.

Examples of Tax-Efficient Retirement Planning Strategies

Consider a scenario where an individual consistently contributes the maximum amount to a Roth IRA throughout their working years. Upon retirement, they can withdraw both contributions and earnings tax-free, significantly boosting their after-tax retirement income. Conversely, an individual who primarily utilizes a traditional 401(k) might strategically withdraw less in higher-income years to avoid jumping into a higher tax bracket, thus preserving more of their retirement savings. Another example involves utilizing a Roth conversion ladder, where a portion of pre-tax savings is converted to a Roth IRA to benefit from tax-free growth and withdrawals later in retirement. This approach requires careful tax planning and consideration of your current and projected tax brackets.

Illustrating Retirement Income Projections

Retirement income projections are crucial for visualizing your financial future and ensuring a comfortable retirement. They provide a roadmap, highlighting potential income sources and expenses, allowing you to identify potential shortfalls or surpluses and make necessary adjustments to your financial plan. A well-constructed projection offers a realistic view of your financial health in retirement, empowering you to make informed decisions about your savings, investments, and spending habits.

Let’s illustrate a retirement income projection with a hypothetical example. Assume John and Mary, aged 55, plan to retire at 65. They anticipate needing $60,000 annually in retirement, adjusted for inflation. Their projected income sources include:

Retirement Income Sources and Expenses

The following table details John and Mary’s projected income and expenses:

| Income Source | Annual Amount |

|---|---|

| Social Security | $25,000 |

| Pension | $10,000 |

| Retirement Savings (401k, IRA) | $20,000 |

| Part-time work (anticipated) | $5,000 |

| Total Projected Annual Income | $60,000 |

| Expenses | |

| Housing | $15,000 |

| Healthcare | $12,000 |

| Food | $8,000 |

| Transportation | $5,000 |

| Other Expenses | $10,000 |

| Total Projected Annual Expenses | $50,000 |

| Projected Annual Surplus | $10,000 |

A simple bar graph could visually represent this data. The graph would have two main bars: one for total projected annual income and one for total projected annual expenses. Each bar would be segmented to show the contribution of each income source and expense category. The difference between the income and expense bars would clearly illustrate the projected annual surplus.

Adjusting Income Projections for Different Scenarios

Retirement income projections are not static; they require regular review and adjustment to account for unforeseen circumstances. Key factors influencing adjustments include inflation and longevity.

Inflation erodes the purchasing power of money over time. To account for this, future income and expense projections should be adjusted upward annually using a projected inflation rate (e.g., 3%). Longevity, or living longer than anticipated, necessitates increased savings and adjustments to spending plans. For instance, if John and Mary live longer than projected, their savings might need to stretch further, requiring reduced spending or additional income generation.

Using Retirement Income Projections for Informed Decisions

Retirement income projections serve as valuable tools for informed decision-making. By analyzing the projections, John and Mary can identify potential shortfalls and proactively address them. If their projections reveal a shortfall, they can adjust their savings rate, explore additional income streams (part-time work, downsizing their home), or re-evaluate their spending habits. Conversely, a surplus allows for flexibility, potentially enabling early retirement, increased charitable giving, or additional investments.

Conclusion

Planning for retirement is a journey, not a destination. This guide has equipped you with the knowledge and tools to embark on this journey with confidence. By understanding your financial situation, setting clear goals, and implementing the strategies Artikeld, you can significantly increase your chances of achieving a comfortable and secure retirement. Remember that regular review and adjustments to your plan are essential to adapt to changing circumstances and ensure your long-term financial well-being. Take control of your future and begin planning today.

FAQ Guide

What is the difference between a traditional IRA and a Roth IRA?

A traditional IRA offers tax deductions on contributions but taxes withdrawals in retirement. A Roth IRA offers tax-free withdrawals in retirement but doesn’t provide upfront tax deductions.

How much should I save for retirement?

The ideal savings amount varies depending on individual factors like lifestyle, expenses, and desired retirement length. A common guideline is to aim for replacing 80% of your pre-retirement income.

When should I start planning for retirement?

The sooner, the better. Starting early allows your investments to grow significantly over time through compounding.

What if I don’t have a 401(k) through my employer?

You can still save for retirement through other vehicles like IRAs, Roth IRAs, and individual investment accounts.