Securing a comfortable retirement requires careful planning and strategic investment. This guide delves into the multifaceted world of retirement savings, exploring various strategies to help you achieve your financial goals. From defining realistic retirement needs and selecting appropriate savings vehicles to managing debt and navigating investment options, we’ll equip you with the knowledge to build a robust retirement plan.

We’ll examine diverse investment approaches, emphasizing the importance of diversification and risk management. Furthermore, we will address crucial aspects like healthcare cost planning, effective withdrawal strategies, and safeguarding your accumulated assets against unforeseen circumstances. By understanding these key elements, you can confidently navigate the path towards a financially secure retirement.

Defining Retirement Goals and Needs

Planning for a comfortable retirement requires a clear understanding of your financial aspirations and the resources needed to achieve them. This involves setting realistic goals, considering various factors influencing your retirement needs, and developing a comprehensive retirement budget. A well-defined plan ensures you can enjoy your retirement years without financial worries.

Setting Realistic Retirement Income Goals

Establishing realistic retirement income goals involves a multi-step process. First, determine your desired lifestyle in retirement. Consider factors such as travel plans, hobbies, and desired living arrangements. Next, estimate your anticipated expenses, factoring in inflation. A common approach is to project your current expenses forward, adjusting for anticipated changes in lifestyle and inflation rates. Finally, determine the amount of savings and investment income needed to support this desired lifestyle. This often involves utilizing online retirement calculators or consulting with a financial advisor to project future income needs based on various savings and investment scenarios. A crucial aspect is aligning your goals with your available resources and adjusting your expectations if necessary. For example, if your current savings fall short of supporting your desired lifestyle, you might need to delay retirement, increase savings contributions, or adjust your expectations regarding retirement spending.

Factors Influencing Retirement Needs

Several key factors significantly influence your retirement needs. Lifestyle choices play a major role; a luxurious retirement will naturally require a larger income than a more modest one. Healthcare costs are another significant consideration, as medical expenses tend to increase with age. Inflation erodes the purchasing power of savings over time, meaning you’ll need more money in the future to maintain the same standard of living. Unexpected expenses, such as home repairs or long-term care, should also be factored into your planning. Finally, geographic location impacts living expenses; retirement in a high-cost area will necessitate a higher retirement income. For instance, someone retiring in Manhattan will require significantly more income than someone retiring in a rural area.

Calculating Estimated Retirement Expenses

Estimating retirement expenses involves a systematic approach. Begin by listing your current monthly expenses, categorizing them into housing, food, transportation, healthcare, entertainment, and other essential items. Next, project these expenses into the future, accounting for inflation. You can use a conservative inflation rate of 3% annually, though this can vary depending on economic conditions. Then, consider anticipated changes in your lifestyle and spending habits. For example, you may anticipate less spending on commuting if you’re no longer working, but increased spending on travel or hobbies. Finally, factor in potential unexpected expenses, such as home maintenance, medical emergencies, or long-term care. Adding a contingency buffer to your estimated expenses is advisable to account for unforeseen circumstances. Consider using online retirement calculators to model different scenarios and refine your estimates.

Sample Retirement Budget

Let’s consider two hypothetical retirement scenarios: a modest retirement and a more comfortable one.

| Expense Category | Modest Retirement (Monthly) | Comfortable Retirement (Monthly) |

|---|---|---|

| Housing | $1,000 | $2,500 |

| Food | $500 | $1,000 |

| Transportation | $200 | $400 |

| Healthcare | $300 | $800 |

| Entertainment & Hobbies | $200 | $500 |

| Other Expenses | $300 | $800 |

| Total Monthly Expenses | $2,500 | $6,000 |

This table illustrates how different lifestyle choices translate into vastly different retirement income needs. The comfortable retirement scenario requires significantly more savings and/or investment income to support the higher monthly expenses. It’s crucial to remember that these are just examples; your specific retirement budget will depend on your individual circumstances and preferences. Regular review and adjustment of your retirement budget are essential to account for changing circumstances and ensure your plan remains on track.

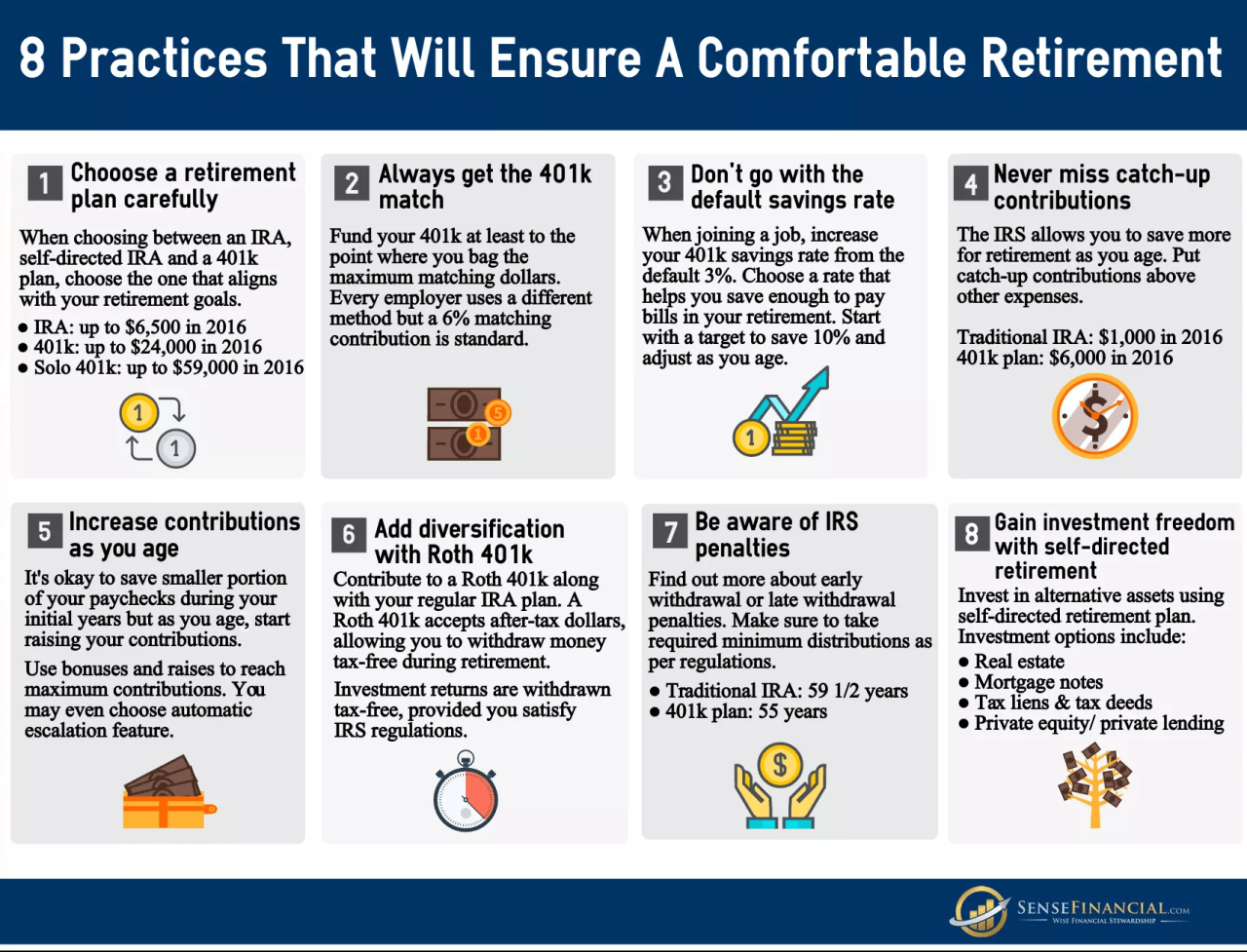

Retirement Savings Vehicles

Choosing the right retirement savings vehicle is crucial for securing your financial future. Understanding the differences between various plans, their tax implications, contribution limits, and withdrawal rules is essential for building a robust retirement portfolio tailored to your individual needs and risk tolerance. This section will explore the key features of several popular retirement savings options.

401(k) Plans

401(k) plans are employer-sponsored retirement savings plans. Contributions are typically made through payroll deductions, often with employer matching contributions. This matching component can significantly boost your savings over time. The contributions are pre-tax, reducing your taxable income in the present year. However, withdrawals in retirement are taxed as ordinary income. Contribution limits are set annually by the IRS. Early withdrawals usually incur penalties unless specific exceptions apply, such as hardship or death.

Traditional IRAs

Traditional Individual Retirement Accounts (IRAs) offer another avenue for retirement savings. Contributions are tax-deductible, lowering your current taxable income. However, withdrawals in retirement are taxed as ordinary income. Similar to 401(k) plans, there are annual contribution limits set by the IRS. Early withdrawals are generally subject to penalties and taxes. Traditional IRAs provide a flexible way to save for retirement, particularly useful for those without employer-sponsored plans.

Roth IRAs

Roth IRAs differ from traditional IRAs in that contributions are made after tax. This means you won’t receive a tax deduction for your contributions in the current year. However, the significant advantage is that withdrawals in retirement are tax-free. This makes Roth IRAs particularly attractive for those who anticipate being in a higher tax bracket in retirement than they are currently. Similar to other retirement plans, there are annual contribution limits set by the IRS, and early withdrawals may be subject to penalties.

Tax Implications Summary

The tax implications of each plan vary significantly. 401(k) and Traditional IRA contributions reduce your taxable income in the present year, resulting in lower taxes now, but withdrawals are taxed later. Roth IRA contributions are made after tax, but withdrawals are tax-free in retirement. The best choice depends on your individual tax situation and projections for future tax brackets.

Contribution Limits and Withdrawal Rules

Annual contribution limits for 401(k)s, Traditional IRAs, and Roth IRAs are established annually by the IRS and can change. Withdrawal rules also vary. Early withdrawals from all three plans typically incur penalties and taxes, except under specific circumstances. It’s crucial to consult the IRS guidelines and your plan documents for the most up-to-date information.

Diversified Retirement Portfolio

A diversified retirement portfolio is essential to mitigate risk and potentially maximize returns. Diversification involves spreading investments across different asset classes, each with varying levels of risk and potential return. A well-balanced portfolio typically includes stocks, bonds, and potentially real estate.

| Asset Class | Risk Level | Potential Return | Example |

|---|---|---|---|

| Stocks | High | High | Individual company stocks, index funds (e.g., S&P 500) |

| Bonds | Medium | Medium | Government bonds, corporate bonds, bond funds |

| Real Estate | Medium-High | Medium-High | Rental properties, REITs (Real Estate Investment Trusts) |

Investment Strategies for Retirement

Planning your retirement investments requires a thoughtful approach, considering your risk tolerance, time horizon, and financial goals. Different investment strategies cater to various risk appetites and financial objectives, ultimately aiming to maximize returns while minimizing potential losses. Understanding these strategies and how they interact is crucial for building a robust retirement portfolio.

Investment Approaches for Retirement Savings

Several distinct investment approaches can be employed to build retirement wealth. Each carries different levels of risk and potential reward. Choosing the right approach, or a blend of approaches, depends heavily on individual circumstances and preferences. Value investing focuses on identifying undervalued securities—assets priced below their intrinsic worth—believing the market has temporarily mispriced them. Growth investing, conversely, targets companies expected to experience significant earnings growth, prioritizing potential future returns over current profitability. Index fund investing offers diversification by mirroring a specific market index (like the S&P 500), providing broad market exposure with lower management fees compared to actively managed funds. A balanced approach, combining elements of all three, is often recommended for diversification.

Asset Allocation and Diversification for Risk Mitigation

Diversification is a cornerstone of successful retirement planning. It involves spreading investments across various asset classes (stocks, bonds, real estate, etc.) to reduce the impact of poor performance in any single asset. Asset allocation determines the proportion of your portfolio dedicated to each asset class. A younger investor with a longer time horizon might allocate a larger percentage to stocks (higher risk, higher potential return), while an investor closer to retirement might favor a greater allocation to bonds (lower risk, lower potential return) to preserve capital. This strategic approach helps to cushion against market volatility and unexpected events. For example, a portfolio heavily weighted in technology stocks could suffer significantly during a tech downturn, whereas a diversified portfolio would experience a less dramatic impact.

Managing Investment Risk Throughout Retirement Planning Stages

Managing investment risk is a dynamic process that adapts to your life stage. Early in your career, you can tolerate higher risk because you have a longer time horizon to recover from potential losses. As you approach retirement, your risk tolerance should generally decrease, shifting towards a more conservative investment strategy to protect accumulated savings. This might involve gradually reducing your equity exposure and increasing your holdings in fixed-income securities. A common strategy is to use a “glide path,” gradually shifting asset allocation over time, becoming more conservative as retirement nears. For instance, someone in their 20s might have 90% stocks and 10% bonds, while someone in their 60s might reverse this ratio.

Adjusting Investment Strategy Based on Changing Conditions and Circumstances

Market conditions and personal circumstances can significantly impact your investment strategy. A major market downturn might necessitate rebalancing your portfolio to restore your desired asset allocation. Similarly, unexpected life events, such as job loss or a major illness, could require adjustments to your investment plan. For example, a sudden job loss might necessitate drawing down on savings more quickly than anticipated, prompting a reassessment of your risk tolerance and investment strategy. Conversely, an unexpected inheritance might allow you to increase your investment contributions and potentially take on more risk. Regularly reviewing and adjusting your investment strategy is essential to ensure it aligns with your evolving needs and circumstances.

Managing Debt and Expenses Before Retirement

Entering retirement with significant debt can severely impact your financial well-being and limit your enjoyment of this life stage. Strategic debt reduction and careful expense management are crucial steps in securing a comfortable retirement. This section Artikels strategies to achieve this balance.

Successfully navigating the pre-retirement years requires a multifaceted approach. Addressing outstanding debts and creating a realistic budget are vital components of this process. By understanding the impact of debt on your retirement savings and implementing effective strategies, you can significantly improve your financial outlook for the years ahead.

Strategies for Reducing Debt Before Retirement

Prioritizing debt repayment is essential. High-interest debts, such as credit card debt, should be tackled aggressively. Consider debt consolidation strategies, such as balance transfers to lower-interest cards or personal loans, to simplify payments and potentially reduce overall interest paid. Negotiating with creditors for lower interest rates or payment plans can also provide relief. Finally, exploring debt management programs, if necessary, can offer structured support in managing and eliminating debt. Remember, consistency and discipline are key to success.

Creating a Pre-Retirement Budget

A detailed pre-retirement budget is crucial for assessing your current financial situation and projecting future expenses. Begin by listing all monthly income sources, including pensions, Social Security, and any part-time income. Then, meticulously track all monthly expenses, categorizing them into necessities (housing, food, utilities), discretionary spending (entertainment, travel), and debt payments. Analyze your spending patterns to identify areas where you can reduce expenses without significantly impacting your quality of life. This might involve cutting back on subscriptions, reducing dining out, or finding more affordable alternatives for everyday goods and services. Utilize budgeting apps or spreadsheets to track your progress and make necessary adjustments. Projecting future expenses, factoring in potential healthcare costs and inflation, will give you a clearer picture of your financial needs in retirement.

Prioritizing Debt Repayment While Saving for Retirement

Balancing debt repayment with retirement savings requires careful planning and prioritization. While saving for retirement remains crucial, aggressively tackling high-interest debt can prevent it from accumulating and consuming a larger portion of your income over time. A common strategy is to allocate a portion of your income to paying down high-interest debt while simultaneously contributing to retirement accounts. For example, you might allocate 60% of your surplus income to debt repayment and 40% to retirement savings. Adjust these percentages based on your individual circumstances and risk tolerance. Remember to regularly review your progress and adjust your strategy as needed. The goal is to create a sustainable plan that addresses both debt and retirement savings simultaneously.

Impact of High-Interest Debt on Retirement Savings

High-interest debt significantly impacts retirement savings. The interest payments on such debt represent a substantial drain on your disposable income, reducing the amount you can allocate to retirement accounts. For example, a $10,000 credit card debt with a 20% interest rate can lead to significant interest payments over time, potentially diverting thousands of dollars that could have otherwise been invested for retirement. This reduces your overall investment returns and delays your ability to reach your retirement savings goals. Moreover, the stress associated with managing high-interest debt can also negatively impact your overall well-being, affecting your ability to focus on long-term financial planning. Therefore, strategically reducing high-interest debt is crucial for maximizing retirement savings.

Planning for Healthcare Costs in Retirement

Planning for retirement often focuses on investments and savings, but a significant and often overlooked factor is the escalating cost of healthcare. The rising expenses associated with medical treatments, medications, and long-term care can dramatically impact your retirement funds, potentially jeopardizing your financial security if not adequately addressed. Proactive planning is crucial to mitigate these risks and ensure a comfortable retirement.

Healthcare costs are consistently increasing at a rate exceeding inflation. This means that the cost of healthcare in retirement will likely be considerably higher than it is today. Factors contributing to this rise include advancements in medical technology, an aging population, and increasing prescription drug prices. Failing to account for these rising costs can lead to significant financial strain and compromise the quality of life during retirement.

Strategies for Minimizing Healthcare Expenses in Retirement

Understanding and utilizing available resources is key to managing healthcare costs. Medicare, the federal health insurance program for people 65 and older, provides essential coverage. However, Medicare doesn’t cover everything. Supplemental insurance, often called Medigap, can help fill the gaps in Medicare coverage, reducing out-of-pocket expenses for deductibles, co-pays, and other uncovered services. Additionally, exploring options like prescription drug plans (Part D) and Advantage plans (Part C) can further optimize cost management. Careful consideration of these options and their respective costs is essential to finding the most suitable plan for individual needs and budgets.

The Importance of Long-Term Care Insurance

Long-term care, which includes assistance with daily living activities such as bathing, dressing, and eating, can become necessary as we age. The costs associated with long-term care, whether in a nursing home or at home, can be substantial. Long-term care insurance is designed to help cover these costs, offering financial protection against the potentially devastating financial burden of extended care. While the premiums can seem significant, the potential savings compared to self-funding long-term care far outweigh the costs for many individuals. It’s important to research policies and consider factors such as coverage limits, benefit periods, and the waiting period before benefits begin.

A Hypothetical Scenario Illustrating the Financial Impact of Unexpected Healthcare Costs

The following scenario highlights the potential financial consequences of unforeseen healthcare events during retirement:

- Scenario: A retired couple, John and Mary, age 68 and 67, have diligently saved for retirement. They have a comfortable nest egg and anticipate a modest retirement lifestyle.

- Unexpected Event: John experiences a sudden and severe stroke, requiring extensive rehabilitation and ongoing medical care.

- Financial Impact: The costs associated with the stroke, including hospitalization, rehabilitation, ongoing medication, and home healthcare, quickly deplete their savings. Their Medicare coverage helps, but significant out-of-pocket expenses remain, forcing them to adjust their retirement plans drastically, potentially impacting their quality of life.

- Impact without Long-Term Care Insurance: Without long-term care insurance, they face the daunting prospect of depleting their retirement savings to cover ongoing care, potentially leaving them vulnerable to financial hardship in the future.

- Impact with Long-Term Care Insurance: Had they purchased long-term care insurance earlier in their lives, a significant portion of these costs would have been covered, alleviating the financial strain and allowing them to maintain a more comfortable retirement.

Withdrawal Strategies During Retirement

Successfully navigating retirement requires a well-defined plan for accessing your accumulated savings. This involves choosing a withdrawal strategy that aligns with your financial goals, risk tolerance, and longevity expectations. Understanding the various approaches and their associated tax implications is crucial for maximizing your retirement income and ensuring financial security throughout your later years.

Fixed Withdrawal Strategies

Fixed withdrawal strategies involve withdrawing a consistent dollar amount from your retirement accounts each year. This approach offers simplicity and predictability, making budgeting easier. However, it doesn’t account for market fluctuations or inflation, potentially leading to depletion of funds earlier than anticipated if returns are low or inflation is high. A common example is withdrawing a set percentage (e.g., 4%) of your initial retirement portfolio value annually. This approach, while seemingly simple, needs careful consideration of the portfolio’s composition and potential longevity of the withdrawals. For example, a 4% withdrawal rate on a $1 million portfolio yields $40,000 annually. This strategy requires regular monitoring to ensure sufficient funds remain to cover expenses.

Variable Withdrawal Strategies

Variable withdrawal strategies adjust the withdrawal amount based on factors such as investment performance and inflation. This approach offers greater flexibility and can help to preserve capital during market downturns. However, it requires more active management and may result in fluctuating income levels from year to year, making budgeting more challenging. One example of a variable strategy is adjusting withdrawals based on a percentage of the portfolio’s value each year, which automatically decreases withdrawals in down markets. Another approach might involve adjusting withdrawals annually to account for the previous year’s inflation rate. This dynamic approach aims to maintain the purchasing power of the retirement income.

Tax Implications of Withdrawal Methods

The tax implications of withdrawals vary depending on the type of retirement account from which you are withdrawing. Withdrawals from traditional IRAs and 401(k) plans are generally taxed as ordinary income. Withdrawals from Roth IRAs are typically tax-free, provided certain conditions are met. Understanding these tax implications is crucial for accurate financial planning and minimizing your tax burden in retirement. For example, a retiree withdrawing $50,000 from a traditional IRA might pay a significant amount in income tax, whereas the same withdrawal from a Roth IRA would be tax-free. This difference highlights the importance of considering the tax implications of different account types when planning your retirement income strategy.

Inflation’s Impact on Retirement Income

Inflation erodes the purchasing power of money over time. This means that the same amount of money will buy fewer goods and services in the future than it does today. Failing to account for inflation can significantly impact the longevity of your retirement savings. For example, if inflation averages 3% annually, a $50,000 annual income today will only have the purchasing power of approximately $35,000 in 10 years. Strategies to mitigate the impact of inflation include investing in assets that tend to keep pace with or outpace inflation, such as stocks and real estate, and adjusting withdrawal amounts annually to reflect the inflation rate.

Creating a Safe Withdrawal Plan

Creating a safe withdrawal plan requires a systematic approach.

- Determine your retirement expenses: Carefully estimate your essential and discretionary expenses in retirement. Consider factors such as housing, healthcare, travel, and entertainment.

- Assess your retirement savings: Calculate the total value of your retirement accounts, including 401(k)s, IRAs, and other savings.

- Choose a withdrawal strategy: Select a strategy that aligns with your risk tolerance, longevity expectations, and tax situation. Consider the trade-offs between fixed and variable approaches.

- Factor in inflation: Account for the anticipated rate of inflation when determining your annual withdrawal amount. Regularly adjust your withdrawals to maintain purchasing power.

- Regularly review and adjust: Periodically review your withdrawal plan and make adjustments as needed based on market performance, your health, and any changes in your expenses.

Creating a safe withdrawal plan requires careful consideration of your individual circumstances and a commitment to regular monitoring and adjustments. A financial advisor can be a valuable resource in this process.

Protecting Your Retirement Savings

Securing your retirement nest egg requires not only diligent saving and investing but also a robust strategy to protect those assets from unforeseen circumstances and market fluctuations. A comprehensive approach encompassing estate planning, risk mitigation, and the utilization of appropriate legal and financial tools is crucial to ensure your retirement savings remain safe and available to support your lifestyle in retirement.

Estate Planning and Asset Protection

Estate planning plays a vital role in protecting your retirement assets. A well-structured plan ensures your assets are distributed according to your wishes, minimizing potential legal disputes and tax burdens. This involves creating or updating a will, establishing trusts (such as revocable living trusts or irrevocable life insurance trusts), and designating beneficiaries for retirement accounts (IRAs, 401(k)s, etc.). These actions can streamline the inheritance process, reducing administrative costs and potential delays. For example, a properly drafted will can prevent family disagreements over the distribution of assets, ensuring a smoother transition for your loved ones. A trust can provide additional asset protection, particularly in the event of unforeseen circumstances such as lawsuits or incapacity.

Potential Risks to Retirement Savings

Retirement savings face several significant risks that can erode their value. Market volatility, a common concern, can lead to substantial losses in the value of investments, especially if retirement is near. Inflation steadily erodes the purchasing power of money, meaning that the same amount of savings will buy less over time. Longevity risk, the risk of outliving your savings, is a significant concern, especially given increasing life expectancies. Unexpected health issues and rising healthcare costs can also significantly impact retirement savings. For instance, a sudden market downturn close to retirement could dramatically reduce the available funds, impacting the planned retirement lifestyle. Similarly, unexpected inflation could make it difficult to maintain a comfortable standard of living on the same level of savings.

Strategies for Mitigating Risks

Several strategies can help mitigate these risks. Diversification of investments across different asset classes (stocks, bonds, real estate, etc.) reduces the impact of market volatility. Regularly rebalancing your portfolio helps maintain your target asset allocation. Considering inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), can help preserve the purchasing power of your savings. Purchasing long-term care insurance can lessen the financial burden of potential healthcare costs in retirement. Working longer or having additional income streams can increase your overall retirement savings and reduce the risk of outliving your funds. For example, a portfolio diversified across stocks, bonds, and real estate is less susceptible to losses from a downturn in a single market sector. Regularly rebalancing ensures your portfolio aligns with your risk tolerance and retirement goals.

Legal and Financial Tools for Asset Protection

Several legal and financial tools help protect retirement assets. As previously mentioned, trusts can offer significant asset protection. Qualified Domestic Trusts (QDOTs) can protect assets from estate taxes for non-citizen spouses. Annuities provide a guaranteed income stream, mitigating longevity risk. Long-term care insurance helps cover the potentially high costs of long-term care. Irrevocable life insurance trusts can protect life insurance benefits from creditors and taxes. For example, a QDOT can protect significant assets from estate taxes if a U.S. citizen is married to a non-citizen. An annuity provides a steady income stream, offering peace of mind against the risk of outliving your savings.

Conclusive Thoughts

Building a successful retirement plan is a journey that requires foresight, discipline, and a proactive approach. By diligently following the strategies Artikeld in this guide, you can increase your chances of achieving financial independence during your retirement years. Remember that regular review and adjustments to your plan are essential to adapt to changing circumstances and market conditions. Take control of your financial future and start planning for a secure and fulfilling retirement today.

Question Bank

What is the difference between a traditional IRA and a Roth IRA?

A traditional IRA offers tax-deductible contributions but taxes your withdrawals in retirement. A Roth IRA has after-tax contributions but provides tax-free withdrawals in retirement.

How much should I be saving for retirement?

The recommended savings amount varies depending on individual circumstances, but a general guideline is to aim for saving at least 15% of your pre-tax income.

When should I start withdrawing from my retirement accounts?

The age at which you can start withdrawing from retirement accounts depends on the specific plan, but the typical age is 59 1/2. However, early withdrawals may incur penalties.

What is the impact of inflation on my retirement savings?

Inflation erodes the purchasing power of your savings over time. To mitigate this, consider investing in assets that can outpace inflation, and adjust your withdrawal strategy accordingly.