Retirement Planning Guide Update: sets the stage for this enthralling narrative, offering readers a glimpse into a world where savvy financial planning meets the hilarious realities of aging gracefully. We’ll navigate the often-bewildering landscape of IRAs, 401(k)s, and the surprisingly complex world of Medicare, all while keeping a lighthearted approach to what can be a daunting topic. Get ready to laugh your way to financial freedom (or at least a slightly less stressful retirement).

This updated guide tackles the ever-changing world of retirement planning, addressing key shifts in the economic landscape, legislative changes that make your head spin, and the simple fact that we’re all living longer (which is great, but also means more years of needing money!). We’ll delve into updated investment strategies, explore ways to maximize your savings while minimizing your tax burden, and even touch upon the delicate art of estate planning – because nobody wants to leave their heirs with a mountain of paperwork and a family feud.

Retirement Planning Guide Update

Ah, retirement! That golden age where you swap spreadsheets for sunrises and conference calls for cocktails. But the path to that blissful state isn’t always paved with gold; it’s more like a constantly shifting landscape of economic tremors, legislative landslides, and the ever-increasing longevity of… well, us! This updated guide navigates these treacherous (but ultimately rewarding) terrains, ensuring your retirement dreams don’t end up in the dustbin of history. Consider this your updated map to financial freedom – a map that’s been painstakingly redrawn to account for the latest twists and turns.

The last time we charted this course, the world was a slightly less chaotic place. Since then, we’ve weathered economic storms (remember those interest rate hikes?), witnessed legislative changes that reshaped the retirement landscape (hello, SECURE Act 2.0!), and, perhaps most surprisingly, discovered that people are living longer than ever before – which, while fantastic news, does present a rather significant financial challenge. This update tackles all of these developments head-on, providing you with the most up-to-date strategies and insights to ensure a comfortable and secure retirement. This isn’t just a guide; it’s your financial survival kit for the next chapter of your life.

Significant Changes in Retirement Planning Since the Last Update

The retirement planning landscape has undergone a significant makeover since our last guide. Key changes include alterations to required minimum distributions (RMDs), new tax incentives for retirement savings, and a greater emphasis on personalized retirement strategies tailored to individual circumstances and risk tolerance. For example, the SECURE Act 2.0 introduced several notable changes, including increased contribution limits for those over 50 and the ability to start taking penalty-free withdrawals from retirement accounts for qualified birth or adoption expenses. These changes significantly impact retirement planning strategies, necessitating an update to our guide. Furthermore, economic shifts, such as inflation and fluctuating market conditions, necessitate a reevaluation of investment strategies and risk management plans.

Key Factors Driving the Need for This Update

Several compelling factors necessitated this comprehensive guide update. Firstly, the increasing life expectancy demands a longer-term financial plan. Imagine needing to fund 30+ years of retirement – that’s a considerable undertaking! Secondly, legislative changes, such as the SECURE Act 2.0, have significantly altered the rules of the retirement game. These changes, while intended to benefit retirees, require a thorough understanding to avoid costly mistakes. Finally, persistent economic uncertainty, marked by inflation and market volatility, necessitates a more adaptable and robust retirement strategy. The recent increase in interest rates, for instance, has impacted bond yields and necessitates a reassessment of fixed-income investments within a retirement portfolio.

Updated Retirement Savings Strategies

Planning for retirement is like planning a really long, luxurious vacation – you want to make sure you have enough funds to enjoy the sunset years without ending up in a budget motel. This update explores some exciting new ways to bolster your retirement nest egg and ensure a comfortable, margarita-filled future.

New Investment Vehicles for Retirement

The world of investment is constantly evolving, offering a smorgasbord of options for the discerning retiree-in-waiting. Beyond the traditional stocks and bonds, consider exploring alternative investments such as real estate investment trusts (REITs), which offer diversification and potential income streams, or even fractional ownership of private equity, providing access to previously exclusive investment opportunities. Remember to carefully assess risk tolerance and diversification before committing. These options are not for the faint of heart (or the retirement-planning novice).

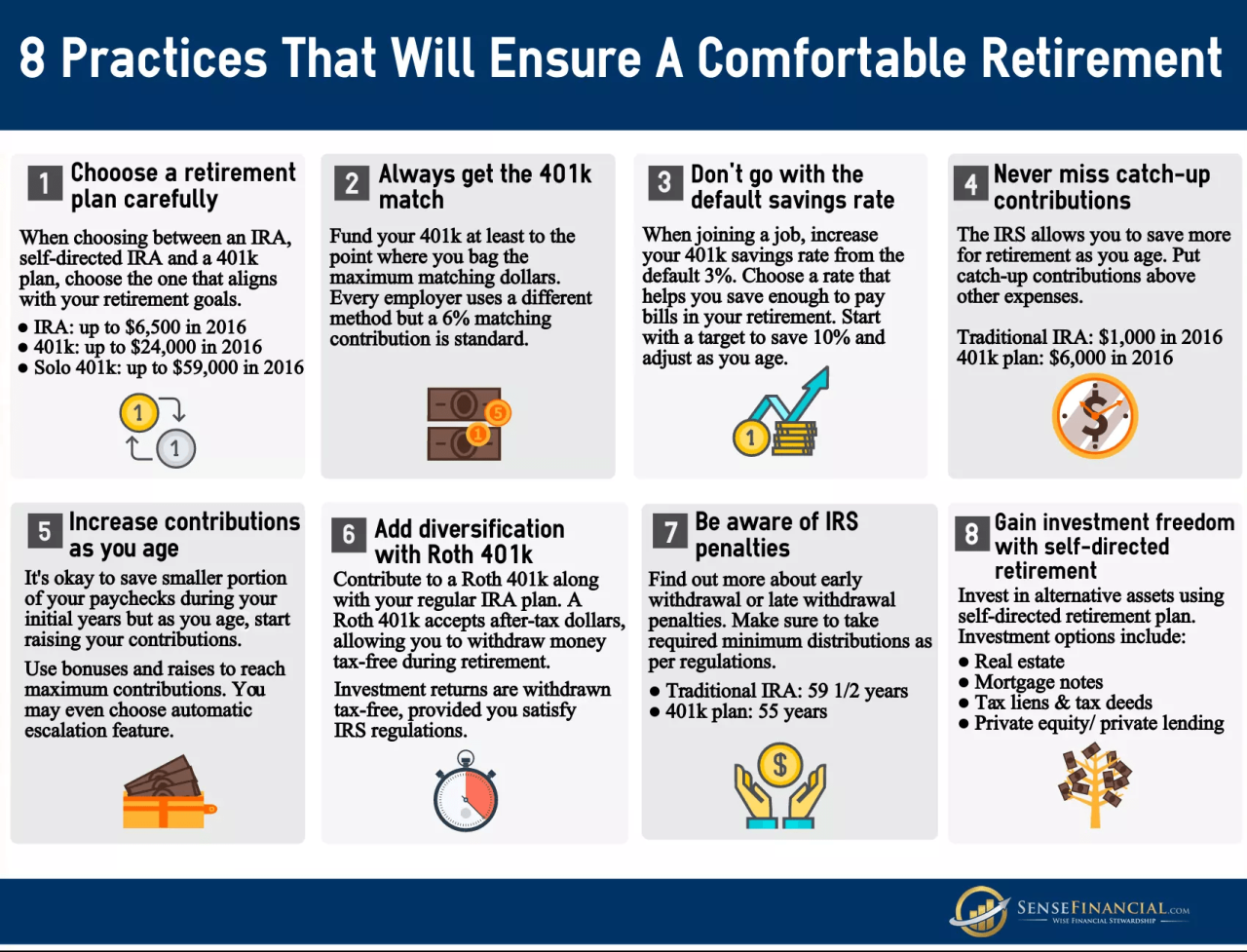

Traditional vs. Roth IRAs: A Taxing Comparison

The age-old battle: Traditional IRA vs. Roth IRA. The traditional IRA allows for pre-tax contributions, reducing your current taxable income, while withdrawals in retirement are taxed as ordinary income. Conversely, Roth IRAs involve after-tax contributions, but withdrawals in retirement are tax-free – a tempting prospect for those who anticipate being in a higher tax bracket during retirement. The best choice depends entirely on your individual circumstances and projections about your future tax bracket. Consult a financial advisor to determine which strategy best aligns with your financial goals.

Maximizing Retirement Contributions and Minimizing Tax Burdens

The key to maximizing retirement savings while minimizing your tax bill is strategic planning, and a touch of financial wizardry. This involves taking full advantage of employer-sponsored retirement plans, such as 401(k)s and 403(b)s, which often include employer matching contributions – essentially free money! Additionally, consider tax-loss harvesting to offset capital gains and explore tax-advantaged accounts, such as health savings accounts (HSAs), to reduce your current tax burden while saving for future healthcare expenses. Remember, consulting a financial professional is always a smart move.

Comparison of Retirement Account Options

| Account Type | Contribution Limit (2024 – Example) | Tax Advantages | Withdrawal Rules |

|---|---|---|---|

| 401(k) | $24,500 (plus $7,500 catch-up for those age 50+) | Pre-tax contributions; potential employer matching; tax-deferred growth | Taxed in retirement; early withdrawals may incur penalties |

| 403(b) | $24,500 (plus $7,500 catch-up for those age 50+) | Similar to 401(k) | Similar to 401(k) |

| SEP IRA | Up to 25% of net self-employment income | Pre-tax contributions; tax-deferred growth | Taxed in retirement; early withdrawals may incur penalties |

| Roth IRA | $7,000 (plus $1,000 catch-up for those age 50+) | Tax-free withdrawals in retirement | Contributions can be withdrawn tax-free and penalty-free; early withdrawals of earnings may be subject to penalties and taxes |

Managing Retirement Income

Retirement: the golden years, a time for leisurely pursuits, and… the nagging question of how to pay for it all. While pensions and Social Security provide a foundation for many, relying solely on these sources can be akin to building a house on sand – sturdy enough perhaps, but vulnerable to the shifting tides of inflation and unforeseen circumstances. Diversifying your income streams is key to ensuring a comfortable and financially secure retirement, allowing you to enjoy your hard-earned relaxation without the constant worry of dwindling funds.

The good news is that there are numerous avenues to explore beyond the traditional pillars of retirement income. Understanding these options, their potential benefits, and inherent risks, allows for the creation of a robust and sustainable financial plan that will weather any storm. Let’s delve into the fascinating world of retirement income diversification, shall we?

Diverse Retirement Income Sources

The key to a financially fulfilling retirement lies in strategically combining various income streams to create a resilient and predictable cash flow. This approach minimizes the impact of potential shortfalls from any single source and offers flexibility to adapt to changing circumstances. A diversified approach is less susceptible to market fluctuations or unexpected life events. For instance, relying solely on a stock portfolio might leave you vulnerable to market downturns, while relying entirely on a fixed annuity could leave you struggling with inflation.

- Part-Time Employment: Pros: Supplemental income, social interaction, continued skill development. Cons: Reduced leisure time, potential for physical strain depending on the job.

- Rental Income: Pros: Passive income stream, potential for appreciation. Cons: Property management responsibilities, vacancy periods, potential for repairs and maintenance costs. Imagine a charming cottage by the sea – the rental income could be quite delightful, but remember the occasional leaky roof and demanding tenants!

- Annuities: Pros: Guaranteed income stream, tax advantages in some cases. Cons: Lower potential returns compared to other investments, potential surrender charges.

- Reverse Mortgages: Pros: Access to home equity without selling your home. Cons: Increased debt, potential loss of home if not managed carefully. Think of it as borrowing against your home’s value – a helpful tool if used wisely, but a potential financial burden if not.

- Investment Income (Dividends, Interest): Pros: Potential for growth and income, diversification opportunities. Cons: Market volatility, potential for losses.

Strategies for Sustainable Retirement Income

Creating a sustainable income stream requires careful planning and a diversified approach. It’s not just about having enough money; it’s about strategically managing that money to ensure it lasts throughout your retirement. Think of it as a well-orchestrated symphony of financial instruments, each playing its part to create a harmonious and enduring melody of financial security.

A key strategy involves the “bucket” approach: allocating funds into separate accounts for different time horizons (short-term, mid-term, long-term). This helps manage risk and ensures you have access to funds when you need them.

This allows for a balanced approach to risk and return, ensuring that your retirement income remains sustainable despite market fluctuations or unexpected expenses. For example, a shorter-term bucket might hold highly liquid assets for immediate expenses, while a longer-term bucket could contain investments with higher growth potential.

Risks of Over-Reliance on Single Income Sources

Relying too heavily on a single income source in retirement is akin to putting all your eggs in one basket – a risky proposition, indeed! The potential consequences of such a strategy can be significant, leading to financial instability and a less enjoyable retirement than envisioned.

For example, over-reliance on Social Security benefits alone exposes you to the risks of inflation eroding the purchasing power of your fixed income and potential changes in Social Security policy. Similarly, dependence on a single investment, like a company pension, could leave you vulnerable if that company experiences financial difficulties.

Healthcare Costs in Retirement: Retirement Planning Guide Update

Retirement: the golden years, a time for leisurely pursuits, and… crippling medical bills? Let’s face it, healthcare costs in retirement can be a significant – and often unexpected – drain on your hard-earned savings. This section will arm you with the knowledge to navigate this potentially treacherous financial landscape. We’ll explore the realities of healthcare expenses, strategies for mitigation, and the often-overlooked but crucial topic of long-term care insurance.

Anticipated Healthcare Expenses in Retirement

The cost of healthcare in retirement is notoriously unpredictable, varying greatly depending on individual health conditions, lifestyle choices, and the specific healthcare services required. However, we can make some educated guesses. Consider these factors: Medicare premiums and deductibles (which are subject to change annually and can be substantial), out-of-pocket expenses for medications, doctor visits, and potential hospital stays, and the ever-present possibility of long-term care needs. A conservative estimate, factoring in inflation, suggests that a healthy couple retiring today might face hundreds of thousands of dollars in healthcare costs over their retirement years. For those with pre-existing conditions or anticipating more extensive care, the figure could easily reach into the millions. Planning for the unexpected is paramount; consider unexpected surgeries, chronic conditions, or simply the rising cost of routine care. Let’s not forget dental and vision care, often overlooked but significant contributors to overall healthcare expenditure.

Strategies for Mitigating Healthcare Costs

Fortunately, there are several strategies to help you manage these costs. Effective Medicare planning is crucial. Understanding the different parts of Medicare (A, B, C, and D) and choosing the plan that best fits your needs is essential. Supplemental insurance, also known as Medigap, can help cover some of the gaps in Medicare coverage, reducing your out-of-pocket expenses. Exploring options like Medicare Advantage plans, which combine Medicare Part A and B with Part D prescription drug coverage, is another vital step. Furthermore, maintaining a healthy lifestyle through diet, exercise, and preventative care can significantly reduce the likelihood of expensive medical interventions later in life. Finally, careful budgeting and financial planning, considering the potential costs of healthcare throughout your retirement, is non-negotiable.

Long-Term Care Insurance and its Options

Long-term care insurance is a critical, yet frequently overlooked, aspect of retirement planning. It’s designed to cover the costs of long-term care services, such as nursing home care, assisted living, or in-home care, should you require them. The cost of these services can be astronomical, quickly depleting your retirement savings. Several options exist, including traditional long-term care insurance policies, hybrid policies (combining long-term care benefits with life insurance), and annuities with long-term care riders. Choosing the right policy depends on your individual needs, financial situation, and health status. It’s advisable to consult with a qualified financial advisor to determine the most suitable option. Delaying this decision can significantly increase the cost of premiums later in life.

Projected Growth of Healthcare Costs

An infographic depicting projected healthcare costs over a typical 30-year retirement would feature a line graph. The x-axis would represent the years of retirement (0-30), and the y-axis would represent healthcare costs in dollars (starting at a reasonable baseline and increasing exponentially). The line itself would show a steep upward trajectory, illustrating the significant projected increase in healthcare expenses over time. Data points along the line could represent projected costs at 5-year intervals (e.g., year 5, year 10, year 15, etc.), with the corresponding dollar amounts clearly indicated. A small inset table could provide a comparison of projected costs for a single individual versus a couple, highlighting the substantial difference. Finally, a title such as “The Escalating Cost of Healthcare in Retirement” would effectively summarize the infographic’s message. The color scheme should be professional but attention-grabbing, perhaps using a combination of blues and oranges to visually represent the rising costs. Specific data points could reflect realistic projections based on reputable sources such as the Centers for Medicare & Medicaid Services (CMS) or the Kaiser Family Foundation.

Estate Planning and Legacy Considerations

Planning for your eventual departure from this mortal coil might not sound like a barrel of laughs, but trust us, getting your estate in order is crucial. It’s not just about avoiding a family feud over your prized collection of rubber ducks; it’s about ensuring your wishes are respected and your loved ones are taken care of. Proper estate planning offers peace of mind, allowing you to enjoy your retirement without the nagging worry of unresolved legal and financial matters.

Failing to plan is, as they say, planning to fail. A well-structured estate plan ensures a smooth transition of your assets, minimizing potential legal battles and tax burdens for your heirs. This process involves several key components, each designed to safeguard your legacy and your family’s future.

Updating Wills, Trusts, and Power of Attorney Documents

Regularly reviewing and updating your will, trust, and power of attorney documents is paramount. Life throws curveballs; marriages, divorces, births, deaths, and significant financial changes all necessitate adjustments to your estate plan. Imagine your will still naming your ex-spouse as beneficiary – not ideal! Similarly, a power of attorney should reflect your current wishes and trust the individuals you appoint to act on your behalf. Outdated documents can lead to unnecessary complications and legal challenges, delaying the distribution of your assets and causing undue stress for your family during an already difficult time. Consider reviewing these documents at least every three to five years, or whenever a significant life event occurs.

Strategies for Minimizing Estate Taxes and Transferring Assets Efficiently

Estate taxes can significantly reduce the inheritance your loved ones receive. Minimizing this tax burden requires careful planning. Strategies include utilizing gifting strategies within annual gift tax exclusion limits, establishing trusts to manage asset distribution, and making charitable donations. For example, gifting smaller amounts annually to family members can effectively reduce the overall value of your estate subject to tax. Remember to consult with a qualified estate planning attorney and tax advisor to tailor a strategy that suits your individual circumstances and complies with all applicable laws. They can help you navigate the complexities of estate tax laws and devise a plan that maximizes the inheritance for your beneficiaries.

Communicating Estate Plans to Family Members

Open communication is key to a smooth estate transition. Don’t leave your family guessing about your wishes. Clearly explain your estate plan to your loved ones, ensuring they understand the distribution of assets, the roles of executors and trustees, and any specific instructions. This transparency can prevent misunderstandings and family conflicts later. Consider preparing a detailed summary of your estate plan, including contact information for your legal and financial advisors. A well-informed family is a less stressed family, particularly during the emotional period following your passing.

Essential Estate Planning Documents and Actions

Creating a comprehensive estate plan involves several crucial steps. The following checklist Artikels essential documents and actions to ensure your wishes are carried out efficiently and effectively:

- Execute or update your Will.

- Establish a Trust (if appropriate).

- Create or update Durable Power of Attorney for Finances.

- Create or update Healthcare Power of Attorney (or Advance Directive).

- Designate beneficiaries for retirement accounts and life insurance policies.

- Create a digital asset inventory and plan for access.

- Store important documents in a secure and accessible location.

- Inform your family members of your estate plan.

- Review your estate plan regularly (at least every 3-5 years).

- Consult with an estate planning attorney and financial advisor.

Technology and Retirement Planning

Embracing technology in retirement planning isn’t just about keeping up with the Joneses; it’s about leveraging powerful tools to secure a financially comfortable future. Think of it as having a highly caffeinated, incredibly organized personal finance butler, available 24/7, without the awkward small talk. This section will explore how technology simplifies the process, the potential pitfalls to avoid, and the best resources to utilize.

Technology significantly streamlines the often-daunting task of retirement planning. Online calculators, for example, allow individuals to quickly estimate their retirement needs based on various factors like current savings, expected income, and desired lifestyle. Sophisticated investment platforms offer automated portfolio management, fractional share investing, and real-time tracking of investments, making it easier than ever to build and manage a diversified portfolio. The accessibility and convenience these tools offer democratize retirement planning, making it achievable for a broader range of individuals.

Online Financial Tools: Benefits and Risks, Retirement Planning Guide Update

The digital revolution has bestowed upon us a plethora of online financial tools, each promising a path to retirement bliss. However, as with any powerful tool, understanding its capabilities and limitations is crucial. The benefits include ease of access, personalized recommendations (often based on algorithms analyzing your financial data), and the ability to track progress in real-time. Risks, on the other hand, involve the potential for errors in algorithms, dependence on technology, and the possibility of data breaches. It’s a bit like having a super-smart parrot offering financial advice – it can be helpful, but you still need to double-check its pronouncements. Thorough research and a healthy dose of skepticism are essential.

Online Retirement Planning Scams and Security Concerns

The digital landscape, while offering incredible opportunities, also harbors a dark side: cybercriminals targeting unsuspecting retirees. Phishing scams, fraudulent investment schemes disguised as legitimate online platforms, and identity theft are significant threats. These scams often prey on the desire for quick riches or the fear of losing hard-earned savings. Protecting yourself involves being vigilant, verifying the legitimacy of websites and emails before sharing personal information, and using strong passwords and multi-factor authentication wherever possible. Think of it as a financial game of whack-a-mole, where you must constantly be on the alert for these digital predators.

Reputable Online Retirement Planning Resources

Navigating the vast ocean of online financial tools requires a discerning eye. Fortunately, several reputable organizations offer valuable resources. For example, the websites of government agencies like the Social Security Administration provide essential information about retirement benefits. Many well-established financial institutions also offer educational materials and tools, though it’s crucial to remember that their advice might be biased towards their own products. Independent, non-profit organizations focused on financial literacy can provide unbiased guidance and educational resources. It’s important to compare information from multiple sources and treat any advice as a starting point for your own research, rather than gospel truth. Remember, due diligence is key – treat your retirement planning like choosing a life partner; thorough investigation is essential.

Addressing Inflation and Market Volatility

Retirement planning is like a thrilling rollercoaster ride – exhilarating highs and stomach-churning lows. One of the biggest villains lurking in the shadows, ready to spoil your golden years, is the unpredictable duo of inflation and market volatility. Understanding their impact and developing strategies to mitigate their effects is crucial for a truly enjoyable retirement.

Inflation, that sneaky price-hiking goblin, erodes the purchasing power of your hard-earned savings. As prices rise, the same amount of money buys you less. Market volatility, on the other hand, is like a wild bronco – unpredictable swings can leave your investments feeling like a rodeo clown after a particularly bad fall. The key is to ride this bronco skillfully, not get thrown off.

Inflation’s Impact on Retirement Savings and Income Streams

Inflation relentlessly chips away at the value of your retirement nest egg. Imagine you saved $1 million for retirement. If inflation averages 3% annually, that $1 million will only buy you $553,676 worth of goods and services in 20 years’ time. This illustrates the critical importance of planning for inflation, ensuring your retirement income keeps pace with rising prices. Failure to account for inflation can lead to a significantly reduced standard of living during your retirement years. Consider that a modest annual inflation rate of 2% will halve the real value of your savings in approximately 35 years.

Strategies for Protecting Retirement Assets

Protecting your retirement assets from inflation and market fluctuations requires a multi-pronged approach. This isn’t about hiding your money under a mattress (though that’s certainly an option if you enjoy the company of dust bunnies). Instead, consider a diversified investment portfolio that includes assets that tend to perform well during inflationary periods, such as inflation-protected securities (TIPS) and real estate. Regularly rebalancing your portfolio is also essential, ensuring you don’t become overly concentrated in any single asset class. Think of it as a financial diet – a balanced approach is key.

The Role of Diversification in Mitigating Investment Risk

Diversification is your best friend in the volatile world of investments. Don’t put all your eggs in one basket – spread your investments across various asset classes (stocks, bonds, real estate, etc.) and geographic regions. This helps to reduce the overall risk of your portfolio. Imagine having all your savings in a single company’s stock. If that company falters, your entire retirement could be at risk. Diversification provides a safety net, cushioning the blow of potential losses in any single investment.

Hypothetical Example of Inflation’s Impact Over 20 Years

Let’s paint a picture. Suppose you have $500,000 saved for retirement. If inflation averages 3% annually, after 20 years, the real value of your savings would be approximately $272,895. This means you’d need to increase your savings or adjust your spending plans to maintain your desired standard of living. Conversely, if inflation were only 1%, your $500,000 would still have a real value of approximately $368,302. This highlights the significant impact that even seemingly small differences in inflation rates can have over the long term. The power of compounding, both positively and negatively, is a force to be reckoned with.

Final Wrap-Up

So, there you have it: a slightly less terrifying (and hopefully more amusing) look at securing your financial future. Remember, retirement planning doesn’t have to be a soul-crushing experience. With a bit of planning (and maybe a healthy dose of humor), you can navigate the complexities of saving, investing, and ultimately, enjoying your well-deserved golden years. Now go forth and conquer (or at least, make a decent retirement plan!).

Answers to Common Questions

What’s the best way to deal with unexpected medical expenses in retirement?

Having a robust emergency fund specifically for healthcare is crucial. Supplemental health insurance and exploring options like a health savings account (HSA) can significantly mitigate the financial impact of unexpected medical bills. Remember, prevention is key – regular checkups can help catch potential problems early.

How can I protect my retirement savings from inflation?

Diversification is your best friend! Spread your investments across different asset classes (stocks, bonds, real estate) to reduce your risk. Consider inflation-protected securities like TIPS (Treasury Inflation-Protected Securities). Regularly rebalancing your portfolio is also essential to adapt to changing market conditions and inflation.

What are some common retirement planning scams to watch out for?

Be wary of unsolicited investment advice, especially those promising unusually high returns with little risk. Never share your personal financial information unless you’re absolutely certain of the recipient’s legitimacy. Do your research and only work with reputable financial advisors.