Securing a comfortable retirement requires careful planning and a proactive approach to saving and investing. This review delves into the essential strategies for building a robust retirement nest egg, covering everything from defining your retirement goals and assessing your current financial situation to implementing effective investment strategies and managing potential risks. We’ll explore various account types, investment options, and withdrawal strategies, empowering you to make informed decisions about your financial future.

Understanding your retirement needs, current savings, and available investment vehicles is paramount. This review provides a framework for evaluating your individual circumstances and tailoring a retirement plan that aligns with your unique goals and risk tolerance. We’ll examine different approaches to investing, risk management, and seeking professional advice, ultimately equipping you with the knowledge to navigate the complexities of retirement planning with confidence.

Defining Retirement Goals and Needs

Planning for a comfortable retirement hinges on accurately defining your goals and needs. Understanding your desired lifestyle and the associated costs is crucial for developing a robust savings strategy. Failing to account for all expenses can lead to significant shortfalls later in life. This section will guide you through the process of assessing your retirement income requirements.

Retirement lifestyles vary widely, from minimalist living to luxurious travel. The cost of each varies dramatically. A minimalist retirement might focus on staying at home, minimizing expenses, and relying heavily on social security and a small pension. This could be achievable on a modest budget, perhaps $30,000 annually, depending on location and health. Conversely, a luxury retirement might involve extensive travel, a larger home, and private healthcare, potentially requiring $150,000 or more per year. Between these extremes lies a wide spectrum of possibilities, each with its own unique cost profile. It’s vital to visualize your ideal retirement and estimate the associated expenses.

Retirement Lifestyle Scenarios and Cost Estimations

Several factors significantly influence retirement income needs. Healthcare costs, for instance, are notoriously unpredictable and often escalate with age. Unexpected medical bills can quickly deplete retirement savings. Travel expenses, while enjoyable, can also be substantial, depending on the frequency and destinations. Furthermore, inflation steadily erodes the purchasing power of money over time, meaning that a certain amount today will buy less in the future. Accurately accounting for inflation is essential for ensuring your retirement savings maintain their value.

Factors Influencing Retirement Income Needs

To calculate your personal retirement income requirements, follow these steps. First, determine your desired annual expenses. Consider housing costs (rent or mortgage payments, property taxes, and maintenance), food, utilities, transportation, entertainment, and healthcare. Next, factor in inflation. A common approach is to use an average annual inflation rate (consult financial resources for current projections). Use this rate to project your future expenses. For example, if you estimate annual expenses of $50,000 today and assume a 3% annual inflation rate, your expenses in 20 years could be approximately $89,542 (using a compound interest calculator). Finally, account for any potential income sources, such as Social Security benefits, pensions, or part-time work. Subtract this income from your projected expenses to arrive at your required retirement savings.

Calculating Personal Retirement Income Requirements

To calculate your needed retirement savings, you can use the following formula: Retirement Savings Needed = (Annual Expenses * Inflation Factor) – Expected Income Sources

For instance, if your projected annual expenses are $80,000 after adjusting for inflation, and you anticipate $20,000 in annual income from Social Security, you would need $60,000 annually from your retirement savings. The specific savings amount required will depend on factors like your investment returns and the length of your retirement. Financial planners can help you determine a more precise figure based on your individual circumstances.

Assessing Current Savings and Investments

Understanding your current financial landscape is crucial for developing a robust retirement plan. This involves evaluating your existing savings and investments, understanding the characteristics of different account types, and strategizing for optimal account management. Let’s delve into the specifics.

Evaluating Retirement Savings

A thorough assessment of your current retirement savings requires a comprehensive review of all your accounts. Begin by gathering statements from all sources, including 401(k)s, IRAs, and any other retirement-specific investment accounts. Calculate the total value of your assets, considering both the current market value and any outstanding loans against those accounts. It’s also beneficial to track the historical performance of your investments to gauge growth trends and identify areas for potential improvement. This detailed overview will form the basis for future planning and adjustments.

Retirement Account Types and Tax Implications

Several types of retirement accounts offer different tax advantages and contribution limits. Understanding these nuances is critical for maximizing your savings and minimizing your tax burden.

Different Retirement Account Types

| Account Type | Tax Advantages | Contribution Limits (2023) | Withdrawal Rules |

|---|---|---|---|

| 401(k) | Contributions may be tax-deductible; earnings grow tax-deferred. | $23,000 (under 50); $30,000 (50+) | Withdrawals before age 59 1/2 are generally subject to a 10% penalty, plus income tax. |

| Traditional IRA | Contributions may be tax-deductible; earnings grow tax-deferred. | $6,500 (under 50); $7,500 (50+) | Withdrawals before age 59 1/2 are generally subject to a 10% penalty, plus income tax. |

| Roth IRA | Contributions are made after tax; withdrawals in retirement are tax-free. | $6,500 (under 50); $7,500 (50+) | Withdrawals of contributions are always tax-free; withdrawals of earnings before age 59 1/2 are generally subject to a 10% penalty, plus income tax. |

Note: Contribution limits are subject to change. Consult a financial professional for the most up-to-date information.

Consolidating and Optimizing Retirement Accounts

Many individuals have retirement assets spread across multiple accounts. Consolidating these accounts can simplify management, potentially reduce fees, and offer better control over investment choices. Strategies include rolling over 401(k) assets into an IRA or consolidating multiple IRAs into a single account. However, careful consideration should be given to the potential tax implications and any associated fees before undertaking consolidation. For example, a rollover from a 401(k) to a traditional IRA generally maintains the tax-deferred status, while a rollover to a Roth IRA involves paying taxes on the transferred amount. Optimizing existing accounts involves reviewing asset allocation, ensuring diversification, and adjusting investment strategies based on your risk tolerance and time horizon. A financial advisor can help determine the best course of action.

Investment Strategies for Retirement

Planning your retirement investments requires a thoughtful approach considering your risk tolerance, time horizon, and financial goals. A well-structured strategy balances potential returns with the acceptable level of risk, aiming for consistent growth while mitigating potential losses. This section explores various investment approaches and asset classes to help you build a suitable retirement portfolio.

Investment Approaches Based on Risk Tolerance and Time Horizon

Your investment strategy should align with your risk tolerance – your comfort level with potential investment losses – and your time horizon – the period until you need the money. Younger investors with longer time horizons can generally tolerate higher risk, aiming for potentially higher returns through investments like stocks. Conversely, those nearing retirement often prefer lower-risk investments to preserve capital.

- Conservative Approach: This strategy prioritizes capital preservation and minimizes risk. It typically involves a higher allocation to low-risk investments like bonds and government securities, offering lower returns but greater stability. This is often suitable for retirees or those close to retirement who need to protect their savings.

- Moderate Approach: This balanced approach aims for a blend of growth and stability. It typically includes a mix of stocks, bonds, and potentially real estate, seeking a balance between potential returns and risk. This strategy is often suitable for individuals with a medium-to-long-term investment horizon.

- Aggressive Approach: This strategy focuses on maximizing potential returns, accepting higher risk in pursuit of growth. It typically involves a higher allocation to stocks, including growth stocks and potentially alternative investments. This approach is generally more suitable for younger investors with a long time horizon who can withstand market fluctuations.

Comparison of Asset Classes

Different asset classes offer varying potential returns and levels of risk. Understanding these differences is crucial for building a diversified portfolio.

| Asset Class | Potential Return | Risk |

|---|---|---|

| Stocks (Equities) | High | High |

| Bonds (Fixed Income) | Moderate | Low |

| Real Estate | Moderate to High | Moderate to High |

| Cash | Low | Very Low |

Stocks generally offer higher potential returns but are subject to market volatility. Bonds provide more stability but typically offer lower returns. Real estate can offer both appreciation and rental income but involves illiquidity and market fluctuations. Cash provides liquidity and safety but low returns.

Example Diversified Retirement Portfolio

This example portfolio illustrates a moderate approach suitable for an individual with a 10-year time horizon before retirement. Note that this is a hypothetical example and individual circumstances should be considered when building a portfolio.

- Stocks (40%): Provides potential for long-term growth. This allocation could include a mix of large-cap, mid-cap, and small-cap stocks for diversification across company sizes and sectors.

- Bonds (30%): Offers stability and income. This could include a mix of government bonds and corporate bonds to balance risk and return.

- Real Estate (20%): Provides potential for appreciation and rental income. This could be through direct ownership of a property or investment in real estate investment trusts (REITs).

- Cash (10%): Provides liquidity for emergencies and short-term needs. This could be held in high-yield savings accounts or money market funds.

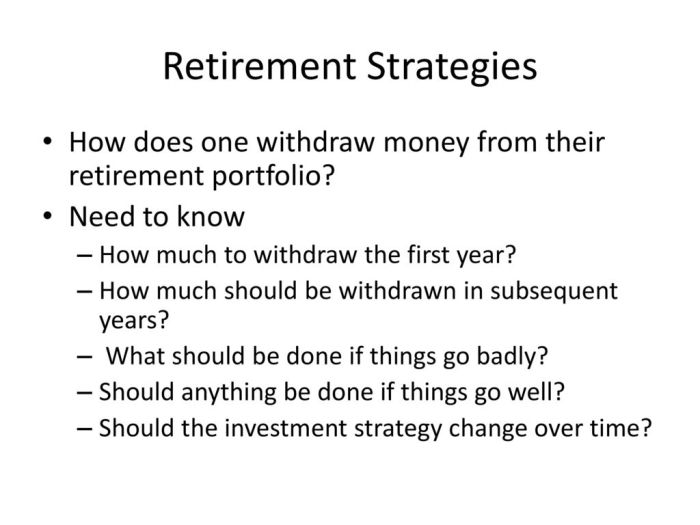

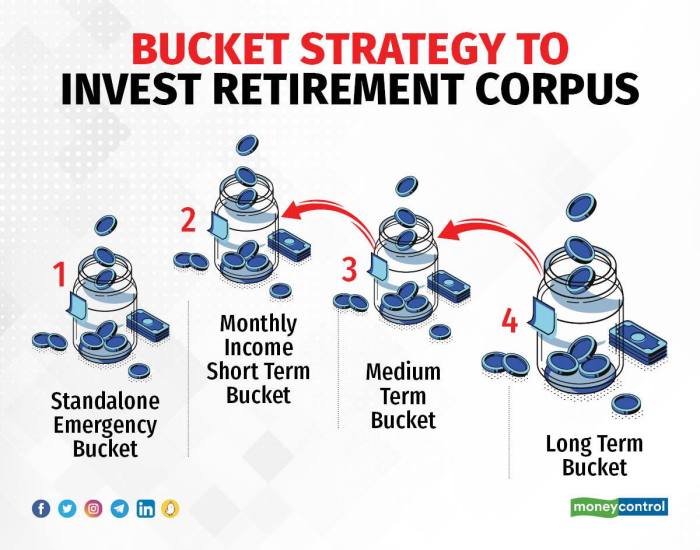

Retirement Withdrawal Strategies

Successfully navigating retirement requires a well-defined plan for accessing your accumulated savings. Choosing the right withdrawal strategy is crucial for ensuring a consistent income stream throughout your retirement years, while also managing potential risks. This section explores various approaches and considerations for drawing down your retirement funds.

Retirement income withdrawal strategies aim to provide a steady flow of funds while preserving capital for the long term. Different approaches cater to various risk tolerances and financial goals. Understanding the nuances of each strategy is key to making informed decisions.

Systematic Withdrawal Strategies

Systematic withdrawal strategies involve withdrawing a fixed amount or percentage of your portfolio at regular intervals, typically monthly or annually. This provides predictability and budgeting ease. A common approach is to use a fixed percentage of your portfolio value, adjusting the withdrawal amount annually to account for investment performance. For example, a retiree might withdraw 4% of their portfolio’s value each year, adjusting the actual dollar amount based on the portfolio’s performance at the beginning of each year. This method helps to manage risk by reducing withdrawals during periods of poor market performance. Another strategy is to withdraw a fixed dollar amount each year, regardless of market fluctuations. This offers simplicity but carries a greater risk of depleting the portfolio faster if returns are low.

Phased Withdrawal Strategies

Phased withdrawal strategies involve gradually decreasing the amount withdrawn from the portfolio over time. This approach is particularly useful for retirees who anticipate increasing expenses later in retirement or want to ensure their funds last longer. For instance, a retiree might withdraw a higher percentage of their portfolio in their early retirement years and gradually reduce the withdrawal rate as they age. This strategy can be combined with other income sources, such as Social Security or pensions, to further reduce the reliance on portfolio withdrawals. The phased approach offers flexibility and can help to mitigate the risk of outliving your savings.

Inflation’s Impact on Retirement Income

Inflation erodes the purchasing power of money over time. A retirement income plan must account for inflation to ensure that the purchasing power of withdrawals remains consistent. For example, if inflation is 3% annually, a $50,000 withdrawal today will only have the purchasing power of approximately $48,500 in one year. To mitigate inflation’s impact, retirees should consider adjusting their withdrawal strategy to account for expected inflation rates. This could involve increasing the annual withdrawal amount by a predetermined percentage each year, or investing in assets that tend to outperform inflation, such as inflation-protected securities or real estate.

Tax Efficiency in Retirement Income Planning

Tax efficiency plays a crucial role in maximizing the after-tax income available during retirement. Different retirement accounts have different tax implications. For example, withdrawals from traditional IRAs are taxed as ordinary income, while withdrawals from Roth IRAs are typically tax-free. Careful planning is essential to minimize the tax burden on retirement income. Strategies such as tax-loss harvesting (selling losing investments to offset capital gains) and strategically withdrawing from different accounts can significantly reduce taxes.

Best Practices for Managing Retirement Funds for Longevity

Managing retirement funds effectively requires a multifaceted approach. Diversification is key to reducing risk; spreading investments across different asset classes helps to protect against losses in any single sector. Regular portfolio rebalancing ensures the asset allocation remains aligned with your risk tolerance and goals. Professional financial advice can provide valuable guidance in developing and implementing a comprehensive retirement income plan. Monitoring your portfolio’s performance and adjusting your strategy as needed is crucial for adapting to changing market conditions and personal circumstances. A well-defined plan, combined with careful monitoring and proactive adjustments, increases the likelihood of achieving a secure and comfortable retirement.

Risk Management and Contingency Planning

Securing your retirement involves not only diligently saving and investing but also proactively managing potential risks that could jeopardize your financial well-being in retirement. A robust risk management strategy is crucial for ensuring your retirement plan remains resilient against unforeseen circumstances. This section details key risks and effective mitigation strategies.

Identifying Potential Retirement Risks

Retirement savings are vulnerable to a variety of risks. Market volatility, a significant concern, can dramatically impact investment returns, potentially leaving you with insufficient funds. Healthcare costs, notoriously unpredictable and often escalating, represent another major risk, potentially consuming a substantial portion of your retirement income. Longevity risk, the possibility of outliving your savings, is also a critical factor to consider, particularly with increasing life expectancies. Inflation, steadily eroding purchasing power, further complicates retirement planning, requiring careful consideration of its long-term impact on savings.

Mitigating Retirement Risks Through Diversification and Insurance

Diversification is a cornerstone of risk mitigation. Spreading your investments across different asset classes (stocks, bonds, real estate, etc.) reduces the impact of poor performance in any single area. For example, if the stock market experiences a downturn, the losses may be offset by gains in other asset classes. Furthermore, strategic asset allocation, tailoring your investment mix to your risk tolerance and time horizon, is vital. Insurance plays a crucial role in protecting against specific risks. Long-term care insurance can help cover the substantial costs associated with nursing home care or in-home assistance, while health insurance remains essential for managing medical expenses. Annuities can provide a guaranteed income stream, mitigating longevity risk.

Developing a Comprehensive Retirement Contingency Plan

A comprehensive contingency plan is essential for navigating unexpected events. This plan should address various scenarios, including job loss, unexpected medical expenses, or a significant market downturn. For example, a plan might include emergency funds readily accessible to cover several months of living expenses. It should also Artikel strategies for adjusting spending in response to unforeseen circumstances, perhaps by delaying certain purchases or downsizing your living arrangements. Regular review and updates of the contingency plan are essential, reflecting changes in your circumstances, market conditions, and personal risk tolerance.

Steps to Develop a Robust Retirement Risk Management Strategy

Developing a robust strategy requires a systematic approach. The following steps Artikel a structured process:

- Assess your risk tolerance: Understand your comfort level with potential investment losses and plan accordingly.

- Identify potential risks: Thoroughly evaluate the specific risks that could impact your retirement savings, considering factors such as your health, family history, and financial situation.

- Develop a diversified investment portfolio: Spread your investments across different asset classes to reduce the impact of poor performance in any single area.

- Secure appropriate insurance coverage: Obtain adequate health, long-term care, and other relevant insurance to protect against unexpected expenses.

- Establish an emergency fund: Set aside enough savings to cover several months of living expenses in case of unexpected job loss or other emergencies.

- Regularly review and update your plan: Monitor your progress, adjust your strategy as needed, and re-evaluate your risk tolerance periodically.

- Seek professional advice: Consult with a financial advisor to create a personalized retirement plan that addresses your specific needs and risk profile.

Seeking Professional Advice

Navigating the complexities of retirement planning can be challenging, even for those with a strong financial understanding. Seeking professional advice significantly enhances the likelihood of achieving your retirement goals securely and efficiently. Leveraging the expertise of qualified professionals can provide clarity, structure, and peace of mind throughout the process.

The roles of various financial professionals are distinct yet often complementary. A well-rounded retirement plan often benefits from the expertise of multiple specialists.

Roles of Financial Professionals

Financial advisors offer comprehensive guidance across various aspects of financial planning, including investment management, retirement savings strategies, and tax optimization. Estate planners specialize in creating strategies to manage and transfer assets, ensuring a smooth transition of wealth to heirs while minimizing tax liabilities. Tax advisors provide specialized knowledge in tax laws and regulations, helping to optimize tax efficiency within the retirement plan. Finally, attorneys can provide crucial legal guidance on various aspects of retirement planning, such as estate planning documents and the legal implications of certain financial decisions. Collaborating with these professionals ensures a holistic and well-structured approach to retirement planning.

Benefits of Professional Guidance

Professional guidance offers several key benefits. Firstly, it provides personalized strategies tailored to individual circumstances, goals, and risk tolerance. A financial advisor can analyze your unique financial situation, identify potential risks and opportunities, and create a customized plan to maximize your retirement savings and income. Secondly, professionals bring expertise in investment management, selecting suitable investment vehicles aligned with your goals and risk profile, and actively managing your portfolio to achieve optimal returns. Thirdly, they offer ongoing support and monitoring, regularly reviewing and adjusting the plan as circumstances change, ensuring it remains relevant and effective throughout your retirement journey. For example, a professional might adjust investment allocations in response to market fluctuations or changes in your personal circumstances, such as unexpected medical expenses. Lastly, professional advice helps alleviate stress and uncertainty, providing confidence in your financial future. Knowing you have a knowledgeable expert guiding you through the process can significantly reduce anxiety and improve your overall well-being.

Importance of Periodic Plan Reviews

Regular review and adjustment of the retirement plan are crucial due to the dynamic nature of financial markets, personal circumstances, and legislative changes. Market fluctuations can significantly impact investment performance, requiring adjustments to portfolio allocation to maintain the desired risk level and growth trajectory. Life events, such as marriage, divorce, job changes, or health issues, necessitate revisiting the retirement plan to accommodate the altered financial landscape. Legislative changes, particularly those related to taxes and retirement regulations, can also necessitate plan adjustments to ensure compliance and optimize tax efficiency. For instance, changes to tax brackets or retirement withdrawal rules may require adjustments to your investment strategy and withdrawal plan. Without periodic reviews, the retirement plan may become outdated, compromising its effectiveness and potentially jeopardizing your retirement security.

Questions to Ask a Financial Advisor

Before engaging a financial advisor, it’s important to gather information and prepare a list of questions to ensure a productive consultation. These questions should focus on their experience, qualifications, fees, and approach to financial planning. It’s crucial to understand their investment philosophy, risk management strategies, and how they handle client communication and reporting. Furthermore, it is important to inquire about their expertise in specific areas relevant to your retirement planning needs, such as estate planning or tax optimization. Clarifying their fee structure and the services included within those fees is essential to avoid any surprises or misunderstandings. Finally, it is vital to understand their process for regular reviews and adjustments to your retirement plan, ensuring ongoing support and alignment with your evolving needs and circumstances. A clear understanding of these aspects will enable you to make an informed decision and choose the most suitable financial advisor for your retirement planning needs.

Final Wrap-Up

Successfully navigating the path to retirement involves a multifaceted strategy encompassing careful goal setting, diligent savings, shrewd investment choices, and proactive risk management. By understanding your personal needs, leveraging diverse investment opportunities, and seeking professional guidance when necessary, you can build a secure financial foundation for your future. This review provides a comprehensive overview of key strategies, empowering you to take control of your retirement planning and build a future you can confidently look forward to.

Questions Often Asked

What is the difference between a 401(k) and a Roth IRA?

A 401(k) is employer-sponsored, often with employer matching, and contributions are tax-deferred. A Roth IRA is funded with after-tax dollars, but withdrawals in retirement are tax-free.

How much should I be saving for retirement?

The ideal savings amount depends on your individual circumstances, including income, expenses, and retirement goals. A common guideline is to aim for saving at least 15% of your pre-tax income.

When should I start withdrawing from my retirement accounts?

The age at which you can begin withdrawing from retirement accounts depends on the specific account type. However, you are generally required to start taking withdrawals at age 73 (75 for those born in 1960 or later).

What are some common retirement risks?

Common risks include market volatility, inflation, unexpected healthcare costs, and longevity risk (outliving your savings).