Retirement Savings Options Guide: Securing your golden years shouldn’t feel like navigating a minefield of confusing jargon and complex financial instruments. This guide aims to demystify the world of retirement planning, offering a clear and engaging exploration of the various paths to financial freedom. From understanding the nuances of 401(k)s and IRAs to exploring the potential of less conventional options, we’ll equip you with the knowledge to make informed decisions about your future. Get ready to ditch the financial anxieties and embrace a retirement filled with sunshine, margaritas (optional, but highly recommended!), and the sweet sound of financial security.

This guide covers a range of retirement savings vehicles, including defined contribution plans (like 401(k)s and 403(b)s), defined benefit plans (pensions), Individual Retirement Accounts (IRAs – both traditional and Roth), and alternative options such as annuities, HSAs, and REITs. We’ll delve into the tax implications of each, compare and contrast their features, and help you determine which strategies best align with your personal financial situation and risk tolerance. We’ll even provide illustrative examples and practical tips for managing and monitoring your savings over time.

Introduction to Retirement Savings: Retirement Savings Options Guide

Planning for retirement might sound like a distant, slightly dusty topic, something you tackle when your hair turns a delightful shade of silver (or, let’s be honest, alarmingly grey). But the truth is, the earlier you start saving for retirement, the more financially comfortable your twilight years will be. Think of it as a marathon, not a sprint; a slow and steady build-up to a golden, not-so-broke, future.

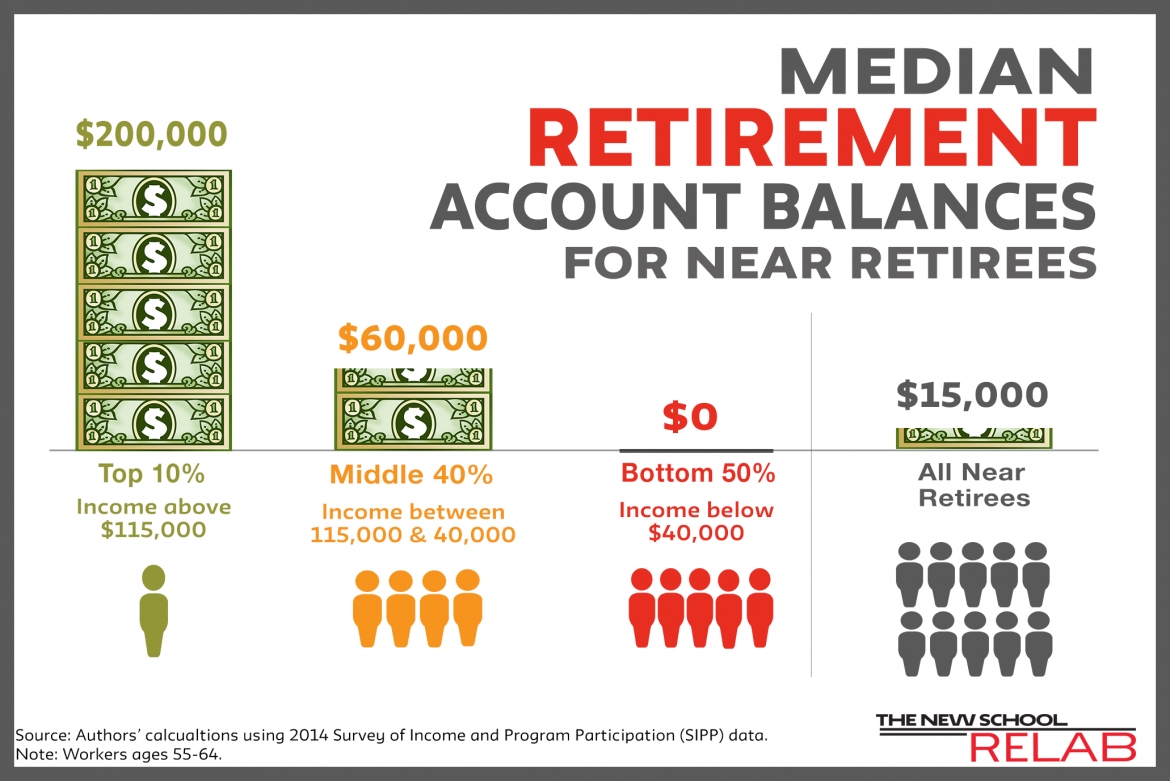

Retirement savings are crucial because relying solely on Social Security or a company pension might leave you feeling a little…underfunded. Let’s face it, nobody wants to spend their golden years fretting over finances instead of enjoying the fruits of their labor. Early planning allows for the magic of compound interest to work its wonders, turning smaller contributions into a substantial nest egg over time. This is not some magical money tree; it’s the power of consistent investment.

Types of Retirement Savings Vehicles

Several options exist for saving for retirement, each with its own set of advantages and disadvantages. Choosing the right vehicle depends on your individual circumstances, risk tolerance, and financial goals. A well-diversified approach, utilizing a combination of options, is often recommended.

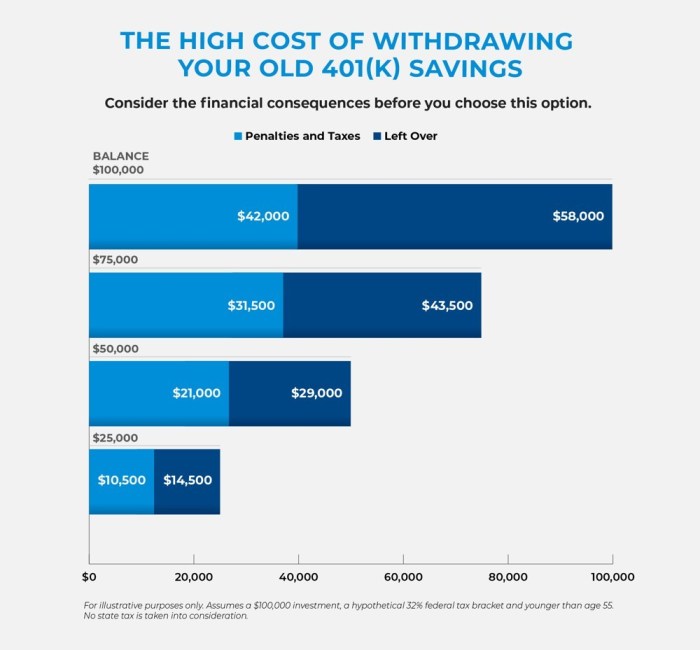

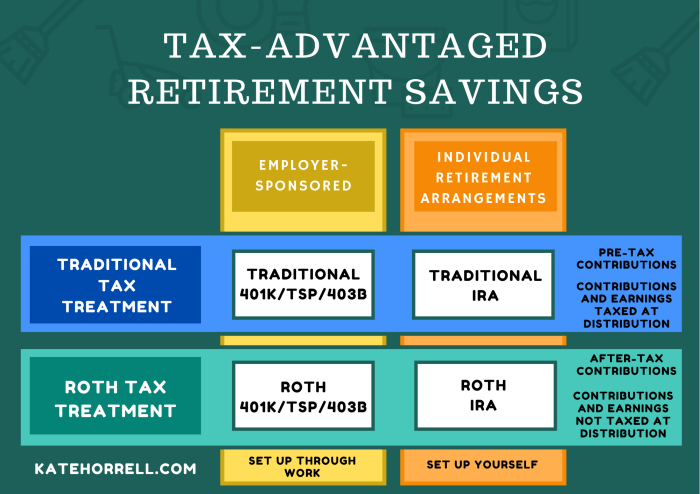

- 401(k)s and 403(b)s: These employer-sponsored plans often come with employer matching contributions, essentially free money! Think of it as a bonus for your future self. Contributions are typically pre-tax, reducing your current taxable income. However, early withdrawals often come with penalties.

- Individual Retirement Accounts (IRAs): Traditional IRAs offer similar pre-tax advantages to 401(k)s, while Roth IRAs allow for tax-free withdrawals in retirement. The choice depends on your current and projected future tax brackets. For example, if you anticipate being in a higher tax bracket in retirement, a Roth IRA might be preferable.

- Annuities: These contracts with insurance companies guarantee a stream of income during retirement. While they offer security, they often come with higher fees and less flexibility than other options. Think of it as a guaranteed monthly payment, but perhaps not the most exciting option.

Factors to Consider When Choosing a Retirement Savings Plan, Retirement Savings Options Guide

Selecting the right retirement savings plan is a personal journey, not a one-size-fits-all affair. Consider these key aspects to make an informed decision.

- Risk Tolerance: Are you a thrill-seeker who’s comfortable with potential market fluctuations, or do you prefer a more conservative approach? Your risk tolerance will influence your investment choices.

- Time Horizon: The longer you have until retirement, the more time your investments have to grow. This allows for potentially higher-risk, higher-reward strategies. Conversely, those closer to retirement may need a more conservative approach.

- Fees and Expenses: Hidden fees can significantly impact your returns over time. Carefully review the expense ratios and other fees associated with each investment option.

- Tax Implications: Understand the tax implications of each plan, considering your current and projected tax brackets. Pre-tax contributions offer immediate tax savings, while tax-free withdrawals offer benefits in retirement.

Defined Contribution Plans (401(k), 403(b), etc.)

Defined contribution plans, like the ubiquitous 401(k) and its slightly less famous cousin, the 403(b), are retirement savings vehicles where you and (sometimes) your employer contribute money to an account that you manage. Think of it as a personal retirement piggy bank, but with some seriously impressive tax benefits. These plans offer a fantastic way to build a nest egg for your golden years, provided you avoid accidentally using it as a giant, tax-advantaged piggy bank for impulse purchases.

Tax Advantages of Contributing to a 401(k) Plan

The magic of a 401(k) lies in its tax advantages. Contributions are often tax-deductible, meaning you reduce your taxable income for the year, resulting in lower taxes *now*. This is like getting a discount on saving for retirement; the government is essentially giving you a bonus for planning ahead. Furthermore, your investments grow tax-deferred, meaning you don’t pay taxes on the earnings until you withdraw them in retirement. This allows your money to compound tax-free for years, leading to potentially significant growth. It’s like a financial magic trick, but instead of a rabbit, you get a comfortable retirement.

Comparison of 401(k) and 403(b) Plans

While both 401(k)s and 403(b)s are defined contribution plans offering tax advantages, they cater to different groups. 401(k) plans are typically offered by for-profit companies to their employees, while 403(b) plans are designed for employees of public schools, non-profits, and certain other tax-exempt organizations. The main differences usually lie in the investment options offered and the contribution limits, which can vary slightly from year to year. Think of it as the same basic retirement savings plan, but with slightly different menus depending on where you work.

Sample 401(k) Investment Strategy for a Young Professional

A young professional with a long time horizon can afford to be more aggressive with their investments. A sample strategy might involve a portfolio heavily weighted towards stocks, given their higher growth potential over the long term. For instance, a young professional might allocate 80% of their 401(k) to a diversified stock index fund (tracking the S&P 500, for example) and the remaining 20% to a more conservative bond fund to provide some balance and reduce overall risk. Remember, this is just a sample, and it’s crucial to consult with a financial advisor to tailor a strategy to your specific risk tolerance and financial goals. Diversification is key; don’t put all your retirement eggs in one basket (unless that basket is magically self-replicating, of course).

Comparison of Traditional and Roth 401(k) Plans

| Feature | Traditional 401(k) | Roth 401(k) |

|---|---|---|

| Tax Treatment of Contributions | Tax-deductible now; taxed in retirement | Taxed now; tax-free in retirement |

| Tax Treatment of Withdrawals | Taxed in retirement | Tax-free in retirement |

| Best for… | Those who expect to be in a lower tax bracket in retirement | Those who expect to be in a higher tax bracket in retirement |

| Withdrawal Penalty | Applies before age 59 1/2 (with exceptions) | Applies before age 59 1/2 (with exceptions) |

Defined Benefit Plans (Pensions)

Ah, pensions! The mythical beast of retirement planning, whispered about in hushed tones by those lucky enough to have snagged one. Unlike their defined contribution cousins (those pesky 401(k)s), defined benefit plans offer a guaranteed income stream in retirement – a veritable golden goose laying eggs of monthly checks. But, like all things shiny and promising, there are caveats. Let’s delve into the delightful (and sometimes daunting) world of pensions.

Defined benefit plans are essentially a promise from your employer: “Work for us for X years, and we’ll pay you Y dollars per month in retirement.” The amount you receive (Y) is typically calculated using a formula that considers factors like your salary, years of service, and the plan’s funding status. Think of it as a meticulously crafted retirement cake, baked with years of dedication and a pinch of actuarial magic.

Vesting Periods in Defined Benefit Plans

Vesting refers to the period you must work for your employer before you own the full value of your pension benefits. Imagine it as a slow reveal of a delicious retirement pie; you get a slice, then another, until finally, the whole pie is yours. Before you’re fully vested, you might only be entitled to a portion of your accrued benefits if you leave your job. Vesting schedules vary, ranging from immediate vesting (you own everything from day one, lucky you!) to longer periods, often 5 to 10 years. Leaving your employer before vesting can mean forfeiting a significant chunk of your future retirement income – a bitter pill to swallow after years of loyal service.

Key Differences Between Defined Contribution and Defined Benefit Plans

The primary difference between these two titans of retirement savings lies in the responsibility for investment risk and the predictability of retirement income. In a defined contribution plan (like a 401(k)), you bear the investment risk – your retirement income depends entirely on the performance of your investments. It’s like playing a high-stakes game of financial roulette. Conversely, in a defined benefit plan, your employer assumes the investment risk. They promise you a specific amount, regardless of market fluctuations. This predictability offers peace of mind, but it also means your employer carries the burden of ensuring the plan’s financial health. It’s a bit like having a reliable financial butler managing your retirement funds, albeit one who might sometimes send you slightly nervous-looking financial reports. Consider this comparison:

| Feature | Defined Contribution Plan (e.g., 401(k)) | Defined Benefit Plan (Pension) |

|---|---|---|

| Risk | Employee bears investment risk | Employer bears investment risk |

| Income in Retirement | Variable, depends on investment performance | Guaranteed, based on a formula |

| Contribution | Employee contributes (and possibly employer match) | Employer contributes |

| Portability | Generally portable | Often not portable |

Individual Retirement Accounts (IRAs) – Traditional and Roth

Ah, IRAs! The unsung heroes of retirement planning, often overshadowed by their flashier 401(k) cousins. But don’t let their seemingly simple name fool you; these accounts offer a surprisingly nuanced approach to saving for your golden years, with two main flavors: Traditional and Roth. Choosing between them is like choosing between a delicious but slightly spicy jalapeno popper and a subtly sweet, perfectly ripe mango – both are good, but cater to different palates.

Traditional and Roth IRAs both offer tax advantages for retirement savings, but they handle those advantages at different stages of your life. The Traditional IRA allows you to deduct your contributions from your current taxable income, reducing your tax burden now. However, you’ll pay taxes on the withdrawals in retirement. The Roth IRA, conversely, offers tax-free withdrawals in retirement, but contributions are made with after-tax dollars. Think of it as paying your taxes upfront to enjoy tax-free withdrawals later – a strategic financial dance, if you will.

Traditional IRA versus Roth IRA

The primary difference lies in when you pay taxes: with a Traditional IRA, you pay taxes later (in retirement), while with a Roth IRA, you pay taxes now (on contributions). This seemingly small distinction has significant long-term implications depending on your current and projected future tax brackets. If you anticipate being in a higher tax bracket in retirement than you are now, a Roth IRA might be more beneficial. Conversely, if you expect to be in a lower tax bracket in retirement, a Traditional IRA might be a better choice. It’s a bit like a financial time machine, allowing you to strategically manipulate your tax burden across different life stages.

Roth IRA Income Limitations

Contributing to a Roth IRA isn’t a free-for-all; there are income limitations. These limits are adjusted annually by the IRS, so always check the most current guidelines. If your modified adjusted gross income (MAGI) exceeds a certain threshold, you may not be able to contribute the full amount, or you may be ineligible to contribute at all. For example, in 2023, single filers could make a full contribution if their MAGI was below $153,000. For married couples filing jointly, the limit was $228,000. Exceeding these limits doesn’t necessarily mean you’re shut out entirely; you might be able to make a partial contribution or consider alternative retirement savings strategies. Think of it as a VIP lounge for retirement savings – access is limited, but the rewards are significant.

Opening a Roth IRA: A Step-by-Step Guide

Opening a Roth IRA is surprisingly straightforward, much like assembling a moderately challenging piece of flat-pack furniture.

- Choose a Financial Institution: Select a brokerage firm, bank, or credit union that offers Roth IRAs. Consider factors like fees, investment options, and customer service.

- Gather Necessary Information: You’ll need your Social Security number, bank account information, and possibly your employer’s 401(k) plan information (if you’re planning to roll over funds).

- Complete the Application: Fill out the application forms provided by your chosen institution. Be accurate and thorough to avoid delays.

- Fund Your Account: Transfer funds from your bank account to your new Roth IRA. You can contribute up to a certain limit each year (this limit also changes annually, so check the IRS website).

- Choose Your Investments: Select investments that align with your risk tolerance and retirement goals. This could range from low-risk bonds to higher-risk stocks.

Tax Implications of Traditional and Roth IRAs

Understanding the tax implications is crucial for making an informed decision. Here’s a concise summary:

- Traditional IRA:

- Contributions are tax-deductible (depending on income and other factors).

- Earnings grow tax-deferred.

- Withdrawals in retirement are taxed as ordinary income.

- Roth IRA:

- Contributions are not tax-deductible.

- Earnings grow tax-free.

- Qualified withdrawals in retirement are tax-free.

Other Retirement Savings Vehicles

Beyond the usual suspects of 401(k)s and IRAs, a savvy retirement planner knows that diversification is key – think of it as a financial Swiss Army knife, ready for any retirement challenge. While these traditional vehicles are crucial, exploring alternative options can significantly boost your golden years’ comfort level (and maybe even fund that dream cruise to Antarctica). Let’s delve into some less-discussed, yet potentially lucrative, avenues for building your retirement nest egg.

Annuities: A Detailed Look

Annuities, often described as insurance products that provide a stream of income, can be a complex beast. Essentially, you pay a lump sum or make regular payments into an annuity, and the insurance company guarantees a certain level of income starting at a future date. Fixed annuities offer a predictable return, but this predictability often comes at the cost of lower potential growth. Variable annuities, on the other hand, invest in a portfolio of assets, offering the potential for higher returns but also higher risk. Consider the potential tax implications and surrender charges before jumping in – those can sting like a jellyfish on a sunny beach. Remember, while annuities can provide guaranteed income, they often come with hefty fees. Careful consideration of your risk tolerance and financial goals is paramount.

Health Savings Accounts (HSAs) and Retirement Planning

While primarily designed for current healthcare expenses, HSAs can play a surprisingly significant role in retirement planning. Contributions are tax-deductible, grow tax-free, and withdrawals for qualified medical expenses are also tax-free. This triple tax advantage makes HSAs a powerful tool for long-term savings. Think of it as a retirement account with a health-focused twist. By strategically using an HSA to cover medical expenses in retirement, you can free up other retirement funds for non-medical expenses, potentially increasing your overall retirement income. For example, a retiree might use HSA funds for Medicare premiums, reducing their reliance on other retirement accounts for these crucial expenses.

Real Estate Investment Trusts (REITs) for Retirement Income

REITs are companies that own or finance income-producing real estate. Investing in REITs offers a way to participate in the real estate market without directly owning property. They often pay high dividends, providing a steady stream of income in retirement. However, REITs are subject to market fluctuations, meaning their value can go up and down. Consider REITs as part of a diversified portfolio to balance risk and reward. For example, a retiree might allocate a portion of their retirement portfolio to REITs to supplement their other income sources, benefiting from both potential capital appreciation and regular dividend payments. Think of it as owning a piece of many different properties, reducing the risks associated with owning just one.

Investment Strategies for Retirement

Planning your retirement investments is like choosing a flavor of ice cream – there’s a vast selection, and finding the perfect match for your palate (risk tolerance) is key. This section explores various investment strategies, demonstrating how different approaches cater to diverse risk appetites. Remember, a well-structured investment plan isn’t about getting rich quick; it’s about steadily building wealth over time to ensure a comfortable retirement.

Risk Tolerance and Investment Strategies

Your investment strategy should directly reflect your comfort level with risk. A higher risk tolerance generally means a higher potential for returns, but also a greater chance of losses. Conversely, a conservative approach prioritizes capital preservation over potentially higher gains. Matching your investment choices to your personality and financial situation is crucial for long-term success. Ignoring your risk tolerance can lead to sleepless nights (and potentially, empty retirement accounts).

Sample Portfolio Allocations

Let’s illustrate this with three sample portfolio allocations: conservative, moderate, and aggressive. These are merely examples, and your ideal allocation will depend on your individual circumstances, time horizon, and goals. It’s always advisable to consult with a qualified financial advisor for personalized guidance.

| Asset Class | Conservative (Low Risk) | Moderate (Medium Risk) | Aggressive (High Risk) |

|---|---|---|---|

| Bonds (Government & Corporate) | 70% | 40% | 20% |

| Stocks (Large-Cap) | 20% | 30% | 40% |

| Stocks (Small-Cap) | 0% | 10% | 20% |

| Real Estate (REITs or Direct Ownership) | 10% | 10% | 10% |

| Alternative Investments (e.g., commodities) | 0% | 10% | 10% |

For example, a conservative investor might prioritize safety and stability, allocating a significant portion to low-risk government bonds. A moderate investor might seek a balance between risk and return, diversifying across stocks and bonds. An aggressive investor, comfortable with higher volatility, might invest heavily in stocks and alternative investments with the potential for substantial growth, but also the risk of significant losses.

The Importance of Diversification

Diversification is the practice of spreading your investments across different asset classes to reduce risk. It’s like not putting all your eggs in one basket – if one investment performs poorly, others might offset the losses. A diversified portfolio reduces the impact of market fluctuations and increases the chances of achieving your long-term financial goals. Imagine a portfolio heavily invested in only one company; if that company fails, your retirement savings could be severely impacted. Diversification helps mitigate this risk.

“Don’t put all your eggs in one basket.” – A timeless proverb, perfectly applicable to retirement investing.

Managing and Monitoring Retirement Savings

Retirement planning isn’t a “set it and forget it” kind of deal; it’s more like tending a slightly temperamental garden. Regular monitoring and adjustments are crucial to ensuring your golden years bloom beautifully, rather than wilting under the weight of unforeseen circumstances. Think of it as financial gardening – a bit of weeding, some fertilizing, and the occasional pest control (aka, adjusting your strategy) are all part of the process.

Regularly reviewing your retirement savings is as important as remembering to water your prize-winning petunias. Ignoring them might lead to a less-than-desirable outcome – a retirement that’s a little less lush than you envisioned. Fortunately, a well-structured plan and consistent monitoring can help avoid this horticultural horror.

Retirement Savings Review Checklist

A proactive approach to managing your retirement nest egg involves regular check-ups. This isn’t about obsessing over daily fluctuations; it’s about strategically assessing your progress and making informed adjustments. Think of it as a financial health check-up, not a financial panic attack.

- Annual Review: At least once a year, review your investment performance, account balances, and contribution amounts. Compare your progress to your retirement goals. Did you hit your targets? If not, what adjustments need to be made?

- Contribution Adjustments: Assess whether your contributions are still aligned with your goals. Life changes, such as a pay raise or a change in family circumstances, might necessitate adjusting your contribution rate. Remember, even small increases can make a big difference over time, like the slow but steady growth of a mighty oak tree.

- Investment Allocation Review: Your risk tolerance and time horizon may change as you get closer to retirement. Review your investment mix and consider shifting to a more conservative strategy. This isn’t about suddenly becoming risk-averse, but about strategically reducing volatility as the finish line approaches.

- Fee Analysis: Keep an eye on the fees associated with your retirement accounts. High fees can significantly eat into your returns. Shop around for lower-cost options if necessary. Remember, even small savings add up over time, just like those pennies you’ve been saving in a jar since 1987.

- Withdrawal Planning (Approaching Retirement): As you approach retirement, start planning your withdrawal strategy. Consider factors like your expected expenses, longevity, and tax implications. It’s like planning a grand picnic – you need to know how much food to bring for everyone!

Adjusting Investment Strategy Near Retirement

As retirement nears, the landscape of your investment strategy shifts. It’s like transitioning from a high-octane sports car to a comfortable, reliable sedan. The thrill of high-risk, high-reward investments becomes less appealing as the need for capital preservation increases. This isn’t about abandoning growth entirely; it’s about carefully managing risk to ensure your nest egg remains safe and secure.

The goal is to transition to a more conservative portfolio, reducing exposure to volatile assets like stocks and increasing the allocation to safer investments such as bonds and fixed-income securities. This doesn’t necessarily mean a complete sell-off of your stocks, but a gradual shift in allocation to minimize potential losses during the crucial years leading up to and during retirement. Imagine it like carefully swapping out your high-risk, high-reward investments for those that are more stable and provide a steady income stream.

For example, a 60-year-old might reduce their stock allocation from 70% to 50%, shifting the remaining 20% to bonds and other fixed-income investments. This gradual shift helps to protect against significant market downturns while still allowing for some growth potential.

Withdrawing Funds from Retirement Accounts

Accessing your hard-earned retirement funds is a significant milestone, but it’s crucial to do it strategically to avoid unnecessary tax burdens and penalties. It’s like finally harvesting the fruits of your labor – you want to savor the sweetness without accidentally spoiling the entire batch.

The rules governing withdrawals vary depending on the type of retirement account. For example, withdrawals from traditional IRAs are generally taxed as ordinary income, while withdrawals from Roth IRAs are typically tax-free. Early withdrawals from many accounts may incur penalties, so it’s crucial to understand the specific rules of your accounts. Consult a financial advisor to create a withdrawal strategy tailored to your individual circumstances. This is not a DIY project; professional guidance can save you from costly mistakes. They can help you navigate the complexities of tax laws and ensure you maximize your retirement income.

Illustrative Example: Retirement Savings Plan for a Couple

Let’s craft a retirement plan for a hypothetical couple, Bartholomew and Guinevere, to illustrate the principles we’ve discussed. Bartholomew, a surprisingly agile accountant, and Guinevere, a remarkably organized librarian, are both 35 years old and aiming for a comfortable retirement at age 65. Their current combined annual income is $150,000, and they’re ready to take their financial future seriously (finally!).

Retirement Goals and Time Horizon

Bartholomew and Guinevere envision a retirement where they can travel extensively, pursue hobbies (Bartholomew dreams of competitive cheese-rolling, Guinevere of competitive book-binding), and maintain their current lifestyle without significant financial strain. Their time horizon is 30 years, allowing for a longer-term investment strategy. They estimate they’ll need $2,000,000 in retirement savings to achieve their goals. This figure accounts for inflation and anticipated healthcare costs, a surprisingly accurate prediction based on their meticulous budgeting habits and a surprisingly insightful crystal ball gifted to Bartholomew by a grateful client.

Income and Expenses

Their annual income is $150,000. After taxes and essential expenses (mortgage, groceries, surprisingly expensive cat insurance for their fluffy Persian, Mittens), they have approximately $50,000 available for savings and investments each year. This represents a significant portion of their income, showcasing their commitment to securing a comfortable future. Their budget is detailed and color-coded (Guinevere’s influence), a testament to their organized approach to finance.

Asset Allocation and Risk Tolerance

Given their long time horizon, Bartholomew and Guinevere can tolerate a moderate level of risk. Their asset allocation strategy will be diversified across stocks (60%), bonds (30%), and real estate (10%). This balanced approach aims to maximize returns while mitigating potential losses. The stock portion will be further diversified across various sectors and market capitalizations, ensuring a well-rounded investment portfolio, much like a well-stocked library.

Contribution Strategies

They plan to maximize contributions to their employer-sponsored 401(k) plans. Bartholomew’s company offers a generous matching program, which they will fully utilize. In addition, they will contribute the maximum amount allowed to Roth IRAs each year, taking advantage of the tax advantages offered by this account type. They will also allocate a portion of their savings to a taxable brokerage account for additional investment opportunities. This multi-pronged approach maximizes their savings potential, much like a librarian carefully categorizing books for optimal access.

Investment Strategy and Monitoring

Their investment strategy focuses on long-term growth. They will utilize low-cost index funds and ETFs to achieve diversification and minimize expenses. They will review their portfolio annually, adjusting the asset allocation as needed based on their risk tolerance and market conditions. They’ve also set up automatic rebalancing to maintain their desired asset allocation, minimizing emotional decision-making during market fluctuations. This systematic approach, inspired by Bartholomew’s accounting precision, ensures their investments remain aligned with their goals.

Glossary of Key Terms

Navigating the world of retirement savings can feel like deciphering a secret code, filled with jargon that could make a seasoned linguist sweat. Fear not, dear reader! This glossary provides clear and (dare we say) entertaining definitions to help you conquer the retirement savings lexicon. We’ve even thrown in a few jokes to keep things lively. Because let’s face it, retirement planning shouldn’t be all doom and gloom.

Key Terms Explained

The following table provides definitions for common terms encountered when planning for retirement. Understanding these terms is crucial for making informed decisions about your financial future. Remember, a little knowledge can go a long way – especially when it comes to securing your golden years.

| Term | Definition | Example | Funny Analogy |

|---|---|---|---|

| 401(k) | A defined contribution retirement plan sponsored by employers. Employees contribute a portion of their pre-tax salary, often with employer matching. | An employee contributes 5% of their salary, and their employer matches 2.5%. | Like a piggy bank your boss helps fill, but you need to put in your own coins first! |

| 403(b) | Similar to a 401(k), but offered by non-profit organizations, such as schools and hospitals. | A teacher contributes to their 403(b) plan to supplement their pension. | Think of it as a 401(k) with a slightly more altruistic vibe. |

| Defined Benefit Plan (Pension) | A retirement plan where the employer promises a specific monthly payment upon retirement, based on factors like salary and years of service. Sadly, these are becoming less common. | A retiree receives a monthly pension check of $2,000. | Like a guaranteed monthly allowance from your former employer – a delightful, if increasingly rare, treat. |

| IRA (Individual Retirement Account) | A retirement savings account that individuals can contribute to, offering tax advantages. There are traditional and Roth variations. | An individual contributes $6,000 annually to their IRA. | Your own personal retirement nest egg, carefully built over time. |

| Traditional IRA | Contributions are tax-deductible, but withdrawals in retirement are taxed. | Contributions reduce current taxable income, but future withdrawals are taxed. | Like paying less taxes now, but paying later when you are hopefully richer! |

| Roth IRA | Contributions are not tax-deductible, but withdrawals in retirement are tax-free. | Contributions are made after tax, but future withdrawals are tax-free. | Paying taxes now to avoid them later – a bit like paying for peace of mind. |

| Vesting | The right to receive employer contributions to a retirement plan, usually after a certain number of years of service. | An employee is fully vested after five years of employment. | Think of it as earning the right to claim your employer’s retirement contributions – no more leaving money on the table! |

| Asset Allocation | The process of dividing your investment portfolio among different asset classes (stocks, bonds, real estate, etc.) to balance risk and return. | A portfolio might be 60% stocks and 40% bonds. | Like a carefully balanced cocktail – a bit of everything to achieve the perfect blend of flavor and kick. |

| Diversification | Spreading investments across different assets to reduce risk. Don’t put all your eggs in one basket! | Investing in a variety of stocks, bonds, and mutual funds. | Not putting all your retirement hopes in one company, ensuring a more resilient portfolio. |

| Annuities | Financial products that provide a stream of income during retirement. | A retiree purchases an annuity to guarantee a steady income stream. | A bit like a pension, but with a bit more flexibility, though often less generous. |

Last Recap

Planning for retirement might seem daunting, but with the right knowledge and a proactive approach, securing a comfortable future is entirely achievable. This Retirement Savings Options Guide has provided you with a comprehensive overview of the various avenues available, empowering you to make informed decisions tailored to your unique circumstances. Remember, the journey to financial security is a marathon, not a sprint – so start planning early, stay consistent, and enjoy the fruits of your labor in your well-deserved retirement. Now, go forth and plan a fantastic retirement! You deserve it.

Questions and Answers

What’s the difference between a traditional IRA and a Roth IRA?

A traditional IRA offers tax deductions on contributions, but withdrawals are taxed in retirement. A Roth IRA has no upfront tax deduction, but withdrawals are tax-free in retirement.

When should I start contributing to a retirement account?

The sooner the better! The power of compounding means that even small contributions early on can significantly grow over time.

Can I contribute to both a 401(k) and an IRA?

Yes, provided you meet the income limits for IRA contributions.

What is asset allocation, and why is it important?

Asset allocation is the diversification of your investments across different asset classes (stocks, bonds, etc.) to manage risk and potentially enhance returns. It’s crucial for long-term growth.

How often should I review my retirement savings plan?

At least annually, or more frequently if your circumstances change significantly (e.g., job change, marriage, birth of a child).