Risk Management Framework Indonesia: Navigating the archipelago of risk, from volcanic eruptions of regulatory hurdles to the seismic shifts of economic change, requires a sturdy framework. This exploration delves into the fascinating world of Indonesian risk management, where the unexpected is, well, expected. We’ll uncover the strategies, the challenges, and the occasional hilarious mishap in managing risk in a nation as vibrant and diverse as Indonesia itself. Prepare for a journey filled with insightful analysis and perhaps a chuckle or two along the way.

Indonesia’s unique blend of economic dynamism, geographical vulnerabilities, and political nuances creates a complex risk landscape. Understanding the interplay between these factors is crucial for businesses and government alike. This framework examines the core principles, methodologies, and practical applications of risk management within this dynamic context, comparing Indonesian practices with international standards and offering a glimpse into future trends. Think of it as a survival guide, but instead of avoiding tigers, we’re navigating bureaucratic jungles and economic tsunamis.

Introduction to Indonesia’s Risk Management Landscape

Indonesia’s risk management scene is a vibrant, if sometimes chaotic, tapestry woven from threads of rapid economic growth, complex regulations, and a dash of unpredictable tropical weather (metaphorically speaking, of course – though the occasional monsoon *does* impact things). While larger corporations often boast sophisticated risk management frameworks, smaller businesses and government agencies are still navigating the complexities of a maturing regulatory environment. It’s a bit like trying to assemble IKEA furniture without the instructions – some manage it brilliantly, others… well, let’s just say there are a few wobbly legs around.

The current state of risk management practices shows a fascinating mix of adoption and adaptation. While international best practices are increasingly influencing larger companies, a significant gap remains between aspiration and reality, particularly in smaller enterprises and across various sectors. This gap often stems from resource constraints, a lack of skilled personnel, and, let’s be honest, a sometimes-overwhelming volume of regulations. The journey toward robust risk management is an ongoing process, filled with both triumphs and, inevitably, a few hilarious mishaps along the way.

Key Regulatory Bodies and Their Influence

Several key regulatory bodies shape Indonesia’s risk management landscape, each wielding its unique brand of influence. The Financial Services Authority (OJK) plays a crucial role in overseeing financial institutions, setting standards for risk management, and occasionally wielding its regulatory stick with impressive force. The Indonesian Deposit Insurance Corporation (LPS) focuses on maintaining stability in the banking sector, influencing risk management practices through its deposit insurance schemes and supervisory actions. Meanwhile, various sectoral ministries also contribute to the regulatory mix, adding layers of complexity and, occasionally, a touch of bureaucratic amusement. Think of it as a complex game of regulatory Jenga – one wrong move, and the whole thing could come tumbling down (though thankfully, it rarely does).

Common Risks Faced by Organizations in Indonesia

Indonesian organizations face a diverse range of risks, a colourful cocktail of economic, political, social, and environmental challenges. Economic risks include fluctuations in commodity prices (Indonesia’s reliance on commodities makes it particularly vulnerable), inflation, and exchange rate volatility. Political risks involve regulatory changes, corruption, and potential political instability. Social risks encompass issues such as demographic shifts, social unrest, and evolving consumer preferences. Environmental risks are increasingly prominent, including natural disasters (those monsoons again!), climate change impacts, and environmental regulations. Navigating this complex web of risks requires agility, foresight, and perhaps a healthy dose of luck. Imagine it as a daring high-wire act, performed on a slightly wobbly wire, in a thunderstorm. Exciting, yes, but also potentially hazardous.

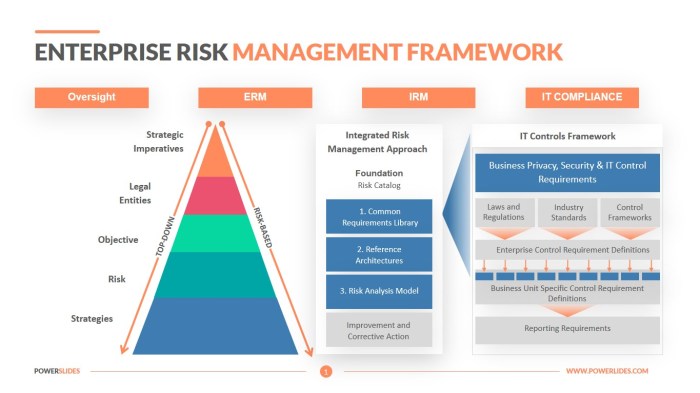

Components of the Indonesian Risk Management Framework

Indonesia’s approach to risk management, while perhaps not as globally renowned as, say, Swiss precision clockmaking, is nonetheless a robust system striving for effectiveness. It blends international best practices with a distinctly Indonesian flavour, acknowledging the unique challenges and opportunities presented by the archipelago’s dynamic economic and social landscape. Think of it as a spicy satay of risk management – a delightful blend of familiar ingredients with a surprising kick.

The core principles underpinning the Indonesian framework emphasize a proactive, rather than reactive, approach to risk. This involves identifying potential risks early, assessing their likelihood and impact, and developing strategies to mitigate or even leverage them. It’s less about fire-fighting and more about strategically navigating a potentially turbulent sea – a wise approach considering Indonesia’s geographical diversity and economic ambitions.

Core Principles and Methodologies

The Indonesian risk management framework draws heavily on internationally recognized methodologies, adapting them to suit the local context. Key methodologies include qualitative and quantitative risk analysis, scenario planning, and sensitivity analysis. These tools allow for a comprehensive assessment of risks, ranging from natural disasters (think volcanic eruptions and earthquakes – Indonesia has a lot of those!) to economic fluctuations and geopolitical events. The framework encourages a holistic view, considering not just financial risks but also operational, strategic, and reputational risks. It’s not just about the rupiah; it’s about the whole darn archipelago!

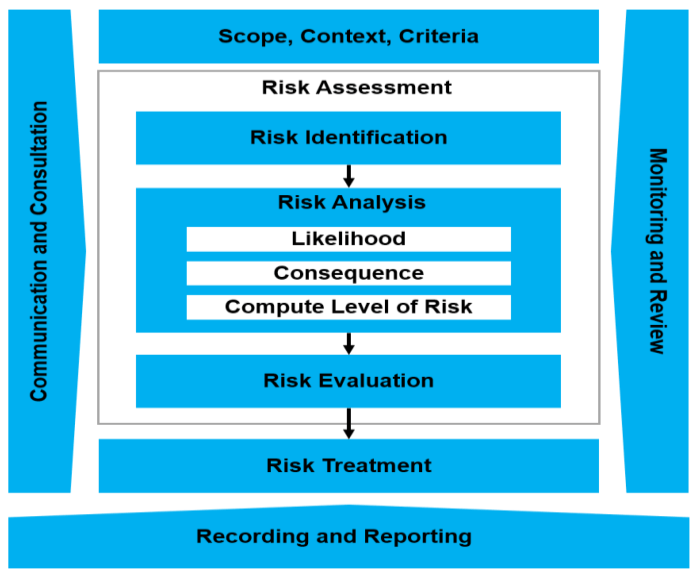

Stages of the Risk Management Process

A typical risk management process in Indonesia typically follows these key stages:

| Stage | Activities | Responsibilities | Example |

|---|---|---|---|

| Risk Identification | Workshops, interviews, data analysis, hazard mapping | Risk Management Team, relevant stakeholders | Identifying potential disruptions to supply chains due to infrastructure limitations in remote areas. |

| Risk Analysis & Evaluation | Qualitative and quantitative assessments, probability and impact matrices | Risk Management Team, subject matter experts | Assessing the likelihood and potential financial impact of a major earthquake on a particular infrastructure project. |

| Risk Response Planning | Developing mitigation strategies, contingency plans, risk transfer options (insurance), risk acceptance | Risk Management Team, senior management | Implementing robust disaster recovery plans for IT systems, including data backups and alternative site access. |

| Risk Monitoring and Review | Regular reporting, audits, performance indicators | Risk Management Team, internal audit | Tracking key risk indicators (KRIs) and regularly reviewing the effectiveness of implemented risk mitigation strategies. |

Comparison with International Standards (e.g., ISO 31000)

The Indonesian framework aligns closely with internationally recognized standards such as ISO 31000. Both emphasize a systematic and comprehensive approach to risk management, highlighting the importance of risk governance, stakeholder engagement, and continuous improvement. However, the Indonesian framework is tailored to the specific challenges and opportunities of the Indonesian context, reflecting the country’s unique regulatory environment and cultural nuances. Think of it as a customized version of a globally recognized recipe, adapted to local tastes and ingredients. While the core principles remain the same, the specific implementation details may vary, resulting in a unique, locally relevant approach.

Specific Risk Categories in Indonesia: Risk Management Framework Indonesia

Indonesia, a vibrant archipelago brimming with natural beauty and economic potential, also faces a unique cocktail of risks. Navigating this landscape requires a robust risk management framework, one that acknowledges not only the opportunities but also the considerable challenges inherent in this dynamic nation. Let’s delve into some specific risk categories that demand particular attention.

The Indonesian risk management environment is a fascinating blend of the predictable and the utterly unpredictable. While standard business risks exist, the sheer scale and frequency of certain hazards necessitate a unique approach. This section explores the unique challenges posed by natural disasters, the impact of governance issues, and the implications of rapid economic development.

Natural Disasters in Indonesia

Indonesia’s geographical location makes it highly vulnerable to a variety of natural disasters. Earthquakes, volcanic eruptions, tsunamis, and floods are not merely possibilities; they are regular occurrences that demand constant vigilance and proactive mitigation strategies. The sheer scale of these events, often impacting millions, necessitates a national-level approach to disaster risk reduction, including robust early warning systems, comprehensive evacuation plans, and well-funded disaster relief programs. The economic cost of these events is staggering, impacting infrastructure, businesses, and the livelihoods of countless individuals. For instance, the 2004 Indian Ocean tsunami devastated coastal communities, highlighting the critical need for resilient infrastructure and effective community preparedness. The eruption of Mount Merapi in recent years also demonstrates the ongoing need for robust volcanic monitoring and evacuation procedures. Effective risk management in this area requires a multi-pronged approach involving government agencies, private sector entities, and local communities working in concert.

Corruption and Political Instability

Corruption, sadly, is a significant risk factor in Indonesia, impacting everything from infrastructure projects to the implementation of disaster relief efforts. Opaque governance structures and a lack of transparency can hinder effective risk management. Political instability, while less frequent in recent years, can still disrupt policy continuity and investment, adding uncertainty to the risk landscape. For example, delays or cancellations of major infrastructure projects due to corruption scandals can have significant economic and social consequences. Similarly, periods of political uncertainty can lead to reduced foreign investment and a slowdown in economic growth. Addressing these risks requires strengthening governance structures, promoting transparency, and fostering accountability across all levels of government and the private sector.

Economic Development and Growth

Indonesia’s impressive economic growth presents both opportunities and challenges. Rapid urbanization, for example, leads to increased vulnerability to natural disasters in densely populated areas, while the expansion of industries can bring about new environmental risks. This rapid growth necessitates a dynamic risk management approach that adapts to the evolving economic landscape.

- Increased Infrastructure Needs: Rapid economic growth necessitates a significant expansion of infrastructure, which, if not properly managed, can create new vulnerabilities. Poorly constructed buildings, for instance, can increase the risk of damage during earthquakes.

- Environmental Degradation: Industrial expansion and deforestation can exacerbate the impact of natural disasters like floods and landslides. Sustainable development practices are crucial to mitigating these risks.

- Social Inequality: Uneven distribution of economic benefits can create social unrest and instability, which, in turn, can impact the effectiveness of risk management strategies. Addressing social inequality is therefore crucial for broader societal resilience.

- Cybersecurity Threats: As Indonesia’s digital economy expands, so too do the risks of cyberattacks targeting financial institutions, government agencies, and critical infrastructure. Robust cybersecurity measures are essential to protect against these threats.

Risk Mitigation and Response Strategies

Navigating the vibrant, yet sometimes unpredictable, landscape of Indonesian business requires a robust risk management approach. Simply put, it’s about anticipating trouble before it throws a durian at your carefully crafted business plan. Effective risk mitigation isn’t about avoiding all risk (because let’s face it, that’s impossible!), it’s about identifying, assessing, and strategically minimizing the impact of potential problems. Think of it as a well-choreographed dance with uncertainty, where you gracefully sidestep the banana peels and expertly navigate the potholes.

Effective risk mitigation hinges on proactive planning and a deep understanding of the Indonesian business environment. This involves leveraging both traditional and innovative strategies tailored to the specific risks faced by each organization. Ignoring risks is like ignoring a rumbling volcano – it might be quiet now, but it could erupt at any moment.

Examples of Effective Risk Mitigation Techniques in Indonesia

Indonesian organizations employ a variety of techniques to mitigate risks, often blending traditional approaches with modern technologies. For instance, many companies utilize robust insurance policies to cover potential financial losses from natural disasters, a very real concern in a country prone to earthquakes and floods. Diversification of supply chains is another popular strategy, reducing reliance on single suppliers and minimizing disruption from unforeseen events. Furthermore, strong internal controls and regular audits help to prevent fraud and financial mismanagement. Finally, investment in employee training and development fosters a culture of risk awareness and preparedness. Imagine a company’s workforce as a well-trained army, ready to tackle any unexpected challenge.

Hypothetical Risk Mitigation Plan for a Small Business

Let’s imagine a small “batik” (traditional Indonesian fabric) shop in Yogyakarta. Potential operational risks include supply chain disruptions (e.g., delays in fabric delivery) and power outages affecting production. Financial risks could include fluctuating exchange rates impacting the cost of imported dyes and reduced sales due to economic downturns.

A mitigation plan would involve:

* Diversifying fabric suppliers: Securing multiple suppliers ensures consistent access to materials even if one experiences delays.

* Investing in a backup generator: This safeguards against power outages, preventing production downtime and ensuring continued operation.

* Hedging against exchange rate fluctuations: Utilizing financial instruments to mitigate the impact of currency fluctuations on import costs.

* Developing a strong online presence: Expanding sales channels beyond the physical shop reduces reliance on local foot traffic and mitigates the risk of reduced sales.

* Maintaining detailed financial records: This allows for better financial planning and quicker response to unexpected financial challenges.

The Importance of Business Continuity Planning in Indonesia, Risk Management Framework Indonesia

Business continuity planning (BCP) is paramount in Indonesia, a nation susceptible to various disruptions, from natural disasters to economic volatility. A well-defined BCP Artikels procedures for maintaining essential business operations during and after disruptive events. This isn’t merely a “nice-to-have”; it’s a necessity. Imagine a company’s BCP as a detailed emergency escape plan for a building – it’s crucial to know the escape routes and procedures before a fire breaks out. A comprehensive BCP includes strategies for data backup and recovery, communication protocols, and alternative work arrangements. It essentially ensures that the business can “bounce back” from adversity, minimizing downtime and protecting its reputation. In the dynamic Indonesian context, a robust BCP is not just a plan; it’s an insurance policy against unexpected disruptions.

Risk Monitoring and Reporting

Keeping tabs on risk in Indonesia isn’t just about ticking boxes; it’s about navigating a vibrant, dynamic landscape where even the most meticulously planned strategies can encounter unexpected “gempa bumi” (earthquakes) – both literal and metaphorical. Effective monitoring ensures that your risk management framework isn’t just a dusty document gathering cobwebs, but a living, breathing system that adapts to the ever-changing Indonesian business environment.

Effective risk monitoring in Indonesia relies on a multi-faceted approach, combining quantitative and qualitative methods. Regular review meetings, internal audits, and key performance indicator (KPI) tracking provide a quantitative backbone. Meanwhile, qualitative assessments, such as stakeholder interviews and scenario planning exercises, add valuable contextual insights. This blend helps organizations not only measure the effectiveness of their risk mitigation strategies but also identify emerging risks before they become full-blown crises, thus preventing a potential “tsunami” of problems.

Methods for Monitoring and Evaluating Risk Management Strategies

Monitoring risk in Indonesia involves a blend of proactive and reactive measures. Proactive measures include regular self-assessments using standardized checklists and frameworks aligned with Indonesian regulatory requirements. Reactive measures involve promptly investigating and analyzing incidents, near misses, and deviations from established risk controls. Data analysis, including trend identification and predictive modeling, is crucial in anticipating future risks. For example, a company experiencing a surge in supply chain disruptions due to unpredictable weather patterns might utilize predictive analytics to forecast future vulnerabilities and proactively adjust its sourcing strategies. This proactive approach helps mitigate potential losses and maintain operational stability. The frequency of monitoring activities varies depending on the nature and severity of the risks involved; high-impact risks require more frequent monitoring than low-impact ones.

Sample Risk Register Template

A well-structured risk register is essential for effectively tracking and managing risks. Here’s a sample template suitable for Indonesian organizations:

| Risk Identification | Risk Assessment (Likelihood & Impact) | Response Strategy | Monitoring & Review |

|---|---|---|---|

| Supply chain disruption due to natural disasters | High Likelihood, High Impact | Diversify suppliers, establish backup supply chains, invest in disaster preparedness | Monthly review of supplier performance, quarterly review of disaster preparedness plans |

| Cybersecurity breaches | Medium Likelihood, High Impact | Implement robust cybersecurity measures, employee training, regular security audits | Quarterly security audits, monthly review of security incident reports |

| Regulatory changes | Medium Likelihood, Medium Impact | Maintain close contact with regulatory bodies, engage legal counsel | Regular review of regulatory updates, annual legal compliance review |

| Reputational damage due to negative publicity | Low Likelihood, High Impact | Proactive crisis communication plan, strong corporate social responsibility initiatives | Regular monitoring of social media and news, quarterly review of communication strategies |

Reporting Requirements and Best Practices

Reporting on risk management activities is crucial for transparency and accountability. In Indonesia, reporting requirements often align with industry-specific regulations and best practices. Regular reports, tailored to the audience (e.g., board of directors, management, regulatory bodies), should provide a clear overview of identified risks, implemented mitigation strategies, and the effectiveness of these strategies. Visual aids, such as dashboards and charts, can enhance understanding and facilitate decision-making. For instance, a heatmap visualizing the likelihood and impact of various risks can provide a quick overview of the organization’s risk profile. Transparency and open communication are paramount; stakeholders need to be informed about potential risks and the steps taken to address them. A “no surprises” approach fosters trust and strengthens the organization’s risk management culture.

Future Trends and Developments

The Indonesian risk management landscape, much like a bustling Jakarta street market, is dynamic and ever-evolving. Predicting the future is, of course, a fool’s errand (unless you’re a particularly insightful fortune teller specializing in macroeconomic indicators), but certain trends are undeniably shaping the way Indonesia approaches risk. We’ll explore the exciting – and sometimes slightly terrifying – possibilities ahead.

The integration of technology is rapidly transforming how risks are identified, assessed, and mitigated. This isn’t just about fancy software; it’s about fundamentally changing how we understand and respond to uncertainty.

Technological Advancements in Indonesian Risk Management

The rise of artificial intelligence (AI) and big data analytics offers Indonesia a powerful toolkit to combat risk. Imagine AI algorithms sifting through mountains of data – from weather patterns to social media sentiment – to predict potential disruptions to infrastructure projects or even anticipate the spread of misinformation during election periods. Big data allows for a more nuanced understanding of risk profiles, moving beyond simple averages to a granular view of specific vulnerabilities. For instance, analyzing historical flood data coupled with real-time rainfall information can lead to more effective flood mitigation strategies in vulnerable areas like Jakarta. This isn’t just about reacting to events; it’s about proactively shaping the future. The successful implementation of these technologies hinges on robust data infrastructure and skilled professionals capable of interpreting the insights generated. Indonesia’s investment in digital infrastructure and education will be key to realizing the full potential of AI and big data in risk management.

Future Challenges and Opportunities

Indonesia faces a complex interplay of challenges and opportunities. Climate change, for example, presents a significant threat, demanding robust adaptation strategies. Rising sea levels and more frequent extreme weather events pose a direct threat to coastal communities and infrastructure. However, the shift towards renewable energy sources also presents an opportunity to reduce reliance on volatile fossil fuel markets and enhance energy security. Similarly, rapid urbanization presents both challenges (increased risk of infrastructure failures, overcrowding) and opportunities (improved infrastructure planning, enhanced disaster response systems). The growing digital economy presents new cybersecurity risks, but also offers innovative solutions for risk management. Successfully navigating this complex landscape requires a proactive and adaptive approach. Consider the potential for increased cyberattacks targeting critical infrastructure. A robust cybersecurity framework, combined with advanced threat detection systems, will be essential.

Adaptations and Improvements to the Indonesian Risk Management Framework

The Indonesian risk management framework will need to evolve to meet these future challenges. We can expect to see a greater emphasis on:

- Proactive risk identification: Moving beyond reactive responses to anticipating and mitigating risks before they materialize.

- Data-driven decision making: Leveraging AI and big data analytics to inform risk assessments and mitigation strategies.

- Enhanced collaboration: Fostering greater cooperation between government agencies, private sector organizations, and communities.

- Increased transparency and accountability: Ensuring that risk management practices are transparent and accountable to the public.

- Capacity building: Investing in training and education to develop a skilled workforce capable of managing complex risks.

These adaptations will not only strengthen Indonesia’s resilience but also contribute to sustainable economic growth and social development. For example, improved disaster preparedness through early warning systems and community-based resilience programs can significantly reduce the economic and social costs of natural disasters. This proactive approach, combined with technological advancements, positions Indonesia for a more secure and prosperous future.

Wrap-Up

From navigating the treacherous waters of natural disasters to the unpredictable currents of political shifts, mastering risk management in Indonesia is a high-stakes game. This exploration has revealed the intricate framework in place, highlighting both its strengths and areas for potential improvement. While the challenges are undeniably significant, the innovative strategies and resilience demonstrated by Indonesian organizations offer a beacon of hope and a testament to the nation’s adaptability. The future of Indonesian risk management promises exciting developments, particularly with the integration of emerging technologies. So, buckle up and prepare for a thrilling ride – the journey to effective risk management is far from over!

Query Resolution

What are the most common types of insurance used in Indonesian risk management?

Common insurance types include property insurance, liability insurance, and business interruption insurance, often tailored to address specific Indonesian risks like natural disasters.

How does the Indonesian framework address cybersecurity risks?

Cybersecurity is increasingly important. The framework is adapting to include data protection regulations and best practices, though specific implementation varies across sectors.

What role does community engagement play in risk mitigation?

Community involvement is vital, particularly for disaster preparedness. Local knowledge and participation are key to effective mitigation strategies.