Retirement Savings Strategies Guide: Ah, retirement – the blissful state of doing absolutely nothing… except maybe nervously checking your investment portfolio. This guide isn’t about becoming a Wall Street wizard overnight (though that would be nice!), but rather about navigating the sometimes-bewildering world of securing your financial future. We’ll explore various strategies, from understanding different retirement accounts to devising smart investment plans and even anticipating those pesky unexpected expenses. Prepare for a journey filled with numbers, but fear not, we’ll keep it engaging (and maybe even a little funny).

We’ll delve into the nitty-gritty details of retirement planning, helping you define your retirement goals, understand the various savings vehicles available, and craft an investment strategy tailored to your risk tolerance. We’ll cover everything from the impact of inflation to the importance of estate planning, offering practical advice and illustrative examples to make the process less daunting and more, dare we say, enjoyable. Think of this as your friendly, slightly sarcastic, guide to a financially secure retirement.

Defining Retirement Goals and Needs

Planning for retirement is like preparing for a ridiculously long vacation – you need a solid itinerary, a hefty budget, and maybe a few extra pairs of comfy socks. Failing to plan is planning to fail, as the old adage goes, and in retirement, failure can mean a less-than-ideal golden age. This section will help you map out your retirement dreams and translate them into a concrete financial plan.

Retirement Lifestyle Scenarios and Cost Estimations

Different retirement lifestyles naturally demand different budgets. Imagine three scenarios: the “Luxury Leisure” retiree, cruising the Caribbean on a private yacht; the “Comfortable Cozy” retiree, enjoying quiet evenings at home with a good book and a glass of wine; and the “Frugal Fun” retiree, backpacking through Southeast Asia. Each requires a drastically different financial commitment. A “Luxury Leisure” retirement might necessitate $100,000 or more annually, while a “Comfortable Cozy” lifestyle might be achievable on $50,000, and a “Frugal Fun” lifestyle could potentially be managed on a much smaller budget, even less than $30,000, depending on location and choices. These are broad estimates, of course, and individual circumstances will significantly influence actual costs.

The Impact of Inflation on Retirement Savings Needs

Inflation, that sneaky thief of purchasing power, is a major factor to consider. A dollar today won’t buy the same amount in 20 years. For example, if your retirement goal is $50,000 annually today, accounting for an average annual inflation rate of 3%, you’ll need significantly more in 20 years to maintain the same purchasing power. Failing to account for inflation can leave you with a retirement shortfall that’s larger than a particularly enthusiastic toddler’s appetite. To illustrate, using a 3% inflation rate, $50,000 today might require $80,000 or more in 20 years to have equivalent buying power. Sophisticated retirement calculators can help estimate this inflation-adjusted need.

Calculating a Personalized Retirement Savings Target, Retirement Savings Strategies Guide

Calculating your target requires a multi-step process, but it’s not as daunting as it sounds.

1. Estimate your annual retirement expenses: Consider your desired lifestyle, inflation, and healthcare costs. Be realistic, but don’t be afraid to dream a little (within reason, of course!).

2. Determine your retirement duration: How many years do you anticipate being in retirement? Longer lifespans necessitate larger savings.

3. Account for other income sources: Will you receive a pension, Social Security benefits, or other forms of income? Subtract these from your annual expenses.

4. Calculate your savings shortfall: This is the difference between your annual retirement expenses (adjusted for inflation) and your other income sources.

5. Determine your savings timeline: How many years do you have until retirement?

6. Use a retirement savings calculator: Many online calculators can help you determine the amount you need to save annually to reach your target, considering investment growth.

Comparison of Retirement Income Sources

| Income Source | Typical Amount | Reliability | Tax Implications |

|---|---|---|---|

| Social Security | Varies based on earnings history | Generally reliable, but subject to potential future changes | Taxed based on income |

| Pension | Varies based on employer plan | Reliable if employer remains solvent | Taxed based on income |

| Personal Investments (401(k), IRA, etc.) | Varies widely based on investment performance | Dependent on investment choices and market performance | Tax implications vary based on account type |

| Part-time Work/Consulting | Highly variable | Dependent on health and job market | Taxed based on income |

Understanding Retirement Savings Vehicles

Ah, retirement savings vehicles – the chariots that will hopefully carry you to the golden sunset of your financial freedom. Choosing the right one is crucial, like picking the perfect steed for a long and comfortable journey. Get it wrong, and you might find yourself hitchhiking on the highway to broke-ville. Let’s explore the options, shall we?

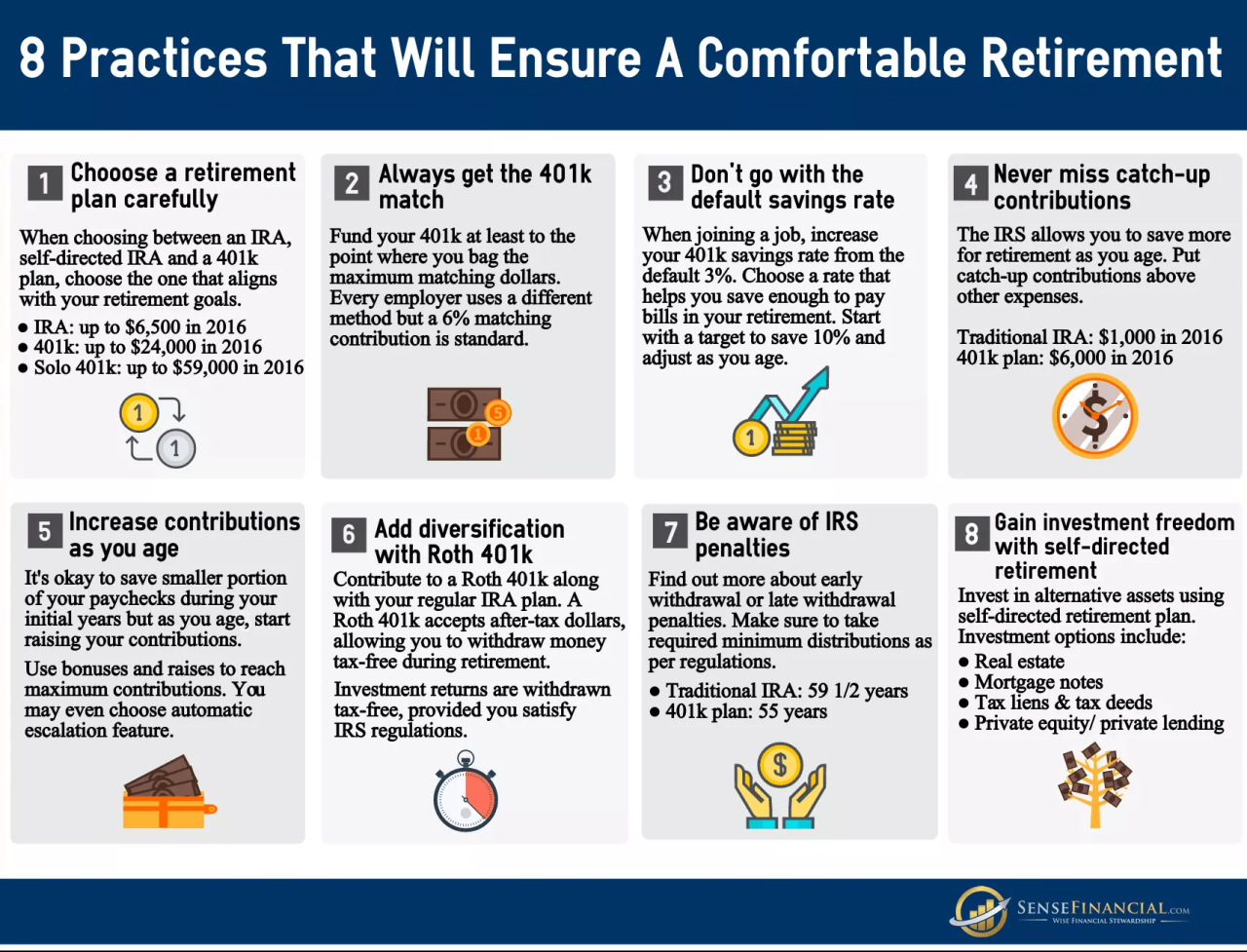

Retirement Account Types: 401(k), IRA, and Roth IRA

The world of retirement savings accounts can feel like a confusing maze, filled with acronyms and tax jargon. But fear not, intrepid saver! We’ll break down the three main players: 401(k)s, traditional IRAs, and Roth IRAs. Each offers a unique approach to building your retirement nest egg.

Tax Implications of Retirement Accounts

Taxes – the inescapable reality of adulting, even in retirement. Understanding the tax implications of each account is paramount to maximizing your savings. Let’s clarify the tax treatment of contributions and withdrawals for each plan.

- 401(k): Contributions are typically made pre-tax, reducing your taxable income in the present. However, withdrawals in retirement are taxed as ordinary income.

- Traditional IRA: Similar to a 401(k), contributions are tax-deductible, lowering your current tax burden. Withdrawals in retirement are taxed as ordinary income.

- Roth IRA: Contributions are made after tax, meaning no immediate tax benefit. However, qualified withdrawals in retirement are tax-free, a significant advantage for those anticipating a higher tax bracket in retirement. Think of it as paying your taxes now to avoid a larger bill later.

Contribution Limits and Withdrawal Rules

Every retirement plan has its own set of rules, like a quirky etiquette guide for your financial future. Knowing these rules is key to avoiding penalties and maximizing your savings. Contribution limits change annually, so always consult the latest IRS guidelines. Withdrawal rules vary depending on the type of account and your age. Early withdrawals often come with penalties, so it’s best to avoid them unless absolutely necessary. Think of it as a financial game of patience – the longer you wait, the sweeter the reward.

Choosing a Retirement Savings Vehicle: A Decision-Making Flowchart

Imagine a flowchart, a visual roadmap to guide you through the jungle of retirement savings options. The flowchart would begin with a simple question: “Do you have access to a 401(k) through your employer?” If yes, the flowchart would branch to explore the benefits of employer matching contributions. If no, it would lead to a comparison of Traditional and Roth IRAs, considering factors like current versus future tax brackets. The final decision node would reflect the optimal choice based on individual circumstances and financial goals. This flowchart simplifies the decision-making process, guiding you towards the most suitable plan for your specific needs. It’s like having a GPS for your retirement savings journey, ensuring you reach your destination – a comfortable and financially secure retirement – without getting lost.

Investment Strategies for Retirement

Planning your retirement investments is less about predicting the future (because, let’s face it, squirrels could win the lottery) and more about strategically navigating the present. A well-crafted investment strategy considers your risk tolerance, time horizon, and, crucially, your desire to avoid ending up eating cat food for dinner. This section will illuminate some paths to a financially comfortable (and cat-food-free) retirement.

Diversified Investment Portfolios for Various Risk Tolerances

The key to a successful retirement portfolio is diversification – don’t put all your eggs in one basket, unless that basket is lined with gold and guarded by a dragon. Different risk tolerances require different strategies. Imagine three individuals: Agnes, a cautious grandma; Brenda, a moderately adventurous businesswoman; and Carlos, a thrill-seeking entrepreneur.

- Agnes (Low Risk Tolerance): Agnes’s portfolio might consist of 80% bonds (providing steady, albeit slower, growth) and 20% in a low-volatility stock index fund. Think stability over skyrocketing returns.

- Brenda (Moderate Risk Tolerance): Brenda balances risk and reward with a portfolio split approximately 50/50 between stocks (a mix of established companies and some growth stocks) and bonds. She’s comfortable with some ups and downs for potentially higher long-term gains.

- Carlos (High Risk Tolerance): Carlos, embracing the rollercoaster, might allocate 70% of his portfolio to stocks (including emerging markets and small-cap companies) and only 30% to bonds. He’s prepared for significant fluctuations in pursuit of potentially substantial returns.

These are just examples; the ideal allocation will depend on individual circumstances and professional advice.

The Importance of Asset Allocation in Retirement Planning

Asset allocation is the art (and science) of distributing your investments across different asset classes – like stocks, bonds, and real estate. It’s the backbone of any sound retirement strategy. Think of it as building a sturdy house: you wouldn’t build it entirely of straw, would you? A balanced approach reduces overall portfolio risk and increases the likelihood of achieving your long-term financial goals. A poorly allocated portfolio is like trying to cross a river on a sieve – you’ll likely get soaked.

The Role of Bonds, Stocks, and Real Estate in a Retirement Portfolio

Each asset class plays a distinct role. Stocks offer the potential for high growth, but also higher volatility. Bonds provide stability and income, acting as a ballast during market storms. Real estate can provide diversification, rental income, and potential appreciation, but it’s also less liquid than stocks or bonds (meaning it’s harder to quickly sell). The optimal mix depends on your risk tolerance and financial goals. For example, a significant portion of real estate in your portfolio might reflect a belief in the long-term growth of the housing market.

Comparison of Various Investment Strategies

Choosing the right investment strategy is like choosing the right weapon for a battle – you wouldn’t use a sword against a dragon (unless you’re exceptionally brave, or foolish).

- Value Investing: This strategy focuses on identifying undervalued companies whose stock prices don’t reflect their true worth. It’s like finding a diamond in the rough – potentially rewarding, but requires patience and thorough research. Think Warren Buffett.

- Growth Investing: This approach targets companies expected to experience rapid growth, often in emerging industries. It’s a higher-risk, higher-reward strategy. Think technology stocks in their early stages.

- Index Funds: Index funds passively track a specific market index (like the S&P 500), offering broad diversification at a low cost. It’s a simpler, more hands-off approach, ideal for those who prefer less active management. Think simplicity and diversification.

Remember, these strategies aren’t mutually exclusive; you can blend elements of each to create a portfolio tailored to your individual needs and risk profile. Consult a financial advisor for personalized guidance.

Managing Retirement Savings and Expenses

Retirement: you’ve diligently saved, invested wisely (hopefully!), and now it’s time to enjoy the fruits of your labor. But before you trade your spreadsheets for shuffleboard, let’s talk about managing your hard-earned nest egg and ensuring a smooth, financially comfortable transition into this exciting new chapter. This isn’t about Scrooge McDuck diving into a pile of coins; it’s about smart planning to ensure your golden years truly shine.

Minimizing Taxes on Retirement Income

Tax efficiency is key to maximizing your retirement income. Strategic withdrawal planning can significantly reduce your tax burden. Consider utilizing tax-advantaged accounts like Roth IRAs, which offer tax-free withdrawals in retirement, or carefully timing withdrawals from traditional IRAs to minimize your tax bracket. Remember, consulting a financial advisor can provide personalized strategies tailored to your specific circumstances and risk tolerance. Think of it as hiring a tax ninja to protect your hard-earned cash.

Managing Healthcare Costs in Retirement

Healthcare expenses can be a significant, and often unpredictable, drain on retirement funds. Understanding Medicare and supplemental insurance options is crucial. Explore Medicare Advantage plans, which often include prescription drug coverage, or consider a Medigap policy to cover Medicare’s gaps. Furthermore, maintaining a healthy lifestyle through regular exercise and preventative care can help reduce long-term healthcare costs – think of it as investing in your own personal health savings account. Proactive healthcare management is not only beneficial for your well-being but also for your wallet.

Creating a Realistic Retirement Budget

Budgeting in retirement requires a different approach than during your working years. Your income streams may change, and unexpected expenses might arise. Start by estimating your monthly expenses, including housing, utilities, food, transportation, and entertainment. Factor in potential increases in healthcare costs and inflation. Consider using online budgeting tools or consulting a financial planner to create a comprehensive and realistic budget. A well-structured budget is your roadmap to a financially secure retirement, ensuring you don’t run out of funds before you run out of activities.

Potential Sources of Unexpected Expenses and Mitigation Strategies

Unexpected expenses can throw even the most meticulously planned retirement off course. Proactive planning can help mitigate these risks.

| Potential Unexpected Expense | Mitigation Strategy | Potential Unexpected Expense | Mitigation Strategy |

|---|---|---|---|

| Major Home Repairs | Home warranty, emergency fund | Unexpected Medical Bills | Comprehensive health insurance, supplemental insurance |

| Long-Term Care Needs | Long-term care insurance, exploring government assistance programs | Vehicle Repairs/Replacement | Regular maintenance, emergency fund |

| Inflationary Increases | Diversified investments, regular budget review | Unexpected Travel Costs (Family Emergencies) | Emergency fund, travel insurance |

Planning for Retirement Withdrawals

Ah, the sweet symphony of retirement – the gentle rustle of leaves, the soothing sound of… your dwindling savings? Fear not, dear reader! Proper planning for retirement withdrawals can turn that potential cacophony into a harmonious tune of financial freedom. This section will equip you with the knowledge to orchestrate your post-retirement funds with the precision of a seasoned conductor.

The way you withdraw your retirement savings significantly impacts how long your nest egg lasts. Choosing the right strategy requires careful consideration of your risk tolerance, desired lifestyle, and, of course, the unpredictable nature of the market. Let’s explore several approaches.

Withdrawal Strategies

Several strategies exist to guide your retirement withdrawals, each with its own set of advantages and disadvantages. The best approach depends on individual circumstances and preferences.

- Fixed Amount Withdrawals: This involves withdrawing a consistent amount each year, regardless of market fluctuations. Think of it as a steady paycheck, providing predictability but leaving you vulnerable to running out of money if the market performs poorly for an extended period.

- Percentage-Based Withdrawals: This strategy adjusts withdrawals annually based on the portfolio’s value. For instance, withdrawing 4% of your portfolio’s value each year. This approach aims to adapt to market fluctuations, but it can lead to larger withdrawals during strong market years and smaller ones during lean times.

- Systematic Withdrawals: A more sophisticated approach that combines elements of both fixed and percentage-based methods. It may involve withdrawing a fixed amount, but with adjustments based on market performance or portfolio rebalancing. This offers a balance between stability and adaptability.

Market Volatility’s Impact on Withdrawals

The stock market, that capricious beast, can throw a wrench into even the best-laid retirement plans. Market volatility directly affects the value of your retirement investments, influencing the amount you can safely withdraw. A significant market downturn can drastically reduce your portfolio’s value, potentially forcing you to withdraw less or deplete your savings faster than anticipated.

Consider the example of a retiree withdrawing a fixed amount of $50,000 annually. If the market drops 20%, the remaining portfolio value shrinks, making the same withdrawal rate riskier. Conversely, a strong market year can allow for higher withdrawals without depleting the principal as quickly. This highlights the importance of having a flexible withdrawal strategy that can adapt to changing market conditions.

Risks of Early Retirement Withdrawals

Retiring early can be tempting, but it comes with financial risks. The longer your money remains invested, the more time it has to grow. Withdrawing funds early reduces your investment horizon, limiting the potential for growth and increasing the risk of outliving your savings. Furthermore, early withdrawals may incur penalties depending on the type of retirement account.

For example, withdrawing from a traditional IRA before age 59 1/2 typically incurs a 10% penalty, in addition to paying income tax on the withdrawn amount. This can significantly impact your retirement income and longevity.

Calculating Safe Withdrawal Rates

Determining a safe withdrawal rate is crucial to ensuring your retirement funds last throughout your retirement years. Various methods exist, each with its own assumptions and limitations. The “4% rule,” a popular guideline, suggests withdrawing 4% of your portfolio’s initial value annually, adjusted for inflation. However, this rule is not foolproof and its success depends on several factors, including market performance and longevity.

The 4% rule is a guideline, not a guarantee.

More sophisticated methods involve Monte Carlo simulations, which use computer models to project various market scenarios and estimate the probability of outliving your savings. These simulations can provide a more personalized and nuanced assessment of a safe withdrawal rate, considering factors such as your expected lifespan, investment portfolio composition, and risk tolerance. Professional financial advice is often recommended for determining a safe and personalized withdrawal strategy.

Protecting Retirement Savings

Securing your golden years isn’t just about accumulating wealth; it’s about safeguarding it from life’s unexpected detours. Think of your retirement savings as your precious pirate treasure – you’ve worked hard to amass it, and now it’s time to protect it from scurvy dogs (creditors), kraken-like lawsuits, and the inevitable storms of aging. This section will explore strategies to keep your hard-earned nest egg safe and sound.

Estate Planning for Retirement Assets

Proper estate planning is crucial for ensuring your retirement assets are distributed according to your wishes after you’re gone. Failing to plan can lead to unnecessary legal battles and delays, leaving your loved ones with a hefty bill and a headache instead of a comfortable inheritance. A well-crafted estate plan, including a will or trust, clearly designates beneficiaries for your retirement accounts, minimizing potential conflicts and tax implications. Consider consulting with an estate planning attorney to create a personalized plan that aligns with your specific circumstances and family dynamics. For instance, a simple will might specify that your spouse inherits your IRA, while a more complex trust could provide for the gradual distribution of assets to your children, ensuring their financial well-being even after your passing.

Protecting Retirement Savings from Creditors and Lawsuits

Nobody wants to think about lawsuits, but life can be unpredictable. Fortunately, several strategies exist to shield your retirement assets from creditors and lawsuits. Many retirement accounts, such as 401(k)s and IRAs, offer some level of protection under federal law, preventing creditors from seizing these funds to settle debts. However, the extent of this protection varies depending on the type of account and the specific circumstances. Consulting a financial advisor and/or legal professional can help you understand your specific protections and explore additional strategies, such as setting up trusts or utilizing asset protection strategies tailored to your individual risk profile. For example, a qualified domestic trust (QDOT) can protect assets from creditors while still allowing for tax advantages.

Long-Term Care Insurance and its Role in Retirement Planning

The cost of long-term care, whether in a nursing home or through in-home assistance, can quickly deplete even substantial retirement savings. Long-term care insurance is designed to mitigate this risk by providing financial assistance for necessary care. While premiums can be significant, the potential cost savings from avoiding the depletion of your retirement funds can be substantial. It’s important to carefully evaluate your health status, family history, and financial situation before purchasing a policy, ensuring the coverage aligns with your potential needs and budget. Think of it as an insurance policy against the unexpected – a safeguard for your retirement funds and your peace of mind.

Beneficiary Designations for Retirement Accounts

Properly designating beneficiaries for your retirement accounts is paramount. This ensures a smooth transfer of assets to your chosen individuals upon your death, avoiding potential delays and disputes. Different retirement accounts have different rules regarding beneficiary designations, so it’s crucial to understand the specifics of each account. For example, your 401(k) plan may have a specific form to complete, while your IRA might allow for more flexible designations. Common beneficiary designations include naming a spouse, children, other family members, or even charities. You can also name contingent beneficiaries, who will inherit the assets if your primary beneficiary predeceases you. Regularly reviewing and updating your beneficiary designations is essential, particularly after significant life events such as marriage, divorce, or the birth or death of a family member. This ensures your wishes are always reflected in your account documentation. Failing to do so can result in unintended consequences and potential financial hardship for your loved ones.

Illustrative Examples of Retirement Plans

Retirement planning, much like choosing a fine wine, requires careful consideration of your palate – or in this case, your financial goals and risk tolerance. Let’s explore some hypothetical scenarios to illustrate the diverse paths to a comfortable retirement. Remember, these are examples, and your own plan should be tailored to your unique circumstances. Consult a financial advisor for personalized guidance, because relying solely on hypothetical examples is about as sensible as navigating a maze blindfolded while juggling chainsaws.

Retirement Plan for a Young Professional with High Earning Potential

Imagine Amelia, a 28-year-old software engineer earning a six-figure salary. Amelia is ambitious and has a high risk tolerance. Her retirement plan focuses on maximizing contributions to tax-advantaged accounts like a 401(k) and Roth IRA, aiming for the maximum allowable contribution limits each year. She invests heavily in growth-oriented stocks and index funds, anticipating significant long-term growth to offset the higher risk. She also explores options like investing in real estate or starting a side business, recognizing the potential for substantial returns, though acknowledging the increased risk involved. Diversification is key; she avoids putting all her eggs in one basket, spreading her investments across different asset classes. Regularly reviewing and adjusting her portfolio based on market conditions and life changes is a crucial part of her strategy. Amelia understands that while this aggressive approach might lead to greater rewards, it also comes with the possibility of greater losses, and she’s prepared to weather market fluctuations.

Retirement Plan for a Couple Nearing Retirement Age

Consider Robert and Mary, a couple in their late 50s, approaching retirement in five years. Their risk tolerance is significantly lower than Amelia’s. Their retirement plan prioritizes capital preservation and generating stable income. A substantial portion of their portfolio is allocated to bonds and low-volatility stocks, aiming for consistent returns and minimizing the impact of market downturns. They also utilize annuities to guarantee a stream of income during retirement. They’ve meticulously calculated their projected expenses and adjusted their savings accordingly, factoring in healthcare costs and potential long-term care needs. They’ve also begun to draw down from their savings in a phased approach to ensure their assets last throughout their retirement. Regular withdrawals are carefully planned to avoid depleting their nest egg too quickly. Their focus is on ensuring a secure and predictable income stream, rather than chasing high returns.

Impact of Different Investment Choices on Retirement Outcomes

Let’s compare two hypothetical scenarios: Sarah and David both start saving for retirement at age 30, contributing $5,000 annually. Sarah invests solely in a low-risk savings account earning a modest 2% annual interest. David, on the other hand, invests in a diversified portfolio of stocks and bonds, achieving an average annual return of 7%. After 35 years, Sarah’s savings would accumulate to approximately $290,000, a respectable sum, but significantly less than David’s. David’s investment strategy, while riskier, yields a substantially larger retirement nest egg, accumulating to approximately $850,000, highlighting the substantial long-term impact of even a modest difference in investment returns. This demonstrates the power of compounding returns and the importance of considering investment risk and return profiles when planning for retirement. This isn’t to say that everyone should rush into high-risk investments; the optimal approach depends entirely on individual circumstances and risk tolerance.

Epilogue

Securing a comfortable retirement isn’t about hitting the jackpot; it’s about making informed decisions and consistently working towards your financial goals. This Retirement Savings Strategies Guide has armed you with the knowledge and tools to navigate the complexities of retirement planning. Remember, while we’ve covered a multitude of strategies, your specific plan should be personalized to reflect your unique circumstances and aspirations. So, go forth and plan your golden years with confidence – and maybe a little bit of humor along the way. After all, who says financial planning can’t be fun?

Detailed FAQs: Retirement Savings Strategies Guide

What if I don’t have a 401(k) through my employer?

You can still save for retirement through individual retirement accounts (IRAs), such as traditional or Roth IRAs. These offer tax advantages and allow you to contribute even if your employer doesn’t offer a 401(k).

How often should I review my retirement plan?

At least annually, and more frequently if there are significant life changes (marriage, job loss, birth of a child, etc.). Regular reviews help ensure your plan remains aligned with your goals and risk tolerance.

What’s the difference between a traditional IRA and a Roth IRA?

A traditional IRA offers tax deductions on contributions, but withdrawals are taxed in retirement. A Roth IRA has no upfront tax deduction, but withdrawals are tax-free in retirement. The best choice depends on your current and projected tax brackets.

Can I withdraw from my retirement accounts early?

While early withdrawals are possible, they often come with penalties and taxes. It’s generally advisable to avoid early withdrawals unless absolutely necessary due to unforeseen circumstances.