Retirement Planning Software: Ah, retirement! The shimmering mirage of endless leisure, beckoning with promises of golf courses and cruises. But before you trade your spreadsheets for shuffleboard, you need a plan – and that’s where Retirement Planning Software steps in, rescuing you from the terrifying abyss of financial uncertainty. It’s not just about numbers; it’s about crafting your dream retirement, one carefully calculated step at a time. This isn’t your grandpa’s retirement plan; this is about leveraging technology to secure your future, with a side of sophisticated financial fun.

This exploration delves into the fascinating world of retirement planning software, examining its core functionalities, the diverse user base it serves (from individual investors to seasoned financial advisors), and the key features that make it an indispensable tool for securing a comfortable retirement. We’ll navigate the complexities of integration with other financial platforms, discuss user experience considerations, and address the critical aspects of data security and privacy. Prepare for a journey filled with insightful comparisons, practical tips, and a healthy dose of financial wit.

Defining Retirement Planning Software

Retirement planning: it’s not exactly a barrel of laughs, is it? Unless, of course, you’re using software designed to make the process less… *financially agonizing*. This software takes the guesswork (and the potential for tears) out of securing your golden years, offering a structured approach to navigating the complexities of retirement savings.

Retirement planning software provides a digital toolkit for individuals and financial professionals to map out a financially comfortable future. It’s essentially a sophisticated financial calculator on steroids, incorporating various factors to create personalized retirement projections and strategies. Think of it as your very own, highly caffeinated retirement guru, available 24/7 (minus the occasional software update).

Core Functionalities of Retirement Planning Software

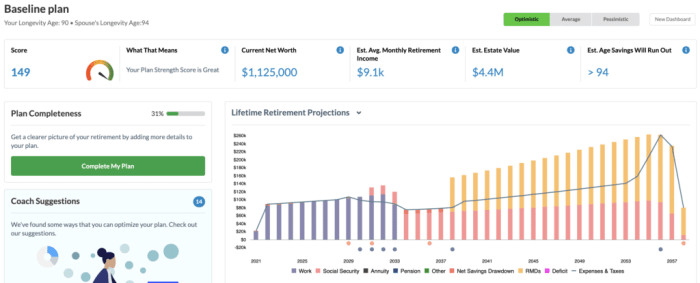

These programs typically offer a range of features designed to simplify the retirement planning process. Key functionalities often include projecting future income needs, analyzing current savings and investments, simulating various retirement scenarios (including early retirement, which is always fun to dream about!), and providing guidance on adjusting savings strategies to meet goals. The software also helps visualize the long-term impact of various financial decisions, allowing users to make informed choices based on realistic projections. This functionality reduces the anxiety often associated with long-term financial planning.

User Types Who Benefit from Retirement Planning Software

A wide range of users can benefit from retirement planning software. Individuals looking to take control of their financial future, whether they’re seasoned investors or just starting out, find these tools incredibly useful. Financial advisors also leverage this software to streamline their client management, providing personalized advice based on sophisticated projections and analyses. Essentially, anyone who wants a clearer picture of their retirement prospects and a plan to achieve them will find this software beneficial.

Common Features of Retirement Planning Software

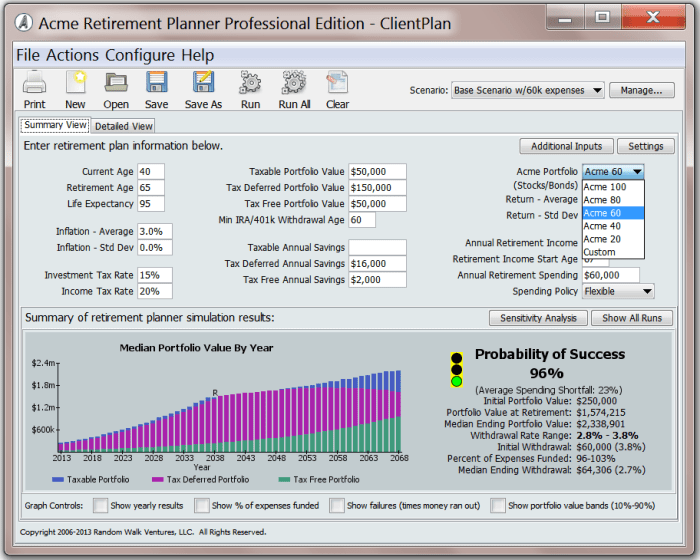

Many programs include features such as investment tracking (so you can keep an eye on those precious nest eggs), tax planning tools (because taxes are always a delightful surprise, right?), and retirement income calculators (to help determine how much you’ll need to live comfortably). Some software also incorporates features like asset allocation recommendations, social security benefit estimation, and even estate planning tools, offering a comprehensive approach to financial planning beyond just retirement. Advanced features might include Monte Carlo simulations, providing a probabilistic view of potential outcomes. This helps users understand the inherent uncertainty in long-term financial projections.

Comparison of Retirement Planning Software Options

The market offers a variety of retirement planning software options, each with its own strengths and weaknesses. Below is a comparison of three hypothetical examples:

| Software | Pricing | Features | User Interface |

|---|---|---|---|

| RetirementPro Max | $99/year | Investment tracking, tax planning, Monte Carlo simulations, estate planning tools | Advanced, potentially steep learning curve |

| EasyRetirementPlanner | $49/year | Investment tracking, retirement income calculator, basic tax planning | User-friendly, intuitive interface |

| FutureSecure Lite | Free (with limited features) | Basic retirement income calculator, limited investment tracking | Simple, easy to navigate |

Key Features and Benefits

Retirement planning: It’s not exactly a barrel of laughs, is it? Unless, of course, you’re laughing all the way to the bank in your golden years. That’s where our retirement planning software comes in – transforming the daunting task of securing your financial future into something…dare we say…enjoyable? Okay, maybe not enjoyable, but definitely less teeth-grindingly stressful.

Manual retirement planning is like navigating a labyrinth blindfolded while juggling chainsaws. Our software offers a clear, well-lit path, complete with a helpful (and chainsaw-free) guide. The benefits of using our software are numerous, offering a level of precision and foresight that simply isn’t achievable with spreadsheets and a whole lot of guesswork.

Scenario Planning Capabilities

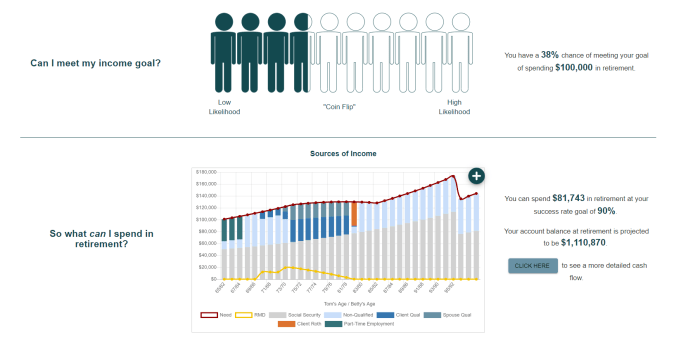

Scenario planning allows users to model different potential retirement outcomes based on varying assumptions. For example, a user could explore the impact of different investment returns, inflation rates, or healthcare costs on their retirement income. This feature allows for a proactive approach to retirement planning, enabling users to identify potential risks and adjust their strategies accordingly. Imagine tweaking your retirement age, adjusting investment allocations, or even factoring in unexpected windfalls (like winning the lottery – fingers crossed!). Our software allows you to play out these “what ifs” with ease, providing a clearer picture of your financial future.

Asset Allocation Tools

Our software’s asset allocation tools provide users with a systematic way to manage their investments. By considering factors such as risk tolerance, investment goals, and time horizon, the software suggests optimal asset allocations across different investment classes (stocks, bonds, real estate, etc.). This feature is particularly beneficial for individuals who lack the financial expertise to create a diversified investment portfolio on their own. For example, a conservative investor might see a portfolio suggestion heavily weighted towards bonds, while a more aggressive investor might see a higher allocation to stocks. The software tailors the advice to the individual’s specific circumstances.

Retirement Income Projections

Retirement income projections help users estimate their future retirement income based on their current savings, projected investment returns, and planned withdrawals. This allows users to assess whether their current savings are sufficient to meet their retirement goals and make necessary adjustments to their savings plan. For instance, if projections show a shortfall, users can explore strategies to increase their savings rate, delay retirement, or reduce their planned retirement expenses. Our software offers detailed, personalized projections, providing a realistic view of your future financial landscape. No more blind faith!

Typical User Workflow, Retirement Planning Software

Below is a flowchart illustrating the typical user workflow within our retirement planning software:

(Imagine a flowchart here. It would start with “Account Creation,” then branch to “Inputting Financial Data” (current savings, income, expenses), then to “Setting Retirement Goals” (retirement age, desired income), followed by “Choosing Investment Strategies,” then “Generating Projections and Reports,” and finally, “Adjusting Plans as Needed” which loops back to “Choosing Investment Strategies.” The whole process is visually represented with boxes and arrows.)

Integration with Other Financial Tools

Retirement planning isn’t a solitary pursuit; it’s a financial ecosystem. Imagine your retirement funds as a vibrant coral reef – teeming with life, but needing careful coordination. That’s where the integration of your retirement planning software with other financial tools comes in. It’s the underwater current that keeps everything connected and thriving.

Retirement planning software, at its best, acts as a central hub, gathering data from various sources to provide a holistic view of your financial landscape. This integration allows for a seamless flow of information, eliminating the need for manual data entry and reducing the risk of human error – a delightful prospect for anyone who’s ever accidentally inputted their net worth as their annual grocery bill. This connectivity paints a much clearer picture of your financial health, helping you make informed decisions about your retirement journey.

Data Integration Mechanisms

Successful integration hinges on the software’s ability to securely communicate with other platforms. Common methods include Application Programming Interfaces (APIs), which allow different software systems to “talk” to each other, exchanging data in a structured format. Some software might also use file imports or secure downloads to bring in data from external sources like brokerage accounts or tax preparation software. The smoother the communication, the less time you spend wrestling with spreadsheets and the more time you spend picturing yourself on a sun-drenched beach, sipping something fruity.

Challenges in Integrating Different Financial Platforms

Integrating various financial platforms isn’t always a walk in the park. Different platforms may use different data formats, requiring the software to act as a skilled translator. Furthermore, some platforms might have restrictive APIs, limiting the data that can be accessed or the frequency of updates. Security concerns also play a crucial role. Ensuring the secure transfer of sensitive financial data requires robust encryption and authentication protocols. Think of it as navigating a complex maze – you need a reliable map and a steady hand to avoid getting lost.

Best Practices for Securing Data During Integration

Security should be paramount when integrating financial tools. This includes employing robust encryption protocols during data transmission (think of it as a secret code only your software and the other platform can understand), implementing multi-factor authentication (adding an extra layer of security, like a password and a security code from your phone), and adhering to industry best practices for data storage and access control. Regular security audits and penetration testing can further enhance the security posture of the integrated system. In short, treat your financial data like a prized possession – protect it fiercely!

Comparison of Integration Capabilities

The following table compares three hypothetical retirement planning software options based on their integration capabilities. Remember, these are hypothetical examples and real-world capabilities may vary.

| Software | Brokerage Account Integration | Tax Software Integration | Other Financial Tool Integration |

|---|---|---|---|

| PlanAhead Pro | Direct integration with most major brokerages; API-based | CSV import; limited direct integration | Supports bank account linking and limited budgeting app integration |

| Retirement Roadmap | Manual import only; limited brokerage support | No direct integration; requires manual data entry | Minimal integration capabilities; relies primarily on manual data input |

| Golden Years Planner | Extensive API integration; supports a wide range of brokerages | Direct integration with leading tax software platforms | Supports various financial tools via APIs and secure file uploads |

User Experience and Accessibility

Retirement planning can be, let’s face it, a bit of a snoozefest. Numbers, projections, and the looming specter of…well, *old age*. But the right software can transform this potentially tedious task into something almost…enjoyable. Or at least, less nightmarish. A user-friendly interface is key to making this happen, ensuring the software is not only functional but also accessible to everyone, regardless of their tech skills or physical limitations.

The user interface design of popular retirement planning software varies wildly, from the elegantly minimalist to the bewilderingly complex. Some resemble a spreadsheet from the dark ages, while others boast sleek dashboards and intuitive navigation. However, the best designs prioritize clarity and simplicity, guiding users through the process with clear instructions and visually appealing elements. Think of it like this: would you rather wrestle a grumpy badger to extract your financial information, or gently coax it out with honeyed words and a soothing interface? The choice, my friend, is clear.

User Interface Design Evaluation

A good retirement planning software interface should be immediately intuitive. Imagine a user, perhaps slightly overwhelmed by the prospect of planning their retirement, opening the software for the first time. They shouldn’t be greeted by a wall of jargon and confusing charts. Instead, the software should gently guide them through the process, using clear language and helpful visual cues. Consider the success of Mint or Personal Capital; their user-friendly interfaces contributed significantly to their popularity. These platforms use clear visual representations of data, intuitive navigation, and straightforward language, making complex financial information easily digestible. Conversely, software with cluttered dashboards, overwhelming amounts of data presented without context, and convoluted navigation will likely frustrate users and discourage engagement.

Accessibility Features for Diverse Users

Accessibility is not just a nice-to-have; it’s a necessity. Retirement planning software should be usable by everyone, regardless of their age, visual acuity, or other disabilities. This means incorporating features like screen reader compatibility, adjustable font sizes, high contrast modes, and keyboard navigation. For example, software that supports screen readers allows visually impaired users to access and understand the information presented. Adjustable font sizes cater to users with low vision, while keyboard navigation eliminates the need for a mouse, benefiting users with motor impairments. The inclusion of these features is not merely a matter of compliance; it’s a matter of ensuring that everyone has the opportunity to plan for a secure and comfortable retirement.

Examples of User-Friendly Design Principles

Effective retirement planning software employs several key user-friendly design principles. Clear and concise labeling of all inputs and outputs is crucial. Progress indicators, such as progress bars or checklists, help users track their progress and maintain motivation. The use of visual aids, such as charts and graphs, makes complex financial data easier to understand. Finally, helpful tooltips and context-sensitive help can provide immediate assistance when needed. Think of it as having a friendly financial advisor built right into the software, always ready to offer a helping hand (or rather, a helpful tooltip).

Recommendations for Improving User Experience

To further enhance the user experience of retirement planning software, several improvements can be made.

- Implement personalized dashboards that adapt to individual user needs and preferences.

- Incorporate scenario planning tools that allow users to explore different retirement scenarios.

- Provide regular feedback and progress updates to keep users engaged.

- Offer multilingual support to cater to a wider range of users.

- Develop interactive tutorials and training materials to guide users through the software’s features.

These recommendations aim to make retirement planning software not only functional but also engaging and accessible to a diverse user base. After all, planning for retirement shouldn’t feel like scaling Mount Everest in flip-flops.

Data Security and Privacy

Protecting your retirement nest egg is serious business, and that includes keeping your financial data safe from prying eyes (and less-than-ethical digital burglars). Reputable retirement planning software providers understand this better than anyone, employing a multi-layered approach to data security that would make Fort Knox blush. Let’s delve into the reassuring world of secure retirement planning.

Data encryption and robust user authentication are the cornerstones of a secure retirement planning system. Think of data encryption as a super-secret code that renders your financial information unreadable to anyone without the correct decryption key – essentially, a digital vault for your hard-earned savings. User authentication, on the other hand, is the digital bouncer, ensuring only you have access to your account through multi-factor authentication, passwords, and other security protocols. Losing your retirement plan to a hacker is far less amusing than losing your keys – and infinitely more expensive.

Data Security Practices of Leading Providers

A comparison of security practices across three hypothetical leading providers (for illustrative purposes, let’s call them “PlanSecure,” “RetireSafe,” and “GoldenYears”) reveals some interesting nuances. Understanding these differences can help you make an informed decision about which software best suits your needs.

- PlanSecure: Employs 256-bit AES encryption for data at rest and in transit, along with multi-factor authentication, regular security audits, and penetration testing. They also offer real-time alerts for suspicious activity.

- RetireSafe: Uses 256-bit AES encryption, but their authentication process relies solely on strong passwords, though they boast a rigorous password reset process. They undergo annual security audits.

- GoldenYears: Utilizes 128-bit AES encryption (less robust than 256-bit), multi-factor authentication, and biannual security audits. They also have a robust customer support system to handle any security concerns promptly.

Impact of Data Breaches and Risk Mitigation

A data breach could expose your sensitive personal and financial information, leading to identity theft, fraudulent transactions, and significant financial losses. Imagine the stress of dealing with such a situation during your retirement! However, several steps can be taken to mitigate this risk. These include choosing providers with strong security measures (like PlanSecure, ideally!), regularly reviewing your account statements for any unauthorized activity, and using strong, unique passwords for all your online accounts. Remember, vigilance is your best friend in the digital age.

Future Trends in Retirement Planning Software

Retirement planning, once a realm of dusty spreadsheets and hushed conversations with financial advisors, is undergoing a thrilling transformation. The advent of sophisticated technologies is poised to revolutionize how we prepare for our golden years, making the process less daunting and significantly more personalized. Imagine a future where your retirement plan adapts to your life, not the other way around – that’s the promise of the next generation of retirement planning software.

The integration of artificial intelligence (AI) and machine learning (ML) is reshaping the landscape of retirement planning software. These technologies are not merely bells and whistles; they are the engines driving a more accurate, proactive, and personalized approach to financial security in retirement.

Artificial Intelligence and Machine Learning Enhancements

AI and ML algorithms can analyze vast datasets – encompassing market trends, economic forecasts, personal financial data, and even individual spending habits – to generate significantly more accurate retirement projections than traditional methods. This enhanced predictive power allows for more effective scenario planning and risk management. For instance, instead of simply presenting a single, potentially optimistic, retirement projection, the software could offer a range of plausible scenarios, factoring in potential market downturns, unexpected healthcare expenses, or even the impact of longevity. This nuanced approach empowers users to make more informed decisions and adapt their plans proactively. Furthermore, AI can personalize investment strategies, recommending portfolios tailored to individual risk tolerance, time horizons, and financial goals. Imagine a system that learns your spending patterns and automatically adjusts your savings contributions based on your actual lifestyle and financial fluctuations.

Innovative Features in Future Retirement Planning Software

Future iterations of retirement planning software will likely incorporate several innovative features designed to enhance user engagement and planning effectiveness. These might include:

- Gamified Retirement Planning: Interactive elements, such as progress bars, badges, and challenges, could transform the often-dry process of retirement planning into a more engaging and motivating experience.

- Hyper-Personalized Financial Advice: AI-powered chatbots capable of providing tailored financial advice, answering specific questions, and offering personalized recommendations based on an individual’s unique circumstances.

- Predictive Modeling of Healthcare Costs: Integration with healthcare data to provide more accurate estimations of future medical expenses, a significant factor often overlooked in traditional retirement planning.

- Integration with Smart Home Devices: Connecting retirement planning software with smart home devices to track spending habits and energy consumption, offering insights into areas where savings could be maximized.

Hypothetical Future Retirement Planning Tool: “Retirement Navigator 3000”

Imagine “Retirement Navigator 3000,” a futuristic retirement planning tool. This software utilizes advanced AI to analyze not only your financial data but also your lifestyle preferences, health metrics, and even your social network. It would proactively suggest adjustments to your plan based on unforeseen events, such as a job loss or a change in health status. Furthermore, it could simulate various retirement scenarios, including different locations and lifestyles, allowing you to visualize and plan for your ideal retirement. The software would even integrate with your smart home devices, providing real-time feedback on your spending habits and suggesting ways to optimize your savings. It’s a personalized, proactive, and incredibly engaging experience, taking the stress and guesswork out of retirement planning and putting you firmly in the driver’s seat.

Illustrative Example: Retirement Plan Scenario

Meet Barnaby Butterfield, a 45-year-old accountant with a penchant for perfectly-formed spreadsheets (a trait that makes him exceptionally well-suited to using our retirement planning software). Barnaby, tired of the relentless march of time and the looming specter of empty coffee cups, decides it’s time to plan his golden years. He envisions a retirement filled with competitive cheese-rolling, copious amounts of Earl Grey tea, and surprisingly intense bocce ball matches.

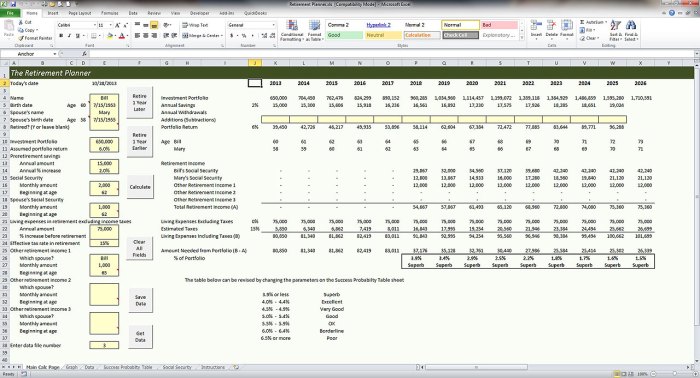

Barnaby inputs his current annual income of $120,000, meticulously detailing his expenses: mortgage payments, that surprisingly expensive cheese-rolling hobby, and his monthly subscription to a rather obscure magazine dedicated to the history of thimbles. He also enters his current investment portfolio, a carefully curated collection of stocks, bonds, and a surprisingly lucrative investment in artisanal pickle brine futures.

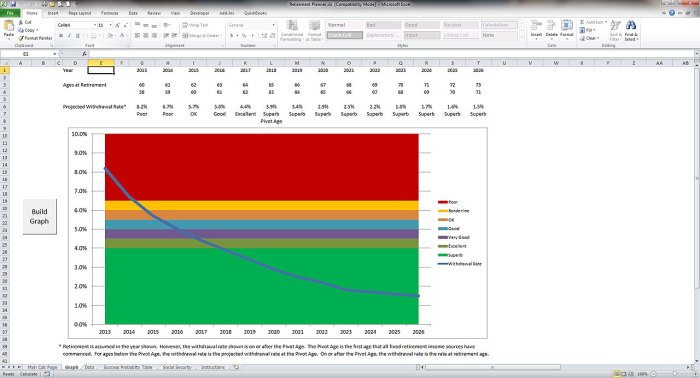

Retirement Plan Visualization

The software presents Barnaby with a dynamic, color-coded chart illustrating his projected retirement savings growth over time. The chart shows a steady upward trajectory, punctuated by minor dips representing anticipated market corrections (the software helpfully points out that these are normal and not a cause for immediate panic). A separate section clearly displays his projected retirement income, factoring in Social Security benefits, his investment portfolio growth, and a surprisingly generous pension plan from his employer, a firm specializing in the manufacture of extremely high-quality rubber ducks. The visualization also shows how his projected income compares to his estimated retirement expenses, clearly illustrating that his planned retirement lifestyle is, at present, well within his projected means. A “What If” scenario allows Barnaby to easily adjust his savings rate or retirement age, and the chart updates instantaneously to reflect these changes. The software also shows him a breakdown of his investment allocation, clearly highlighting the risk associated with each asset class. This is displayed in a simple pie chart, allowing Barnaby to easily understand the composition of his portfolio and the level of risk he is taking.

Detailed Plan Breakdown

The software provides Barnaby with a comprehensive breakdown of his retirement plan, detailing his projected savings, investment growth, and estimated income in retirement. It also offers various “What If” scenarios, allowing him to explore different retirement ages and savings rates. For example, if Barnaby decides to retire at 60 instead of 65, the software immediately recalculates his projected savings needs and adjusts his savings rate accordingly. If he decides to significantly increase his cheese-rolling budget, the software highlights the impact on his overall financial plan, perhaps even suggesting a reduction in his thimble magazine subscription to compensate. This level of detail and flexibility allows Barnaby to fine-tune his plan to perfectly match his retirement aspirations, even if those aspirations involve an unexpectedly large quantity of artisanal pickle brine.

Last Word

So, there you have it – a comprehensive look at the world of retirement planning software. From meticulously tracking investments to navigating the often-murky waters of tax planning, these powerful tools offer a level of control and clarity that was simply unimaginable just a few decades ago. While the technology continues to evolve, the underlying principle remains constant: proactive planning is the key to a secure and enjoyable retirement. Now go forth, and plan your happily ever after – responsibly, of course!

Detailed FAQs: Retirement Planning Software

Is retirement planning software only for the wealthy?

Absolutely not! While high-net-worth individuals may utilize more sophisticated features, many excellent, affordable, and even free options exist for individuals of all income levels. The key is finding a software that aligns with your specific needs and financial situation.

How often should I update my retirement plan?

Ideally, your retirement plan should be a living document, reviewed and adjusted at least annually, or more frequently if there are significant life changes (marriage, job loss, etc.).

What if I don’t understand the technical aspects of the software?

Most reputable retirement planning software provides excellent tutorials, FAQs, and often customer support to help users navigate the interface and understand the features. Don’t be intimidated – many are designed with user-friendliness in mind.

Can I access my retirement plan from anywhere?

Many modern retirement planning software platforms offer cloud-based access, allowing you to view and manage your plan from any device with an internet connection.