Planning for retirement might seem daunting, but understanding your options is the first step towards a financially secure future. This guide navigates the complexities of retirement savings, demystifying various accounts, investment strategies, and crucial considerations like tax implications and risk management. We’ll explore different approaches to help you build a retirement plan tailored to your individual needs and goals, empowering you to make informed decisions about your financial well-being.

From the basics of 401(k)s and IRAs to advanced investment strategies and managing your portfolio over time, we’ll cover essential aspects of retirement planning. We aim to provide you with the knowledge and tools necessary to confidently navigate this crucial life stage and achieve your retirement aspirations. This isn’t just about numbers; it’s about securing your future and enjoying the life you’ve worked for.

Introduction to Retirement Savings

Planning for retirement is crucial for securing financial stability and maintaining your desired lifestyle after your working years. Failing to adequately save can lead to significant financial hardship in later life, potentially impacting your health, well-being, and independence. A well-defined retirement savings plan allows you to enjoy a comfortable and fulfilling retirement, free from financial worries.

The amount you need to save for retirement is influenced by several key factors. These include your desired lifestyle in retirement (e.g., travel, hobbies, healthcare costs), your expected lifespan, your current age and savings, the anticipated inflation rate, and your potential sources of retirement income (e.g., Social Security, pensions). For example, someone aiming for an active retirement with extensive travel will require a significantly larger nest egg than someone planning a more modest lifestyle. Similarly, longer life expectancies necessitate larger savings to cover a longer retirement period. Inflation also erodes the purchasing power of savings over time, meaning you need to save more to maintain your desired living standard.

Factors Influencing Retirement Savings Needs

Several interconnected factors determine your retirement savings needs. Understanding these helps in setting realistic and achievable goals. These factors include your desired retirement lifestyle, your anticipated healthcare expenses, your expected lifespan, and the inflation rate. For instance, someone expecting significant healthcare costs in retirement will need to save more than someone with a lower anticipated healthcare burden. Similarly, a longer life expectancy directly increases the amount needed to maintain a consistent standard of living throughout retirement. The impact of inflation should also be carefully considered, as the purchasing power of your savings will diminish over time. Accurately forecasting these factors is crucial for successful retirement planning.

Setting Realistic Retirement Goals

Establishing realistic retirement goals involves a combination of careful planning and honest self-assessment. Start by determining your desired retirement lifestyle and associated expenses. Consider your current income and expenses to estimate your required retirement income. Then, use online retirement calculators or consult a financial advisor to estimate how much you need to save to achieve your goals, considering factors like inflation and investment returns. For example, if you envision a comfortable retirement spending $50,000 annually, and you expect to live for 20 years after retirement, you would need approximately $1,000,000 (not accounting for inflation or investment returns). Regularly reviewing and adjusting your goals as your circumstances change is essential for maintaining a sound retirement plan.

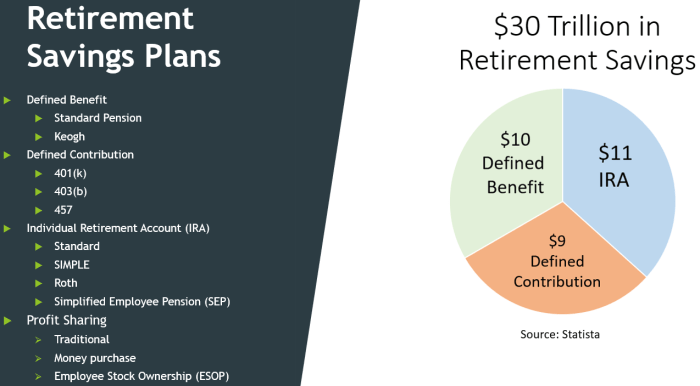

Types of Retirement Accounts

Planning for retirement involves choosing the right savings vehicles to maximize your returns and minimize your tax burden. Understanding the differences between various retirement accounts is crucial for building a secure financial future. This section will Artikel the key features of 401(k)s, 403(b)s, and IRAs, highlighting their tax implications and withdrawal rules.

401(k)s, 403(b)s, and IRAs: A Comparison

401(k)s, 403(b)s, and IRAs are all tax-advantaged retirement savings plans, but they differ significantly in their structure, eligibility, and contribution limits. 401(k)s are offered by employers, while 403(b)s are typically found in non-profit organizations and public schools. IRAs, on the other hand, are individual retirement accounts that anyone can open, regardless of employment.

Tax Advantages and Disadvantages of 401(k)s, 403(b)s, and IRAs

The primary tax advantage of 401(k)s and 403(b)s is that contributions are often made pre-tax, reducing your taxable income in the present. This means you pay less in taxes now, but you will pay taxes on the withdrawals in retirement. Traditional IRAs also offer this pre-tax contribution benefit. However, Roth IRAs work differently; contributions are made after-tax, but withdrawals in retirement are tax-free. A disadvantage of traditional plans (401(k)s, 403(b)s, and traditional IRAs) is the potential for higher taxes in retirement if your tax bracket is higher then. A disadvantage of Roth IRAs is that you pay taxes now, potentially reducing your disposable income currently. The optimal choice depends on your individual circumstances and projected tax rates.

Roth and Traditional Retirement Accounts: Key Differences

Roth and traditional retirement accounts (which include 401(k)s, 403(b)s, and traditional IRAs) represent distinct approaches to retirement savings. The core difference lies in when taxes are paid: contributions to traditional accounts are tax-deductible, meaning you pay taxes later on withdrawals, while Roth contributions are made after tax, but withdrawals are tax-free in retirement. This makes Roth accounts particularly attractive for individuals who anticipate being in a higher tax bracket in retirement than they are now. The choice between Roth and traditional depends heavily on individual financial projections and risk tolerance.

Key Features Comparison Table

The following table summarizes the key features of 401(k)s, 403(b)s, traditional IRAs, and Roth IRAs:

| Feature | 401(k) | 403(b) | Traditional IRA | Roth IRA |

|---|---|---|---|---|

| Contribution Limits | Varies by employer and plan; subject to annual IRS limits | Varies by employer and plan; subject to annual IRS limits | $6,500 (2023) plus $1,000 catch-up for those age 50 and over | $6,500 (2023) plus $1,000 catch-up for those age 50 and over |

| Tax Implications (Contributions) | Pre-tax | Pre-tax | Pre-tax (deductible) | After-tax |

| Tax Implications (Withdrawals) | Taxed in retirement | Taxed in retirement | Taxed in retirement | Tax-free |

| Withdrawal Rules | Early withdrawals generally penalized | Early withdrawals generally penalized | Early withdrawals generally penalized; exceptions for certain circumstances | Early withdrawals allowed without penalty after 5 years, provided certain conditions are met |

Investment Strategies for Retirement

Planning your retirement investments requires a thoughtful approach, balancing risk and reward to achieve your long-term financial goals. A well-diversified portfolio, tailored to your risk tolerance and time horizon, is crucial for maximizing returns while mitigating potential losses. This section will explore various investment options and strategies to help you build a robust retirement nest egg.

Investment Options for Retirement

Several asset classes offer different levels of risk and potential return, each playing a unique role in a diversified portfolio. Choosing the right mix depends on your individual circumstances and financial objectives. Understanding the characteristics of each option is key to making informed decisions.

- Stocks: Stocks represent ownership in a company and offer the potential for high returns over the long term. However, they are also subject to significant volatility and risk of loss. Growth stocks, for example, tend to be associated with higher risk and higher potential rewards than value stocks. The historical average annual return for the S&P 500 index, a widely followed benchmark for US large-cap stocks, has been around 10%, but this is not a guarantee of future performance.

- Bonds: Bonds are debt instruments issued by governments or corporations, offering a fixed income stream and generally lower risk than stocks. While offering lower potential returns compared to stocks, bonds provide stability and help reduce overall portfolio volatility. Government bonds are typically considered less risky than corporate bonds. A diversified bond portfolio might include Treasury bonds, corporate bonds, and municipal bonds, each with varying levels of risk and yield.

- Mutual Funds: Mutual funds pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other assets. They offer professional management and diversification, making them a convenient option for investors with varying levels of experience. Different mutual funds cater to different investment objectives and risk tolerances, from aggressive growth funds to conservative income funds. The expense ratios of mutual funds should be considered as they impact overall returns.

- Exchange-Traded Funds (ETFs): ETFs are similar to mutual funds but trade on stock exchanges like individual stocks. They offer diversification and low expense ratios, making them a popular choice for many investors. ETFs can track specific market indices (like the S&P 500) or focus on particular sectors or asset classes. Their liquidity allows for easy buying and selling.

Diversification and its Importance

Diversification is the practice of spreading investments across different asset classes to reduce risk. By investing in a variety of assets, you lessen the impact of poor performance in any single investment. For example, if the stock market declines, your bond holdings may help offset some of those losses. A well-diversified portfolio is not guaranteed to eliminate losses, but it can significantly reduce the volatility and potential for substantial losses. The level of diversification needed depends on your risk tolerance and time horizon.

Asset Allocation Strategies

Asset allocation refers to the proportion of your portfolio invested in different asset classes. Your asset allocation strategy should align with your risk tolerance and time horizon. Younger investors with a longer time horizon can typically tolerate more risk and allocate a larger portion of their portfolio to stocks. Older investors closer to retirement generally prefer a more conservative approach with a higher allocation to bonds.

- Example 1 (Aggressive): A younger investor with a high risk tolerance and a long time horizon might allocate 80% to stocks and 20% to bonds. This strategy aims for higher growth potential but also carries greater risk.

- Example 2 (Moderate): An investor with a moderate risk tolerance and a medium time horizon might allocate 60% to stocks and 40% to bonds. This strategy seeks a balance between growth and stability.

- Example 3 (Conservative): An investor nearing retirement with a low risk tolerance and a short time horizon might allocate 40% to stocks and 60% to bonds. This strategy prioritizes capital preservation over growth.

Retirement Planning Tools and Resources

Planning for retirement involves careful consideration of various factors, and utilizing available tools and resources can significantly simplify the process. Effective retirement planning requires a comprehensive understanding of your financial situation, retirement goals, and risk tolerance. Fortunately, numerous resources are available to assist in this process, from online calculators to professional financial advisors.

Online Retirement Calculators and Planning Tools

Many websites offer free online retirement calculators and planning tools. These tools allow individuals to input their current financial situation, projected income, and desired retirement lifestyle to estimate how much they need to save and how long their savings might last. Popular examples include Fidelity’s Retirement Income Planner, Schwab’s Retirement Calculator, and the AARP’s Retirement Calculator. These calculators vary in their complexity and features, offering estimates ranging from simple projections to more sophisticated analyses incorporating factors like inflation and potential investment returns. While these tools provide valuable estimations, it’s crucial to remember that they are based on projections and assumptions that may not perfectly reflect future realities. Therefore, using multiple calculators and consulting with a financial advisor is recommended for a more holistic perspective.

Resources for Finding Qualified Financial Advisors

Seeking professional guidance from a qualified financial advisor can significantly enhance the retirement planning process. Several resources can assist in locating advisors who meet your specific needs and preferences. The Certified Financial Planner Board of Standards (CFP Board) website provides a directory of CFP professionals, who have met rigorous education, examination, experience, and ethical requirements. Similarly, the National Association of Personal Financial Advisors (NAPFA) offers a directory of fee-only financial advisors, who are compensated solely by their clients and not through commissions on investment products. Online platforms like SmartAsset and XY Planning Network also connect individuals with financial advisors, often providing filtering options based on location, specialization, and fee structures. It’s essential to carefully research potential advisors, verify their credentials, and understand their fee structures before engaging their services.

Creating a Personalized Retirement Plan: A Step-by-Step Guide

Developing a personalized retirement plan requires a systematic approach. This step-by-step guide provides a framework for individuals to create a plan tailored to their specific circumstances.

- Assess your current financial situation: Determine your current income, assets (savings, investments, property), debts, and expenses. This provides a baseline for your planning.

- Define your retirement goals: Clearly articulate your desired retirement lifestyle, including your desired income level, location, and activities. This helps determine your savings needs.

- Estimate your retirement expenses: Project your future expenses in retirement, considering factors like healthcare costs, housing, travel, and entertainment. Consider inflation’s impact on these costs.

- Calculate your retirement savings needs: Use online calculators or consult a financial advisor to estimate the amount of savings required to support your desired retirement lifestyle. This calculation often considers your anticipated income sources in retirement (e.g., Social Security, pensions).

- Develop a savings and investment strategy: Based on your savings needs, create a plan to save and invest your money effectively. This may involve contributing to retirement accounts (e.g., 401(k), IRA), adjusting your spending habits, or exploring additional income streams.

- Regularly review and adjust your plan: Life circumstances change, so it’s crucial to review and adjust your retirement plan periodically (e.g., annually) to ensure it aligns with your evolving goals and financial situation. This might involve recalculating your savings needs, adjusting your investment strategy, or seeking professional advice.

A well-defined retirement plan, regularly reviewed and adjusted, is crucial for achieving financial security in retirement.

Managing Retirement Savings

Successfully navigating retirement requires diligent management of your accumulated savings. This involves proactive monitoring, strategic adjustments, and a thoughtful approach to withdrawals, all while considering the persistent threat of inflation. Failing to actively manage your retirement portfolio can significantly impact your financial security in your later years.

Regularly reviewing and adjusting your retirement portfolio is crucial for maintaining its long-term health and ensuring it aligns with your evolving financial goals and risk tolerance. Market fluctuations, changes in your personal circumstances (such as unexpected health expenses or changes in family needs), and shifts in your retirement timeline all necessitate periodic adjustments. A well-managed portfolio adapts to these changes, maximizing growth potential while minimizing risk.

Portfolio Review and Adjustment Strategies

A comprehensive review should assess your asset allocation, diversification, and overall performance. Consider rebalancing your portfolio annually or semi-annually to maintain your target asset allocation. For example, if your stock holdings have grown significantly beyond your target percentage, you might sell some stocks and reinvest in bonds or other less volatile assets. Conversely, if the value of your bond holdings has decreased, you might consider reallocating some funds from stocks to bonds. This strategy helps mitigate risk and capitalize on market opportunities. Furthermore, regularly review your investment fees and expenses, seeking ways to reduce them to maximize returns. Consider consulting a financial advisor for personalized guidance on adjusting your portfolio based on your specific circumstances and risk profile.

Withdrawal Strategies During Retirement

Managing withdrawals during retirement requires careful planning to ensure your savings last throughout your retirement years. A common strategy is the “4% rule,” which suggests withdrawing 4% of your retirement savings annually, adjusting for inflation each year. However, this is just a guideline and the appropriate withdrawal rate depends on various factors, including your life expectancy, health, and spending habits. Other strategies include systematic withdrawals based on a fixed dollar amount or a percentage of your portfolio’s value. A diversified withdrawal strategy, potentially combining several approaches, might be more suitable to ensure consistent income while mitigating the risk of depleting your savings prematurely. Consider consulting with a financial advisor to determine the most suitable withdrawal strategy for your individual circumstances.

Inflation’s Impact and Mitigation Strategies

Inflation erodes the purchasing power of your savings over time. A retirement portfolio that doesn’t account for inflation risks falling short of its intended goals. For example, if inflation averages 3% annually, a $100,000 nest egg will only have the purchasing power of approximately $74,409 after 10 years. To mitigate the impact of inflation, consider investing in assets that historically outpace inflation, such as stocks, real estate, and inflation-protected securities (TIPS). Diversifying your portfolio across different asset classes is also crucial, as it helps reduce the overall impact of inflation on your savings. Regularly rebalancing your portfolio, as previously discussed, also plays a significant role in mitigating inflation’s effects. Finally, planning for higher healthcare costs in retirement is essential, as healthcare expenses are particularly susceptible to inflation.

Tax Implications of Retirement Savings

Understanding the tax implications of your retirement savings is crucial for maximizing your returns and minimizing your tax burden. Different retirement accounts offer varying levels of tax advantages at both the contribution and withdrawal phases, significantly impacting your overall retirement income. Careful planning can help you optimize your tax strategy and ensure a comfortable retirement.

Tax Implications of Traditional Retirement Accounts

Traditional IRAs and 401(k)s offer significant upfront tax advantages. Contributions are typically made pre-tax, meaning they reduce your taxable income in the year you contribute. This lowers your current tax liability. However, withdrawals in retirement are taxed as ordinary income. For example, if you contribute $6,000 to a traditional IRA and are in the 22% tax bracket, you save $1,320 in taxes that year. But when you withdraw that $6,000 (plus accumulated earnings) in retirement, you’ll pay taxes on the full amount at your then-current tax bracket. The tax implications at withdrawal depend heavily on your income bracket during retirement. Higher income brackets mean higher taxes on your withdrawals.

Tax Implications of Roth Retirement Accounts

Roth IRAs and Roth 401(k)s operate differently. Contributions are made after tax, meaning they don’t reduce your current taxable income. However, qualified withdrawals in retirement are tax-free. This means you pay taxes now but avoid taxes later. For someone in a lower tax bracket now, but anticipating a higher bracket in retirement, a Roth account can be particularly advantageous. For instance, a young professional contributing to a Roth IRA might pay a lower tax rate now than they anticipate in retirement, making this a strategic choice. The growth and withdrawals in retirement are not taxed, unlike with traditional accounts.

Tax Benefits of Tax-Advantaged Accounts

The primary tax benefit of tax-advantaged retirement accounts is the deferral or elimination of taxes on investment earnings. This allows your investments to grow tax-free or tax-deferred, leading to a larger nest egg compared to taxable accounts. The tax savings accumulate over time, compounding the benefits. The specific tax advantages vary depending on the account type, as detailed above. Furthermore, some retirement accounts offer additional tax benefits such as tax credits for contributions, which can further reduce your tax burden.

Tax Laws Affecting Retirement Income

Tax laws can significantly influence your retirement income. Changes in tax brackets, tax rates, and deductions can affect the amount of taxes you pay on your withdrawals. For example, a change in tax legislation could alter the tax rates applied to withdrawals from traditional retirement accounts. Also, the required minimum distributions (RMDs) from traditional IRAs and 401(k)s, which begin at a certain age, can impact your taxable income in retirement, regardless of your financial needs. It is crucial to stay informed about current and potential changes in tax legislation to adjust your retirement savings and withdrawal strategies accordingly. Seeking professional tax advice can be invaluable in navigating the complexities of retirement tax planning.

Illustrative Example: Retirement Savings Plan

This section details a hypothetical retirement savings plan for Sarah, a 30-year-old marketing professional, to illustrate the practical application of the concepts discussed previously. This example is for illustrative purposes only and should not be considered personalized financial advice. Consult a financial advisor for guidance tailored to your specific circumstances.

This example considers Sarah’s income, expenses, risk tolerance, and investment choices to demonstrate a potential retirement savings strategy. We’ll Artikel her contributions, investment allocations, and a projected withdrawal plan. Remember, actual results may vary.

Sarah’s Retirement Savings Plan Assumptions

Sarah earns an annual salary of $75,000 and anticipates a 3% annual salary increase. Her annual expenses are approximately $45,000. She has a moderate risk tolerance, comfortable with some market fluctuations to achieve potentially higher returns. She aims to retire at age 65.

Sarah’s Investment Allocation

Sarah’s portfolio will be diversified across different asset classes to manage risk effectively. The following table shows her proposed allocation:

| Asset Class | Allocation Percentage | Rationale | Expected Annual Return (Estimate) |

|---|---|---|---|

| Stocks (US Equities) | 50% | Provides long-term growth potential. | 7% |

| Bonds (US Government Bonds) | 30% | Offers stability and income. | 3% |

| Real Estate Investment Trust (REITs) | 10% | Diversification and potential for income. | 5% |

| International Equities | 10% | Global diversification to reduce risk. | 6% |

Sarah’s Contribution Strategy

Sarah plans to contribute 15% of her pre-tax income to her retirement accounts annually. This includes contributions to a 401(k) plan through her employer and a Roth IRA. She will increase her contribution percentage by 1% each year, aiming to maximize tax advantages and savings.

Sarah’s Projected Retirement Income

Based on the assumptions above and an estimated average annual return of 5% on her investments, Sarah’s retirement portfolio is projected to be approximately $1,500,000 by age 65. This is a simplified projection and does not account for potential market downturns or unexpected expenses.

Sarah’s Withdrawal Strategy

Upon retirement, Sarah plans to withdraw approximately 4% of her portfolio annually, adjusting for inflation. This strategy aims to provide a sustainable income stream throughout her retirement years while preserving her capital. This withdrawal rate is common, but its suitability depends on various factors, including longevity and unexpected expenses.

Common Mistakes to Avoid in Retirement Planning

Planning for retirement requires careful consideration and proactive steps. Many individuals, however, unknowingly make mistakes that can significantly impact their financial security in their later years. Understanding these common pitfalls and implementing preventative strategies is crucial for a comfortable and secure retirement.

Underestimating Retirement Expenses

Many people underestimate the true cost of retirement. They may base their calculations on their current spending habits, failing to account for increased healthcare costs, inflation, and potential unforeseen expenses. This can lead to a significant shortfall in their retirement savings. For example, someone relying solely on Social Security benefits may find that these funds are insufficient to cover their living expenses, particularly as healthcare needs increase with age. A comprehensive budget that accounts for inflation and potential healthcare expenses is vital.

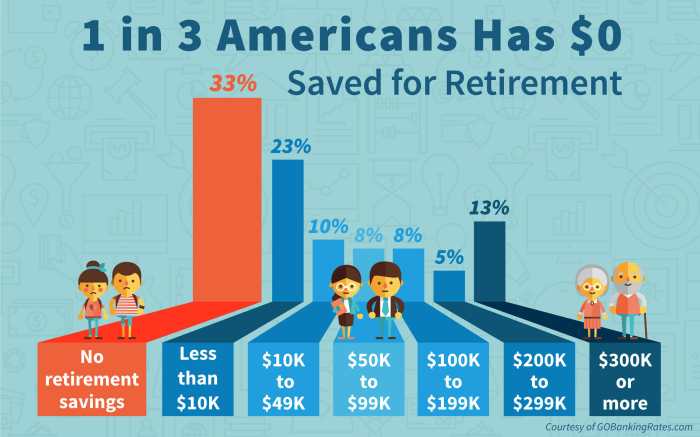

Saving Too Little, Too Late

Starting to save for retirement early is critical due to the power of compounding. Delaying saving significantly reduces the potential for growth and may necessitate much higher contributions later to reach the same retirement goal. For instance, someone who begins saving at age 30 will accumulate significantly more wealth by age 65 than someone who starts at age 50, even if they contribute the same amount annually. Utilizing retirement calculators and committing to regular contributions, even small ones, are essential strategies.

Ignoring Inflation

Inflation steadily erodes the purchasing power of money. Failing to account for inflation when planning for retirement can lead to a significant reduction in the real value of savings. For instance, $100,000 in savings today may only have the purchasing power of $70,000 in 20 years due to inflation. Adjusting savings goals and investment strategies to account for anticipated inflation rates is essential.

Failing to Diversify Investments

Concentrating investments in a single asset class, such as stocks or bonds, exposes retirement savings to significant risk. A diversified portfolio, including a mix of stocks, bonds, and potentially other asset classes, can mitigate risk and potentially enhance returns. For example, a portfolio heavily weighted in stocks could experience substantial losses during a market downturn, while a diversified portfolio would likely experience less volatility. Consulting a financial advisor to create a suitable diversified portfolio is advisable.

Not Adjusting the Investment Strategy Over Time

Investment strategies should be adjusted periodically to reflect changing life circumstances and market conditions. A strategy suitable for a young investor may not be appropriate for someone nearing retirement. For instance, a young investor might tolerate higher risk with a larger allocation to stocks, while an older investor may prefer a more conservative approach with a greater allocation to bonds. Regularly reviewing and adjusting the investment strategy based on risk tolerance and time horizon is essential.

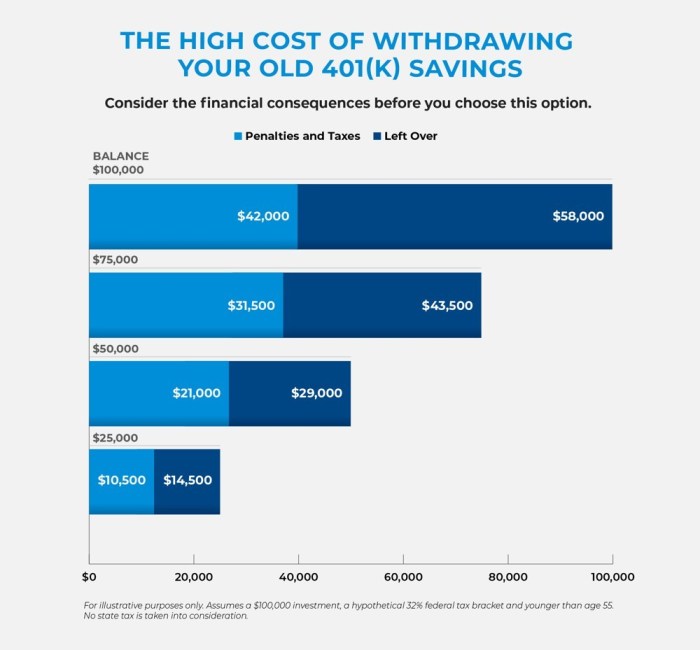

Withdrawing Retirement Savings Too Early or Too Quickly

Withdrawing retirement savings too early or too quickly can significantly deplete funds, leaving insufficient resources for later years. Penalties for early withdrawals can also further reduce the available funds. Carefully planning withdrawals to ensure a sustainable income stream throughout retirement is crucial. For example, following a systematic withdrawal plan based on life expectancy and anticipated expenses can help ensure funds last throughout retirement.

Failing to Account for Healthcare Costs

Healthcare expenses can be substantial in retirement. Failing to account for these costs can lead to a significant shortfall in retirement savings. Medicare coverage does not cover all expenses, and supplemental insurance can be costly. Developing a realistic healthcare cost projection and incorporating this into retirement planning is vital. For example, planning for long-term care expenses, which can be particularly expensive, is a crucial aspect of retirement planning.

Not Having a Contingency Plan

Unexpected events, such as job loss, illness, or market downturns, can significantly impact retirement savings. Having a contingency plan in place to address such events is essential. This might include an emergency fund, supplemental income sources, or strategies for adjusting spending during unforeseen circumstances. For example, having a plan to cover expenses if one spouse experiences a prolonged illness or job loss can significantly mitigate potential financial hardship.

Summary

Securing a comfortable retirement requires careful planning and proactive decision-making. This guide has provided a framework for understanding the various options available, from choosing the right retirement account to developing a sound investment strategy. By regularly reviewing your plan and adapting it to changing circumstances, you can increase your chances of achieving your financial goals and enjoying a fulfilling retirement. Remember, seeking professional financial advice can be invaluable in navigating this complex process and ensuring your retirement plan aligns perfectly with your unique circumstances.

Query Resolution

What is the difference between a Roth IRA and a Traditional IRA?

A Roth IRA offers tax-free withdrawals in retirement, but contributions are made after tax. A Traditional IRA allows for tax-deductible contributions, but withdrawals are taxed in retirement.

How much should I contribute to my retirement savings each year?

The ideal contribution amount depends on your income, expenses, retirement goals, and risk tolerance. Financial advisors can help determine a suitable contribution strategy.

When should I start withdrawing from my retirement accounts?

The age at which you can begin withdrawing from retirement accounts depends on the specific account type. There are also tax implications to consider, so planning ahead is essential.

What happens if I don’t have enough saved for retirement?

Insufficient retirement savings can lead to financial hardship. Consider adjusting your lifestyle, increasing contributions, or seeking financial advice to address the shortfall.