Planning for a comfortable retirement requires a proactive and strategic approach. Securing your financial future involves more than simply saving money; it demands a comprehensive understanding of investment vehicles, risk management, and long-term financial goals. This guide explores key strategies to help you navigate the complexities of retirement planning, empowering you to make informed decisions and build a secure financial foundation for your later years.

From defining your retirement aspirations and assessing your current financial standing to understanding various savings vehicles and investment options, we’ll delve into the crucial aspects of building a robust retirement plan. We’ll also address critical considerations such as managing debt, planning for healthcare costs, mitigating inflation’s impact, and developing effective withdrawal strategies. By the end, you’ll have a clearer understanding of how to create a personalized retirement plan that aligns with your individual needs and goals.

Defining Retirement Goals

Planning for retirement requires a clear understanding of your aspirations. Without well-defined goals, saving becomes a nebulous exercise, lacking direction and motivation. Setting SMART goals—Specific, Measurable, Achievable, Relevant, and Time-bound—provides the framework for a successful retirement savings strategy. This structured approach ensures your savings align with your desired lifestyle and financial security in your later years.

Setting SMART retirement goals transforms a vague notion of “being comfortable” into a concrete plan with specific financial targets. This allows for effective tracking of progress and adjustments along the way, making the process more manageable and less daunting. The process involves identifying your vision for retirement, quantifying its financial requirements, and creating a timeline for achieving those targets.

SMART Retirement Goal Examples

The SMART framework provides a practical approach to goal setting. For example, instead of aiming for a “comfortable retirement,” a SMART goal might be: “To have $1.5 million in retirement savings by age 65 to maintain my current lifestyle, adjusted for inflation, and fund anticipated healthcare costs.” This goal is specific, measurable, achievable (with diligent saving and investment), relevant to the desired lifestyle, and time-bound. Another example could be: “To save $50,000 by age 40 to fund a three-month backpacking trip through Southeast Asia upon early retirement at age 55.” This goal is equally SMART, highlighting the adaptability of the framework to various retirement visions.

Translating Goals into Financial Targets

Converting retirement goals into concrete financial targets involves several key steps. First, estimate your annual expenses in retirement. Consider factors like housing costs (mortgage payments, rent, property taxes), healthcare expenses (insurance premiums, medical bills), travel, entertainment, and everyday living costs. Adjust these estimates for inflation to reflect future costs accurately. For example, using a conservative inflation rate of 3% annually, a current annual expense of $50,000 will be approximately $86,000 in 20 years. Second, determine how long your retirement will last. This depends on your desired retirement age and life expectancy. Third, calculate your total retirement savings needed. This involves multiplying your annual expenses by the number of years in retirement. Finally, factor in any additional financial needs, such as paying off debts or providing for heirs. For instance, if your annual expenses are $86,000 and you plan to retire for 20 years, you will need approximately $1,720,000 in retirement savings. This calculation, however, is simplified and doesn’t consider investment growth or potential additional income streams during retirement.

Assessing Current Financial Situation

Understanding your current financial health is crucial before strategizing for retirement. A clear picture of your assets, liabilities, and spending habits provides a solid foundation for building a robust retirement plan. This involves creating a personal balance sheet, calculating your savings rate, and tracking your income and expenses.

Personal Balance Sheet: Determining Net Worth

A personal balance sheet is a snapshot of your financial position at a specific point in time. It shows your net worth, which is the difference between your assets (what you own) and your liabilities (what you owe). Creating one involves listing all your assets – including cash, investments (like stocks, bonds, and retirement accounts), real estate, and personal property – and then listing all your liabilities – such as mortgages, loans, credit card debt, and other outstanding bills. Subtracting your total liabilities from your total assets gives you your net worth. For example, if your assets total $500,000 and your liabilities total $100,000, your net worth is $400,000. This figure provides a valuable benchmark to track your financial progress over time.

Personal Savings Rate Calculation and Improvement

Your savings rate represents the percentage of your income that you save each year. Calculating this involves dividing your total savings (including contributions to retirement accounts and other investments) by your gross income. For instance, if you saved $20,000 and your gross income was $80,000, your savings rate is 25%. A higher savings rate generally indicates better financial preparedness for retirement. Areas for improvement could include reducing discretionary spending, increasing income through a side hustle or promotion, or re-evaluating investment strategies for better returns. Aiming for a higher savings rate, perhaps closer to 15-20% or more depending on individual circumstances and retirement goals, is a key step towards securing a comfortable retirement.

Income and Expense Tracking: Understanding Spending Habits

Tracking income and expenses is essential to understand your spending patterns and identify areas where you can potentially save. This can be done using budgeting apps, spreadsheets, or even a simple notebook. Categorize your expenses (e.g., housing, transportation, food, entertainment) to see where your money is going. This process reveals spending habits, highlighting areas of overspending and opportunities for budget adjustments. For example, meticulously tracking expenses might reveal that dining out consumes a significant portion of the monthly budget, suggesting a potential area for reduction. This detailed understanding of income and expenses allows for more effective financial planning and budgeting.

Retirement Savings Vehicles

Choosing the right retirement savings vehicle is crucial for securing your financial future. Understanding the differences between various accounts, their tax implications, and how they fit into your overall financial plan is key to maximizing your retirement savings. This section will explore the key features of several popular options, allowing you to make informed decisions based on your individual circumstances.

Several retirement savings accounts offer distinct advantages and disadvantages depending on your income, risk tolerance, and long-term financial goals. The most common options include 401(k) plans, traditional IRAs, and Roth IRAs. Each offers different tax benefits and contribution limits.

Comparison of 401(k), Traditional IRA, and Roth IRA

The choice between a 401(k), traditional IRA, and Roth IRA depends heavily on individual circumstances and projections of future tax brackets. Below is a comparison highlighting key differences.

| Feature | 401(k) | Traditional IRA | Roth IRA |

|---|---|---|---|

| Contributions | Employer-sponsored; contributions are pre-tax | Individual contributions are pre-tax | Individual contributions are made after tax |

| Tax Implications (Growth) | Tax-deferred growth; taxed upon withdrawal in retirement | Tax-deferred growth; taxed upon withdrawal in retirement | Tax-free growth; tax-free withdrawals in retirement |

| Tax Implications (Contributions) | Reduces taxable income in the year of contribution | Reduces taxable income in the year of contribution | No reduction in taxable income in the year of contribution |

| Withdrawal Penalties | Early withdrawals generally incur penalties and taxes | Early withdrawals generally incur penalties and taxes | Early withdrawals of contributions are penalty-free; early withdrawals of earnings may incur penalties |

| Contribution Limits | Vary by employer and year | Set annually by the IRS | Set annually by the IRS |

Tax Implications of Retirement Savings Accounts

The tax implications of each account type significantly impact your overall retirement savings strategy. Understanding these implications is crucial for making informed decisions.

With a 401(k), contributions are made pre-tax, reducing your current taxable income. However, withdrawals in retirement are taxed as ordinary income. Traditional IRAs also offer pre-tax contributions and tax-deferred growth, leading to taxed withdrawals in retirement. Roth IRAs, conversely, involve after-tax contributions, but withdrawals in retirement are tax-free.

Understanding your projected tax bracket in retirement is vital when choosing between a traditional and Roth IRA. If you anticipate being in a higher tax bracket in retirement, a Roth IRA might be more advantageous. Conversely, if you expect a lower tax bracket, a traditional IRA could be preferable.

Sample Asset Allocation for a Risk-Averse Retiree

A risk-averse investor nearing retirement should prioritize capital preservation and income generation. A sample asset allocation strategy might involve a heavier weighting towards low-risk investments.

For example, a portfolio could consist of 60% bonds (e.g., government bonds, high-quality corporate bonds) and 40% stocks (e.g., large-cap, dividend-paying stocks, a small allocation to real estate investment trusts (REITs) for diversification and potential income generation). This allocation emphasizes stability and income over high-growth potential, aligning with the risk tolerance of a retiree approaching retirement. This is just a sample, and a financial advisor can help tailor a strategy based on individual circumstances and goals. Remember that past performance is not indicative of future results.

Investment Strategies

Choosing the right investment strategy is crucial for achieving your retirement goals. Your approach will depend heavily on your risk tolerance, time horizon, and financial situation. Understanding the benefits and drawbacks of different asset classes is key to building a diversified and effective portfolio.

Investment Options: Benefits and Risks

Several investment options exist, each carrying its own set of benefits and risks. Stocks, bonds, and real estate are three major asset classes, and each offers unique characteristics. Stocks represent ownership in a company and offer the potential for high returns but also carry significant risk, as their value can fluctuate dramatically. Bonds, on the other hand, are debt instruments issued by governments or corporations, generally considered less risky than stocks, but offering lower potential returns. Real estate involves investing in properties, offering potential for rental income and appreciation, but requires significant capital investment and can be illiquid.

Diversified Investment Portfolios

Diversification is a cornerstone of successful investing. Spreading your investments across different asset classes helps to mitigate risk. The optimal portfolio composition varies greatly depending on individual circumstances. A conservative investor with a low risk tolerance might favor a portfolio heavily weighted towards bonds and low-risk stocks, perhaps 80% bonds and 20% stocks. A more aggressive investor with a higher risk tolerance and a longer time horizon might opt for a portfolio with a higher allocation to stocks, perhaps 70% stocks and 30% bonds, potentially including a small percentage in alternative investments like real estate. A balanced approach might involve a 50/50 split between stocks and bonds. These are examples, and individual circumstances should always guide portfolio allocation.

Historical Asset Class Performance Comparison

| Asset Class | Average Annual Return (Last 10 Years) | Standard Deviation (Last 10 Years) | Risk Level |

|---|---|---|---|

| Large-Cap Stocks (e.g., S&P 500) | 8% (Illustrative) | 15% (Illustrative) | High |

| Small-Cap Stocks | 10% (Illustrative) | 20% (Illustrative) | Very High |

| Bonds (Investment Grade) | 3% (Illustrative) | 5% (Illustrative) | Medium |

| Real Estate (REITs) | 7% (Illustrative) | 12% (Illustrative) | Medium-High |

Note: These are illustrative figures and actual returns will vary. Past performance is not indicative of future results. Consult with a financial advisor for personalized guidance.

Managing Debt and Expenses

Planning for a comfortable retirement involves not only diligently saving but also strategically managing your existing debts and expenses. High-interest debt can significantly eat into your retirement savings, while unexpected expenses can derail your carefully crafted plans. Therefore, addressing these financial aspects is crucial for achieving your retirement goals.

Strategies for Reducing High-Interest Debt Before Retirement

Tackling high-interest debt, such as credit card debt or personal loans, is paramount before retirement. High interest rates can quickly accumulate, leaving less money available for retirement savings. Prioritizing debt reduction through strategic methods can significantly improve your financial health.

- Debt Snowball Method: This method focuses on paying off the smallest debt first, regardless of interest rate, to build momentum and motivation. The psychological boost of quickly eliminating a debt can encourage continued effort.

- Debt Avalanche Method: This method prioritizes paying off the debt with the highest interest rate first, minimizing the total interest paid over time. This approach is mathematically more efficient but can be less motivating initially.

- Debt Consolidation: Consolidating multiple debts into a single loan with a lower interest rate can simplify payments and potentially reduce the overall interest paid. However, carefully compare terms and fees before consolidating.

- Balance Transfers: Transferring high-interest credit card balances to cards offering a 0% introductory APR can provide a temporary reprieve to focus on paying down the principal. Remember that this is a short-term solution, and the interest rate will eventually increase.

Identifying Potential Hidden Expenses That Could Impact Retirement Savings

Beyond obvious expenses, several hidden costs can unexpectedly impact retirement savings. Proactive identification and planning for these expenses are crucial to avoid financial strain during retirement.

- Healthcare Costs: Unexpected medical bills can significantly deplete retirement funds. Consider supplemental health insurance options and explore long-term care insurance to mitigate potential risks.

- Home Maintenance: Maintaining a home requires ongoing expenses, which can increase significantly with age. Factor in costs for repairs, renovations, and property taxes.

- Unexpected Travel Expenses: While retirement often involves travel, unforeseen costs can arise. Budget for potential emergencies and unexpected travel expenses.

- Inflation: The rising cost of goods and services over time can erode the purchasing power of your savings. Factor in inflation when planning your retirement budget.

Practical Steps to Reduce Monthly Expenses

Reducing monthly expenses frees up funds for retirement savings and debt repayment. Implementing these practical steps can lead to significant savings over time.

- Create a Detailed Budget: Track your spending meticulously to identify areas where you can cut back. Budgeting apps and spreadsheets can be helpful tools.

- Negotiate Lower Bills: Contact service providers (internet, phone, insurance) to negotiate lower rates or explore alternative, more affordable options.

- Reduce Food Costs: Plan meals, cook at home more often, and reduce eating out to significantly lower grocery expenses. Consider buying in bulk for non-perishable items.

- Cut Unnecessary Subscriptions: Review your subscriptions (streaming services, gym memberships) and cancel those you rarely use.

- Embrace Frugal Living: Adopt cost-saving habits such as using public transportation, walking or cycling, and repurposing items.

Planning for Healthcare Costs

Healthcare expenses represent a significant and often underestimated challenge in retirement planning. The escalating costs of medical care, prescription drugs, and long-term care services can quickly deplete retirement savings if not adequately addressed. Failing to plan for these expenses can severely impact your quality of life and financial security during your retirement years.

The rising cost of healthcare is a complex issue driven by factors such as technological advancements, an aging population, and increased administrative costs. These rising costs necessitate proactive planning to ensure sufficient funds are available to cover anticipated healthcare needs. A comprehensive retirement plan must include a realistic assessment and allocation of resources specifically for healthcare expenses.

Medicare and Supplemental Insurance

Medicare is a federal health insurance program for people age 65 or older and some younger people with disabilities. Understanding Medicare’s coverage is crucial, as it forms the foundation of most retirees’ healthcare plans. Medicare is divided into four parts: Part A (hospital insurance), Part B (medical insurance), Part C (Medicare Advantage), and Part D (prescription drug insurance). Each part has its own costs and coverage limitations. While Medicare provides significant benefits, it often doesn’t cover all expenses.

Many retirees opt for supplemental insurance, also known as Medigap, to help fill the gaps in Medicare coverage. Medigap plans are sold by private insurance companies and help pay for some of the costs that Medicare doesn’t cover, such as co-pays, deductibles, and coinsurance. The cost of Medigap plans varies depending on the plan and the individual’s health status. Additionally, other supplemental insurance options exist, such as plans offered through employers or unions, that may provide additional coverage.

Estimating Future Healthcare Expenses

Accurately estimating future healthcare expenses is challenging, but several resources can help. Online calculators and financial planning tools provide estimates based on factors such as age, health status, and location. These tools often allow users to input various scenarios and adjust assumptions to generate personalized estimates. For example, the AARP’s website offers a healthcare cost calculator that helps individuals estimate their potential healthcare expenses in retirement.

It’s important to remember that these are just estimates, and actual costs may vary. It’s advisable to use a range of estimates to account for potential uncertainties. For instance, if a calculator provides an estimate of $50,000 per year, it’s prudent to consider a range of $40,000 to $60,000 to account for unexpected medical events or inflation. Regularly reviewing and adjusting these estimates based on changes in health status or healthcare costs is crucial to maintain an accurate financial plan. Furthermore, consulting with a financial advisor can provide personalized guidance and assistance in developing a comprehensive retirement healthcare plan. They can help you incorporate these estimations into your overall retirement savings strategy.

Inflation and its Impact

Inflation, the persistent increase in the general price level of goods and services in an economy, significantly impacts retirement savings and the purchasing power of those savings. Understanding its effects is crucial for effective retirement planning. Failing to account for inflation can lead to a shortfall in retirement funds, jeopardizing the desired lifestyle.

Inflation erodes the value of money over time. This means that the same amount of money will buy fewer goods and services in the future than it does today. For example, if your retirement savings are projected to provide $50,000 annually in today’s dollars, and inflation averages 3% annually, that same $50,000 will have significantly less purchasing power in 10 or 20 years. This reduction in purchasing power directly impacts your ability to maintain your desired standard of living during retirement. The longer you plan to be in retirement, the more significant the impact of inflation becomes.

Adjusting Retirement Savings Goals for Inflation

To accurately estimate future retirement needs, it’s essential to adjust savings goals for inflation. This involves projecting future expenses based on anticipated inflation rates. A common method is to use an inflation-adjusted discount rate to determine the present value of future expenses. For instance, if you anticipate needing $60,000 annually in retirement in 20 years, and the average inflation rate is 2%, you would need to save a significantly larger sum today to account for the accumulated inflation. Financial planning software and online calculators can greatly assist in these calculations. It is also prudent to consider using a conservative inflation rate estimate to account for potential unforeseen economic fluctuations.

Strategies for Protecting Retirement Savings from Inflation

Several strategies can help mitigate the impact of inflation on retirement savings. Diversifying investments across different asset classes, such as stocks, bonds, and real estate, can help to hedge against inflation. Stocks, particularly those in growing sectors, tend to perform better during inflationary periods, as companies can often pass on increased costs to consumers. Real estate, another tangible asset, also often appreciates in value alongside inflation. Furthermore, investing in inflation-protected securities, such as Treasury Inflation-Protected Securities (TIPS), can provide a safeguard against inflation as their principal value adjusts with the Consumer Price Index (CPI). Regularly rebalancing your investment portfolio to maintain your desired asset allocation is also a key strategy for managing inflation risk. Finally, staying informed about economic trends and adjusting your investment strategy accordingly is crucial for long-term success.

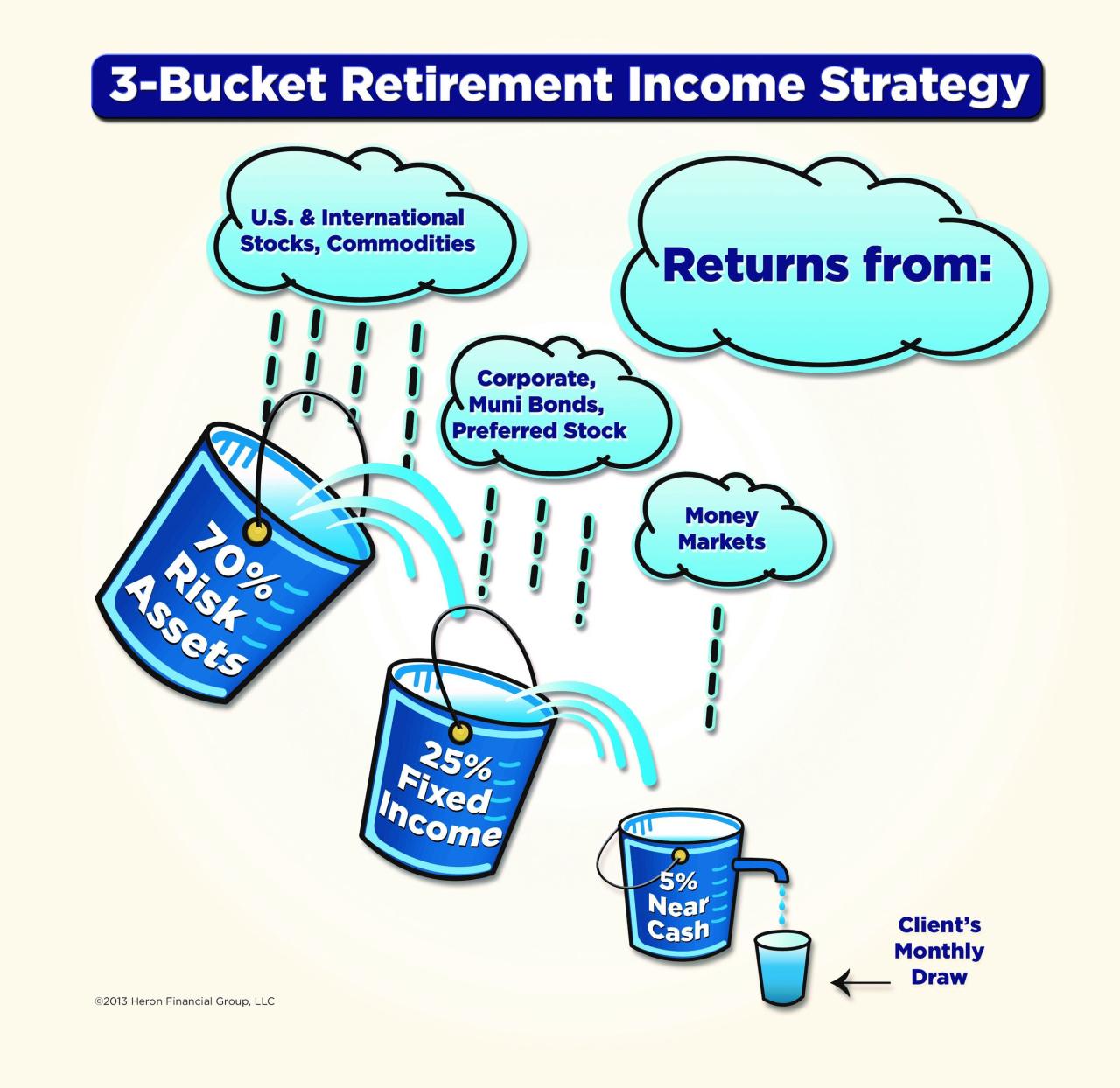

Withdrawal Strategies

Choosing the right retirement income withdrawal strategy is crucial for ensuring your retirement funds last throughout your golden years. The approach you select will significantly impact your financial security and lifestyle. Several key strategies exist, each with its own advantages, disadvantages, and associated risks. Understanding these nuances is vital for making informed decisions.

Fixed-Income Withdrawal Strategy

This strategy involves withdrawing a fixed dollar amount from your retirement savings each year, regardless of market fluctuations. For example, you might withdraw $50,000 annually. This offers predictability and budgeting simplicity. However, it carries the risk of depleting your funds prematurely if returns are consistently low, or if you live longer than anticipated. In periods of high inflation, a fixed income may not maintain its purchasing power.

Variable-Income Withdrawal Strategy

A variable-income strategy allows for adjustments to your withdrawals based on investment performance. For instance, you might withdraw 4% of your portfolio’s value annually, adjusting that percentage upward or downward based on investment gains or losses. This strategy aims to preserve capital while adapting to market conditions. The primary risk is increased volatility; your income stream will fluctuate, potentially leading to unpredictable cash flow. Furthermore, poor market performance can severely impact your income and even lead to premature depletion of funds.

Systematic Withdrawal Strategy

Systematic withdrawal plans often combine elements of fixed and variable approaches. They might involve a base fixed withdrawal amount supplemented by a percentage of investment gains. This offers a balance between predictability and adaptability. Risks are mitigated somewhat compared to purely fixed or variable strategies, but market downturns can still affect the supplemental income component. Careful planning and monitoring are crucial for success.

Hypothetical Retirement Income Plan: A Safe Withdrawal Rate

Let’s consider a hypothetical scenario. Suppose a retiree has accumulated $1,000,000 in retirement savings. A commonly cited “safe” withdrawal rate is 4% annually. This means withdrawing $40,000 per year ($1,000,000 x 0.04). This strategy assumes a diversified portfolio with a mix of stocks and bonds, and aims to balance income needs with long-term capital preservation. However, this is just a guideline, and the actual safe withdrawal rate can vary depending on individual circumstances, risk tolerance, and market conditions. For example, during periods of low market returns, a lower withdrawal rate might be necessary to avoid depleting the principal too quickly. Conversely, periods of strong market performance might allow for slightly higher withdrawals without compromising long-term sustainability. A comprehensive financial plan, tailored to individual circumstances, is crucial for determining an appropriate and sustainable withdrawal strategy.

Estate Planning Considerations

Planning for the distribution of your assets after retirement is crucial. A well-structured estate plan ensures your wishes are respected, minimizes potential family disputes, and protects your loved ones’ financial well-being. Failing to plan can lead to unintended consequences, such as lengthy legal battles and unnecessary tax burdens on your heirs. It’s a vital component of securing your legacy and providing for your family’s future.

Estate planning involves the legal process of determining how your assets will be distributed after your death. This encompasses a range of strategies designed to minimize taxes, ensure efficient transfer of assets, and protect your family from potential financial hardship. Effective estate planning considers your specific circumstances, including the size and type of your assets, your family structure, and your personal wishes.

Types of Wills and Trusts

Several types of wills and trusts can facilitate the transfer of assets. The choice depends on individual circumstances and goals. A simple will, for example, is straightforward and suitable for smaller estates with relatively uncomplicated distributions. More complex wills, such as those with testamentary trusts, are used for larger estates or when specific provisions are needed to manage assets for beneficiaries, like minor children. Living trusts, on the other hand, allow for the management of assets during your lifetime and can offer additional benefits for estate tax reduction.

Strategies for Minimizing Estate Taxes

Minimizing estate taxes involves utilizing various legal and financial strategies. These strategies aim to reduce the amount of tax owed on the transfer of assets upon death. One common approach is gifting assets during your lifetime, within the annual gift tax exclusion limits. This reduces the size of your taxable estate. Another strategy is the establishment of trusts, which can help to reduce or eliminate estate taxes depending on the type of trust and its structure. For example, a qualified personal residence trust (QPRT) can be used to remove the value of a home from the taxable estate. Additionally, charitable donations can provide a significant estate tax reduction. It’s important to consult with an estate planning attorney and financial advisor to determine the most suitable strategies for your specific situation. These professionals can help you navigate the complexities of estate tax laws and implement strategies tailored to your needs.

Seeking Professional Advice

Navigating the complexities of retirement planning can be daunting. A financial advisor can provide invaluable guidance and support, helping you create a personalized strategy tailored to your specific circumstances and goals. Seeking professional advice is often a crucial step in ensuring a secure and comfortable retirement.

The benefits of working with a financial advisor extend beyond simply managing investments. A skilled advisor acts as a trusted partner, offering holistic financial planning services that encompass various aspects of your financial life, from retirement savings and investment strategies to debt management and estate planning. This comprehensive approach ensures that all facets of your financial well-being are considered, leading to a more robust and effective retirement plan.

Financial Advisor Qualifications and Experience

Choosing the right financial advisor is paramount. Look for professionals with the appropriate credentials and a proven track record. Certifications such as a Certified Financial Planner (CFP) designation indicate a commitment to professional standards and ongoing education. Experience in managing portfolios similar in size and investment goals to your own is also a key consideration. A thorough review of their background, including any disciplinary actions or client complaints, should be part of your due diligence process. It’s beneficial to inquire about their investment philosophy and how it aligns with your own risk tolerance and long-term objectives. Consider advisors with a demonstrated understanding of tax optimization strategies related to retirement planning.

Types of Financial Advisors

Financial advisors utilize different compensation models. Understanding these models is essential to making an informed decision. Fee-only advisors charge a predetermined fee for their services, typically based on an hourly rate or a percentage of assets under management. This structure eliminates potential conflicts of interest associated with commission-based compensation. Commission-based advisors earn a commission on the financial products they sell, such as mutual funds or insurance policies. While this model can be less transparent, some commission-based advisors provide valuable advice alongside their product recommendations. Hybrid models also exist, combining elements of both fee-only and commission-based structures. Carefully review the fee structure and understand how it impacts the advisor’s recommendations before engaging their services. Transparency regarding fees and potential conflicts of interest is crucial.

Ultimate Conclusion

Successfully navigating the path to a financially secure retirement requires careful planning, consistent effort, and a proactive approach. By setting clear goals, diligently managing your finances, and making informed investment decisions, you can significantly increase your chances of achieving a comfortable and fulfilling retirement. Remember that seeking professional advice can provide valuable insights and guidance throughout this journey. Start planning today, and secure a brighter financial future for yourself.

Helpful Answers

What is the difference between a 401(k) and a Roth IRA?

A 401(k) is a retirement savings plan sponsored by your employer, often with employer matching contributions. Contributions are tax-deductible, but withdrawals in retirement are taxed. A Roth IRA is a personal retirement account where contributions are made after tax, but withdrawals in retirement are tax-free.

How much should I be saving for retirement?

There’s no one-size-fits-all answer. A common guideline is to aim to save at least 15% of your pre-tax income, including employer contributions. However, your ideal savings rate depends on your age, income, expenses, and retirement goals.

When should I start withdrawing from my retirement accounts?

The age at which you can begin withdrawing from retirement accounts depends on the specific account type (e.g., 401(k), IRA). Generally, you can start withdrawing from traditional 401(k)s and IRAs at age 59 1/2 without penalty, though early withdrawals may be subject to taxes and penalties. Full retirement age for Social Security benefits varies.

What is a safe withdrawal rate in retirement?

A commonly cited safe withdrawal rate is 4% annually, adjusted for inflation. This means withdrawing 4% of your retirement savings in the first year, and then adjusting that amount each year for inflation. However, the appropriate withdrawal rate depends on individual circumstances and risk tolerance.