Retirement Savings Options Guide: Facing retirement can feel like navigating a minefield of financial jargon and confusing choices. But fear not, intrepid saver! This guide isn’t just another dry recitation of facts; it’s your passport to a financially secure and (dare we say it?) *fun* retirement. We’ll unravel the mysteries of 401(k)s, IRAs, and other exotic retirement beasts, leaving you armed with the knowledge to make informed decisions and secure your future hammock-swinging days. Prepare for a journey filled with surprisingly delightful insights into the world of retirement planning – because let’s face it, even saving for the future can be an adventure.

This guide will walk you through the various retirement savings vehicles available, helping you understand the tax implications, contribution limits, and investment strategies involved. We’ll explore the pros and cons of different options, from traditional and Roth IRAs to 401(k) plans and even more unconventional choices. By the end, you’ll be well-equipped to craft a retirement plan that aligns perfectly with your financial goals and risk tolerance, allowing you to confidently plan for a relaxing and fulfilling retirement.

Introduction to Retirement Savings

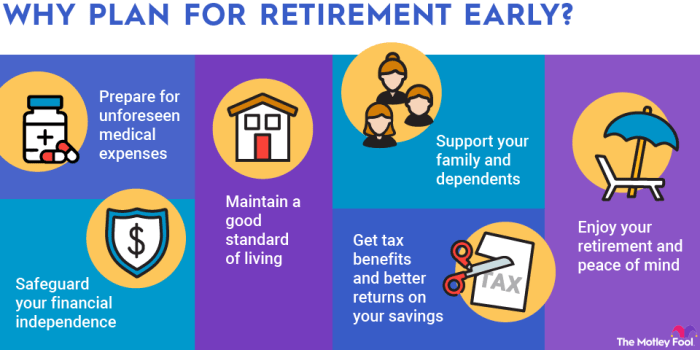

Planning for retirement might sound like a distant humdrum, a song for your future self, but trust us, your future self will thank you profusely (and possibly buy you a very nice retirement home). The earlier you start saving, the more time your money has to grow, thanks to the magic of compound interest – a financial fairy godmother, if you will. Ignoring this crucial life stage is akin to leaving your most important vacation planning to the last minute – expect chaos and potentially a less-than-ideal outcome.

Retirement savings aren’t just about having enough money to pay the bills; it’s about securing the lifestyle you envision for your golden years. Do you dream of leisurely cruises, volunteer work in exotic locations, or simply relaxing on your porch with a good book? These dreams require financial fuel, and that fuel is diligently saved retirement funds.

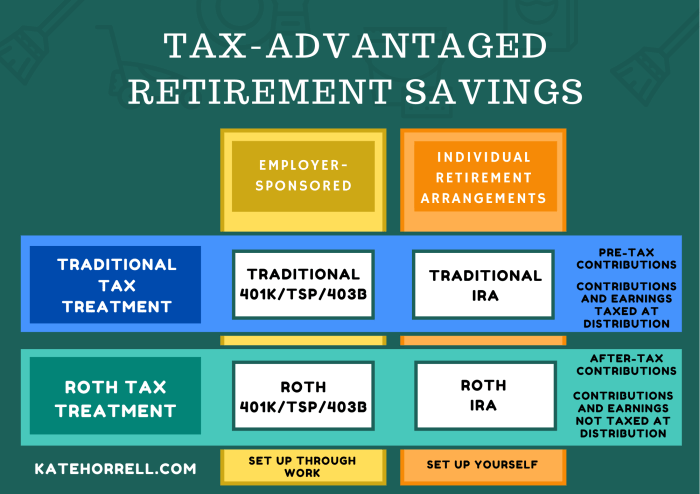

Types of Retirement Savings Vehicles

A diverse range of options exists to help you achieve your retirement goals. Each vehicle has its own set of rules, benefits, and drawbacks, and choosing the right mix is key. Understanding these options allows for a personalized approach, ensuring your retirement savings plan is tailored to your specific circumstances and risk tolerance.

- 401(k)s and 403(b)s: These employer-sponsored plans often offer matching contributions, essentially free money! Think of it as your employer’s way of saying, “We want you to retire comfortably!”

- Individual Retirement Accounts (IRAs): Traditional and Roth IRAs offer tax advantages, allowing you to either deduct contributions now or withdraw funds tax-free in retirement. Choosing between them depends on your current and projected tax bracket – a financial advisor can help navigate this.

- Annuities: These contracts offer a guaranteed stream of income in retirement, providing a sense of security and predictability. However, they often come with fees and limitations, so careful consideration is needed.

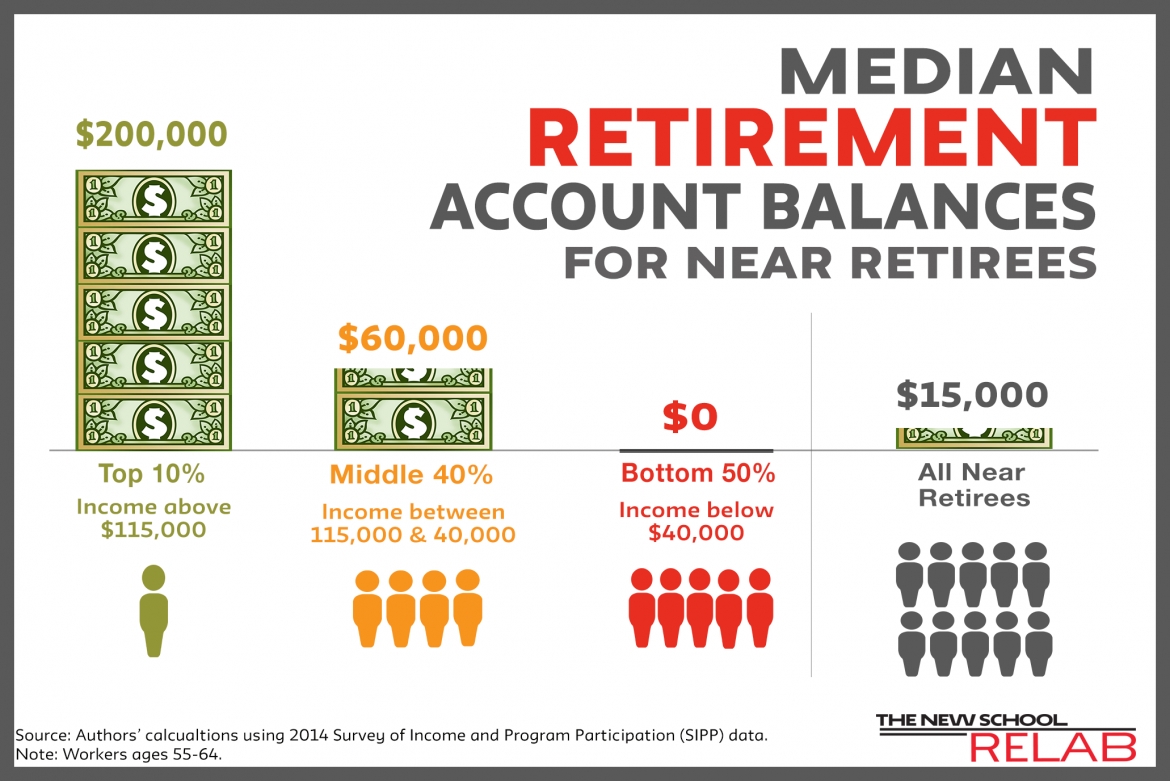

Average Retirement Savings and Income Needs

Let’s face it: The statistics can be a bit sobering. The average American nearing retirement age often has significantly less saved than what’s generally recommended. For example, a recent study might show that the median retirement savings for those aged 55-64 is considerably lower than the amount needed to maintain a similar lifestyle in retirement. This shortfall highlights the importance of starting early and saving consistently. Consider this: the amount needed for retirement is often estimated to be a multiple of your final working year’s income, varying based on lifestyle expectations and longevity. Let’s say your final income is $70,000. You might need $2.5 million to maintain a similar standard of living in retirement. This is a broad estimate and can change based on several factors, but it showcases the significance of long-term savings.

“Failing to plan is planning to fail.” – A proverb so true, it hurts.

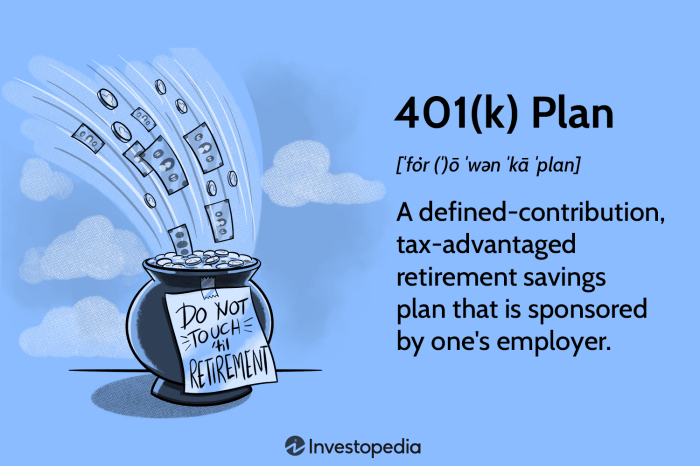

Defined Contribution Plans (401(k), 403(b), etc.): Retirement Savings Options Guide

Defined contribution plans, like the ubiquitous 401(k) and its slightly less famous cousin, the 403(b), are retirement savings vehicles where you and (sometimes) your employer contribute money to an account that you manage. Think of it as your personal retirement piggy bank, but with significantly more sophisticated investment options than your average piggy bank (unless your piggy bank is, inexplicably, also a high-yield savings account. In that case, we salute you). The beauty of these plans lies in their flexibility and tax advantages, making them a cornerstone of many retirement strategies.

Tax Advantages of Contributing to a 401(k) Plan

Contributing to a 401(k) offers significant tax advantages. For traditional 401(k)s, contributions are typically made pre-tax, meaning you reduce your taxable income for the current year. This results in lower taxes *now*, which can be a considerable benefit, especially in higher tax brackets. Your investments grow tax-deferred, meaning you don’t pay taxes on investment gains until you withdraw the money in retirement. Think of it as a tax-sheltered oasis in the desert of your tax liability. This deferral can lead to substantial long-term savings. Roth 401(k)s offer a different twist, allowing you to contribute after-tax dollars, but withdrawals in retirement are tax-free. It’s a delicious retirement sandwich, where the bread is tax-free.

Traditional 401(k)s vs. Roth 401(k)s

The choice between a traditional and Roth 401(k) depends heavily on your current and projected future tax brackets. If you expect to be in a lower tax bracket in retirement than you are now, a traditional 401(k) might be more advantageous, allowing you to pay taxes at a lower rate later. Conversely, if you anticipate being in a higher tax bracket in retirement, a Roth 401(k) offers the benefit of tax-free withdrawals. Consider your financial crystal ball – what does it foresee for your future tax situation?

Investment Options in 401(k) Plans

Most 401(k) plans offer a variety of investment options, allowing you to tailor your portfolio to your risk tolerance and retirement goals. Common choices include mutual funds (a diversified collection of investments), index funds (which track a specific market index), and sometimes individual stocks or bonds. Some plans also offer target-date funds, which automatically adjust the asset allocation based on your retirement date. Remember, the goal is not to pick the *winning* investment, but to build a diversified portfolio that aligns with your comfort level and time horizon. Avoid putting all your retirement eggs in one basket, unless that basket is made of unbreakable adamantium and is constantly monitored by a team of highly trained financial eagles.

Fees and Contribution Limits for Different 401(k) Plans

The fees and contribution limits for 401(k) plans can vary depending on your employer’s specific plan. It’s crucial to understand these factors before making contributions.

| Plan Type | Annual Contribution Limit (2024) | Typical Expense Ratio Range | Administrative Fees (Example) |

|---|---|---|---|

| Traditional 401(k) | $23,000 (plus $7,500 catch-up for those age 50+) | 0.05% – 1.5% | Varies widely; check your plan documents. |

| Roth 401(k) | $23,000 (plus $7,500 catch-up for those age 50+) | 0.05% – 1.5% | Varies widely; check your plan documents. |

| 403(b) | $23,000 (plus $7,500 catch-up for those age 50+) | 0.05% – 1.5% | Varies widely; check your plan documents. |

Individual Retirement Accounts (IRAs)

Ah, IRAs! The very words conjure images of sun-drenched beaches and leisurely retirement pursuits – or at least, that’s the dream. But before you start picturing yourself sipping margaritas on a yacht (fueled entirely by tax-advantaged savings, naturally), let’s navigate the sometimes-murky waters of Traditional and Roth IRAs. Understanding the key differences is crucial to maximizing your retirement nest egg and avoiding a tax-induced shipwreck.

IRAs offer a powerful way to save for retirement, allowing you to shelter your earnings from immediate taxation (in the case of a Traditional IRA) or to withdraw your earnings tax-free in retirement (in the case of a Roth IRA). The choice between a Traditional and a Roth IRA depends heavily on your current tax bracket and your projected tax bracket in retirement. It’s a bit like choosing between a delicious, but immediately expensive, cake versus a smaller, less immediately appealing cupcake that grows into a magnificent cake later on.

Traditional IRA vs. Roth IRA

The core difference lies in when you pay taxes. With a Traditional IRA, contributions are tax-deductible in the year you make them, reducing your current taxable income. However, withdrawals in retirement are taxed as ordinary income. A Roth IRA, conversely, involves contributing after-tax dollars, meaning no immediate tax break. But the reward? Tax-free withdrawals in retirement! Think of it as paying your taxes upfront to enjoy a tax-free retirement feast. Choosing wisely depends on whether you believe your tax bracket will be higher now or later in life.

Roth IRA Income Limitations

Unfortunately, the Roth IRA isn’t a free-for-all. There are income limitations. If your modified adjusted gross income (MAGI) exceeds a certain threshold, you may not be able to contribute the full amount, or you might be ineligible altogether. These limits are adjusted annually by the IRS and vary depending on your filing status (single, married filing jointly, etc.). Failing to meet these requirements could result in penalties. Think of it as a VIP lounge for retirement savings – you need the right credentials to enter.

Tax Implications of IRA Withdrawals

The tax consequences of withdrawals depend entirely on the type of IRA. With a Traditional IRA, withdrawals of contributions are tax-free, but withdrawals of earnings are taxed as ordinary income. Roth IRA withdrawals of contributions and qualified withdrawals of earnings are completely tax-free. The term “qualified” refers to withdrawals made after age 59 1/2 and after at least five years of contributions. Early withdrawals from either type of IRA may be subject to penalties, unless specific exceptions apply. It’s a bit like a delicious, carefully-guarded treasure chest – access requires following the rules.

IRA Contribution Limits and Deadlines

Staying within the contribution limits is key to avoiding penalties. The annual contribution limits are set by the IRS and adjusted periodically. Missing the deadline can also lead to penalties. It’s like a very important birthday – you don’t want to forget it.

- Annual Contribution Limit: This limit changes annually and is the maximum amount you can contribute to either a Traditional or Roth IRA in a given year.

- Deadline: The deadline for contributions is typically the tax filing deadline (April 15th, or the next business day if the 15th falls on a weekend or holiday) unless you choose to file for an extension. This extension applies to filing your taxes, not necessarily to making your IRA contributions.

- Catch-Up Contributions: Individuals age 50 and older are often allowed to make additional “catch-up” contributions, increasing their maximum contribution amount.

Other Retirement Savings Vehicles

Beyond the usual suspects of 401(k)s and IRAs, a colorful cast of characters awaits in the world of retirement savings. These options, while potentially lucrative, require a discerning eye and a healthy dose of understanding. Let’s dive into some of the more… *interesting* choices.

Annuities: A Retirement Riddle Wrapped in an Insurance Policy

Annuities, those enigmatic financial instruments, offer a guaranteed stream of income in retirement. Think of them as a pension plan you design yourself. You pay a lump sum or make regular contributions, and the insurance company promises to pay you back, often with interest, over a set period or for life. The appeal is obvious: guaranteed income, shielding you from market volatility. However, the devil, as they say, is in the details. Annuities often come with high fees and surrender charges, meaning you might pay a hefty penalty for withdrawing your money early. Furthermore, the returns might not always outpace inflation, leaving you with less purchasing power than you initially anticipated. Choosing the right annuity requires careful consideration of your risk tolerance, time horizon, and, perhaps most importantly, the fine print.

Health Savings Accounts (HSAs): A Double-Duty Retirement Booster

HSAs are often overlooked as retirement savings vehicles, but they deserve a spot in the limelight. Designed to help pay for qualified medical expenses, contributions are tax-deductible, and the money grows tax-free. The best part? After age 65, you can withdraw the funds for any purpose, penalty-free. So, not only do you have a dedicated fund for current healthcare costs, but you also have a growing nest egg for retirement, providing a buffer against potentially skyrocketing medical expenses later in life. Consider it a retirement savings plan with a built-in health insurance discount. However, remember that HSAs are only available to those enrolled in high-deductible health plans, so eligibility is a crucial factor.

Real Estate Investment Trusts (REITs): Bricks and Mortar for Your Golden Years

REITs offer a unique way to participate in the real estate market without the hassle of directly owning and managing properties. These publicly traded companies own and operate income-producing real estate, such as apartment buildings, office complexes, or shopping centers. They are required to distribute a significant portion of their income as dividends, providing a steady stream of cash flow to investors. This can be a valuable addition to your retirement portfolio, offering diversification and potential for higher returns than traditional bonds. However, REITs are subject to market fluctuations, and their performance can be sensitive to interest rate changes and economic downturns. Diversification within your REIT investments is therefore highly recommended.

Comparison of Retirement Savings Vehicles

| Feature | Annuities | HSAs | REITs |

|---|---|---|---|

| Guaranteed Income | Yes (depending on type) | No | No |

| Tax Advantages | Tax-deferred growth (often) | Tax-deductible contributions, tax-free growth and withdrawals (for qualified medical expenses) | Dividend income may be taxed |

| Risk Level | Moderate to Low (depending on type); High fees possible | Low | Moderate to High |

| Liquidity | Low (penalties for early withdrawal) | Moderate (penalties for non-medical withdrawals before 65) | High (publicly traded) |

Investment Strategies for Retirement

Planning your retirement investments is like choosing your adventure – except instead of battling dragons, you’re battling inflation and the unpredictable whims of the market. The goal? A comfortable nest egg large enough to support your golden years without resorting to eating cat food (unless you *really* like cat food). Let’s explore some strategies to help you achieve this.

Diversified Investment Portfolios for Different Risk Tolerances

A diversified portfolio is your financial shield against market volatility. It’s about spreading your investments across different asset classes to reduce risk. Think of it as not putting all your eggs in one basket – unless that basket is magically self-replicating, in which case, go for it!

- Conservative Portfolio (Low Risk): A conservative investor prioritizes capital preservation over high returns. A suitable allocation might be 70% bonds (government and corporate), 20% large-cap stocks (established companies), and 10% cash. This strategy minimizes potential losses but also offers lower growth potential. Think of it as a steady, reliable tortoise in the investment race.

- Moderate Portfolio (Medium Risk): This balanced approach aims for a mix of growth and stability. A possible allocation could be 40% stocks (a mix of large-cap, mid-cap, and small-cap), 40% bonds, and 20% cash. This strategy offers a more dynamic growth potential than a conservative portfolio, while still incorporating risk mitigation.

- Aggressive Portfolio (High Risk): Aggressive investors are comfortable with higher volatility in pursuit of potentially greater returns. An example might be 70% stocks (including international stocks and potentially emerging markets), 20% real estate investment trusts (REITs), and 10% alternative investments (such as commodities). This is like the hare in the race – potentially faster, but with a higher chance of stumbling.

The Importance of Asset Allocation in Retirement Planning

Asset allocation is the cornerstone of successful retirement planning. It’s the strategic distribution of your investments across different asset classes (stocks, bonds, real estate, etc.). Proper asset allocation helps manage risk, align your portfolio with your risk tolerance, and strive for optimal returns over the long term. It’s not about picking individual stocks – it’s about building a well-structured investment framework. Think of it as building a house – you wouldn’t use only bricks, right? You need a solid foundation and various materials to create a sturdy and comfortable structure.

Calculating a Retirement Savings Goal Based on Desired Income

Determining your retirement savings goal requires a bit of financial forecasting, but don’t worry, it’s not as daunting as it sounds. A common approach involves estimating your desired annual retirement income and then calculating the lump sum needed to generate that income through investments.

The formula is somewhat complex, but a simplified version is: Savings Goal = (Desired Annual Income * Years in Retirement) / (Estimated Annual Investment Return).

For example, if you want $50,000 annually for 20 years, and expect a 5% annual return, your savings goal would be approximately $666,667. This is a simplified example and doesn’t account for inflation or taxes. Consulting a financial advisor is always recommended for personalized planning.

Sample Asset Allocation Strategy for a Conservative Investor

Imagine a pie chart. This pie represents a conservative investor’s portfolio. Approximately 70% of the pie is a rich, deep blue, representing the steady and reliable bonds. A smaller, but still significant, slice of about 20% is a light green, representing the large-cap stocks. Finally, a small sliver of 10% is a pale yellow, signifying the cash reserves. This visual representation demonstrates a well-balanced, low-risk strategy, focusing on capital preservation and a steady income stream. The color coding is purely for illustrative purposes – your pie chart might look differently depending on your actual investment choices.

Managing Retirement Savings and Withdrawals

Retirement: you’ve diligently saved, invested, and (hopefully) avoided any questionable get-rich-quick schemes involving exotic birds. Now comes the fun part – actually enjoying the fruits of your labor. But managing those savings and withdrawals requires a bit more finesse than simply raiding your piggy bank. This section will guide you through the process, ensuring a smooth transition into your golden years (and avoiding any unexpected tax-related wrinkles).

Rolling Over a 401(k) to an IRA, Retirement Savings Options Guide

Transferring your 401(k) to an IRA is a common strategy, offering greater investment flexibility and potentially lower fees. The process generally involves contacting your current 401(k) provider to initiate a direct rollover to your chosen IRA provider. This direct rollover avoids the potential tax penalties associated with a withdrawal. Remember, it’s best to consult a financial advisor to determine if a rollover is right for your individual circumstances, considering factors like the existing fees in your 401(k) plan versus those charged by your IRA provider. Failing to do your homework could leave you with a bigger headache than a particularly stubborn tax form.

Strategies for Managing Withdrawals During Retirement to Minimize Tax Liability

Minimizing your tax burden during retirement is crucial for maximizing your enjoyment of those hard-earned funds. One key strategy is to carefully manage your withdrawals to stay within the appropriate tax brackets. This may involve withdrawing a smaller amount annually, thereby keeping your taxable income low. Another approach is to diversify your income sources, potentially using a combination of withdrawals from tax-advantaged accounts (like your IRA) and taxable accounts. This can help spread your taxable income over a wider range. Remember, consult a qualified tax professional; they’re not just for people who accidentally filed their taxes upside down.

The Potential Impact of Inflation on Retirement Savings

Inflation, the insidious creep of rising prices, is a silent threat to your retirement nest egg. Over time, inflation erodes the purchasing power of your savings. For example, if your retirement savings can buy a certain number of groceries today, that same amount might only buy a fraction of those groceries in 20 years due to inflation. To combat this, consider investing in assets that tend to outpace inflation, such as stocks or inflation-protected securities. Diversification across different asset classes is also a critical strategy to mitigate inflation’s impact. Failing to account for inflation could lead to a retirement that’s less luxurious than you’d envisioned – perhaps ditching that planned cruise to the Bahamas for a slightly less glamorous trip to the local swimming pool.

Potential Sources of Retirement Income Beyond Savings Accounts

Retirement income isn’t solely reliant on savings accounts. Consider these additional avenues:

- Social Security: A vital source of income for many retirees. The amount received depends on your work history and earnings.

- Pensions: If you’re lucky enough to have a defined benefit pension plan from a previous employer, this provides a steady stream of income.

- Part-time work: Many retirees supplement their income with part-time jobs, allowing them to stay active and engaged.

- Rental income: Owning rental properties can provide a passive income stream, although it does come with its own set of responsibilities.

- Annuities: These financial products provide a guaranteed income stream, often purchased with a lump sum of savings.

Diversifying your income streams is crucial for building a resilient retirement plan that can withstand unexpected financial shocks. It’s akin to building a sturdy house with multiple supporting beams – one beam might falter, but the rest will hold strong.

Seeking Professional Advice

Navigating the complex world of retirement planning can feel like trying to assemble IKEA furniture without the instructions – frustrating, confusing, and potentially leading to a wobbly outcome. That’s where a financial advisor comes in: your personal retirement furniture assembly expert. They can help you build a solid, stable, and potentially lucrative retirement plan, ensuring you don’t end up with a wonky nest egg.

A financial advisor acts as your personalized retirement guru, offering expert guidance tailored to your specific financial situation, goals, and risk tolerance. They provide valuable insights into investment strategies, tax optimization techniques, and risk management, helping you chart a course towards a financially secure retirement. Think of them as your retirement Sherpa, guiding you through the sometimes treacherous terrain of investment choices and long-term financial planning.

The Role of a Financial Advisor in Retirement Planning

Financial advisors provide a comprehensive range of services to help individuals plan for a comfortable retirement. These services can include developing a personalized retirement plan, selecting appropriate investment vehicles, managing assets, and providing ongoing financial advice and monitoring. They also assist with estate planning considerations related to retirement assets. Essentially, they’re your financial Swiss Army knife, equipped to handle a variety of retirement-related challenges.

Questions to Ask a Potential Financial Advisor

Before entrusting your financial future to a financial advisor, it’s crucial to thoroughly vet them. The questions you ask should reveal their experience, fees, and approach to financial planning. Asking about their investment philosophy, client success stories (without violating client confidentiality, of course!), and their fee structure will give you a good understanding of their professionalism and suitability for your needs. For example, clarifying their approach to risk management and understanding their conflict of interest policies is paramount.

Finding a Reputable Financial Advisor

Finding a trustworthy financial advisor requires diligence. Start by seeking referrals from trusted sources like friends, family, or colleagues. Thoroughly research potential advisors online, checking for any disciplinary actions or complaints filed against them with regulatory bodies. Confirm their credentials and certifications, ensuring they possess the necessary expertise and qualifications. Consider meeting with several advisors before making a decision to find the best fit for your personality and financial goals. Remember, finding the right advisor is a crucial step in securing your financial future, so don’t rush the process.

Conclusion

So, there you have it – a whirlwind tour of the exciting (yes, exciting!) world of retirement savings. While the specifics might seem daunting, remember the core principle: start early, diversify wisely, and don’t be afraid to seek professional guidance. With a little planning and a dash of adventurous spirit, you can transform your retirement dreams into a reality – a reality filled with leisurely pursuits, exotic travels (maybe!), and enough financial freedom to finally master that sourdough bread recipe you’ve always wanted to try. Happy saving!

FAQ Overview

What’s the difference between a traditional and Roth IRA?

Traditional IRAs offer tax deductions on contributions but tax withdrawals in retirement. Roth IRAs have no upfront tax deduction but offer tax-free withdrawals in retirement. The best choice depends on your current and projected tax brackets.

Can I contribute to both a 401(k) and an IRA?

Yes, provided you meet the income requirements for IRA contributions and don’t exceed the annual contribution limits for each.

What happens if I change jobs and have a 401(k)?

You can generally roll over your 401(k) into a new employer’s plan, or into an IRA to maintain tax-advantaged growth.

How much should I be saving for retirement?

A general rule of thumb is to aim for saving at least 15% of your pre-tax income, but the ideal amount depends on your individual circumstances, risk tolerance, and desired retirement lifestyle.