Retirement Planning Guide Update: Embark on a hilarious yet insightful journey into the often-dreaded, but undeniably crucial, world of retirement planning! We’ll navigate the treacherous waters of investment strategies, the sometimes-bewildering maze of retirement accounts (401(k)s, IRAs – oh my!), and the surprisingly exciting possibilities of a life less ordinary. Prepare for a rollercoaster of financial wisdom and witty observations, all designed to make planning for your golden years less daunting and more…dare we say…fun?

This guide covers everything from calculating your retirement income needs (because let’s be honest, knowing how much you need is half the battle) to understanding the nuances of Medicare (a topic that could easily fill a novel, but we’ll keep it concise and amusing). We’ll also explore smart ways to manage expenses, leaving you with a clear roadmap to a retirement that’s both financially sound and ridiculously enjoyable. Think of it as your personal financial comedian, guiding you through the process with a blend of expert advice and laugh-out-loud moments.

Understanding Retirement Income Needs

Retirement. The word itself conjures images of sun-drenched beaches and leisurely rounds of golf. However, the reality often involves a more intricate dance with numbers, budgets, and the ever-present specter of inflation. Understanding your retirement income needs is crucial to ensuring those sun-drenched beaches don’t become a mirage shimmering in the desert of financial insecurity. Let’s delve into the surprisingly fun world of retirement financial planning.

Factors Influencing Retirement Income Requirements

A multitude of factors influence how much you’ll need to live comfortably in retirement. It’s not a one-size-fits-all scenario; your individual circumstances dictate your unique needs. Think of it like choosing a bespoke suit – it needs to be tailored precisely to your measurements. This involves considering your desired lifestyle, healthcare costs (which can be surprisingly substantial!), anticipated longevity (do you plan on living to 100? We hope so!), and any potential unexpected expenses. A lavish lifestyle will naturally require a larger nest egg than a more modest one.

Calculating a Realistic Retirement Budget

Creating a realistic retirement budget is akin to planning a meticulously organized (and fun!) road trip. You wouldn’t embark on a cross-country adventure without mapping out your route, would you? Similarly, start by listing your essential expenses: housing, food, transportation, utilities, and healthcare. Then, add in the non-essentials that contribute to your desired lifestyle: travel, hobbies, entertainment. A good starting point is to estimate your current annual expenses and then adjust them for inflation and potential changes in your lifestyle during retirement. Remember, you can use online retirement calculators to assist you, but always treat the output as a starting point for further refinement based on your individual circumstances.

Different Retirement Income Streams

Retirement income doesn’t magically appear; it’s the culmination of strategic planning and various income streams. These streams work together like a well-oiled machine (or, perhaps, a well-orchestrated symphony).

Pension Income

Many retirees rely on pension income, a regular payment from a former employer based on years of service. However, the prevalence of defined-contribution plans over traditional defined-benefit plans means that pension income may be less significant for many future retirees. It’s essential to understand the specifics of your pension plan and its projected payout.

Social Security Benefits, Retirement Planning Guide Update

Social Security provides a crucial safety net for many retirees. The amount you receive depends on your earnings history and when you begin receiving benefits. Delaying benefits can result in a higher monthly payment, but this must be weighed against the risk of not living long enough to reap the full rewards. For example, a retiree who delays benefits until age 70 will receive a significantly higher monthly payment than one who begins receiving benefits at age 62.

Investment Income

Investments, including stocks, bonds, and real estate, form a cornerstone of many retirement plans. The returns on these investments will significantly impact your overall retirement income. Careful diversification and risk management are crucial here. For instance, a retiree might allocate their investments across a mix of low-risk bonds and higher-risk stocks to balance growth potential with the need for capital preservation.

Managing Inflation’s Impact on Retirement Savings

Inflation is the silent thief of retirement savings. It erodes the purchasing power of your money over time. To combat this, consider investing in assets that tend to keep pace with or outpace inflation, such as inflation-protected securities or real estate. Regularly rebalancing your investment portfolio can also help mitigate inflation’s effects. For example, if inflation rises unexpectedly, you may need to adjust your portfolio allocation to maintain your purchasing power. Let’s say you initially planned for a 3% annual inflation rate, but the rate jumps to 5%. You’ll need to re-evaluate your investment strategy to ensure your savings maintain their value.

Investing for Retirement

So, you’ve figured out how much moolah you’ll need for your golden years (phew!). Now comes the fun part – making that money grow! Investing for retirement isn’t just about throwing darts at a board (although that *could* be surprisingly lucrative, we won’t recommend it). It’s about strategically allocating your resources to achieve your financial goals, while hopefully avoiding a nervous breakdown along the way.

Comparison of Investment Vehicles

Choosing the right investment vehicle is like picking the perfect pair of comfy slippers for your retirement – you want something supportive, durable, and ideally, not covered in glitter (unless that’s your thing). Stocks offer the potential for high growth, but come with higher risk. Bonds, on the other hand, are generally considered safer, offering a steadier, if less exciting, return. Mutual funds diversify your investments across multiple stocks or bonds, reducing risk, while real estate can provide both income (rent) and long-term appreciation, but requires significant upfront capital and ongoing management. Each has its own unique set of advantages and disadvantages, and the best choice depends on your individual risk tolerance and financial goals.

Advantages and Disadvantages of Investment Strategies

Investing strategies are like different recipes for financial success. An aggressive growth strategy aims for high returns, but involves higher risk. Think of it as the spicy jalapeno popper of investment strategies – delicious, but might leave you with a bit of a burn if things go south. A moderate growth strategy balances risk and reward, similar to a well-balanced salad – healthy and satisfying, but maybe not as thrilling. A conservative strategy prioritizes capital preservation over high returns, akin to a comforting bowl of oatmeal – reliable, predictable, and perfect for a chilly morning (or a volatile market).

Example Diversified Portfolio for a Hypothetical Retiree

Let’s say Agnes, a 65-year-old retiree with a moderate risk tolerance, wants to build a diversified portfolio. A suitable allocation might include 40% in a balanced mutual fund (a mix of stocks and bonds), 30% in government bonds (for stability), 20% in real estate investment trust (REIT) (for diversification and potential income), and 10% in a high-yield savings account (for liquidity). This is just an example, of course, and a financial advisor should help tailor a portfolio to Agnes’ specific circumstances and goals. Remember, diversification is key! Don’t put all your eggs in one basket, unless that basket is lined with gold, in which case, carry on.

Asset Allocation and Risk Management in Retirement Investing

Asset allocation is the art of spreading your investments across different asset classes (stocks, bonds, real estate, etc.) to optimize returns while managing risk. It’s like a well-orchestrated symphony – each instrument (investment) plays its part to create a harmonious whole. Risk management involves identifying and mitigating potential threats to your investments. This could include diversifying your portfolio, setting stop-loss orders, or regularly rebalancing your investments to maintain your desired asset allocation. Think of it as having a well-equipped emergency kit for your financial journey – preparedness is key.

Retirement Savings Vehicles

Ah, retirement savings vehicles – the chariots that will hopefully carry you to the golden shores of financial freedom (or at least, a comfortable enough retirement to afford slightly less-than-golden shores). Choosing the right vehicle is crucial, much like choosing the right chariot for a Roman emperor (assuming they had 401(k)s back then – imagine the paperwork!). Let’s explore your options.

401(k) Plans: The Workplace Wonder

401(k) plans are employer-sponsored retirement savings plans. The benefits are significant: tax-deferred growth (meaning you don’t pay taxes on the earnings until retirement), often employer matching contributions (free money!), and automatic payroll deductions (making saving effortless, which is a huge win for the perpetually distracted). However, drawbacks exist. Portability can be an issue if you change jobs, investment options might be limited, and high fees can eat into your returns. Think of it as a loyal steed, but one you might need to carefully groom and feed to maximize its potential.

IRAs: The Individual Investor’s Ally

Individual Retirement Accounts (IRAs) offer more flexibility than 401(k)s. You have complete control over your investments, and the variety of investment options is typically broader. Traditional IRAs offer tax-deductible contributions, while Roth IRAs offer tax-free withdrawals in retirement. The main drawback is the contribution limits, which are considerably lower than many 401(k) plans. Consider it a trusty bicycle: nimble, versatile, and perfect for navigating the winding roads of personal finance, though it might require more effort to reach your destination.

Roth IRAs: The Tax-Free Triumph

Roth IRAs are a shining beacon of tax-efficient retirement planning. Contributions aren’t tax-deductible, but withdrawals in retirement are completely tax-free! This is particularly attractive for those who anticipate being in a higher tax bracket in retirement. However, the contribution limits are lower than many 401(k)s, and there are income limitations for eligibility. Picture it as a sleek sports car: a thrilling ride with impressive long-term prospects, but perhaps less spacious than a minivan (401k).

Retirement Savings Vehicle Comparison

| Feature | 401(k) | Traditional IRA | Roth IRA |

|---|---|---|---|

| Contribution Limit (2023) | $23,000 (plus $7,500 for those 50 and over) | $6,500 (plus $1,000 for those 50 and over) | $6,500 (plus $1,000 for those 50 and over) |

| Tax Implications (Contributions) | Tax-deductible (pre-tax) | Tax-deductible (depending on income) | Not tax-deductible (after-tax) |

| Tax Implications (Withdrawals) | Taxed in retirement | Taxed in retirement | Tax-free in retirement |

| Withdrawal Rules | Penalties for early withdrawal (generally before age 59 1/2) | Penalties for early withdrawal (generally before age 59 1/2) | Penalties for early withdrawal (generally before age 59 1/2) |

Calculating Retirement Savings Growth

The potential growth of your retirement savings can be estimated using the following formula:

Future Value = Present Value x (1 + Rate of Return)^Number of Years

For example, if you contribute $5,000 annually with a 7% annual return over 30 years, your savings could grow to approximately $568,000. This is a simplified calculation and doesn’t account for factors like fees or fluctuating returns. However, it illustrates the power of compounding.

Maximizing Contributions and Minimizing Tax Liabilities

Strategies for maximizing contributions include increasing your contribution percentage each year, contributing the maximum allowed, and taking advantage of employer matching programs. To minimize tax liabilities, consider contributing to tax-advantaged accounts like 401(k)s and IRAs, and explore tax-loss harvesting strategies with your financial advisor. Remember, consulting a financial professional is always advisable to create a personalized retirement plan tailored to your specific circumstances.

Managing Retirement Expenses

Retirement: the golden years, a time for leisurely pursuits, and… unexpectedly hefty bills? Let’s face it, while sipping margaritas on a beach sounds idyllic, reality often involves unexpected plumbing emergencies and the ever-increasing cost of prescription medications. This section will help you navigate the sometimes-treacherous waters of retirement spending, ensuring your hard-earned savings last as long as you do.

Unexpected Retirement Expenses

Retirement often unveils a hidden world of unforeseen costs. While you’ve diligently planned for the predictable, life has a knack for throwing curveballs. Common unexpected expenses include major home repairs (that leaky roof has a penchant for choosing inopportune moments to worsen), unforeseen medical costs (even with insurance, out-of-pocket expenses can be substantial), and the need for long-term care (which can quickly drain your retirement nest egg). To mitigate these risks, consider establishing an emergency fund specifically for unforeseen expenses – think of it as a “life happens” account. This fund should ideally hold 3-6 months’ worth of living expenses. Furthermore, proactively researching and comparing home warranty plans and supplemental health insurance can provide a valuable safety net.

Cost-Saving Measures for Retirees

Careful budgeting is key to a comfortable retirement. Let’s explore some potential cost-saving strategies, categorized for your convenience:

Housing Cost Savings

Downsizing your home can significantly reduce housing costs, freeing up funds for other expenses. Consider moving to a smaller home, a less expensive neighborhood, or even a retirement community that offers amenities and reduces maintenance responsibilities. For those staying put, regular home maintenance can prevent costly repairs down the line. A proactive approach can save thousands in the long run. Think of it as preventative maintenance for your financial health.

Healthcare Cost Savings

Healthcare costs are a significant concern for many retirees. Negotiating prescription drug prices, exploring generic alternatives, and taking advantage of senior discounts can help control expenses. Regular check-ups and preventative care can also help avoid more expensive treatments later. Joining a senior center or utilizing community resources can provide access to affordable healthcare services and support networks. Remember, an ounce of prevention is worth a pound of expensive cure.

Transportation Cost Savings

Transportation costs can be surprisingly high. Consider downsizing to a more fuel-efficient vehicle, utilizing public transportation, carpooling, or even biking or walking when feasible. Regular vehicle maintenance can also prevent costly breakdowns. Planning trips in advance and taking advantage of off-season travel deals can save money on vacations and outings.

Sample Retirement Budget

Creating a realistic budget is crucial. The following is a sample budget, remember to tailor it to your specific circumstances.

| Category | Percentage of Budget | Example Amount (USD) |

|---|---|---|

| Housing | 25% | $2,500 |

| Healthcare | 15% | $1,500 |

| Food | 10% | $1,000 |

| Transportation | 5% | $500 |

| Utilities | 5% | $500 |

| Entertainment & Leisure | 10% | $1,000 |

| Savings & Investments | 10% | $1,000 |

| Other Expenses | 20% | $2,000 |

Note: This is a sample budget and percentages may vary depending on individual circumstances and lifestyle. Remember, flexibility is key; review and adjust your budget regularly to accommodate changing needs and priorities.

Long-Term Care Insurance

Long-term care insurance is a crucial consideration, particularly given the rising costs of nursing homes and assisted living facilities. This insurance helps cover expenses related to long-term care, such as nursing home stays, home healthcare, and assisted living. While the premiums can seem substantial, the potential financial burden of long-term care without insurance is far greater. Consider your family history of health issues, your current health status, and your financial resources when evaluating the need for long-term care insurance. It’s an investment in your future peace of mind (and your family’s financial security).

Healthcare in Retirement

Ah, retirement – the golden years! Picture yourself on a sun-drenched beach, sipping margaritas… until the doctor’s bill arrives. Healthcare costs in retirement can be a significant, and frankly, rather alarming, wrinkle in your otherwise idyllic plan. Understanding your options and strategizing early is crucial to avoid a financial tsunami that could capsize your retirement bliss.

Medicare Parts A, B, C, and D

Navigating the world of Medicare can feel like deciphering ancient hieroglyphics. Let’s break down the four main parts: Part A (Hospital Insurance) generally covers inpatient hospital stays, skilled nursing facilities, hospice, and some home healthcare. It’s usually premium-free if you’ve worked and paid Medicare taxes for a sufficient amount of time. Part B (Medical Insurance) helps cover doctor visits, outpatient care, and some preventive services. You’ll pay a monthly premium for this. Part C (Medicare Advantage) is an alternative to original Medicare (Parts A and B). It’s offered by private insurance companies and often includes extra benefits like vision and dental coverage. Finally, Part D (Prescription Drug Insurance) helps cover the cost of prescription medications. This also involves a monthly premium and may have a deductible and coverage gap. Choosing the right combination of parts depends on your individual health needs and budget. Consider consulting with a Medicare specialist for personalized advice; they can be your trusty Sherpas through this sometimes treacherous terrain.

Supplemental Health Insurance Options for Retirees

Medicare doesn’t cover everything. Think of it as a sturdy raft, but you might need a motorboat to navigate some choppier waters. Medigap (Medicare Supplement Insurance) policies help fill the gaps in original Medicare coverage, such as copayments and deductibles. These are sold by private insurance companies. There are different Medigap plans (A through N), each with varying levels of coverage and premiums. Another option is a Medicare Advantage plan (Part C), which often includes additional benefits like vision and dental care, but coverage can vary significantly between plans. It’s vital to compare plans carefully before making a decision. Remember, a little extra insurance can provide a huge peace of mind, especially when unexpected health issues arise.

Strategies for Managing Healthcare Costs During Retirement

Managing healthcare costs requires a proactive approach. One key strategy is to focus on preventative care. Regular check-ups and screenings can help identify potential problems early, preventing more expensive treatments down the line. Consider joining a health savings account (HSA) if you’re eligible; contributions are tax-deductible, and the funds can be used for qualified medical expenses. Negotiating prices with healthcare providers can also save money. Don’t be afraid to ask about discounts or payment plans. Finally, carefully review your insurance policy to understand your coverage and out-of-pocket expenses. Knowing your policy inside and out is like having a secret weapon against unexpected costs. It’s all about being a savvy consumer of healthcare services.

Finding Affordable Healthcare Options

Finding affordable healthcare involves research and resourcefulness. Start by exploring your Medicare options and comparing plans using Medicare.gov’s online tools. Many states also offer assistance programs for seniors with limited incomes. These programs can help cover Medicare premiums and other healthcare costs. Consider using online tools and comparison websites to find affordable prescription drugs and other healthcare services. Don’t hesitate to seek assistance from a qualified healthcare professional or financial advisor; they can offer valuable guidance in navigating the complexities of healthcare financing in retirement. For example, a retiree in Florida might find substantial savings by comparing Medicare Advantage plans offered by different insurers, potentially reducing their monthly premiums and out-of-pocket costs compared to sticking with Original Medicare and supplemental insurance. A similar comparison in California could reveal cost-effective options within their state’s specific healthcare landscape.

Estate Planning for Retirement

Retirement: you’ve diligently saved, invested wisely, and now you’re ready to enjoy the fruits of your labor. But before you trade your spreadsheets for shuffleboard, let’s talk about something equally important (and arguably less boring): estate planning. Proper planning ensures your hard-earned assets go where you intend, minimizing potential headaches for your loved ones and the taxman.

Creating a Will, Trust, and Power of Attorney

A will dictates how your assets will be distributed after your passing. Think of it as your final instruction manual for your possessions. Without one, the state decides, and that might not align with your wishes (imagine your prized collection of rubber ducks going to the state!). A trust, on the other hand, allows for more complex asset management and protection, particularly beneficial for larger estates or families with unique needs. Finally, a power of attorney designates someone to manage your financial affairs if you become incapacitated. This is crucial; you don’t want your cat inheriting your retirement funds simply because you can no longer sign a check.

Transferring Assets to Beneficiaries

Transferring assets to your beneficiaries involves designating them as recipients of specific assets or portions of your estate. This process often involves updating beneficiary designations on retirement accounts, insurance policies, and other financial instruments. For example, you might specify that your daughter inherits your stocks and bonds, while your son receives your real estate. It’s like writing a highly specific and legally binding shopping list for your afterlife. Ensure your beneficiaries are clearly identified to avoid confusion and potential legal battles—nobody wants a family feud over a slightly chipped teacup.

Minimizing Estate Taxes

Estate taxes can significantly reduce the amount your heirs receive. Strategies to minimize these taxes include utilizing gifting strategies (giving away assets during your lifetime, within legal limits), charitable giving (reducing your taxable estate), and proper asset allocation (strategic investment choices to minimize tax implications). Imagine this: you’ve worked your entire life, and a large chunk disappears to taxes. Estate planning helps avoid this scenario. Specific tax laws and strategies are complex and vary depending on your individual circumstances; professional advice is strongly recommended.

Estate Planning Techniques

Various estate planning techniques exist, including simple wills, complex trusts (like revocable living trusts or irrevocable life insurance trusts), and strategies focused on minimizing probate (the court process of distributing assets). The best approach depends on your specific financial situation, family structure, and long-term goals. Think of it as choosing the right tool for the job – a simple hammer might suffice for small projects, but a more sophisticated power tool is needed for more complex tasks. Consider consulting with an estate planning attorney to determine the most appropriate technique for your needs.

Retirement Lifestyle Considerations: Retirement Planning Guide Update

Retirement: the golden years! Or, as some might jokingly call them, the “golden handcuffs” of leisure – unless you plan ahead, of course. This section explores how to craft a retirement lifestyle that’s both fulfilling and financially feasible, because let’s face it, lounging on a beach all day requires a certain level of… preparation.

Retirement offers a unique opportunity to redefine your life’s rhythm. It’s a chance to pursue passions, cultivate new interests, and enjoy the fruits of your labor (hopefully, a lot of them!). But achieving a satisfying retirement experience necessitates careful consideration of various lifestyle factors, from where you live to how you spend your time.

Relocating, Downsizing, and Part-Time Work

The allure of a sun-drenched villa in Tuscany or a cozy cabin in the mountains is strong, but relocation requires careful planning. Consider factors like proximity to family, healthcare access, and the cost of living in your desired location. Downsizing your home can significantly reduce expenses and simplify your life, freeing up resources for travel or other pursuits. For some, continuing to work part-time provides a welcome source of income, social interaction, and a sense of purpose. Many retirees find fulfilling part-time positions in areas aligned with their skills and interests, maintaining a sense of professional engagement without the pressures of a full-time career. For example, a retired teacher might tutor students, a retired accountant could offer freelance bookkeeping services, and a retired nurse might work part-time at a clinic.

Maintaining a Healthy and Active Lifestyle

Retirement doesn’t mean retirement from life! Maintaining a healthy and active lifestyle is crucial for both physical and mental well-being. Regular exercise, a balanced diet, and sufficient sleep are essential for preventing age-related health issues and maintaining energy levels. Think of it as preventative maintenance for your most valuable asset: yourself. Consider joining a gym, taking up a new sport like golf or swimming, or simply committing to regular walks in the park. A healthy lifestyle in retirement is not just about physical fitness; it also encompasses mental and emotional well-being. Engaging in activities that stimulate the mind, such as learning a new language, reading, or pursuing hobbies, helps to maintain cognitive function and prevent mental decline. For example, a retiree might participate in a book club, take up painting, or volunteer at a local library.

Staying Engaged and Socially Connected

Social isolation is a significant concern for many retirees. Maintaining strong social connections is vital for mental and emotional well-being. Engage with friends, family, and your community through volunteering, joining clubs, or taking classes. Consider joining a senior center, taking part in community events, or volunteering at a local charity. These activities provide opportunities for social interaction, a sense of purpose, and a feeling of belonging. For instance, a retiree might volunteer at a local animal shelter, join a gardening club, or participate in a community theater group. Maintaining social connections can also involve embracing technology. Staying connected with family and friends through video calls, social media, and email helps to combat loneliness and maintain strong relationships.

Examples of Activities and Hobbies for Retirees

The possibilities are endless! Retirement offers the freedom to explore long-dormant passions or discover entirely new ones. Consider these examples: taking up photography, learning to play a musical instrument, writing a memoir, traveling the world, volunteering for a cause you care about, starting a small business, or simply spending more time with loved ones. The key is to find activities that bring you joy, challenge you mentally and physically, and contribute to a sense of purpose and fulfillment. Think about what you’ve always wanted to do but never had the time for. Now is the time! Perhaps it’s mastering a new language, learning to cook gourmet meals, or finally writing that novel you’ve always dreamed of. The options are as limitless as your imagination.

Final Summary

So, there you have it – a comprehensive (and hopefully entertaining) overview of retirement planning. Remember, planning for retirement doesn’t have to be a stressful ordeal; with the right information and a touch of humor, it can actually be a surprisingly enjoyable process. By understanding your income needs, investing wisely, and managing your expenses effectively, you can pave the way for a retirement that’s both financially secure and brimming with the joy of well-deserved leisure. Now go forth and conquer your retirement – one witty financial decision at a time!

FAQ Overview

What if I don’t have a 401(k)?

Don’t despair! There are plenty of other retirement savings vehicles available, such as IRAs and Roth IRAs. Consider exploring options that suit your income and risk tolerance.

How can I account for unexpected health issues in my retirement plan?

Long-term care insurance is a valuable tool to mitigate the financial impact of unexpected health issues. It’s also wise to build a financial buffer into your retirement plan to handle unforeseen medical expenses.

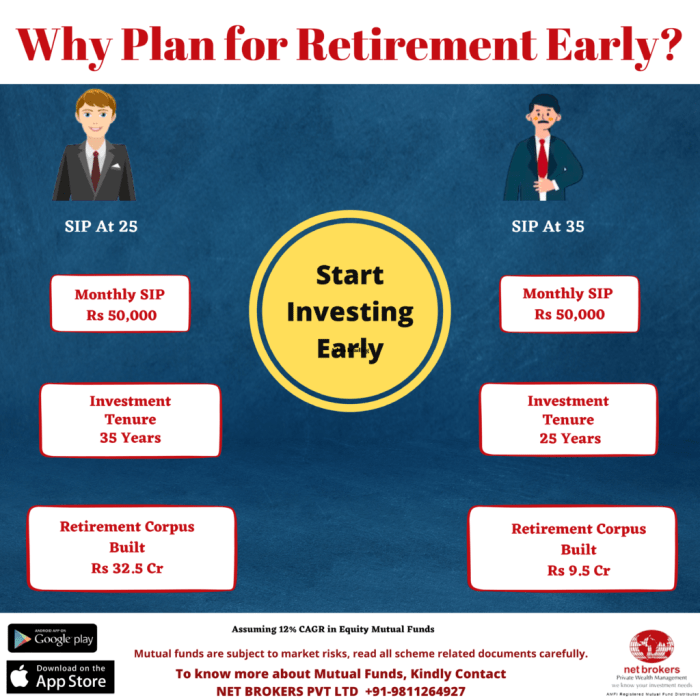

When should I start planning for retirement?

The sooner, the better! Even small contributions early on can make a significant difference due to the power of compound interest. Don’t procrastinate – your future self will thank you.

Can I still work part-time during retirement?

Absolutely! Many retirees choose to continue working part-time to supplement their income or maintain social engagement. This is a perfectly valid and often enjoyable option.